MARKET OVERVIEW

The US 401(k) Software market stands within the financial technology sector, sculpting the digital contours of retirement savings management. This sector encapsulates a multifaceted ecosystem of software solutions designed to streamline and optimize the administration of 401(k) retirement plans. The US 401(k) Software market caters to the intricate needs of employers and financial institutions, offering sophisticated tools to manage retirement accounts with precision and efficiency. The software in question operates as a digital maestro orchestrating the symphony of contributions, investment choices, and regulatory compliance that characterize the complex domain of retirement planning.

One of the pivotal aspects of this market is its role in automating and simplifying the otherwise labyrinthine tasks associated with 401(k) administration. These solutions go beyond mere record-keeping, providing a seamless interface for employers to manage contributions, track employee enrollments, and ensure compliance with the ever-evolving regulatory landscape. In doing so, the US 401(k) Software market emerges as an indispensable ally in navigating the regulatory intricacies that surround retirement savings plans.

Moreover, this software market doesn't solely revolve around traditional financial institutions; it extends its reach to employers of all sizes. Small and medium-sized enterprises, in particular, benefit from tailored solutions that empower them to offer competitive retirement benefits without succumbing to the administrative burdens that can accompany such endeavors. The democratization of 401(k) management through innovative software solutions marks a transformative aspect of this market, fostering inclusivity in retirement planning.

In the digital tapestry of the US 401(k) Software market, customization emerges as a key motif. The software solutions available cater to a spectrum of needs, allowing employers to tailor retirement plans according to the unique preferences and financial goals of their workforce. This flexibility not only enhances employee satisfaction but also positions 401(k) plans as a potent tool for talent retention and recruitment in the fiercely competitive job market.

An additional layer to the canvas is the integration of cutting-edge technologies within these software solutions. Artificial intelligence algorithms, for instance, are increasingly becoming instrumental in predicting investment trends, optimizing portfolio allocations, and enhancing overall fund performance. The infusion of such advanced technologies amplifies the efficacy of 401(k) software, ushering in a new era of data-driven decision-making in the realm of retirement planning.

The US 401(k) Software market epitomizes a transformative force within the financial technology landscape. It is not merely a collection of tools but a dynamic ecosystem that empowers employers, financial institutions, and employees alike in sculpting the contours of retirement planning. With its emphasis on automation, customization, and integration of cutting-edge technologies, this market is poised to shape the future of how we navigate the intricate path towards financial security in our golden years.

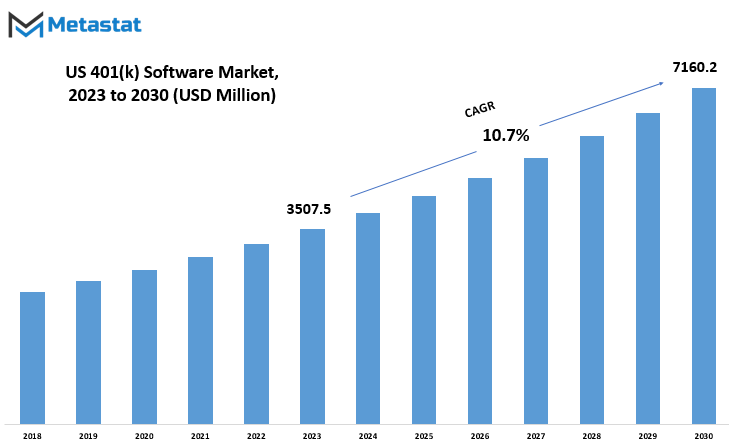

US 401(k) Software market is estimated to reach $7160.2 Million by 2030; growing at a CAGR of 10.7% from 2023 to 2030.

GROWTH FACTORS

In the landscape of financial planning, the US 401(k) Software market plays a pivotal role, influencing how individuals manage their retirement savings. The market's trajectory is shaped by various factors, with growth being a central theme. The global Hoses market, on the other hand, is intricately linked to external pressures that dictate its growth patterns.

The US 401(k) Software market's growth is propelled by several key driving factors. The increasing awareness among individuals about the importance of retirement planning has significantly contributed to the market's expansion. As more people recognize the need to secure their financial future, the demand for sophisticated software solutions to manage 401(k) plans has surged.

Moreover, the evolving regulatory landscape in the financial sector has played a crucial role in the growth of the US 401(k) Software market. Regulatory changes often necessitate updates and enhancements in software solutions to ensure compliance, creating a constant demand for innovative and adaptive technology.

However, like any market, challenges and obstacles are not uncommon. Economic downturns and financial uncertainties can hamper the growth of the US 401(k) Software market. In times of economic instability, individuals may prioritize immediate financial needs over long-term retirement planning, impacting the market negatively.

Additionally, technological limitations and cybersecurity concerns pose potential threats to the market. The reliance on digital platforms makes the software susceptible to cyberattacks, emphasizing the need for robust security measures. Technological constraints, if not addressed promptly, can hinder the market's progress.

Despite these challenges, the US 401(k) Software market is poised for growth, with promising opportunities on the horizon. The integration of artificial intelligence (AI) and machine learning (ML) in software solutions presents a transformative prospect. Automation and data-driven insights can enhance the efficiency of 401(k) management, offering a compelling incentive for market expansion.

Furthermore, the growing trend of personalized financial planning opens doors for innovative software solutions. Tailored approaches that consider individual preferences and financial goals provide a competitive edge in the market. Companies that can adapt to this trend are likely to thrive, creating a lucrative avenue for sustained growth in the coming years.

The US 401(k) Software market is a dynamic space influenced by factors such as increasing awareness, regulatory changes, economic conditions, and technological advancements. While challenges exist, they are counterbalanced by opportunities stemming from AI integration and personalized financial planning trends. The market's future trajectory will depend on the industry's ability to navigate these dynamics, providing valuable solutions to meet the evolving needs of individuals planning for their retirement.

MARKET SEGMENTATION

By Type

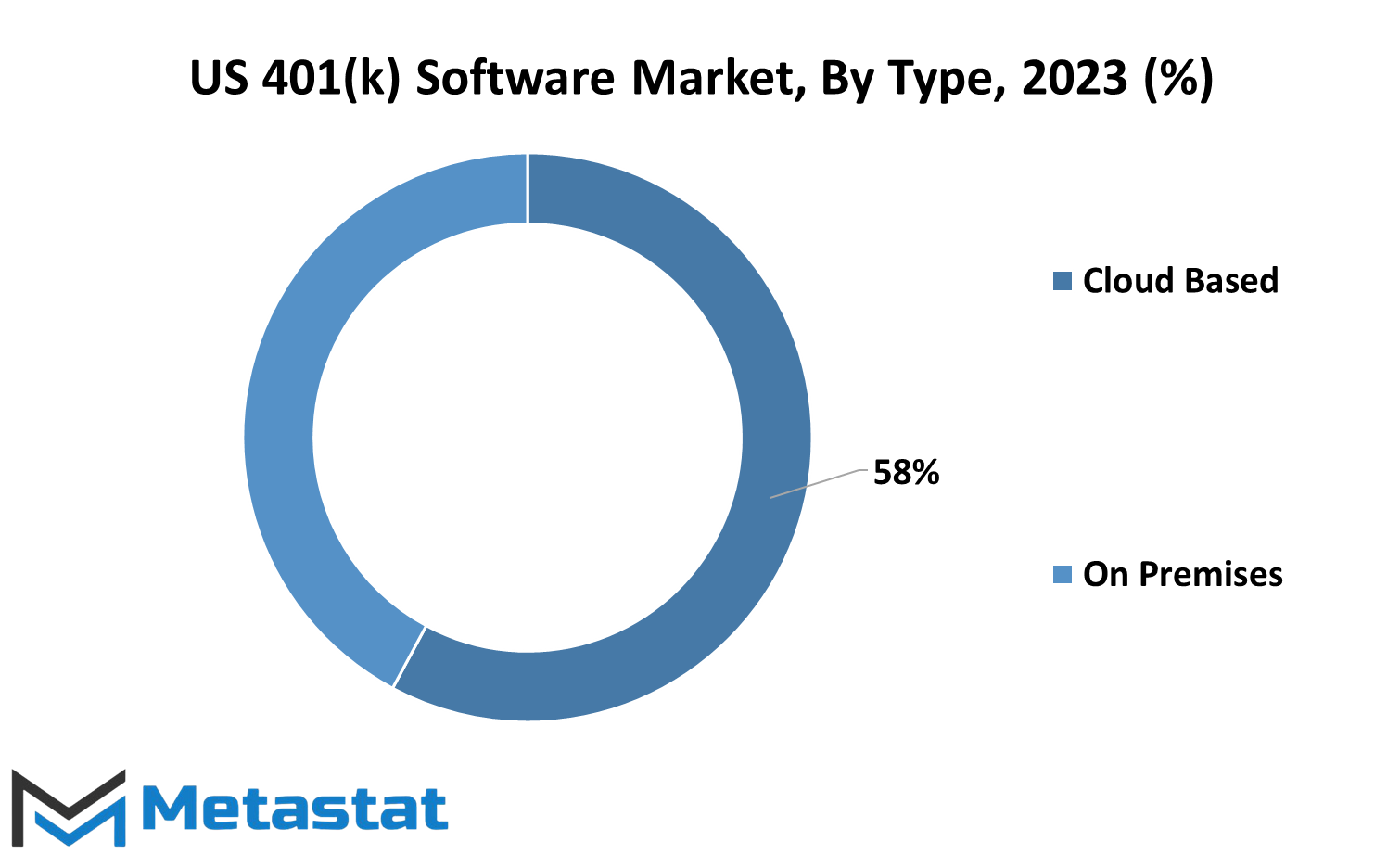

The US 401(k) Software market is a dynamic landscape with various segments catering to different preferences and needs. When we look at the types of 401(k) software available, we find a clear distinction between Cloud-Based and On-Premises solutions.

Cloud-Based 401(k) software operates on the principle of remote accessibility, allowing users to manage their retirement plans through an online platform. This type of software offers flexibility, as users can access their 401(k) accounts from anywhere with an internet connection. The convenience of Cloud-Based solutions makes them particularly popular among individuals who value accessibility and the ability to manage their retirement savings on the go.

On the other hand, On-Premises 401(k) software is designed for those who prefer a more localized and controlled approach to managing their retirement plans. With On-Premises software, all data and operations are kept within the user's own system or network. This can be appealing to individuals or businesses that prioritize maintaining direct control over their 401(k) management processes and data security.

Both Cloud-Based and On-Premises 401(k) software options have their advantages and drawbacks. Cloud-Based solutions offer accessibility and convenience, while On-Premises solutions provide a sense of control and security. The choice between these types of software depends on individual preferences, business requirements, and considerations related to data privacy and security.

The US 401(k) Software market is not a one-size-fits-all scenario. The segmentation into Cloud-Based and On-Premises solutions reflects the diverse needs of users in managing their retirement plans. Whether one opts for the flexibility of Cloud-Based software or the localized control of On-Premises solutions, the market caters to a range of preferences, ensuring that individuals and businesses can find a suitable 401(k) software solution that aligns with their unique needs and priorities.

By Application

In today's business landscape, the US 401(k) Software market plays a pivotal role in providing financial solutions for both large enterprises and small to medium-sized enterprises (SMEs). This market is distinctly categorized based on its applications, primarily catering to the unique needs of Large Enterprises and SMEs.

The term "US 401(k) Software market" refers to the sector that deals with software solutions related to 401(k) retirement plans in the United States. This market is dynamic and has a significant impact on businesses of varying sizes. It is crucial to understand the two primary categories that define its reach: Large Enterprises and SMEs.

Large Enterprises, as the name suggests, encompass organizations with substantial resources and a large workforce. These companies often have complex financial structures and require sophisticated 401(k) software solutions to manage the retirement plans of their numerous employees. The applications designed for Large Enterprises focus on scalability and comprehensive features to meet the diverse needs of a sizable workforce.

However, SMEs, or Small to Medium-sized Enterprises, represent businesses with fewer employees and modest financial resources. The 401(k) software solutions tailored for SMEs aim to address the unique challenges faced by smaller businesses. These solutions are characterized by user-friendly interfaces, cost-effectiveness, and scalability that align with the specific requirements of SMEs.

When we delve into the applications of the US 401(k) Software market, it becomes evident that the market's segmentation into Large Enterprises and SMEs caters to the diverse needs of businesses across the spectrum. The software solutions provided are designed to streamline the management of 401(k) retirement plans, ensuring efficiency and compliance with regulatory standards.

The US 401(k) Software market is a dynamic sector that distinguishes its offerings based on the size and complexity of businesses. Whether serving the needs of Large Enterprises with intricate financial structures or providing user-friendly solutions for SMEs, the market contributes significantly to the effective management of 401(k) retirement plans in the ever-evolving landscape of business operations.

COMPETITIVE PLAYERS

The US 401(k) Software market is characterized by the presence of several key players, each contributing to the industry's growth and development. These companies play a crucial role in shaping the landscape of 401(k) software solutions, catering to the evolving needs of businesses and individuals alike.

Among the notable players in the 401(k) Software industry are Paychex Inc., Human Interest, Inc., Guideline, Inc., ForUsAll Inc., 401GO, Betterment Holdings, Inc., Ubiquity Retirement + Savings, Slavic401k, Transamerica Corporation, Vestwell Holdings Inc., AB401k, and Actuarial Systems Corporation. Each of these companies brings its own set of strengths and capabilities to the table, contributing to the overall competitiveness of the market.

Paychex Inc. stands out with its comprehensive suite of 401(k) software solutions, addressing the diverse needs of businesses in managing employee retirement plans. Human Interest, Inc. emphasizes user-friendly platforms, making it easier for both employers and employees to navigate and utilize their 401(k) offerings. Guideline, Inc. is known for its innovative approach, incorporating technology to streamline plan administration and enhance user experience.

ForUsAll Inc. and 401GO are recognized players that focus on simplifying the 401(k) process for employers and employees alike. Betterment Holdings, Inc. brings a fresh perspective with its robo-advisory features, providing automated investment solutions for retirement planning. Ubiquity Retirement + Savings and Slavic401k contribute to the market with their expertise in creating customizable retirement solutions tailored to the specific needs of clients.

Transamerica Corporation, Vestwell Holdings Inc., AB401k, and Actuarial Systems Corporation round out the list of key players, each contributing to the competitive dynamics of the 401(k) Software market through their respective strengths and specialization areas.

The US 401(k) Software market is fueled by the active participation of diverse and competitive players. These companies, including Paychex Inc., Human Interest, Inc., Guideline, Inc., ForUsAll Inc., 401GO, Betterment Holdings, Inc., Ubiquity Retirement + Savings, Slavic401k, Transamerica Corporation, Vestwell Holdings Inc., AB401k, and Actuarial Systems Corporation, collectively shape the industry by offering innovative solutions and services to meet the evolving demands of businesses and individuals engaged in retirement planning.

US 401(k) Software Market Key Segments:

By Type

- Cloud Based

- On Premises

By Application

- Large Enterprises

- SMEs

Key US401(k) Software Industry Players

- Paychex Inc.

- Human Interest, Inc.

- Guideline, Inc.

- ForUsAll Inc.

- 401GO

- Betterment Holdings, Inc.

- Ubiquity Retirement + Savings

- Slavic401k

- Transamerica Corporation

- Vestwell Holdings Inc.

- AB401k

- Actuarial Systems Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383