Global Electrophysiology Devices Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

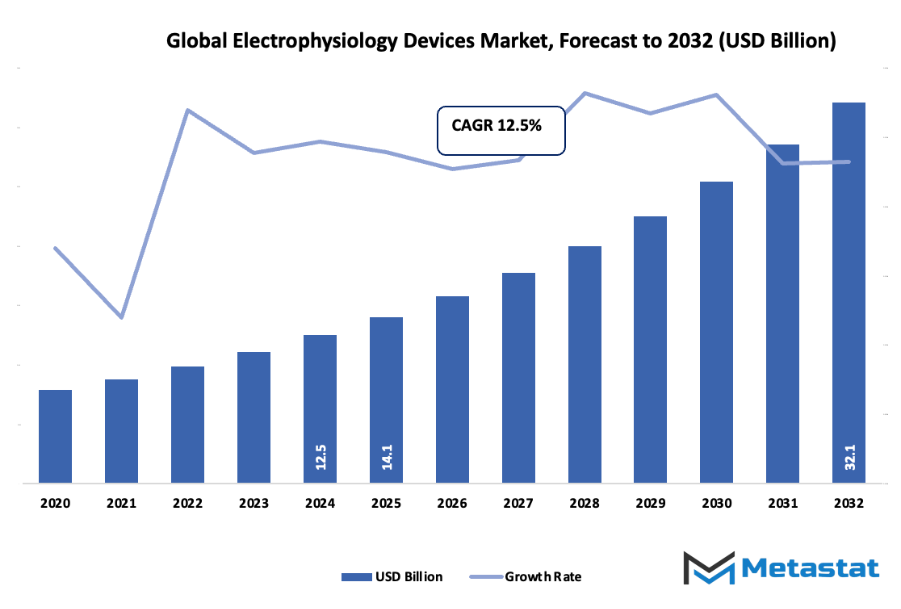

- The global electrophysiology devices market valued at approximately USD 14.1 billion in 2025, growing at a CAGR of around 12.5% through 2032, with potential to exceed USD 32.1 billion.

- Diagnostic EP Catheters account for a market share of 17.7% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising prevalence of atrial fibrillation and other arrhythmias., Growing adoption of minimally invasive electrophysiology procedures.

- Opportunities include: Increasing use of robotic navigation and real-time imaging in EP labs.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global electrophysiology devices market along with the industry itself was the product of the amalgamation of cardiology, biomedical engineering, and the growing demand to comprehend electrical disorders of the heart all of which existed long before the present-day systems. The saga began in the early 1900s when scientists managed to record electrical signals coming from the heart through the use of very large devices which barely revealed anything. However, the major turning point was in the 1970s when it became possible to locate the sources of arrhythmias in the heart with the help of catheter-based recording methods instead of only using surface electrocardiograms. This move triggered the creation of the first commercial market for tools that in time would turn into contemporary diagnostic and ablation platforms.

The latter part of the 1990s saw the refinement of catheter materials, signal processors, and low-radiation imaging that brought about a total clinician's expectation of the readings to be very fast and precise. The electrophysiology units in hospitals became larger and the manufacturers of the industry reacted to this situation by launching multi-electrode systems that were capable of gathering much data (up to thousands) in one single session. In the 2000s, even stronger the demand for high precision overshadowed the already strict regulations for device energy delivery, sterility and patient safety in both North America and Europe. These changes set off a chain of catheter redesigns, insulation improvements and software-driven mapping which would eventually allow real-time visualization to be a reality.

The present scenario is the result of many years of development where patient demand for safer and basically shorter cardiac procedures played a crucial role. One of the main resources of the global data on the subject, the World Health Organization, published a report stating that more than 37 billion people around the planet have atrial fibrillation, a disease that frequently calls for electrophysiology treatments, and hospital records.

As the industry moves forward, artificial intelligence, radiation-free mapping, and expanded digital interoperability will shape how future devices are designed and adopted. Regulatory agencies will introduce updated protocols for data security and cross-platform compatibility as hospitals integrate cloud-based records with electrophysiology equipment. The market will continue to trace its path from experimental electrical recordings to an advanced clinical field built on decades of scientific milestones, shifting medical needs, and technology that will keep evolving alongside global cardiovascular care.

Market Segmentation Analysis

The global electrophysiology devices market is mainly classified based on Product, Application, End User.

By Product is further segmented into:

- Diagnostic EP Catheters:

Focus on mapping tools within the global electrophysiology devices market supports careful assessment of cardiac signals for improved treatment planning. Steady demand reflects growing preference for early rhythm assessment, allowing healthcare facilities to build structured workflows that support accurate evaluation and smoother guidance during therapeutic procedures without adding strain to clinical resources. - Ablation Catheters:

Ablation-focused devices offer targeted energy delivery that supports rhythm correction with greater precision. Rising adoption highlights strong confidence in minimally invasive methods, allowing medical teams to address abnormal pathways while maintaining consistent performance standards. Steady development encourages broader access to dependable treatment options across diverse care environments focused on controlled cardiac intervention. - EP Laboratory Capital Equipment:

Laboratory systems used during electrical rhythm assessment offer stable platforms that support imaging, monitoring, and mapping functions. Reliable hardware encourages smooth coordination within clinical environments and reinforces efficient communication between various diagnostic components, creating well-supported procedures that maintain consistent accuracy during routine or complex cardiac evaluations. - Implantable Electrophysiology Devices:

Implantable solutions provide sustained monitoring and correction of irregular rhythms, offering long-term rhythm stability for individuals requiring continuous oversight. Robust design features allow consistent data collection and timely corrective action, supporting healthcare facilities seeking dependable options for chronic rhythm management across varied clinical situations requiring durable and responsive device performance.

By Application the market is divided into:

- Atrial Fibrillation:

Atrial fibrillation treatment within this sector emphasizes steady rhythm stabilization through accurate mapping and guided energy delivery. Increased focus on early detection encourages broader use of devices that support controlled intervention, giving medical environments structured tools that help limit symptom progression and reduce the likelihood of repeated clinical episodes. - Atrial Flutter:

Atrial flutter management relies on tools that assist in identifying circular electrical activity and applying targeted correction. Consistent device accuracy allows medical facilities to address rhythm disturbances efficiently, supporting smoother procedures that limit unnecessary delays while offering dependable guidance for restoring stable cardiac patterns across varied patient groups. - Atrioventricular Nodal Re-entrant Tachycardia (AVNRT):

AVNRT procedures benefit from mapping tools that highlight nodal pathways responsible for rapid heart rates. Focused ablation helps remove problematic circuits with high precision, supporting dependable outcomes that strengthen confidence in minimally invasive approaches designed to reduce recurrent episodes and encourage stable rhythm patterns within everyday clinical practice. - Wolff-Parkinson-White (WPW) Syndrome:

Management of WPW Syndrome depends on tools that locate accessory pathways contributing to rapid conduction. Targeted therapy supports safe pathway interruption, allowing cardiac teams to restore orderly electrical flow. Clear visualization and controlled energy delivery enable dependable outcomes that reduce episode frequency while maintaining smooth procedural coordination. - Ventricular Tachycardia:

Ventricular tachycardia treatment requires devices that support careful mapping of lower-chamber electrical activity. Advanced tools help isolate disruptive zones responsible for rapid rhythms, enabling structured intervention that promotes consistent stabilization. Dependable device performance is essential for addressing complex cases requiring detailed evaluation and controlled corrective action. - Other Arrhythmias:

Additional rhythm disturbances benefit from devices that offer adaptable mapping and treatment support. Flexible designs allow smooth adjustments during varied procedures, giving medical environments reliable options for identifying and correcting electrical disruptions. Broad applicability ensures steady demand for tools that maintain accuracy across multiple rhythm-related conditions.

By End User the market is further divided into:

- Hospitals:

Hospitals remain central users of electrophysiology systems, using advanced equipment to support diagnostic and therapeutic procedures. Comprehensive infrastructure allows seamless integration of mapping and ablation tools, helping facilities deliver consistent outcomes through structured workflows that promote safe, efficient, and accurate cardiac rhythm management. - Ambulatory Surgical Centers:

Ambulatory centers use compact and efficient electrophysiology tools to support same-day procedures focused on rhythm correction. Streamlined setups enhance workflow speed while maintaining procedural accuracy, giving facilities flexible options that reduce patient wait times and encourage wider access to minimally invasive cardiac care solutions. - Cardiac Electrophysiology Labs:

Specialized labs rely on dedicated systems designed for high-precision rhythm evaluation. Advanced mapping platforms, recording tools, and ablation equipment support structured procedures that promote consistent performance. Focus on accuracy ensures reliable identification of electrical disturbances and controlled application of corrective therapy within focused cardiac environments. - Academic & Research Institutes:

Research institutions use electrophysiology tools to study rhythm disorders and evaluate emerging technologies. Access to advanced equipment supports continuous development of improved methods, helping research teams generate valuable clinical insights that contribute to stronger treatment strategies and more informed device innovation across the wider cardiac care landscape.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$14.1 Billion |

|

Market Size by 2032 |

$32.1 Billion |

|

Growth Rate from 2025 to 2032 |

12.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

- Based on geography, the global electrophysiology devices market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

Rising prevalence of atrial fibrillation and other arrhythmias:

Growing incidence of atrial fibrillation and related arrhythmias continues to create stronger demand across the global electrophysiology devices market. Rising cases encourage wider use of diagnostic and therapeutic systems, supporting improved patient management. Medical facilities respond by expanding EP services, leading to steady uptake of advanced solutions and broader clinical acceptance.

Growing adoption of minimally invasive electrophysiology procedures:

Minimally invasive EP procedures attract broader medical and patient support due to reduced recovery time, lower procedural discomfort, and improved treatment efficiency. Hospitals invest in modern tools to enhance accuracy and safety. Broader acceptance encourages more facilities to upgrade EP capabilities, supporting sustained momentum and promoting faster integration of new technology.

Restraints & Challenges:

High cost of ablation devices and procedural setup:

Ablation systems and related setup generate substantial financial burden for hospitals, especially centers with limited budgets. Expensive equipment slows purchasing decisions and restricts broader access. Many facilities prioritize essential services, leading to slower adoption of newer EP technology. Cost challenges limit overall penetration and create significant pressure on healthcare expenditure planning.

Regulatory challenges and device recalls affecting manufacturer reputation:

Regulatory reviews, compliance demands, and occasional recalls create uncertainty for manufacturers and healthcare providers. Any safety concern can reduce confidence in available devices, extending evaluation timelines for new products. Market stability becomes harder to maintain when scrutiny increases, creating hesitation among hospitals regarding long-term purchases and supplier reliability.

Opportunities:

Increasing use of robotic navigation and real-time imaging in EP labs:

Robotic navigation and real-time imaging support more precise mapping, enhanced procedural safety, and better workflow management inside EP laboratories. Growing interest encourages hospitals to modernize treatment environments. Expanded use of advanced visualization and robotic assistance strengthens accuracy, promotes efficient interventions, and opens promising pathways for future technological improvement.

Competitive Landscape & Strategic Insights

The competitive landscape within the global electrophysiology devices market shows steady activity driven by long-established manufacturers and newer regional groups working toward wider recognition. Strong participation from major companies such as Abbott Laboratories, Johnson & Johnson, Medtronic plc, Boston Scientific Corporation, Biotronik SE & Co KG, MicroPort Scientific Corporation, Acutus Medical, Stereotaxis Inc, Koninklijke Philips NV, Siemens Healthineers, GE HealthCare, Lepu Medical, CathVision ApS, Kardium Inc, CoreMap, Oscor Inc, Imricor Medical Systems, Adagio Medical, JenaValve Technology, and Vektor Medical shapes overall movement within this field. Each organization brings a different background, production strength, and research plan, creating steady competition that encourages constant improvement in device accuracy, safety, and ease of use.

Growing demand for better diagnosis and treatment of heart rhythm disorders continues to guide decisions made by these groups. More hospitals and care centers seek dependable and advanced tools, encouraging manufacturers to focus on steady quality, dependable performance, and strong service support. Larger international companies often hold a wider distribution network and greater funding for research, allowing faster development of updated systems. At the same time, smaller regional competitors frequently work on focused designs that respond to local needs, creating fresh options for clinics seeking cost-effective solutions.

Partnerships with medical centers, investment in updated testing systems, and expansion into new geographical areas continue to shape future plans. Many manufacturers choose to place strong attention on training programs for medical teams, helping build trust and stronger long-term relationships with hospitals. Shifts in regulations and approval processes also influence decisions across the market, encouraging companies to maintain consistent quality standards.

Overall market activity reflects steady growth supported by advancing technology and rising awareness of heart rhythm care. Continued progress from established leaders and energetic regional groups ensures a steady stream of new ideas, shaping future development and maintaining strong competition throughout the global electrophysiology devices market.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 14.1 billion in 2025 to over USD 32.1 billion by 2032. Electrophysiology Devices will maintain dominance but face growing competition from emerging formats.

Report Coverage

This research report categorizes the global electrophysiology devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global electrophysiology devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global electrophysiology devices market.

Electrophysiology Devices Market Key Segments:

By Product

- Diagnostic EP Catheters

- Ablation Catheters

- EP Laboratory Capital Equipment

- Implantable Electrophysiology Devices

By Application

- Atrial Fibrillation

- Atrial Flutter

- Atrioventricular Nodal Re-entrant Tachycardia (AVNRT)

- Wolff-Parkinson-White (WPW) Syndrome

- Ventricular Tachycardia

- Other Arrhythmias

By End User

- Hospitals

- Ambulatory Surgical Centers

- Cardiac Electrophysiology Labs

- Academic & Research Institutes

Key Global Electrophysiology Devices Industry Players

- Abbott Laboratories

- Johnson & Johnson

- Medtronic plc

- Boston Scientific Corporation

- Biotronik SE & Co KG

- MicroPort Scientific Corporation

- Acutus Medical

- Stereotaxis Inc

- Koninklijke Philips NV

- Siemens Healthineers

- GE HealthCare

- Lepu Medical

- CathVision ApS

- Kardium Inc

- CoreMap

- Oscor Inc

- Imricor Medical Systems

- Adagio Medical

- JenaValve Technology

- Vektor Medical

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252