MARKET OVERVIEW

In the years to come, the Global Renewable Energy Asset Management Software market would be the pivot around which energy management revolves, as the world slowly shifts its focus toward utilizing renewable sources of energy. The specific focus will therefore be on how upgrades of renewable energy assets, such as wind farms, solar installations, and hydroelectric plants, can be done with innovative software solutions for increasing efficiency and performance. Amid growing demands for transparency and accountability in energy production, operator energy will aim to produce software solutions to allow comprehensive monitoring, reporting, and optimization of all assets to ensure that they work at their optimal level. Advanced analytics and data-driven processes will ensure the streamlining of operations, reduce downtime, and enhance asset lifecycle management and the way towards a more sustainable energy future.

As the future landscape of energy management evolves, Global Renewable Energy Asset Management Software will accommodate a range of functionalities specific to the needs of renewable energy operators. In this landscape, operators will be able to monitor asset performance in real-time with software solutions, allowing them to catch problems before they become significant. This is predicated on its integrative approach of the power of the Internet of Things (IoT) and artificial intelligence. The software will thus facilitate predictive maintenance strategies, which will generally decrease operational upsets while increasing the overall reliability of renewable energy systems. This capability, therefore, goes a long way in decreasing operational costs and guaranteeing good returns on investment for a renewable energy project.

As regards the Global Renewable Energy Asset Management Software market, it will also engage with ensuring compliance of regulations and reporting environmental impact metrics. To cope with the increasingly stringent regulations around emissions and greater sustainability practice, the software will be of great importance to renewable energy operators; they will be able to prove and show high levels of commitment toward sustainability. Better reporting capabilities will further enable operators to report their results to stakeholders, investors, and the public, thus achieving further industry transparency and trust.

Collaboration between the stakeholder will become more paramount in the Global Renewable Energy Asset Management Software market. Software providers will collaborate with energy operators to develop customized solutions that target specific challenges unique to their operations. That would have meant that the software would not remain stagnant but instead innovative and relevant as fast-paced changes in market dynamics and technological advancements happened within the industry. With the rising investments of companies into renewable energy assets, there would be an increasing demand for specialized software solutions, which would fuel the innovation and competition in the market.

Thus, the Global Renewable Energy Asset Management Software market shall find operators exploiting new business models and revenue streams based on the data produced by their assets. Optimized software products shall bring forth valuable insights into energy production patterns, strategies towards optimization of trading energy, and profitability. The analysis of historical performance data will allow the operators to take informative decisions with regard to asset acquisition, divestment, and resource-allocation that may lead to better competitive advantage in the marketplace.

The Global Renewable Energy Asset Management Software, in the wake of rapid transition towards renewable energy sources, will be an important part of the energy landscape. The software will also help achieve maximum operational efficiency and compliance while encouraging innovation and collaboration from all stakeholders. With the ever-changing technology landscape and an increasing focus on sustainability, the industry will play a vital role in ensuring the long-term survival and success of renewable energy assets worldwide. The key would lie in software solutions that allow the operators to maneuver best, navigate the complexities of the renewable energy sector, and maximize value for all parties involved.

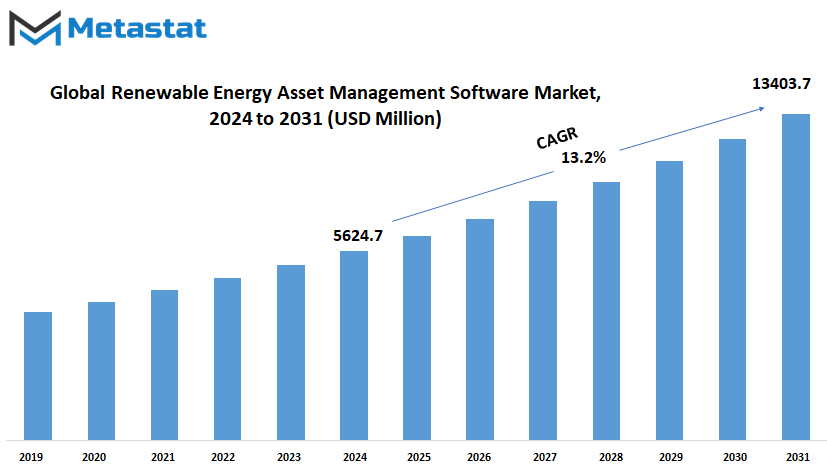

Global Renewable Energy Asset Management Software market is estimated to reach $13403.7 Million by 2031; growing at a CAGR of 13.2% from 2024 to 2031.

GROWTH FACTORS

It is probable that the Global Renewable Energy Asset Management Software market will be tagged as a rising market, based on several factors. The major growth factors are the rising demand for renewable energy production all over the world. In this respect, governments and companies aspire to decrease carbon emissions and shift to cleaner sources of energy; a greater emphasis is placed on the effective management of renewable energy assets. This trend is likely to raise demand in software solutions that optimize performance and maintenance on renewable energy systems at wind and solar farms.

A further element to account for in this market's growth is the technological advancement of asset management software. Advances such as artificial intelligence and machine learning would further empower these software solutions in monitoring in real-time and predictive maintenance while providing analytics into data. All these improve the operations of energy provision and its related costs. As an offshoot, the complexity in energy systems will heighten the demand for sophisticated management tools to manage these complexities, which would further spur the growth in the market.

Despite all these positive trends, however, the market for Global Renewable Energy Asset Management Software may encounter some negative trends. The first and foremost is huge initial investment in implementing such software solutions for a company. This can be quite high, especially for small companies and new markets. Another major drawback is the unavailability of trained professionals to handle such systems. Companies might not have some really good talent with the necessary expertise to help them leverage advanced software effectively, thereby slowing down the adoption of these technologies.

On the other hand, the market also holds a lot of promise. Renewables and the pressure for energy efficiency may spur a great deal more investment in renewable energy infrastructure. These tend to call up a need for innovative software solutions specifically designed to address the particular needs of the renewable energy sector. Companies that deliver asset management tools that are user friendly and affordable will have a ready market since businesses are looking to really reduce their expenses.

The Global Renewable Energy Asset Management Software market is witnessing tremendous growth spurt, majorly due to increasing demand for renewable energy sources and technological enhancements that lead to effectiveness. However, higher investment in skilled labor would be a stumbling block for growth. This future holds within it huge opportunities for companies that are ready to innovate and adapt accordingly. This means that in the future years ahead, all these factors will converge in the market and influence its direction.

MARKET SEGMENTATION

By Type

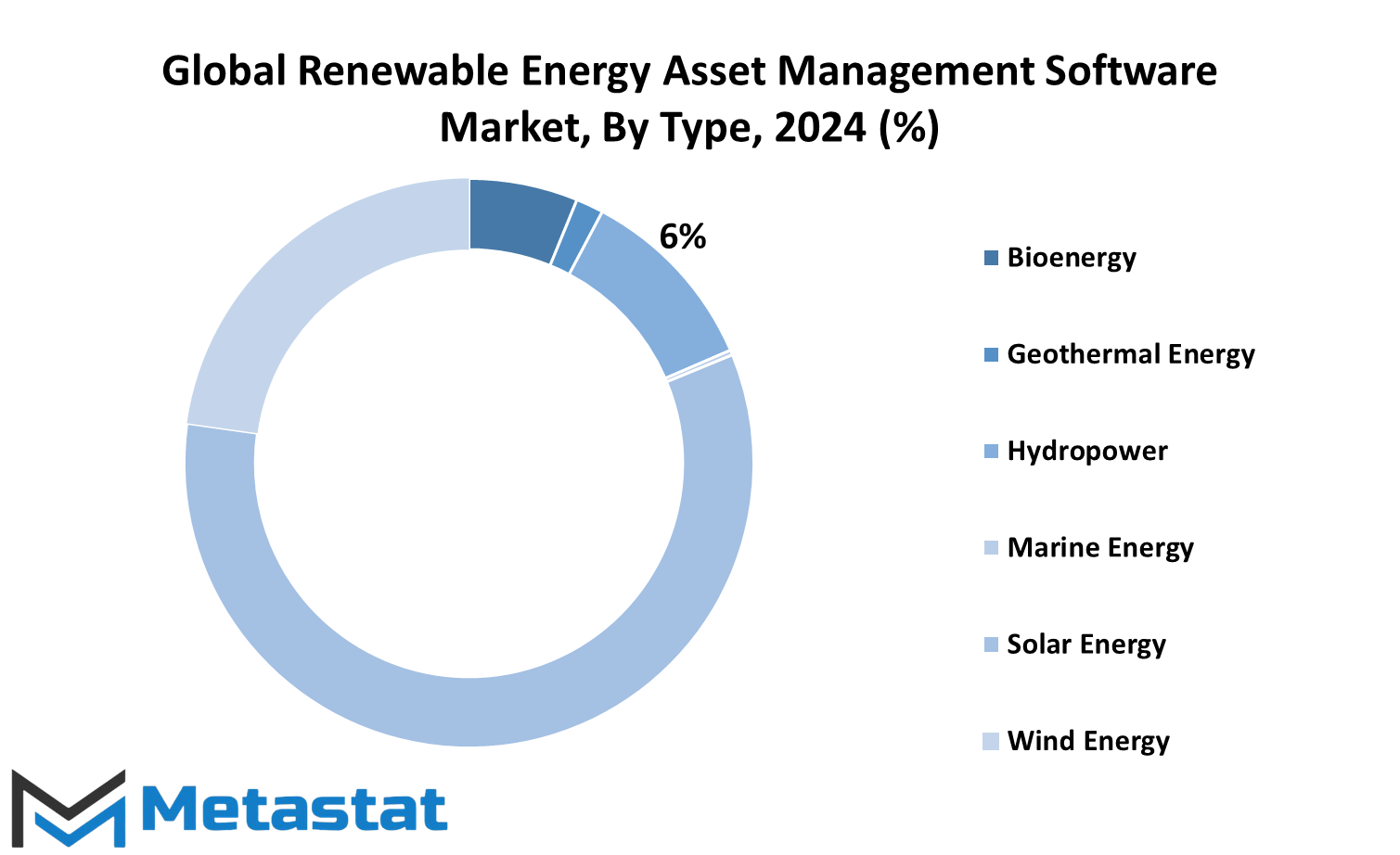

The global renewable energy asset management software market is one of the fastest-growing markets in the renewables industry. Focus on sources of sustainable energy has become a fundamental area of focus. The urgency to meet climate objectives by developing cleaner sources of energy underscores that effective asset management solutions in the renewable industry are at an all-time high. The market has been looking at software solutions that are management and optimization of the renewable energy assets in order to maximize run times with negligible cost. Increasing investments in renewable energy projects, demand for energy, and the need to comply with the existing regulatory framework are factors that will lead the growth of the market in the software sector. Each type of renewable energy throws up specific challenges and opportunities thus demanding different software solutions tailored to the requirements for each type of renewable energy. Bio-energy, for instance, since it is converting organic materials into energy, will demand some special management software that tracks feedstock availability and conversion efficiency.

Geothermal power relies on the Earth’s internal warmth. In this sector, software would be built mainly to track the performance of geothermal plants, manage data relative to resources, and optimize drilling operations. Similarly, hydropower, one of the oldest forms of renewable power, will use softwares that monitor water flow energy production as well as maintain dams and turbines.

Marine energy is the newest entrant within the renewable energy landscape. It captures the power of waves and tides in oceans. As an effect, software for assets would be dealing with specific environment impact, monitoring of equipment conditions, as well as predicting the outputs of energy based on oceanographic data. For solar energy management software, real-time monitoring of solar panels, solar panels related energy storage integration, and grid connectivity would take preference for maximizing energy yield.

A very significant area is wind energy. The use of software for wind turbines will be focused on health monitoring, analytics on performance, and predictive maintenance. The increasing size and complexity of wind farms mean good asset management will be critical for reliability as well as for cost minimization.

The Global Renewable Energy Asset Management Software market, by type, will change as the developed technology improves data analytics, automatized, and machine learning. Such evolutions will enhance decision-making capabilities, improvements in operational efficiency, and thus contribute to a sustainable energy future. Investments in these solutions will be led by organizations and will thus push the market, all for a clean energy and environmentally friendly option.

By Deployment Model

The Global Renewable Energy Asset Management Software market is an emerging market, related to the whole shift by world economies toward the use of renewable energy sources for energy production. This software is very pivotal in the management and optimization of renewable energy assets, putting them into maximum efficient and profitable work. With increased demand in renewable energy, the requirement of advanced monitoring, control, and analytical tools for energy production and consumption increases.

In this market, the two fundamental deployment models are on-premise and cloud-based systems. In the on-premise solution, the software will be installed directly on the user’s local servers. This model grants absolute control over the company’s data and its infrastructure. Organizations that have strict data security regulations or prefer to manage their hardware and software environment will probably prefer the on-premise solutions. However, such systems frequently entail significant IT infrastructure and maintenance costs at the outset. Cloud-based solutions are, on the other hand, being widely adopted in the Global Renewable Energy Asset Management Software market.

Cloud-based platforms are operated on remote servers. The users can access their data and applications from any geographical location through the internet. This type of deployment model has a significant reduction in initial cost as well as scope for scalability. It can be accessed with ease and from any part of the world. Organizations can take up the arising needs and incorporate new developments to compete with the fast-paced industry. Such flexible nature of cloud-based systems also offers scope for cooperation without hassle, thus improving communication and efficiency between teams. Looking forward, the cloud-based solutions would progressively gain a position of dominance in the Global Renewable Energy Asset Management Software market. The systems, based on the advancements in technology, would be more sophisticated with capabilities that are built on artificial intelligence and machine learning.

This would further allow for real-time data analysis and predictive maintenance to continually optimize asset performance. The increasing emphasis on sustainability, along with the need to reduce carbon footprints, is likely to fuel demand for more sophisticated management tools. Companies are similarly well-placed to continually innovate in software. Thereby, the Global Renewable Energy Asset Management Software market is likely to boom significantly through both on-premise as well as cloud-based solutions. The companies would need to seriously consider their requirements and select the deployment model that best suits the requirements of the organization. In this regard, the asset management software would further play a crucial role in energy supply organizations, allowing them to realize their investment to support a greener future more effectively.

By Service

Global Renewable Energy Asset Management Software Market to Shape and Grow Renewable Energy Assets Managements with Efficiency in Operational Management and Decision-Making: In respect to the paramount importance of the industry marked by the shift of the world toward sustainable forms of energy, high emphasis on the reduction of carbon footprint efficiency factors enhance the adoption of sophisticated software solutions designed to optimize renewable energy operations.

As the future goes by, Global Renewable Energy Asset Management Software will prove to be an essential part of process streamlining and productivity building. It will offer a suite of services unique to renewable energy operators’ needs. Amongst those will be Asset Performance Management, which is emerging as a corner stone. This service focuses on ensuring that renewable assets, in this case wind turbines and solar panels, are put to their highest potential productive output. Companies can determine performance issues even before costly downtimes can develop in their renewable assets through the use of real-time monitoring and data analysis.

Predictive Maintenance will also be more of the need in this landscape. Advanced analytics and machine learning algorithms will be used by software to predict when equipment requires maintenance. Operators will be given ample time to schedule interventions proactively. More than that, it will help companies cut down on costs for maintenance while elongating the lifespan of renewable assets. It will thereby help companies attain higher operational reliability and minimize unexpected failures that will go a long way in improving the performance of the asset as a whole.

Aside from this, Regulatory Compliance Management will also become much more crucial in the light of increasing regulations for renewable energy productions and emissions from almost all parts of the world. Software solutions will help companies navigate the complex regulatory environment, ensuring they meet all compliance requirements while making as few risks related to non-compliance as possible. This feature, especially for multi-jurisdiction business enterprises, will simplify compliance because of the varied regulations under which they have to operate.

Financial Management will be another key area for this market. The companies will be utilizing software applications in managing budgets, forecasting expenses, and analyzing their financial health in their renewable assets. Thus, with sound financial tools in place, operators will make informed investment decisions and maximize growth and profitability opportunities.

Lastly, Business Intelligence and Analytics will give the stakeholders much needed insight over their operations. Companies will derive trends and patterns using the usage of data analytics that inform strategic planning and changes in the operational levels of the companies. It will become the input that organizations will need to remain competitive in a market slowly getting crowded.

The Global Renewable Energy Asset Management Software market is poised for significant growth. By focusing on services such as Asset Performance Management, Predictive Maintenance, Regulatory Compliance Management, Financial Management, and Business Intelligence & Analytics, the market will enable companies to enhance operational efficiency and sustainability in a world that is rapidly embracing renewable energy solutions.

By End Users

Renewable energy asset management software will no doubt be at the heart of energy management in the future. The more the world takes over sustainable practices, the more the asset management of renewable energy is going to become crucial. The software is developed to assist utility users who make use of various utilities, independent power producers, renewable energy developers, and industrial companies with on-site renewables in optimizing their operations, streamlining processes, and boosting profitability.

The two main end-users of renewable energy asset management software are utilities. They would greatly benefit from the capability to monitor and manage several energy assets real-time. Such software would allow utilities to monitor the performance of other renewable sources, such as solar and wind energy, which mean that these resources can be operated at peak efficiency. Utilities will become better at dealing proactively with issues such as downtime or faults-which enhances service reliability-with advanced predictive maintenance capabilities and performance analytics.

With great benefit, independent power producers, or IPPs, will also benefit from this software. Since they generate electricity from renewable sources, their asset management issues are concentrated to many places. Renewable energy asset management software will allow IPPs to have central data coming from different sites. In the central information, they shall find a platform of clear decisions regarding asset distribution, performance enhancement, and investment policies.

Renewing energy developers will use this software to manage the different phases of renewable energy projects. Including planning and development, operation, and maintenance, this software helps manage resources efficiently and provides tools for tracking and reporting compliance. By using these capabilities, developers can maximize their return on investment and better address regulatory complexities.

Further development of the Global Renewable Energy Asset Management Software market is bound to happen as a result of on-site renewable energy penetration from industrial companies. As those companies continue to seek renewable means to power their operations, they would call for robust management solutions to integrate and optimize those assets. In a larger sense, it will lead to better management of energy production, consumption, and cost savings towards sustainability in model.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$5624.7 million |

|

Market Size by 2031 |

$13403.7 Million |

|

Growth Rate from 2024 to 2031 |

13.2% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Global Renewable Energy Asset Management Software market has been gaining pace as more countries move toward more sustainable energy solutions. This market has been divided according to regions, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. These areas have some other specific characteristics and needs that influence how renewable energy technologies are adopted and managed.

North America generally embodies a significant stimulus to push the advance of renewable energy infrastructure, including a mix of investments in solar and wind energy through significant government policies aimed toward curbing carbon emissions within the U.S., while Canada continues down this path through its immense hydroelectric capabilities and an increasingly strong stance in terms of solar energy. Mexico is also moving ahead with renewable energy, especially solar power, that has driven business behind the supportive policies and natural resources. This region's growth in software demand will be crucial in optimizing its assets' performance and sustainability.

The UK, Germany, France, Italy, and the Rest of Europe combined is another hot spot, where renewable energy is showing growth. The European Union now aggressively pursues greenhouse emission reduction, and countries in this region are putting technologies to their maximum utilities for achieving this goal. Germany is also among the strongest renewable energy policies with strong utilization of solar and wind power energy with the setting of next-generation software to monitor and manage its utilization at full capacity. UK Offshore wind projects are under way. France is moving ahead with the development of nuclear and solar capabilities. The joint Europe approach to energy transition will drive up the demand for asset management software on renewable energy.

The Asia-Pacific countries are India, China, Japan, South Korea, and the Rest of Asia-Pacific. They form a fast growing segment in the Global Renewable Energy Asset Management Software market. China is the world's largest maker of solar panels, and its renewable energy targets are ambitious. The Indian solar market is also expanding very rapidly. There are government initiatives put in place to try to accelerate the adoption of renewable energies. Japan and South Korea are investing in improving the energy efficiency aspects of these advanced technologies and in integrating renewables in the energy grids. Increasing urbanization and growing energy demand in this region will be a guarantee of increasing demand for innovative management software.

Renewable energy is increasingly being tapped to meet energy demands and reduce reliance on fossil fuel in South America, particularly in Brazil and Argentina. As more interest is voiced in wind and solar projects, good asset management software will be necessary to ensure that such projects operate efficiently.

The Middle East & Africa, including the GCC and South Africa countries, are also forging a new future on renewable energy. They will be investing gradually in much more solar and wind, which will demand good asset management tools so that they can extract maximum from those resources.

Overall, the Global Renewable Energy Asset Management Software market will continue its growth as all regions embrace renewable energy solutions and require innovative technologies to manage and optimize their energy assets efficiently.

COMPETITIVE PLAYERS

Global Renewable Energy Asset Management Software market is increasing at a healthy rate. The interest in renewable energy solutions has emerged at a great rate on both industry and government levels. Renewable energy asset management software plays a critical role in managing renewable energy assets to optimize performance through efficient operation. With growing interest in renewable energy, companies rely more on advanced versions of software to handle energy assets.

There are a few key players in the Global Renewable Energy Asset Management Software market that will play crucial roles in developing the future of energy. Among the top energy companies is GE Vernova, and they offer the most complete digital technology solutions aligned with renewable energy management. Its software would assist organizations in monitoring their assets in real time and then adjust them accordingly. It will provide insights to help organizations improve operations efficiency. Similar is the case with Hitachi Energy Ltd., which is characterized by an asset management approach. It utilizes data analytics to become more performance-wise and reliability-assured. Its solutions suit renewable energy systems.

A few of the other key players include Fluence Energy, Inc., which focuses on energy storage and optimization. Its software solutions optimize renewable sources of energy with maximal throughput to ensure the optimal availability of energy when it is needed. Fluence takes advantage of advanced algorithms and real-time data to make it easier for organizations to better run their energy assets.

AVEVA Group Limited is also notable in the Global Renewable Energy Asset Management Software market, with a portfolio of solutions that increase visibility and control over energy assets. Its solutions enable companies to be smarter in decision making within operations, thereby reflecting greater performance coupled with lesser costs. Emerson Electric Co is also complemented by its end asset management software that gives holistic integration-thus easy transition to renewable sources of energy.

Other promising players in this space include Cenosco, QBI Solutions, Nexsysone, and Greensolver. These organizations are coming out with innovative solutions for the marketplace and thereby are serving to meet the emergent needs of the renewable energy business. Sky Specs- Asset management upgrades based on Drone Inspection Technology Sky Specs is using drone inspection technology to upgrade the asset management, providing deep insights into the condition of renewable energy facilities. More importantly, Apollo Energy Analytics deals with data-driven insight, helping an organization make appropriate decisions to optimize its energy assets and prepare strategic decision-making.

As the Global Renewable Energy Asset Management Software market continues growing, competition between these key players increases. Innovations and sustainability within their product offerings will be relentless, driving the advancement of technology and the services that change everything for the rest of the renewable energy sector. The future is bright for these companies, which are leading the way in the transformation of how we manage and optimize our renewable energy resources.

Renewable Energy Asset Management Software Market Key Segments:

By Type

- Bioenergy

- Geothermal Energy

- Hydropower

- Marine Energy

- Solar Energy

- Wind Energy

By Deployment Model

- On-Premise

- Cloud-Based

By Service

- Asset Performance Management

- Predictive Maintenance

- Regulatory Compliance Management

- Financial Management

- Business Intelligence & Analytics

By End Users

- Utilities

- Independent Power Producers

- Renewable Energy Developers

- Industrial Companies with On-Site Renewables

- Others

Key Global Renewable Energy Asset Management Software Industry Players

- GE Vernova

- Hitachi Energy Ltd.

- Fluence Energy, Inc.

- AVEVA Group Limited

- Emerson Electric Co.

- Cenosco

- QBI Solutions

- Nexsysone

- Greensolver

- Sky Specs

- Apollo Energy Analytics

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252