MARKET OVERVIEW

The Global Software Testing Automation Market represents a pivotal domain where innovative solutions converge to streamline and enhance the testing processes integral to software deployment. Software testing automation is not merely a facet of the tech industry; rather, it is a dynamic ecosystem driven by the perpetual quest for precision and reliability. At its core, the Global Software Testing Automation Market is a response to the escalating demands of software development and the need for rapid, error-free deployment in an era where digital prowess defines competitiveness.

The significance of the market lies in its role as a catalyst for expediting the software development life cycle. By harnessing automation tools and technologies, organizations can transcend the traditional constraints of manual testing, unlocking possibilities for increased speed, accuracy, and scalability in the testing phase. In this market, cutting-edge tools and platforms are continuously emerging, offering solutions that address the nuances of diverse software applications. From functional testing to regression testing, the Global Software Testing Automation Market spans a spectrum of methodologies and techniques, each tailored to meet the specific demands of modern software development projects.

As businesses strive to roll out software updates and new features swiftly, the demand for efficient testing processes becomes increasingly pronounced. Software testing automation emerges as a linchpin in this scenario, allowing organizations to iterate and deploy with confidence, knowing that rigorous testing has been conducted seamlessly and comprehensively.

Moreover, the market is characterized by a confluence of artificial intelligence and automation, ushering in an era where intelligent testing tools go beyond script-based automation. Machine learning algorithms play a pivotal role in adaptive testing, enabling systems to learn and evolve with each testing cycle, thereby enhancing the overall efficacy of the testing process.

The Global Software Testing Automation Market epitomizes the relentless pursuit of excellence in the software development life cycle. It is not merely a market; it is a dynamic ecosystem where innovation converges with necessity, shaping the future of software testing. As organizations across industries navigate the complexities of digital transformation, the role of software testing automation becomes increasingly indispensable, ensuring that the software they deliver is not just functional but also resilient and future ready.

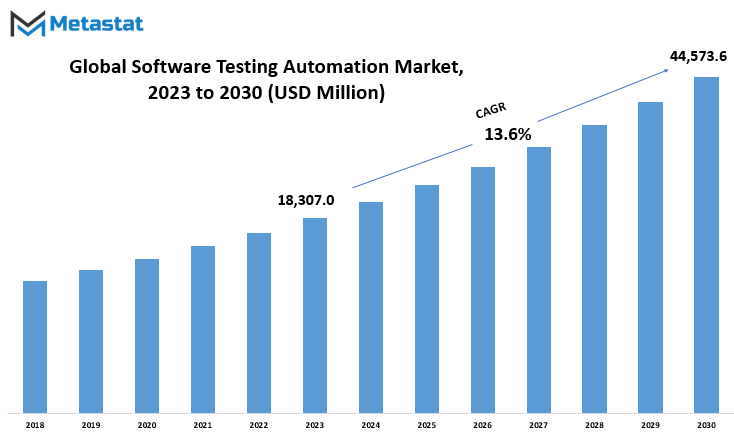

Global Software Testing Automation market is estimated to reach $44,573.6 Million by 2030; growing at a CAGR of 13.6% from 2023 to 2030.

GROWTH FACTORS

The global Software Testing Automation market is propelled by the escalating demand for swifter software development cycles and the pervasive adoption of Agile and DevOps methodologies in software development. These dynamics form the bedrock of the market’s growth, reflecting the industry’s pursuit of efficiency and agility.

The imperative for faster software development cycles and continuous delivery has become a driving force behind the surge in the Software Testing Automation market. As businesses race to deploy software swiftly, automation emerges as a strategic enabler, facilitating rapid testing processes and ensuring the timely release of applications.

The adoption of Agile and DevOps methodologies further accentuates the market’s trajectory. These methodologies, characterized by their iterative and collaborative approach, necessitate streamlined and continuous testing. Software Testing Automation aligns seamlessly with these methodologies, offering the speed and efficiency required to meet the demands of iterative development and continuous integration.

The high initial investment and maintenance costs pose significant hurdles for some organizations looking to venture into the realm of automation. Additionally, the scarcity of skilled professionals proficient in operating and maintaining testing automation tools creates a bottleneck in the market’s growth, hindering the seamless integration of these tools into development processes.

The rise of cloud-based testing automation tools stands out as a transformative trend. These tools not only address the cost concerns but also offer flexibility and scalability, aligning perfectly with the dynamic needs of modern software development. The cloud-based approach brings about cost-effectiveness, making automation accessible to a broader spectrum of businesses.

Looking ahead, the Software Testing Automation market is poised for lucrative opportunities, driven by the flexibility, scalability, and cost-effectiveness offered by cloud-based tools. As businesses continue to navigate the complex terrain of software development, automation emerges not just as a necessity but as a strategic asset, ensuring not only efficiency but also the resilience needed in a rapidly evolving technological landscape.

MARKET SEGMENTATION

By Type

In the global Software Testing Automation market, the various types of deployment play a pivotal role in shaping its dynamics. The market is adeptly categorized into Cloud Based and On-premises segments, each contributing to the industry's multifaceted nature.

The Cloud Based segment, valued at 10423.4 USD Million in 2022, stands as a testament to the growing trend of cloud adoption across industries. This deployment method allows for flexibility and scalability, catering to the evolving needs of businesses. Companies are drawn to the Cloud Based approach for its ease of access, cost-effectiveness, and the ability to harness the power of distributed computing.

On the other side of the spectrum, the On-premises segment holds its ground, valued at 5795.6 USD Million in 2022. This traditional deployment method retains its relevance, particularly for enterprises with specific security and regulatory considerations. On-premises solutions offer a level of control and customization that resonates with businesses seeking to maintain their software testing processes within their physical infrastructure.

Both segments, Cloud Based and On-premises, address distinct requirements within the Software Testing Automation market. The choice between them often hinges on factors like organizational structure, security concerns, and the strategic objectives of businesses. While Cloud Based solutions ride the wave of technological innovation, On-premises options provide a reliable foundation for those prioritizing control and compliance.

The segmentation of the Software Testing Automation market by deployment type encapsulates the industry's adaptability to diverse organizational needs. The coexistence of Cloud Based and On-premises solutions reflects the dynamic nature of the market, offering businesses choices that align with their specific preferences and requirements. As technology continues to shape the future of testing automation, these deployment types will likely evolve, ensuring that the Software Testing Automation market remains responsive to the changing needs of businesses worldwide.

By Application

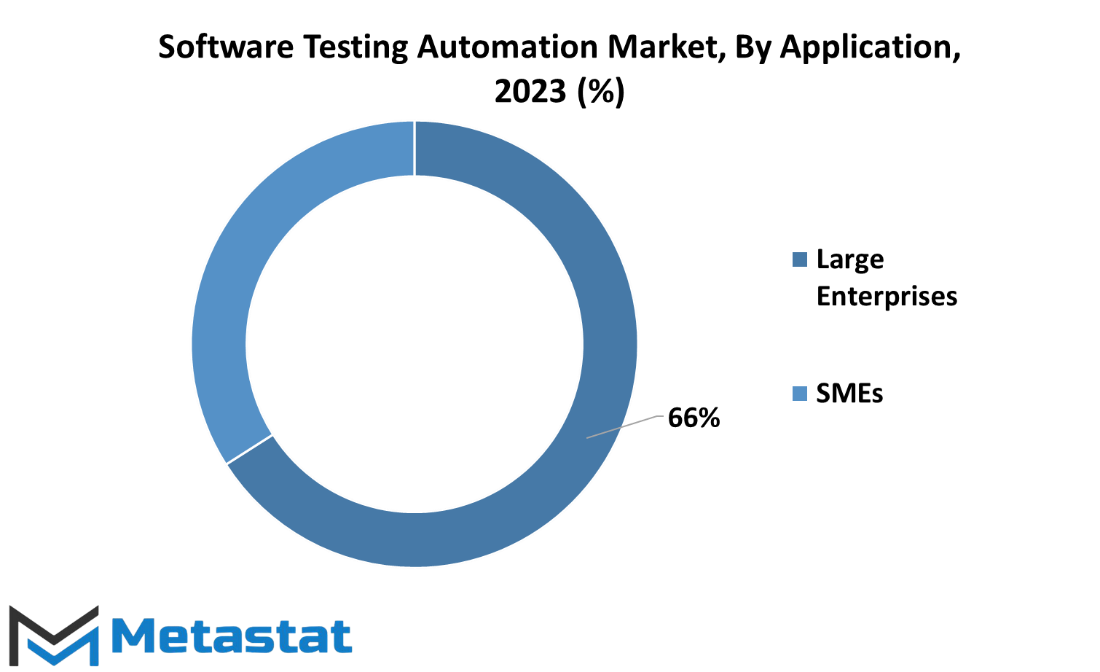

The two primary categories emerge are Large Enterprises and SMEs, each contributing significantly to the market's dynamism. Large Enterprises, with a valuation of 10707.7 USD Million in 2022, represent the substantial players in this domain. These entities, with their extensive operations and complex software systems, rely on automation to streamline and optimize their testing processes. The value attached to Large Enterprises underscores the critical role of automation in managing the intricacies of extensive software frameworks, ensuring efficiency and reliability.

On the other hand, SMEs, valued at 5511.3 USD Million in 2022, signify the importance of automation in catering to the needs of smaller-scale enterprises. Despite varying in scale and operational complexities, SMEs find value in adopting automation to enhance their software testing procedures. The market's recognition of SMEs emphasizes the adaptability and accessibility of automation solutions, making them relevant across diverse business sizes.

Both Large Enterprises and SMEs are integral components of the Software Testing Automation market, each benefiting from the efficiency and accuracy that automation brings to software testing. Whether navigating the intricate software landscapes of large corporations or streamlining operations for smaller enterprises, automation proves to be a versatile and indispensable tool in ensuring the functionality and reliability of software systems. As technology continues to advance, the role of automation in software testing is expected to grow, providing benefits to businesses of all sizes.

REGIONAL ANALYSIS

The global Software Testing Automation market, when dissected by geography, reveals a spread that encapsulates North America and Europe. These two regions, with their distinct characteristics and market dynamics, contribute significantly to the global landscape of software testing automation.

North America, a prominent player in the software industry, stands at the forefront of adopting testing automation technologies. The region's advanced technological infrastructure, coupled with a robust demand for efficient software solutions, fuels the growth of the Software Testing Automation market. Companies in North America, cognizant of the benefits that automation brings to the testing process, actively integrate these solutions to enhance their software development life cycle.

Moving across the Atlantic, Europe emerges as another crucial hub for the Software Testing Automation market. The European landscape, marked by a diverse range of industries and a strong emphasis on technological innovation, sees an increasing reliance on automated testing methods. As organizations across Europe seek to streamline their software testing processes, the demand for automation solutions continues to rise.

Both North America and Europe share a common thread in their pursuit of technological excellence. The prevalence of automation in software testing is not just a trend but a strategic approach adopted by companies to improve efficiency, reduce manual errors, and expedite the software delivery pipeline. This commonality transcends geographical boundaries, forming a cohesive global movement towards harnessing the power of automation in the software testing domain.

While distinct in their market dynamics, both regions reflect a shared understanding of the transformative impact of Software Testing Automation. It is not merely a regional phenomenon but a global shift towards a more efficient and effective paradigm in software development and quality assurance. The Software Testing Automation market, as delineated by North America and Europe, exemplifies the convergence of technological advancements and market needs on a global scale.

COMPETITIVE PLAYERS

In the expansive landscape of the global Software Testing Automation market, key players shape the industry's dynamics, influencing its trajectory and growth. Among these influential entities, two notable names stand out: Broadcom Inc. and Capgemini SE.

Broadcom Inc., a prominent player in the Software Testing Automation sector, brings its expertise to the forefront. The company's footprint in the market is characterized by a commitment to innovation and a comprehensive suite of solutions. With a focus on addressing the evolving needs of the industry, Broadcom Inc. contributes significantly to the advancement of Software Testing Automation.

Capgemini SE, another heavyweight in this domain, contributes its own set of strengths to the market. Renowned for its global presence and extensive service offerings, Capgemini SE plays a crucial role in shaping the landscape of Software Testing Automation. The company's approach is marked by a blend of technological prowess and a keen understanding of industry demands.

These key players, Broadcom Inc. and Capgemini SE, embody the competitive spirit and innovation that define the Software Testing Automation market. Their influence extends beyond individual contributions, collectively steering the industry towards efficiency, reliability, and enhanced performance.

As the Software Testing Automation market continues to evolve, the roles of major players like Broadcom Inc. and Capgemini SE become increasingly pivotal. Their actions and innovations not only define their individual trajectories but also contribute to the overall advancement of the Software Testing Automation industry. In this dynamic arena, these key players serve as pillars of progress, shaping the future landscape of Software Testing Automation through their expertise, solutions, and commitment to excellence.

Software Testing Automation Market Key Segments:

By Type

- Cloud Based

- On-premises

By Application

- Large Enterprises

- SMEs

Key Global Software Testing Automation Industry Players

- Broadcom Inc.

- Capgemini SE

- Cognizant Technology Solutions Corp.

- IBM Corporation

- Idera, Inc.

- Katalon, Inc.

- Keysight Technologies Inc.

- Micro Focus International plc (OpenText)

- Parasoft Corporation

- QualiTest Group

- SmartBear Software, Inc.

- Tricentis USA Corp.

- Worksoft, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383