MARKET OVERVIEW

The global order management software market in the software and technology sector will be characterized by its ability to change the way businesses manage orders through multiple channels. The market will be driven by solutions that enable businesses to synchronize their inventory, customer information, payment systems, and delivery operations within one platform. With increasing complexity of trade, particularly with the ongoing convergence between online and offline business models, the need for sophisticated systems that ensure order processing and tracking with precision will keep growing. Such platforms will not only cater to the retail and e-commerce businesses but will also find their reach in manufacturing, wholesale distribution, and service industries. Order management software in this industry will come to be much more than merely tracking orders.

Companies will implement systems that are integrated directly with enterprise resource planning software, customer relationship management systems, and supply chain management systems. This integration will provide real-time visibility into stock levels, order processing speed, and communicating with customers, removing delays and minimizing manual intervention. In the short term, businesses will be able to watch and change workflows in real time so that it would be possible to respond to emergent shifts in consumer demand or supply-chain issues.

The reach of this market will expand across geographies, with applications that appeal both to small businesses in need of affordable solutions as well as large firms requiring highly customizable platforms. This variety will drive software developers to create modular systems that can be scaled based on operational requirements. Cloud deployment models will gain increased visibility, with companies being able to handle orders remotely while enjoying automatic updates and improved data security mechanisms. The technology in the global order management software market will shift more and more to automation and smart decision-making. Artificial intelligence and machine learning algorithms will be integrated into the platforms to anticipate order volumes, identify anomalies, and streamline delivery routes.

Not only will it enhance operational efficiency but also act as a competitive edge for companies that want to enhance customer satisfaction. The capacity to study historic sales data and predict seasonal or promotional spikes will enable businesses to remain one step ahead of fulfillment requirements without stockpiling or running short of inventory. Along with the technological improvements, the market will also be shaped by changing compliance needs and cross-border trade regimes. Companies will look for solutions that make it easier to comply with tax regulations, labeling regulations, and international shipping documents. This will be particularly relevant for firms undertaking multi-country operations where regulatory worlds are quite different. The global order management software market will be a key facilitator of effective, responsive, and customer-focused commerce over the coming years. As goods and services continue to move faster in an interconnected digital economy, this market will be a key component in making sure that each aspect of the order lifecycle from purchase to delivery runs with accuracy and clarity.

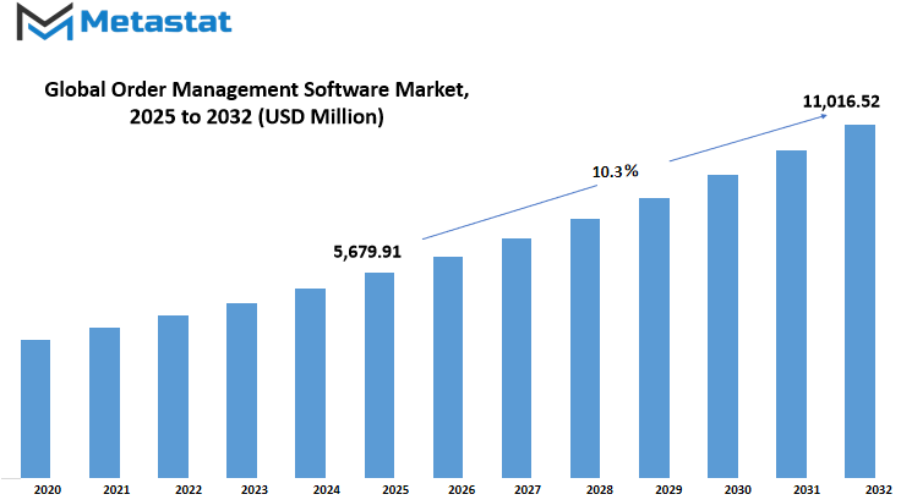

Global order management software market is estimated to reach $11,016.52 Million by 2032; growing at a CAGR of 10.3% from 2025 to 2032.

GROWTH FACTORS

The global order management software market will experience steady growth in the next few years as companies persist in trending toward faster, more efficient ways of handling orders from various sources. Companies today are faced with meeting the needs of customers for fast delivery, accurate tracking, and easy returns. This has placed order management software on the must-have list for organizations looking to automate and remove errors from processes. Growth drivers such as the increasing adoption of e-commerce platforms and increasing need for real-time order tracking are driving organizations to invest in such solutions. Cloud-based systems also become a contributing trend, with cloud systems allowing enterprises of any size to leverage advanced tools without having to incur huge infrastructure costs.

Increasing automation of supply chain processes is another strong driving force. Firms are realizing that human effort cannot match demand in a digital-first economy. Automated order management streamlines efficiency, eliminates delays, and improves customer satisfaction. Integration with inventory, shipping, and customer service platforms is also driving adoption as it creates a more integrated and responsive system.

However, certain difficulties can prevent the growth of the global order management software market. The exorbitant prices of adopting advanced tools can prevent small and medium-sized enterprises from adopting them. In addition, concerns of data security and coordinating new systems with the installed base may prevent some companies from adopting these tools. Inadequate training and technical support can also cause the process to disrupt regular operations, discouraging potential users.

In the coming years, the business will benefit from growing advances in artificial intelligence and machine learning capabilities of these platforms. These technologies have the promise to make systems smarter so that they can predict patterns in demand, simplify stock levels, and choose best shipping routes independently. As companies seek ways to stay competitive in an increasingly changing marketplace environment, these innovations will create extremely lucrative opportunities for service providers and vendors.

The future of the global order management software market will lie in the capacity of providers to improve upon existing challenges as well as innovate. By offering scalable, secure, and easy-to-use products, software developers will be able to reach an increasing number of businesses. As cross-border e-commerce expands ever larger, the need for efficient order management will also increase, guaranteeing that this market will be an increasingly vital participant in global trade in the decades to come.

MARKET SEGMENTATION

By Deployment Type

The global order management software market is steadily gaining attention as businesses continue to search for ways to improve efficiency, reduce costs, and meet growing customer expectations. By Deployment Type, this market is further segmented into On-Premise and Cloud-Based solutions, each offering its own benefits and future potential. On-Premise deployment has traditionally been preferred by organizations that value direct control over their systems and data. It allows for customized setups that fit specific operational needs, often making it the choice for businesses with unique workflows or strict data security requirements. However, it can require higher upfront investment in infrastructure and ongoing maintenance, which some companies may find challenging as demands change over time.

Cloud-Based deployment, on the other hand, is rapidly becoming the more popular option due to its flexibility and scalability. It allows companies to access their systems from virtually anywhere, offering real-time updates and easier integration with other digital tools. This is particularly valuable as more businesses operate across multiple regions and need unified platforms to handle orders seamlessly. The reduced need for physical hardware and the ability to quickly adjust resources based on demand make Cloud-Based solutions appealing for both growing businesses and established enterprises looking to modernize.

Looking ahead, the global order management software market will likely see increasing innovation in both deployment types. For On-Premise systems, future developments may focus on improving automation, enhancing security features, and making updates easier to implement without disrupting operations. For Cloud-Based systems, advances in artificial intelligence and predictive analytics will likely play a larger role, enabling companies to forecast demand, optimize inventory, and personalize customer experiences with greater precision.

The integration of these platforms with other business systems such as supply chain management, payment processing, and customer service tools will also become more seamless. This will create a connected environment where every step of the order lifecycle is monitored and managed in real time. As e-commerce continues to expand globally, the ability to handle high volumes of transactions across various channels will be a defining factor in choosing the right deployment type.

Ultimately, the decision between On-Premise and Cloud-Based will depend on each organization’s goals, resources, and long-term strategy. Both options are expected to continue evolving, offering new features and improved performance. As businesses strive to meet faster delivery expectations and maintain customer loyalty, the global order management software market will remain a key driver in shaping how orders are processed, tracked, and fulfilled in the years ahead.

By Organization Size

The global order management software market will continue to play a central role in the way businesses handle their sales, inventory, and customer service in the years ahead. As technology moves forward, companies are looking for solutions that make their operations smoother, faster, and more reliable. Order management software allows businesses to keep track of customer purchases, manage stock levels in real time, and process returns with greater accuracy. This growing need for efficiency is pushing demand for these systems across different industries, from retail to manufacturing. The ability to connect online and offline sales channels into a single platform will become even more important as customers expect a seamless buying experience.

By organization size, the global order management software market is divided into Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs often face challenges such as limited staff and tighter budgets, which means they require cost-effective and easy-to-use solutions. For them, cloud-based platforms are likely to be the most attractive, as these reduce the need for heavy IT infrastructure while offering flexibility and scalability. Such systems will allow smaller businesses to compete more effectively with bigger players, giving them access to advanced features like automated order processing and data-driven forecasting without high costs.

Large Enterprises, on the other hand, have complex operations that often span multiple regions and sales channels. They need powerful software capable of handling high transaction volumes, integrating with various business tools, and ensuring smooth coordination across departments. For these companies, customization will be a priority, enabling them to tailor the software to match their unique processes. As supply chains become more global, these enterprises will seek advanced capabilities such as AI-powered demand prediction, real-time analytics, and automated decision-making to remain competitive.

Looking ahead, the global order management software market will benefit from ongoing developments in artificial intelligence, machine learning, and the Internet of Things. These technologies will allow businesses to anticipate customer needs more accurately, reduce waste, and improve delivery times. The focus will shift from simply managing orders to creating intelligent systems that adapt to changes in demand, supply chain disruptions, and customer behavior patterns.

Both SMEs and large enterprises will continue to invest in this technology, though their priorities may differ. While SMEs will look for affordability and simplicity, large enterprises will prioritize scalability and integration. Together, these factors will shape a future where order management software is not just a tool for processing transactions but a key driver of business growth and customer satisfaction.

By End-Use Industry

The global order management software market will continue to transform the way businesses operate across various industries. As technology advances and customer expectations rise, companies will increasingly rely on these solutions to manage orders more efficiently, reduce delays, and improve customer satisfaction. The future will see a stronger focus on real-time tracking, automation, and integration with other business systems, making order management not just a back-end function but a central part of business strategy.

By end-use industry, the global order management software market is further divided into Retail and E-commerce, Consumer Goods, Healthcare, Telecom, and others. In the Retail and E-commerce sector, the adoption of order management software will become even more important as online shopping continues to grow worldwide. With faster delivery expectations and the need for accurate inventory visibility, retailers will depend on advanced systems to handle high volumes of orders without errors. The integration of artificial intelligence will allow these businesses to predict demand patterns, optimize stock levels, and provide personalized shopping experiences.

In the Consumer Goods industry, efficiency and speed will be key. Companies in this sector will use order management solutions to coordinate production schedules with order volumes, helping them respond quickly to changes in consumer demand. This will be especially critical in managing seasonal spikes or unexpected surges, ensuring that supply chains remain flexible and cost-effective.

The Healthcare sector will experience significant benefits from the adoption of such software. Hospitals, pharmacies, and medical suppliers will use it to manage orders for medicines, medical devices, and essential equipment with greater accuracy and compliance. The need for timely deliveries in healthcare makes automation and error reduction vital, and the technology will also help in monitoring product expiration dates and regulatory requirements.

In Telecom, order management systems will support the growing demand for faster service activation, better inventory control, and improved customer onboarding. As telecom services expand with the rollout of 5G and other innovations, the ability to process complex service orders accurately and quickly will become a competitive advantage.

The “others” category will include industries such as manufacturing, logistics, and hospitality, each finding unique ways to apply this technology to improve operations. In the coming years, these solutions will increasingly use cloud-based platforms, allowing global operations to be managed from anywhere, at any time. The global order management software market will not only streamline processes but also shape how companies interact with customers, ensuring that speed, accuracy, and adaptability remain at the core of business growth.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$5,679.91 million |

|

Market Size by 2032 |

$11,016.52 million |

|

Growth Rate from 2025 to 2032 |

10.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

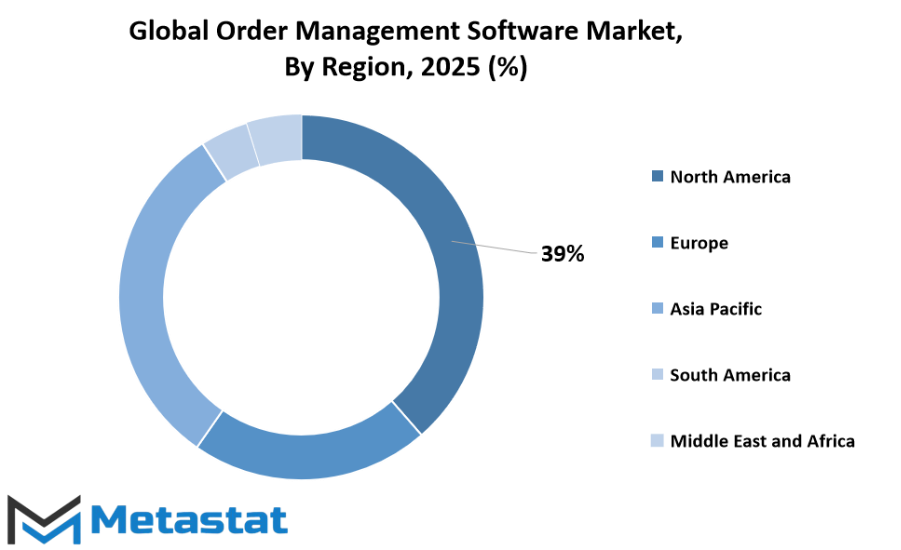

The global order management software market is experiencing steady growth, driven by the increasing need for businesses to streamline their operations and improve customer satisfaction. As technology continues to advance, companies in different regions are adopting more efficient systems to handle orders, track inventory, and ensure smooth delivery processes. Based on geography, the market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, each with its own economic strengths and adoption trends.

North America, which includes the U.S., Canada, and Mexico, has been a strong hub for innovation in software solutions. The high demand for fast and accurate order processing, combined with well-established e-commerce infrastructure, is expected to keep this region ahead in terms of adoption. Europe, consisting of the UK, Germany, France, Italy, and the Rest of Europe, is also witnessing growth, supported by the rise in online retail and cross-border trade. Many businesses here are focusing on automation to stay competitive and meet evolving consumer expectations.

In the Asia-Pacific region, which covers India, China, Japan, South Korea, and the Rest of Asia-Pacific, rapid digital transformation and the expansion of online shopping platforms are creating significant opportunities. Countries like China and India are seeing a surge in small and medium enterprises moving toward advanced order management tools to keep up with increasing sales volumes. South America, including Brazil, Argentina, and the Rest of South America, is gradually adopting these solutions as businesses look for ways to reduce operational costs and improve efficiency in distribution networks.

The Middle East & Africa, segmented into GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa, is also showing potential. Growth here is likely to be supported by the expansion of retail chains, the entry of global e-commerce platforms, and the push for better logistics solutions.

Looking ahead, the global order management software market will benefit from further integration of artificial intelligence, predictive analytics, and cloud-based platforms. These advancements will allow companies to anticipate demand more accurately, manage supply chains with greater efficiency, and provide customers with faster, more transparent order tracking. As globalization continues to connect buyers and sellers across continents, businesses in all regions will likely prioritize software that can handle complex order processes seamlessly. This shift will not only boost productivity but also enhance the overall buying experience, making order management a central focus for sustainable growth worldwide.

COMPETITIVE PLAYERS

The global order management software market is shaped by a mix of established technology giants and agile, innovative companies that are redefining how businesses handle orders across multiple channels. As digital transformation continues to influence almost every sector, the demand for solutions that streamline inventory tracking, order processing, and customer communication is expected to grow steadily. This growth will not only enhance efficiency for retailers, wholesalers, and manufacturers but also set higher standards for integration, automation, and analytics in the future.

Large corporations like Oracle Corporation, SAP SE, and IBM Corporation bring decades of experience and robust infrastructure to the market. Their solutions are designed to handle complex business operations and integrate seamlessly with other enterprise systems, making them ideal for global companies with high transaction volumes. These firms are also investing heavily in artificial intelligence and machine learning to provide predictive analytics, which will help businesses anticipate demand, manage supply chains proactively, and reduce delays.

Meanwhile, companies such as Cin7, Manhattan Associates, and Intuit Inc. are carving a strong position by offering more specialized and user-friendly platforms. These solutions often target small to medium-sized enterprises that need powerful tools without the complexity of enterprise-scale systems. By focusing on flexibility, scalability, and ease of use, they are ensuring that businesses of all sizes can compete effectively in a market where speed and accuracy are crucial.

The presence of cloud-based innovators like monday.com, Netsuite Inc., and Zoho Inventory shows a clear shift toward subscription-based models that allow for continuous updates and remote access. Such models are increasingly appealing to companies looking for lower upfront costs and faster deployment. Salesforce.com, Inc., with its strong background in customer relationship management, is integrating order management features into its ecosystem, offering businesses a unified view of customer interactions from order placement to delivery.

Niche players like Blue Yonder, Inc., Brightpearl, Sana Commerce, Katana, Linnworks, Extensiv, Veeqo, and Freestyle Solutions are pushing the boundaries of automation and integration. Many of these companies are focused on omnichannel retail, helping businesses synchronize orders from physical stores, e-commerce platforms, and marketplaces in real time. This level of coordination will become even more critical as customer expectations for same-day or next-day delivery become the norm.

Looking ahead, competition in the global order management software market will likely intensify, with every player striving to offer faster, smarter, and more connected solutions. The winners will be those who can combine advanced technology with practical usability, enabling businesses to meet rising customer demands while staying agile in an unpredictable economic environment.

Order Management Software Market Key Segments:

By Deployment Type

- On-Premise

- Cloud-Based

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By End-Use Industry

- Retail and E-commerce

- Consumer Goods

- Healthcare

- Telecom

- Others

Key Global Order Management Software Industry Players

- Oracle Corporation

- SAP SE

- IBM Corporation

- Cin7

- Manhattan Associates

- Intuit Inc.

- monday.com

- Netsuite Inc.

- Veeqo

- Salesforce.com, Inc.

- Blue Yonder, Inc.

- Brightpearl

- Sana Commerce

- Katana

- Linnworks

- Extensiv

- Veeqo

- Zoho Inventory

- Freestyle Solutions

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252