Global Content Delivery Network Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global content delivery network market and its associated industry were initially driven by a very basic necessity: to provide the users with online material quicker than a single server could possibly do. The late 1990s saw a period when websites were predominantly static pages and suffered very slow loading times, which the new concept found its way to the surface. Rather than having one data center, companies would use a geographic distribution of servers to place their most frequently accessed content (like pictures, downloads, and later on, streaming files) on more than one server, so at least one server would always be close to the user. This kind of architecture decreased the distance that the user had to travel to reach the data source, thus eliminating the delays caused by the early internet experience.

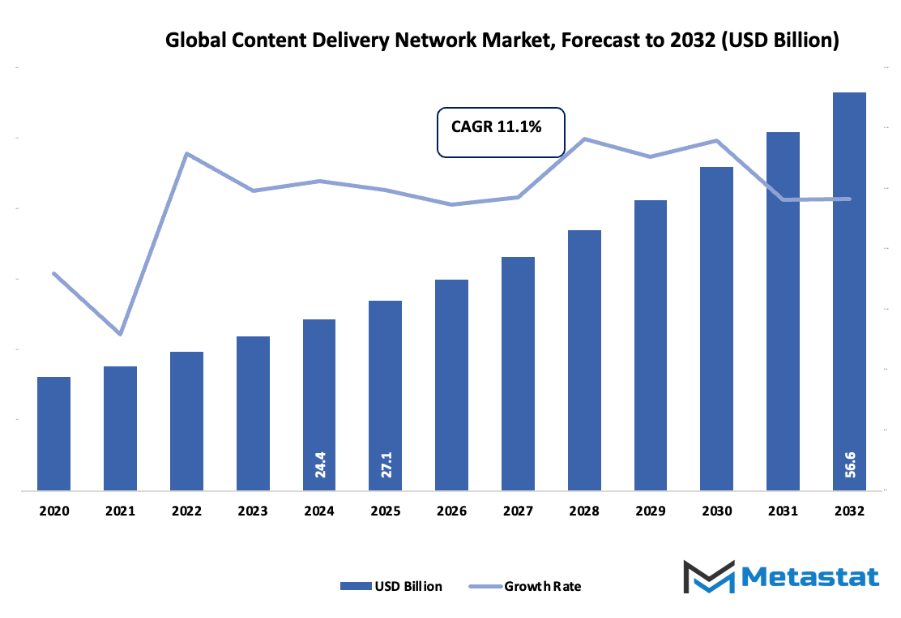

- The global content delivery network market is likely to be around USD 27.1 billion by 2025 with an annual growth rate of approximately 11.1% leading to a market size of more than USD 56.6 billion

- Web Performance Optimization segment captures almost 41.8% market share which acts as a major force encouraging the innovation and expansion of the applications by the intensive research.

- The significant trends boosting the market are increased usage of video streaming services, higher internet, and smart devices penetration.

- The rising demand for cloud-based services is one of the key areas where companies can invest.

- Insight: The market forecast shows exponential growth in value within the next decade, thus revealing substantial growth opportunities.

The moment of breakthrough was when video streaming platforms began to attract the masses. Immediately people wanted to access movies, shows, and even live broadcasts. Classic infrastructures were unable to cope with such demands and often went down when traffic was heavy. Content delivery networks took the matter into their hands, and they not only wisely routed the traffic but also balanced the settings so that billions could watch the same event simultaneously without any delay. Gradually, these networks were no longer just simple caching systems but fully developed platforms that were able to control the traffic flow in real time. They would soon be capable of providing dynamic content, personalized recommendations, and encrypted security for online payment transactions.

The smartphone revolution was the next big push in the market. People wouldn’t wait to get home anymore to take a look at or watch something. Mobile internet led to unforeseeable data use spikes all over the world. The technical fix for slow loading websites that turned into a critical backbone for entertainment, e-commerce, gaming, and remote communication was intercontinental data transfer. Governments started to put stronger data protection laws into practice and these networks had to use better encryption, be more strict in their privacy protocols, and route data regionally to fulfill the legal requirements.

The coming up of the technologies like interactive streaming and extended reality will make the networks keep on changing. They will be more dependent on automated systems and intelligent routing dictated by user behavior. The movement of data at a faster rate will be required not only by entertainment but also by other industries like digital education and virtual collaboration. The global content delivery network market will continue to determine how people connect to digital experiences, moving from mere data delivery to being a critical part of the internet's functioning.

Market Segments

The global content delivery network market is mainly classified based on Solutions, Service, Provider Type, Vertical.

By Solutions is further segmented into:

- Web Performance Optimization: The main purpose of web performance optimization is to ensure quicker access to pages and content that doesn't change. The faster the content delivery, the more users are likely to engage, and the less the abandonment rates. Content transfer is made quicker by means of modern caching, smart routing and resource compression. Along with the growth of the business, there is more interaction of users due to longer browsing and more sales even during the busiest hours.

- Media Delivery: Media delivery is the process of guaranteeing uninterrupted video streaming and top-grade digital content delivered all over the world. A dependable and trustworthy distribution system goes a long way in eliminating buffering and keeping the user hooked for a longer time. The data moves through the nearest server with less traffic, thanks to efficient routing. This way, the online entertainment and digital teaching platforms that demand the most all over the world can get their needs met.

- Cloud Security: The cloud security mechanism secures the data that goes through the distributed servers. The combination of strong encryption, real-time monitoring, and protective barriers shuts the doors on cyber threats. The security measures not only cut off the harmful traffic but also secure access for the authorized only. The companies get uninterrupted protection that gradually builds trust and that helps with meeting the stringent data safety standards compliance in various regions and industries.

By Service the market is divided into:

- Designing and Consulting Services: Designing and consulting services guide organizations in selecting suitable delivery solutions for digital content. Specialists evaluate current infrastructure, traffic demands and expansion plans. Personalized planning supports better performance and reduced costs. Expert guidance helps businesses use advanced delivery methods that match specific goals and future digital growth strategies.

- Storage Services: Storage services hold content in distributed data centers to reduce delays during user access. Cached files near the user allow quick viewing of media, documents and applications. Reduced server strain speeds up response time and enhances reliability during traffic surges. This supports consistent performance across global digital platforms.

- Analytics and Performance Monitoring: Analytics and performance monitoring track data movement and measure user experience. Detailed insights highlight delays, peak usage periods and error sources. Continuous tracking encourages timely improvements that keep services fast and stable. This performance data supports informed decision-making and improved service quality for digital platforms and applications.

- Website and API Management: Website and API management controls content flow between servers and digital services. Proper configuration supports faster responses and stable communication within applications. API oversight ensures smooth function of connected software. Website tuning helps businesses deliver consistent performance and better user interaction, even during high demand.

- Network Optimization Services: Network optimization services adjust routing paths to reduce distance between users and stored content. Intelligent load balancing spreads traffic evenly across multiple servers. Streamlined routing prevents congestion and supports better reliability. Optimized networks provide faster downloads and stable connections for online platforms across different locations.

- Other: Other services include custom development, migration assistance and support packages that help organizations handle unique delivery requirements. Specialized solutions address unusual traffic conditions or specific regulatory environments. Flexible service models allow adoption of features that match business size, industry demands and long-term digital expansion goals.

By Provider Type the market is further divided into:

- Traditional CDN: Traditional delivery uses large distributed server networks to move digital content closer to users. Established architecture supports ongoing reliability and predictable performance for websites and media platforms. Stable caching and routing processes reduce delays and support consistent service for organizations requiring fixed and dependable delivery methods.

- Telco CDN: Telco delivery integrates content distribution into telecommunications infrastructure. Network operators manage traffic with direct access to backbone connections, providing efficient routing and reduced congestion. Integrated services offer strong performance for high-traffic media streaming and enterprise data needs across multiple regions serviced by telecom networks.

- Cloud CDN: Cloud delivery relies on virtualized infrastructure to distribute content rapidly. On-demand scaling supports sudden traffic growth without physical server limitations. Flexible deployment enables faster setup and cost-efficient expansion. Cloud-based routing and caching deliver strong performance for businesses relying on digital platforms and remote user access.

- P2P CDN: P2P delivery shares data across a network of user nodes, reducing pressure on central servers. Distributed sharing supports stable access during heavy usage. Balanced resource sharing can improve speed while lowering operational costs. This method works well for platforms where content is frequently accessed by many users at the same time.

- Other: Other provider types include custom hybrid systems blending multiple delivery methods. Flexible infrastructure supports organizations with specialized content needs, unique security requirements or variable traffic patterns. Tailored configurations improve speed, reduce cost and maintain consistent performance during rapid service growth or market expansion.

By Vertical the global content delivery network market is divided as:

- Media & Entertainment: Media and entertainment use fast distribution to support smooth video streaming, gaming and digital events. Stable delivery reduces buffering and improves viewer satisfaction. High traffic during popular releases demands strong performance. Reliable content transfer supports audience engagement and revenue growth across large user bases.

- Advertisement: Digital advertisement benefits from quick content loading and real-time campaign updates. Rapid distribution of visuals and promotional material increases audience engagement. Faster viewing helps reduce bounce rates and enhances the effectiveness of marketing efforts. Timely delivery supports targeted advertising strategies across websites and mobile platforms.

- IT & Telecom: IT and telecom sectors use enhanced delivery to manage large volumes of data. Continuous connectivity supports cloud applications, software distribution and enterprise communication. Efficient routing and quick response times improve operational efficiency and customer satisfaction. Strong delivery performance supports modern digital services and remote business activity.

- Healthcare: Healthcare platforms require secure and reliable digital content transfer. Fast access to records, scans and telehealth platforms supports decision-making and improves user experience. Secure delivery methods protect patient data from unauthorized access. Stable infrastructure ensures uninterrupted service during critical digital healthcare operations.

- Government: Government platforms distribute public information, digital documents and secure data through reliable delivery methods. Strong security and stable performance support high traffic during public announcements or essential services. Quick loading and consistent system access build public trust and support smooth digital operations.

- Other: Other sectors include education, retail and finance, each benefiting from faster digital content access. Distributed infrastructure improves the reliability of online tools, learning platforms and transaction systems. Fast response times contribute to user satisfaction and stronger engagement across various digital environments.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$27.1 Billion |

|

Market Size by 2032 |

$56.6 Billion |

|

Growth Rate from 2025 to 2032 |

11.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

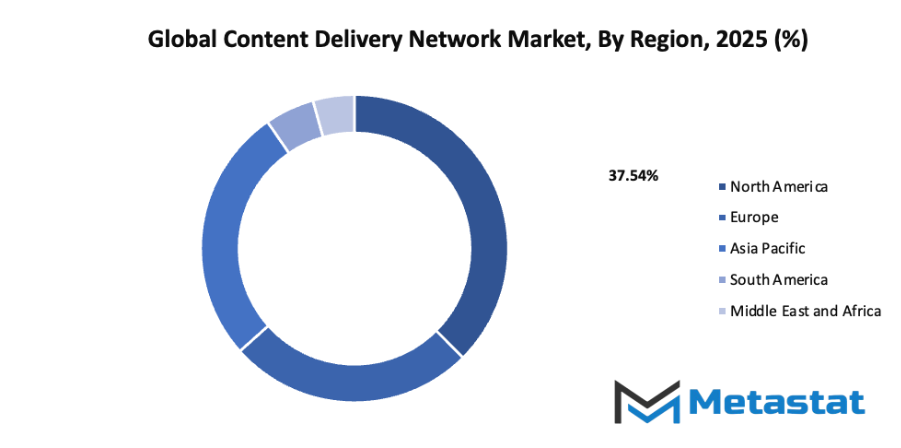

By Region:

- Based on geography, the global content delivery network market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Increased Use of Video Streaming Services:

Growing demand for video streaming services pushes companies to improve speed and stability of online content delivery. More viewers expect quick loading and smooth playback. To support this expectation, strong network support becomes necessary. The global content delivery network market gains attention as more platforms want fast data transfer for movies, shows, and online events.

Growth in Internet and Smart Device Penetration:

A larger number of homes and businesses now connect through high-speed internet and smart devices. Faster network access encourages more online browsing, shopping, and media use. More connected devices create greater demand for quick delivery of digital content. As a result, stronger delivery systems support consistent performance across many locations.

Challenges and Opportunities

High Initial Cost of Deployment:

A major challenge involves the large investment needed to set up advanced content delivery systems. Hardware, security, and skilled technical support require significant spending. Smaller companies may struggle to enter the market due to this cost barrier. This financial pressure slows expansion and decreases the number of new competitors.

Complexity in Management and Integration:

Building and maintaining a delivery network requires coordination across many platforms and servers. Different systems need smooth communication with one another. Managing this structure demands careful planning and constant monitoring. Any technical issue can interrupt content delivery and reduce service quality for online users.

Opportunities

Rising Demand for Cloud-Based Services:

More organizations now shift storage and data systems to the cloud to reduce physical infrastructure needs. Cloud solutions offer easier scaling and better flexibility for handling sudden online traffic. Businesses look for faster ways to deliver information to users, creating strong opportunity for advanced content delivery services.

Competitive Landscape & Strategic Insights

The competitive landscape of the global Content Delivery Network (CDN) market reflects a dynamic balance between established multinational corporations and fast-growing regional players. The presence of major companies such as Akamai Technologies, Amazon Web Services (AWS), Cloudflare, Limelight Networks, CDNetworks, Google LLC, Microsoft Corporation, and Fastly highlights the strength of innovation and the growing demand for reliable digital delivery systems. These organizations continue to invest heavily in infrastructure and technology to enhance speed, security, and efficiency across the network. Their strategies focus on improving global reach, reducing latency, and ensuring consistent service performance for businesses and consumers.

Alongside these global giants, regional competitors such as Tencent Cloud, Bunny.net, Imperva Inc., Lumen Technologies, G-Core Labs, Edgio Inc., and KeyCDN are gaining recognition by offering cost-effective and specialized solutions tailored to local markets. Many of these companies focus on partnerships and collaborations with telecom providers and enterprises to expand coverage and optimize network efficiency. The increasing demand for cloud-based services, video streaming, online gaming, and e-commerce continues to push the market toward greater diversification and competition.

Market size is forecast to rise from USD 27.1 billion in 2025 to over USD 56.6 billion by 2032. Content Delivery Network will maintain dominance but face growing competition from emerging formats.

Firms such as AT&T, Tata Communications, Deutsche Telekom, OnApp Limited, Citrix Systems, NTT Communications, Comcast Technologies, Broadpeak, StackPath, EVG Corp, and Kingsoft Cloud are further intensifying the competition through technological advancements and strategic acquisitions. These developments strengthen their positions and help deliver faster, more secure, and scalable CDN solutions. The focus across the market remains on improving user experience, maintaining strong data protection, and achieving seamless global connectivity. As digital content consumption continues to grow, strategic innovation and adaptive approaches will determine long-term success and sustainability within the CDN industry.

Report Coverage

This research report categorizes the global content delivery network market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global content delivery network market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global content delivery network market.

Content Delivery Network Market Key Segments:

By Solutions

- Web Performance Optimization

- Media Delivery

- Cloud Security

By Service

- Designing and Consulting Services

- Storage Services

- Analytics and Performance Monitoring

- Website and API Management

- Network Optimization Services

- Other

By Provider Type

- Traditional CDN

- Telco CDN

- Cloud CDN

- P2P CDN

- Other

By Vertical

- Media & Entertainment

- Advertisement

- IT & Telecom

- Healthcare

- Government

- Other

Key Global Content Delivery Network Industry Players

- Akamai Technologies

- Amazon Web Services (AWS)

- Cloudflare

- Limelight Networks

- CDNetworks

- Google LLC

- Microsoft Corporation

- Fastly

- Verizon Digital Media Services

- Rackspace Technology

- Tencent Cloud

- IBM Corporation

- Bunny.net

- Imperva Inc.

- Lumen Technologies

- G-Core Labs

- Edgio Inc.

- KeyCDN

- AT&T

- Tata Communications

- Deutsche Telekom

- OnApp Limited

- Citrix systems

- NTT Communications

- Comcast Technologies

- Broadpeak

- StackPath

- EVG Corp

- Kingsoft Cloud

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252