MARKET OVERVIEW

Mining software is a genre of meticulously crafted digital tools tailored to meet the unique demands of the mining industry. These software solutions traverse the entire spectrum of mining operations, serving as the backbone for seamless coordination, optimization, and decision-making. No longer relegated to mere support tools, mining software has metamorphosed into indispensable assets, driving the sector towards a future defined by efficiency, sustainability, and safety.

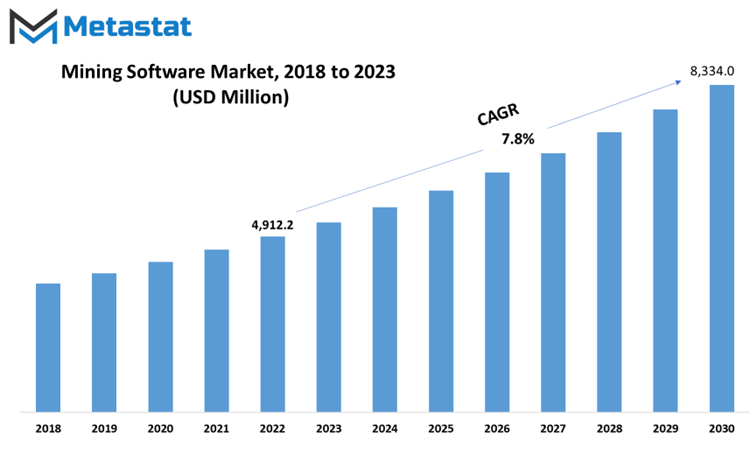

As of 2023, the global mining software market is on a meteoric rise, projected to reach a staggering $8,334.0 million by 2030. This remarkable growth, with a Compound Annual Growth Rate (CAGR) of 7.8%, is emblematic of the mining industry's recognition of the indispensable role software plays in its future.

In a world where every ounce of precious resource counts, mining software emerges as the mining industry's silent yet indispensable partner. Its applications span the entire mining continuum, from geological exploration to resource estimation, production tracking, and safety management. The dynamic evolution of the mining software market mirrors the industry's quest for efficiency, sustainability, and safety. As we move forward, it is evident that mining software will continue to be at the forefront of an industry marked by profound transformation.

GROWTH FACTORS

The mining industry, a cornerstone of resource extraction, has undergone significant transformation in recent years. Central to this transformation is the integration of technology and software solutions aimed at improving efficiency, reducing costs, and increasing safety.

One of the primary growth factors propelling the mining software market is the increasing demand for automation and digitalization within the industry. Traditionally, mining has been a labor-intensive and physically demanding field. However, with the advent of advanced software solutions, mining operations can now be streamlined and optimized through automation. Automation, driven by mining software, has numerous benefits. It enhances safety by reducing the exposure of workers to hazardous conditions. It also improves precision and accuracy in mining processes, leading to higher resource recovery rates. Additionally, automation can operate around the clock, maximizing the utilization of mining equipment and infrastructure

Furthermore, digitalization plays a crucial role in data management and analysis. Mining software allows for the efficient collection, storage, and analysis of vast amounts of data generated during mining operations. This data-driven approach enables better decision-making, predictive maintenance, and the identification of optimization opportunities. Operational efficiency and cost reduction are paramount in the highly competitive mining industry. To remain competitive and sustainable, mining companies are increasingly turning to software solutions to optimize their operations. Mining software offers real-time monitoring and control of equipment and processes, allowing for immediate adjustments to improve efficiency.

Cost reduction is achieved through various means, including better resource allocation, reduced downtime, and energy savings. By optimizing operations with the help of software, mining companies can achieve significant cost savings over time. This cost-conscious approach is particularly crucial in times of fluctuating commodity prices.

Despite the promising growth factors, the mining software market faces certain challenges that could hamper its expansion. The adoption of mining software often requires a substantial initial investment. This includes not only the purchase of software licenses but also the hardware and infrastructure needed to support these applications. For some mining companies, especially smaller ones, the upfront costs can be a barrier to entry. Additionally, the implementation of mining software may involve training employees and integrating new processes into existing operations. These transitional phases can lead to disruptions and additional costs, further complicating adoption.

The mining industry has a history deeply rooted in traditional practices. Many mining professionals have extensive experience with conventional methods and may be resistant to change. The introduction of new technologies and software solutions can be met with skepticism and resistance, slowing down the adoption process. Overcoming this resistance requires effective change management strategies and clear communication of the benefits that mining software can bring. Companies need to demonstrate that the transition to software-driven operations will ultimately lead to improved safety, efficiency, and profitability.

On the flip side, the mining software market also presents significant growth opportunities, particularly in emerging economies. As these regions experience increased industrialization and urbanization, the demand for raw materials, such as minerals and metals, grows.

To meet this demand sustainably, mining operations in emerging economies are turning to technology and software solutions. The implementation of mining software can help them leapfrog traditional methods and achieve higher levels of efficiency from the outset.

However, challenges such as high initial investment costs and resistance to change must be addressed. The expansion of mining activities in emerging economies presents a promising avenue for market growth in the coming years. Ultimately, the adoption of mining software is poised to revolutionize the industry, making it safer, more efficient, and more sustainable.

MARKET SEGMENTATION

By Software Type

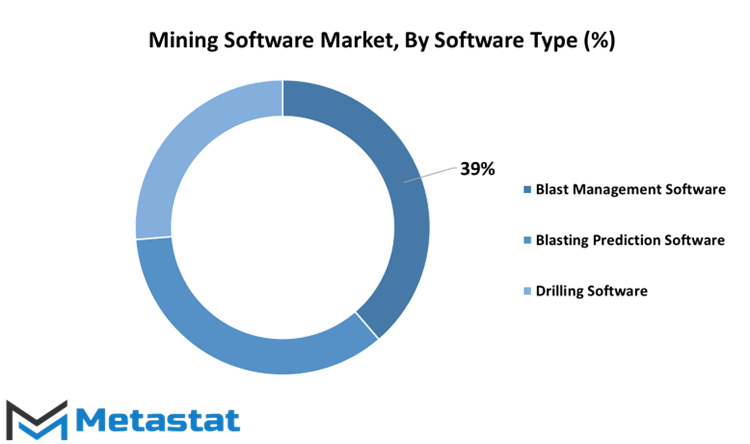

In the world of software applications tailored for the mining industry, segmentation plays a crucial role in categorizing these tools based on their specific functions. One such segmentation scheme involves dividing the software into various types, each designed to serve distinct purposes within the mining process.

Blast Management Software is a category of software applications that focus on optimizing the planning aspect of blasting operations in mining. This software is vital for ensuring that blasting activities are carried out safely, efficiently, and with minimal environmental impact. The Planning segment within Blast Management Software holds considerable significance, as it forms the foundation for the entire blasting process. In 2022, this segment was valued at 891.3 USD Million, underlining its importance in the mining industry.

Blasting Prediction Software is another key category that aids in forecasting the outcomes of blasting operations. This type of software plays a crucial role in ensuring the safety and precision of blasting activities. Within Blasting Prediction Software, the Scheduling segment takes center stage. It was valued at 636.2 USD Million in 2022. Effective scheduling is essential to ensure that blasting operations align with overall mining plans and objectives, minimizing disruptions and optimizing resource utilization.

Drilling Software, the third category, is designed to enhance the efficiency and accuracy of drilling operations in mining. This software is a valuable asset in the mining process, contributing to cost savings and improved productivity. Within Drilling Software, the Design segment is of particular importance. In 2022, the Design segment was valued at 903.9 USD Million. This segment focuses on the planning and design of drilling activities, ensuring that boreholes are strategically located and accurately executed, thereby maximizing the extraction of valuable minerals.

The segmentation of mining software by software type serves as a strategic approach to cater to the diverse needs of the mining industry. Blast Management Software, Blasting Prediction Software, and Drilling Software each play a pivotal role in ensuring the safety, efficiency, and productivity of mining operations. Within these categories, the Planning, Scheduling, and Design segments hold significant value, reflecting their central roles in the mining process and the substantial investments made in these areas in 2022. These software tools are indispensable aids in an industry that relies heavily on precision and optimization for successful mineral extraction.

By Application

The market for a particular product or service can be understood and analyzed by considering its various applications. In this context, we will explore how different applications can segment and define a market, using specific examples.

One common way to divide a market is by its applications, which essentially means how and where the product or service is used. This division allows businesses and analysts to gain a deeper understanding of the market's dynamics and potential growth opportunities.

Planning application involves using software for forecasting and strategizing. Businesses might use it to plan their budgets, set sales targets, or predict market trends. The Planning segment of the market is expected to grow at a steady rate of 7.73% between 2023 and 2030. This indicates a consistent demand for software that aids in planning activities. Scheduling is another crucial application of this software. It involves creating and managing schedules for various tasks, appointments, or projects. In 2022, the Scheduling segment of the market was valued at 636.2 USD Million, reflecting the importance of efficient scheduling in business operations.

Next is the Design applications which involve using the software for creative purposes, such as graphic design, architectural planning, or product design. The Design segment is projected to experience robust growth, with a forecasted CAGR of 8.25% from 2023 to 2030. This growth signifies an increasing need for design-related functionalities.

Further, the Operations segment of the market plays a significant role in streamlining day-to-day business activities. It was valued at 1241.7 USD Million in 2022, highlighting its substantial presence in the market. Operations applications help businesses run smoothly and efficiently. Along with the tracking applications involve monitoring and tracing various elements, such as shipments, inventory, or vehicles. In 2022, the Tracking segment was valued at 503.2 USD Million, indicating the demand for software solutions that enable accurate tracking. Analysis applications focus on data analysis and reporting. Businesses use this software to gather insights from their data, make informed decisions, and generate reports. The Analysis segment was valued at 388 USD Million in 2022, emphasizing the importance of data-driven decision-making.

In essence, by examining how a software product is applied in different scenarios, we can see the diverse needs and preferences of the market. Some segments may experience steady growth, while others might see rapid expansion. This segmentation approach helps businesses tailor their products or services to meet specific demands within each application, ultimately driving success in the market.

By End-Users

The mining industry, a vital component of the global economy, is a sector that encompasses a wide range of activities and subcategories. One way to categorize this diverse industry is by examining it through the lens of end-users. By doing so, we can gain valuable insights into the specific segments that make up this ever-evolving field.

End-users are the ultimate consumers or beneficiaries of the products and services provided by the mining industry. They represent the various sectors and industries that rely on mined resources for their operations and processes. When we analyze the mining market based on end-users, we can identify distinct segments that have their unique characteristics and growth trajectories.

One of the prominent end-user segments in the mining industry is Open Pit Coal Mining. This segment focuses on the extraction of coal from open-pit mines, where large quantities of overburden are removed to access coal seams. It is worth noting that this segment is forecasted to experience substantial growth, with a projected Compound Annual Growth Rate (CAGR) of 8.21% during the period from 2023 to 2030. This growth is indicative of the continued demand for coal in various industries, despite increasing concerns about environmental impacts.

Another significant end-user segment is Open Pit Metal Mining. In 2022, this segment had a market value of 894.4 USD Million. Open pit metal mining involves the extraction of valuable metals such as gold, copper, and iron from open-pit mines. The large-scale operations in this segment often require extensive earthmoving and processing equipment to access and process ore deposits.

In contrast to open-pit mining, Underground Coal Mining represents a distinct end-user segment within the industry. This segment involves the extraction of coal from underground mines, where miners work in tunnels and shafts to access coal seams. In 2022, the market value for Underground Coal Mining reached 759.1 USD Million. Despite the challenges associated with underground mining, it remains a crucial source of coal production in many regions.

Similarly, the Underground Hard Rock (Metal) Mining segment focuses on the extraction of valuable metals, but it does so from underground deposits. This end-user segment had a market value of 715.4 USD Million in 2022. Underground hard rock mining is characterized by its technical complexity and the need for specialized equipment and safety measures to access and extract ore.

The Quarry segment is another notable category within the mining industry. Quarries are sites where natural stone, aggregates, and other non-metallic resources are extracted. This segment is projected to grow at a CAGR of 7.32% from 2023 to 2030, indicating sustained demand for construction materials and other quarry products.

There are other end-users within the mining industry, encompassing a range of activities and materials not covered by the segments. These may include specialty mining operations, niche markets, or emerging sectors. In 2030, this category is expected to reach a market value of 663.2 USD Million. Understanding the growth trajectories and market dynamics of these segments is essential for stakeholders in the mining industry to make informed decisions and adapt to the evolving demands of their respective markets.

REGIONAL ANALYSIS

The global landscape of mining software markets is a dynamic and ever-changing one, shaped by geographic regions all over the world. We will delve into the key insights regarding the European and Asia Pacific mining software markets, shedding light on their estimated values and projected growth rates. The European mining software market is a significant player in the global arena, estimated to be valued at 881.2 USD Million in 2018. What's intriguing is the trajectory it's set on, with a projected expansion at a Compound Annual Growth Rate (CAGR) of 6.22% over the forecast period.

The European market's value underscores the importance of technology in the mining sector within this region. Mining software solutions are increasingly sought after to enhance operational efficiency, ensure compliance with regulations, and manage the complexities inherent in mining activities. The projected CAGR of 6.22% signals a steady and robust growth trend. This growth can be attributed to factors such as the adoption of advanced technologies, increasing investments in mining operations, and the drive for sustainability and environmental responsibility in the mining sector. Mining software, with its capacity to optimize processes and minimize environmental impacts, aligns perfectly with these industry imperatives.

As we shift our focus to the Asia Pacific region, we encounter another facet of the global mining software market. Here, the market is estimated to have been valued at a substantial 1628.7 USD Million in 2018. Asia Pacific's prominence in the mining software sector reflects the region's vast mineral resources and its growing mining industry. The demand for mining software solutions in this region is driven by the need to harness these resources efficiently and sustainably.

The market's estimated value speaks to the scale of mining operations and the reliance on technology for optimized resource extraction. Mining software not only aids in improving productivity but also contributes to safety and environmental objectives, both of which are of paramount importance in Asia Pacific. Moreover, the projected growth rates underscore the enduring relevance of mining software in an industry that continues to evolve and adapt to the demands of a changing world.

COMPETITIVE PLAYERS

The mining industry has always been a vital component of global economies, providing essential raw materials for various sectors. In recent years, the industry has witnessed significant transformations, with technological advancements playing a pivotal role. One of the critical enablers of this transformation is mining software, which enhances efficiency, safety, and sustainability in mining operations. The mining software market, like many other industries, is characterized by several key players who wield considerable influence in shaping the direction of the industry. These key players are at the forefront of developing innovative solutions that address the evolving needs of the mining sector.

Among the prominent players in the mining software market, ABB stands out for its strong commitment to innovation and sustainability. ABB is not solely a software provider but a comprehensive technology company that offers a wide range of solutions for various industries, including mining. Caterpillar is another key player in the mining software market that has a substantial global presence. Known primarily for its heavy machinery, Caterpillar offers a range of solutions, including software, to enhance mining operations. The company's global footprint and extensive dealer network ensure that its products and services reach customers in various regions around the world.

The mining software market plays a crucial role in modernizing the mining industry. Key players like ABB and Caterpillar are instrumental in driving innovation and sustainability in mining operations. Their commitment to developing environmentally friendly technologies, promoting sustainable practices, and enhancing operational efficiency underscores their significant contributions to the mining sector's evolution. As the mining industry continues to adapt to changing demands and challenges, these key players will remain at the forefront, shaping its future direction.

Mining Software Market Key Segments:

By Software Type

- Blast Management Software

- Blasting Prediction Software

- Drilling Software

By Application

- Planning

- Scheduling

- Design

- Operations

- Tracking

- Analysis

By End-Users

- Open Pit Coal Mining

- Open Pit Metal Mining

- Underground Coal Mining

- Underground Hard Rock (Metal) Mining

- Quarry

- Others

Key Global Mining Software Industry Players

- ABB Ltd.

- Schneider Electric (AVEVA)

- Carlson Software

- Caterpillar Inc.

- Coencorp

- Dassault Systèmes

- Datamine

- Deswik

- Haultrax

- Hexagon AB

- Hitachi, Ltd.

- GroundHog

- IBM Corporation

- Maptek Pty Limited

- Micromine

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383