MARKET OVERVIEW

The global mobile security market occupies the nexus of cybersecurity and telecommunications as a vital industry focused on safeguarding mobile devices, networks, and users' data from unauthorized access, breaches, and other online threats. With the growing centrality of mobile technology in individual life and business operations, this market will increasingly define the building blocks of safe communication and data integrity among smartphones, tablets, and other mobile connected platforms.

In contrast to the more traditional desktop environments, mobile ecosystems exist within heterogeneous networks, employ location-based technologies, and regularly interface with third-party applications. Such a configuration presents a new set of issues that traditional security models will not be able to address in their entirety. The market will gravitate toward adopting its tactics in response to the change in user behavior, enterprise mobility requirements, and ongoing developments of mobile operating systems. As a result, mobile security will no longer act as an afterthought but rather as a built-in component of mobile infrastructure. The global mobile security market will extend beyond software-based solutions to incorporate hardware-level safeguards, biometric authentication, and encrypted communication layers.

Developers and security professionals will face rising expectations to deliver tools that not only detect anomalies but also predict potential breaches before they materialize. As smartphones are increasingly used for banking, remote work, healthcare, and identity authentication, security will no longer be a luxury add-on but an integral requirement woven into each mobile interaction layer. Enterprise devices running Bring Your Own Device (BYOD) policies will also see greater focus on securing those devices. Such an environment will erode the lines between personal and corporate data, and the global mobile security market will be required to offer solutions that can protect corporate assets without violating individual privacy.

Endpoint protection platforms, Mobile Device Management (MDM), and secure access gateways will evolve further in meeting these demands with higher degrees of sophistication and automation. New mobile threats will become more sophisticated. Rather than depending solely on established malware signatures, mobile security solutions will adapt to identify behavioral trends and contextual anomalies. This anticipatory strategy will enable enterprises to respond prior to vulnerability exploitation.

Regulatory agencies in different countries will also start to levy stricter guidelines, which will impact the way vendors and enterprises design their mobile security architectures. Compliance will be at the core of product design, making data protection harmonious with both legal and ethical requirements. The future of the global mobile security market will be determined by its capacity to scale the global digital revolution. With the 5G networks spreading out and the Internet of Things interconnecting billions of devices, protection volume will have to expand accordingly. Mobile security vendors will commit to AI-based monitoring, secure cloud integration, and self-healing systems that require minimal human intervention. These technologies will not just prevent breaches but also help to build trust within an environment that happens in real time and without perimeters.

In the coming years, the global mobile security market will remain a vital part of determining how secure mobility will operate globally serving silently but imperatively to drive a world that operates in the palm of one's hand.

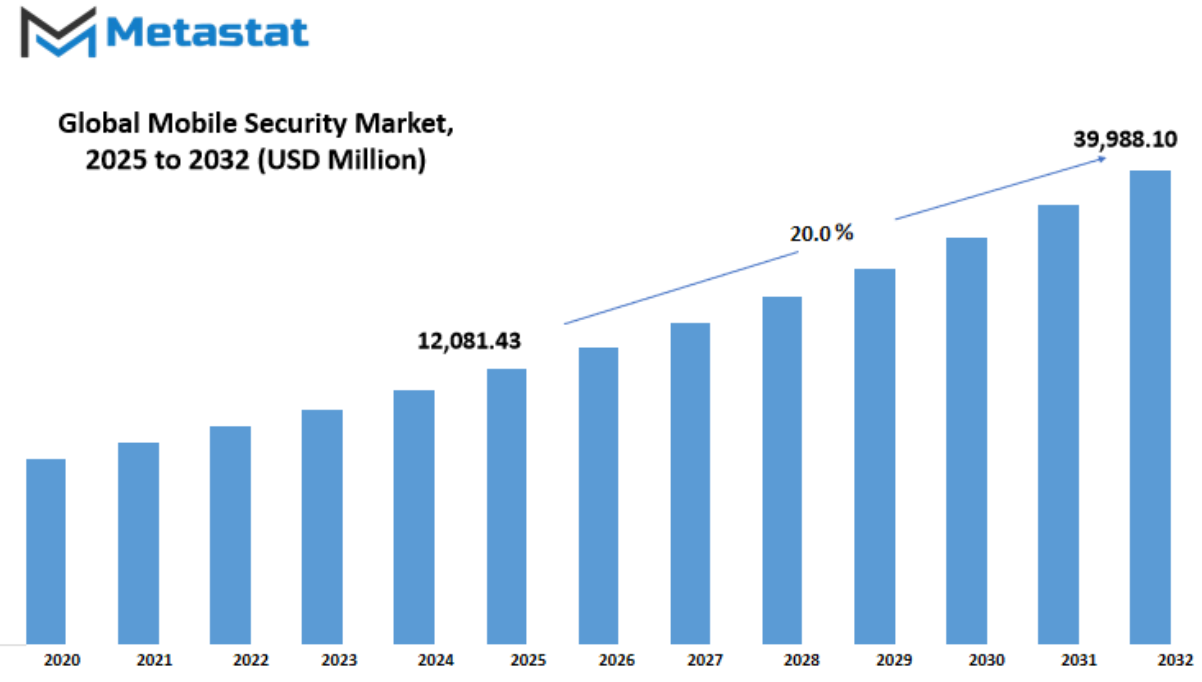

Global mobile security market is estimated to reach $39,988.10 Million by 2032; growing at a CAGR of 20.0% from 2025 to 2032.

GROWTH FACTORS

The global mobile security market is expected to see steady growth in the future, mainly due to how often mobile phones and tablets are now used for work. Many companies are moving toward the BYOD (Bring Your Own Device) approach, where employees use their personal phones for business purposes. While this adds flexibility and lowers costs for companies, it also creates new risks. Personal devices used for work are often less protected, making them an easy target for cybercriminals. As a result, the need for better mobile security is growing.

Data privacy is another serious concern that is helping to drive the market. People and businesses store more sensitive information on mobile devices than ever before, from personal photos to financial details and business communications. Any data breach can lead to major losses, whether financial or reputational. As more companies depend on digital tools and apps, they will look for reliable mobile security solutions to keep their data safe. Cyberattacks are getting more advanced, and the rising number of mobile users makes the situation even more urgent. This puts pressure on businesses and governments to invest in mobile security systems that can handle modern threats.

However, there are still a few challenges that may slow the progress of the global mobile security market. One major issue is the difficulty of securing multiple types of devices. With various platforms like Android and iOS, each with its own design and vulnerabilities, creating a single solution that works for all of them is complex. Another problem is the general lack of awareness among users. Many people don’t realize the risks involved when using their phones for both personal and work tasks, often ignoring important security updates or using weak passwords.

Despite these obstacles, the future still holds promise. One area where demand is expected to rise is healthcare. Hospitals and clinics are now using mobile devices for patient records, remote care, and communication. This shift opens up new doors for mobile security providers, as the need for safe and private handling of medical data becomes more critical. In the coming years, the global mobile security market will likely expand as new technology brings both opportunities and new risks, pushing companies and users alike to prioritize safety on mobile platforms.

MARKET SEGMENTATION

By Solutions

The global mobile security market is growing quickly as the world becomes more connected through smartphones and wireless devices. People rely on mobile technology not just for personal use but also for business tasks, making the need for stronger security solutions more important than ever. As threats get more advanced, the demand for better protection will continue to rise. Businesses and users alike want to feel safe while handling sensitive data, and this is leading to more attention being placed on mobile security. In the future, security will not be just an extra feature but a main requirement in all mobile services.

One key part of this growth is the range of solutions offered. These solutions include data security and encryption, cloud security, web security, and identity and access management. Each of these plays a unique role in protecting users from different kinds of attacks. For instance, data security and encryption will keep improving to make sure that messages, documents, and passwords stay safe even if a device gets hacked or lost. Cloud security will also grow, as more apps and files are stored online. This kind of protection will help users feel confident when using cloud-based tools without the fear of losing their data.

Web security will become more important as people spend more time online. This means tools that block harmful sites or unsafe downloads will become standard. At the same time, identity and access management will help confirm that only the right person can open or use certain apps, files, or systems. This will help both businesses and individuals stay secure while using mobile devices.

Other kinds of mobile security tools will continue to be developed to meet new threats that may not even exist yet. Technology is moving fast, and attackers are always finding new ways to trick users or break into devices. Because of this, mobile security tools will need to stay one step ahead by using smart systems that learn and adjust over time.

Looking ahead, the global mobile security market will become a necessary part of mobile growth across industries. Whether it’s for small businesses, large companies, or everyday users, the need for strong mobile protection will shape the future of mobile technology in a big way. As more people connect through mobile devices, strong, smart, and flexible security will be the foundation for safe and trusted digital communication.

By Services

The global mobile security market is growing steadily as mobile devices continue to be a major part of both personal and professional life. As more people rely on smartphones and tablets to work, shop, and communicate, the need to protect these devices from threats becomes more urgent. With this shift, businesses and individuals are looking for ways to keep their data safe. Two important types of services helping to meet this need are Professional Services and Managed Services. These services are expected to play a much bigger role in the future, shaping how mobile security will work.

Professional Services include things like consulting, risk assessment, and support during software deployment. These services help organizations understand their risks and choose the right tools. Experts working in this space will continue to support companies by offering insights and customized solutions. In the coming years, as mobile threats become more advanced, the demand for expert advice will likely increase. Businesses won’t just want software they will want people who can help them plan long-term strategies to stay ahead of hackers and data leaks.

Managed Services, on the other hand, provide ongoing monitoring and management. Companies that do not have the resources to run their own security operations can rely on these services to handle everything from threat detection to responding to incidents. Looking forward, Managed Services will become more common as businesses try to reduce costs while still staying secure. With new technologies like artificial intelligence and machine learning becoming more involved in mobile security, Managed Services will likely offer smarter and faster protection than ever before.

The global mobile security market will keep changing as threats grow and new solutions are developed. With more companies moving to cloud-based systems and employees working remotely, the risk of mobile-based attacks will rise. This will create a stronger push for both Professional and Managed Services to adapt and offer better support. These services will also need to keep up with new regulations and customer demands, making them a key part of the mobile security landscape.

In the future, the global mobile security market will not just be about stopping threats, but also about helping people and companies use mobile devices with confidence. Services that can evolve and respond quickly will be the ones that lead the way in this space.

By Deployment Mode

The global mobile security market will continue to grow as more businesses and individuals depend on mobile devices for daily communication, banking, shopping, and work. As mobile use spreads, so does the need to protect sensitive information from threats like malware, phishing, and data breaches. With every new app or update, attackers find new ways to get around weak security measures. Because of this, the mobile security market will stay relevant and necessary. One of the main ways this market is divided is by deployment mode, which includes cloud-based and on-premises solutions. Both options have their uses, and their roles are expected to change as technology moves forward.

Cloud-based mobile security solutions are likely to see the most growth in the future. They offer fast updates, flexibility, and are easier to manage across multiple devices. As companies grow and become more global, they need security that can keep up without slowing things down. Cloud systems allow for real-time monitoring and can be managed remotely, which fits well with the trend of hybrid and remote work environments. Startups and small companies, in particular, will turn to cloud-based systems because they are more affordable and don’t require heavy setup or ongoing maintenance. This ease of use will make them a top choice in the coming years.

On the other hand, on-premises solutions will still be important for organizations that want complete control over their data. These are usually larger companies or government bodies that handle highly sensitive information. They will continue to invest in systems they can manage in-house, especially in sectors like defense or finance. However, the use of on-premises systems may become more limited over time due to higher costs and the need for constant hardware updates.

As mobile devices become smarter, so must the tools that protect them. Artificial intelligence and machine learning will likely play a bigger role in detecting threats before they cause damage. Security systems that can learn from patterns and react quickly will be in high demand. The global mobile security market will shift based on these needs and the speed of mobile technology. Looking ahead, a blend of cloud-based tools and trusted on-premises options will offer the balance companies need. The future will focus on faster response, smarter systems, and easier use, making mobile security not just a requirement but a core part of everyday digital life.

By Industry Vertical

The global mobile security market is expected to grow steadily as mobile devices become more essential in different parts of life and work. As more industries rely on mobile platforms for their daily operations, the need to protect sensitive data is rising. This trend will only continue in the years ahead, especially as new technologies emerge. Each industry has its own reasons for adopting mobile security tools, and their growing dependence on digital systems makes this protection a necessity rather than a choice.

In the healthcare sector, mobile devices are now used to store patient information, schedule appointments, and access medical records. These tools improve efficiency, but they also open the door to potential risks. As health providers increase their use of mobile systems, securing patient data will remain a top priority. In the future, mobile security solutions will likely include smarter ways to detect threats and stop breaches before they happen.

Banking, Financial Services, and Insurance (BFSI) organizations also rely heavily on mobile systems. With customers using apps for everything from transferring funds to managing investments, keeping these platforms secure is a must. The global mobile security market will grow in this space as more companies look for ways to keep customer data safe without adding barriers to access. As digital banking expands, companies will invest in systems that offer both safety and speed.

Government and defense bodies are no exception. These organizations handle information that could impact national security. As they shift more of their systems to mobile platforms, they will need strong security measures in place. Looking forward, governments will adopt advanced systems that not only protect data but also track any attempts at unauthorized access in real time.

The retail sector depends on mobile tools for payments, tracking inventory, and engaging with customers. As shopping habits continue to shift toward online and app-based purchases, retailers will turn to mobile security tools to protect both customer data and business operations. This trend will only grow as more small and mid-sized retailers enter the mobile market.

Telecom and IT companies are expected to lead innovation in this space. They will likely drive the future of the global mobile security market by developing smarter, faster, and more reliable protection tools. Meanwhile, other industries like education and manufacturing will follow suit, adapting to new demands and securing their systems as they, too, become more mobile-focused.

Overall, this market will keep expanding as industries recognize that mobile security is not just helpful it’s essential.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$12,081.43 million |

|

Market Size by 2032 |

$39,988.10 Million |

|

Growth Rate from 2025 to 2032 |

20.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

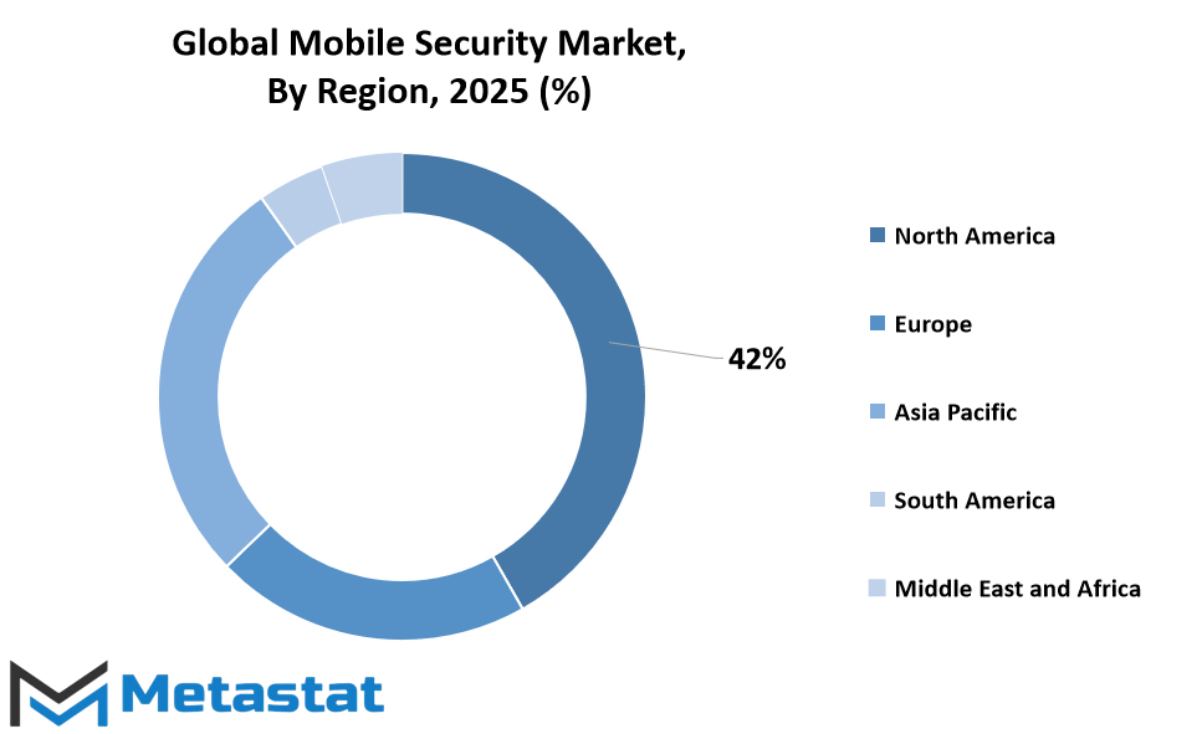

The global mobile security market is influenced by various regional developments that are shaping its growth today and will continue to impact its future. Looking at the geographical breakdown, each region shows distinct trends and potential based on its economic condition, technology adoption, and government regulations.

North America stands as one of the leading areas in this market. The presence of major tech companies, along with rising awareness about data protection and strong digital infrastructure, supports the growth of mobile security in the U.S., Canada, and Mexico. The U.S., in particular, has always been quick in adopting advanced mobile security systems due to the rising number of cyber threats and data breaches. As more businesses rely on mobile platforms for work, the demand for advanced mobile protection tools will continue to increase in this part of the world.

In Europe, countries like the UK, Germany, France, and Italy are focused on improving user privacy and implementing data protection laws. These nations are investing in mobile safety solutions as mobile banking, online shopping, and remote work continue to grow. Users and businesses alike are becoming more cautious, pushing companies to offer safer mobile platforms. This shift is expected to keep growing, especially as digital tools become more common in everyday tasks.

Asia-Pacific, which includes fast-developing countries like India and China, shows the highest potential for growth in the coming years. As smartphone usage grows and internet access becomes more affordable, the region is experiencing a major shift in mobile usage. Japan and South Korea are also progressing quickly, driven by tech innovation and government backing. The need for mobile security in these countries will only grow as people handle more personal and business activities on their devices.

In South America, nations like Brazil and Argentina are beginning to pay more attention to mobile safety. Although the pace is slower compared to North America or Asia-Pacific, the need is rising steadily. As mobile-based financial services expand and more people use smartphones for day-to-day work, mobile security will become a key part of digital progress in the region.

The Middle East & Africa is also moving forward, with countries such as the UAE, Egypt, and South Africa starting to embrace better mobile protection systems. As digital services expand, users will look for safer experiences. This region may not be the fastest-growing yet, but the signs point to steady progress in the coming years. With ongoing changes and future demands, regional differences will continue to shape the global mobile security market in powerful ways.

COMPETITIVE PLAYERS

The global mobile security market is moving toward a future shaped by rapid digital growth, where protecting mobile devices is not just a choice but a necessity. As smartphones, tablets, and other connected devices become a central part of people’s daily lives, the demand for strong mobile security solutions continues to grow. Companies and individuals now handle more sensitive data through mobile platforms than ever before, creating the need for constant protection against cyber threats. Because of this shift, the market is witnessing the rise of many competitive players aiming to provide secure environments across all types of mobile usage.

Some of the most active and influential companies in this market include OneSpan, McAfee LLC, Trend Micro Inc., Kaspersky Lab, Sophos Group plc, Cisco Systems, Inc., and IBM Corporation. Each of these companies brings its own approach to mobile security, with a focus on providing software and tools that stop attacks before they cause harm. Check Point Software Technologies Ltd., Fortinet, Inc., and Palo Alto Networks, Inc. are also pushing the boundaries of mobile defense by using AI and machine learning to detect suspicious behavior early. These innovations are making mobile security more responsive and adaptable.

In the coming years, ESET, Bitdefender, CrowdStrike, Avira Operations GmbH & Co. KG, and Lookout, Inc. are likely to shape how mobile protection tools respond to changing digital habits. These companies are not only defending devices but are also creating smarter systems that learn from threats in real-time. As mobile threats grow more complex, these firms are expected to introduce features that help users protect their data without needing advanced technical knowledge.

MobileIron, Inc., BlackBerry Limited, VMware, Zimperium, Inc., and F-Secure are also working toward building flexible and efficient systems that work smoothly across all mobile devices and operating systems. Their focus will likely remain on giving users control over their security settings while running tools quietly in the background. What stands out across the entire industry is the shared goal of making mobile security easier, faster, and stronger without slowing down performance or user experience.

With technology evolving every day, the global mobile security market will continue to bring new players and smarter solutions into the picture. These companies are not only competing with each other but also racing against rising threats. Their future success will depend on how well they can protect users while keeping mobile use simple and safe.

Mobile Security Market Key Segments:

By Solutions

- Data Security & Encryption

- Cloud Security

- Web Security

- Identity & Access Management

- Other

By Services

- Professional Services

- Managed Services

By Deployment Mode

- Cloud-based

- On-premises

By Industry Vertical

- Healthcare

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense

- Retail

- Telecom and IT

- Others (Education, Manufacturing, etc.)

Key Global Mobile Security Industry Players

- OneSpan

- McAfee LLC

- Trend Micro Inc.

- Kaspersky Lab

- Sophos Group plc

- Cisco Systems, Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- ESET

- Bitdefender

- CrowdStrike

- Avira Operations GmbH & Co. KG

- Lookout, Inc.

- MobileIron, Inc.

- BlackBerry Limited

- VMware

- Zimperium, Inc.

- F-Secure

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383