MARKET OVERVIEW

Europe's Investment Management Regulatory Reporting market plays a crucial role in the financial landscape, serving as the bedrock for transparent and compliant financial operations within the investment management industry. This market is an intricate ecosystem where regulatory reporting requirements intersect with the nuanced needs of investment management firms, creating a dynamic environment shaped by evolving regulatory frameworks and industry demands.

The Europe Investment Management Regulatory Reporting market is the epicenter of regulatory compliance for investment management entities across the continent. With an ever-changing regulatory landscape, investment management firms are compelled to navigate a complex web of reporting obligations, ranging from MiFID II to AIFMD and beyond. The market functions as a conduit, translating these regulatory mandates into actionable reporting processes that ensure adherence to legal requirements.

In this industry, precision is paramount. Investment management firms must accurately capture, analyze, and report a myriad of data points to regulatory authorities. The Europe Investment Management Regulatory Reporting market provides the tools and solutions necessary for these firms to streamline their reporting processes, minimizing the risk of errors and ensuring that they meet their regulatory obligations with utmost accuracy.

Moreover, the market serves as a hub for technological innovation within the investment management sector. As regulatory requirements become more intricate, the need for sophisticated reporting solutions has surged. The industry has responded with cutting-edge technologies such as artificial intelligence, machine learning, and automation, empowering investment management firms to enhance the efficiency and accuracy of their reporting mechanisms.

One of the key challenges addressed by the Europe Investment Management Regulatory Reporting market is the harmonization of reporting standards across different jurisdictions. As investment management firms operate across borders, the market facilitates the alignment of reporting practices, ensuring a standardized approach that meets the diverse regulatory expectations of European countries.

The ecosystem of the Europe Investment Management Regulatory Reporting market is populated by a diverse array of stakeholders, including regulatory technology (RegTech) providers, software developers, and consulting firms. These entities collaborate to deliver comprehensive solutions that cater to the multifaceted needs of investment management firms, offering not just compliance but also strategic insights derived from the data collected during the reporting process.

The Europe Investment Management Regulatory Reporting market is indispensable for the seamless functioning of the investment management industry in the face of evolving regulatory landscapes. By providing the tools, technologies, and expertise necessary to navigate these challenges, the market ensures that investment management firms can not only meet their reporting obligations but also derive valuable insights from the data they generate, contributing to a more resilient and adaptive financial ecosystem in Europe.

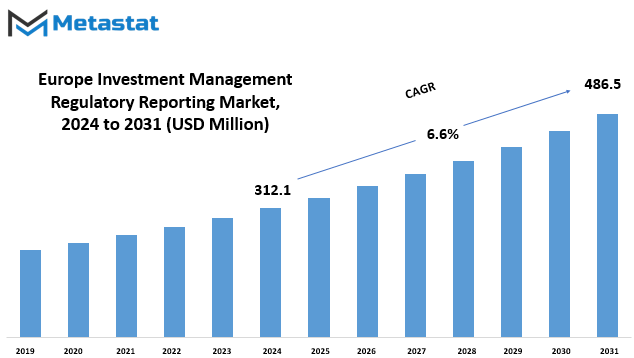

Europe Investment Management Regulatory Reporting market is estimated to reach $486.5 Million by 2031; growing at a CAGR of 6.6% from 2024 to 2031.

GROWTH FACTOR

The Europe Investment Management Regulatory Reporting market is influenced by various factors that shape its dynamics. One significant driver is the heightened level of regulatory scrutiny. In recent times, regulatory bodies have intensified their oversight of the investment management sector, prompting firms to adapt and comply with evolving standards.

The rising complexity of investment products further contributes to the changing landscape of regulatory reporting. As financial instruments become more intricate, the need for comprehensive and accurate reporting has grown. Investment firms find themselves navigating through a landscape were staying compliant means grappling with intricate financial instruments and their associated reporting requirements.

However, this landscape is not without its challenges. High compliance costs act as a restraint, posing a financial burden on investment firms. The resources required to meet stringent regulatory standards can strain budgets, affecting the overall operational efficiency of these entities.

Technological and operational challenges also hinder the seamless functioning of the regulatory reporting process. The integration of technology to streamline reporting procedures faces hurdles, and operational inefficiencies may arise due to the complexity of implementing such solutions.

Amidst these challenges, there exists an opportunity for progress. The advancement of Regulatory Technology (RegTech) solutions provides a ray of hope for investment firms. These solutions leverage technology to simplify and enhance the regulatory reporting process. As firms adopt more sophisticated RegTech solutions, the potential for improved efficiency and accuracy in compliance reporting becomes evident.

The Europe Investment Management Regulatory Reporting market is shaped by a delicate balance of drivers, restraints, and opportunities. Regulatory scrutiny and the increasing complexity of investment products drive the need for more robust reporting. However, the high costs of compliance and technological challenges pose hurdles. The bright side lies in the evolving realm of RegTech solutions, offering a path towards streamlined and effective regulatory reporting for investment management firms.

MARKET SEGMENTATION

By Type

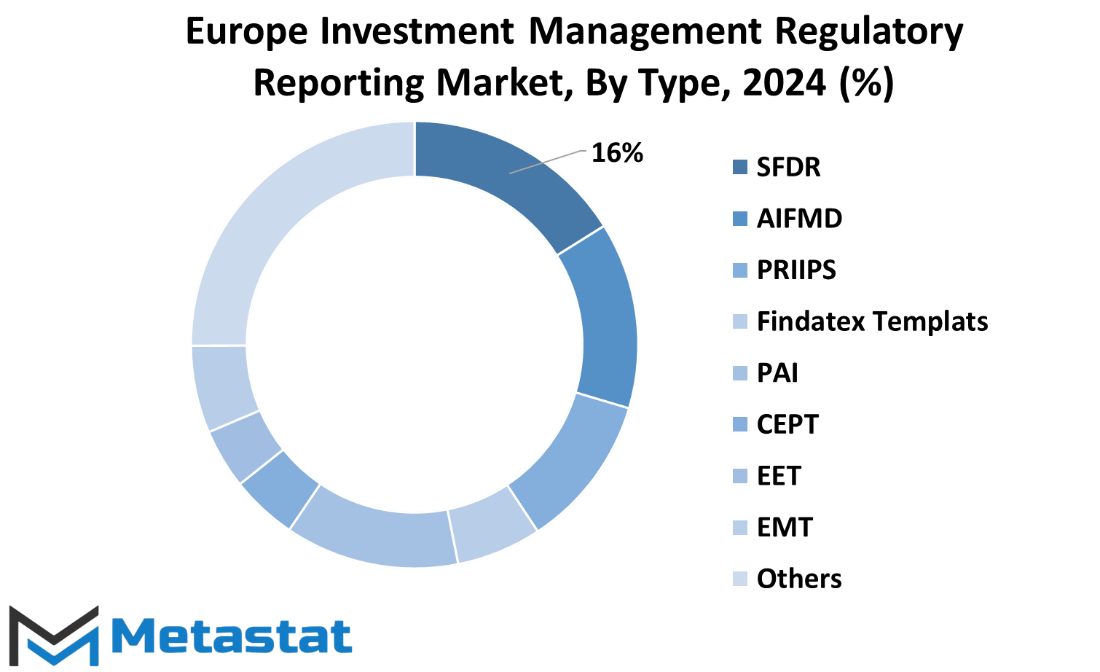

The European Investment Management Regulatory Reporting market is a dynamic landscape that involves various reporting solutions and services. When we delve into the market segmentation by type, we find a diverse range of offerings tailored to meet specific regulatory requirements.

One significant category within this market is Sustainable Finance Disclosure Regulation (SFDR) Reporting Solutions. These solutions are designed to assist financial entities in complying with SFDR regulations, ensuring transparency in disclosing the environmental and social impact of their investment activities.

Another key segment is Alternative Investment Fund Managers Directive (AIFMD) Reporting Services. These services cater to investment fund managers, aiding them in adhering to the regulatory framework outlined by AIFMD. This directive focuses on creating a harmonized and transparent regulatory regime for alternative investment fund managers across the European Union.

In addition, the market encompasses Packaged Retail and Insurance-Based Investment Products (PRIIPS) Reporting Solutions. These solutions play a crucial role in helping financial institutions comply with PRIIPS regulations, which aim to provide retail investors with clear and understandable information on investment products.

The FinDatEx Templates represent another facet of the market, offering standardized reporting templates. These templates facilitate consistency and ease in reporting, streamlining the process for financial institutions and ensuring adherence to regulatory guidelines.

Performance Attribution and Analysis (PAI) Statement Services form a vital component, aiding in the evaluation and analysis of investment performance. This contributes to a more comprehensive understanding of the returns and attribution within the investment portfolio.

The market also includes the Comfort European PRIIPs Template (CEPT), which provides a standardized template for presenting key information documents for packaged retail and insurance-based investment products. This template simplifies the reporting process and enhances transparency for end investors.

Furthermore, the European ESG Template (EET) addresses the growing emphasis on environmental, social, and governance factors in investment decisions. This template facilitates the integration of ESG considerations into the reporting framework, aligning with the evolving priorities of the investment management industry.

The MiFID Template (EMT) is another noteworthy inclusion, focusing on the Markets in Financial Instruments Directive. This template aids in compliance with MiFID regulations, contributing to the overall regulatory adherence of financial institutions operating in the European market.

Beyond these specific categories, the market also encompasses other solutions and services catering to diverse reporting needs within the realm of investment management regulatory requirements. The varied offerings reflect the adaptability and responsiveness of the market to the evolving regulatory landscape, providing financial entities with a range of tools to navigate and comply with regulatory frameworks efficiently. In essence, the European Investment Management Regulatory Reporting market thrives on its ability to offer tailored solutions that empower financial institutions to meet their regulatory obligations effectively.

By Application Segments

In Europe's Investment Management Regulatory Reporting market, various application segments play a pivotal role in shaping its dynamics. These segments cater to a diverse set of entities, each contributing to the market's overall valuation in 2023.

Asset Management Firms stand as one of the prominent players in this landscape, influencing the market with their financial strategies and management practices. The value attributed to this segment in 2023 underscores its significance in the broader context of regulatory reporting, totaling a noteworthy figure.

Hedge Funds constitute another integral part of the market, making their impact felt with a valuation of 41 USD Million in 2023. The substantial value reflects the substantial role played by Hedge Funds in the investment landscape, contributing to the overall health and diversity of the regulatory reporting market.

Mutual Funds, with a valuation of 54.6 USD Million in 2023, form a considerable segment within the regulatory reporting market. Their influence is reflected in the financial metrics, indicating their substantial contribution to the market's economic landscape.

Private Equity Firms, valued at 33.7 USD Million in 2023, represent a distinct segment with its own set of dynamics. Their unique position in the market contributes to the overall complexity and diversity, underscoring the multifaceted nature of the regulatory reporting landscape.

Institutional Investors, holding a valuation of 31.4 USD Million in 2023, bring their own weight to the market dynamics. Their role in shaping investment strategies and decisions adds another layer of complexity to the regulatory reporting landscape.

Regulatory Authorities, though comparatively smaller in valuation at 6.52 USD Million in 2023, play a crucial role in maintaining order and compliance within the market. Their influence is not measured solely by financial metrics, as they contribute significantly to the overall regulatory framework.

Financial Technology (FinTech) Companies, Investment Consultants, Insurance Companies, and Investor Relations and Compliance Teams collectively contribute to the intricate tapestry of the regulatory reporting market. Each of these segments brings its unique set of perspectives and practices, collectively shaping the market's trajectory.

The Europe Investment Management Regulatory Reporting market, dissected through various application segments, reflects a dynamic and interconnected ecosystem. The values associated with each segment in 2023 underscore the diverse contributions of different entities, highlighting the nuanced nature of regulatory reporting in the ever-evolving landscape of investment management.

REGIONAL ANALYSIS

In recent times, there has been a notable focus on the Europe Investment Management Regulatory Reporting market. This sector plays a pivotal role in ensuring transparency and compliance within the investment management landscape. In this essay, we will delve into the regional analysis of this market, shedding light on its dynamics and impact.

Europe, as a region, has witnessed significant developments in investment management regulatory reporting. The regulatory landscape has evolved, prompting market participants to adapt to new requirements and standards. This adaptability is crucial for businesses to thrive in an environment where regulatory compliance is not just a legal obligation but a fundamental aspect of operations.

The regulatory reporting market in Europe is marked by diversity. Different countries within the region have distinct regulatory frameworks, creating a dynamic landscape for investment management. Understanding and navigating these diverse regulatory environments is essential for businesses operating in the sector.

One of the key aspects of the Europe Investment Management Regulatory Reporting market is the emphasis on transparency. Regulatory requirements aim to provide stakeholders with clear and comprehensive information about the financial activities of investment management entities. This transparency fosters trust and confidence in the market, benefiting investors and the industry.

Moreover, the regulatory reporting landscape in Europe is characterized by a continuous evolution. Regulatory bodies regularly update and refine reporting standards to address emerging challenges and align with global best practices. This necessitates a proactive approach from market participants, requiring them to stay abreast of regulatory changes and implement necessary adjustments to their reporting processes.

The regional analysis also reveals the interconnected nature of the Europe Investment Management Regulatory Reporting market. With many global firms operating within the region, the impact of regulatory changes in one country often resonates across borders. This interconnectedness underscores the need for a holistic and globally aware approach to regulatory compliance.

The Europe Investment Management Regulatory Reporting market is a dynamic and evolving landscape. The regional analysis highlights the diversity of regulatory frameworks, the importance of transparency, and the ongoing evolution of reporting standards. Businesses operating in this sector must navigate these dynamics with agility and a proactive mindset to ensure sustained compliance and success in the ever-changing regulatory environment.

COMPETITIVE PLAYERS

In the dynamic landscape of the Europe Investment Management Regulatory Reporting market, various players contribute to shaping its trajectory. These key participants wield influence and play pivotal roles in the industry's functioning. Among them are notable entities such as BNP Paribas Securities Services, BNY Mellon Investment Management, Broadridge Financial Solutions, Inc., CACEIS (Crédit Agricole), Confluence Technologies, Inc., FactSet Research Systems Inc., Infosys Limited, Adenza, PricewaterhouseCoopers International Limited (PwC), SimCorp A/S, SS&C Technologies Holdings, Inc., State Street Corporation, Waystone, MSCI Inc., S&P Europe Market Intelligence, Wolters Kluwer N.V., Bloomberg Finance L.P., Landy Tech Ltd, Systemic R.M. S.A., and Qontigo.

These competitive players form the backbone of the Investment Management Regulatory Reporting sector, each contributing its unique strengths and capabilities. BNP Paribas Securities Services, for instance, brings its financial expertise, while BNY Mellon Investment Management leverages its extensive investment knowledge. Broadridge Financial Solutions, Inc., is recognized for its comprehensive financial services, and CACEIS, a part of Crédit Agricole, plays a crucial role in shaping the regulatory landscape.

Confluence Technologies, Inc., and FactSet Research Systems Inc., stand out for their technological prowess, offering innovative solutions to navigate the complex regulatory requirements. Meanwhile, Infosys Limited, a global leader in consulting and technology, brings its extensive IT capabilities to the table. Adenza, with its niche focus, contributes specialized insights, and PwC, a renowned name in professional services, provides strategic guidance.

SimCorp A/S and SS&C Technologies Holdings, Inc., specialize in investment management solutions, while State Street Corporation and Waystone bring their financial expertise to the forefront. MSCI Inc. and S&P Europe Market Intelligence are recognized for their data and analytics capabilities, shaping informed decision-making.

The landscape also includes Wolters Kluwer N.V., Bloomberg Finance L.P., and Landy Tech Ltd, each contributing unique facets to the regulatory reporting ecosystem. Systemic R.M. S.A. and Qontigo, with their respective strengths, add further depth to the competitive dynamics.

In this vibrant industry, the presence of these key players fosters competition and drives innovation. Their collective impact ensures that the Europe Investment Management Regulatory Reporting market remains dynamic, responsive to regulatory changes, and poised for sustained growth. As these entities evolve and adapt, their contributions will shape the industry's future trajectory.

Investment Management Regulatory Reporting Market Key Segments:

By Type

- SFDR (Sustainable Finance Disclosure Regulation) Reporting Solutions

- AIFMD (Alternative Investment Fund Managers Directive) Reporting Services

- PRIIPS (Packaged Retail and Insurance-Based Investment Products) Reporting Solutions

- FinDatEx Templates

- PAI (Performance Attribution and Analysis) Statement Services

- Comfort European PRIIPs Template (CEPT)

- European ESG Template (EET)

- MiFID Template (EMT)

- Others

By Application Segments

- Asset Management Firms

- Hedge Funds

- Mutual Funds

- Private Equity Firms

- Institutional Investors

- Regulatory Authorities

- Financial Technology (FinTech) Companies

- Investment Consultants

- Insurance Companies

- Investor Relations and Compliance Teams

Key Europe Investment Management Regulatory Reporting Industry Players

- BNP Paribas Securities Services

- BNY Mellon Investment Management

- Broadridge Financial Solutions, Inc.

- CACEIS (Crédit Agricole)

- Confluence Technologies, Inc.

- FactSet Research Systems Inc.

- Infosys Limited

- Adenza

- PricewaterhouseCoopers International Limited (PwC)

- SimCorp A/S

- SS&C Technologies Holdings, Inc.

- State Street Corporation

- Waystone

- MSCI Inc.

- S&P Europe Market Intelligence

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252