MARKET OVERVIEW

The Global Respiratory Care Devices market stands as a cornerstone within the healthcare industry, providing essential tools and technologies to support individuals afflicted with respiratory ailments. This industry encompasses a diverse array of devices designed to aid in the diagnosis, treatment, and management of respiratory disorders, ranging from chronic conditions like asthma and chronic obstructive pulmonary disease (COPD) to acute respiratory distress syndrome (ARDS) and respiratory failure.

The Global Respiratory Care Devices market is driven by the pressing need to address the growing prevalence of respiratory diseases worldwide. Factors such as pollution, smoking, aging populations, and lifestyle changes contribute to the rising incidence of respiratory disorders, prompting an increased demand for innovative respiratory care solutions. As a result, the industry continuously evolves to meet the evolving needs of patients and healthcare providers alike.

One of the primary categories within the Global Respiratory Care Devices market is diagnostic devices. These include spirometers, peak flow meters, and gas analyzers, which play a crucial role in assessing lung function and diagnosing respiratory conditions. By providing accurate measurements of lung capacity, airflow, and gas exchange, these devices enable healthcare professionals to formulate tailored treatment plans for patients.

Another vital segment of the market comprises therapeutic devices, which are instrumental in delivering respiratory support and alleviating symptoms. Mechanical ventilators, continuous positive airway pressure (CPAP) machines, nebulizers, and oxygen therapy devices are among the key therapeutic tools used to manage respiratory disorders. These devices assist patients in breathing more effectively, relieve airway constriction, and ensure adequate oxygenation, thereby improving overall respiratory function and quality of life.

Moreover, the Global Respiratory Care Devices market encompasses a range of monitoring and consumable products essential for ongoing respiratory care. Pulse oximeters, capnographs, and respiratory rate monitors enable continuous monitoring of patients' respiratory status, facilitating timely interventions and adjustments to treatment protocols. Additionally, consumables such as oxygen masks, tubing, and filters are integral components of respiratory care delivery, ensuring the safe and effective operation of therapeutic devices.

In recent years, technological advancements have propelled innovation within the Global Respiratory Care Devices market, leading to the development of more efficient and user-friendly solutions. Miniaturization, wireless connectivity, and integration with digital health platforms have enhanced the accessibility and effectiveness of respiratory care devices, empowering patients to actively participate in self-management and remote monitoring of their conditions.

Furthermore, the COVID-19 pandemic has underscored the critical importance of respiratory care devices in managing respiratory distress and supporting patients with severe respiratory complications. The surge in demand for ventilators, oxygen therapy equipment, and airway clearance devices during the pandemic highlighted the indispensable role of the respiratory care industry in safeguarding public health and saving lives.

The Global Respiratory Care Devices market is a dynamic and indispensable sector within the healthcare industry, dedicated to addressing the complex needs of individuals with respiratory disorders. By providing innovative diagnostic, therapeutic, and monitoring solutions, this industry plays a vital role in improving patient outcomes, enhancing quality of life, and advancing respiratory health on a global scale.

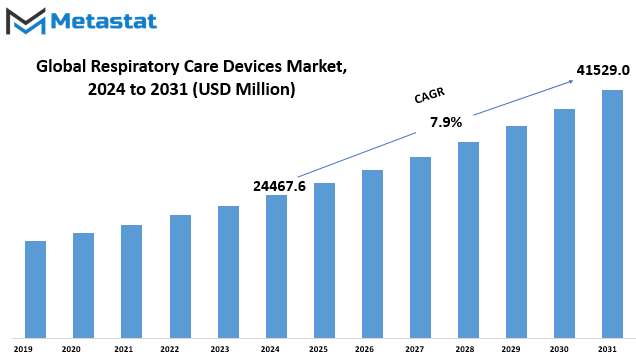

Global Respiratory Care Devices market is estimated to reach $41529.0 Million by 2031; growing at a CAGR of 7.9% from 2024 to 2031.

GROWTH FACTORS

The global market for respiratory care devices is witnessing significant growth, primarily driven by two main factors: the increasing prevalence of respiratory diseases worldwide and continuous technological advancements. These factors have contributed to a rising demand for respiratory care devices, which are essential for managing various respiratory conditions effectively.

Respiratory diseases, including asthma, chronic obstructive pulmonary disease (COPD), pneumonia, and respiratory infections, among others, have become more prevalent across the globe. Factors such as air pollution, smoking, aging populations, and lifestyle changes have contributed to the growing burden of respiratory illnesses. As a result, there is a greater need for advanced respiratory care devices to diagnose, monitor, and treat these conditions.

Furthermore, continuous advancements in technology have led to the development of innovative respiratory care devices that offer improved efficiency, accuracy, and patient comfort. These advancements include the integration of wireless connectivity, digital sensors, and real-time monitoring capabilities, allowing healthcare professionals to deliver personalized and timely care to patients.

Despite the promising growth prospects, the market for respiratory care devices faces certain challenges that may hinder its expansion. One such challenge is the stringent regulatory requirements for product approval imposed by regulatory authorities such as the FDA (Food and Drug Administration) and the European Medicines Agency (EMA). Compliance with these regulations is essential for ensuring the safety, efficacy, and quality of respiratory care devices, but the lengthy and complex approval processes can delay market entry and increase development costs for manufacturers.

Additionally, the high cost associated with advanced respiratory care devices presents a barrier to market growth, particularly in developing regions with limited healthcare budgets. The affordability and accessibility of these devices remain key concerns, especially for patients in low-income countries who may not be able to afford expensive treatment options.

Despite these challenges, the market for respiratory care devices is poised for growth, thanks to the emergence of new opportunities driven by technological innovation and changing healthcare trends. One such opportunity is the growing adoption of telemedicine and remote monitoring solutions, which enable healthcare providers to deliver respiratory care services remotely, without the need for in-person visits.

Telemedicine allows patients to consult with healthcare professionals virtually, using video conferencing and other digital communication tools, reducing the need for physical appointments and improving access to care, especially in rural and underserved areas. Remote monitoring devices, such as wearable sensors and home-based spirometers, enable patients to track their respiratory health and share data with their healthcare providers in real-time, facilitating early intervention and personalized treatment plans.

The global market for respiratory care devices is driven by the increasing prevalence of respiratory diseases and continuous technological advancements. While challenges such as regulatory requirements and high costs may impede market growth, opportunities such as telemedicine and remote monitoring offer promising avenues for expansion in the coming years. By addressing these challenges and capitalizing on emerging trends, manufacturers and healthcare providers can meet the growing demand for respiratory care devices and improve outcomes for patients worldwide.

MARKET SEGMENTATION

By Product

The global respiratory care devices market is categorized based on its products, which are divided into therapeutic devices, monitoring devices, and diagnostic devices. These classifications help organize the various tools and equipment used in respiratory care.

Therapeutic devices play a crucial role in treating respiratory conditions by aiding in the delivery of medication or providing support to the patient’s airways. Examples of therapeutic devices include inhalers, nebulizers, continuous positive airway pressure (CPAP) machines, and ventilators. These devices help patients manage conditions such as asthma, chronic obstructive pulmonary disease (COPD), and sleep apnea by delivering medication or ensuring proper airflow to the lungs.

Monitoring devices are designed to assess and track the respiratory status of patients. These devices provide valuable information to healthcare providers about a patient’s breathing patterns, oxygen levels, and lung function. Common monitoring devices include pulse oximeters, capnographs, and spirometers. These tools assist healthcare professionals in monitoring the effectiveness of treatment and making informed decisions about patient care.

Diagnostic devices are used to identify and diagnose respiratory conditions accurately. These devices enable healthcare providers to assess lung function, identify abnormalities, and determine the underlying causes of respiratory symptoms. Examples of diagnostic devices include peak flow meters, bronchoscopes, and polysomnography equipment. These tools play a vital role in diagnosing conditions such as asthma, bronchitis, pneumonia, and sleep disorders.

By categorizing respiratory care devices into therapeutic, monitoring, and diagnostic categories, healthcare professionals can better understand their functionalities and applications. Therapeutic devices are used to administer treatment and support respiratory function, monitoring devices help track patient progress and assess respiratory status, and diagnostic devices aid in identifying and diagnosing respiratory conditions accurately.

The segmentation of the global respiratory care devices market by product highlights the diverse range of tools and equipment available to healthcare providers. Each category serves a unique purpose in the management and treatment of respiratory conditions, contributing to improved patient outcomes and quality of life. As advancements in technology continue to drive innovation in respiratory care, the development of new and improved devices will further enhance the capabilities of healthcare professionals in diagnosing, monitoring, and treating respiratory conditions effectively.

By Application

The global respiratory care devices market encompasses various applications, catering to a range of respiratory conditions. These applications include Chronic Obstructive Pulmonary Disease (COPD), Sleep Apnea, Asthma, Infectious Diseases, and Others.

COPD stands for Chronic Obstructive Pulmonary Disease, a chronic lung condition that obstructs airflow, making it difficult to breathe. It includes chronic bronchitis and emphysema, often caused by long-term exposure to irritants like cigarette smoke. Respiratory care devices play a crucial role in managing COPD by helping patients breathe more comfortably and effectively.

Sleep Apnea is a sleep disorder characterized by pauses in breathing or shallow breaths during sleep. These interruptions can occur multiple times per hour, leading to fragmented sleep and daytime fatigue. Respiratory care devices such as continuous positive airway pressure (CPAP) machines are commonly used to treat sleep apnea by keeping the airway open during sleep, allowing for uninterrupted breathing.

Asthma is a chronic inflammatory condition of the airways, causing symptoms like wheezing, shortness of breath, coughing, and chest tightness. Respiratory care devices like inhalers and nebulizers deliver medication directly to the airways, providing relief from asthma symptoms and helping to prevent asthma attacks.

Infectious Diseases affecting the respiratory system, such as pneumonia and tuberculosis, can cause inflammation and fluid buildup in the lungs, leading to breathing difficulties. Respiratory care devices like mechanical ventilators and oxygen therapy equipment are used to support patients with severe respiratory infections, ensuring adequate oxygenation and ventilation while their body fights off the infection.

The category of Others in the respiratory care devices market encompasses various respiratory conditions and therapeutic interventions not specifically mentioned above. This may include devices used in the treatment of conditions like cystic fibrosis, pulmonary fibrosis, and respiratory distress syndrome, as well as procedures such as pulmonary rehabilitation and airway clearance techniques.

Overall, the global respiratory care devices market serves a vital role in managing a wide range of respiratory conditions, from chronic diseases like COPD and asthma to acute infections like pneumonia. These devices help patients breathe easier, improve their quality of life, and reduce the risk of complications associated with respiratory illnesses. As the prevalence of respiratory diseases rises globally, the demand for respiratory care devices is expected to grow, driving innovation and advancements in respiratory medicine.

By Diagnostic Devices

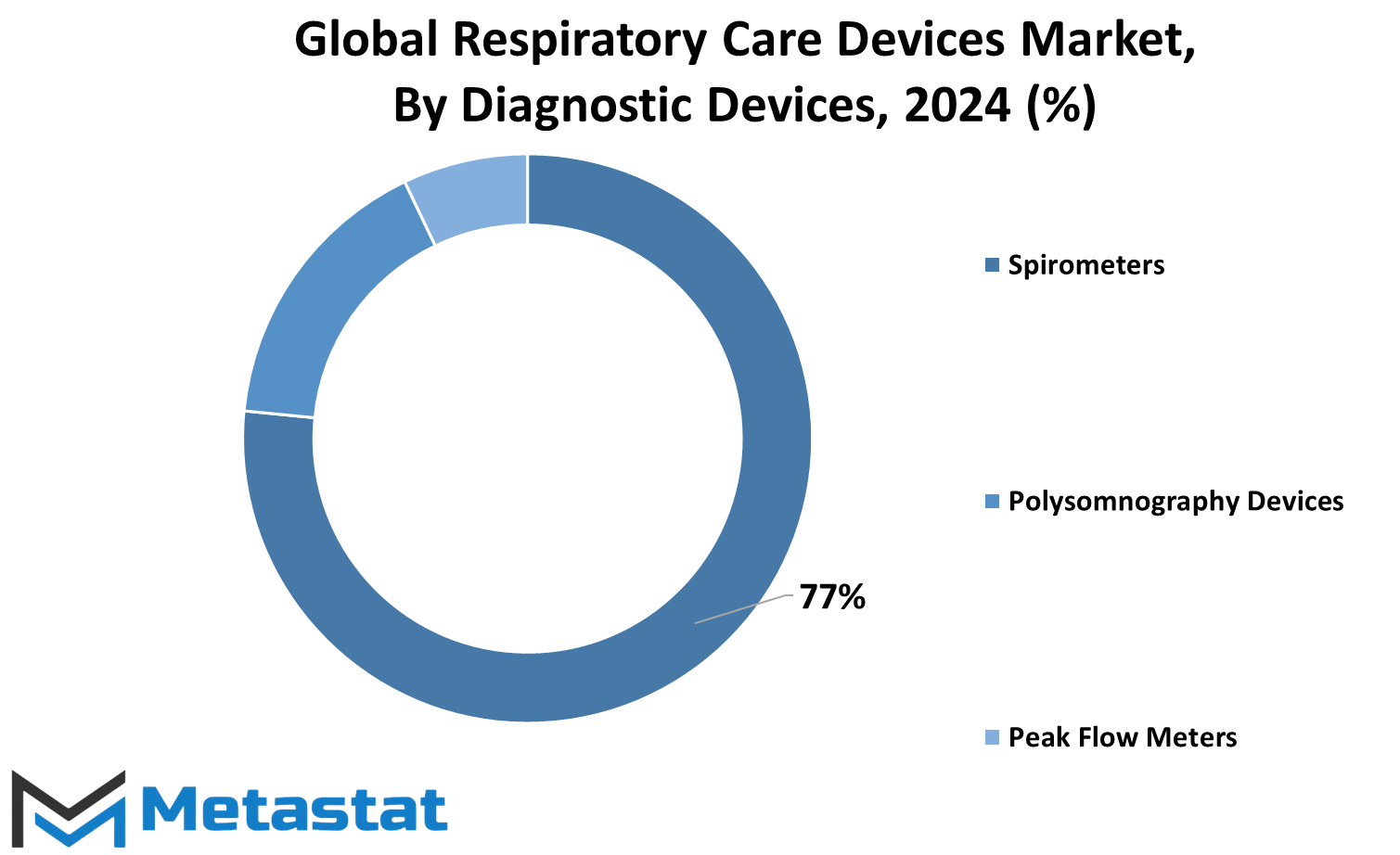

The global market for respiratory care devices includes various diagnostic devices, which are further categorized into spirometers, polysomnography devices, and peak flow meters. These diagnostic tools play a crucial role in assessing and monitoring respiratory health.

Spirometers are devices used to measure lung function by assessing the volume of air inhaled and exhaled by the lungs. They are commonly used to diagnose conditions such as asthma, chronic obstructive pulmonary disease (COPD), and other respiratory disorders. Spirometry tests are often performed in clinics, hospitals, and even at home to monitor lung function over time.

Polysomnography devices, however, are mainly used to diagnose sleep-related breathing disorders such as sleep apnea. These devices monitor various physiological parameters during sleep, including airflow, respiratory effort, oxygen saturation, and brain activity. By analyzing these data, healthcare professionals can diagnose sleep disorders and recommend appropriate treatment options.

Peak flow meters are simple devices used to measure the maximum airflow rate that a person can generate during a forced exhalation. They are commonly used by individuals with asthma to monitor their lung function and detect changes in airway narrowing or obstruction. Peak flow meters are portable and easy to use, making them valuable tools for self-management of asthma symptoms.

Each type of diagnostic device serves a specific purpose in respiratory care, helping healthcare professionals accurately diagnose and manage respiratory conditions. By providing valuable insights into lung function, these devices enable timely interventions and personalized treatment plans for patients with respiratory disorders.

In addition to diagnostic devices, the global respiratory care devices market also includes therapeutic devices aimed at improving respiratory function and managing symptoms. These therapeutic devices encompass a wide range of products, including continuous positive airway pressure (CPAP) machines, nebulizers, oxygen concentrators, and ventilators.

CPAP machines are commonly used to treat obstructive sleep apnea by delivering a continuous flow of air through a mask worn during sleep. This airflow helps keep the airway open, preventing episodes of apnea and improving sleep quality. Nebulizers are devices that convert liquid medication into a fine mist, which can be inhaled directly into the lungs to relieve respiratory symptoms such as wheezing and shortness of breath.

Oxygen concentrators are medical devices that extract oxygen from the surrounding air and deliver it to patients who require supplemental oxygen therapy. These devices are often used to treat conditions such as COPD, pulmonary fibrosis, and severe asthma. Ventilators are mechanical devices used to support breathing in patients unable to breathe adequately on their own due to respiratory failure or other medical conditions.

Together, diagnostic and therapeutic respiratory care devices play a crucial role in managing respiratory conditions and improving the quality of life for patients worldwide. As the prevalence of respiratory disorders continues to rise, the demand for these devices is expected to grow, driving innovation and advancements in respiratory care technology.

By End Use

The global market for respiratory care devices is segmented by end-use into three main categories: Point of Care, Hospitals, and Clinics. Each of these segments plays a crucial role in ensuring the effective delivery of respiratory care solutions to patients worldwide.

The Point of Care segment refers to settings where respiratory care devices are utilized outside of traditional medical facilities, such as in-home care or community health centers. Point of Care devices are designed to provide convenience and accessibility to patients who require continuous respiratory support but may not be able to visit hospitals or clinics regularly. These devices often include portable oxygen concentrators, nebulizers, and CPAP machines, allowing individuals to manage their respiratory conditions from the comfort of their own homes.

Moving on to Hospitals, this segment encompasses the use of respiratory care devices within medical facilities specifically dedicated to providing acute care services. Hospitals serve as primary hubs for treating patients with severe respiratory illnesses, such as pneumonia, COPD exacerbations, or acute respiratory distress syndrome (ARDS). Within hospital settings, a wide range of respiratory care devices are employed, including mechanical ventilators, oxygen delivery systems, and airway clearance devices. These devices are essential for stabilizing patients' breathing and supporting their respiratory function during critical care interventions.

The Clinics segment refers to outpatient healthcare facilities where respiratory care services are provided more routinely. Clinics cater to patients with chronic respiratory conditions, such as asthma, bronchitis, or sleep apnea, who require ongoing monitoring and management of their respiratory health. Respiratory care devices commonly used in clinics include spirometers, peak flow meters, and continuous positive airway pressure (CPAP) devices. These tools enable healthcare professionals to assess lung function, monitor disease progression, and optimize treatment strategies to improve patients' quality of life.

In summary, the global market for respiratory care devices is diversified across various end use segments, each serving distinct healthcare settings and patient populations. From the convenience of Point of Care solutions to the critical care interventions provided in Hospitals and the routine management offered in Clinics, respiratory care devices play a vital role in meeting the diverse needs of individuals with respiratory conditions worldwide. As advancements in technology continue to drive innovation in this field, the availability and accessibility of respiratory care devices are expected to further improve, enhancing the overall quality of care for patients across the globe.

REGIONAL ANALYSIS

The global market for respiratory care devices is segmented by region, with North America and Europe being significant regions in this industry. Each region presents unique opportunities and challenges for companies operating in the respiratory care devices market.

North America holds a prominent position in the global market due to several factors. The region boasts advanced healthcare infrastructure, high healthcare expenditure, and a large patient population suffering from respiratory diseases. Moreover, there is a growing awareness among patients regarding the importance of respiratory care, which drives the demand for devices such as ventilators, nebulizers, and CPAP machines. Additionally, favorable reimbursement policies and government initiatives further support market growth in North America.

Europe also plays a crucial role in the global respiratory care devices market. Like North America, Europe has well-established healthcare systems and high prevalence of respiratory diseases. Countries like Germany, the UK, and France are major contributors to the market due to their large patient populations and robust healthcare infrastructure. Additionally, the presence of leading manufacturers and technological advancements in the region contribute to market growth.

However, despite their significance, both North America and Europe face challenges in the respiratory care devices market. One challenge is the increasing healthcare costs, which can limit the adoption of advanced devices, especially in countries with budget constraints. Moreover, regulatory requirements and standards for medical devices can pose hurdles for companies entering these markets.

In addition to North America and Europe, other regions such as Asia-Pacific, Latin America, and the Middle East & Africa are also witnessing growth in the respiratory care devices market. In Asia Pacific, rapid urbanization, changing lifestyles, and increasing pollution levels contribute to the rising prevalence of respiratory diseases, driving the demand for respiratory care devices. Similarly, in Latin America and the Middle East & Africa, improving healthcare infrastructure and rising awareness about respiratory health are fueling market growth.

Each region presents unique opportunities and challenges for companies operating in the global respiratory care devices market. Understanding the market dynamics, regulatory landscape, and consumer preferences in each region is essential for companies to succeed and expand their presence globally. By strategically addressing the needs of different regions, companies can capitalize on the growing demand for respiratory care devices and improve patient outcomes worldwide.

COMPETITIVE PLAYERS

In the global market for respiratory care devices, there are several key players who play significant roles. These companies are essential in driving innovation, providing quality products, and competing for market share. Among these prominent players are Drägerwerk AG & Co. KGaA and Fisher & Paykel Healthcare Limited.

Drägerwerk AG & Co. KGaA is a renowned company in the respiratory care devices industry. They have established themselves as leaders through their commitment to research, development, and manufacturing of high-quality respiratory care equipment. Their products are known for their reliability and effectiveness in treating respiratory conditions. Drägerwerk AG & Co. KGaA's presence in the market contributes to the overall competitiveness and advancement of respiratory care technology.

Similarly, Fisher & Paykel Healthcare Limited is another notable player in the respiratory care devices market. With a focus on innovation and customer satisfaction, Fisher & Paykel Healthcare Limited has become a trusted name in the industry. Their range of products includes masks, humidifiers, and other respiratory care devices designed to improve the quality of life for patients with respiratory conditions. By consistently delivering innovative solutions, Fisher & Paykel Healthcare Limited continues to compete effectively in the global market.

These competitive players drive the industry forward by continually striving to improve their products and services. Their presence encourages innovation and pushes other companies to enhance their offerings to remain competitive. Additionally, the competition between these key players fosters market growth and benefits consumers by providing them with a variety of options to choose from.

Companies like Drägerwerk AG & Co. KGaA and Fisher & Paykel Healthcare Limited are integral to the respiratory care devices market. Their commitment to innovation, quality, and customer satisfaction drives competition and fosters growth in the industry. As key players, they play significant roles in shaping the future of respiratory care technology and improving the lives of patients worldwide.

Respiratory Care Devices Market Key Segments:

By Product

- Therapeutic Device

- Monitoring Devices

- Diagnostic Devices

By Application

- Chronic Obstructive Pulmonary Disease (COPD)

- Sleep Apnea

- Asthma

- Infectious Diseases

- Others

By Diagnostic Devices

- Spirometers

- Polysomnography Devices

- Peak Flow Meters

By End Use

- Point of Care

- Hospitals and Clinics

Key Global Respiratory Care Devices Industry Players

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare Limited.

- General Electric Company

- Getinge AB

- Inogen, Inc.

- Masimo.

- Medtronic

- Koninklijke Philips N.V.

- ResMed

- VYAIRE.

- 3B Medical Inc.

- Airon Corporation

- alpha trace medical systems

- APEX MEDICAL CORP.

- Besco Medical

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

+91 73850 57479

+91 73850 57479