MARKET OVERVIEW

The Global Monolithic Microwave IC market and its industry are important towards the advancement of such acts as wireless communication, radar systems, and satellite technologies. Monolithic Microwave Integrated Circuits meaning MMICs, are semiconductor devices that operate at microwave frequencies-normally from about 300 MHz to about 300 GHz.

These circuits integrate all active and passive components, including transistors, diodes, capacitors, and resistors, in a single semiconductor substrate. This kind of integration leads to better performance in smaller-sized packages, which are more reliable than their traditional hybrid counterparts, making them important for any modern high-frequency application.

The Global Monolithic Microwave IC market, as mentioned earlier, covers major industries such as telecommunications, defense, aerospace, and consumer electronics. In the telecommunications industry, MMICs provide high-frequency signal processing with minimal loss and increased efficiencies for 5G networks and wireless infrastructures.

On the other hand, MMIC technology is extremely important in defense for advanced radar systems, electronic warfare, and secure communication systems. Satellite communication and navigation systems must be accurate and reliable in aerospace; these circuits are a guarantee of that accuracy and reliability. MMICs benefit consumer electronics as well, particularly in transmitting high-speed data and supporting a strong wireless connection.

As the technology advances, the demand for these MMICs will rise due to the capacity to efficiently handle high-frequency signals. These circuits occupy small physical space, which translates to the relatively smaller footprint of electronic components when they exist on the substrate in an equally good manner concerning signal integrity.

Their rugged design offers low power consumption and heat generation, ideal for applications where long-term efficiency and reliability are needed. Their efficiency thus favors applications in the emerging autonomous vehicle market, Internet of Things (IoT) devices, and next-generation wireless systems.

The Global Monolithic Microwave IC market will grow substantially, backed by growing investments in research and development. New MMIC capabilities will ultimately stimulate new materials and fabrication techniques to create improved performance and cost-effective circuits.

North America, Europe, and some parts of Asia-Pacific, which have developed strong technological ecosystems, will probably be ahead in production and adoption of these techniques. However, developing regions may increasingly also attract attention as infrastructure development gathers pace, which will, in turn, spur demand for advanced communication systems.

Standardization and regulatory compliance will, therefore, go a long way in determining the path the market will take, ensuring that only products that comply with prevailing stringent quality and performance criteria are allowed into the market. Collaborative industry efforts among semiconductor manufacturers, research institutions, and government agencies will serve to stimulate innovation and fast-track the realization of MMIC-based solutions. As competition grows stiffer among industry players, companies will distinguish their offerings using superior product design, reliability, and scalability.

The Global Monolithic Microwave IC market will keep on reflecting every trend apparent in wireless technology and digital transformation from now on. MMICs will serve as a good basis for the pursuit of accelerated data speeds, low latency, and robust connectivity. Their ability to operate easily across multiple frequency bands and blend seamlessly with complex electronic systems will make them critical in tomorrow’s technological ecosystems.

Ultimately, the Global MMIC market is a niche and crucial segment of the very large semiconductor industry existing for a variety of applications which require very high-frequency performance and efficiency. This will be a fast-moving area through innovation, MMIC technology will essentially determine the communication, defense, aerospace, and consumer electronics of tomorrow. From the development of this evolving field will come many new avenues for growth, investment, and technological advancement across the globe.

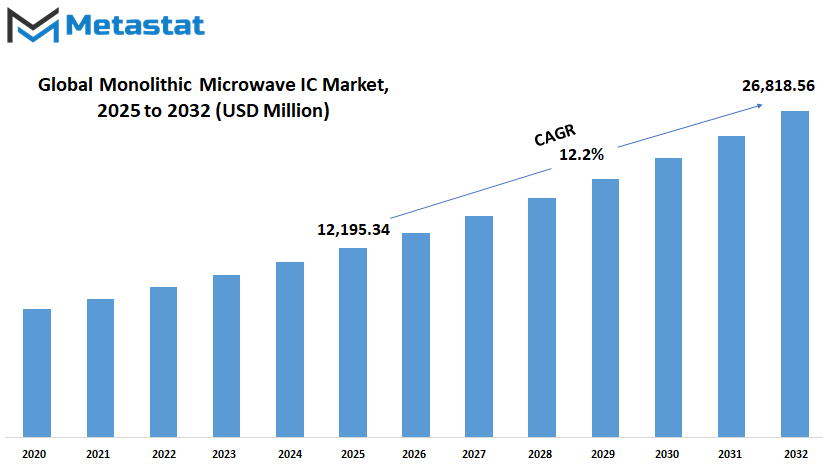

Global Monolithic Microwave IC market is estimated to reach $26,818.56 Million by 2032; growing at a CAGR of 12.2% from 2025 to 2032.

GROWTH FACTORS

The Global Monolithic Microwave IC market is expected to grow significantly in coming years, driven by technological advances and increasing demand for high-frequency communication systems. With continuous advances in industries, there is a growing need for even greater efficiency and more high-performance ICs. This is noticed most in areas such as telecommunications, aerospace, and defense, where increasingly advanced radio frequency technology is becoming crucial to operations.

One of the major factors driving market growth is how the demand for high-frequency components increases due to the ubiquitous deployment of 5G networks or other satellite systems that further improve the communication networks with high reliability and speed.

The advent of 5G has given birth to a very critical market demand for devices that can manage very high data rates with low latency telecommunications. The entire Global Monolithic Microwave IC market can benefit from this, as these circuits are operated at high frequencies and are thus suitable for meeting the new advanced infrastructure that 5G requires.

The other contributor to expanding the market is the satellite communication space, where several nations and private companies have been actualizing space-launched systems into global connectivity. These applications demand highly efficient and compact components, which can resist hostile environments but deliver high performance. MMICs are thus applied.

Another major growth driver in this market is increasing applications of advanced RF technology in the defense and aerospace sectors. Military systems usually depend on advanced communication, radar, and electronic warfare technologies, all of which indulge in high-frequency and high-power circuits. With growing global security issues and rising investments that countries make to boost their defense capabilities, so will the demand for advanced MMICs increase.

Aerospace applications also benefit from these innovations with their modern aircraft and unmanned systems, needing lightweight and efficient electronic components for navigation and communication.

This holds true, nonetheless, in positive growth prospects both because the market is not without its challenges. Exorbitant development and fabrication costs are a major limiting factor for widespread adoption. The cost incurred in developing and manufacturing these types of circuits is prohibitively high because it involves very advanced technologies and materials.

In addition, very complex design and integration of these circuits into larger systems limit scalability of performance and thus restrict their application in specific industries. Not only do these materials promise to offer higher efficiency and frequency capability than other materials, but also the initiative indicates a very positive future for the Global Monolithic Microwave IC market in that specific area with ongoing developments in new materials such as gallium nitride (GaN) and silicon-germanium (SiGe).

There seem to be good preventive measures to overcome the problem's obstacles. As the research and development work continues breaking the limits of what these materials can do, new possibilities in the market are likely to emerge, leading to innovation in progress over the coming years.

MARKET SEGMENTATION

By Material Type

It is quite in terms of upcoming growth in terms of advances in the area of wireless communication, satellite technology in the defense systems in the coming few years. In the future, with the increasing evolution of technology, it will define the market as it demands fast, efficient and very integrated circuitry. Monolithic Microwave Integrated Circuits (MMICs) are very important in high-frequency applications since they achieve miniaturization, high performance, and the ability to combine complex functions into a single chip. MMICs will thus be crucial in shaping the next era of mobile satellite and wireless systems as the seamless connectivity and advanced network capability demands grow.

One of the key factors influencing the Global Monolithic Microwave IC market is the choice of materials used to manufacture these circuits. Unique characteristics regarding efficiency, performance, and deterioration emerge due to the different materials selected. Gallium Arsenide (GaAs) has gained wide usage because of its high mobility of electrons and adaptation for much high-frequency applications. It supports a quicker and less noisy signal, which is crucial during high-tech operations in the field of communication.

As a result, GaAs is likely to remain one of the important materials for producing MMICs as demand for high-speed data transmission increases. Indium Phosphide (InP) is yet another most prioritized material known for its capabilities regarding frequency and efficiency at high value. In addition, it suited advanced optical communications and high-speed electronics applications, providing superior performance for high power-low noise applications. With all new moves focusing on developing faster, more efficient ways of communicating, there are good expectations of an increase in use of InP at the Global Monolithic Microwave IC market.

Indium Gallium Phosphide (InGaP) provides additional benefits, particularly in terms of power efficiency, thermal stability, and mainly combined with other semiconductor materials to give the best result in performance and reliability. Hence, an expected increase in the usage of InGaP in MMIC manufacturing supports the development of next-generation communication and radar systems as more robust and energy-efficient circuits are demanded.

Silicon Germanium (SiGe) offers an equation of performance-cost. High-frequency capabilities are common, but the material is less expensive compared with other materials. For these reasons, SiGe has been used in consumer electronics and mobile wireless devices, where both affordability and efficiency come into play. As wireless technology progresses, the demand for SiGe-based MMICs is expected to grow, especially in the case of developing 5G and future wireless standards.

GaN scores high on power and efficiency and has proved to be the right choice for applications demanding excellent output under extreme environments. It operates as a star performer when slapped under high temperatures and voltages; hence, it becomes essential in defense systems incorporated satellite communications and power amplifiers. Growing demand for very sturdy and powerful electronic components promises to boost GaN’s stature in the Global Monolithic Microwave IC market.

By Component

This is a Global Monolithic Microwave Integrated circuit market growth opportunity in the future. The ongoing revolution in wireless communications, satellite systems, and defense technologies will drive this market much further. The specialized efficient and compact solutions at high frequencies are going to create this market strong in shaping modern electronic devices.

Rising demand for faster transmission of data with seamless connectivity has made advanced microwave integrated circuits more imperative. These components offer high performance in terms of power efficiency, signal quality, and miniaturization, thus making them relevant currently to almost every industry.

Starters for Driving Market Growth. Increasing Wireless Technology Applications. It will be typically risen with increasing numbers of high-speed devices capable of handling data, built on high frequencies, with the advancement of 5G and beyond applications.

On the other hand, Global Monolithic Microwave IC markets bring the technology required for these high frequency applications to ensure that operation remains stable and efficient, thus resistance becomes apparent in technologies considered as key to modern telecommunications, satellite communications, and radar systems.

By component, the market is divided into a number of important features that serve specific purposes in adding particular efficiencies and functionalities to microwave systems. Power amplifiers are important to boosting the signal strength so that a message may be transmitted clear, jam-free, and powerful across long distances.

Low noise amplifier, on the other hand, maintains the integrity of weak signals mainly through micro-isolation from other signals as well as background noise all important for high-quality reception of data. These components will remain key items in the age where wireless systems are demanding finer and finer delineations.

It provides added strength and capability to such networks. Attenuators and switches facilitate this in terms of concentrated media signal routing strength and its allocation. Enables proper signal management, distribution, and balancing of power in the electronic circuit. Phase shifters change the signals in time for synchronization with advanced radar and communication systems. This is important for the accurate and timely transmission and receipt of signals, especially in defense and aerospace applications.

Mixers are used primarily in frequency conversion, enabling a mix of different signals to form new frequencies for various applications. Voltage-controlled oscillators are a foundation for producing stable and adjustable frequency signals in wireless communication. Future frequency multipliers expand these ranges and provide for the trend toward higher frequencies in modern technology.

As seen, push innovative limits to the industries, and so will this Global Monolithic Microwave IC market. Still a foundation for communication-aerospace-defensive systems advancement in the future. The continuous increasing demand for more compact, efficient, and high-performing components drives research and development toward more sophisticated, reliable microwave technologies. Promising future lies ahead with this market, continually improving with the generation shaping the next generation of electronic devices.

By Technology

The market concerning Global Monolithic Microwave Integrated Circuits is expected to broaden in all dimensions in the forthcoming years as a result of the commercialization, technological advances, and the insatiable wish for advanced high-frequency applications. The requirement for highly efficient and compact microwave integrated circuitry would be intensified as wireless communication and satellite systems continue to burgeon and as defense electronics progresses.

These circuits play an important part in transmitting and receiving high-frequency signals, thereby improving power, speed, and reliability features. This growth is likely to be affected by the continuing developments in semiconductor technology and by the increasing demands for miniaturization and efficiency.

Global Monolithic Microwave Integrated Circuits have so many promising methods for improving circuit performance. One such technology is the Metal-Semiconductor Field-Effect Transistor (MESFET), which would still go a long way. MESFETs operate at high frequencies and have very fast switching characteristics, which enables them to function well in applications where speed and efficiency are requirements. Their efficiency in working well with microwave frequencies assures keeping there with respect to wireless and satellite communications.

Among the eminent factors of this market, High Electron Mobility Transistor (HEMT) technology is vital in shaping the future of this sector. HEMTs are fast on speed and have low noise characteristics and find their best applications in amplifiers for very high frequencies and in communication systems. It can be speculated that the increasing need for better data transfer and faster networks will boost the prevalence of HEMT technology.

Besides, PHEMT can be given much attention because of its advanced design, which makes a distinction in efficiency and performance. PHEMT has demonstrated power output and improved linearity that are very much suited for application demanding environments like radar systems and high-speed wireless communication. As strong, efficient electronic devices demand will rise substantially in the future, pHEMT technology will play an important role in fulfilling this need.

The Metamorphic High Electron Mobility Transistor (mHEMT) has much more novelty by providing the advantage of support for very high frequencies and better material compatibility. It is quite possible that it will get an upsurge due to the need for more sophisticated and compact designs for communication and sensing applications. With time, mHEMTs will come to be known for supporting faster and more efficient systems.

Heterojunction Bipolar Transistor (HBT) technology itself offers opportunities for posting gains to the Global Monolithic Microwave Integrated Circuit market. The HBT devices handle signals these days at very high power with respect to their consumption and their output powers and employ very fast operating speeds, making them a perfect fit for power amplification and high-speed digital circuits. The signal can be transmitted over long distances with relatively less power, thus increasing the consumption of the HBTs in applications where high-frequency signals are accepted.

Finally, Metal-Oxide-Semiconductor technology is the foundation of everything in the semiconductor industry. Its diversified capability and superior performance make it very crucial to several microwave applications from signal processing to power management. Innovations in the MOS technology will continue to be absorbed into microwave ICs, enhancing their performance and reliability.

The future is bright for the Global Monolithic Microwave IC market because of advancements in technology and a growing demand for solutions that are not only high frequency but also efficient and compact. Most encouraging, given the expectation of imminent technological evolution, is that the market will be ripe for strong growth and an equally broad uptake in several industries.

By Application

The Global Monolithic Microwave Integrated Circuit market is destined to be a promoter of advanced technology in the future. With a growing rate of adoption across the enterprises, the market is likely to witness an increase in its demand for efficient, high-performance electronic components. Monolithic Microwave Integrated Circuits are often referred to as MMICs, and they find applications in essential high-frequency signal handling with high reliability and precision.

This technology drives a lot of momentum in many applications that continue to push the boundaries of communication and functionality in electronics. Arguably, one of the key applications of the Global Monolithic Microwave IC market is found in consumer and commercial electronics. The more advanced these devices get, while being interconnected, the more the demand for Compactness, increased speed, and reduced power consumption.

MMICs entertain high-frequency performance modern devices demand; hence, they will play a crucial role in the future of smartphones, smart home systems, and wearable technologies. The end result of these circuits is to achieve more rapid data transfer and improved network reliability for the corporate office, thereby creating a smoother, more immediate digital environment.

Another impressive novel impact of Global Monolithic Microwave IC will be on the wireless communication infrastructure. The Global Monolithic Microwave IC market is geared for development owing to the growing number of 5G networks in operation and the inevitable future fast evolving wireless technologies.

MMICs will be a critical component for efficient transmission of signals through these circuits. They facilitate achieving well-defined data speeds with a minimum latency required in communication. Thus, as demand continues for fast and reliable communication, MMICs remain at the heart of this transformation.

The adoption of MMICs is expected to grow within the automotive industry as automobiles get more advanced. From systems assisting drivers to autonomous driving, there is a need for rapid and accurate data processing. MMICs are part of the radar systems, vehicle-to-vehicle communication, and advanced safety features responsible for making roads more secure and vehicles “smarter.”

High-frequency technologies have always been relied on for mission-critical operations by the aerospace and defense sectors. At the very forefront are MMICs with respect to radar systems, satellite communications, and electronic warfare. Their ability to perform under extremes makes them priceless in such applications. So, as policy initiatives in defense and space exploration develop, the need for MMICs with improved capabilities is likely to keep growing.

Another important application is test and measurement equipment, CATV and wired broadband services, and many special purposes. These applications are the kind which requires highly precise and ultrafast signal processing making MMICs significant in their realization. The same technology is being developed from time to time, and hence the growth and efficiency in these circuits will ensure their scope in numerous industries, thus holding strong importance again.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$12,195.34 million |

|

Market Size by 2032 |

$26,818.56 Million |

|

Growth Rate from 2025 to 2032 |

12.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

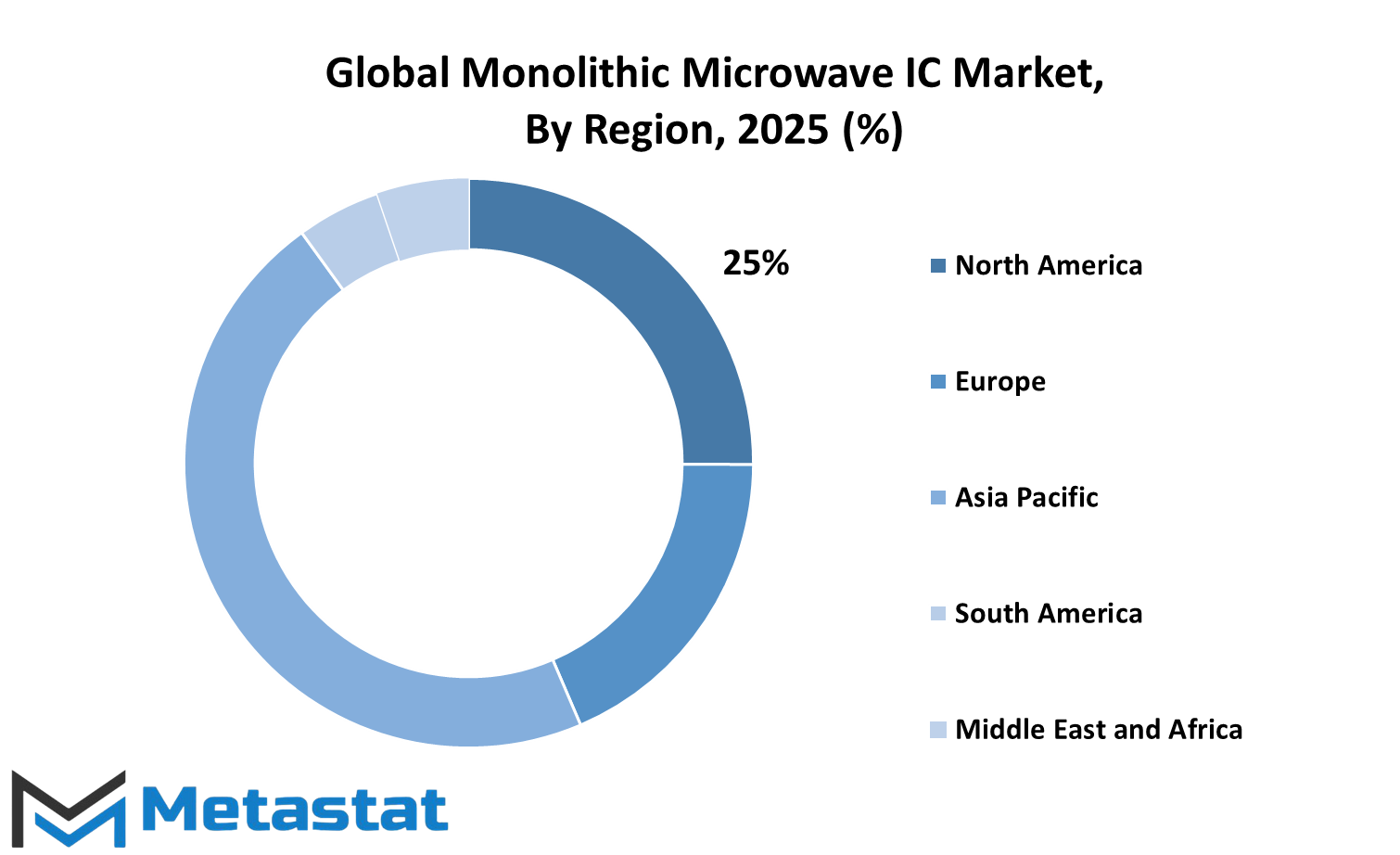

The Monolithic Microwave IC market worldwide is expected to develop significantly in the areas in the coming years. As the trend of improving technology shapes industries worldwide, so will the demand for efficient microwave integrated circuits with high performance. Each region has its strengths and advantages to offer in the market's development.

In terms of North America, the United States is a significant contributor to the growth of this market, alongside Canada and Mexico. Research and development investments by the region's well-established technology sector provide the framework for innovation. In this case, the U.S. is unique because of its advanced telecommunications infrastructure and the presence of strong industry players.

With 5G technologies and satellite communication systems getting more common, the adoption of Monolithic Microwave ICs will perhaps increase more widely in this region. The modernization and expansion of the communication networks in Canada and Mexico also contributed to North America, which is an important part of the global market.

Europe also holds a prominent position in the global Monolithic Microwave IC market. Countries such as the UK, Germany, France, and Italy account for the region's growth in such a way, with sound industrial capabilities and government support for technological innovation. The push of Germany in automation and high-tech manufacturing increases the demand for electronic components. With the smart cities and advanced transport systems being developed in Europe, the demand for high-frequency reliable IC envisages to rise.

Asia-Pacific is emerging as one of the fastest-growing regions in this market. Countries such as China, India, Japan, and South Korea are leading in terms of technology innovations and mass production. The massive electronics industry in China and the investment in the deployment of 5G have created a great demand for Monolithic Microwave IC. Japan's specialization in producing high-precision electronics will add to the market's growth.

The digital infrastructure developing in India and South Korea's dominance in communication and semiconductor production further add value to this region. Therefore, with continued investments in next-generation technologies by these nations, the growth of the Asia-Pacific market is expected to be significant.

South America, too, presents scope for development in this market. Brazil and Argentina are gradually elevating their technological capabilities, with investments in telecommunications and defense sectors. Modern infrastructure creates a rising need for advanced integrated circuits, particularly for South America-an area of untapped potential.

Investment in technology development is also evident in the countries of the Middle East and Africa such as those of the GCC, Egypt, and South Africa. Investment in smart infrastructure and modern communication networks has the potential to provide opportunities for market growth. As more nations focus on improving their digital footprints, so too will the need for the most effective and high-performance ICs grow across this region.

Overall, the global Monolithic Microwave IC market promises to spread across regions with each bringing unique strengths and opportunities. With the technology evolving day by day, the demand will keep increasing according to requirements and develop growth around the global market.

COMPETITIVE PLAYERS

The Global Monolithic Microwave IC market would experience growth and addition during the forthcoming years by advanced technology and increased demand for high-frequency applications. Among the other prominent reasons for the growing popularity of Monolithic Microwave Integrated Circuits is the possibility of better performance in terms of size and efficiency in electronic devices as industries continue to adopt wireless communication and radar systems.

The competition will, however, become more intense and innovative in the coming years as a result of the great importance being attached to the applications mentioned above, and the main players, therefore, would have to brace themselves for this form of serious competition.

Leading companies in the Global Monolithic Microwave IC market include Qorvo, Inc. which constantly pursues high performance in radio frequency solutions advanced for defense, wireless connectivity, and infrastructure applications. Other leading companies include Analog Devices, Inc., best known for its contributions high-end quality analog and mixed signal processing technologies to the domain.

Today, NXP Semiconductors N.V. plays an important role: integrating secure connectivity and cutting-edge design into its products, ensuring reliability and efficiency across all industries. Broadcom Inc. is also a market leader, continuing to use its extensive intellectual property in semiconductor solutions to provide innovative products that drive connectivity and data transmission.

MACOM Technology Solutions Holdings, Inc. focuses its business primarily on the development, production, and marketing of high-frequency solutions for aerospace, defense, and commercial markets. Skyworks Solutions, Inc. continues to launch high-integration systems while enabling wireless communication across multiple devices.

Infineon Technologies AG has therefore contributed significantly as a developer of energy-efficient and high-performance semiconductor technologies, while Mitsubishi Electric Corporation has continued to push towards developing advanced electronics toward bringing innovations to the market. WIN Semiconductors Corp. remains key for its continued production of high-frequency compound semiconductor devices. United Monolithic Semiconductors is also known for its microwave and millimeter-wave component design and manufacture capabilities.

Microsemi Corporation and RFHIC Corporation also have vital importance in that regard as these two companies provide tough, reliable semiconductor solutions for even harsh environments and more advanced applications. Continuous investment on the part of these companies includes research and developmental projects that will break new grounds with performance and efficiency in the Monolithic Microwave Integrated Circuits.

In fact, the competition in the near future at the Global Monolithic Microwave IC market would actually be technological innovation, strategizing partnerships, and responsiveness to ever-evolving consumer and industrial needs. These companies are bound to propel the market to great heights through the innovation of quality when demand for faster and reliable wireless communication and high-frequency applications gets increasing. Thus, these companies will shape the future of this industry in developing the future advancement of all.

Monolithic Microwave IC Market Key Segments:

By Material Type

- Gallium Arsenide (GaAs)

- Indium Phosphide (InP)

- Indium Gallium Phosphide (InGaP)

- Silicon Germanium (SiGe)

- Gallium Nitride (GaN)

By Component

- Power Amplifiers

- Low Noise Amplifiers

- Attenuators

- Switches

- Phase Shifters

- Mixers

- Voltage-Controlled Oscillators

- Frequency Multipliers

By Technology

- Metal-Semiconductor Field-Effect Transistor (MESFET)

- High Electron Mobility Transistor (HEMT)

- Pseudomorphic High Electron Mobility Transistor (pHEMT)

- Metamorphic High Electron Mobility Transistor (mHEMT)

- Heterojunction Bipolar Transistor (HBT)

- Metal-Oxide-Semiconductor (MOS)

By Application

- Consumer/Enterprise Electronics

- Wireless Communication Infrastructure

- Automotive

- Aerospace & Defense

- Test & Measurement

- CATV & Wired Broadband

- Others

Key Global Monolithic Microwave IC Industry Players

- Qorvo, Inc.

- Analog Devices, Inc.

- NXP Semiconductors N.V.

- Broadcom Inc.

- MACOM Technology Solutions Holdings, Inc.

- Skyworks Solutions, Inc.

- Infineon Technologies AG

- Mitsubishi Electric Corporation

- WIN Semiconductors Corp.

- United Monolithic Semiconductors (UMS)

- Microsemi Corporation

- RFHIC Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383