MARKET OVERVIEW

Non-woven air-laid products for hygiene are an absorbent material created by spreading fibers into the air and then sticking them together through processes involving heat, pressure, or adhesives. These products find widespread use in different hygiene-related applications, including baby diapers, adult incontinence products, feminine hygiene items, and medical supplies.

These materials are designed to efficiently absorb and retain liquids, making them an essential component in products like baby diapers. When a baby wets a diaper, the non-woven air-laid material quickly soaks up the moisture, keeping the baby's skin dry and comfortable. This absorbent quality is crucial for preventing diaper rash and ensuring the overall well-being of infants.

In the case of adult incontinence products, these non-woven air-laid materials provide a reliable solution for individuals with incontinence issues. They can absorb and lock away significant amounts of liquid, maintaining the user's dignity and comfort. This makes them an indispensable component of adult diapers and similar products. Feminine hygiene products, such as sanitary napkins and tampons, also rely on these absorbent materials to keep women feeling dry and protected during their menstrual cycles. The non-woven air-laid material helps prevent leakage and provides a sense of confidence and comfort for women during this time.

Moreover, the medical industry extensively employs non-woven air-laid products for various purposes. These materials are used in wound dressings, surgical drapes, and disposable medical gowns, where their absorbent and soft characteristics are highly advantageous. They help in maintaining a sterile environment and promote the healing process. Non-woven air-laid products for hygiene play a crucial role in maintaining cleanliness, comfort, and hygiene in a range of everyday situations, from caring for infants and adults to addressing the needs of women during their menstrual cycles and supporting medical procedures. These versatile materials continue to be a fundamental part of our lives, ensuring our well-being and convenience.

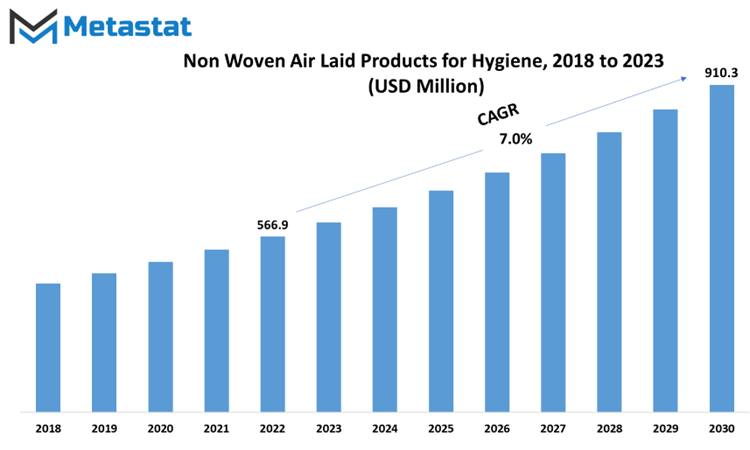

Global Non-Woven Air Laid Products for Hygiene market is estimated to reach $910.3 Million by 2030; growing at a CAGR of 7.0% from 2023 to 2030.

MARKET DYNAMICS

The COVID-19 pandemic had a significant impact on the Nonwoven Air Laid Products for Hygiene Market. Lockdowns, travel restrictions, and the closure of manufacturing units disrupted the supply chain of raw materials, leading to reduced production. Mandatory social distancing rules also hindered production facilities, causing a decrease in manufacturing efforts. Additionally, disruptions in distribution channels and the shutdown of retail stores affected product delivery and sales. However, as the pandemic subsided, the market began to recover, driven by increasing consumer demand for improved hygiene products.

Drivers of markets include a growing focus on hygiene products that offer comfort and quality, especially wipes and pads. non woven air laid products gained popularity due to their enhanced absorbency and reduced rewet properties. Consumer awareness of the material's benefits, such as smoothness and softness, led to a shift in preference from traditional hygiene products. Companies responded by innovating their product offerings.

Volatile pricing of raw materials and supply chain disruptions pose challenges to the market. Fluctuating procurement costs and additional tariffs on transportation impact product pricing and consumer perception. The complexity of setting up non woven air laid material production processes, including the need for specialized machinery and skilled workforce, is another restraint.

Market opportunities arise from the growing demand in untapped emerging economies, driven by an aging population and the need for feminine and baby care products. Regulatory standards in the industry focus on environmental compliance, with regulations governing the use of chemicals in manufacturing and disposal processes. Companies must adhere to these standards to ensure sustainable production.

MARKET SEGMENTATION/REPORT SCOPE

By Product Type

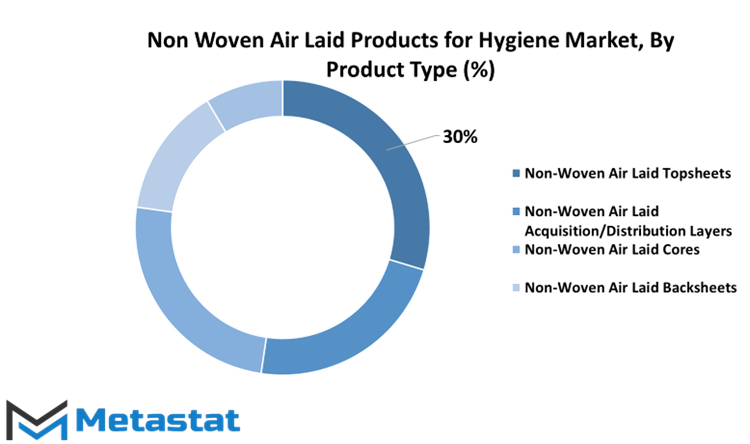

In the Hygiene Product Market focusing on Nonwoven Air Laid Products, the categorization based on product types unfurls as an intricate terrain, with each classification carrying its own distinctive significance and impact on the market. This complex differentiation serves as a testament to the multifaceted character of nonwoven air laid products and underscores the adaptability of their applications.

First and foremost, is the Non-Woven Air Laid Topsheets. Within the sphere of hygiene items, these topsheets constitute a pivotal element. These nonwoven air laid topsheets are meticulously crafted to provide an unparalleled level of comfort and softness to the end-consumer. Their distinguishing trait lies in their capacity to deliver a gentle, cushioned tactile experience, ensuring that users encounter a soothing and irritation-free interaction with the product. This segment caters to those who prioritize not only functionality but also the delicate texture and overall user experience that these topsheets bring to hygiene products. It is forecast to grow at a CAGR of 7.35% during 2023-2030.

As we proceed, we encounter the category of Non-Woven Air Laid Acquisition/Distribution Layers. This segment plays a vital role in ensuring the efficient absorption and distribution of fluids within hygiene products. The intricate design of these layers permits swift acquisition of liquids, averting potential discomfort or leakage. Essentially, they act as a barrier between the user and moisture, safeguarding against any unwelcome dampness. It is in these layers that the sorcery of fluid management transpires, guaranteeing a dry and comfortable experience for the user. The Non-Woven Air Laid Acquisition/Distribution Layers segment was valued at 411.4 USD Million in 2022

Continuing through the classification, we reach the realm of Non-Woven Air Laid Cores. These cores constitute the heart of hygiene products, meticulously engineered to absorb and retain moisture effectively. They are designed with a focus on rapid absorption and high retention capacity, ensuring that users can depend on the product to keep them dry and comfortable throughout its usage. These cores epitomize the essence of hygiene products, standing as a testament to their functionality and reliability.

The category of Non-Woven Air Laid Backsheets leads us to the posterior aspect of hygiene products, yet their significance cannot be underestimated. These backsheets provide a crucial layer of protection, averting any seepage or leakage from the product onto external surfaces. Their impermeable nature ensures that users can confidently utilize hygiene products without concern for any unintended consequences. In this segment, the durability and reliability of these products are reinforced, providing peace of mind to users. It is forecast to grow at a CAGR of 6.31% during 2023-2030

Lastly, the all-encompassing category of Others encapsulates the diverse array of nonwoven air laid products that do not neatly fit into the segments. This is a domain of innovation and versatility, where manufacturers continually explore new possibilities and applications for this remarkable material. It is in this space that we find room for creativity and adaptability as industry evolves to meet the ever-changing needs and preferences of consumers.

The segmentation of the Nonwoven Air Laid Products for Hygiene Market by product type reveals a rich tapestry of specialized components, each with its unique role and significance. From topsheets that prioritize user comfort to acquisition layers that manage fluids with precision, cores that excel in absorption, and backsheets that provide essential protection, these segments collectively contribute to the overall functionality and desirability of hygiene products. The category of "Others" remains a realm of potential, where innovation continues to propel the industry forward. Together, they form a cohesive ecosystem that underscores the importance of nonwoven air laid products in enhancing the hygiene and well-being of individuals worldwide.

By Thickness

The Less than 1 mm category encompasses products that are slender and featherlight, offering an impeccable solution for scenarios demanding subtlety and pliability, exemplified by ultra-thin sanitary napkins. This niche serves the discerning clientele in quest of discreet hygiene alternatives. The Less than 1 mm segment was valued at 542.6 USD Million in 2022

Within the 1 mm to 2 mm bracket, we encounter products that strike an optimal equilibrium between thinness and absorbency. These find their niche in absorbent diapers, catering to the needs of both infants and adults, where paramount comfort and absorbent capability hold sway and it will be 1402 USD Million in 2030.

On the other end of the spectrum, the Exceeding 2 mm category showcases products endowed with substantial thickness, endowing them with exceptional absorbency and durability. Illustrative instances encompass high-absorbency adult diapers and industrial wipes, meticulously crafted to meet the exigencies of situations demanding remarkable liquid retention and resilience. It is forecast to grow at a CAGR of 6.7% during 2023-2030.

The strategic segmentation of this market predicated on thickness aptly mirrors the intricate interplay between form and function. The triad of categories adeptly caters to a spectrum of consumer demands: Less than 1 mm for discretion, 1 mm to 2 mm for versatility, and Exceeding 2 mm for unyielding durability and top-tier performance. This meticulous stratification empowers both manufacturers and consumers, offering the wherewithal to make judicious choices within the domain of hygiene and comfort.

By Application

Among the various applications, the segment of Feminine Hygiene Products stands as a testament to the industry's commitment to providing women with advanced and reliable solutions. These products encompass a wide range of items, from sanitary pads to tampons, all designed with a singular focus: to ensure women's comfort and confidence during menstruation. non woven air laid materials have gained immense traction in this segment due to their exceptional absorbency and softness. As the demand for products that prioritize both effectiveness and comfort continues to surge, manufacturers are compelled to innovate continually, resulting in an ever-evolving market and it will be 1014.9 USD Million in 2030.

The Adult Incontinence Products segment caters to the unique needs of an aging population. In an era marked by increasing life expectancy, the market for products that offer discreet and reliable protection for adults experiencing incontinence issues has witnessed remarkable growth. non woven air laid materials, with their high absorbency and leak-preventing properties, have become indispensable in the creation of adult diapers and incontinence pads. As demographic shifts continue to drive demand, manufacturers must focus on enhancing product performance while ensuring comfort and dignity for the end-users.

The Baby Diapers segment has undergone a profound transformation, moving away from conventional cloth diapers to more sophisticated and convenient disposable options. non woven air laid materials have played a pivotal role in this transition, offering superior absorbency and a dry, comfortable experience for infants. With parents increasingly prioritizing convenience and the well-being of their babies, this segment remains dynamic and competitive. Manufacturers are challenged to develop eco-friendly solutions while maintaining the highest standards of performance and safety. The Baby Diapers segment was valued at 473.1 USD Million in 2022.

In Personal Care Products, non woven air laid materials have found applications in a plethora of items, ranging from wet wipes to facial masks. These materials are cherished for their softness, durability, and capacity to hold lotions and cleansing agents. As consumers become more discerning and seek products that not only cleanse but also pamper their skin, this segment offers vast opportunities for innovation and differentiation. Manufacturers must continually explore novel formulations and product designs to capture this discerning market.

The Others category is a catch-all for a wide array of hygiene products that utilize non woven air laid materials. This diverse category encompasses products such as medical wound dressings, pet care products, and more. It is underscores the versatility of non woven air laid materials and their adaptability to a broad spectrum of applications. As emerging trends and consumer demands continue to shape this segment, manufacturers must remain agile and responsive to seize new opportunities and it will be 148.1 USD Million in 2030.

By Feminine Hygiene Products

Within the expansive domain of the global Nonwoven Air Laid Products for Hygiene market, the segment dedicated to Feminine Hygiene Products stands as a pivotal and meticulously stratified market. It is a domain where meticulous attention to detail and the unique characteristics of the various product categories are essential to understanding the dynamic market landscape. In essence, this segment can be effectively dissected into three distinct categories: Sanitary Napkins, Panty Liners, and Tampons.

Sanitary Napkins have evolved significantly over the years, from their humble beginnings as rudimentary cloth-based solutions to the modern, technologically advanced pads available today. The modern sanitary napkin's ergonomic design and breathable layers provide a sense of security and convenience to users, making them an indispensable part of the feminine hygiene routine. The Sanitary Napkins segment was valued at 382.7 USD Million in 2022.

Panty Liners constitute another vital category within Feminine Hygiene Products, offering a different level of protection and versatility. Their slender profile, akin to that of a traditional adhesive strip, allows for discreet wear, contributing to their popularity among women seeking a practical and discreet solution and it will be 262.5 USD Million in 2030.

In contrast, Tampons represent a unique and highly specialized category within the Feminine Hygiene segment. The versatility of tampons lies in their ability to provide an exceptionally high level of discretion and comfort, allowing women to engage in a wide range of physical activities, including swimming and sports, without concern for external visible elements. Tampons have gained popularity for their effectiveness in controlling menstrual flow while preserving the wearer's mobility and comfort.

REGIONAL ANALYSIS

Geographically, the global Non Woven Air Laid Products for Hygiene market is thoughtfully categorized into several key regions, each with its unique market dynamics. North America is further subdivided into the United States, Canada, and Mexico, with each nation contributing to the regional market in its own distinct way. The North America Non-Woven Air Laid Products for Hygiene market held a substantial share of 29.9% within the overall Non-Woven Air Laid Products for Hygiene market in the year 2022. This statistic underscores the significant presence and influence of North America in the realm of hygiene products.

Meanwhile, the European Non-Woven Air Laid Products for Hygiene market boasted an estimated valuation of 440.3 USD Million in the year 2018. Furthermore, it is anticipated to exhibit a steady expansion at a Compound Annual Growth Rate (CAGR) of 6.55% over the forthcoming forecast period. This growth trajectory emphasizes the resilience and potential for market expansion within the European landscape. Europe comprises the United Kingdom, Germany, France, Italy, and the Rest of Europe, each of which brings its own set of characteristics and demands to the table. These nations collectively shape the European hygiene product market.

Moving towards the dynamic Asia-Pacific region, it encompasses economic powerhouses like India, China, Japan, South Korea, and the Rest of Asia-Pacific. Each of these countries plays a pivotal role in influencing the demand and supply of Non-Woven Air Laid Products for Hygiene, making it a region of immense importance and growth potential.

COMPETITIVE PLAYERS

In the competitive landscape of the Non Woven Air Laid Products for Hygiene industry, a roster of formidable players emerges, each making a distinct mark in various regions across the globe. Airlaid A/S, Bandz, Inc., Convermat Corp., Domtar Corporation, Fibematics Inc., Fitesa S.A., Glatfelter Corporation, KARA FİBER, Kinsei Seishi Co., Ltd., M&J Airlaid Products A/S, MAGIC Spa, MAIN s.p.a. P.I., McAirlaid's Vliesstoffe GmbH, NAPAL, National Nonwovens, Phoenix Fabrikations bv, Sellars Nonwovens, Inc., Sharpcell, Roihu Inc., Technical Absorbents Ltd., and TWE GmbH & Co. KG constitute the array of key players steering this thriving industry.

These industry leaders bring their expertise and innovation to different regions, shaping the dynamics of the market with their unique product offerings and strategies. From North America, where companies like Domtar Corporation and National Nonwovens make their mark, to Europe, where players like Airlaid A/S and TWE GmbH & Co. KG showcase their prowess, each region experiences the influence of these prominent entities. In Asia-Pacific, the likes of Fitesa S.A. and Kinsei Seishi Co., Ltd. cater to the burgeoning demand for hygiene products. South America benefits from the presence of companies such as Phoenix Fabrikations bv and Roihu Inc., while the Middle East & Africa region observes the impact of players like Sharpcell and Technical Absorbents Ltd.

Non Woven Air Laid Products for Hygiene Market Key Segments:

By Product Type

- Non-Woven Air Laid Topsheets

- Non-Woven Air Laid Acquisition/Distribution Layers

- Non-Woven Air Laid Cores

- Non-Woven Air Laid Backsheets

- Others

By Thickness

- Less than 1 mm

- 1 mm to 2 mm

- More than 2 mm

By Application

- Feminine Hygiene Products

- Adult Incontinence Products

- Baby Diapers

- Personal Care Products

- Others

By Feminine Hygiene Products

- Sanitary Napkins

- Panty Liners

- Tampons

Key Global Non Woven Air Laid Products for Hygiene Industry Players

- Airlaid A/S

- Bandz, Inc.

- Convermat Corp.

- Domtar Corporation

- Fibematics Inc.

- Fitesa S.A.

- Glatfelter Corporation

- KARA FİBER

- Kinsei Seishi Co., Ltd.

- M&J Airlaid Products A/S

- MAGIC Spa

- MAIN s.p.a. P.I.

- McAirlaid's Vliesstoffe GmbH

- NAPAL

- National Nonwovens

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252