Global Packaging Machinery Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global packaging machinery market has evolved through decades of development, and now it's one of the main supporting sectors of modern manufacturing and consumer goods distribution. The journey of the market started with the opening of the modern era in the late 1800s when the demand for rapid and uniform dispensing of industrial products was the main reason for the introduction of various packaging machines. The first machines used were just simple hand-operated ones, but soon the semi-automatic systems came into existence, which could handle the volume required for the early large-scale packaging that was later on to characterize the market

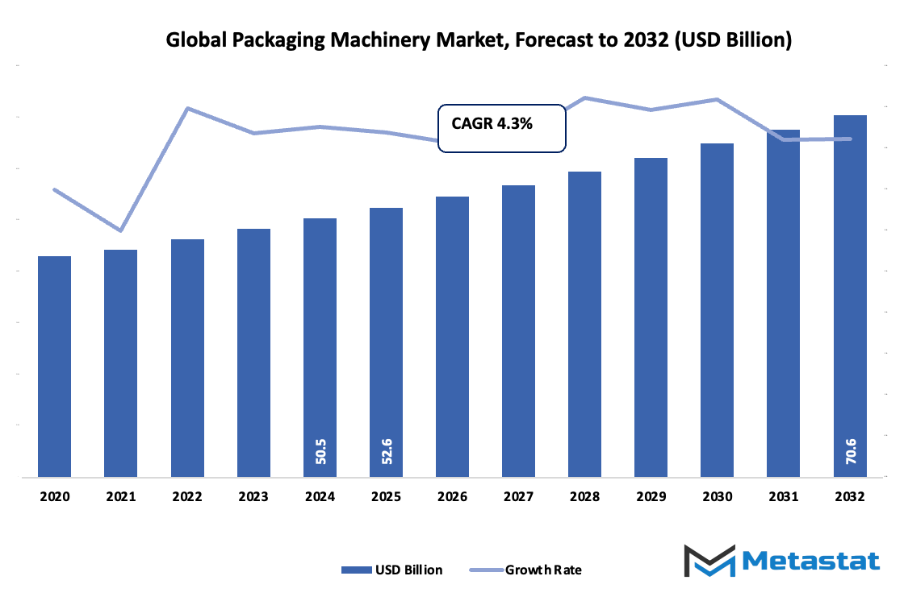

- The global packaging machinery market is anticipated to be worth nearly USD 52.6 billion in 2025, growing at a CAGR of approximately 4.3% until 2032, with a possibility of going beyond USD 70.6 billion.

- Filling Machines contribute around 16.7% of market share, leading the research work for the new applications of the products and driving innovations in this direction.

- Major factors causing upsurge of market: Growing Requirement for Food and Beverages in Packaged Forms, Rise in E-commerce and Retail Industries

- Automated technologies and smart packaging technologies are some of the market opportunities.

- The market will be worth much more than today in a decade, which shows the possibility of huge growth in the coming time.

The sixties of the past century marked a turning point for the industry witnessing a radical transformation due to the broader world trade and the era of consumerism. The emergence of the supermarkets and the ubiquitous branded goods not only demanded higher quality, but also packaging to be precise and consistent, thus opening a path for innovations in filling, bottling, and labeling machines. Manufacturers started to invest heavily in technology to ensure that hygiene, accuracy, and durability were up to the required standards especially in the food, beverage, and drug industries. The time was such that for packaging machines, they were their day of reckoning wherein they were no longer called auxiliary tools but rather indispensable parts of production lines.

The Digital Revolution was a major factor in the industry’s shift. Packaging division was changing :- computer-control; robotics; and sensor-based automation were starting to come all at once. Machines that were in the past fully dependent on physical superintendence were now utilizing real-time monitoring and predictive maintenance. The world market for packaging machinery was now getting acquainted with data-driven manufacturing practices and this was in line with the ongoing trend of Industry 4.0. This transition empowered the manufacturers not only to enhance their efficiency but also to lessen their waste and be more responsive to the change in packaging formats.

The changing preferences of the consumers have also been a big factor in deciding the course of events. With the concern for sustainability growing and lifestyles changing, the machinery manufacturers will still be on the go designing equipment that can handle recyclable materials, less packaging, and energy-efficient production. It is more likely that the regulations in different parts of the world will dictate the pace of innovation that will force companies to juggle between being compliant and being creative.

Market Segments

The global packaging machinery market is mainly classified based on Machine Type, Packaging Technology, End User, Sales Channel.

By Machine Type is further segmented into:

- Filling Machines: Typically, filling machines get used for very precise filling of containers with liquids, powders, or granules, as well as for ensuring that there is no product wastage at all. These machines also play a big part in letting the production lines become uniform and that the same amount of work done is efficient. They are mainly seen in food, beverages, and pharmaceutical industries as precision, speed, and the ability to handle various packaging formats have been major contributors to their decision making.

- Form, Fill and Seal (FFS) Machines: The Form, Fill and Seal machines unite three tasks in one system which is creating the package, filling it with the product, and sealing it for shipping. These machines minimize time and labor cost involved in handling and thus large-scale manufacturing is their main area of application. They not only secure the packaging but also contribute towards keeping the product fresh and prolonging its shelf life.

- Cartoning Machines: The use of cartoning machines for the efficient packaging of products into cartons or boxes is also a common practice. The uniformity of machine size and sealing leads to an increase in product quality and protection. Cartoning machines are gaining popularity in the food, pharmaceutical, and consumer goods industries as they can handle high-speed operations with accuracy.

- Palletizing Machines: Palletizing machines directly take care of the stacking and organizing of products on pallets for storage and transport purposes that are more convenient. They cut down on the manual labour required and thus workplace safety gets improved. The use of such machines will lead to more efficient logistics and warehousing operations, hence making them essential in large-scale production facilities dealing with bulk goods.

- Labelling Machines: Labelling machines have the ability to apply labels that are very accurate and clear to the packaging, thus making sure that the product is identified correctly and conforming to the regulatory standards. They also machines bring about enhancement of the brand and give the necessary product information to the consumers. They are utilized in various industries such as food, pharmaceuticals, chemicals, etc., for decorative and informational uses.

- Wrapping Machines: Wrapping machines have the function of wrapping the products with materials such as plastic films or paper to secure them against dust, moisture, and damage during transportation. Moreover, they do enhance the product quality and assure its preservation. Such machines are widely used in those industries keeping in view that a packaged retail product has to be both secure and hygienic at the same time, hence the retail and distribution operations.

- Cleaning & Sterilizing Machines: Machines of cleaning and sterilization maintain hygiene in the packaging process by the use of such machines which are mainly in the food and pharmaceuticals sector. They guarantee that the containers and packaging materials are free from contamination before they are used. This whole process plays a crucial role in maintaining safety standards and preventing either spoilage of the product or health hazards.

- Other: Other types of packaging machines include capping, sealing, and coding equipment, among others, that together with the main packaging processes are used during the whole packaging process. The machines play an important role in the process of sealing, labeling, and preparing the products for delivery, and providing additional support. Owing to their versatility and efficiency they can be used for different packaging requirements in various industries.

By Packaging Technology, the market is divided into:

- Automatically: The machines for automatic packaging utilize cutting-edge technology and thus, the human intervention is almost zero in the packaging processes. Their increasing demand is based on the fact that they not only reduce labor costs but also increase the output in the areas of high-volume manufacturing, thus, the rise of automatic systems.

- Manually: The packaging machines that require human involvement are called manual ones. The small producers usually rely on them because they are very economical and easy to operate. Although manual systems cannot match the efficiency of automatic ones, they are still vital for short production runs as well as for those businesses that have limited budgets.

- Semi-Automatic: The machines of semi-automatics employ the combination of manual input and automated functions to reach the balance of efficiency. These machines not only support production flexibility but also perfectly fit medium-scale operations. They provide control over the packaging quality that is better than fully manual systems and at the same time requiring less labour effort, thus, offering a cost-effective solution for growing businesses.

By End User the market is further divided into:

- Beverages Industry: The beverages industry uses packaging machinery to handle liquids such as water, soft drinks, and juices. Machines ensure proper sealing and filling to maintain product freshness and safety. The need for attractive and sustainable packaging drives the adoption of advanced machinery in beverage production facilities worldwide.

- Food Industry: The food industry relies heavily on packaging machinery to ensure product preservation, hygiene, and extended shelf life. Machines such as filling and sealing systems help maintain food quality and prevent contamination. Increasing demand for packaged and ready-to-eat foods continues to support growth in this segment.

- Chemicals Industry: Packaging machinery in the chemicals industry focuses on safety, precision, and durability. Machines are designed to handle both liquid and powdered chemicals securely, preventing leaks or spills. The need for reliable and compliant packaging solutions drives demand for specialized machinery in this sector.

- Homecare & Personal Care: Homecare and personal care sectors use packaging machinery for products like detergents, cosmetics, and toiletries. These machines ensure appealing and functional packaging designs that attract consumers. Automation in this segment supports faster production, consistent quality, and flexible packaging options for different product types.

- Pharmaceutical Industry: In the pharmaceutical industry, packaging machinery is essential for maintaining product integrity, hygiene, and traceability. Machines handle packaging for tablets, capsules, and liquid medicines under strict quality control. The growing focus on safety and labeling regulations has increased the adoption of advanced systems in this field.

- Other: Other end users include sectors such as electronics, agriculture, and industrial goods that use packaging machinery for product protection and branding. These machines provide durable and efficient packaging options tailored to specific material requirements, ensuring safe handling and improved supply chain management.

By Sales Channel the global packaging machinery market is divided as:

- Direct Sales: Direct sales channels involve selling machinery directly to end users without intermediaries. This approach allows manufacturers to offer customized solutions, technical support, and better pricing. Direct relationships with customers help build trust and improve after-sales services, supporting long-term business growth.

- Distributors: Distributors play a major role in expanding the reach of packaging machinery manufacturers. They help connect producers with clients across various regions, offering installation and maintenance support. This channel is essential for reaching small and medium-sized businesses that rely on local partners for equipment sourcing.

- Online: Online sales channels are gaining popularity due to digital transformation and the convenience of e-commerce platforms. Buyers can compare prices, specifications, and reviews before making a purchase. The online segment supports global accessibility and cost efficiency, encouraging manufacturers to strengthen their digital presence.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$52.6 Million |

|

Market Size by 2032 |

$70.6 Million |

|

Growth Rate from 2025 to 2032 |

4.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

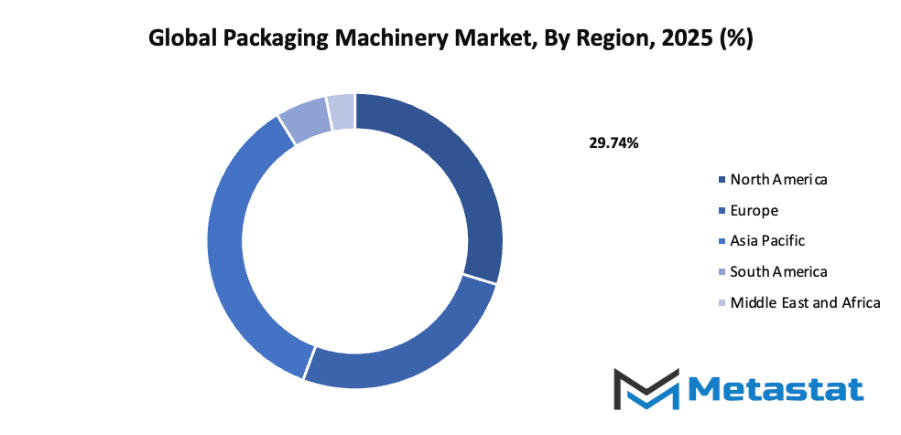

By Region:

- Based on geography, the global packaging machinery market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing Demand for Packaged Food and Beverages: The global packaging machinery market is experiencing steady growth due to the rise in demand for packaged food and beverages. Busy lifestyles and changing consumption patterns have led to the preference for ready-to-eat and convenience products. This shift encourages manufacturers to invest in efficient packaging solutions that maintain product freshness, extend shelf life, and ensure safety during transportation. Continuous innovations in packaging design also attract consumers and improve brand appeal, further driving the market’s expansion.

- Growth in E-commerce and Retail Sectors: The global packaging machinery market growth is supported by the rapid development of e-commerce and retail industries. The increase in online shopping requires reliable packaging that ensures product protection during delivery. Automated and flexible packaging machines help businesses handle high volumes efficiently. Retailers are also focusing on sustainable and visually appealing packaging to enhance customer experience. This trend has led to higher demand for machinery that can adapt to diverse product sizes, materials, and labeling needs, strengthening market growth.

Challenges and Opportunities

- High Initial Investment and Maintenance Costs: The global packaging machinery market faces challenges due to the high initial investment and maintenance expenses. The cost of installing advanced machinery and maintaining it regularly can be a financial burden for small and medium enterprises. Frequent technological upgrades and the need for skilled labor add to operational costs. Despite these expenses, many companies recognize that investing in modern packaging equipment leads to higher productivity, less waste, and long-term savings, making it a strategic decision for future competitiveness.

- Stringent Regulatory Requirements: The global packaging machinery market is influenced by strict regulatory standards related to food safety, labeling, and environmental sustainability. Compliance with these regulations increases production costs and demands constant monitoring to avoid penalties. Manufacturers are compelled to design machinery that meets hygiene standards and supports eco-friendly packaging materials. While these requirements pose challenges, they also encourage innovation and the development of safer, more sustainable technologies, fostering trust among consumers and partners in the global market.

Opportunities

- Advancements in Automation and Smart Packaging Technologies: The global packaging machinery market is benefiting from advancements in automation and smart packaging technologies. Automated systems improve speed, accuracy, and efficiency in production, while smart packaging solutions provide features such as tracking, freshness indicators, and quality assurance. Integration of artificial intelligence and IoT allows real-time monitoring and data analysis, helping manufacturers reduce downtime and optimize operations. These innovations not only enhance productivity but also align with sustainability goals, opening new avenues for market growth and competitiveness.

Competitive Landscape & Strategic Insights

The global packaging machinery market continues to grow as demand increases across sectors such as food and beverages, pharmaceuticals, cosmetics, and consumer goods. Automation and innovation play a major role in shaping production efficiency, product quality, and operational safety. Companies seek machinery that not only enhances productivity but also reduces waste and improves sustainability. As packaging requirements become more diverse, manufacturers of machinery focus on flexible systems that can handle a wide range of materials, product sizes, and packaging formats efficiently.

The industry is a mix of both international industry leaders and emerging regional competitors. Important competitors include Krones AG, Tetra Pak International S.A., SIG Combibloc Group Ltd., IMA Group, Marchesini Group, Serac Group, Fuji Machinery Co., Ltd., Multivac Group, Barry-Wehmiller Companies, Inc., Syntegon Technology GmbH, Triangle Package Machinery Company, Optima Packaging Group GmbH, Ishida Co., Ltd., Wenzhou Zhonghuan Packaging Machinery Co., Ltd., Winpak Ltd., Nordson Corporation, Uhlmann Group, GEA Group AG, KHS GmbH, Sacmi Imola S.C., Bradman Lake Group Ltd., and Romaco Group in global packaging machinery market. These companies continue to strengthen their market positions through product innovation, mergers, partnerships, and the integration of advanced technologies such as robotics and smart control systems.

Growing awareness of environmental impact has pushed the market toward sustainable packaging solutions. This includes machinery that supports recyclable materials, reduces energy consumption, and minimizes packaging waste. Companies are investing in research to create machines that allow quicker changeovers, lower maintenance costs, and enhanced operational control. Digitalization also plays a key role, as smart systems allow better monitoring, predictive maintenance, and improved process accuracy, which in turn increases reliability and reduces downtime.

Customer expectations are changing as well. Manufacturers need to meet high standards for product safety, appearance, and convenience, especially in sectors like food and pharmaceuticals where hygiene and quality control are critical. Packaging machinery designed for such industries must meet strict regulations and safety requirements. This pushes producers to adopt equipment that ensures precision, traceability, and compliance with international quality standards.

Market size is forecast to rise from USD 52.6 million in 2025 to over USD 70.6 million by 2032. Packaging Machinery will maintain dominance but face growing competition from emerging formats.

The overall growth of the global packaging machinery market reflects a combination of innovation, efficiency, and sustainability. As competition continues, technological advancement and adaptability remain essential. Companies that can deliver versatile, cost-effective, and eco-friendly solutions are expected to maintain strong positions. With the support of automation, digital control, and global collaboration, packaging machinery will continue to evolve to meet the demands of industries and consumers around the world.

Report Coverage

This research report categorizes the global packaging machinery market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global packaging machinery market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global packaging machinery market.

Packaging Machinery Market Key Segments:

By Machine Type

- Filling Machines

- Form, Fill and Seal (FFS) Machines

- Cartoning Machines

- Palletizing Machines

- Labelling Machines

- Wrapping Machines

- Cleaning & Sterilizing Machines

- Other

By Packaging Technology

- Automatic

- Manual

- Semi-Automatic

By End User

- Beverages Industry

- Food Industry

- Chemicals Industry

- Homecare & Personal Care

- Pharmaceutical Industry

- Other

By Sales Channel

- Direct Sales

- Distributors

- Online

Key Global Packaging Machinery Industry Players

- Krones AG

- Tetra Pak International S.A.

- SIG Combibloc Group Ltd.

- IMA Group

- Marchesini Group

- Serac Group

- Fuji Machinery Co., Ltd.

- Multivac Group

- Barry-Wehmiller Companies, Inc.

- Syntegon Technology GmbH

- Triangle Package Machinery Company

- Optima Packaging Group GmbH

- Ishida Co., Ltd.

- Wenzhou Zhonghuan Packaging Machinery Co., Ltd.

- Winpak Ltd.

- Nordson Corporation

- Uhlmann Group

- GEA Group AG

- KHS GmbH

- Sacmi Imola S.C.

- Bradman Lake Group Ltd.

- Romaco Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252