Global Aerospace Composites Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

What role will superior composites play in redefining plane performance and sustainability because the aerospace enterprise movements towards greener technologies, and how may this shift assignment conventional fabric alternatives? Could sudden disruptions in supply chains or raw cloth availability adjust the increase trajectory of the aerospace composites marketplace, opening the door to opportunity improvements and partnerships?

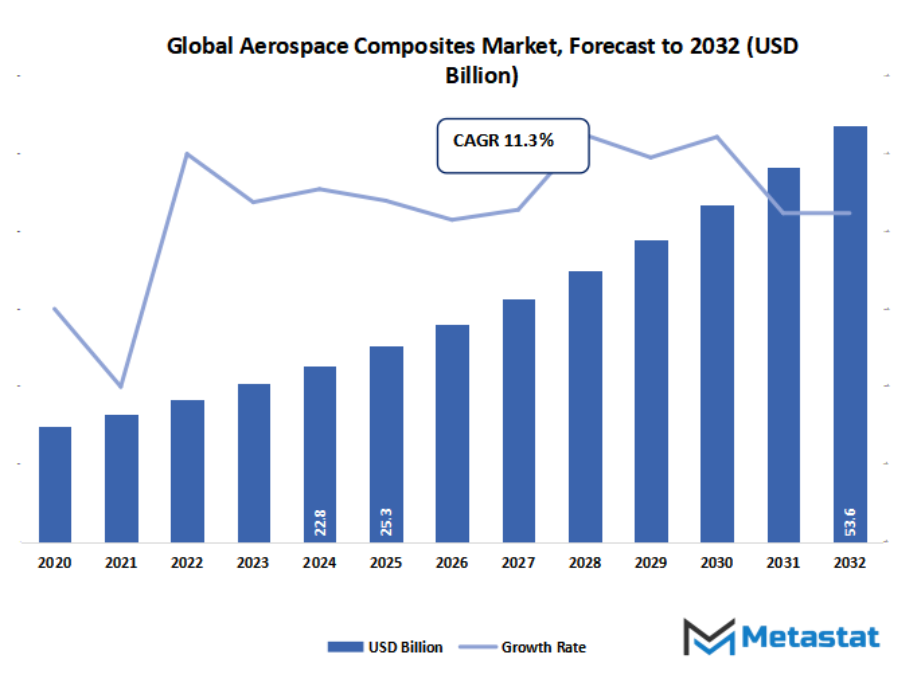

- Global aerospace composites market valued at approximately USD 25.3 Billion in 2025, growing at a CAGR of around 11.3% through 2032, with potential to exceed USD 53.6 Billion.

- Carbon account for nearly 64.8% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Intense industry focus on fuel efficiency and emissions reduction through lightweighting., Rising production rates of next-generation aircraft (e.g., narrow-body jets).

- Opportunities include Growing adoption in urban air mobility (e.g., eVTOLs) and satellite structures.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The global aerospace composites market will be an industry that goes far beyond the realm of traditional manufacturing. In the approaching years, the arena will not just recognition on developing lighter or stronger substances but will dictate the way complete flight systems are developed and optimized. Aerospace composites will now not be relegated to structural reinforcement by myself; they may increasingly form how aerodynamics, thermal resistance, and gasoline usage are treated in aircraft development. This shift will not only optimize aircraft efficiency but will reshape the very foundations on which engineering decisions are based.

What is so extraordinary about this industry's future is the way it will stretch into realms traditionally relegated to secondary status by today. Repair and maintenance procedures will be revolutionized as composites will require new techniques of recycling and cutting-edge inspection technology. Manufacturers and airlines will come to regard recycling composites as a part of normal business instead of an afterthought, and sustainable processes will be a byproduct of production cycles. This will shape an environment where material afterlife matters just as much as material performance in the first place.

Market Segmentation Analysis

The global aerospace composites market is mainly classified based on Fiber Type, Aircraft, Application.

By Fiber Type is further segmented into:

- Carbon - Carbon fiber will play a dominant component in the global aerospace composites market as weight loss and strength are set to outline next-era aircraft designs. With heightened gas performance requirements, carbon fibers will locate wider adoption, facilitating sustainable aviation whilst bearing in mind modern aerostructures and novel aircraft configurations.

- Glass - Glass fiber will remain pertinent in the global aerospace composites market because of its affordability and versatility in secondary structures. Although it is not as robust as carbon, it will still serve a range of aerospace applications, especially cabin structures and some components where durability and cost are considerations.

- Aramid - Aramid fiber will experience expanded use in the global aerospace composites market because of its high heat and impact resistance. With tightening safety standards, this product will find major use in developing protective layers and key aerospace systems, with reliability in defense and commercial aviation applications.

- Others - Other types of fibers will appear in the global aerospace composites market as research continues. Hybrid composites and advanced materials will enable more customization of performance. The requirements for exact strength-to-weight ratios and flexibility will spur innovations, enabling manufacturers to have more options available for specialized aerospace use.

By Aircraft the market is divided into:

- Commercial Aircraft - The global aerospace composites market will witness commercial aircraft continuing to lead usage. Airlines will favor lighter airframes to reduce fuel consumption and emissions. Growing passenger demand and sustainability requirements will propel higher usage of composites, especially in large commercial fleets to balance efficiency and operating expenditures.

- Military Fixed Wings - Military fixed-wing aircraft will create constant demand in the global aerospace composites market because of the need for stealth, agility, and survivability. High-performance composites will offer lightweight structures and better strength, which will be essential in high-performance combat aircraft where mission effectiveness and resilience are still paramount.

- Business Aircraft - The global aerospace composites market will grow with business aircraft as high-performance, lightweight materials guarantee improved fuel savings and range. Luxury private travel will drive demand for more efficient yet luxurious private transport as manufacturers incorporate superior composites, merging comfort with structural integrity to enhance the changing demands of this specialized market.

- General Aviation - General aviation will continue to support the global aerospace composites market by emphasis on value-effective, safe, and efficient travel solutions. Composites will find broad application in small aircraft design, promoting enhanced aerodynamics, fuel efficiency, and maintenance ease, as well as supporting the increasing accessibility of private and recreational aviation.

- Jet Engines - The global aerospace composites market will experience more and more high-level integration of composites in jet engines. Heat resistance, lighter weight, and longer lifecycle performance will make composites an essential element. Since aircraft makers will look for improved efficiency, the usage of composites in turbine blades and housings will become much more significant.

- Helicopter - Helicopters will depend significantly on the global aerospace composites market to improve maneuverability, noise reduction, and fuel economy. Composites will make rotor blades, fuselage elements, and internal structures stronger, allowing for enhanced performance in both civil and defence uses while satisfying the needs of vertically accelerating technology.

- Others - Other segments of aircraft will make up the global aerospace composites market by incorporating custom composite materials for individual missions. Unmanned aircraft vehicles, space exploration, and testing vessels will continue to take advantage of composites, which demonstrate the versatility of these materials to address various aerospace innovation needs.

By Application the market is further divided into:

- Exterior - The World Aerospace Composites Market will target exterior uses where strength, durability, and weight reduction are paramount. Composites will be predominant on aircraft skins, wings, and fuselage structures. The future will be marked by greater resistance to environmental stress, guaranteeing safety and efficient operation under increasingly demanding global flight regimes.

- Interior - Interior uses will keep influencing the global aerospace composites market, with lightweight cabin components, seats, and panels providing improved passenger comfort and energy efficiency. Fire resistance, sound attenuation, and design versatility will dominate the drivers of adoption, rendering interiors sustainable as well as responsive to changing passenger desires.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$25.3 Billion |

|

Market Size by 2032 |

$53.6 Billion |

|

Growth Rate from 2025 to 2032 |

11.3% |

|

Base Year |

2024 |

|

Regions Covered |

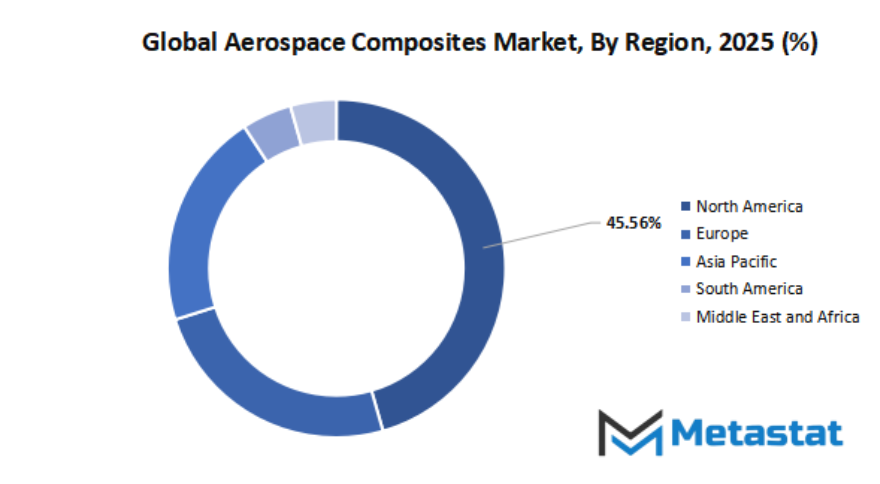

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Geographic Dynamics

Based on geography, the global aerospace composites market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

global aerospace composites market is gradually defining the aviation and defense sector's future. Advanced materials are increasingly being utilized since aircraft manufacturers continually look for lighter, stronger, and more efficient solutions. Aerospace composites are not only a technological preference but also mandatory as companies globally transition toward emission reductions and increased performance. The market will keep experiencing attention from both veteran players and emerging entrants, which will make the market scenario dynamic with possibilities of growth and innovation.

This market is special in that it has a combination of global leaders and regional players who are discovering ways to leave their own imprint. Large companies like LMI Aerospace, Inc., Owens Corning, Hexcel Corporation, Solvay S.A., Toray Advanced Composites, and Teijin Limited have established themselves as reliable providers with consistent quality and long-term R&D investments. In their footsteps, companies like SGL Carbon, Mitsubishi Chemical Corporation, VX Aerospace Corporation, and Unitech Aerospace are growing their bases and finding their niches in various parts of the market. This combination of global leaders and new entrants will make the industry not stagnant but continue to advance with novel materials and applications.

The application of aerospace composites will not just enhance aircraft efficiency but also the cost-effectiveness of production. Lightweight without compromising strength is one of the primary reasons that these materials are so coveted, as even a modest weight reduction for an aircraft translates into immense savings in fuel and operation overall. Companies also are currently using composites to increase the longevity of aircraft structures, which will ultimately reduce airline and defense sector maintenance costs. With producers under pressure to provide high-performing planes, composites will probably become increasingly prevalent in commercial and military fleets.

The competitive dynamics of the market will persist in being robust as firms keep pushing their experience and experimenting with new applications. Global leaders will shape massive-scale trends, and small regional players will introduce niche answers and specialised paintings. Combined, these drivers will build a marketplace to be able to maintain to command investor and policymaker attention, positioning aerospace composites as an imperative participant inside the aviation destiny.

Market Risks & Opportunities

Restraints & Challenges:

Extremely high material and manufacturing costs (e.g., autoclave curing). - The global aerospace composites market will persist below strain from high manufacturing charges, particularly due to sophisticated processes together with autoclave curing. These technology, even as important for precision and power, require extensive funding, perhaps restricting get right of entry to for smaller producers. Except that different cost-effective technology emerge, charges will remain a restricting thing.

Complex certification processes and stringent safety requirements. - Strict standards for aviation will define the global aerospace composites market, as each element need to go through sizable testing and certification. Certification requirements take time, assets, and complicated knowledge, making it tough for novices to compete. Innovation in the future will ought to align state-of-the-art cloth performance with compliance, or development might be slowed.

Opportunities:

Growing adoption in urban air mobility (e.g., eVTOLs) and satellite structures. - The global aerospace composites market will be favoured with growth in city air mobility and satellite building. Durable yet lightweight composites will increase efficiency for electric vertical take-off and landing aircraft and advanced spacecraft. Demand for cutting-edge materials will grow in these industries, opening opportunities that reimagine aerospace transport and connectivity.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 25.3 Billion in 2025 to over USD 53.6 Billion by 2032. Aerospace Composites will maintain dominance but face growing competition from emerging formats.

In addition to the legacy airplane, the global aerospace composites market will branch out into future aerospace initiatives like unmanned systems and space exploration vehicles. Those same materials used for commercial aircraft today will, in the future, comprise the framework for spacecraft that operate in extreme environments. This will redefine the way the industry aligns itself, shifting from an aviation-focused industry toward a more expansive aerospace horizon. As the edges of the industry keep expanding, the market will not be considered in isolation anymore using the perspective of aviation demand but as a force that drives the destiny of aerospace innovation to come. Its expansion beyond the present scope will mark a redefinition of what humans imagine air and space travel itself to be.

Report Coverage

This research report categorizes the Aerospace Composites market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Aerospace Composites market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Aerospace Composites market.

By Fiber Type:

- Carbon

- Glass

- Aramid

- Others

By Aircraft:

- Commercial Aircraft

- Military Fixed Wings

- Business Aircraft

- General Aviation

- Jet Engines

- Helicopter

- Others

By Application:

- Exterior

- Interior

Key Global Aerospace Composites Industry Players:

- LMI Aerospace, Inc.

- Owens Corning

- Hexcel Corporation

- Solvay S.A.

- Toray Advanced Composites

- Teijin Limited

- SGL Carbon

- Mitsubishi Chemical Corporation

- VX Aerospace Corporation

- Unitech Aerospace

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252