Global Neonatal Hearing Screening Devices Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

How will improvements in early-detection technologies reshape the future of new childcare, and what new opportunities may end up screening becomes extra handy worldwide? As hospitals undertake smarter diagnostic gear, what challenges could get up in balancing innovation with affordability and equitable get right of entry to for infants across unique regions? With developing awareness around youth listening to health, how might converting healthcare rules and technological shifts influence the pace at which neonatal screening practices evolve globally?

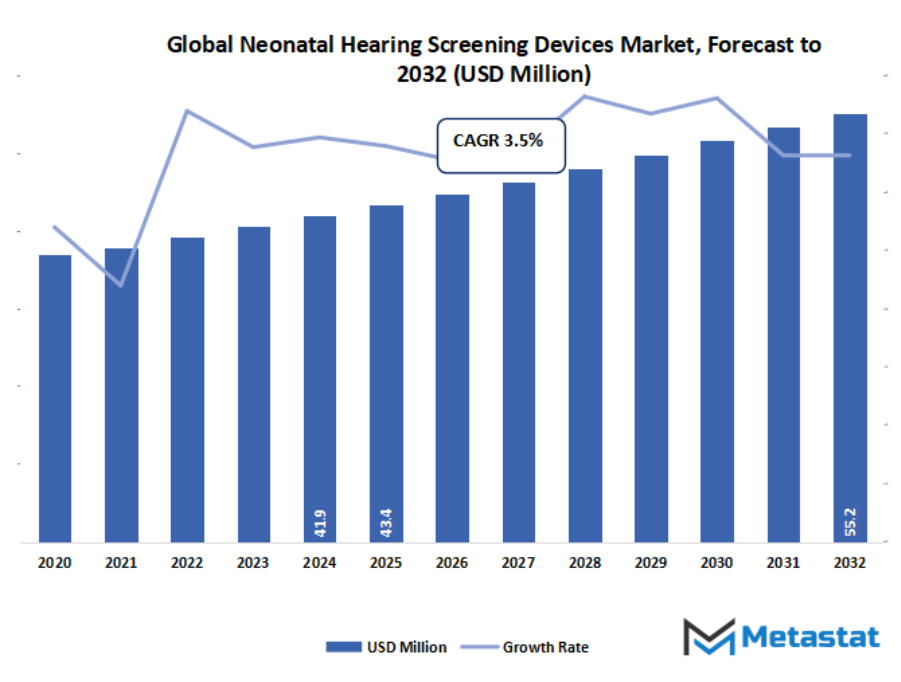

- The global neonatal hearing screening devices market valued at approximately USD 43.4 million in 2025, growing at a CAGR of around 3.5% through 2032, with potential to exceed USD 55.2 million.

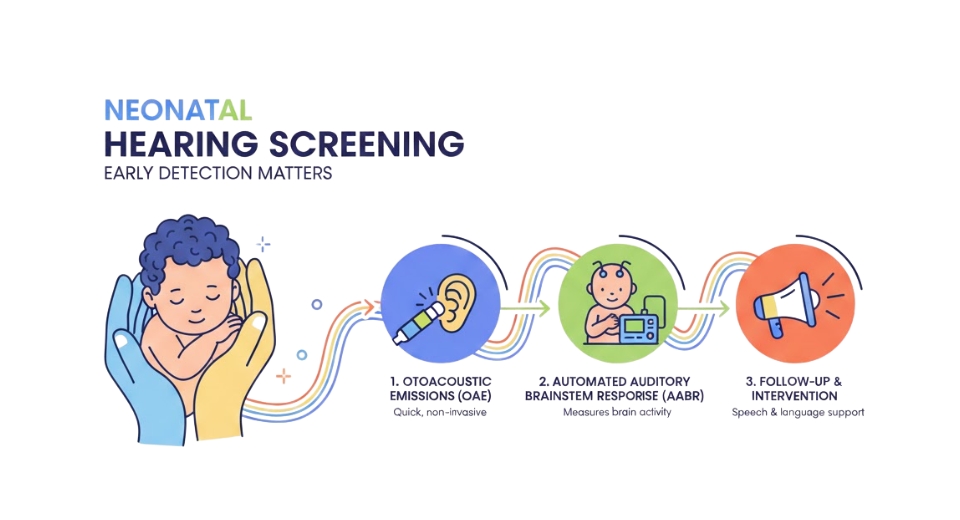

- Auditory Brainstem Response (ABR) Systems account for nearly 48.7% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Mandatory newborn hearing screening programs in many countries., Growing awareness of early intervention benefits for language development.

- Opportunities include Development of faster, more accurate, and lower-cost screening solutions.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The global neonatal hearing screening devices market will hold to form the wider clinical tool enterprise, informing how early-lifestyles diagnostics are understood, adopted, and advanced. This market will push conversations past the ordinary test-americaand in the direction of growing surroundings where hearing assessment becomes a herbal extension of newborn wellbeing, as hospitals and clinics prepare for the next wave of neonatal care standards. In the approaching years, it's going to also no longer be limited to product distribution but will steer how healthcare structures imagine long-time period developmental monitoring for infants.

Looking in advance, the call for for smoother and more reliable methods of screening will lead engineers, practitioners, and policymakers to reconsider how era interacts each with mother and father and medical personnel. The marketplace will inspire builders to layout gadgets that work quietly, deliver quicker results, and fit easily into busy maternity gadgets. This trade will not handiest beautify workflow in hospitals however may even in the end inspire a new way of life of confidence amongst families who will anticipate clean verbal exchange and early steerage as a part of their child's first scientific stories.

Geographic Dynamics

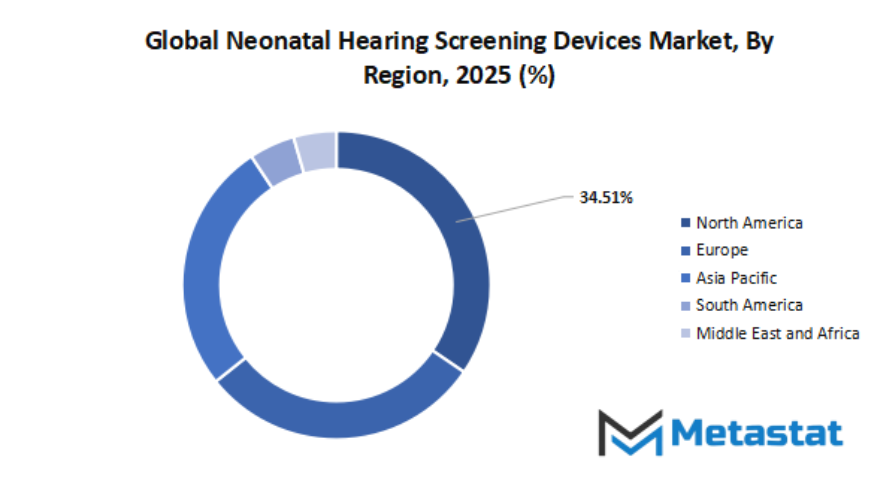

Based on geography, the global neonatal hearing screening devices market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Market Segmentation Analysis

The global neonatal hearing screening devices market is mainly classified based on Product Type, Modality, End User.

By Product Type is further segmented into:

- Auditory Brainstem Response (ABR) Systems

Adoption of ABR systems will continue to increase in the future as health settings look toward acquiring more reliable signals and accelerating testing processes for hearing checks among newborns. Improved accuracy, noise control, and better integration with digital patient records are prompting wider usage across advanced and developing regions to support the early recognition of hearing problems in newborns.

- Otoacoustic Emission (OAE) Systems

Future OAE system development will refine sound output, stabilize performance, and reduce handling effort in screening sessions. This will be possible with lightweight structures and enhancement in signal filters that shall help medical teams handle larger volumes of screening to aid early-stage detection programs in both high-resource and low-resource healthcare environments.

- Combination Systems

Combination systems will receive stronger attention due to the need for dual-method testing strategies in newborn care units. Unified testing platforms will offer faster assessments, lower device movement, and better coordination of screening data; this will help facilities introduce broader programs that support more accurate early hearing evaluations.

By Modality the market is divided into:

- Table Top Devices

Tabletop units will continue providing service for structured newborn screening areas where steady surfaces and controlled spaces are still crucial. Improved processing boards, clearer interfaces, and dependable calibration tools will be important in helping care teams maintain consistent test outcomes while supporting extensive screening operations within organized clinical departments.

- Trolley Mounted Devices

Trolley-mounted systems will facilitate flexible screening across multiple sections of a medical facility. Stronger wheels, lighter frames, and improved battery backup solutions will help the clinical team move devices smoothly between newborn wards to assist in higher workflow efficiency and timely hearing evaluations during routine care.

- Portable and Hand-held Devices

Portable and hand-held screening tools will get wider preference because of increasing demand for fast mobility, outreach programs, and community-level newborn checks. Compact structures, quick-start operations, and stable sensor performance will allow broader access to hearing evaluations beyond large hospital units, thereby supporting national screening efforts.

By End User the market is further divided into:

- Hospitals

Large-scale newborn screening will continue to be driven by hospital units, owing to strong patient flow, wide device networks, and large diagnostic teams. Advanced connectivity tools, smooth data handling, and stronger training support will enable hospitals to manage faster screening cycles and ensure earlier decision-making during neonatal care.

- Specialty Clinics

Specialty clinics will adopt refined screening platforms that allow for focused newborn hearing assessments. Enhanced diagnostic clarity, compact device setups, and features for quicker interpretation will assist the clinical teams in delivering focused assessments to the families seeking structured follow-up appointments and early hearing guidance.

- Others

Other end-user groups, including community health centers and outreach units, will further increase the reach of newborn screening with portable systems and ease-of-use features that simplify handling. Greater coverage, easy-to-use workflows, and closer collaboration with hospitals will contribute to the success of early hearing programs in different regions and within different medical infrastructures.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$43.4 Million |

|

Market Size by 2032 |

$55.2 Million |

|

Growth Rate from 2025 to 2032 |

3.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Competitive Landscape & Strategic Insights

The global neonatal hearing screening devices market will keep on growing around a mix of long-established international manufacturers and newer regional companies steadily setting their place in the industry. This need for early stage detection of hearing issues has pushed hospitals and clinics to rely on technology that is accurate, safe, and easy to use. As the demand widens, companies in different stages of maturity are finding their opportunities to bring in their respective strengths into the market. While some focus on long-term research and advanced testing systems, others aim to offer cost-effective tools that will support facilities with limited resources.

The more well-known names include Natus Medical, Hill-Rom, MAICO Diagnostics, Interacoustics A/S, Path Medical, Intelligent Hearing Systems, and Vivosonic. For firms dealing in newborn care, these names have gained a level of trust over the years with their range of dependable devices. Experience stands to their advantage in fine-tuning the screening methods for better sound detection, much faster test results, and safer ways of monitoring the infants. Alongside them, firms like Grason-Stadler, Pilot Blankenfelde, Frye Electronics, Echodia, and Homoth Medizinelektronik give depth to the market with their set of technologies that help healthcare workers identify hearing issues at the very first stage of a child's life.

With more regions improving their health care services, smaller and emerging competitors step in with devices tailored to meet local needs. These may not have the breadth of reach, but for neonatal testing, they offer new ideas and practical solutions. Their presence will give hospitals and clinics a range of choices at various price levels, thereby easing the route toward adoption of newborn screening programs. This mix of established and rising players will support ongoing improvements in device design, from better comfort for newborns to more user-friendly systems for medical staff.

The balance between lengthy-depended on worldwide manufacturers and ambitious local agencies will shape how the market movements forward. Each of them brings something extraordinary to the table, whether or not it's miles superior generation, wider distribution, or low-priced answers for developing healthcare systems. Together, they will drive the enterprise in the direction of extra accurate trying out strategies and better screening prices to make sure that extra newborns get the vital early assist.

Because of this joint effort, the global neonatal hearing screening devices market will see further expansion in a manner to continue supporting innovation and accessibility. As new technologies enter the space, and healthcare standards continue to rise across regions, the industry will answer with tools that help every child get the earliest chance at proper hearing care.

Market Risks & Opportunities

Restraints & Challenges

High fees of fake-positives causing tension to parents and comply with-up prices

High fake-nice readings in the global neonatal hearing screening devices market will continue to area stress on households who must return for confirmatory trying out, frequently at unexpected expense. These effects additionally place delivered stress on hospitals, which have to control repeated visits. As such, developers of destiny systems should look to refine sign clarity and decrease needless referrals.

Limited access and resources in low-profits regions and rural areas

The limited testing infrastructure within the global neonatal hearing screening devices market will limit the fee of adoption in the ones regions wherein both the team of workers, reliable electricity deliver, or protection finances are not available in the hospitals. Future upgrades ought to be towards easy operability, sturdy production, and wider dissemination to make certain that even useful resource-negative facilities are capable of offer reliable screening for newborns.

Opportunities

Development of faster, more correct, and lower-value screening answers

Growing innovation within the global neonatal hearing screening devices market will open paths for up to date equipment that shorten testing time even as enhancing sound detection accuracy. Lower manufacturing charges will assist hospitals undertake these systems extra easily, making new child screening greater regular global and allowing fitness applications to attain babies who currently leave out early evaluation.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 43.4 million in 2025 to over USD 55.2 million by 2032. Neonatal Hearing Screening Devices will maintain dominance but face growing competition from emerging formats.

The increase of the global neonatal hearing screening devices market past its cutting-edge limitations will engender discussions about accessibility and consistency in new child care. Countries nevertheless constructing strong maternal fitness packages are probably to take cues from regions where neonatal screening has come to be a common practice. This will influence patterns of training, procurement decisions, and the expectations of public health. Ultimately, the market will move beyond supplying devices into shaping how societies imagine early intervention.

Its future direction will encourage a world where the identification of hearing challenges at birth becomes a natural promise in healthcare: that every child starts life with support systems both attentive and forward-looking.

Report Coverage

This research report categorizes the global neonatal hearing screening devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global neonatal hearing screening devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global neonatal hearing screening devices market.

Neonatal Hearing Screening Devices Market Key Segments:

By Product Type

- Auditory Brainstem Response (ABR) Systems

- Otoacoustic Emission (OAE) Systems

- Combination Systems

By Modality

- Table Top Devices

- Trolley Mounted Devices

- Portable and Hand-held Devices

By End User

- Hospitals

- Specialty Clinics

- Others

Key Global Neonatal Hearing Screening Devices Industry Players

- Natus Medical

- Hill-Rom

- MAICO Diagnostics

- Interacoustics A/S

- Path Medical

- Intelligent Hearing Systems

- Vivosonic

- Grason-Stadler

- Pilot Blankenfelde

- Frye Electronics

- Echodia

- Homoth Medizinelektronik

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252