Global Offshore Support Vessel Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global offshore support vessel market and industry have followed a path shaped by necessity, resilience, and transformation. The history began during the mid-20th century when offshore exploration for oil first spurred action into deeper deep waters, creating the urgent need for purpose-designed vessels with capabilities beyond standard ships. Early support ships were uncomplicated in design, occasionally converted cargo or fishing ships, but established a trend for an industry that would expand as offshore operations became more ambitious.

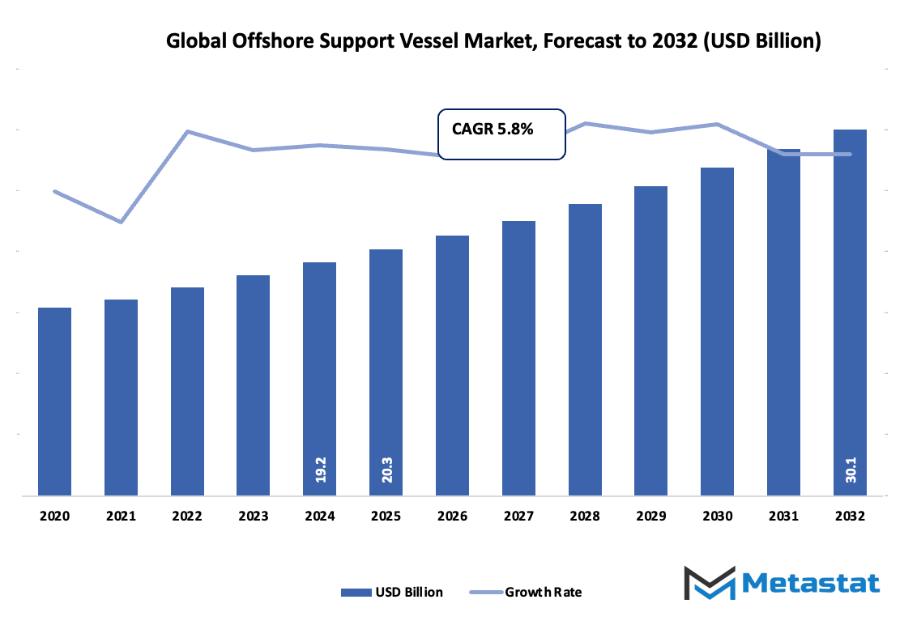

- Global offshore support vessel market of approximately USD 20.3 Billion in 2025, which would increase at a CAGR of approximately 5.8% in 2032, with potential to reach over USD 30.1 Billion.

- Anchor Handling Tug Supply Vessel possess nearly 32.0% market share and are the growth drivers through intense research, innovation at the cutting edge, and expanding uses.

- Key growth drivers: Rising demand for oil & gas exploration in deepwater and ultra-deepwater areas

- Growth opportunities are: Vessel automation and digitalization technology improvements

- Key insight: The global offshore support vessel market will grow exponentially in value in the course of the decade, reflecting potential growth opportunities.

The 1970s were the turning point years when offshore drilling in the North Sea and Gulf of Mexico needed more robust ships with advanced towing and anchor-handling capabilities.

It was then that there was more pronounced differentiation between different types of vessels, such as platform supply vessels and anchor handling tug supply vessels, which allowed the operator to match capacity with increasingly complex projects. Offshore support fleets by the late 1980s were no longer an added feature but were a permanent part of the oil and gas infrastructure. Consumer needs and operational desires continued to drive the trend of the global offshore support vessel market. Energy corporations called for safer, faster, and more efficient operations off shore, and vessel designs increasingly featured innovation like dynamic positioning systems that would allow for precision positioning without anchoring.

Early 2000s witnessed a new layer of change as the regulators began to bolster safety and environmental regulations following high-profile offshore incidents. This regulatory drive pushed vessel operators to redefine fleets with cleaner power technologies, fire-protection systems, and crew welfare enhancements.

Market Segments

The global offshore support vessel market is mainly classified based on Vessel Type, Water Depth, Application

By Vessel Type is further segmented into:

- Anchor Handling Tug Supply Vessel: The Anchor Handling Tug Supply Vessel market will be at the forefront of anchors handling and positioning for offshore installations. Growing offshore exploration and production activities will create the demand for effective heavy anchor handling vessels with the assistance of towing. Technological advancements will enhance operational safety and efficiency in fuel consumption, making the vessels an absolute necessity for offshore operations in the future.

- Platform Supply Vessels: Platform Supply Vessels will provide service to the offshore oil rigs by transporting equipment, chemicals, and supplies. Deepwater and ultra-deepwater investments will create demand for vessels that operate in harsh weather. Future developments will focus on larger storage capacity, load automation systems, and environmentally friendly propulsion systems to improve efficiency and reduce operation costs.

- Crew Vessel: Crew Vessels shall provide essential personnel transportation from onshore locations to offshore structures. As the size of offshore projects in remote locations enlarges, these vessels shall see growing utilization of safe, secure, and quicker personnel transfer. Incorporation of sophisticated navigation systems and enhanced onboard protection features will make these vessels inevitable in offering offshore labor force logistics.

- Other: Other vessels in the global offshore support vessel market will include multi-purpose support vessels, fire boats, and emergency response vessels. Offshore activity growth will create demand for specialized vessels that can satisfy various requirements during operations. Design breakthroughs and automation will increase flexibility and preparedness for operation, resulting in a stronger offshore support fleet.

By Water Depth the market is divided into:

- Shallow Water: The shallow water segment will remain important for coastal oil and gas fields. Vessels operating in this category will benefit from technological improvements in manoeuvrability and fuel efficiency. Future developments will focus on optimizing vessel size and cargo capacity to enhance operational efficiency in limited water depths.

- Deepwater: Deepwater operations will require vessels capable of supporting offshore installations far from the coast. Rising investment in offshore oil fields and wind projects will boost demand for deepwater-capable support vessels. Future vessels will emphasize advanced navigation, stronger hull designs, and robust onboard systems to manage challenging environmental conditions.

- Ultra-Deepwater: Ultra-deepwater support will become critical as exploration shifts to extreme offshore locations. Vessels in this segment will focus on high-performance capabilities, including precise anchor handling and long-distance supply runs. Innovations in autonomous operation, fuel efficiency, and remote monitoring will ensure safe and reliable performance in ultra-deepwater environments.

By Application the market is further divided into:

- Oil & Gas: Oil and gas applications will continue to drive the largest demand in the global offshore support vessel market. Rising exploration and production activities will require vessels for supply, towing, and personnel transport. Future vessels will integrate digital monitoring, fuel-saving technologies, and enhanced safety features to meet growing operational demands efficiently.

- Offshore Wind: Offshore wind applications will see increasing use of support vessels for turbine installation, maintenance, and crew transportation. As governments emphasize renewable energy, vessels designed for precise operations in harsh offshore conditions will become critical. Advanced equipment handling, low-emission engines, and adaptability will define future support vessels in this segment.

- Patrolling: Patrolling applications will expand to ensure offshore infrastructure security. Vessels dedicated to surveillance and emergency response will gain importance with the rise of offshore activities. Future vessels will include improved monitoring technologies, faster response capabilities, and enhanced endurance to maintain security across large offshore zones.

- Research & Surveying: Research and surveying applications will require vessels equipped for oceanographic studies, environmental monitoring, and seabed mapping. Growing offshore exploration and climate research initiatives will increase the need for high-tech, multi-functional vessels. Integration of autonomous systems, real-time data collection, and specialized equipment will define future developments.

- Others: Other applications include firefighting, rescue operations, and multi-purpose support. The increasing complexity of offshore operations will demand vessels that can perform multiple roles efficiently. Future vessels will focus on versatility, rapid response, and sustainability to support diverse offshore activities effectively.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$20.3 Billion |

|

Market Size by 2032 |

$30.1 Billion |

|

Growth Rate from 2025 to 2032 |

5.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

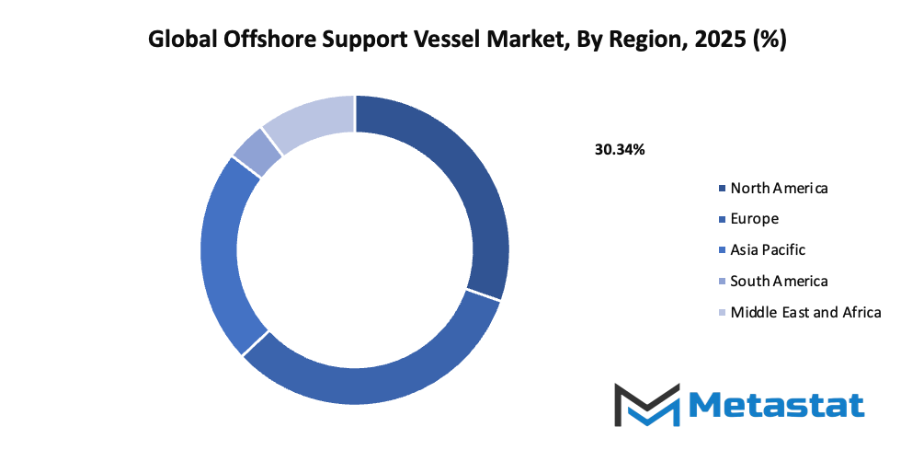

- Based on geography, the global offshore support vessel market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Growing demand for oil & gas exploration in deepwater and ultra-deepwater locations: The global offshore support vessel market will continue to expand as deepwater, and ultra-deepwater oil and gas exploration increases. Rising energy requirements will drive the need for specialized vessels that can operate efficiently in challenging offshore conditions, supporting drilling, transportation, and maintenance activities far from shore.

Increasing investment in offshore wind farms and renewable energy projects: Investment in offshore wind farms and renewable energy will create new opportunities for the global offshore support vessel market. Vessels will be needed to transport equipment, assist in installation, and maintain offshore renewable infrastructure. This growth will position support vessels as crucial assets in the clean energy transition.

Challenges and Opportunities

High operational and maintenance costs of offshore support vessels: High operational and maintenance costs remain a significant challenge. The global offshore support vessel market will face pressures from fuel expenses, crew management, and equipment upkeep. Managing these costs efficiently will be essential to maintain profitability while supporting increasing offshore activities.

Stringent environmental regulations and emission norms: Environmental regulations and emission standards are becoming stricter. The global offshore support vessel market will need to adapt vessels to comply with low-emission technologies and sustainable practices. Operators will face challenges but will also gain recognition for adopting environmentally responsible approaches.

Opportunities

Technological advancements in vessel automation and digitalization: Technological progress in automation and digital systems will reshape the global offshore support vessel market. Remote monitoring, predictive maintenance, and smart navigation will enhance operational efficiency, safety, and cost-effectiveness. These advancements will allow vessels to perform complex offshore tasks with greater precision and minimal human intervention.

Competitive Landscape & Strategic Insights

The industry is a mix of both international industry leaders and emerging regional competitors. Important competitors include Wartsila, GC Rieber, Solstad Offshore ASA, Maersk Supply Service, SEACOR Marine Holdings, Tidewater Marine, Siem Offshore, BOURBON, Kawasaki Kisen Kaisha, Ltd, MMA Offshore Limited, Havila Shipping ASA, Edison Chouest Offshore, Nam Cheong Offshore Pte. Ltd, Hornbeck Offshore, Vroon, Harvey Gulf International Marine, POSH, M3 MARINE GROUP, Group CBO, Deltamarin Ltd, FEG in global offshore support vessel market.

Market size is forecast to rise from USD 20.3 Billion in 2025 to over USD 30.1 Billion by 2032. Offshore Support Vessel will maintain dominance but face growing competition from emerging formats.

Today, the global offshore support vessel market is characterized by its diversity of craft and the global scale of deployment. Technology will continue to re-define efficiency and safety, while operators will respond to shifting expectations in energy logistics and marine standards. The journey from makeshift boats serving shallow waters to fleets of highly engineered vessels illustrates an industry that will evolve alongside new offshore challenges. Its history will serve as a reminder that progress at sea is not only about exploration but also about building the means to support it.

Report Coverage

This research report categorizes the global offshore support vessel market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global offshore support vessel market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global offshore support vessel market.

Offshore Support Vessel Market Key Segments:

By Vessel Type

- Anchor Handling Tug Supply Vessel

- Platform Supply Vessels

- Crew Vessel

- Other

By Water Depth

- Shallow Water

- Deepwater

- Ultra-Deepwater

By Application

- Oil & Gas

- Offshore Wind

- Patrolling

- Research & Surveying

- Other

Key Global Offshore Support Vessel Industry Players

- Wartsila

- GC Rieber

- Solstad Offshore ASA

- Maersk Supply Service

- SEACOR Marine Holdings

- Tidewater Marine

- Siem Offshore

- BOURBON

- Kawasaki Kisen Kaisha, Ltd

- MMA Offshore Limited

- Havila Shipping ASA

- Edison Chouest Offshore

- Nam Cheong Offshore Pte. Ltd

- Hornbeck Offshore

- Vroon

- Harvey Gulf International Marine

- POSH

- M3 MARINE GROUP

- Group CBO

- Deltamarin Ltd

- FEG

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252