MARKET OVERVIEW

The global octene copolymer linear low density polyethylene market will keep evolving the packaging and polymer processing industry as material science innovations kick into high gear. As industries move toward lighter, stronger, and greener materials, this segment will take a leading role in reshaping how performance plastics are utilized in actual applications. It is expected that the global octene copolymer linear low density polyethylene market will be transformed by factors not just determined by production capacity or local consumption but more deeply rooted in the path of technology, changing environmental policies, and product design customization.

One of the most significant areas that will determine the fate of the global octene copolymer linear low density polyethylene market is how polymer blends are going to be designed to fulfill particular end-user needs. Instead of developing universal material solutions, manufacturers will be pushed to create unique applications based on the mechanical and barrier characteristics needed throughout packaging, medical, agricultural, and industrial markets. These specialty formulations will broaden the functionality of octene copolymer-based polyethylene to enable it to challenge or even substitute traditional materials once considered irreplaceable because of cost or strength constraints.

The global octene copolymer linear low density polyethylene market will be impacted by emerging regulatory models requiring enhanced recyclability and traceability of materials. As sustainability drops from a choice and becomes an expected norm, producers will most probably go back to resin design and manufacturing methodologies to minimize environmental burden. The global octene copolymer linear low density polyethylene market will then extend to encompass not just virgin polymer but also advances in post-consumer Recyclites and hybrid blends that marry performance with sustainability. This change will not be trouble-free, but it will create opportunities for collaborations among manufacturers, research organizations, and end-use industries.

Digitalization and automation in manufacturing will again move the boundaries of what is possible for the global octene copolymer linear low density polyethylene market to achieve. With the maturing of digital twin technology, predictive maintenance, and AI-powered quality control systems, operational efficiency will increase. This will enable firms that are active in this sector to concentrate not just on the volume of output but also on the consistency and accuracy of polymer attributes. These improvements will confer a competitive advantage to manufacturers who opt to invest in smart production facilities and process innovation.

The use of the global octene copolymer linear low density polyethylene market in high-performance applications like medical packaging, solar panel encapsulation, and specialty films will receive more focus. The demand will no longer be restricted to conventional packaging but will start penetrating niche markets that require chemical resistance, added flexibility, and excellent optical properties. This diversion will stimulate investigation into coextrusion processes and multilayer film uses, extending the limits of where this resin can be applied.

Beneath the surface of the apparent commercial world, the global octene copolymer linear low density polyethylene market will appear not only to change in response to new needs but to assist in creating them. The emphasis will move away from merely making a material and toward engineering performance via precision, sustainability, and application flexibility. These changes will redefine industries' relationships with polymers throughout the globe and establish new standards for material design innovation.

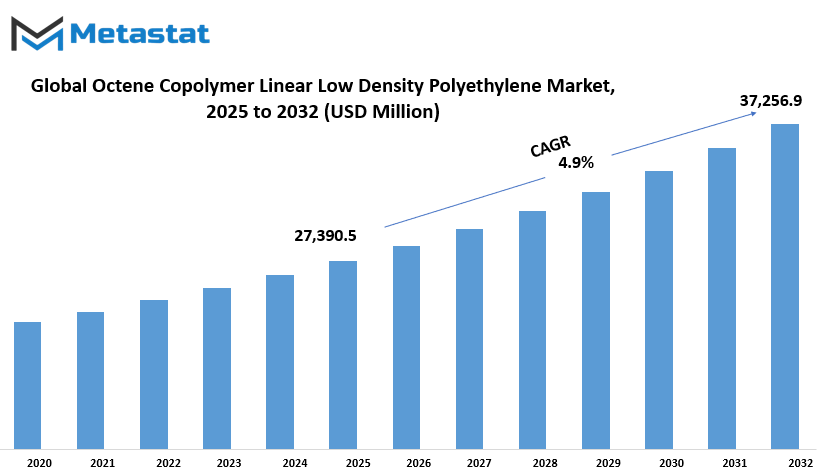

Global octene copolymer linear low density polyethylene market is estimated to reach $37,256.9 Million by 2032; growing at a CAGR of 4.9% from 2025 to 2032.

GROWTH FACTORS

The global octene copolymer linear low density polyethylene market will experience notable changes due to many affected factors. A primary driver flexible for this market will still need to grow strong packaging materials, especially in the food and beverage industry. As consumer changes lifestyle and increases food consumption, the demand for packaging which is both durable and light will continue to grow. The Octene Copolymer LLDPE stands out as it provides a balance between flexibility and cruelty, making it ideal for wrapping, sealing and safety of various products without adding excess weight.

Another major reason for the increasing use of this material will be its growing application in the agriculture sector. Farmers and suppliers are turning to high -performing films for mischief and greenhouse coverings. These films help manage temperature and moisture, eventually increasing crop yield. Octene Copolymer LLDPE will offer better strength and clarity, making it suitable for large -scale agricultural use where durability and performance are important. As agricultural practices become more advanced and climate challenges continue, the demand for reliable film content will probably be strong.

Even with these benefits, the global octene copolymer linear low density polyethylene market may face some challenges. The cost of production of Octene Copolymer LLDPE is directly associated with raw material prices, which uplifts based on oil prices and supply disruption. These changes can affect profit margins for manufacturers and lead the price variation for the end users. In addition to economic challenges, environmental concerns and its long -term effects around plastic waste will also play an important role. Governments and regulatory bodies worldwide are placing strict rules on plastic production and disposal. These rules can limit the use of traditional plastic materials, including LLDPE, unless proper waste management systems occur.

However, these challenges can also lead to positive changes. The Octene Copolymer LLDPE will make more attractive for companies with the aim of completing environmental goals with advances and durable production processes in recycling methods. Better recycling and use of bio-based materials in production will open widespread adoption opportunities in environment-conscious industries. Companies that invest in greenery technologies and circular practices will benefit from increasing demand, especially from brands focused on stability. In the coming years, a combination of practical benefits and environmentally friendly upgrades will give this material a position as a preferred option in various applications.

MARKET SEGMENTATION

By Type

The global octene copolymer linear low density polyethylene market will maintain to shape industries that depend upon versatile plastic answers. This sort of polyethylene is specifically designed the usage of octene as a comonomer, which gives the cloth precise power and versatility. Within this marketplace, the segmentation by octene content material performs an essential function in assembly unique business wishes. High Octene Content LLDPE holds a prime proportion, valued at $21,256.8 million. This type gives greater sturdiness and advanced effect resistance, making it useful for heavy-obligation packages along with business packaging and stretch movies. Industries that require more potent and greater bendy substances will probably decide upon this phase.

Meanwhile, Low Octene Content LLDPE will cater to regions that call for substances with more mild mechanical properties. It might not offer the equal level of energy because the high-content material model, however its ease of processing and balanced performance make it appropriate for applications like thin-film packaging, agricultural films, and family products. Medium Octene Content LLDPE, on the other hand, will probable offer a center ground among the 2. This segment offers a first rate stability of longevity, flexibility, and readability, and it will be used in applications wherein neither extreme is needed. These three kinds aren't competing however rather supporting the overall the global octene copolymer linear low density polyethylene market by means of becoming into one of a kind degrees of business necessities.

As the global octene copolymer linear low density polyethylene market grows, the industries will look rapidly towards polymer solutions. The ability to fix strength, cruelty and processing performance will become an important feature by adjusting the octene content. This adaptability will make the Octene Copolymer LLDPE more attractive in areas such as packaging, construction, consumer goods and even motor vehicle applications. The manufacturer will focus more on finding the correct type of octene content to the octene content LLDPE for its specific requirements rather than relying on a size-fit-all material.

With increasing global demand for efficient and light materials, the global octene copolymer linear low density polyethylene market will further expand. The partition based on octene content will continue to guide industries in choosing the right type of material to match its product design, cost goals and performance goals. Focusing on expertise rather than standardization will help companies to remain competitive and improve product efficiency in supply chains.

By Form

The global octene copolymer linear low density polyethylene market will also keep changing according to form-specific end-uses, customer requirements, and developments in processing technologies. Film among the different forms will remain in high demand because of its extensive application in flexible packaging, farm films, and stretch wraps. Increasing demand for light, tough, and economical packaging solutions will keep pressurizing manufacturers to prefer film-grade materials. It is also expected to be promoted by commercial business and consumer goods markets emphasizing convenience, cleanliness, and shelf life.

Sheet form will be used in instances where materials that are ever so slightly thicker and stronger on a material-to-material basis are required, particularly in construction, transportation, and industrial packaging. While less flexible than film, sheet material provides a compromise between strength and flexibility, making it appropriate for protective packaging and insulation. Since industries seek materials that can easily be processed but are strong enough to withstand environmental stress, sheet-form octene copolymer LLDPE will remain in the picture.

Molding applications will continue to be a smaller but consistent sector. This type of form facilitates the production of precise shapes and structures needed in containers, caps, and other semi-rigid or rigid pieces. Molding is not the biggest category, but it has a targeted market that demands consistency and load resistance. It will continue to be significant in industries that depend on lightweight but dependable molded components, such as parts of the consumer goods and automotive sectors.

Coating applications, while fairly specialized, will increase steadily as the need for advanced surface protection and water barrier properties increases. Coatings find application in the areas of paper lamination, wires, and cables, where a thin, smooth layer of protection is needed without excessive weight or loss of flexibility. Increased use of electronics, as well as the demand for more effective insulation materials, will drive the global octene copolymer linear low density polyethylene market demand in future years.

Every type will still fill a particular niche in the overall global octene copolymer linear low density polyethylene market environment. End-use requirements like flexibility, strength, thickness, and process compatibility will determine whether to use film, sheet, molding, or coating. As manufacturers evolve to meet customer demands and industry conditions, they will target enhancing performance and manufacturing efficiency for every form. The interplay of cost, material characteristics, and manufacturing simplicity will determine the direction of each segment and how products are positioned by companies in order to remain competitive.

By Application

The global octene copolymer linear low density polyethylene market, when studied through lenses of its various applications, presents a wide spectrum of industries that depend on its specific properties. This type of polyethylene, which is known for resistance to its flexibility, strength and environmental stress, will remain a significant material in many practical areas. Packaging is one of the largest segments where this material is used. It will continue to be used in both flexible and rigid packaging due to its excellent effect power, sealing performance and durability. As companies seek light and cost-effective options to ensure product protection and shelf-life, the demand for LLDPE in this segment will be consistent and efficient food and product may increase with the increasing requirement of packaging solutions.

In the automotive sector, the Octene Copolymer LLDPE durable will support the demand for mild components yet. With vehicles being designed for better fuel efficiency and low emissions, materials that provide strength without adding extra weight will play an important role. Liners, interior trims and lightweight -molded parts such as components will use LLDPE due to its molding ease and flexibility. In construction, the material will be widely adopted in pipes, sheets and insulation products. Its flexibility and chemical resistance makes it a reliable option for applications where it is common from exposure to various substances and mechanical stress. This will help reduce the cost of maintenance and expand the lives of materials used in infrastructure.

Consumer goods will be another important application area. Items such as containers, lids and domestic storage solutions will benefit from the resistance of materials for wear and tears. Its smooth finish and cost-patriotism also makes it suitable for daily use items. In healthcare, Octene Copolymer LLDPE will be used in making medical devices and equipment, which will be due to its compatibility with hygiene requirements and resistance to contaminants. In the agricultural industry, this material will serve its objective in the production of films and mulch. Its ability to face sunlight, moisture and temperature changes will support crop safety and better yield.

Finally, various industrial applications will also adopt Octene Copolymer LLDPE for special use where durability and chemical resistance is required. From insulation layers to protective covering, its use will be directed by its performance in changing conditions. Each application will continue to highlight the functional powers of this versatile polymer in real -world settings.

By End-Use Industry

The global octene copolymer linear low density polyethylene market will continue to shape the future of many industries due to its flexibility, durability and efficiency in manufacturing. This material has already had a strong impact in areas relying high quality and light packaging or structural solutions. As industries seek options that balance the performance with costs, the Octene Copolymer LLDPE will remain the content of interest.

For example, the food and beverage industry will use this material widely for packaging purposes. Tearing, flexibility in pressure, and thin yet make it ideal to keep its resistance products safe and fresh for the ability to make strong movies. As consumer preferences lead to more convenient and long-lasting packaging, the demand for this polymer will increase. Not only does it support better shelf-life, but it also makes it easy to manufacture products that meet security and quality standards.

In the drug field, this polymer will be given importance to its clean, non-reactive properties. This helps to ensure that drugs are sealed and stored without contamination or decline. Packaging plays an important role in maintaining the integrity of drugs, and as medical distribution becomes more global and time-sensitive, the requirement of reliable packaging materials will increase. Octene Copolymer LLDPE will be a practical option for its chemical stability and clarity, which are essential in this area.

In building and construction, material will provide solutions in insulation, protective sheets and piping. Since construction projects are often involved in contact with moisture, temperature changes and mechanical stress, they can withstand such situations without adding additional weight. The octene-based LLDPE will meet these requirements by providing both safety and flexibility.

The motor vehicle industry will also trust this polymer for the ability to lose weight without compromising strength. From seat cover to wire insulation, materials will be used to improve efficiency in vehicles. Lighter material contributes to fuel saving and better performance, making them important to manufacturers to meet both regulatory and consumer demands.

In agriculture, Octene Copolymer LLDPE will help in producing films for greenhouse coverings, silage raps and irrigation tubing. These products need to be worn for elements and handle the risk, and this polymer provides essential resistance and flexibility.

Consumers, including domestic and personal care products, will use this material for goods, packaging and containers. Its tenderness, power and ability to mold in various shapes will support creative and functional product design.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$27,390.5 million |

|

Market Size by 2032 |

$37,256.9 Million |

|

Growth Rate from 2025 to 2032 |

4.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

.

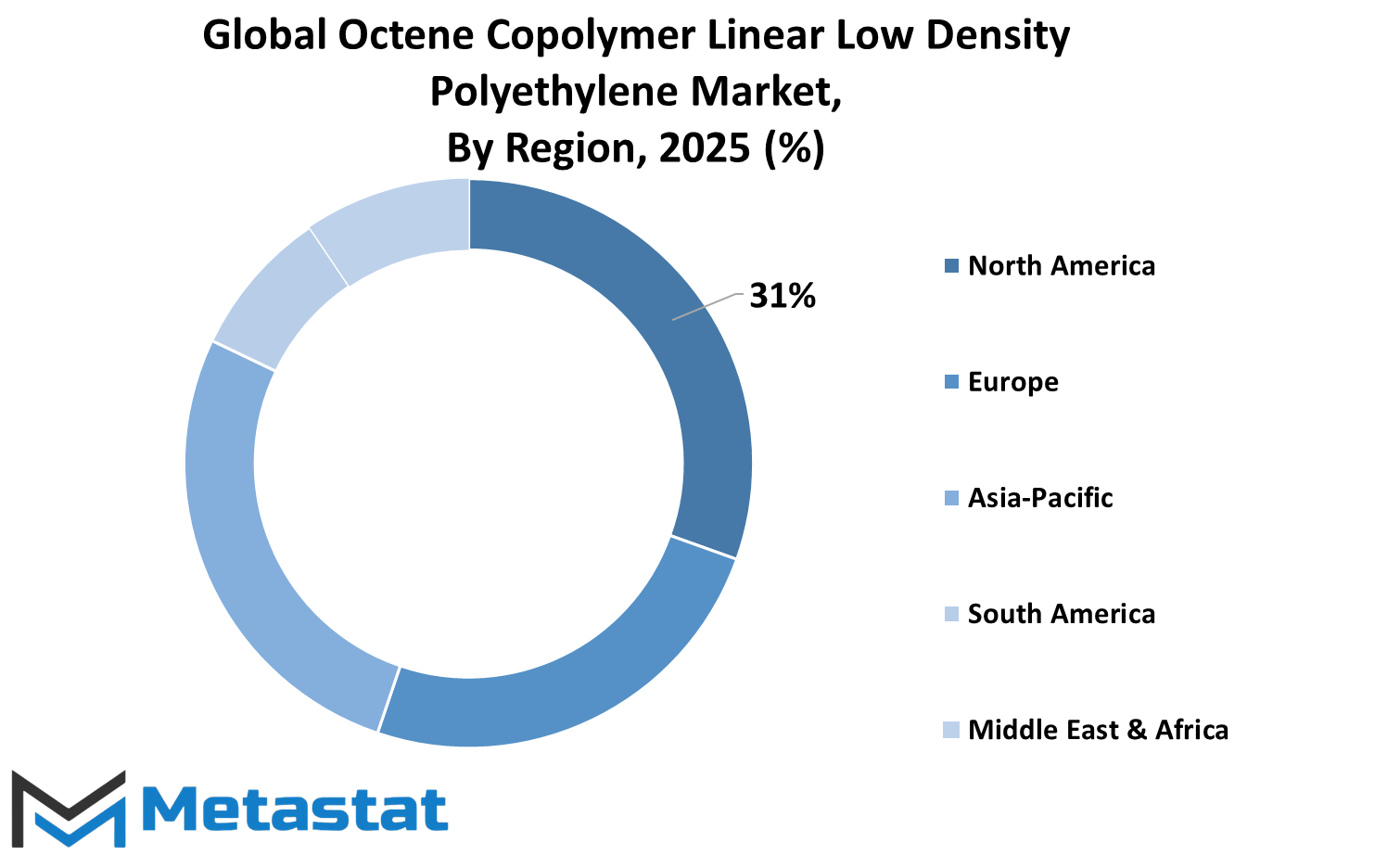

REGIONAL ANALYSIS

The global octene copolymer linear low density polyethylene market is geographically divided into several areas, playing its role in shaping the direction of each industry. North America is divided into the United States, Canada and Mexico. This area will possibly maintain a stable speed due to its mature manufacturing base and continuous demand in packaging and consumer goods. The American will remain central due to its production capacity and innovation led initiative. Canada and Mexico will contribute through regional trade agreements and their growing industrial needs.

Europe is another important part of the global octene copolymer linear low density polyethylene market and includes UK, Germany, France, Italy and the rest of Europe. Countries like Germany and France will continue to invest in permanent options, which may affect the demand pattern in the coming years. While environmental rules in Europe will insist on better product performance, they will also change the trends of the application. UK and Italy are expected to look at the moderate demand due to progress in flexible packaging and automotive sectors. The rest of Europe will see gradual development based on infrastructure and regional trade dynamics.

In the Asia-Pacific region, countries such as India, China, Japan, South Korea and others are expected to show noticeable growth. With a strong emphasis on packaging, agriculture and construction, the region will look at the growing interest in the Octene Copolymer linear low density polyethylene. China and India, especially, will remain prominent consumers due to their expanded economies and growing industrial activities. Japan and South Korea will focus more on quality and innovation, pushing for special applications that demand better physical properties. The rest of the Asia-Pacific will follow this trend, gradually increasing its consumption and grows local industries.

South America includes Brazil, Argentina and the rest of South America. Brazil will be the leading country in the region, supported by demand in the food and beverage industry, while Argentina and other parts will have a slight contribution in the size of local economic conditions and government policies.

The Middle East and Africa consists of GCC countries, Egypt, South Africa and other nations. The GCC country will probably play a large part due to its established petrochemical industries. Egypt and South Africa are also inspired by infrastructure development and local packaging needs. The rest of the sector may experience slow but coherent movement as industries gradually expand and modernize. Each of these geographical areas will affect how the market takes shape based on local demands, rules and industrial strategies.

COMPETITIVE PLAYERS

The global octene copolymer linear low density polyethylene market will continue to experience new innings of size by the changing demands of the linear market packaging, construction, agricultural and consumer goods industries. This material, which is known for its flexibility, cruelty and clarity, has been chosen for a wide range of applications. This will play a large role in manufacturing processes that require strength with light features. As consumer preferences bend towards convenient, long -lasting packaging, the global octene copolymer linear low density polyethylene market will be expected to align itself with this growing trend.

Manufacturers will continue to detect ways to improve product performance, reducing waste. This will focus more on adopting and recycling advanced production methods. Brands and producers using Octene Copolymer LLDPE will be likely to invest in innovations that help expand the shelf life of the products, improve transport efficiency, and ensure that packaging remains resistant during handling. These reforms will help businesses to remain competitive as global trade expands and customers demand better quality.

There are many prominent players at the core of the global octene copolymer linear low density polyethylene market instruction. Companies like Exonmobil Chemical, Lyndalebasel Industries, Dow Chemical Companies and Sabik are investing in product development and expanding their global access. Along with them, Ineos Group, Totalenergies, Braskem, Chevron Philips Chemical Company, and Mitsui chemicals affect industry with their technologies and comprehensive distribution networks. There is also a strong appearance of LG Cam, Borelis AG, Formosa Plastic Corporation, Reliance Industries Limited, and Nova Chemicals. Their efforts in stability and efficiency will show how materials are used in industries.

As more countries tighten the rules on the use of plastic, producers of Octene Copolymer LLDPE will need to rethink how they attach to manufacturing and design. They will be expected to create more environmentally friendly grades that support recycling goals. Cleaner will be a strong push towards producing options that do not compromise on strength or quality. This will probably run a partnership between petrochemical companies, research institutes and packaging giants.

Overall, the global global octene copolymer linear low density polyethylene market will remain focused on versatility and strength, while stability and changing consumer will be conscious of needs. By adjusting new demands, investing in cleaner technologies, and working together, the lead players will shape the next stage of development for this widely used material.

Octene Copolymer Linear Low Density Polyethylene Market Key Segments:

By Type of Octene Copolymer

- High Octene Content LLDPE

- Low Octene Content LLDPE

- Medium Octene Content LLDPE

By Form

- Film

- Sheet

- Molding

- Coating

By Application

- Packaging (Flexible and Rigid Packaging)

- Automotive

- Construction (Pipes, Sheets, and Insulation)

- Consumer Goods

- Healthcare (Medical Devices and Equipment)

- Agriculture (Films and Mulches)

- Others (Industrial Applications, etc.)

By End-Use Industry

- Food and Beverage

- Pharmaceuticals

- Building and Construction

- Automotive

- Agriculture

- Consumer Goods

Key Global Octene Copolymer Linear Low Density Polyethylene Industry Players

- ExxonMobil Chemical

- LyondellBasell Industries

- Dow Chemical Company

- SABIC

- INEOS Group

- TotalEnergies

- Braskem

- Chevron Phillips Chemical Company

- Mitsui Chemicals

- LG Chem

- Borealis AG

- Formosa Plastics Corporation

- Reliance Industries Limited

- Nova Chemicals

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252