MARKET OVERVIEW

The Global Military Parachutes industry and market go well beyond typical deployment situations, influencing contemporary warfare and defense strategies that are often not fully appreciated. Though airborne operations are the major purpose of military parachutes, their influence is more deeply embedded in other specialized areas including training, emergency situations, and tactical mobility. As defense forces all over the globe continue to sharpen their airborne forces, the role of this market will grow to encompass new and emerging areas that redefine military readiness and strategic execution. Thanks to developments in material science and aerodynamics, the future for military parachutes will not be limited to traditional troop deployment.

Research and development will take the industry to systems that enhance precision, reduce vulnerability, and support multiple operating environments. Increasing reliance on unmanned and autonomous aerial systems will also be a factor affecting the demand for parachutes employed in payload delivery, e.g., high-altitude surveillance equipment, unmanned ground systems, and tactical resupply. Modular parachute systems will also be a crucial component of future warfare, with flexibility for varied mission requirements and ensuring higher safety and reliability for individuals and gear. Beyond their direct military use, defense-purpose parachutes will impact civilian and humanitarian activities. Search and rescue, disaster relief efforts, and medical evacuations will gain from the increasing capabilities of such systems.

Being able to send emergency goods to difficult-to-reach terrain will become even more critical, particularly in natural disaster situations and conflict areas where accessibility is a continued problem. As the emphasis on quick response strategies increases, defense agencies will spend on parachute technology that enables quick and controlled delivery of personnel and aid. The convergence of technology and military parachute systems will also transform training practices. Simulation methods, virtual reality, and artificial intelligence-based analytics will enhance the manner in which airborne forces are trained for intricate missions. Insight based on data will maximize jump precision, measure environmental conditions, and enhance parachute performance across diverse conditions.

Secondly, advanced materials will reshape longevity, with longer use over extreme conditions possible without sacrificing safety requirements. As automation continues to play a more dominant role in defense operations, intelligent parachute systems with self-compensating navigation systems will become a priority area of future innovations. Strategic partnerships among defense contractors, government agencies, and research institutions will further expand the possibilities of the military parachute industry.

These associations will not merely augment current capability but also make it possible for innovative solutions to be integrated into practical applications. Whether through improvements in aerodynamics or advances in lightweight materials, these developments will dramatically change the efficiency and flexibility of military parachutes in the coming years. Environmental factors will also contribute to the direction of the Global Military Parachutes market. With sustainability becoming increasingly important in defense sectors, measures will be taken to minimize the environmental impact of parachute manufacturing and disposal.

Biodegradable materials and environmentally friendly manufacturing processes will be included in future procurement strategies, so that operational performance is matched with environmental stewardship. As the Global Military Parachutes market grows, its applications will extend far beyond the classical boundaries of airborne troops. Its development will be shaped by the incorporation of innovative materials, autonomous technology, and cross-domain uses. As military strategies evolve to counter contemporary challenges, the role of military parachutes will find new frontiers, further enhancing their importance in shaping the global security forces' operational environment.

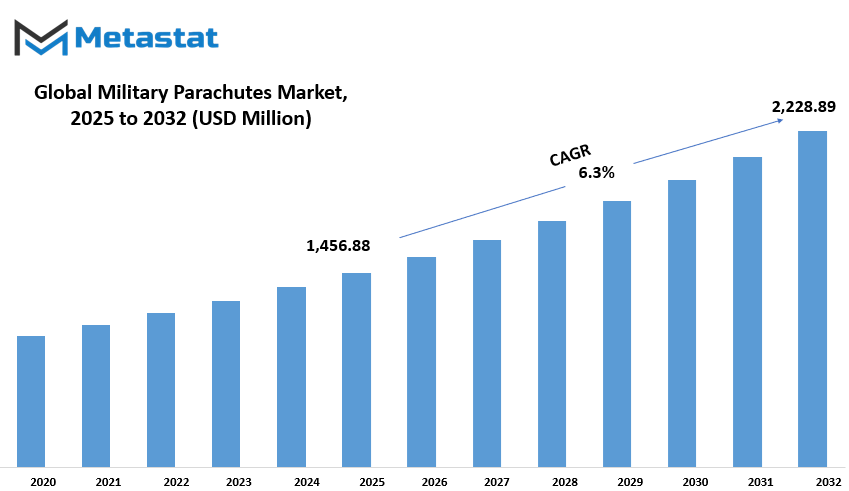

Global Military Parachutes market is estimated to reach $2,228.89 Million by 2032; growing at a CAGR of 6.3% from 2025 to 2032.

GROWTH FACTORS

The global Military Parachutes market is observing consistent growth as defense expenditure is rising consistently. Governments of the world are investing heavily in the military, thus creating a growing demand for high-tech parachuting equipment. With the armies upgrading their hardware and equipment, there is extra emphasis on equipping paratroopers and airborne troops with advanced technology. Demand for such parachutes is also supported by the increasing number of airborne and special operations when highly reliable and effective parachutes are needed to facilitate safe and efficient transport of equipment and personnel. Parachute insertion into hostile environments by special forces and quick response is prevalent in modern military tactical operations.

As global security concerns grow, militaries are placing emphasis on agility and rapid deployment capabilities. This has resulted in a higher rate of acquisition of parachuting systems that facilitate precision landing and high-altitude jump capabilities. Further, technological developments in guided parachutes are enabling more precise transportation of military troops and cargo, keeping risks to an absolute minimum in battlefields. Despite increasing demand, the industry is faced with certain challenges which could deter growth. The biggest challenge is that production and maintenance of military parachutes are too costly.

The systems have to meet high-performance standards, necessitating the use of advanced materials and strict test protocols. The expense of research, development, and continuous upgrades renders it difficult for certain defense agencies to make bulk purchases. Furthermore, maintenance costs remain high, as these parachutes need regular inspections and servicing to ensure reliability. Another obstacle is the strict safety rules and testing procedures that parachuting systems have to comply with. Because these systems are used in high-risk settings, they must be tested to a high military standard.

The bureaucratic regulatory process can serve as a brake on the availability of new technologies, hindering innovation in the industry. While safety always has to be the primary concern, the long process of regulations can dissuade manufacturers from responding to changing military requirements quickly. Meanwhile, ongoing development in extremely durable and light materials is opening up new opportunities for the market. New-generation materials and composites employed in parachutes maximize their performance through increased resistance to extreme weather conditions and use.

Not only do these technologies improve safety but also extend the life of the equipment, thereby making it a valuable investment for defense forces. With ongoing research, the evolution in materials and design will certainly drive the growth further, resulting in more efficient and effective military parachutes in the future.

MARKET SEGMENTATION

By Type

The global market for military parachutes broadens due to increasing defense technology and increasing military operations across the world. Parachutes play a very essential function in various uses in the military, including deploying soldiers, providing soldiers with supplies, and performing emergency rescue operations. With safety, precision, and dependability as the priorities, different parachutes are created for different uses to cater to the extensive needs of the military.

Among the various types, round parachutes share a dominant market value of $287.44 million. The parachutes have extensive use in training and tandem troop deployment with their stability and ease to lower with a steady speed. The parachutes have been a constant feature in military intervention for decades with an effective method of dropping equipment and humans from planes onto the ground.

Ram-air parachutes are more controllable and maneuverable. Paratroopers and special forces primarily use them to provide precise landings and greater glide distances. The parachutes are steerable and allow soldiers to navigate in the air and land precisely in desired locations. The advanced design ensures greater safety and operational efficiency, which makes them a high-risk mission favorite.

Drogue parachutes are utilized for another function, generally to stabilize objects moving at high speeds prior to the release of a main parachute. They are typically strapped onto fighter aircraft, drones, and space capsules to slow down prior to landing. They assist in deploying larger parachutes in some cases, enabling a gentle descent and prevention of damage to valuable equipment.

Cargo parachutes are necessary in military supply to enable timely and safe transport of ammunition, supplies, and heavy equipment to combat or isolated regions. Cargo parachutes support heavy loads and operate under hostile conditions, and they provide guarantees that vital supplies reach ground units. They greatly contribute to ensuring military operations via timely and credible supply drops.

Emergency parachutes provide survival equipment for pilots and crew in hazardous environments. During airplane malfunction or in-flight emergency, emergency parachutes provide a means of last resort for survival. Their rapid deployment and robust construction make them a useful part of military aviation safety procedures.

With changing global defense strategies, military parachutes are still being advanced with advanced materials and technology. Advances in aerodynamics, light material, and automatic opening mechanisms make them more efficient and reliable. With rising military budgets and emphasis on quick deployment forces, demand for advanced parachutes will continue to be strong over the next couple of years.

By Material

Across the globe, military parachutes are subject to all kinds of forces, some of which include the rising demand for materials technology, increasing defense budgets, and changing military strategies. Countries are strengthening their defense systems, and in parallel increasing demand for parachutes that are reliable and efficient. Parachutes are a backbone to several military operations ranging from troop deployments, cargo drops, and rescue operations. The integrity of performance under adverse conditions is vital for these insane parachutes, obviously, they do not fail!

Materials used to manufacture military parachutes are, by far, an influential factor in their performance. The global military parachutes market can be divided into three big divisions, Nylon, Kevlar, and Polyester. These materials have their benefits suited for special military application areas. The most widely used material, nylon, is lightweight with high tensile strength and abrasion-resistant; it is flexible yet durable in some military parachute applications. Kevlar, well known for its strength and heat resistance, will be used when increased durability and protection are desired. Polyester is less light than nylon but retains shape and stands up well to moisture and UV radiation. The choice of materials influences the overall performance and life expectancy of military parachutes, thus making sure that safety and operational requirements are achieved.

Demand for military parachutes continuously links with world security issues and military modernization programs. Improvements in airborne operations have increased contracts for advanced parachute systems in many countries. High-altitude jump military parachutes are gaining popularity with their precision-guided landings and cargo-feeding capabilities. Besides troop deployments, parachutes are used by military forces to airlift supplies in some necessary remote locations in search and rescue and humanitarian missions. Fast and functional transport of equipment and personnel is still a priority for defence forces globally.

In their steady attempt to improve parachute designs for safety, reliability and practical use by the end-user, parachute manufacturers are ever engaged in such activities. Advances in materials, aerodynamics, and deployment mechanisms all favor the subsequent generations of parachutes. Technology has led to the molding of such modern parachutes that are light, strong, and capable of standing against harsh external conditions equally like any other. All these enhancements give an edge to military personnel to carry out their missions with confidence and effectiveness.

The importance of parachute usage in defense operations remains crucial through changing military strategies. Continuous demand for parachutes of high quality combined with ever-growing advancements in materials and engineering are the primary factors sustaining the growth of this market. Military forces across the globe formulate the opinions to invest in reliable parachute systems to ensure the safe and efficient deployment of personnel and equipment in any situation.

By Deployment Type

Parachutes are an essential component of the global military parachutes market defense systems. The necessary elements in airborne operations are also safety and efficiency for conducting any or all airborne operations from troop deployment, cargo delivery, and emergency evacuation in military missions. Technology has made parachute systems transform in trustworthiness, precision, and performance.

Parachutes are classified as two systems: automatic activation parachute systems and manual activation parachute systems based on the type of deployment. Automatic activation parachutes are triggered automatically, without human intervention, after reaching a pre-defined altitude or according to a timer setting. Some features include deployment in emergencies such as bailouts of the users or states of unconsciousness in high-risk situations requiring rapid or emergency deployment.

Manual activation requires the action of the user, either upon detaching from the aircraft or at some specific altitude, by meaning of either pulling a ripcord or initiating deployment. Such parachutes give higher control to the experienced trooper as to when to release according to the requirement of the mission and existing conditions.

Globally, all countries continued investing in advanced parachute technologies for their soldiers that would enhance safety and effective mission execution. Moreover, within the last few years, quite a number of new designs and materials in parachutes have been engineered, resulting in lighter but stronger parachutes and premium maneuverability with heavy-load capabilities. Further, modernization of parachute systems is on the way to include navigation and guidance so that increasingly accurate and less risky off-target deployment can be realized.

Factors that determine the demand of military parachutes include defense budgets, military modernization programs, and geopolitical tensions. The ones that really prioritize the acquisition of parachute systems are those countries that have established functional airborne divisions. Besides, the increasing incidences to seek humanitarian assistance coupled with the natural disasters demanding relief have also boosted the demand for parachute systems that are reliable for dropping-loads in such remote or inaccessible areas.

Key players operating in this market put great effort in the research and development of next-generation parachutes to further enhance their efficiency, safety, and usability. Joint efforts between defense agencies and private enterprises resulted in the research and development of next-generation parachutes that provide greater stability and controlled descent in terms of parachute use. In addition, they employ the most stringent quality standards and ensure rigorous test procedures so that they are ready to perform in a real combat rescue practice scenario.

Military strategies, thus, change, and therefore the use of parachutes remains quite vital in the air forces of all countries. It may be on troops deployment or equipment transport or even for emergency rescues-these systems would always remain an asset within the armies. Recent developments and advancements in parachute technologies will continue boosting their worth and reliability and increasing adaptability to various operational needs.

By End-Users

The global military parachutes market is vital in contemporary defense strategies, providing indispensable support to a spectrum of military operations. Personnel and equipment would safely land through parachutes in varied combat and training scenarios. Worldwide, armed forces continue to show demand for such military parachutes as they place great emphasis on advanced technologies that would appropriately enhance safety, accuracy, and efficiency in airborne missions.

The market is classified based on end-users into Airborne Military Forces, Special Operations Forces, Defense Contractors, and Military Logistics Units. High-performance parachutes for controlled descents and precise landings are required by Airborne Military Forces so that once on the ground, they are not exposed to threats. So the Special Operations Forces work in high-risk missions and utilize maximum maneuverability and most-stealthy para operations sometimes even requiring the designs of parachutes like HALO (high-altitude, low-opening) or HAHO (high-altitude, high-opening), permitting covert insertions into hostile or sensitive areas.

Although Defense Contractors contributions in the military parachutes market are usually regarded concerning developing and supplying advanced parachute systems to armed forces, these companies generally work with the defense agencies to achieve innovation and improvements in parachute technology dealing usually with features such as guided systems, lightweight material, and enhanced load-bearing capabilities. As an example, Military Logistics Units, whose mandate is to move supplies, equipment, and vehicles, usually deploy cargo parachutes when ensuring that essential commodities are reachable to remote or combat areas. These parachutes meet some heaviness and flying conditions, with the results becoming necessary in sustaining military operations in difficult terrains.

The growing desire for speed in deployment and rapid emergency responses has necessitated improvements in the design and manufacture of parachutes. High-performance forms of modern military parachutes systems use technologically advanced fabrics, aerodynamic improvements, and automated release mechanisms to achieve superior performance and safety levels. Furthermore, countries also step up into R&D studies to develop a more efficient and durable parachute system to ensure operational superiority among their forces.

Global conflicts, geopolitical tensions, and modernization programs in defense contribute to the market volume. They also continue to make nations spend heavily on military budgets in the search to continually upgrade their airborne capabilities; hence, ever-present demand for high-quality parachute systems. In this manner, manufacturers focus on military standards for reliability improvement and increasing overall effectiveness in the products offered.

Today, the global military parachutes market is an essential part of modern warfare, as different defense strategies are applied with technological progress. This adds importance in relying upon these systems across various military sectors in a mission and operational preparedness.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,456.88 million |

|

Market Size by 2032 |

$2,228.89 Million |

|

Growth Rate from 2024 to 2031 |

6.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

Many factors such as defence budgets, technological advancements, and regional conflicts contribute to the global military parachutes market. These parachutes are absolutely fabricated for military operations like troop deployment, cargo movement, and emergency evacuation. The need for such parachutes is spawned by growing defense budgets of the different countries and transformations in the airborne equipment toward safer and efficient military personnel and supplies.

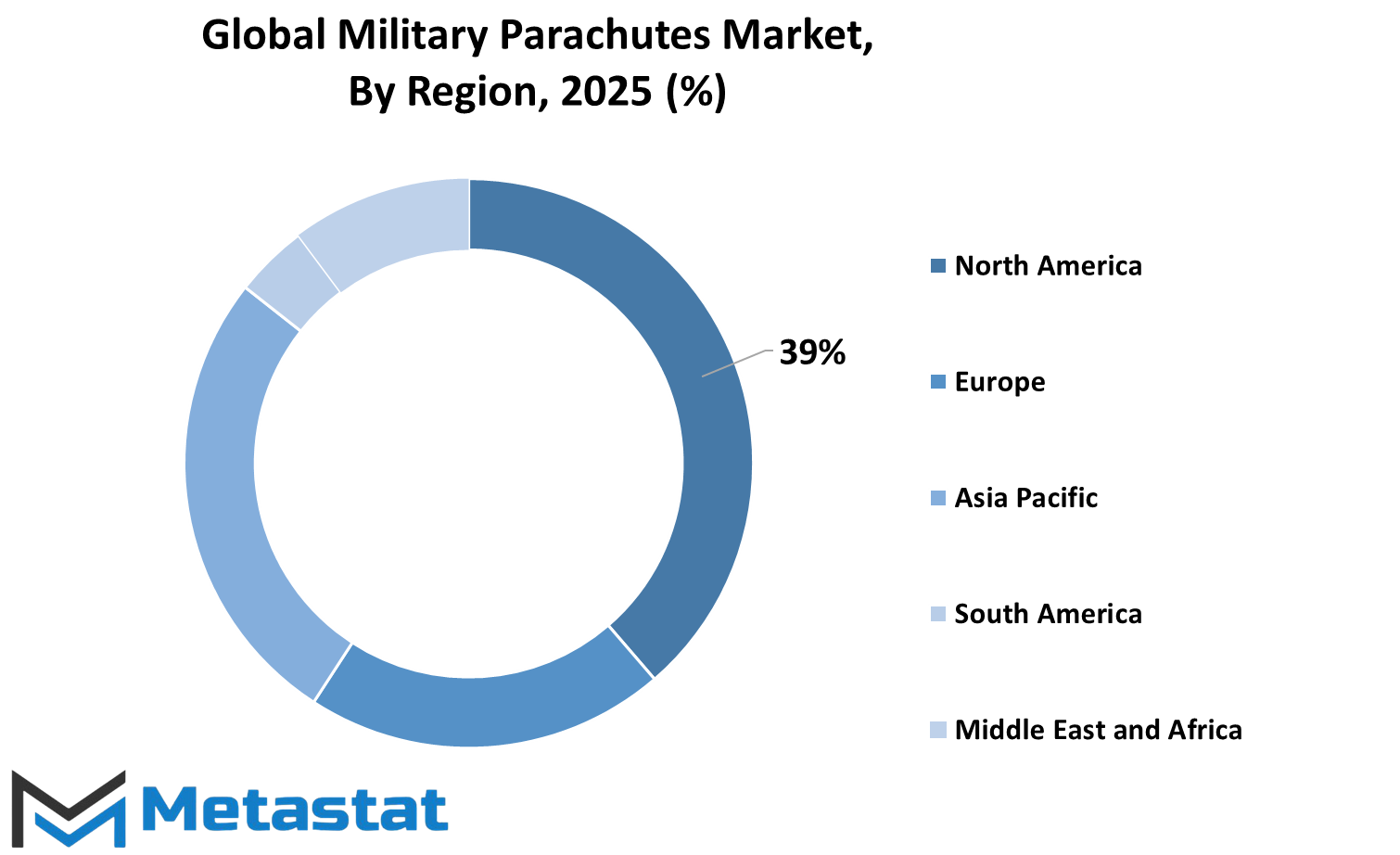

The market is also divided by geography into some major regions, and each region has a certain specific way to serve the market growth. North America continues to be the leading regional market, where the US, Canada, and Mexico have been making serious investments in military equipment, especially in the advanced parachute systems allocated major resources for the required US high safety and performance standards.

Europe still stands strong, with countries like the UK, Germany, France, and Italy collectively enhancing their defense systems. Military modernization programs and joint defense initiatives among European nations contribute to the steady expansion of the market in this area.

Asia-Pacific is another emerging market where countries like India, China, Japan, and South Korea devote their attention toward enhancing airborne capacity. All these altogether have contributed to increased investments in military parachutes due to the rising security threats and territory disputes. Further acceleration of the expansion of the market comes from improving manufacturing and the presence of major industry players. South America, currently led mainly by Brazil and Argentina, is also increasing military strength gradually, albeit with budgetary constraints, which sometimes hinder quick expansion. Nevertheless, active defense projects and joint ventures with international military suppliers help create an environment for continued market development.

The Middle East States and Africa are also significant in expanding the market, as the countries of GCC, Egypt, and South Africa are investing in military infrastructure. These countries are ramping up their airborne assets to address the regional security concerns. Military parachute demand in this region is consequently. This demand is a result of modernization in the defense systems and preparedness against inevitable threats.

The military parachutes market largely keeps shifting globally: nations are, as a matter of priorities, investing in reliable airborne options to better their defense strategies. Continuous research, development, and government support are going to shape the future of this industry. As security issues become rife across the world, securing a very efficient yet advanced parachute remains critical for any military in every region.

COMPETITIVE PLAYERS

Some of the factors which are propelling the global military parachutes market include advances in technology, modernization spending, and demands for better safety and accuracy in airborne operations. Military parachutes are used for numerous applications, such as troop deployment, cargo delivery, and emergency ejection. Countries' governments are putting in money to improve airborne ability, which translates into the increasingly updated parachute systems military forces would have to use to support missions.

The continuous demand for high-performance parachutes with higher reliability and safety is a key driving factor of the market. Modern military parachutes are lightweight, long-lasting-high-performance materials that increase performance and operational efficiency. Aeroedynamic improvements have brought improvement in control so that the accuracy of both the parachutist and cargo will be enhanced. These improvements are most necessary for special military missions requiring landings in difficult conditions.

Increased budgets of defense funds of many countries besides technical improvements have fueled growth of the military parachutes market. Many countries are spending publicly on enhancing their airborne capabilities to boost stand-in and stand-off quick response in various engagements-both combat and humanitarian missions. Such changes have a direct toll on the demand for parachutes that ultimately operate under any extreme condition yet reliable performance provided. Also, the increases center on specialization with regard to operations; thus, an increasing number of defense systems are acquiring custom advanced parachute systems for a specific mission.

The market is very much competitive, with several key players leading the industry. A few lead organizations include Airborne Systems, Zodiac Aerosafety (Safran Group), BAE Systems, Mills Manufacturing Corporation, Butler Parachute Systems, FXC Corporation, CIMSA Ingenieria de Sistemas, SPEKON (Spezialkonfektion GmbH), Parachute Systems, North American Aerodynamics, Inc., The Para Gear Equipment Co., Pioneer Aerospace Corporation, and Performance Designs, Inc. Based on current activities, these companies invest R&D in the design and manufacture of military parachutes, and innovative solutions will be introduced in place of former ones to meet changing demands in military operations.

There will likely remain a tremendous need for advanced para systems as military doctrines develop over long periods. The emphasis on airborne mobility augmented with technological improvement makes it impossible to escape expansion for the military parachutes market. Improvement in modernized infrastructures and defense programs will see the industry grow up into brighter years. Competition will play a catalyst in pushing innovation further as a result of which, and improved and reliable parachute system will be developed by the industry.

Military Parachutes Market Key Segments:

By Type

- Round Parachutes

- Ram-Air Parachutes

- Drogue Parachutes

- Cargo Parachutes

- Emergency Parachutes

By Material

- Nylon

- Kevlar

- Polyester

By Deployment Type

- Automatic Activation

- Manual Activation

By End-Users

- Airborne Military Forces

- Special Operations Forces

- Defense Contractors

- Military Logistics Units

Key Global Military Parachutes Industry Players

- Airborne Systems

- Zodiac Aerosafety (Safran Group)

- BAE Systems

- Mills Manufacturing Corporation

- Butler Parachute Systems

- FXC Corporation

- CIMSA Ingenieria de Sistemas

- SPEKON (Spezialkonfektion GmbH)

- Parachute Systems

- North American Aerodynamics, Inc.

- The Para Gear Equipment Co.

- Pioneer Aerospace Corporation

- Performance Designs, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252