MARKET OVERVIEW

The global retail execution software market is building an industry that will revolutionize the way companies think about in-store operations and customer interaction over the next few years. With retail environments turning into more experiential spaces, the use of digital tools for effortless execution will no longer be a choice but a strategic imperative. This software segment will go much beyond its present use as mere basic compliance and task management, becoming a smart ecosystem that predicts consumer behavior and equips decision-makers with real-time data.

Future deployments will focus on hyper-personalized solutions that fit distinct business models while being agile enough to adapt to volatile market conditions. Rather than being seen as a mere operational weapon, retail execution software will be the foundation for integrated retail strategies. It will hyperlink area representatives, providers, and retailers in a harmonized way wherein all moves are synchronized with client wishes and logo objectives. This exchange will come approximately as businesses undertake predictive analytics, allowing them to anticipate shifts in call for and better optimize vending techniques earlier than troubles occur.

The zone will see elevated incorporation of synthetic intelligence and device mastering functionality, permitting shops to advantage greater than easy historic insights. Such technologies will transform uncooked records into actionable intelligence, informing decisions with a view to reduce operational inefficiencies whilst maximizing profitability. Further, software structures will easily integrate with different enterprise packages like inventory control and purchaser courting systems, supplying a centralized environment for all retail features. This integrated infrastructure will open the door to precision-based execution techniques that evolve in real time.

Another factor that will define the future of the global retail execution software market will be whether it is capable of augmenting the human aspect and not diminishing it. Field agents will use easy-to-use mobile interfaces to perform tasks with ease, aided by automated systems that minimize mistakes and maximize compliance. The move towards visual merchandising that is fueled by augmented reality will bring creativity and precision into one platform, allowing brands to ensure consistency across various locations.

As global retail execution software market grow and purchaser expectancies boom, companies may be dependent on these answers to keep operations in music at the same time as growing efficiently. The emphasis will move faraway from reactive techniques and towards proactive fashions wherein technology anticipates disruptions and prescribes remedies in real-time. This method will present scope for companies to provide world-class customer experiences all the time, irrespective of location.

Eventually, the global retail execution software market will exceed its existing definition, as a growth and innovation strategic enabler. It will not just automate processes but also bring a fresh vision of how retail businesses function in a technologically enabled world. By infusing intelligence in every layer of execution, this market will create a future where efficiency, agility, and consumer-centric strategies are no longer a desire but achievable norms.

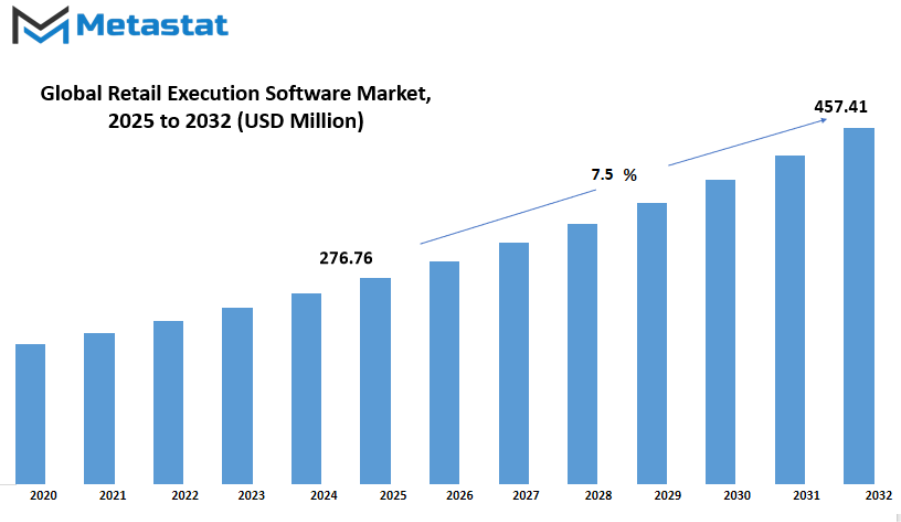

Global retail execution software market is estimated to reach $457.41 Million by 2032; growing at a CAGR of 7.5% from 2025 to 2032.

GROWTH FACTORS

The global retail execution software market is getting more attention as companies look for improved means of managing store-level operations and overall efficiency. Retailers are turning to tools that can improve sales performance, inventory monitoring, and adherence to merchandising plans. This kind of software is fast becoming a requirement for brands and retailers that require real-time visibility of what occurs at the store level. It assists in closing the gap between strategy and action to guarantee that plans become quantifiable outcomes.

One significant category in the global retail execution software market is deployment type, which provides businesses with flexibility according to their requirements and budget. On-premises options, worth $108.52 million, are still an option for businesses that want to maintain complete control over infrastructure and data. These options are deployed on company servers and provide greater customization, which is deemed essential to some organizations for security and compliance purposes. Nevertheless, these tend to demand dedicated IT resources and higher initial investment.

Cloud deployment, however, is gaining traction due to its ability to scale and lower initial cost. Cloud software lets companies have access to the program at any place, making it the best for teams operating at different locations. Cloud answers minimize the demand for bulky infrastructure and ease the updating technique, with the entirety being controlled remotely by using the provider of the service. This technique also comprises actual-time information sharing, allowing firms to respond fast to marketplace and purchaser wishes.

The alignment of these fashions of deployment offers companies the flexibility to select what's most suitable for his or her commercial enterprise. Some agencies pass for on-premises structures for security and management at the same time as others go for the cloud for convenience and flexibility. Both strategies are fueling the development of retail execution software program, as outlets appearance to enhance visibility, boost productivity, and deliver a continuing shopping revel in. Competition inside the retail industry will force call for higher for those solutions as groups are forced to apply tools that allow them to execute more effectively.

MARKET SEGMENTATION

By Deployment Type

The global retail execution software market is building an industry that will revolutionize the way companies think about in-store operations and customer interaction over the next few years. With retail environments turning into more experiential spaces, the use of digital tools for effortless execution will no longer be a choice but a strategic imperative. This software segment will go much beyond its present use as mere basic compliance and task management, becoming a smart ecosystem that predicts consumer behavior and equips decision-makers with real-time data.

Future deployments will focus on hyper-personalized solutions that fit distinct business models while being agile enough to adapt to volatile market conditions. Rather than being seen as a mere operational weapon, retail execution software will be the foundation for integrated retail strategies. It will hyperlink subject representatives, providers, and retailers in a harmonized way in which all actions are synchronized with patron wishes and brand targets. This alternate will come about as organizations undertake predictive analytics, allowing them to count on shifts in call for and higher optimize vending strategies earlier than problems occur.

The sector will see extended incorporation of synthetic intelligence and device studying functionality, allowing outlets to gain more than easy historical insights. Such technologies will remodel raw information into actionable intelligence, informing decisions in an effort to reduce operational inefficiencies whilst maximizing profitability. Further, software structures will easily integrate with other agency programs like stock control and customer relationship systems, imparting a centralized environment for all retail features. This incorporated infrastructure will open the door to precision-based totally execution methods that evolve in real time.

Another factor that will define the future of the global retail execution software market will be whether it is capable of augmenting the human aspect and not diminishing it. Field agents will use easy-to-use mobile interfaces to perform tasks with ease, aided by automated systems that minimize mistakes and maximize compliance. The move towards visual merchandising that is fueled by augmented reality will bring creativity and precision into one platform, allowing brands to ensure consistency across various locations.

As worldwide markets develop and consumer expectancies increase, companies could be dependent on these answers to preserve operations in tune whilst developing efficaciously. The emphasis will flow far from reactive tactics and closer to proactive models in which generation anticipates disruptions and prescribes remedies in actual-time. This approach will present scope for groups to offer international-elegance purchaser studies all of the time, no matter location.

Eventually, the global retail execution software market will exceed its existing definition, as a growth and innovation strategic enabler. It will not just automate processes but also bring a fresh vision of how retail businesses function in a technologically enabled world. By infusing intelligence in every layer of execution, this market will create a future where efficiency, agility, and consumer-centric strategies are no longer a desire but achievable norms.

By Organization Size

The global retail execution software market is seeing strong interest as companies work to make their operations more streamlined and efficient overall. Such software program packages are aimed at allowing stores to govern the entirety from stock and income to promotions in actual time, making for a rigorous and efficient approach of retail management. With growing call for visibility and manipulate, businesses are embracing sophisticated tools to stay competitive in a panorama where purchaser requirements and marketplace forces are in a kingdom of flux. This emphasis on generation-based solutions is remodeling the nature of commercial enterprise, so retail execution software is now a mandatory factor of modern retail strategies.

When thinking about the global retail execution software market primarily based on company size, it's far extensively classified into Small and Medium Enterprises (SMEs) and Large Enterprises. Both segments have their character wishes and adoption behavior, which have an effect on the marketplace's typical growth. SMEs tend to have restrained assets, so it will become crucial for them to select low-price and clean-to-enforce solutions. Retail execution software program for this tier generally specializes in simplicity, scalability, and occasional costs, so that SMEs are not careworn by means of heavy economic or technological hundreds. With this accessibility, SMEs can compete with important players and keep their floor in a distinctly competitive market.

Large corporations, however, have more requirements because of their large operations, numerous store locations, and intricate distribution networks. For such organizations, retail execution software is critical to drive consistency between regions and as well as corporate compliance. Large enterprises need advanced analytics, automation capabilities, and integration features to enhance decision-making and operational effectiveness. Such companies are likely to spend on strong systems that offer end-to-end visibility to optimize product placement to marketing campaigns.

Both SMEs and large corporates value retail execution software, but both have different priorities depending on size and complexity. While SMEs search for value-powerful, smooth-to-use structures where they could scale up without overburdening sources, massive corporates require excessive-powered solutions to control massive records sets and hook up with other enterprise platforms. This divergence in demand gives an possibility for software program organizations to create custom designed answers for various segments of the marketplace. With digitalization driving the retail industry forward, the usage of such software is likely to grow, helping businesses of all sizes become operationally excellent and Customer Delight-oriented.

The global retail execution software market is going to keep growing with businesses seeking out new ways to remain competitive in an increasingly dynamic business scenario. By catering to the unique requirements of both small and medium-sized businesses as well as larger organizations, software makers are creating the future of intelligent retail management. From making things easier for smaller businesses to providing sophisticated capabilities for international organizations, retail execution software is proving to be a key weapon for success in contemporary retailing.

By Application

The global retail execution software market is transforming the way organizations manage operations and connect with customers. Companies are more and more turning to era to streamline their methods and increase productiveness. This marketplace is gaining interest as stores purpose to preserve consistency across numerous channels and locations. With growing opposition and the need for correct, real-time statistics, agencies are counting on software program answers that may simplify execution obligations and enhance performance. The demand for these tools maintains to develop because they help companies live prepared and adapt to changing client expectations.

By application, the global retail execution software market is further divided into Retail Operations, which makes a specialty of dealing with in-keep activities correctly. This area guarantees cabinets are stocked properly, promotions are executed as planned, and shops keep a strong emblem presence. Field Service Management is any other important section that facilitates businesses screen and manipulate field groups. Through this application, businesses can agenda obligations, tune performance, and remedy problems fast. Mobile Forms Automation is gaining popularity because it eliminates the need for paper-based totally tactics, making statistics collection faster and greater accurate. These capabilities store time for employees and help businesses preserve correct statistics without guide errors.

Field Sales is a essential application that helps income representatives in managing their sports at the move. It gives tools for order taking, stock assessments, and reporting, which improve ordinary sales performance. Trade Promotion Management, on the other hand, helps organizations plan, execute, and track promotional campaigns effectively. This guarantees that resources are used wisely and campaigns deliver the anticipated results. Employee Engagement applications additionally play an important function in preserving staff inspired and knowledgeable. These equipment frequently offers schooling materials, communication channels, and overall performance tracking features that decorate team productivity.

Other packages include solutions designed for area of interest duties or specialized approaches. Businesses use those to deal with particular demanding situations or enterprise-precise necessities. As retailers retain to stand pressure from each on-line and offline competition, the function of execution software becomes even extra massive. These applications no longer only improve operational performance but additionally decorate consumer pleasure by way of ensuring consistent service and well timed responses. The destiny of this market will probable see similarly integration of advanced technologies inclusive of artificial intelligence and analytics to make methods smarter and extra predictive.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$276.76 million |

|

Market Size by 2032 |

$457.41 Million |

|

Growth Rate from 2025 to 2032 |

7.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

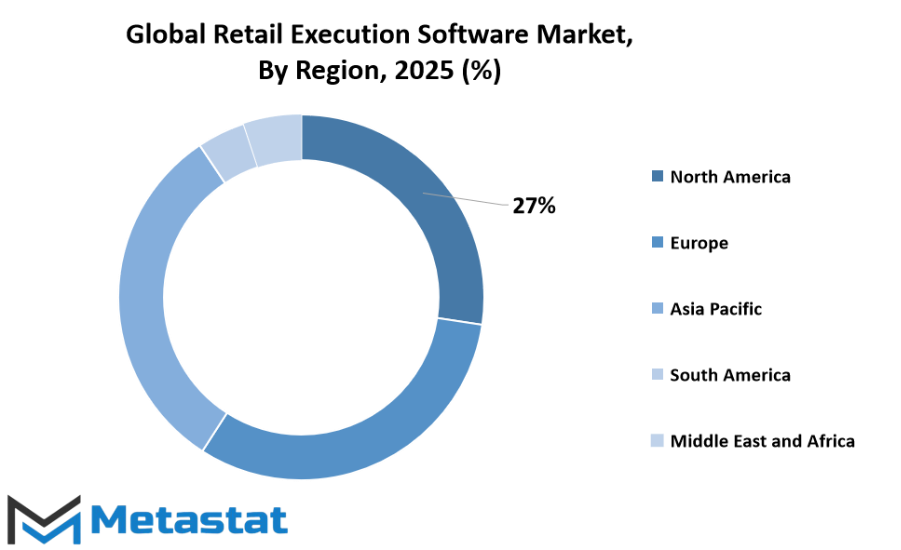

The global retail execution software market is expanding as global groups search for gear to improve income strategies, decorate visibility, and make certain better in-save execution. This growth is major across different regions, every contributing in specific approaches. Based on geography, the market is split into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, with every region displaying awesome traits motivated by using nearby business practices and consumer behavior.

North America is still a primary contributor to the marketplace due to its superior retail infrastructure and strong adoption of era. The place is in addition divided into the U.S., Canada, and Mexico, with the U.S. Main due to its established retail giants and the demand for analytics-pushed answers. Retailers in this location recognition closely on statistics integration and actual-time insights, which makes the want for execution software more substantial. Canada and Mexico also are witnessing growth, pushed via the modernization of retail structures and accelerated funding in digital gear.

Europe follows carefully, comprising nations just like the UK, Germany, France, Italy, and the Rest of Europe. This area advantages from a mature retail sector and a growing emphasis on compliance and inventory accuracy. Companies here purpose to enhance subject crew productivity and streamline distribution, which fuels demand for such software. The presence of several multinational retail manufacturers and an increasing hobby in optimizing save operations further helps market expansion in these countries.

Asia-Pacific represents one of the quickest-growing areas within the global retail execution software market. It includes India, China, Japan, South Korea, and the Rest of Asia-Pacific. This fast boom is fueled by way of the booming retail region, increasing urbanization, and rising purchaser spending. Countries like China and India are witnessing robust virtual transformation in retail, supported by way of huge-scale e-trade platforms and current alternate codecs. Japan and South Korea, with their tech-savvy populations, also make contributions substantially by adopting superior software program solutions to enhance operational efficiency.

South America and the Middle East & Africa are progressively strengthening their presence on this market. South America consists of Brazil, Argentina, and the Rest of South America, wherein the increase is supported through an expanding retail network and growing adoption of mobile-primarily based execution equipment. The Middle East & Africa, categorised into GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa, is seeing consistent development, largely pushed by using investments in retail modernization and the growing reputation of organized retail formats. Together, these areas spotlight the worldwide push closer to virtual transformation and operational excellence in the retail quarter.

COMPETITIVE PLAYERS

The global retail execution software market is also gaining major adoption as companies seek to streamline operations and enhance efficiency. This software aids brand and retail companies in controlling field forces, monitoring sales performance, and ensuring compliance with in-store standards. Demand for such solutions has increased as companies seek to increase visibility and maintain consistency across various locations. As retail settings get increasingly competitive, organizations are looking towards digital solutions offering real-time analysis and actionable information to enable better decision-making.

Retail Execution Software is a key driver in enhancing communication between head office and field staff. Through the use of these systems, businesses can schedule store visits, track shelf positions, and verify promotion compliance without any delays. The capacity for real-time capture and analysis of data facilitates quick response to challenges, making operations responsive and agile. The technology also aids in predicting trends and streamlining inventory to ensure that products arrive at the right place at the right time. The trend towards data-driven decision-making and automation is compelling most firms to implement these solutions.

Some large companies are spearheading innovation in this sector. Major players in the global retail execution software market include Salesforce, Pepperi, SAP SE, Vertex Computer Systems, Inc., Movista Inc., SimplyDepo, TELUS, Repsly Inc., StayinFront, Inc., Zipline, and Spring Global. These players offer platforms that help enhance workflow effectiveness, field productivity, and proper reporting. Their solutions include capabilities like task management, photo capture, GPS tracking, and performance analytics, which help retailers effectively implement strategies at the store level.

The future for Retail Execution Software continues to look strong as more companies adopt technology to become more competitive. Businesses are spending on sophisticated solutions that combine artificial intelligence and machine learning to provide greater insights and predictive analytics. This trend is sure to go on as companies look for means to enhance customer experience, streamline operations, and enhance sales performance. With stiff competition among vendors and growing demand from retailers of all sizes, the market will continue to grow, providing scope for ongoing innovation and expansion.

Retail Execution Software Market Key Segments:

By Deployment Type

- On-premises

- Cloud

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Application

- Retail Operations

- Field Service Management

- Mobile Forms Automation

- Field Sales

- Trade Promotion Management

- Employee Engagement

- Others

Key Global Retail Execution Software Industry Players

- Salesforce

- Pepperi

- SAP SE

- Vertex Computer Systems, Inc.

- Movista Inc.

- SimplyDepo

- TELUS

- Repsly Inc.

- StayinFront, Inc.

- Zipline

- Spring Global

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383