Global Once-through Steam Generator (OTSG) Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global once-through steam generator (OTSG) market started to take shape at the end of the 20th century when energy producers were looking for small equipment that could produce steam quickly without the bulky drum designs of the older boilers. The oil recovery projects in North America, where the operators required the unit to heat water quickly and tolerate the fluctuating field conditions, were the main reasons for the first OTSG use. With time, in the course of recognizing the industry through a series of engineering advancements, the 1990s saw the industry shift to modular skid-mounted structures and the introduction of low-NOx burner systems, which, besides their performance, were becoming subject to stringent environmental rules issued by the U.S. Environmental Protection Agency and the Canadian Energy Regulator. Eventually, these milestones were a technological breakthrough that would later dominate the direction of the global OTSG market.

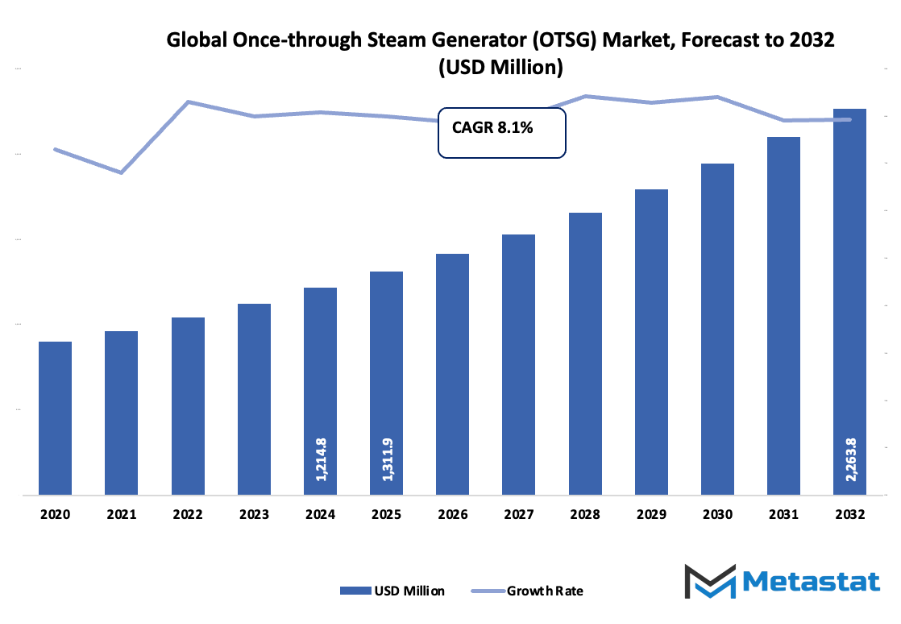

- The global once-through steam generator (OTSG) market, which is valued at around USD 1311.9 million in 2025, is projected to witness a rapid growth of about 8.1% CAGR through 2032, and therefore, it is expected that its value will surpass USD 2263.8 million.

- OTSG horizontal segments are expected to take up around 68.5% of the total market, with their research activities driving innovation and creating new applications.

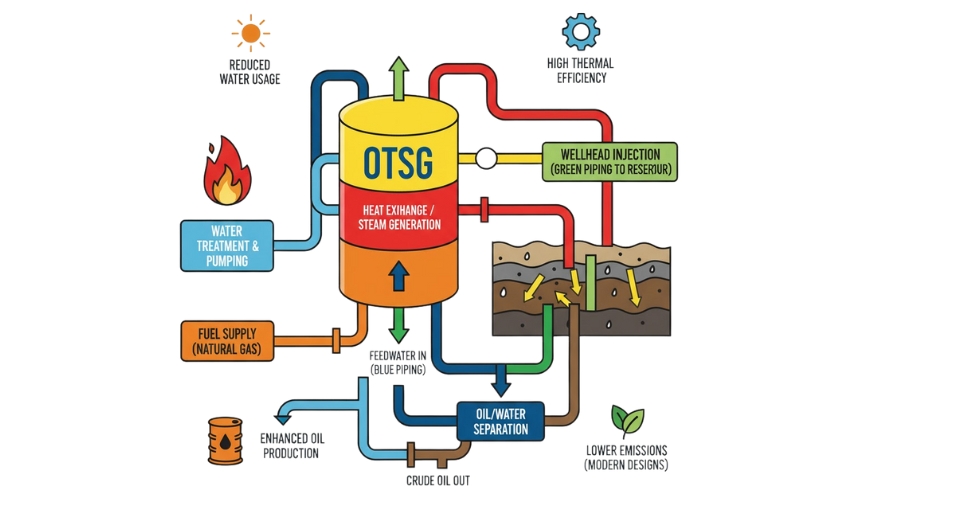

- The major trends that will stimulate the market are: The progressively higher demand for efficient heat recovery solutions in combined-cycle power plants, An increase in the use of steam-based enhanced oil recovery (EOR) techniques, particularly SAGD

- The health of the market is very good and the prospects of it are broad, the rising trend of integrating OTSGs in low-emission and waste-heat recovery systems can be considered the right path to follow.

- A major takeaway of this report is that not only the market value will grow tremendously over the next 10 years, but also many new avenues will be opened.

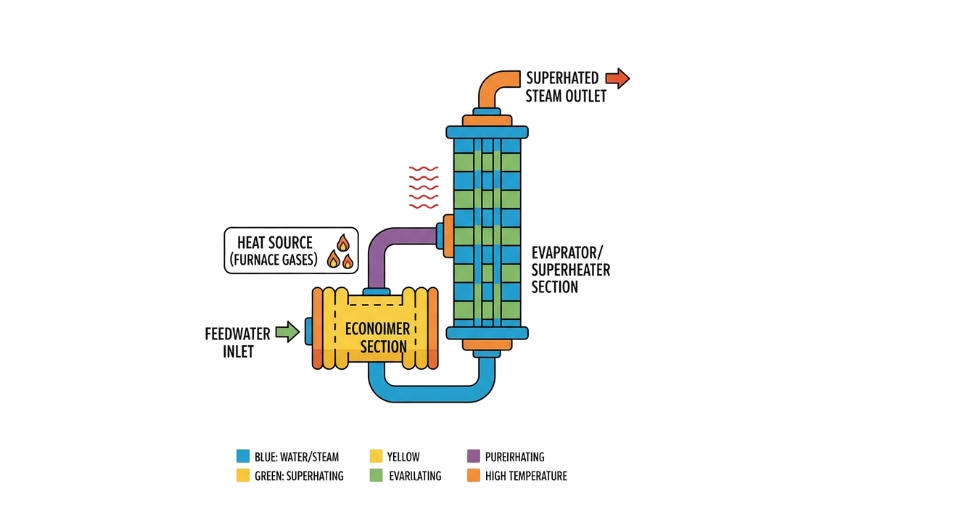

Over time, the expectations of end users changed as oilfield operators, gas processors, and industrial facilities began seeking equipment that would cut maintenance downtime and reduce water use. This shift coincided with research programs led by national laboratories documenting that once-through systems could achieve thermal efficiencies above 90 percent under optimized conditions, a figure confirmed in several U.S. Department of Energy technical papers. Manufacturers responded by designing units with improved heat-transfer surfaces, automated control loops, and real-time monitoring systems able to track fuel input, flue-gas temperature, and steam purity with far greater precision than earlier models.

Regulatory pressure also influenced the market’s path. The European Commission’s industrial emissions directives and updated boiler codes in Asia encouraged operators to select equipment that would align with projected environmental targets. As a result, producers began investing in metallurgy capable of handling higher pressures, anticipating that future installations will demand even cleaner combustion and lower water discharge. Industry bodies such as the American Society of Mechanical Engineers documented rising adoption of advanced alloys in pressure-vessel components, driven by the need for longer operational lifespans.

Today the global once-through steam generator (OTSG) market stands at a turning point shaped by decades of technological refinement and shifting operational expectations. Newer installations will continue emphasizing efficiency, automated diagnostics, and regulatory alignment, building on a lineage that started with field-driven ingenuity and evolved through sustained innovation.

Market Segments

The global once-through steam generator (OTSG) market is mainly classified based on Type, Capacity, Application.

By Type is further segmented into:

- Horizontal: Horizontal units in the global once-through steam generator (OTSG) market hold steady demand due to steady performance, straightforward placement, and adaptability in varied industrial layouts. Adoption grows in facilities seeking balanced output and simple maintenance needs. Market movement reflects gradual preference for systems that support steady production without major structural adjustments.

- Vertical: Vertical units in the global once-through steam generator (OTSG) market gain attention for space-saving design, stronger circulation, and efficient heat transfer. Installation suits locations with limited floor area, helping facilities reach better output within restricted setups. Growing investment in compact power systems supports interest in vertical configurations for long-term operational stability.

By Capacity the market is divided into:

- Up to 60 MW: The up to 60 MW segment in the global once-through steam generator (OTSG) market attracts small and mid-scale operations seeking manageable output and reliable performance. Adoption often appears in industrial plants aiming for moderate power levels with controlled energy use. Consistent demand comes from sectors prioritizing efficient solutions without large-scale infrastructure.

- 60-100 MW: The 60-100 MW category in the global once-through steam generator (OTSG) market serves facilities focusing on stronger generation capacity while maintaining balanced operating costs. Selection often aligns with expanding industrial setups eager to boost production. Market growth reflects steady investment in units offering dependable performance and practical energy output.

- Above 100 MW: Above 100 MW systems in the global once-through steam generator (OTSG) market target high-capacity operations needing substantial and continuous power. Adoption mainly appears in major plants prioritizing durability, efficiency, and sustained load support. Demand increases in regions pushing for large-scale energy projects requiring strong and consistent steam generation.

By Application the market is further divided into:

- Power Generation: Focus within the global once-through steam generator (OTSG) market supports steady output for plants aiming for efficient thermal processes. Demand grows as many facilities seek equipment that helps maintain stable operations, better fuel use, and consistent heat transfer. Modern units allow smoother functioning, reduced maintenance needs, and reliable steam supply across various power stations.

- Oil & Gas: Application in this sector centers on steady steam creation that supports extraction tasks, enhanced recovery efforts, and safe processing activity. Many sites look for systems that reduce downtime and support harsh-environment performance. Use of strong materials and compact layouts helps maintain flow stability while supporting long-term field activity across diverse project locations.

- Industrial: Industrial facilities depend on dependable steam output for production lines, material treatment, and controlled heating steps. Equipment selection often focuses on stable pressure handling, smooth integration with existing layouts, and predictable operation. Efficient steam delivery supports steady workflow, reduced waste, and better resource use across factories seeking continuous and safe thermal performance.

- Others: Additional applications cover sectors using steady steam for cleaning tasks, heating networks, and specialized technical operations. Many organizations value equipment that offers compact form, quick response, and low water requirement. Flexible design supports varied site needs, allowing smooth installation and operation across different settings that benefit from consistent steam support.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1311.9 Million |

|

Market Size by 2032 |

$2263.8 Million |

|

Growth Rate from 2025 to 2032 |

8.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

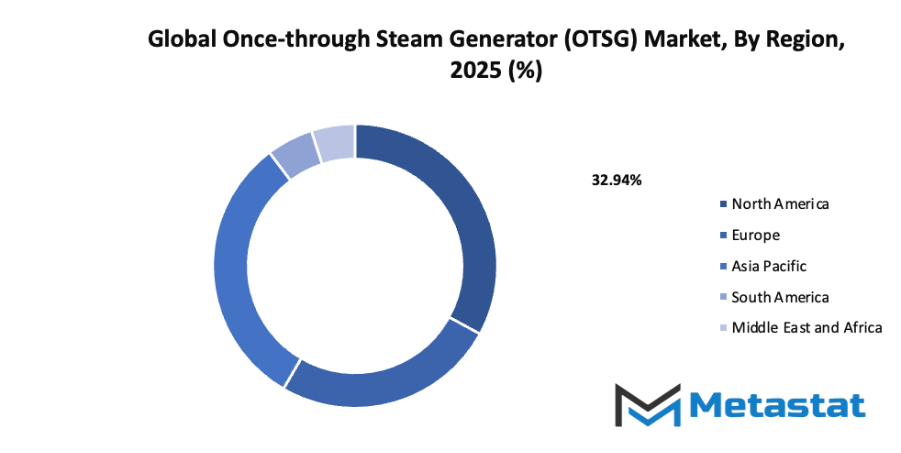

- Based on geography, the global once-through steam generator (OTSG) market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Growing demand for efficient heat recovery solutions in combined-cycle power plants: Strong interest in better heat recovery within combined-cycle facilities supports steady movement in the global once-through steam generator (OTSG) market. Improved fuel use, better thermal output, and reduced waste encourage wider use of this equipment, as plant operators aim for dependable systems that raise overall energy performance while keeping operating costs steady.

- Increasing adoption of steam-based enhanced oil recovery (EOR) techniques, especially SAGD: Wider use of steam methods in oil extraction strengthens the need for reliable generators that deliver steady steam output. SAGD projects rely on equipment that performs under demanding conditions, and this demand supports expansion of the market by encouraging steady upgrades and new installations that boost long-term field productivity.

Challenges and Opportunities

- High initial investment and installation complexity: Large upfront spending and demanding setup steps limit faster growth in many regions. Detailed planning, specialised parts, and skilled labour extend project timelines, creating hesitation for some operators. These factors place pressure on budgeting decisions and slow wider acceptance, even when long-term performance benefits remain clear.

- Operational challenges related to scaling and fouling in high-temperature environments: Build-up inside critical sections affects heat transfer, lowers steam output, and increases maintenance demands. Harsh conditions require frequent checks, careful water management, and timely cleaning. These issues raise operating costs and create interruptions, discouraging broader adoption among facilities seeking predictable performance and minimal downtime.

Opportunities

- Rising integration of OTSGs in low-emission and waste-heat recovery systems: Strong interest in cleaner operations encourages the use of equipment that supports reduced output of harmful gases and better use of leftover heat. New projects favour systems that cut energy waste and strengthen environmental goals, creating fresh openings for manufacturers and service providers able to deliver dependable, efficient solutions.

Competitive Landscape & Strategic Insights

The global once-through steam generator (OTSG) market shows strong activity, with constant pressure for higher efficiency, dependable performance, and cleaner energy production. Demand for advanced steam generation continues to rise, and competition among major manufacturers encourages steady improvement in design, safety, and operational standards. Many long-standing engineering groups bring deep experience, while newer regional producers add fresh approaches and lower-cost options, creating a balanced competitive landscape.

Major participants such as Babcock & Wilcox Enterprises Inc., Mitsubishi Heavy Industries Ltd., General Electric Company, Doosan Heavy Industries & Construction Co. Ltd., Siemens AG, Alstom SA, Foster Wheeler AG, Thermax Limited, Harbin Electric Company Limited, Nooter/Eriksen Inc., Bharat Heavy Electricals Limited (BHEL), Hangzhou Boiler Group Co. Ltd., John Wood Group PLC, and Shanghai Electric Group Company Limited contribute to broad product variety and continuous innovation. Each organization brings unique strengths, from large-scale power solutions to flexible systems suited for industrial projects. This mix supports wide adoption across sectors that require stable heat transfer, reduced fuel waste, and strict environmental compliance.

Growing interest in energy efficiency encourages manufacturers to focus on designs that support steady output with lower emissions. Strong research investment helps develop materials that handle high pressure, reduce corrosion, and extend equipment lifespan. Service support also plays a major role, as many operators look for reliable maintenance programs, fast replacement parts, and long operational guarantees. These added services help build long-term trust between suppliers and industrial users.

Regional markets show rising activity as governments set clearer rules for cleaner production. Supportive policies, funding programs, and stronger infrastructure planning give producers more confidence to expand manufacturing lines and enter new partnerships. This wider participation strengthens supply chains and offers buyers more competitive prices and shorter delivery times.

Market size is forecast to rise from USD 1311.9 million in 2025 to over USD 2263.8 million by 2032. Once-through Steam Generator (OTSG) will maintain dominance but face growing competition from emerging formats.

Overall growth in the global market reflects steady demand for dependable steam generation and continuous improvement across major manufacturers. Strong competition, active research, and expanding regional capabilities shape a market that encourages better performance and broader access to advanced thermal technology.

Report Coverage

This research report categorizes the global once-through steam generator (OTSG) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global once-through steam generator (OTSG) market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global once-through steam generator (OTSG) market.

Once-through Steam Generator (OTSG) Market Key Segments:

By Type

- Horizontal

- Vertical

By Capacity

- Up to 60 MW

- 60-100

- Above 100 MW

By Application

- Power Generation

- Oil & Gas

- Industrial

- Others

Key Global Once-through Steam Generator (OTSG) Industry Players

- Babcock & Wilcox Enterprises Inc.

- Mitsubishi Heavy Industries Ltd.

- General Electric Company

- Doosan Heavy Industries & Construction Co. Ltd.

- Siemens AG

- Alstom SA

- Foster Wheeler AG

- Thermax Limited

- Harbin Electric Company Limited

- Nooter/Eriksen Inc.

- Bharat Heavy Electricals Limited (BHEL)

- Hangzhou Boiler Group Co. Ltd.

- John Wood Group PLC

- Shanghai Electric Group Company Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383