MARKET OVERVIEW

The global Semaglutide API market will keep to reshape the pharmaceutical enterprise as advancements in metabolic ailment remedies advantage momentum. With the growing cognizance on improving diabetes care and addressing associated health complications, this segment of the active pharmaceutical component region will revel in noteworthy shifts, extending beyond the instant business panorama. While semaglutide is already widely recognized for its effectiveness in treating kind 2 diabetes and obesity, the direction of the market will shift an increasing number of towards method innovation, transport structures, and extension of healing use.

Looking ahead to future applications, the global Semaglutide API market will propel research into less invasive drug forms, with major emphasis placed on increasing patient compliance. The conventional injectable form, effective though it may be, presents barriers to accessibility and patient satisfaction. According to this, pharmaceutical firms will focus on creating oral semaglutide forms with better bioavailability. This will not only make therapeutic compliance better but also open up potential in developing markets where cold-chain logistics continue to be an issue.

Another way the market will go is through strategic partnerships between biotech companies and mass manufacturers. These partnerships will not only be focused on manufacturing capabilities but also look at how to best optimize cost structures, which will become important as demand builds. With healthcare systems under mounting pressure to provide effective treatments at lower costs, affordability will be a big issue. Thus, industry players will tend to redirect investments into process improvement and cleaner synthesis pathways towards anticipation of future regulatory requirements on sustainability and clean manufacturing.

Also, as semaglutide continues to prove its utility outside of glycemic control—cardiovascular and renal protection, for example—researchers will increasingly expand the range of clinical trials. These investigations will investigate whether semaglutide might be repurposed for other metabolic diseases or even neurodegenerative disease. If the answer is yes, the global Semaglutide API market will not only increase its medical scope but also gain interest from therapeutic areas that now fall beyond its reach.

Globally, localized production will be a major driver of the future horizon. Governments and regulators will continue to encourage domestic capabilities to lesser their reliance on foreign sources of supply. This will create capacity expansion across markets like Southeast Asia, Eastern Europe, and selected markets in Latin America. Decentralization of production clusters will present opportunities and challenges, particularly in the maintenance of quality standards while attaining volume economics.

Regulatory environments will also change, calling for greater source transparency, safety profiling, and efficacy measurement. Consequently, businesses that compete in the global Semaglutide API market will need to embrace more lively regulatory concepts. These will involve real-time exchange of facts, post-marketplace monitoring, and compliance with next-generation regulatory guidelines that focus on affected person protection and extended therapeutic effects.

In its essence, the global Semaglutide API market will pass a long way beyond its existing pharmaceutical use. It will influence destiny healthcare techniques with innovation, collaboration, and developing healing reach, solidifying its fame as a force that transforms the worldwide pharmaceutical sphere.

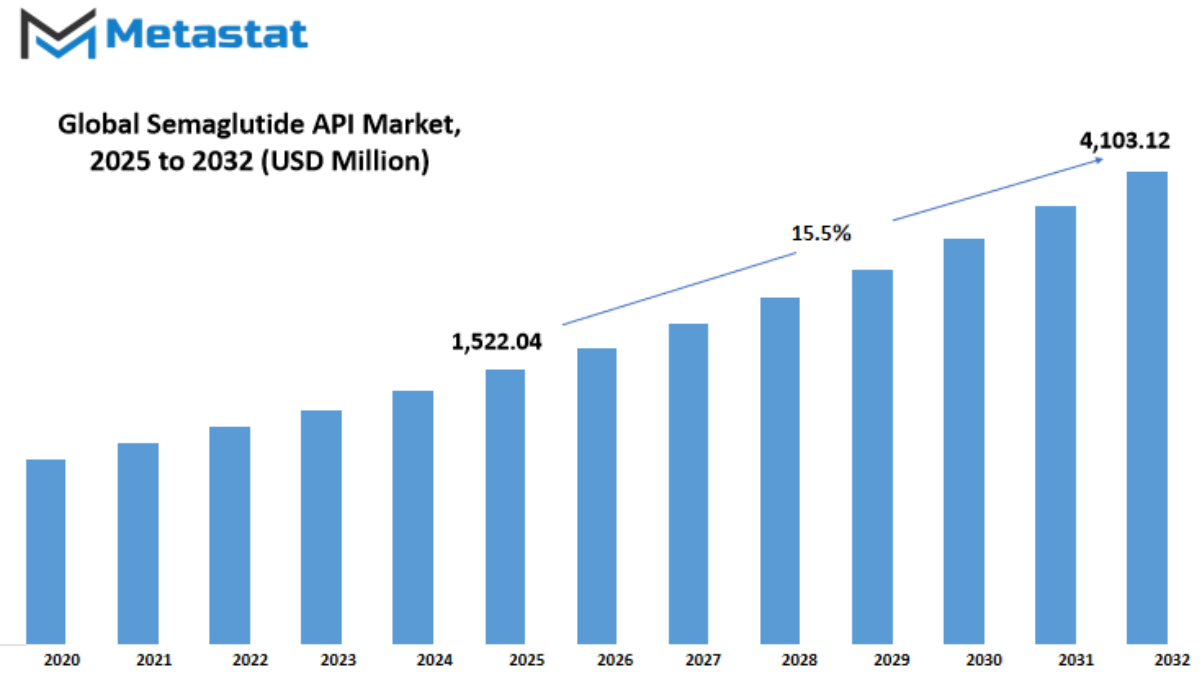

Global Semaglutide API market is estimated to reach $4,103.12 Million by 2032; growing at a CAGR of 15.5% from 2025 to 2032.

GROWTH FACTORS

The global Semaglutide API market is taking major momentum, fueled by the increasing prevalence of diabetes and obesity globally. While individuals struggle with these chronic conditions, there exists an increased demand for successful treatments, and GLP-1 receptor agonists such as semaglutide have proved to be of great value. Not most effective do those remedies manage blood glucose, however additionally facilitate weight reduction, making them viable candidates for lengthy-term remedy. As there is expanded focus and the healthcare systems placed greater emphasis on treating life-style-related sicknesses, semaglutide call for is in all likelihood to remain robust.

Supporting this momentum is the growing number of clinical trials and regulatory approvals which have broadened semaglutide use beyond type 2 diabetes. Its achievement in medical trials has stepped forward self belief among healthcare professionals, ensuing in broader prescription and utilization. The potential of the drug has gone beyond control of sugar—it is now being investigated for weight management and even as a means of lowering cardiovascular risk. All these good things are encouraging pharmaceutical firms to invest more in the global Semaglutide API market as this paves the way to controlling multiple diseases with a single therapy.

Yet, with the apparent medical need and growing therapeutic applications, the market is still confronted with some challenges. One of the great challenges is the production price, that's excessive. Semaglutide is a synthetic peptide, and its production process is lengthy and complicated. This increases the cost of the final product, which restricts get admission to, specifically to nations with much less strong investment for healthcare. In addition, supply chain has generated greater barriers. Delays in manufacturing and uncooked fabric availability can postpone delivery schedules, and it will become more and more difficult for corporations to ramp up and deal with growing demand correctly.

All these issues aside, however, the future of the semaglutide API market remains highly promising. With further clinical studies backing its application for chronic weight management and cardiovascular wellness, semaglutide is turning into more than just a diabetes medication. Its broader use also means that drug developers are not only considering an increasing patient population but also extended treatment periods. That change may propel a more stable and more profitable market in the next several years, particularly as more efficient new methods of producing the medications reduce costs.

Overall, though manufacturing and supply-related demanding situations preserve to affect increase, the developing blessings and programs of semaglutide put it on a strong trajectory. The marketplace's boom could be a feature of the way well producers are capable of strike a balance among innovation and affordability, and the way well they can meet the growing worldwide health threat from weight problems and diabetes.

MARKET SEGMENTATION

By Purity Level

The global Semaglutide API market has experienced consistent growth over the last few years, fueled by growing demand for effective type 2 diabetes and obesity treatments. As more people learn of the health hazards associated with these conditions, drug manufacturers are investing in creating stable and effective formulations. Semaglutide, which has been used for blood sugar management and weight loss, has become a go-to active pharmaceutical ingredient (API) for most manufacturers. Its popularity is directly related to its potential to assist patients in maintaining improved glycemic control and enhancing metabolic health, thereby gaining popularity on a global scale.

The quality and purity of the Semaglutide API is one of the main drivers of the market. Purity grade is one of the major determinants of performance and safety, with multiple grades supporting different pharmaceutical needs. The market for the segment with a purity grade of ≥ 95% is now worth $94.44 million, a testament to the dominant market position it occupies. The grade is commonly the minimum standard that many manufacturers operate at, providing an optimal mix of affordability and efficiency. With increasing focus on patient safety and compliance, increased purity is gaining popularity.

The ≥ 98% purity is sought by manufacturers that target more purified and focused formulations. Such high-purity APIs are typically carried out in which precision and consistency are of utmost importance, in medical environments. In the same vein, Pharmaceutical Grade Semaglutide continues to be being sought after for its strict first-class requirements, which make it safe for human use with out compromise. As more investment goes into studies and production technology, substances of such better-grade APIs are likely to come to be more available and reasonably priced.

Various producers are increasing their production levels and collaborating with others to satisfy increasing global demands. As much as the market is confronted with a challenge of production costs, supply chain reliability, and stringent regulations, it remains ripe for expansion. With assistance from government health programs and a consistent increase in healthcare spending, demand for high-quality Semaglutide API will most likely remain firm in both developed and emerging countries.

In the future, the global Semaglutide API market will be steady with incremental growth. Those companies that emphasize purity, yield enhancement, and cost-efficient solutions will have every opportunity to succeed. As the needs of patients develop and the need for successful treatment increases, emphasis will continue to be placed on supplying safe, high-quality Semaglutide APIs following international standards.

By Synthesis Method

The global Semaglutide API market has garnered enormous interest over the last few years, and a primary cause for that is the developing want for green kind 2 diabetes and obesity remedies. As semaglutide maintains to show off solid scientific responses, a better range of drug companies are entering the marketplace, fueling the producing of energetic pharmaceutical ingredients (APIs) to unheard of heights. The way wherein such APIs are synthesized is one of the main factors that have an impact on the marketplace landscape. The artificial manner no longer best affects the yield and great of semaglutide but additionally extensively contributes to cost-effectiveness, time to release, and normal scalability.

The global Semaglutide API market is widest to classify by using synthesis strategies, together with Solid-Phase Peptide Synthesis (SPPS), Liquid-Phase Peptide Synthesis (LPPS), and Hybrid Synthesis. SPPS is the most popular method used nowadays. It provides an efficient and convenient method of constructing intricate peptide chains such as semaglutide, particularly in commercial quantities. SPPS is widely used by many manufacturers due to its simplified process and increased purity product, ideal for high volumes needed in increasing therapeutic demand.

LPPS, although less used for semaglutide, remains relevant to certain applications. It is better adapted to lower-volume production and offers benefits in improved control of reaction conditions. Nonetheless, the method can be time- and exertions-extensive, which restricts its use while excessive throughput is critical. All that being said, some corporations nonetheless look at LPPS due to its flexibility and reduced cloth price in a few steps of synthesis, in particular while synthesizing shorter peptide sequences or wearing out studies trials.

Hybrid Synthesis is likewise gaining prominence as a viable opportunity, which leverages the positives of each SPPS and LPPS. By utilising SPPS for a few components of the peptide and LPPS for others, producers gain the best feasible mixture of efficiency and exceptional. This process is being widely embraced through companies seeking inexpensive and more agile production techniques with out sacrificing the very last product. It also lets in stepped forward scalability, that's important as global call for semaglutide maintains rising.

With development of peptide manufacturing technologies, competition between synthesis methods will probably increase. Those firms that can find the optimal balance between innovation, efficiency, and cost when producing APIs will be the best placed to capitalize on this expanding market. With more semaglutide-based therapies being prescribed, the demand to produce high-quality APIs in large quantities will only get greater—rendering the synthesis method a strategic choice with far-reaching implications for the future of many pharmaceutical companies.

By Application

The global Semaglutide API market is attracting considerable importance because of its increasing role in contemporary healthcare. Semaglutide, being a glucagon-like peptide-1 (GLP-1) receptor agonist, is properly renowned for its software towards the control of lengthy-time period metabolic illnesses. Its increasing call for is mainly pushed by using the increasing international cases of Type 2 diabetes, which stays one of the key fitness troubles in each developed and growing countries. With increasing demand for trustworthy, long-term treatments, pharmaceutical manufacturers are concentrating on manufacturing high-quality active pharmaceutical ingredients (APIs) to serve the needs of the marketplace economically.

Semaglutide API has several key uses. Its most major application is in the treatment of Type 2 diabetes. Its efficacy in controlling blood sugar and enhancing glycemic control has made it a treatment of choice with physicians. It not only assists in the control of insulin levels but also helps in preventing diabetes complications. Due to the increasing number of patients requiring weekly or daily management therapy, the market for Semaglutide-based drugs is constantly increasing, which is compelling API producers to enhance production and invest in regular quality check.

Apart from diabetes, Semaglutide is investigated and applied for controlling obesity. With obesity levels increasing globally, particularly in urban and sedentary communities, there has been a greater need for drugs that enable sustainable weight loss. Semaglutide has been impressive in clinical environments in causing patients to lose a lot of weight over an extended period. This use is attracting interest from medical practitioners and consumers, hence being a prime driver in the growth of the market. The growing consciousness of obesity's long-term consequences on health is prompting more and more patients to move towards medically-supported options, of which those involving Semaglutide are no exception.

A similarly new application of Semaglutide API is inside the prevention of cardiovascular headaches in diabetes and weight problems. Evidence shows that Semaglutide lowers the risk of widespread cardiovascular events, which include coronary heart attacks and strokes, in individuals with Type 2 diabetes. This benefit is increasingly more understood in clinical and customer groups and similarly helps its utility in extra expansive remedy regimens. The drug has also found investment for clinical trials by pharmaceutical companies to back these assertions in the hope of establishing openings for new therapeutic approvals that can further increase its market presence.

Semaglutide is also finding increased support in research environments. Scientists and medical researchers are also examining its potential beyond present approved indications, investigating how it can benefit other metabolic and endocrine diseases. Demand driven by research creates a further complexity to the market's expansion, particularly since academic and pharmaceutical organizations persist in driving innovation for treatments of chronic disease. With its various uses in key areas of health, the global Semaglutide API market is poised to expand steadily backed by rising investments, regulatory support, and patient need.

By End User

The global Semaglutide API market is selecting up pace as there may be developing demand for a success remedies of diabetes and obesity. With increased health attention and a growing diabetic population throughout the globe, pharmaceutical advancements have end up even greater peptide-oriented, along with semaglutide. This substance is mainly prized for its ability in coping with blood glucose degrees and assisting weight loss. Consequently, agencies that produce and increase semaglutide are experiencing growing possibilities, mainly in regions in which situations associated with lifestyle are growing.

In terms of who consumes semaglutide APIs, the market is divided into four broad categories: pharmaceutical industries, biotech companies, contract development and manufacturing organizations (CDMOs), and research centers. Pharmaceutical firms are the leading demand drivers, employing the API to create drugs that are already on the market or undergoing clinical trials. The companies desire to launch new formulations or gain access in unexplored markets. Their relentless desire to expand their pipelines and compete based on differentiation places them at the forefront of semaglutide API demand.

Biotech companies, although fewer in quantity, bring innovation and nimbleness into the market. They are investigating newer uses or delivery systems that might enhance semaglutide's efficacy or compliance. Their work might be less apparent, but it is key to advancing the limits of what can be done with this API. While the CDMOs do their part by assisting both small and big businesses in scaling up production. They bring technical sophistication, cost-effectiveness, and conformity to international manufacturing standards—advantages highly relevant in a market where quality and speed are critical.

Research centers are a less loud but integral component of the landscape. Their work is more about discerning the long-term consequences and further therapeutic applications of semaglutide. Government-funded and academic research ensures safety is confirmed, aids in clinical innovation, and frequently paves the way for subsequent commercial use. As worldwide demand for weight control and the treatment of chronic diseases remains high, their efforts will be crucial.

Together, the global Semaglutide API market is aided by a well-balanced composition of players. Ranging from large pharma companies to research centers, each category of end user presents a distinct role. Their combined push not only fuels existing demand but also directs the future pathway in which semaglutide will be utilized throughout the healthcare industry.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,522.04 million |

|

Market Size by 2032 |

$4,103.12 Million |

|

Growth Rate from 2025 to 2032 |

15.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

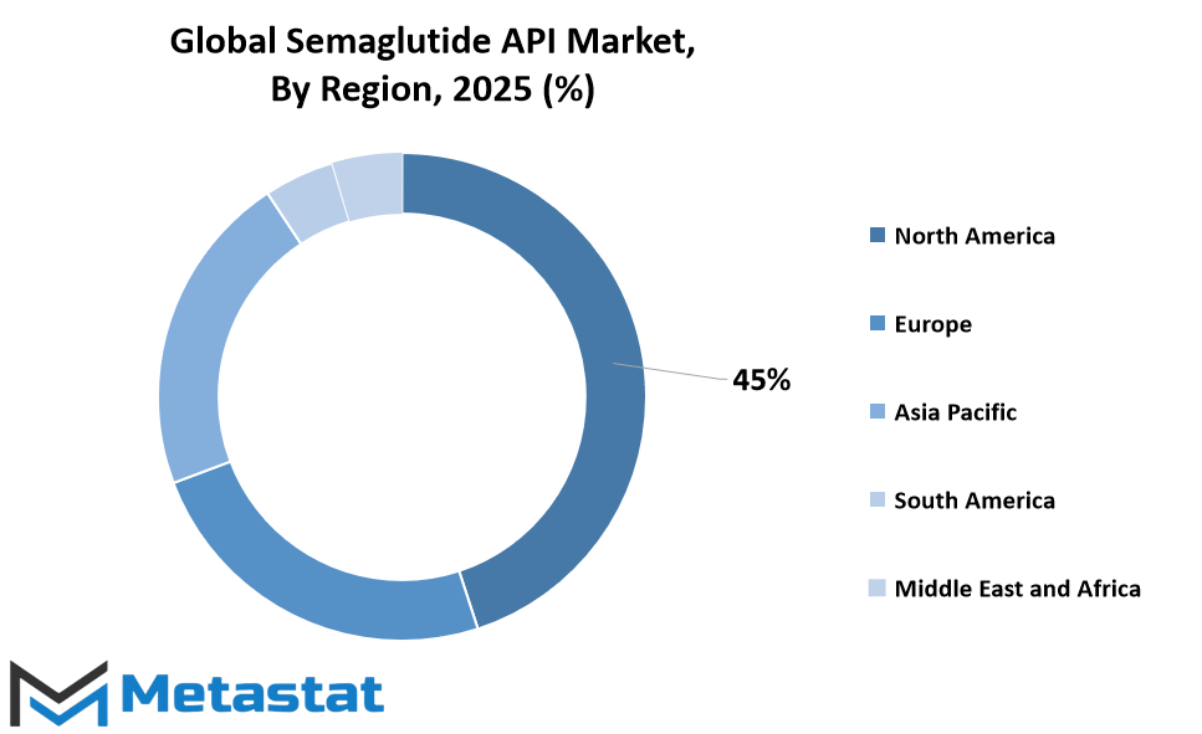

The global Semaglutide API market demonstrates a substantial geographical reach, with demand increasing in several regions as the healthcare system and pharma research grow. North America is outstanding, specially inside the United States, wherein the provision of famend pharma businesses and excessive diabetes incidence hold the marketplace developing. Canada and Mexico additionally pressure the regional call for, though at a smaller scale. With growing focus of GLP-1 receptor agonists consisting of Semaglutide and rising R&D investments, the North American continent holds a commanding role in this arena.

Europe takes a near 2nd position, with countries consisting of the United Kingdom, Germany, France, and Italy being key players in furthering the utility and production of Semaglutide APIs. These international locations are diagnosed for having favorable healthcare policies, clear regulatory frameworks, and an amazing base of pharmaceutical manufacturers. As increasing numbers of sufferers have get admission to to contemporary diabetes care and weight control solutions, the European market keeps to make consistent gains. Western Europe is out in front, despite the fact that the Rest of Europe is ultimate the distance thanks to expanded healthcare infrastructure and clinical recognition.

The Asia-Pacific market is experiencing dramatic boom, pushed frequently with the aid of populous international locations which includes India and China. These international locations are experiencing a upward push in diabetes instances, causing governments and private investors to increase their healthcare efforts. Japan and South Korea also play a prime role, as a result of their sturdy pharmaceutical sectors and emphasis on innovation. Efficient production and skilled hard work make Asia-Pacific the place of choice for global corporations to installation manufacturing and R&D facilities. As a result, this place is rising as a aggressive participant within the global Semaglutide API market.

In South America, Brazil and Argentina dominate. Both nations are experiencing enhanced access to healthcare and enhanced government assistance towards chronic disease care. While the size of the market here is smaller than in others, the increase in lifestyle diseases will generate new opportunities. The Rest of South America, though developing, is slowly becoming more engaged in pharmaceutical use and trade.

The Middle East & Africa region has also got promise, particularly in GCC nations, Egypt, and South Africa. With growing healthcare awareness and economic stability, an increasing number of people are getting diagnosed and treated for diabetes and other diseases. These regions are putting efforts into developing medical infrastructure and collaborations with multinational pharma companies. Though there are still some challenges like affordability and access, the market is gradually picking up all over the region, adding to the overall global growth of the Semaglutide API market.

COMPETITIVE PLAYERS

The global Semaglutide API market is increasing steadily due to rising demand for efficient treatment of type 2 diabetes and obesity. Semaglutide, which is a glucagon-like peptide-1 (GLP-1) receptor agonist, has produced impressive results with regard to the improvement of blood glucose control and weight loss and has, therefore, become the preferred medication for patients and clinicians alike. With the global health community still aiming at long-term options for long-term chronic metabolic diseases, the supply of semaglutide active pharmaceutical ingredients (APIs) is bound to increase. The increasing demand is spurring producers and suppliers to enhance production capacity, maintain quality, and make their supply chain more efficient.

Several companies are making their presence felt in producing and formulating Semaglutide API. Some of these players are Bachem Holding AG, AmbioPharm Inc., JPT Peptide Technologies GmbH, Chempep Inc., CEM Corporation, and GenScript Biotech Corporation. These players, each in their own way, offer a unique strength — ranging from good synthesis quality to timely delivery and affordable manufacturing. These companies, with the growth of peptide-based therapeutic solutions, have been looking for improved technologies and alliances to address growing global demands.

Creative Peptides, CPC Scientific Inc., Neuland, Chemwerth, and Chemxpert form a part of this competitive scenario as well. They are actively engaged in research, innovation, and mass production to address the expanding demand from pharmaceutical companies globally. Their emphasis on compliance, purity, and scalability aids worldwide drugmakers in introducing or sustaining semaglutide-based cures. With an increasing emphasis on affordability and get entry to in growing economies, these firms are expected to grow further and accommodate regional regulatory norms.

Demand for semaglutide APIs is also impacted through ongoing clinical trials, government-driven healthcare programs, and developing uptake of GLP-1 treatments outside the confines of diabetes care, for heart and kidney-related benefits. As the uses of semaglutide make bigger, so too does the demand for pinnacle-great API, retaining manufacturers in line to supply amount as well as best. The role of pro providers becomes more and more crucial as the scientific discipline actions towards greater sophisticated treatments.

Overall, the global Semaglutide API market holds superb potential. With a extensive array of gamers engaged to keep up with demand, the market is subsidized by using each reliability and innovation. The future of this industry will depend upon how successfully groups manage pleasant, scalability, and compliance, even as addressing the growing health needs of a worldwide populace.

Semaglutide API Market Key Segments:

By Purity Level

- ≥ 95%

- ≥ 98%

- Pharmaceutical Grade

By Synthesis Method

- Solid-Phase Peptide Synthesis (SPPS)

- Liquid-Phase Peptide Synthesis (LPPS)

- Hybrid Synthesis

By Application

- Type 2 Diabetes Treatment

- Research Use

- Obesity Management

- Cardiovascular Risk Reduction

By End User

- Pharmaceutical Companies

- Biotechnology Firms

- Contract Development & Manufacturing Organizations (CDMOs)

- Research Institutions

Key Global Semaglutide API Industry Players

- Bachem Holding AG

- AmbioPharm Inc.

- JPT Peptide Technologies GmbH

- Chempep Inc.

- CEM Corporation

- GenScript Biotech Corporation

- Creative Peptides

- CPC Scientific Inc.

- Neuland

- Chemwerth

- Chemxpert

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252