Global Off-Highway Vehicle (ROV) Wheel Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

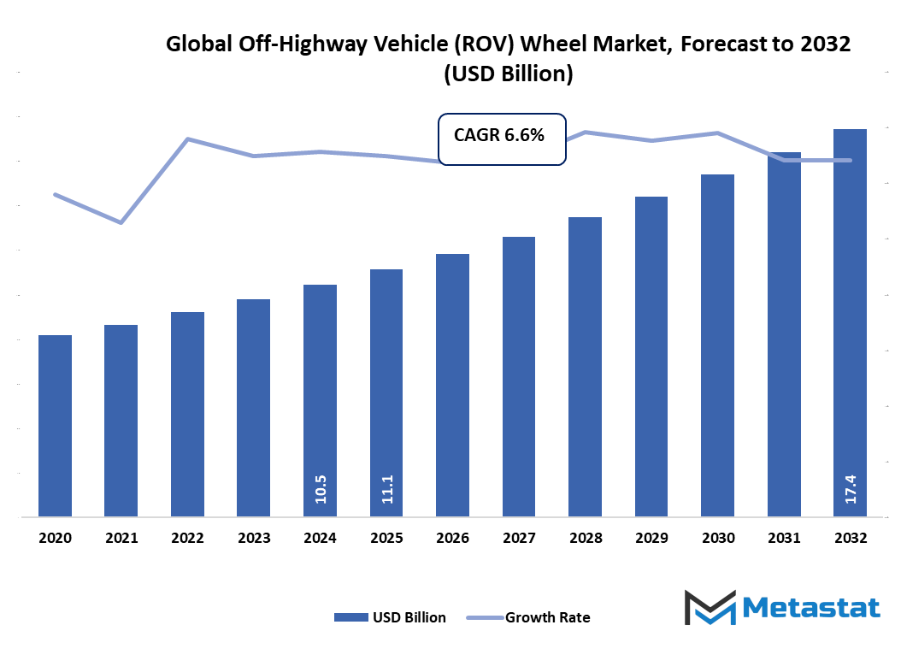

- Global off-highway vehicle (ROV) wheel market valued at approximately USD 11.1 Billion in 2025, growing at a CAGR of around 6.6% through 2032, with potential to exceed USD 17.4 Billion.

- Steel Wheels account for a market share of 61.7% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising popularity of recreational and adventure sports activities, Growing demand for durable and lightweight wheel materials

- Opportunities include: Increasing customization and aftermarket upgrades create new opportunities

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

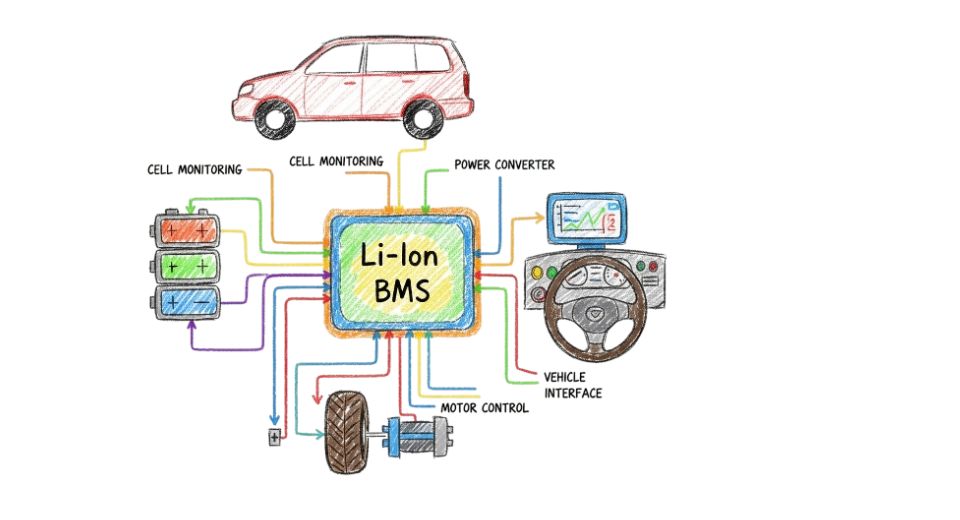

The global off-highway vehicle (ROV) wheel market is the upcoming guild sector of the automotive and industrial vehicle market, concentrating on the conception, fab, and supply of wheels made specifically for recreation off-highway vehicles, four-wheel drive vehicles, and side-by-side ROVs. This market would be a comprehensive range of wheel types, materials, and load capacities that could be used for traveling on rough terrains, uneven surfaces, and changing weather conditions and at the same time provide the stability, traction, and durability necessary. Manufacturers would use advanced materials and engineering solutions to improve performance, weight efficiency, and safety for both the recreational and industrial sectors.

This industry would be different from the vehicle components of the past due to innovations such as alloy composition, bead retention technology, and resistance to wear and corrosion being included in the products. In other words, the vehicle will be optimized for handling by car manufacturers, the support will be strong and reliable, even in stress situations, and the performance will be the structural integrity over a long time of usage. The customization element of a product will be more discussed among the market players. At the same time, the customers will be given the opportunity to choose wheels based on the nature of the terrain, carrying capacity, and the style of the vehicle. Thus, the products become flexible in terms of both personal and professional uses.

Market Segmentation Analysis

The global off-highway vehicle (ROV) wheel market is mainly classified based on Type, Application, End-User.

By Type is further segmented into:

- Steel Wheels: Steel wheels will be the most popular product in the global off-highway vehicle (ROV) wheel market for the next 10 years. The main reason for that would be their strength and durability. Besides, technologies and processes used in metal production will improve not only the performance but also the life of steel wheels under extreme conditions, which will lead to these types of wheels being used in heavy industries over a long period of time without any noticeable downtime and maintenance costs in future off-road vehicle industries.

- Aluminum Alloy Wheels: One of the most significant trends contributing to the global off-highway vehicle (ROV) wheel market is driven by the increasing demand for aluminum alloy wheels. The main driving force being the benefits that come with the lightweight nature of the wheels such as fuel efficiency. What further will give these wheels excellent strength and will make them the first choice of the operators will be the advancements in technology, which will enable these light metal-wheeled vehicles to carry heavy loads without loss of strength. Thus, operators concerned with vehicle agility and wear over off-road recreational or commercial activities will be attracted.

- Composite Wheels: Composite wheels will reshape the global off-highway vehicle (ROV) wheel market in the future as a result of the combination of strength, flexibility, and lower weight. Besides, these new materials will offer improved shock absorption, reduced vibration, and extended durability thus they will be the go-to wheels for smoother rides and better handling for recreational as well as heavy commercial users.

- Beadlock Wheels: Beadlock wheels will become increasingly popular, thus their market share in the global off-highway vehicle (ROV) wheel market will be bigger in the future and especially when it comes to extreme off-road applications. Just a few of the modifications that we can expect in the future are the ones in the locking mechanism and the material that will both be lighter and stronger. These developments will improve the safety and the state of the tire preventing them from rolling off thus allowing professionals and enthusiasts to take difficult terrains to the max with higher confidence and performance reliability when tackling future vehicle designs.

By Application the market is divided into:

- Recreational Off-Roading: One of the main factors that will enhance the global off-highway vehicle (ROV) wheel market is recreational off-roading. This is so because nowadays people love adventure tourism and outdoor activities, which have also become very trendy over the last period. Wheels that will be designed for rough terrain considering aspects such as traction, durability, and performance will be the ones to attract hobbyists allowing manufacturers to take a step more and focusing on their innovative designs to be suitable for extreme landscapes.

- Agricultural Operations: Agricultural sector is another area where demand for the Off-Road Vehicle (ROV) Wheel market will be on the upsurge. These wood log wheels will be used in applications where they will be required to handle heavy loads, rough terrain, and wet or muddy fields like tractors and harvesters. Future designs will be centered on strength, self-cleaning treads for longevity and operation of efficient farming and thus increasing productivity in agriculture.

- Construction & Mining: The construction and mining sectors will be the main customers of the Off-Road Vehicle (ROV) Wheel Market who will rely on the need for more enhanced and specialized wheels. The key features will be the upgraded load-bearing capacities, puncture resistance, and durability under extreme conditions that will assure a more efficient work with a slower rate of downtime for heavy machinery in harsh industrial environments, hence, it will be safer too.

- Military & Defense: Military and defense applications will be among the main contributors to the growth of the Off-Road Vehicle (ROV) Wheel market with their extremely high-performance requirements. For example, wheels will be designed for the roughest terrains, coldest weather, and hardest combat situations using the most futuristic materials and with smart designs enhancing the durability, the mobility, and the operational efficiency of the defense vehicles regardless of the different environments.

- Others: The global off-highway vehicle (ROV) wheel market will not only gain from applications pertaining to emergency services and recreational fleets but will also be able to increase the number of other such uses. No longer in a limitation stage, the new condition design of wheels adaptable to specialized tasks will bring about safety and efficiency increases, while the development of materials and models will extend the number of places where off-road vehicles may be utilized.

By End-User the global off-highway vehicle (ROV) wheel market is divided as:

- Individual Enthusiasts: Individual enthusiasts will continue to be one of the major sources of support for the global off-highway vehicle (ROV) wheel market. They will always be looking for wheels that will be optimized for performance, aesthetics, and reliability. The progress in wheel technology and the use of light materials will be the main factors affecting hobbyists who need good grip and easy handling while they are on the adventure trip in difficult places for recreation purposes.

- Agricultural Enterprises: Modern agriculture cannot exist without high-tech equipment and innovative solutions. Only agri-business will be able to create a greater demand for wheels in the Off-Road Vehicle (ROV) Wheel Market with the adoption of a high-quality and reliable fleet suitable for difficult terrain like forestry and agriculture. The future developments will be directed towards increasing the service life and reducing soil compaction, thus modern agriculture operations become more efficient and economically viable.

- Construction Companies: Construction companies will provide a major contribution to the Global Off-Highway Vehicle (ROV) Wheel) Market when they make demands for the wheels that can support heavy machinery under extreme conditions. Principal areas of innovations will be loading capacity, puncture resistance, and longevity thus the wheels will be the cause for low maintenance costs and the construction sites and infrastructure projects will be able to run smoothly without their flow being interrupted.

- Military Organizations: Military sectors will most likely have a say in the development of the global off-highway vehicle (ROV) wheel market when it comes to the request for the most reliable and extremely durable wheels for their defense vehicles. Some of the futuristic trends that will be present in the last will be improved materials for the structure, adjustment for the treads and monitoring by intelligence which together will make these vehicles capable of operating efficiently in different terrains and even under harsh environmental conditions.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$11.1 Billion |

|

Market Size by 2032 |

$17.4 Billion |

|

Growth Rate from 2025 to 2032 |

6.6% |

|

Base Year |

2024 |

|

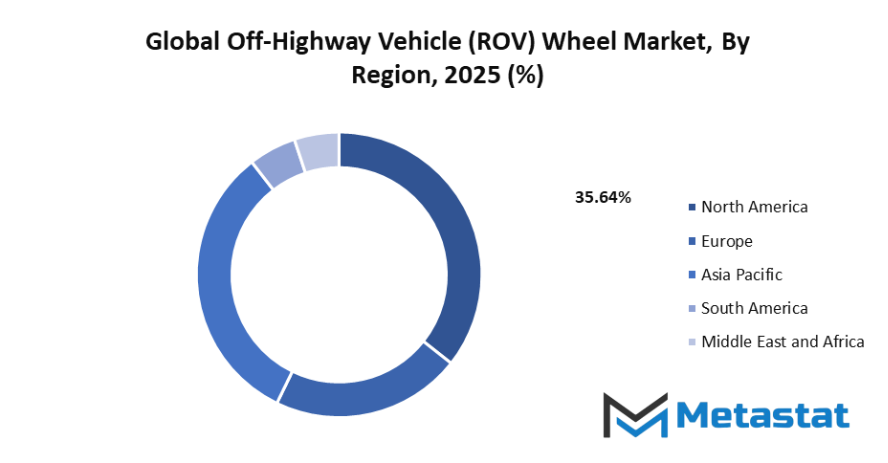

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

The global off-highway vehicle (ROV) wheel market will have characteristics that are very different depending on the region, it will be in line with variations in the number of vehicles, trends of the leisure time, and industrial applications. The U.S., Canada, and Mexico, which make up North America, will be the greatest contributors to the market for off-road wheels as a result of the steady popularity of recreational off-highway vehicles, after-market support that is very strong, and the adoption of utility terrain vehicles in the industrial and agricultural sectors. To satisfy the demands of the two groups, one of which consists of the enthusiasts and the other of professional operators, the companies located in this area of the globe will be concentrating on the following subjects: high-performance wheels, advanced materials, and the introduction of new designs.

The United Kingdom, Germany, France, Italy, and the rest of the continent are all part of Europe. The continent will stress its solid reputation for precision engineering, quality control, and observance of regional safety standards. European consumers and industrial users will ask for tough, reliable, and interchangeable products with various terrain characteristics. This will motivate the producers to come up with a variety of wheel shapes in order that the wheels can not only be used for fun but also be helpful in the industry with different agricultural applications.

Moreover, India, China, Japan, South Korea, and their neighbouring areas form the Asia-Pacific region, which will be known for its rapid development, and this can be attributed to the progressive acceptance of off-highway vehicles in the sectors of agriculture, construction, and recreation in the region. Also, Brazil and Argentina holding the South American continent will be occupied with the development of a market for those wheels which are designed to be used in difficult terrain and which adapt well to the existing terrain to meet the off-highway vehicle segment growing steadily. Apart from that, the Middle East & Africa territory comprising GCC countries, Egypt, and South Africa, will be relying on advanced technology solutions to not only support the recreational industry but also to industrial processes thus making it possible for activities to be carried out in face of severe environmental conditions. In general, the global off-highway vehicle (ROV) wheel market, which is found in all these regions, is about transitioning into the future, where manufacturers will be putting durability, performance, and regional customization as their top priorities to adequately cater for the diverse needs of recreational and professional users worldwide.

Market Dynamics

Growth Drivers:

Rising popularity of recreational and adventure sports activities: The rising popularity of recreational and adventurous sports activities has been one of the major factors behind the increased global off-highway vehicle (ROV) wheel market. More and more people are getting involved in the off-roading as well as outdoor adventures and therefore the demand for wheels with better traction, durability, and reliability will also increase, and this will in turn lead to higher production of the wheels with the designs that fit with different and difficult terrains by the manufacturers.

Growing demand for durable and lightweight wheel materials: The shift in consumer focus towards durable and lightweight wheel materials has been driving the global off-highway vehicle (ROV) wheel market. Just like the case with other vehicles in the transportation sector, wheels manufactures carefully selected their raw materials and composites in order to achieve weight reduction and at the same time, increase fuel efficiency of the whole transport system through the use of lightweight aluminum.

Restraints & Challenges:

High cost of advanced alloy and composite wheels limits adoption: Reasonably high cost of using advanced alloys while producing composite wheels limits the number of new customers in the global off-highway vehicle (ROV) wheel market. Small-scale operators with limited financial resources as well as individual users may experience budget shortages which consequently may slow down the market growth. It will be necessary for manufacturers to come up with new production methods in order to make these performances affordable while keeping the high quality that the customers demand.

Stringent safety and environmental regulations increase compliance burden: Rigid safety and environmental regulations have become a factor in escalating the costs of compliance in the global off-highway vehicle (ROV) wheel market. The requirements that have to be fulfilled are investment in testing, certification, and the use of the green method of manufacturing. The companies that are able to adjust in advance will be the ones who retain their competitiveness and at the same time, are sure that wheels meet the safety and sustainability requirements and are in line with the ever-changing standards.

Opportunities:

Increasing customization and aftermarket upgrades create new opportunities: The popularity of customization and aftermarket upgrades has contributed to the global off-highway vehicle (ROV) wheel market boombing opportunities. Future trends include modular designs, intelligent components, and the digital ordering platform, which makes it easier for buyers to personalize the wheel according to their terms. Customers want parts and accessories not only improved their functionality but also to fit with their performance needs and aesthetics. Expansion of aftermarket services and accessories is another factor further that opens the doors to the global off-highway vehicle (ROV) wheel market. Manufacturers and service providers are able to tap into the growing interest in vehicle personalization and off-road performance by offering upgraded wheels, an installation package, and other maintenance services to a broader audience of recreational and industrial users.

Competitive Landscape & Strategic Insights

The global off-highway vehicle (ROV) wheel market will feature a combination of the diverse compositions of the already globally known leaders and the newly coming regional players, which will be good for the competition and a great environment for the innovation to flourish. Top companies such as Maxion Wheels, Alcoa Corporation, Superior Industries, CLN Group, and Accuride Corporation are expected to keep on being the market drivers by undergoing the modernization of the manufacturing process, the application of high-strength alloys, and precision engineering for the production of steady and performance-driven wheels suitable for off-highway vehicles both for leisure and for the industry. Besides, these firms will employ their worldwide distribution channels combined with their know-how on the subject to ensure they maintain the top position and meet all the requirements of safety and quality in effect.

Among the regional and niche rivals are such firms as Enkei Corporation, BBS Kraftfahrzeugtechnik, Method Race Wheels, Fuel Off-Road, and Black Rhino Wheels who will enrich market diversity by providing specially designed products according to various terrains, vehicle types, and performance requirements. As far as these players are concerned, they will work with the products made of lightweight materials and will additionally focus on the aesthetic customization and provide aftermarket solutions that will satisfy enthusiasts as well as professional operators.

Development of the strategic market will be the infusion of continuous innovation, the combination of advanced materials, and the entry into new regions where off-highway vehicles are becoming more popular. Companies will focus on useability, support, and altars to help the variety of demands of recreational and industrial users to grow. The competition between big multinationals and the niche players will ensure that the global off-highway vehicle (ROV) wheel market will not only be up to date with the latest technology but will keep progressing in performance and regional adaptation, thus leading to a market landscape that in robust and resilient.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 11.1 Billion in 2025 to over USD 17.4 Billion by 2032. Off-Highway Vehicle (ROV) Wheel will maintain dominance but face growing competition from emerging formats.

Further on, the global off-highway vehicle (ROV) wheel market will act as a platform for the entire off-highway vehicle ecosystem, connecting manufacturers with suppliers and end-users by providing technical knowledge, quality assurance, and performance-focused design. Such a market will shift in the direction where the stakeholders are driven not only by the use of innovative manufacturing techniques but also by their compliance with the strict quality standards and their actions in response to the different needs of recreational enthusiasts and industrial operators. The industry by letting out the durable and high-performance wheels that are suitable for even the most extreme conditions is going to make the off-highway vehicles not only more functional but also safer and versatile and thus, can be used all over the globe.

Report Coverage

This research report categorizes the Off-Highway Vehicle (ROV) Wheel market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Off-Highway Vehicle (ROV) Wheel market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Off-Highway Vehicle (ROV) Wheel market.

Off-Highway Vehicle (ROV) Wheel Market Key Segments:

By Type

- Steel Wheels

- Aluminum Alloy Wheels

- Composite Wheels

- Beadlock Wheels

By Application

- Recreational Off-Roading

- Agricultural Operations

- Construction & Mining

- Military & Defense

- Others

By End-User

- Individual Enthusiasts

- Agricultural Enterprises

- Construction Companies

- Military Organizations

Key Global Off-Highway Vehicle (ROV) Wheel Industry Players

- Maxion Wheels

- Alcoa Corporation

- Superior Industries

- CLN Group

- Accuride Corporation

- Enkei Corporation

- BBS Kraftfahrzeugtechnik

- Method Race Wheels

- Fuel Off-Road

- Black Rhino Wheels

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252