MARKET OVERVIEW

The Global Blood Collection Devices market, within the healthcare sector, encompasses a diverse array of devices utilized for the collection and extraction of blood samples from individuals for diagnostic and therapeutic purposes. This industry plays an integral role in supporting various healthcare practices, including clinical diagnostics, blood transfusions, therapeutic drug monitoring, and disease monitoring. Blood collection devices facilitate the safe and efficient procurement of blood samples, ensuring accurate diagnosis and treatment for patients worldwide.

One of the primary components of the blood collection devices market is the assortment of devices designed for venous blood collection. These devices, ranging from needles and syringes to vacuum tubes and lancets, are crucial for obtaining blood samples from veins for various medical procedures. Venous blood collection devices are meticulously engineered to minimize patient discomfort and reduce the risk of complications such as hematoma formation or nerve injury.

Another significant segment within the blood collection devices market is capillary blood collection devices. These devices are specifically tailored for collecting blood samples from capillary beds, commonly found in the fingertips, heels, or earlobes. Capillary blood collection devices are essential for point-of-care testing, where rapid and convenient blood sampling is required for immediate analysis. They are commonly utilized in settings such as clinics, emergency rooms, and home healthcare environments.

In recent years, technological advancements have spurred innovation within the blood collection devices industry, leading to the development of novel devices with enhanced functionality and user friendliness. Automated blood collection systems, for instance, streamline the blood collection process by automating various steps, thereby reducing the reliance on manual labor and improving efficiency. Additionally, the integration of safety features such as needlestick protection mechanisms has significantly enhanced the safety profile of blood collection devices, reducing the risk of occupational injuries among healthcare professionals.

The global blood collection devices market is driven by several factors, including the increasing prevalence of chronic and infectious diseases, rising demand for blood transfusions, and growing awareness regarding the importance of early disease detection and monitoring. Furthermore, the expansion of healthcare infrastructure in emerging economies and the growing adoption of point-of care testing solutions are expected to fuel market growth in the coming years.

Despite the promising outlook, the blood collection devices market faces certain challenges, including stringent regulatory requirements, concerns regarding the safety and efficacy of blood collection devices, and the presence of alternative diagnostic technologies. Additionally, the high cost associated with advanced blood collection devices and the lack of skilled healthcare professionals proficient in blood collection techniques pose significant barriers to market growth in certain regions.

The Global Blood Collection Devices market is a dynamic and vital component of the healthcare industry, facilitating the collection of blood samples for diagnostic and therapeutic purposes. With ongoing technological innovation and increasing demand for healthcare services worldwide, the blood collection devices market is poised for continued growth and evolution in the years to come.

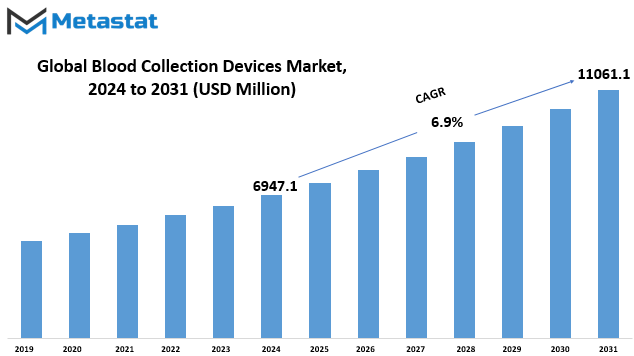

Global Blood Collection Devices market is estimated to reach $11061.1 Million by 2031; growing at a CAGR of 6.9% from 2024 to 2031.

GROWTH FACTORS

The Global Blood Collection Devices market has been influenced by various factors, both positively and negatively. One of the driving forces behind its growth is the increasing prevalence of chronic and infectious diseases. As these diseases become more widespread, the demand for blood collection devices rises, as they are essential for diagnostic and treatment purposes.

Advancements in blood collection technologies have also played a significant role in propelling the market forward. These advancements have led to the development of more efficient and user friendly devices, making the process of blood collection easier and less invasive for both patients and healthcare professionals.

However, despite these drivers, the market faces certain restraints that hinder its growth. One such restraint is the cost associated with automated blood collection devices. These devices, while offering numerous benefits, can be expensive to purchase and maintain, especially for smaller healthcare facilities with limited budgets.

Additionally, product recalls pose another challenge to the market. When blood collection devices are recalled due to safety concerns or manufacturing defects, it not only affects the reputation of the companies producing them but also shakes the confidence of healthcare professionals and patients in the reliability of these devices.

Nevertheless, amidst these challenges, there are also opportunities for growth within the market. One such opportunity lies in the increasing demand for apheresis, a medical procedure that involves removing blood from a donor or patient and separating it into its components before returning it to the bloodstream. Apheresis is used in the treatment of various conditions, including autoimmune disorders, and as the demand for these treatments continues to rise, so does the demand for blood collection devices capable of supporting apheresis procedures.

The Global Blood Collection Devices market is influenced by a variety of factors, including drivers such as the rising prevalence of diseases and advancements in technology, as well as restraints like the cost of devices and product recalls. However, opportunities for growth, such as the increasing demand for appreciation, continue to present themselves, shaping the trajectory of the market in the years to come.

MARKET SEGMENTATION

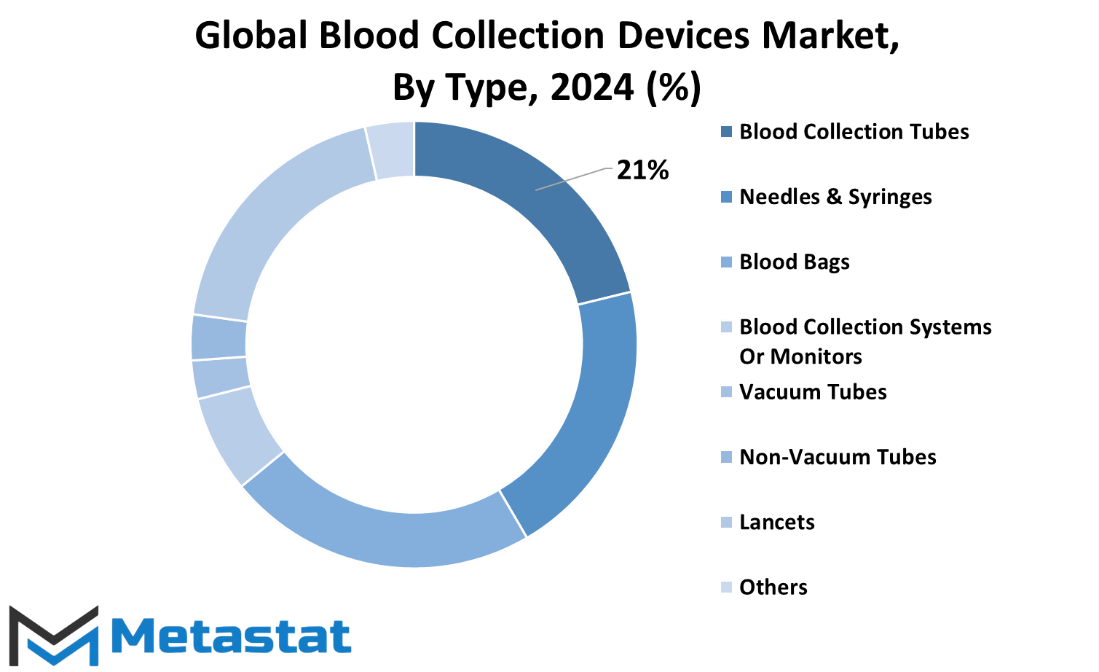

By Type

The global market for blood collection devices encompasses various types of equipment used in collecting blood samples for medical purposes. These devices are essential for various medical procedures, including blood transfusions, diagnostic testing, and medical research. The types of blood collection devices include blood collection tubes, needles, syringes, blood bags, Blood collection systems or monitors, Vacuum Tubes, Non-Vacuum Tubes, lancets, and other miscellaneous items.

Blood collection tubes are commonly used to collect and store blood samples for laboratory analysis. These tubes come in different sizes and with various additives depending on the specific tests being conducted. Needles and syringes are essential tools for drawing blood from patients’ veins. They come in different sizes and gauges to accommodate various patient populations and procedures.

Blood bags are used for collecting and storing larger volumes of blood, typically for blood transfusions. These bags are sterile and come with anticoagulants to prevent blood clotting during storage. Blood collection systems or monitors are advanced devices used to automate the blood collection process, ensuring accuracy and efficiency.

Lancets are small, disposable devices used to prick the skin and obtain capillary blood samples, commonly used for glucose monitoring and other point-of-care tests. Other blood collection devices include tourniquets, adhesive bandages, and alcohol swabs, which are essential for maintaining a sterile environment during blood collection procedures.

The global market for blood collection devices is driven by the increasing demand for blood transfusions, rising prevalence of chronic diseases, and advancements in healthcare technology. Additionally, the growing geriatric population and the increasing number of surgical procedures contribute to the market’s growth.

By End User

The Global Blood Collection Devices market caters to various end users, including Hospitals, Ambulatory Surgical Centers & Nursing Homes, Blood Banks, Diagnostic & Pathology Laboratories, and others. These end users play critical roles in the process of blood collection, storage, and analysis, each with distinct needs and requirements.

Hospitals represent a significant portion of the market’s end users. These medical facilities require blood collection devices for various purposes, including surgeries, treatments, and emergency situations. Blood collection devices used in hospitals must adhere to strict quality standards to ensure patient safety and accurate test results.

Ambulatory Surgical Centers & Nursing Homes also rely on blood collection devices to provide medical care to patients outside of traditional hospital settings. These facilities often have unique requirements due to their smaller scale and different patient demographics. Blood collection devices used in these settings need to be efficient, easy to use, and compatible with the limited space available.

Blood Banks are essential components of the healthcare system, responsible for collecting, processing, and storing donated blood. These facilities require specialized blood collection devices designed to handle large volumes of blood donations while maintaining the integrity of the samples. Blood collection devices used in blood banks must meet stringent regulatory standards to ensure the safety and quality of donated blood.

Diagnostic & Pathology Laboratories play a crucial role in disease diagnosis and treatment monitoring. These laboratories rely on blood collection devices to collect blood samples from patients for various diagnostic tests, such as blood cell counts, cholesterol levels, and infectious disease screenings. Blood collection devices used in diagnostic laboratories need to be precise, reliable, and compatible with a wide range of testing procedures.

Other end users of blood collection devices may include research institutions, veterinary clinics, and home healthcare providers. Each of these users has specific needs and preferences when it comes to blood collection devices, depending on the nature of their work and the populations they serve.

The Global Blood Collection Devices market serves a diverse range of end users, each with unique requirements and preferences. Whether it’s hospitals, ambulatory surgical centers, blood banks, diagnostic laboratories, or other healthcare facilities, the demand for blood collection devices continues to grow as the need for accurate and efficient blood collection and testing remains paramount in modern healthcare.

By Method

The global blood collection devices market is segmented based on method into manual blood collection and automated blood collection. These methods play a crucial role in gathering blood samples for various medical purposes. Manual blood collection involves the traditional method of using needles and syringes to draw blood from patients. On the other hand, automated blood collection utilizes advanced technologies and devices to streamline the process, making it more efficient and less prone to errors.

Manual blood collection has been the conventional method used by healthcare professionals for decades. It involves inserting a needle into a vein and using a syringe to draw blood into a tube or vial. While this method is effective, it can be time-consuming and requires skilled personnel to perform the procedure accurately. Additionally, manual blood collection may cause discomfort or pain for some patients, leading to potential issues with compliance and patient satisfaction.

In contrast, automated blood collection offers several advantages over manual methods. These devices are designed to automate the process of drawing blood, reducing the need for manual intervention and minimizing the risk of human error. Automated blood collection devices often feature built-in safety mechanisms to ensure proper needle insertion and blood collection, reducing the likelihood of needlestick injuries and other complications. Furthermore, these devices are typically faster and more efficient than manual methods, allowing healthcare providers to collect blood samples more quickly and with greater precision.

By Application

The global blood collection devices market encompasses various applications, primarily divided into diagnostic and therapeutic categories. These two sectors play crucial roles in the healthcare industry, facilitating the collection of blood samples for analysis and treatment purposes.

In the diagnostic, blood collection devices serve as essential tools for healthcare professionals to obtain samples for laboratory testing. These tests are instrumental in diagnosing a wide range of medical conditions, from infectious diseases to chronic illnesses. By accurately collecting blood samples, healthcare providers can gain valuable insights into a patient’s health status, enabling them to make informed decisions regarding treatment and management strategies.

On the other hand, blood collection devices also play a vital role in therapeutic applications. In this context, these devices are used to collect blood for therapeutic purposes, such as transfusions or therapeutic apheresis procedures. Blood transfusions are commonly administered to patients who have experienced significant blood loss due to trauma, surgery, or medical conditions such as anemia or leukemia. Additionally, therapeutic apheresis involves the selective removal of specific components from the blood, such as plasma or platelets, to treat various autoimmune disorders or blood diseases.

Both diagnostic and therapeutic blood collection devices are essential components of modern healthcare systems, contributing to the delivery of high-quality patient care worldwide. However, the market for these devices is not without its challenges and opportunities.

One significant challenge facing the blood collection devices market is the need for continuous innovation to meet evolving healthcare demands. As medical technologies advance and new diagnostic and therapeutic techniques emerge, there is a growing need for blood collection devices that can support these developments. Manufacturers must invest in research and development to design and produce devices that are not only efficient and reliable but also compatible with emerging healthcare technologies.

Moreover, the global blood collection devices market is also influenced by factors such as regulatory requirements, reimbursement policies, and healthcare infrastructure. Regulatory bodies impose stringent standards and guidelines to ensure the safety, efficacy, and quality of blood collection devices, which can impact market dynamics and manufacturers’ operations. Additionally, reimbursement policies and healthcare budgets influence the adoption and utilization of blood collection devices, particularly in resource-constrained settings.

Despite these challenges, the blood collection devices market presents significant opportunities for growth and expansion. The increasing prevalence of chronic diseases, aging populations, and rising demand for blood products are driving market growth. Furthermore, advancements in technology, such as the development of innovative blood collection techniques and devices, are creating new avenues for market players to capitalize on.

The global blood collection devices market plays a critical role in supporting various diagnostic and therapeutic applications in the healthcare industry. While facing challenges such as regulatory compliance and evolving healthcare landscapes, the market presents significant opportunities for innovation and growth. By addressing these challenges and leveraging emerging trends, stakeholders in the blood collection devices market can contribute to improving patient care and advancing healthcare outcomes globally.

REGIONAL ANALYSIS

The global market for blood collection devices is segmented by geography into North America, Europe, and Asia-Pacific. This segmentation allows for a better understanding of how these devices are used and distributed across different regions.

North America, comprising countries like the United States and Canada, is a significant market for blood collection devices. The region boasts advanced healthcare infrastructure and a high prevalence of chronic diseases, leading to a constant demand for blood collection devices for diagnostic and therapeutic purposes. Moreover, stringent regulations and standards regarding blood collection and transfusion further drive the market in this region.

In Europe, which includes countries such as the United Kingdom, Germany, and France, the market for blood collection devices is also robust. Like North America, Europe has well-established healthcare systems and a growing geriatric population, contributing to the demand for blood collection devices. Additionally, increasing awareness about blood donation and the importance of safe blood transfusion practices fuel market growth in this region.

Asia-Pacific, encompassing nations like China, Japan, and India, represents a rapidly expanding market for blood collection devices. Factors such as the large population, rising healthcare expenditure, and improving healthcare infrastructure drive market growth in this region. Furthermore, initiatives by governments and non-governmental organizations to promote blood donation and enhance blood transfusion services contribute to the increasing adoption of blood collection devices.

Overall, the global market for blood collection devices exhibits significant regional variations in terms of market size, growth potential, and adoption rates. Understanding these regional dynamics is essential for stakeholders in the blood collection device industry to effectively target their marketing and distribution strategies and capitalize on emerging opportunities.

The segmentation of the global blood collection devices market into North America, Europe, and Asia-Pacific provides valuable insights into regional trends and market dynamics. Each region has its unique characteristics and drivers influencing the demand for blood collection devices, highlighting the importance of tailored approaches to meet the diverse needs of healthcare systems and blood collection facilities worldwide.

COMPETITIVE PLAYERS

The Blood Collection Devices market boasts several notable players driving competition. Among these are Becton, Dickinson and Company (BD), Terumo BCT, and Fresenius Kabi AG. These companies play significant roles in shaping the dynamics of the industry.

Becton, Dickinson and Company (BD) is a prominent player in the field of blood collection devices. With its wide range of products and established reputation, BD has carved out a significant market share. The company's commitment to innovation and quality has positioned it as a leader in the industry.

Terumo BCT is another key player in the blood collection devices market. Known for its advanced technologies and focus on customer satisfaction, Terumo BCT competes vigorously to maintain its position in the market. The company's dedication to research and development ensures that it stays ahead of emerging trends and customer demands.

Fresenius Kabi AG is also a major contender in the blood collection devices industry. With its diverse portfolio of products and global presence, Fresenius Kabi AG competes effectively in various market segments. The company's emphasis on product quality and regulatory compliance has enabled it to gain the trust of healthcare professionals worldwide.

These competitive players continually strive to innovate and enhance their offerings to meet the evolving needs of the market. By investing in research and development, expanding their product portfolios, and forging strategic partnerships, they maintain their competitive edge in the blood collection devices market.

Blood Collection Devices Market Key Segments:

By Type

- Blood collection tubes

- Needles & syringes

- Blood bags

- Blood collection systems or monitors

- Vacuum Tubes

- Non-Vacuum Tubes

- Lancets

- Others

By End User

- Hospitals

- Ambulatory Surgical Centre & Nursing Homes • Blood Bank

- Diagnostic & Pathology Laboratories

- Others

By Method

- Manual Blood Collection

- Automated Blood Collection

By Application

- Diagnostic

- Therapeutic

Key Global Blood Collection Devices Industry Players

- Becton, Dickinson and Company (BD)

- Terumo BCT

- Fresenius Kabi AG

- Grifols, S.A.

- Nipro Medical Corporation

- Greiner Holding AG

- Quest Diagnostics Incorporated

- Sarstedt AG & Co. KG

- Macopharma

- Haemonetics Corporation

- Smiths Medical

- Cardinal Health

- Retractable Technologies, Inc.

- Liuyang Sanli Medical Technology Development Co., Ltd.

- FL Medical SRL

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252