MARKET OVERVIEW

The Saudi Arabia Cosmetic Surgery market is an industry that has been rapidly developing and changing how people define beauty and see themselves. With an open society advancing in new, modernistic definitions of beauty and advancements in science and technology, this would propel the cosmetic surgical market further. Aesthetic interventions as well as reconstructive procedures are to be demanded in this field since people have started investing more in this kind of procedure, be it for self-esteem or because of medical necessities.

It comprises the majority of surgical procedures that are noninvasive and very minor in nature, like Botox and fillers, and much more significant surgical procedures like facelifts, breast augmentations, and liposuctions. This is because advanced techniques and technology must be used to cater to different clients in this profession. The growing interest in self-enhancement will lead to new innovations in the way surgeries are performed, further attracting individuals who are eager to invest in cosmetic procedures. With an increasing focus on personalized treatment plans and recovery experiences, the market is poised to continue expanding Saudi Arabialy.

The Saudi Arabia Cosmetic Surgery market is very diverse and involves all genders because both men and women pursue cosmetic enhancements. Cultural factors, as well as media coverage of idealized beauty, will decide such procedures. Surgeons will adapt the changing paradigms of beauty with customized solutions capturing a wide range of body shapes, skin tones, and facial forms. Cosmetic surgery, now perceived as an integral part of daily health care and wellness programs, means that those who choose cosmetic services would opt for services best-suited to fulfill their requirements, thereby increasing the demand for this business.

The future of medical technology will see advancements that promote less invasive, more accurate procedures with less recovery time. Innovations such as robotic-assisted surgeries and 3D imaging for preoperative planning will allow cosmetic surgery professionals to achieve greater safety with better results. Such technologies are likely to change the face of surgeries performed and will be made more accessible and appealing to a broader population.

More intricate procedures will demand the services of more competent cosmetic surgeons to ensure that surgery is conducted in a safe manner with the market still growing. More stringent professional education and certification will be demanded for professionals in the industry, thereby ensuring patients receive the best care and results possible.

Regulatory bodies will keep the market clean by preventing the practice of malpractice cases from going to cover. With increased safety and acceptance of cosmetic surgery, more people are expected to opt for such procedures, and therefore the demand is likely to rise steadily across the world. In the future, the Saudi Arabia Cosmetic Surgery market is going to see further integration of digital technologies. As more people take online consultations, use virtual reality, and augmented reality, patients will be able to see their desired outcomes better.

This would also see the use of artificial intelligence in diagnostic tools and surgical planning, thus giving better outcomes to both doctors and patients. The increased availability and personalization of cosmetic surgery procedures are expected to fuel huge growth in the market for years to come. Essentially, Saudi Arabia Cosmetic Surgery market is better positioned to continue growing and take advantage of technological advancements, changes in demographics, and other shifts in beauty standards. With the growth of this industry, patients will increasingly be offered more personalized and safer, innovative procedures which can definitely make cosmetic surgery a still good option for those who desire aesthetics.

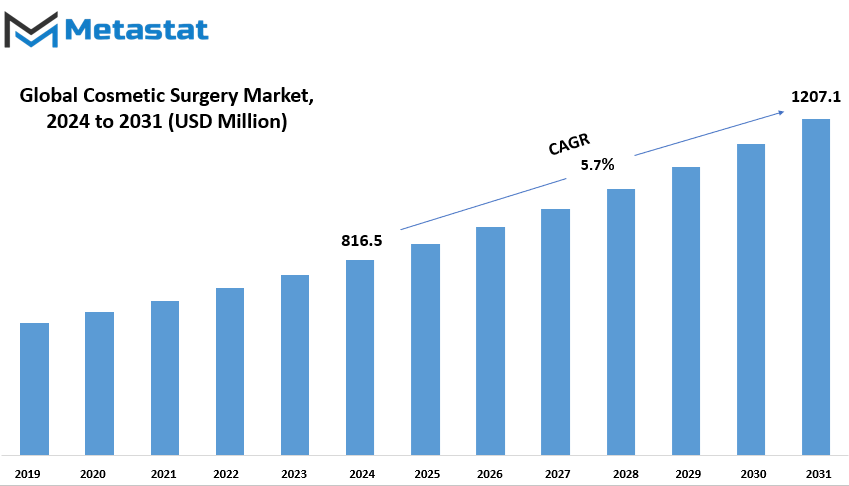

Saudi Arabia Cosmetic Surgery market is estimated to reach $1207.1 Million by 2031; growing at a CAGR of 5.7% from 2024 to 2031.

GROWTH FACTORS

Changes over time in Saudi Arabia Cosmetic surgery market in that country: Several factors drive such change over time in this industry. The main cause of the growth factor, however is the high demand of aesthetic improvement. When more conscious people appear about themselves as well as personal grooming habits, there comes out an aesthetically improved change which many people nowadays achieve from it through the help of cosmetic surgeries. This is highly apparent in both developing and developed countries, where individuals are aware of how they can improve their appearances. Such a growing demand stimulates the growth of the Saudi Arabia cosmetic surgery market as even more people want to get a procedure that will transform them.

Another key driver is the advancements in minimally invasive procedures, which make cosmetic surgery appealing to a larger audience. These procedures carry less risk, have faster recovery times, and less pain than traditional surgeries, thus popularizing them even more. With advancing technology, the minimally invasive options are becoming more complex, thereby encouraging people to opt for these as a suitable alternative to more invasive surgery. The preference for this shift has mainly contributed to the growth of the overall market, where more and more people opt for such procedures for aesthetic improvement.

However, there are certain limitations that restrict the growth of the market for cosmetic surgeries. Some of the major concerns are the high cost and thereby not affordable for most sections of the population. Economic insecurity also affects demand as no one would like to indulge in cosmetic surgeries when no one knows how the economy might shape up in the long term. All these can limit access to the market and hinder the industry from growing at its normal rate in areas where economic instability exists.

Moreover, regulatory issues and safety factors have been a big hurdles for the growth of this market. Cosmetic surgery laws in every country vary. As such, this is sometimes a source of confusion for those seeking safe procedures from known clinics. Other issues relating to safety and efficiency will be a hindrance for one seeking cosmetic surgery since most will be scared off due to lack of clear-cut risks.

Despite these challenges, there are ample opportunities for growth in the cosmetic surgery market. For instance, cosmetic surgery is increasingly being accepted in emerging markets. As these markets develop and grow in affluence, there is a projected rise in demand for cosmetic procedures. This shift is creating new growth avenues for the industry. Moreover, on-going technological advancements will probably open more room for safer, effective and affordable procedures, so in the years to come, cosmetic surgery will become increasingly accessible to a much greater population.

MARKET SEGMENTATION

Type

The cosmetic surgery market can be broadly categorized into two segments: Surgical Procedures and Non-Surgical Procedures. The Non-Surgical Procedures segment accounted for 345.2 USD Million in 2023, which is approximately 43.5% of the total market share in that year. This segment includes treatments such as Botox injections, dermal fillers, and laser skin resurfacing, which are less invasive compared to surgical options. Non-surgical procedures have been very popular because of convenience, minimal recovery time, and results that are noticeable even without spending much time for recuperation.

The segment is believed to expand at a CAGR of 6.59% from 2024 to 2031. It will therefore fetch the value of 558.9 USD Million during this period. The trend, which involves an upswing for this group as a whole, has become dominant due to several drivers for these growths: advancements in the technology itself, treatment availability with options, and an up-gradation towards self-care along with aesthetic requirements. More and more people are now seeking these procedures to beautify themselves without major surgery, given the continued improvement in the effectiveness and safety of these procedures.

The popularity of minimally invasive treatments is also related to new attitudes toward cosmetic procedures. Many people are looking for alternatives that do not require any surgical intervention. They simply want to enhance or regain their looks without long recovery times associated with more invasive surgeries. Moreover, the cost tends to be relatively lower and, therefore, can reach many more people.

The non-surgical procedures sector of the cosmetic surgery industry has witnessed significant growth within the past few years. The growth is anticipated to continue with a healthy momentum during the next ten years. In 2031, the segment is likely to have a value of approximately 558.9 USD Million and, by all means, will remain in the mainstream market for consumers to pick as a more aesthetic but less invasive alternative for cosmetic correction.

By Age Group

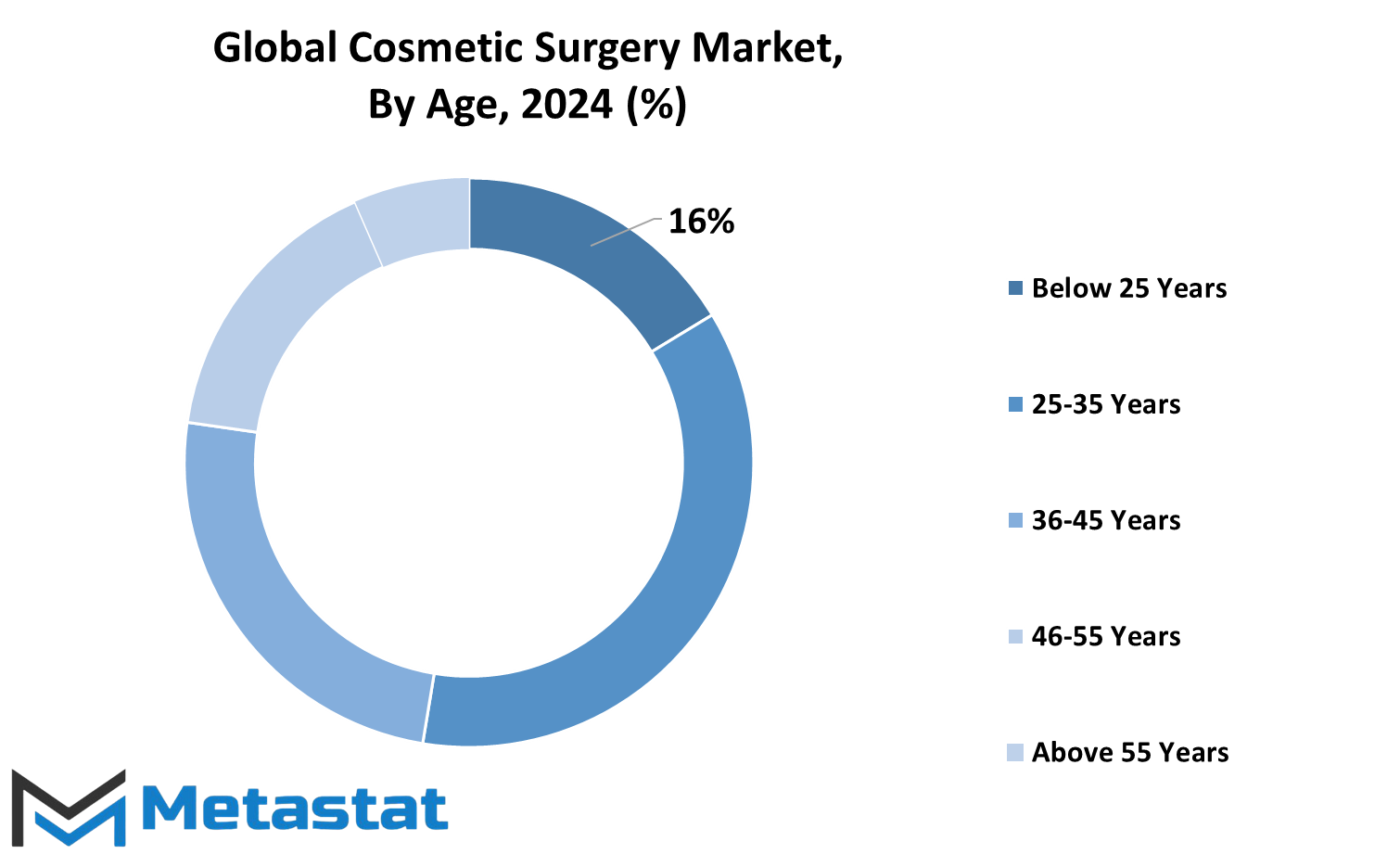

The market is segmented into age groups, which are Below 25 Years, 25-35 Years, 36-45 Years, 46-55 Years, and Above 55 Years. This segmentation helps businesses understand the preferences and behaviors of different age demographics. The needs and purchasing patterns of individuals in each age group can differ significantly, so dividing the market in this way makes it easier to create targeted products and services.

Market and products for the Below 25 Years group are likely going to have a focus on younger consumers more engaged in using technology. The Below 25 Years age group are relatively looking for cheap alternatives; they are usually trend-dependent, social media, or what their friends tell them that is cool. Brands should consider appealing to this age bracket with trendy, innovative products, and digital marketing strategy that resonates with that lifestyle.

The 25-35 Years group is a transitional age where people may be starting their careers, settling into adulthood, or beginning families. This age group will have more disposable income than the younger group and possibly require higher-quality or more durable products. Marketing to this group will need to encompass both professional and personal aspects of their lives, targeting convenience, style, and practicality.

In the 36-45 Years category, individuals are likely at the height of their professional and family lives. The purchasing decisions for such individuals tend to be more pragmatic and value-driven, with better-established financial situations. This group would be interested in products that emphasize comfort, efficiency, and family-centric solutions. They may also seek products that align with their health and wellness goals, which makes this an important group for businesses offering those types of products.

The 46-55 Year old group is normally set in a stability phase both from a financial and personal view. In this phase of life, consumers may tend toward products that improve their lives, such as luxury goods and health-oriented products, also comfort and leisure solutions. Marketing to this age segment will most probably revolve around reliability, durability, and well-being.

Finally, the Above 55 Years age group represents consumers who are either entering into retirement or nearing retirement age. This age group likely focuses on products that enhance one's lifestyle through convenience, comfort, or health. Such consumers may not have strong purchasing power as younger generations, but they tend to value products that ensure long-term well-being and monetary stability. The age groupings help the businesses in tailoring their products, marketing, and services in relation to each age group's specific needs and preferences.

By End-User

The market can further be categorized by end-users in the two main categories, such as hospitals and clinics. Among all these, the category of hospitals is one major factor in this market since hospitals offer a holistic level of healthcare services to the patient populations across various medical disciplines. They are equipped with advance technologies in medicine and possess wide-range healthcare professionals in-house. Hospitals will mostly possess resources and capacity for even more complex medical procedures and surgical practices and emergency care. Hospitals, due to the size of operations and their ability to treat large volumes of patients, form the core players of healthcare operations.

On the other hand, clinics are focused on offering more specialized or routine care in a more accessible setting. Clinics are usually smaller compared to hospitals and offer outpatient services. They usually offer preventive care, diagnosis, and treatment of common health issues. Clinics are ideal for patients who want non-emergency care or follow-up visits for continued treatments. They can be located in many communities and are more localized and personal in healthcare delivery.

Both hospitals and clinics complement each other in the healthcare system, meeting different needs for patients. While hospitals offer more extensive, high-tech medical care, clinics provide a more approachable environment for everyday health concerns. Each end-user category has its own unique set of requirements, which drives the demand for products and services within the healthcare market. The growth of these sectors would depend on increasing demand for quality care, an aging population, and developments in medical technology.

With the progression of health care, this will continue, where hospitals, as well as clinics, shall adapt and provide services meeting the needs of the patients. Hospitals would look to widen their treatment facilities to incorporate specialized treatment and clinics should look to streamline routine healthcare provision. Together, these end-users will shape the future of healthcare delivery, ensuring that all people get the care they deserve, whether it is an advanced procedure or a simple check-up. The lines between hospitals and clinics then help in more efficient and focused provision of diverse healthcare needs among the population.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$816.5 million |

|

Market Size by 2031 |

$1207.1 Million |

|

Growth Rate from 2024 to 2031 |

5.7% |

|

Base Year |

2022 |

COMPETITIVE PLAYERS

A few notable players include organizations which are responsible for the large number of cosmetic surgery organizations. Key players include the highly recognized and reputed healthcare service provider in the form of King Faisal Specialist Hospital & Research Centre and Cynosure UK Ltd which is another well-known player who has received significant recognition due to innovation in aesthetic technology. Enfield Royal Saudia is one of the biggest brands in the region that performs cosmetic surgery procedures, as well as the Dr. Sulaiman Al Habib Medical Group, which has built one of the most robust presences via its network of specialized healthcare institutions. NMC Healthcare is amongst the largest private healthcare providers in this region, providing a wide spread of cosmetic surgery services across this extensive network of hospitals and clinics.

The Derma Clinics is the other significant company, operating in dermatology and aesthetics, with services being provided by skin care and rejuvenation. Al Hammadi Hospital, due to its services related to cosmetic surgery, is one of the primary healthcare providers within the industry. Mouwasat Medical Services provides various services, such as cosmetic surgery, at established hospitals. Cosmoderm Clinics and Kaya Skin Clinic are leading names in the cosmetic surgical field. They offer not only advanced skin care treatments, but also surgery that beautifies and improves health.

Novomed Centers are famous for the wide portfolio of medical and aesthetic procedures and Harley Clinic Saudia is more for skilled surgeons and modern facilities. Medcare is another trusted name in cosmetic surgery, known for its high-quality services and advanced technologies. Lastly, Dubai Plastic Surgery Clinic by Dr. Riad Roomi is highly regarded for its expertise in cosmetic surgery, providing patients with personalized care and exceptional results. These and other organizations have become the leading entities in cosmetic surgery, striving to innovate and improve upon aesthetic procedures. Through their excellence, they provide various services that would help address the ever-growing demand for cosmetic enhancements and ensure the best care for patients with the most optimal results. Their influence keeps on shaping the future of cosmetic surgery, making them necessary players in the industry.

Saudi Arabia Cosmetic Surgery Market Key Segments:

By Type

- Surgical Procedures

- Non-Surgical Procedures

By Age Group

- Below 25 Years

- 25-35 Years

- 36-45 Years

- 46-55 Years

- Above 55 Years

By End-User

- Hospitals

- Clinics

Key Saudi Arabia Cosmetic Surgery Industry Players

- King Faisal Specialist Hospital & Research Centre

- Cynosure UK Ltd

- Enfield Royal Saudia

- Dr. Sulaiman Al Habib Medical Group

- NMC Healthcare

- Derma Clinics

- Al Hammadi Hospital

- Mouwasat Medical Services

- Cosmoderm Clinics

- Kaya Skin Clinic

- Novomed Centers

- Harley Clinic Saudia

- Medcare

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252