MARKET OVERVIEW

The market for the Netherlands Surgical Sutures plays an important role in the structure of health care, showing progress and increases in the number of surgical operations within the country. As one of the key parts of the Dutch healthcare sector, this market is foreseen to take shape from technological innovation and changing population needs.

Surgical sutures play an indispensable role in almost all kinds of surgery-from normal to complicated ones-in the Netherlands. The market meant for such sutures includes a variety to address different surgical needs and patients’ requirements, such as absorbable and non-absorbable sutures, each serving distinct purposes depending on the type of surgery and the healing requirement of the tissue involved. It is also clear that Dutch medical professionals have a penchant for certain suture types depending on the general surgery methods followed in the country and research into better material providing positive patient outcomes.

Overall, this trend is likely to get a fillip with strong healthcare infrastructure in the Netherlands and focus on offering high-class medical care. Dutch hospitals and clinics claim to be very much in the lead in implementing recent advances in medical technologies, including state-of-the-art suturing techniques that ensure surgical outcomes are optimized to minimize complications and reduce recovery times. The continuous investment in health facilities across the nation will likely keep demand for surgical sutures supported due to more surgical procedures conducted to help address population health needs.

The market for Surgical Sutures in the Netherlands will continue to mirror overall trends in the world health market. The sophistication of surgical practices, for example, will further necessitate the use of sutures capable of delivering enhanced performance with respect to strength, absorption rates, or reduction in the risk of infection. This is likely driven by manufacturing strategies attuned to meet the expanding needs of healthcare providers in the Netherlands.

Another important segment of the market for Surgical Sutures in the Netherlands is the regulatory landscape. The Dutch government requires, along with other European authorities, strict standards for all medical devices, including surgical sutures. Such regulation ensures that all products reaching the market can guarantee nothing but the highest degree of safety and effectiveness. Such is the case that the manufacturers have to take serious testing and quality control measures, adding to the overall reliability of the surgical sutures in use within the Netherlands. This framework will continue to be a key driver of the landscape, as changes or updates will result in how developers create and market their products.

The market for surgical sutures in the Netherlands will also change in the future with the advancement of newer techniques in surgery and changes in health needs. For example, advancement in the field of minimally invasive surgery will see sutures being made solely for such techniques. Moreover, due to the aging of the Dutch population, there might arise a particular demand for certain kinds of surgeries that would call for high-class suturing products, thereby affecting the market as well.

The surgical sutures market in the Netherlands therefore continues to form an integral component of the national health system, with a principal representation not only of the status quo but also of the spectrum of future improvements. Emphasizing high-value care, innovation, and strict standards of regulation, this market is going to be in continuous evolution in line with the changing needs of healthcare providers and patients alike.

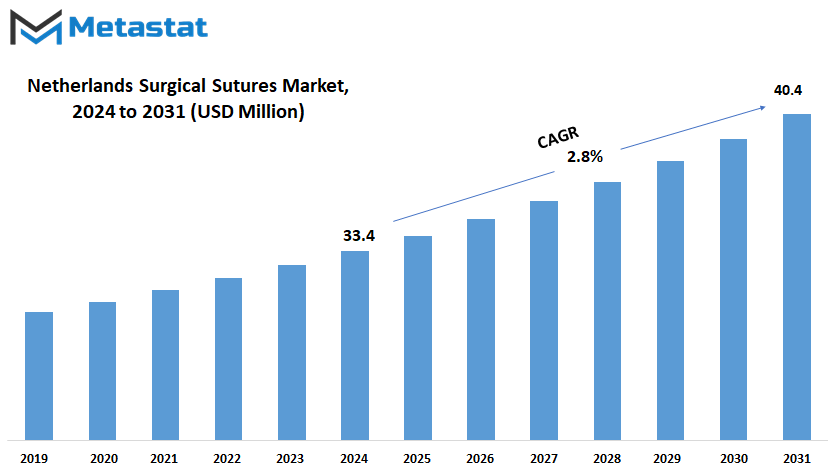

Netherlands Surgical Sutures market is estimated to reach $40.4 Million by 2031; growing at a CAGR of 2.8% from 2024 to 2031.

GROWTH FACTORS

The Netherlands Surgical Sutures market is at an edge where growth is going to be very high, driven by a number of pivotal factors that promise to shape its future. The main growth drivers are the growing demand for advanced surgical procedures, which become more frequent with improved medical technology. As innovations in surgical techniques are being taken up with greater frequency by hospitals and clinics, there is a corresponding increase in demand for quality sutures so as to ensure effective healing with minimal complications. This demand for precision in surgical care is one of the main factors that will drive the market forward.

Another key factor driving the growth of the market is the fact that suture technology has continued to evolve. Both in substance and design, improvements ensure sutures offer durability, good biocompatibility, and performance. Such innovations improve the results of surgeries and, hence, faster recovery, which drives the growth of the market. Besides, an increasing awareness of less invasive procedures brings an increasing demand for sutures that can meet such applications. As less invasive methods continue to be emphasized within the medical community, the need for these specialized sutures has likewise increased.

However, alongside these positive drivers, there are also a few challenges that may potentially hold back the advance of the surgical sutures market in the Netherlands. One of them is the high cost related to the advanced type of surgical sutures. On one hand, their superior performance is really indispensable, and on the other hand, there is some cost barrier to their adoption for some healthcare providers. Among other concerns, there are highly stringent regulatory requirements in place for medical devices in the Netherlands, which may hamper the approval and launch of new suture products into the country's healthcare marketplace and further impede market growth.

On the other hand, opportunities might exist which could favor the market during the forecast period. Growing focus on ensuring patient safety, and thereby promoting better outcomes from surgical procedures, is likely to boost investment in novel suture technologies. Moreover, an increase in the elderly population, which needs more surgeries, will continue to raise demand for effective sutures. The healthcare industry is growing and developing, and these factors will lead to new opportunities for the market.

The growth of the market for Netherlands Surgical Sutures will be immense based on improved surgical techniques and technologies of sutures. While there are some drawbacks, such as high costs and some regulatory challenges, opportunities from an aging population and growing concern for patient safety could result in huge possibilities for market growth.

MARKET SEGMENTATION

By Product Type

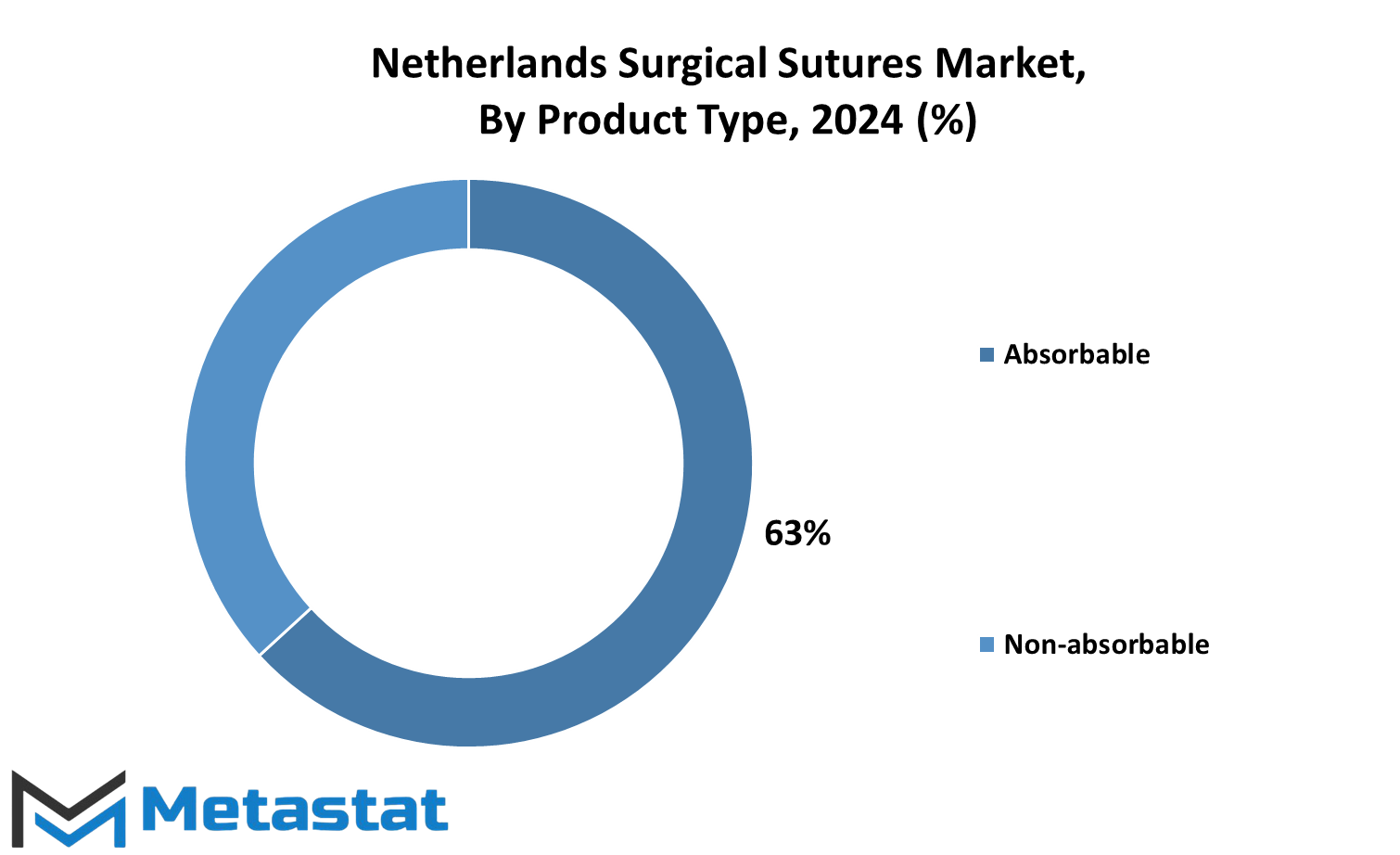

The future of the surgical sutures market in the Netherlands is very promising, reflecting wider trends and innovations in health. It is a very important market in wound closure and also in tissue repair, influenced by the varied requirements from surgical procedures and developments in suture technologies. For the purpose of this attempt at understanding the future of the market, its current segmentation rests on two product types: absorbable and non-absorbable sutures.

Absorbable sutures are normally manufactured in such a way that they get degraded naturally in the body itself within a certain period of time. These sutures are used for major internal tissues or sometimes in places where it would be very cumbersome to remove. In such cases, there is no need for another surgery to remove them, making it quite hassle-free for both the patient and the health care provider. Advancements in the field of material science continue to raise the performance of absorbable sutures, making them more reliable and effective in a growing variety of surgical applications. The segment is expected to be driven by new biocompatible material development and enhanced manufacturing techniques. Nonabsorbable sutures, on their part, are used for tissues that are external or when support for longer periods is required.

The catch here is that these sutures need to be removed after some time, but the strength and durability they confer make them suitable for high-tension areas. Most innovations in this area normally target flexibility, infection resistance, and easy handling of sutures during surgery. Since nonabsorbable sutures are critically needed in surgeries, demand is always on the rise. In the near future, continued developments in absorbable and non-absorbable suture materials will continue to drive the surgical sutures market in the Netherlands. Other factors that will help to drive the market include a growing interest in minimally invasive procedures and a growth in the number of elderly people, who are more likely to undergo surgery. Other factors likely to drive the market include growth in healthcare expenditure and a trend toward cost-effective and efficient surgical treatments.

By Type

The Surgical Sutures market is one such notable change that has been taking place due to advances in medical technology and the changing face of healthcare in the Netherlands. Sutures may, broadly, be classified according to the type of suture material into two categories: Monofilament Sutures and Multifilament Sutures.

Monofilament sutures are manufactured as a single strand of material and have obvious advantages regarding smooth passage through tissues. These sutures are less likely to house bacteria and, hence, reduce chances of infections. They are suitable, therefore, for sterile environments. Their smoothness and single-strand nature mean minimum tissue drag and inflammation, which is important for healing. As technology advances, sutures will continue to be fine-tuned, with innovations focusing on enhancing their biocompatibility and durability. This progress is likely to lead to better outcomes for the patient and will facilitate further entry into the use of monofilament sutures in a wide range of surgical procedures.

On the contrary, Multifilament Sutures consist of multiple interwoven strands and are stronger and more resilient. The braided configuration presents this type of suture with better tensile strength, which is ideal for applications requiring heavy and tight approximation of tissues. They also have larger surface areas, perhaps providing an advantage in the security of knots and in holding tissues together more firmly. However, their complexities mean they might carry a higher risk of infection if not applied appropriately. Future developments are likely to be focused on reducing this risk while preserving the strength and flexibility of the suture. Further innovations in materials and the manufacturing process would more than likely raise the performance level of multifilament sutures, enabling their further versatility and efficiency within a wide range of surgical applications.

That is to say, the prospects for growth and innovation in the Netherlands Surgical Sutures market can be envisioned. The formulation of Monofilament and Multifilament Sutures, taken together, will bring a sea change in this industry, and the future innovations after that promise better performance and safety. As the technology would further advance, the market is likely to re-strategize itself to suit the needs of the healthcare industry towards better and effective surgical operations.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$33.4 million |

|

Market Size by 2031 |

$40.4 Million |

|

Growth Rate from 2024 to 2031 |

6.5% |

|

Base Year |

2022 |

COMPETITIVE PLAYERS

The market of Surgical Sutures in the Netherlands is at a point where it is taking a new turn due to the main actors that play a role in shaping the future. Companies such as Ethicon, part of Johnson & Johnson, Medtronic, and BBraun maintain leading positions that make them driving forces in innovation and competition as industries continue to grow and find their way in answering new demands.

Ethicon, a Johnson & Johnson company, is well-recognized for its broad line of surgical sutures and commitment to leading medical technology. For over a century, Ethicon has been in the vanguard of this industry because of its commitment to developing fine quality sutures that answer the varying needs of surgery. It is a firm that strongly believes in research and development; it keeps on updating its products for better results for the patients and to enhance efficiency in surgery.

Other leading participants in the market include Medtronic, known for a variety of medical products, including surgical sutures. Innovation-oriented, Medtronic invests extensively in state-of-the-art technologies designed to offer solutions to both simple and complex surgical needs. With an influential focus on technological advancement, the company sustains business competitiveness and meets the dynamic needs of the health sector.

While being one of the leaders in the medical device market, the BBraun Company contributes much to the field of surgical sutures. Products offered by this company are meant to guarantee reliability and precision throughout the operation process. Given the quality and novelty of its products, BBraun holds a competitive position and addresses all the market needs quite successfully.

The market for surgical sutures is expected to have further growth in the near future and undergo transformation in the Netherlands. It is expected that these major companies will further develop the technology of sutures in the future. Their continuous support for innovation ensures further development in suture technology within the country.

Major companies in the market of the Netherlands Surgical Sutures include Ethicon, Medtronic, and BBraun. These leading industries are not only holding on to their prominent market positions but also leading the path to future discoveries. Their contribution toward research, development, and advancement in technology will remain significant in the growth and development of this market.

Netherlands Surgical Sutures Market Key Segments:

By Product Type

- Absorbable

- Non-absorbable

By Type

- Monofilament Sutures

- Multifilament Sutures

Key Netherlands Surgical Sutures Industry Players

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252