MARKET OVERVIEW

The Global Optical Sorting Machines for Waste Recycling market will meet the new kind of expectations resulting from, on one hand, the technological innovations, and, on the other hand, from the fact that it drives the wastage of industries towards a more sustainable approach. With the rapid urbanization and increasing industrial waste generation, the need for efficient sorting solutions seems hard to ever cease. These machines, made possible by sophisticated sensors and artificial intelligence, have changed the way recyclables are identified, separated, and processed. Their reach is much broader than just waste management per se but also covers those industries where precise sorting leads towards improved efficiency and resource use.

Waste recycling has advanced beyond the traditional separation and is now fast being transformed into automated, optimized data-using systems guaranteeing higher recovery levels with minimal human intervention. Optical sorting machines operate speedily combining high-speed cameras with light wavelengths such as hyperspectral imaging and near-infrared (NIR) to enable rapid seizing and sorting of a different material in a matter of seconds. This type of accuracy is anticipated to drive the industry such that it can improve efficiencies in recycling reducing contaminations of sorted input materials and providing better quality recyclables to manufacturers. These machines' value-addition role towards a circular economy has been gradually increasing with the focus on waste reduction strategies across industries.

The market Global Optical Sorting Machines for Waste Recycling is probably going to go beyond waste management facilities and then into other places such as mining, food processing, and pharmaceuticals, where it is vital to differentiate materials accurately. For instance, companies in mining are increasingly using this sorting technology to further limit the amount of waste and raise their yields by extracting precious minerals from ore. This information is then separated from spoil from the food which is projected will play an even larger role in removing contaminants and setting high standards in quality control that may reduce wastage of food. It is not different for pharmaceutical companies that are gearing up in similar fashion to handling stringent quality measures a definite reduction of defective or contaminated materials into the supply chain.

With the advancements in artificial intelligence and machine learning, the uptake of optical sorting machines will be faster. Systems like the future ones will detect and separate materials more efficiently and learn to adapt and evolve in the event that new sorting requirements develop. Therefore, self-improvement encourages system efficiency within industries that rely on automated sorting processes to minimize operational costs. Real-time monitoring, predictive maintenance, and performance optimization can be expected as a result of cloud computing and IoT integration, which will enable uninterrupted operations.

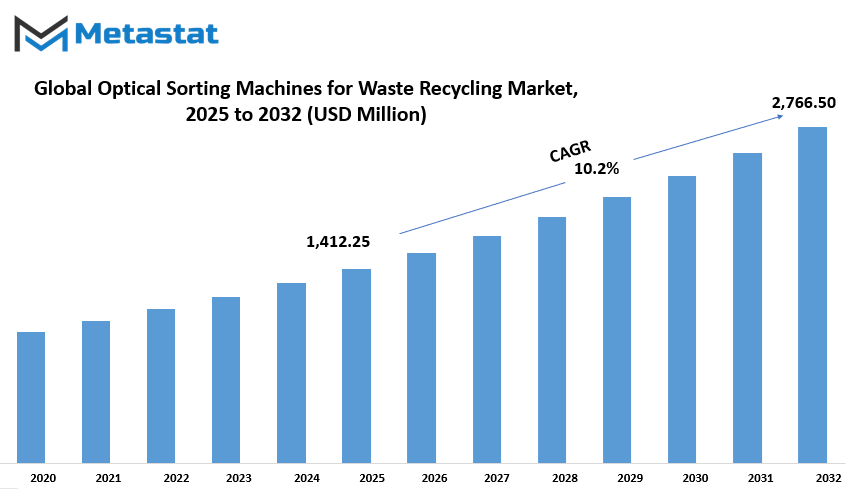

Global Optical Sorting Machines for Waste Recycling market is estimated to reach $2,766.50 Million by 2032; growing at a CAGR of 10.2% from 2025 to 2032.

GROWTH FACTORS

Emphasis on waste management has been ramped up by industries and governments alike as the Global Optical Sorting Machines for Waste Recycling market is receiving its fair share of attention. Rising environmental sustainability concerns are pushing for increasing demand for improved sorting solutions. Optical sorting machines equipped with sensors and cameras can detect and separate recyclable materials from useable waste to optimize waste processing. They reduce labor in waste management practices while providing better sorting accuracy, rendering them indispensable in waste management facilities today.

Another important reason behind the market growth is the ever-increasing importance given to establishing a sustainable environment for waste disposal traceable to the policy and regulations implemented by several governments and organizations across the world. Such laws are largely enforced to promote recycling and avoid wastage into the landfill. In return, waste management companies begin to invest in machinery like optical sorting to assist in following these rules while becoming efficient in their operations. The other important aspect of automation is that it increases the accuracy of sorting mere human intervention and errors and act as a metric to reduce costs in the future. Through the introduction of optical sorting machines, better recovery of materials can be ensured, leading to better recycling.

Nonetheless, some challenges are posing a hindrance to the rapid growth of this market. The major concern for the waste management companies is the high cost of purchasing these machines and their maintenance, especially when talking about smaller to medium-scale businesses. These machines need a lot of maintenance and also need to be calibrated for optimum performance; thus, this adds to the overhead cost. After that, there exists the technical limitation of these machines to detect and sort certain waste materials. For example, some materials like multilayered plastics or recyclable materials that may get contaminated may not be adequately detectable by the existing optical sorting technologies for some applications.

However, new scope for growth in the market is expected to open with advancements in artificial intelligence and machine learning. AI-based sorting systems are developed to enhance material detection and sorting accuracy. These advanced systems can learn and adapt to various waste materials for better separation and recovery rates. AI used by companies will contribute to the efficiency of their recycling processes with reduced waste contamination and thus render more efficient and profitable recycling.

The adoption of optical sorting machines seems fairly tempting, as industries keep innovatively investing in waste management solutions. The market would then have its great contribution during the continued birth of new technologies wherein very efficient, cost-effective, and sustainable solutions will be provided for the challenges waste recycling poses.

In an era where industries are still investing in more innovative solutions for waste management, optical sorting machines will likely have some consideration toward adoption. Demand in the market will then further deepen with the continued birthing of new technologies wherein solutions are very efficient, cost-efficient, and sustainable to meet the challenges of waste recycling.

MARKET SEGMENTATION

By Type

The Global Optical Sorting Machines for Waste Recycling continue to thrive in the face of potential demand from industries coming to realize the various, unmet needs in waste collection. The machines perform a major duty-by automating a sorting process so that materials can be segregated with high precision while slashing human error involvement and enhancing the overall efficiency of the activity. The growing demands for green waste management practices are pushing forward the technologies under constant advancement for application of effective sorting systems, which are a fad part in recycling plants worldwide.

Sorting techniques of the machines will include a variety of categories, which facilitate the type of sorting technology among all those developed to specifically improve the accuracy of material separation. Near Infrared (NIR) Sorting Machines seem to attract significant responses and come to market at a value of $858.01 million. They use infrared light to identify and classify materials on the basis of their chemical compositions, making a much-refined sorting process. Also popular is X-ray Sorting Machines, which come in handy with materials that are challenging to differentiate by traditional optical means identification.

Their merits in identifying and separating objects according to density are valuable for sorting metal, glass, and some types of plastics. Color Sorting Machines, on the other hand, work by reading the colors of materials, resulting in effective separation of items based on hypothetical color parameters. This is mainly applied in plastic recycling, food processing, and in many other applications where visual identification is needed. Specialized sorting technologies for specific waste management needs also contribute toward an overall improvement in the efficiency of recycling operations.

The rise of waste generation has put higher demands on speedier sorting solutions. Optical sorting machines are being installed in recycling facilities to enhance recovery rates and production of high-quality recycled merchandise. Investments towards furthering research and development in this area are made possible by the increasing sustainability measures. These are further supplemented by governments and environmental organizations that raise the bar with respect to waste disposal and promote recycling initiatives.

There's a dependence on bringing good amounts of optical sorting machines with the promise of a cleaner, greener environment. As time passes and technology evolves, such machines would take a more important role in the optimization of waste management practices to meet industries' sustainability responsibilities while reducing the adverse impacts on the environment.

By Waste Type

The Global Optical Sorting Machines for Waste Recycling market is now considered a central player in the modern waste management system. Such machines deploy advanced technologies to identify and segregate different types of wastes, leading to great efficiency with minimal human intervention. Under these dynamics of worldwide increase in waste generation, better sorting solutions are becoming a necessity for sustainability. The wider industry is largely focused on decreasing waste going into landfills and increasing rates of material recovery; within this context, optical sorting machines become much valued within recycling operations.

Types of waste are classified by source, such as Municipal Solid Waste (MSW), Industrial Waste, and Construction and Demolition Waste. Municipal Solid Waste mainly includes solid wastes from households and commercial establishments. Proper separation is crucial in recovering recyclable plastics, papers, and metals. Industrial Waste includes waste generated in the manufacturing process, containing non-desired materials associated with recyclable ones. Construction and Demolition Waste includes debris from building operations requiring sorting for recoverable concrete, wood, and metals. Other categories of waste fall under those different types that seek specialized sorting solutions.

Optical sorting technology involves the inspection of waste materials by means of sensors and cameras that detect changes in color, composition, and shape. In the presence of such differences, air jets or mechanical arms are used by the machines to guide the specific materials into appropriate bins. Automation helps speed the sorting process while enhancing accuracy to realize higher recycling rates. With these machines, manual labor becomes less useful, lower contamination of the recycled material is achieved, and the facilities treating waste are helped to further comply with their regulatory requirements.

The acceptance of optical sorting machines has been spurred by growing environmental awareness and government regulations. Many countries aim for ever-stricter recycling targets, causing industries and municipalities to invest in advanced waste management systems. The circular economy agenda, where materials are reused over and over, additionally accents the need for efficient sorting technology. Further, improvements in artificial intelligence and machine learning are aiding in enhancing the precision of sorting, permitting facilities to process complex waste streams with great accuracy.

The future for the Global Optical Sorting Machines for Waste Recycling market will depend on the persistence of innovation and greater appreciation of sustainable waste practices. With the constant improvement of sensor technology and sorting mechanism, these machines will have a leading role in molding waste management strategies worldwide. As recycling efficiency moves up the priority list for industries and governments, optical sorting solutions will remain central to reducing waste and cleaning up the environment.

By Application

As an increasing number of industries introduce efficient and automated ways into waste management and resource recovery, the international market for optical sorting machines for waste recycling is booming. These machines use high-end technologies to identify materials based on composition, color, shape, and size, ensuring precision and accuracy in the recycling system while minimizing manual sorting. With growing environmental concerns, industries are opting for technologies that will minimize waste, improve the efficiency of their operations, and maximize recovery of valuable materials. Among these technologies is optical sorting, aiding quicker and more accurate separation of recyclables from mixed waste streams.

Industries span from the glass manufacturing industry, the paper industry, and many others; all will benefit from increased process efficiency and cash savings. In waste treatment and recycling, these machines specifically implement plastic, metals, and glass separation, which has undergone further refinement in processing. Increased accuracy in sorting can maintain recovery rates without contamination, which might be one of the key arguments for more sustainable waste management systems. Excellent strides have also been made in optical sorting technology as tools for the efficient separation of the desired minerals from other materials in the mining and metallurgy industries. It further optimizes the use of available resources while reducing waste and suffering from the environment, thereby making the process sustainable.

The chemical sector too utilizes optical sorting machines to a considerable extent for the identification and removal of impurities from raw materials. High level of purity must be assured for product quality and industry standards. Such a type of machine provides a non-contact and efficient way to assure this, reducing manual intervention and increasing overall productivity. In addition, other sectors have adopted sorting technology to the benefit of process optimization-whether these sectors are food processing, pharmaceuticals, or industrial manufacturing, in which precision in material selection is required.

Demand for optical sorting machines is likely to continue owing to the industries' emphasis on sustainability and efficiency. Companies are investing in research and development to improve the accuracy, speed, and flexibility of the machines, thus opening the doors to an even greater applicability. With the further maturation of artificial intelligence and sensor technologies, next-generation optical sorting solutions will, in all likelihood, triumph even more within application domains, marking a stampede of change in waste recycling and resource recovery methodologies. The global optical sorting machines for waste recycling market will form a principal pillar of modern industrial operations by assisting businesses to achieve their sustainability goals while enhancing efficiency and lowering operational costs.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,412.25 million |

|

Market Size by 2032 |

$2,766.50 Million |

|

Growth Rate from 2025 to 2032 |

10.2% |

|

Base Year |

2024 |

|

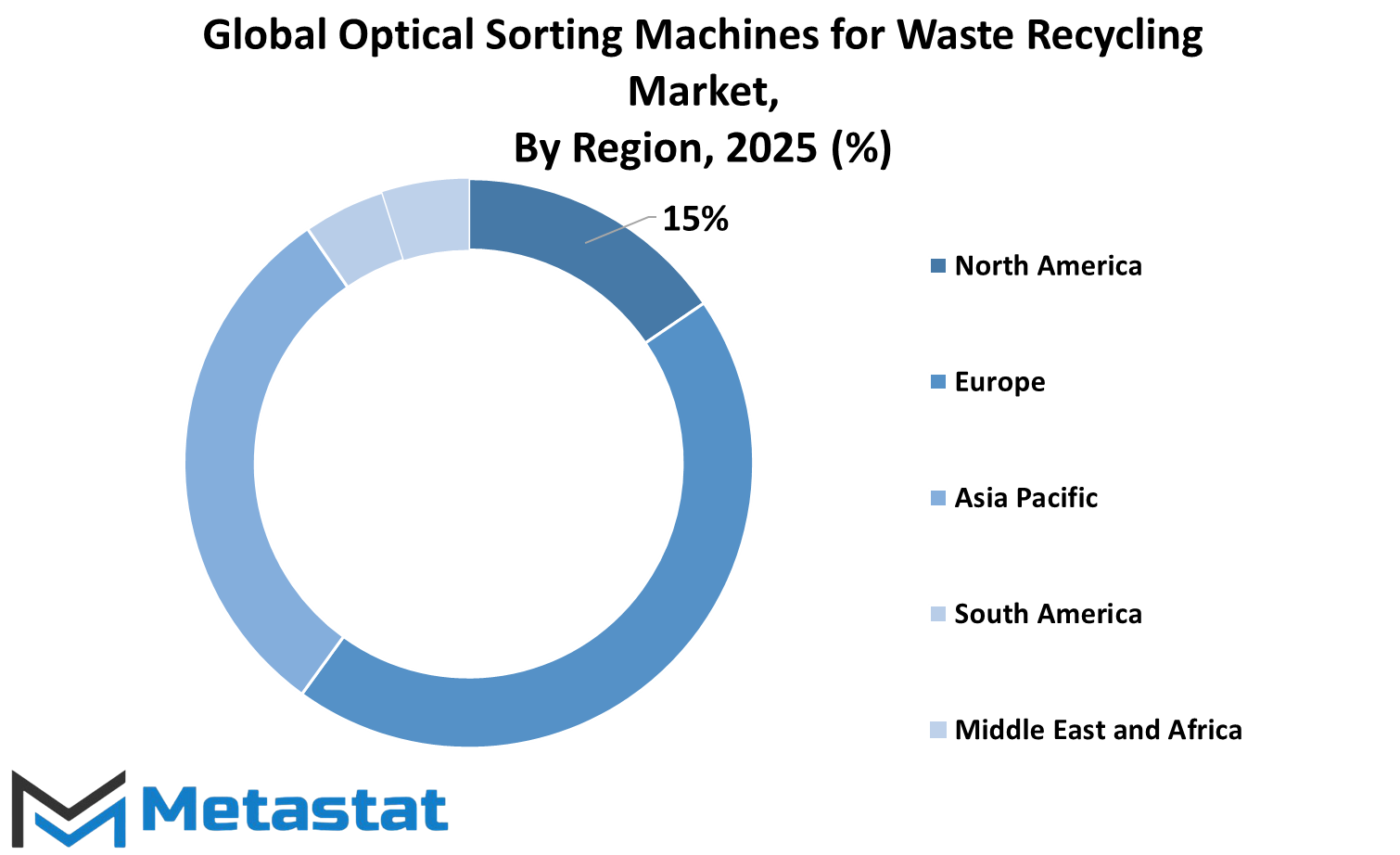

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The analysis of the Global Optical Sorting Machines for Waste Recycling market is further narrowed down to geographic distribution so as to classify the industry into broad regional segments. North America consists of countries like the U.S., Canada, and Mexico. Europe is composed of the UK, Germany, France, Italy, and other European nations while the Asia-Pacific comprises India, China, Japan, South Korea, and other countries in the region. South America includes Brazil, Argentina, and other countries in that continent. The Middle East & Africa segment includes GCC Countries, Egypt, South Africa, and the rest of the area.

There are several thrusts to the development of market growth now being witnessed in the regions: technological innovations, government regulations, and policies on waste management. North America is a big market in that it has tough environmental regulations and also increased uptake of automated sorting solutions. In addition, this market develops in the region because of well-established recycling facilities and continuous investment on advanced waste management technology.

The second-largest share of the region is occupied by Europe due to strict disposal laws for waste and policy initiatives on sustainability. Some countries like Germany and the UK are leading countries in embracing automated sorting technologies to make recycling effective. Modernized infrastructure for waste management and a drive towards a circular economy support the market development in this region.

In Asia-Pacific, rapid industrialization as well as urbanization have been generating a lot of waste, thus increasing the requirement for advanced recycling solutions. China and India count among the greatest waste generators that focus on improving waste management systems. The governments have come up with policies and initiatives for reducing landfill waste and a strong push for recycling, thus drawing the attention of optical sorting machines toward these countries.

South America is developing steadily with Brazil and Argentina showing interest in automated waste sorting. Investment in recycling facilities and minimizing environmental impact promotion is one of the initiatives that the market growth. The Middle East & Africa is slowly embracing modern waste management technology. The GCC countries put much into recycling programs, while South Africa is improving waste segregation processes.

With a growing global consciousness regarding environmental sustainability, the demand for effective waste sorting solutions becomes ever more pressing. To the extent that the optical sorters find their way into recycling operations for waste, their penetration is likely to be even greater by improved technology and through favorable policy from governments.

COMPETITIVE PLAYERS

Innovations are taking place in the Global Optical Sorting Machines for Waste Recycling market as industries stride forward for the advancement of improved waste management and resource recovery. Such machines facilitate easy and quick sorting of materials and are indispensable for reducing contaminations and improving the recycling algorithm. With the push from governments and organizations for sustainable waste-management practices, more optical sorting technologies would be required. An increased awareness of environmental footprints has seen organizations put more reliance on automated sorting systems to improve efficiencies and lessen human labor.

Optical sorting machines work with the help of digital images based on sensor-based technologies in recognizing and sorting a number of different types of waste materials, be it plastics, metals, glass, or paper. Because these machines offer identification of materials based on their color, shape, and composition, they are largely effective in waste segregation; moreover, this improves the quality of recycled materials while limiting landfill waste with a global commitment towards a circular economy. Such long-term benefits have been recognized by industries as worthy of investment into automated sorting.

As strict government regulations on waste disposal, high recycling rates, and the need for cost-effective waste management solutions made an impact on capturing these, so did the real-time improvement of the sorting process. Many companies are using artificial intelligence and machine learning in their sorting systems, allowing for a cleaner and faster identification of the materials to achieve this innovation-increased sorting accuracy while lowering costs and utilizing more resources from the developments of waste generation.

Several key players are actively involved in the shape-building of the Global Optical Sorting Machines for Waste Recycling market. To name a few, these include TOMRA Sorting Solutions, Pellenc ST, MEYER Europe s.r.o., Steinert, Sesotec GmbH, MSWsorting, CP Group, Green Machine LLC, Redwave, Euro Machinery ApS, Binder+Co, and Machinex Technologies, all of which were shown to top the forefront in the most cutting-edge sorting technology developments. Intensive investment in research and development is focused on machine efficiency, throughput capacity, and systems capable of handling complex waste streams.

Optical sorting machines will continue to evolve with technology and will soon be able to offer improved accuracy and higher recovery. The introduction of AI applications will further improve the capacity to categorize waste more accurately, while recycling activities become more efficient. The Global Optical Sorting Machines for Waste Recycling market will, therefore, be a panacea for a sustainable future by reducing waste and promoting reused materials as haulage continues to develop in waste management technologies.

Optical Sorting Machines for Waste Recycling Market Key Segments:

By Type

- NIR (Near-Infrared) Sorting Machines

- X-ray Sorting Machines

- Color Sorting Machines

- Other

By Waste Type

- Municipal Solid Waste (MSW)

- Industrial Waste

- Construction and Demolition Waste

- Other

By Application

- Waste Treatment & Recycling

- Mining & Metallurgy

- Chemical Industry

- Other

Key Global Optical Sorting Machines for Waste Recycling Industry Players

- TOMRA Sorting Solutions

- Pellenc ST

- MEYER Europe s.r.o.

- Steinert

- Sesotec GmbH

- MSWsorting

- CP Group

- Green Machine LLC

- Redwave

- Euro Machinery ApS

- Binder+Co

- Machinex Technologies

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252