MARKET OVERVIEW

The global apron bus market and industry will establish a niche category of ground transportation oriented toward airport operations, where between-aircraft stand and terminal building passenger mobility is critical. This market will provide transportation solutions specifically designed to meet busy apron airport needs, where conventional transit buses cannot operate with the same degree of efficiency or operational fit. Apron buses, or airport shuttle buses, will be a key component of airside logistics, designed to operate through aircraft parking areas with safety, speed, and accuracy.

Product engineering and design in this market will center on capacity, maneuverability, and adherence to aviation safety procedures. Unlike typical city buses, apron buses will have wider doors, low-floor boarding, and strengthened bodies to ensure uninterrupted operation under tough conditions. They will frequently shuttle passengers over the tarmac in a climatized environment, with less disruption and delay, and where boarding and deboarding are managed with less disturbance to flight scheduling. The global apron bus market will be part of a wider movement within aviation to enhance the efficiency of passenger handling, alleviate terminal congestion, and simplify turnaround times.

Manufacturers will create apron buses with bespoke features to accommodate diverse airport configurations and traffic volumes. These buses will be designed for easy integration within airport operations, with models that accommodate high-density passenger loads and premium-class setups. Automatic ramps, climate control units, and ergonomic seating will maximize passenger comfort and accessibility. Customized solutions for extreme climates in certain regions will also be crucial to ensuring smooth performance under extreme temperature conditions and high operation cycles.

Geographically, the global apron bus market will grow as a result of investments and modernization within airport infrastructure. International airports, regional airports, and military airbases will all be different segments of demand. Large-sized airports of North America, Europe, and Asia will demand high-capacity, state-of-the-art vehicles, whereas smaller or emerging terminals will demand cost-saving models that are compliant with regulations without unnecessary complexity. Regional purchasing decisions will be guided by the local environmental regulations, airport authority requirements, and supply networks.

The sector will address these diverse requirements through modularity of vehicle platforms, providing operators with some customization at minimal lead times. Powertrain solutions, such as electric and hybrid options, will be configured in accordance with the drive for cleaner apron operations. Charging infrastructure, battery life, and optimizing range will influence the way apron buses are deployed at airports that seek to minimize their carbon footprint.

Distribution and aftermarket support will be addressed by manufacturers, who will establish global service footprints through local partnerships and service agreements. Spare parts, training programs, and real-time diagnostics will be key to high fleet uptime and retaining operational standards. Leasing models, extended warranties, and digital fleet management systems will provide additional value for airport operators requiring performance reliability and total cost predictability.

The global apron bus market will also continue to hold prominence in the aviation ground support services industry, realigning itself with the changing needs of airport facilities and operational methodology. As volumes of air traffic increase and passengers' preferences change, the global apron bus market will keep providing transport solutions that ensure safety, efficiency, and hassle-free airside mobility.

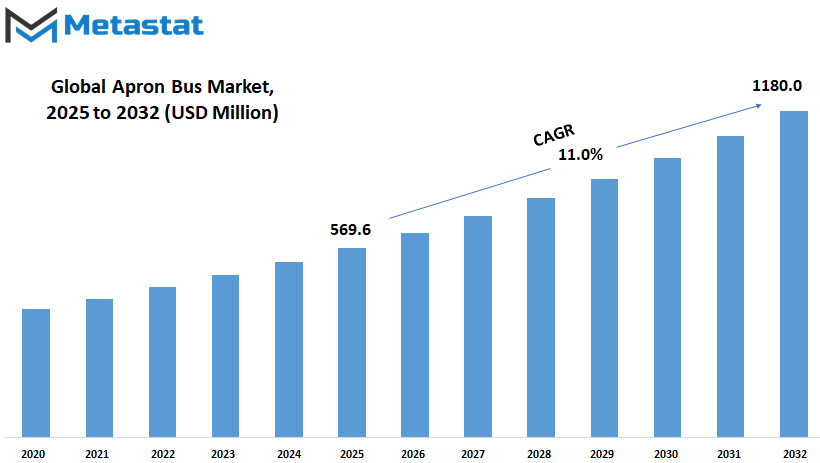

Global apron bus market is estimated to reach $1180.0 Million by 2032; growing at a CAGR of 11.0% from 2025 to 2032.

GROWTH FACTORS

The global apron bus market will continue to grow steadily over the years because of a combination of demand-led alterations and airport operational improvements. With global air traffic on the rise, there is an increased need for more effective ground transportation within airports. Apron buses assist in carrying passengers between terminals and planes, particularly in areas where jet bridges are not present. This role becomes ever more critical at congested airports, where time, space, and safety are constantly under strain. As airport facilities become increasingly stretched, apron buses provide an efficient solution to alleviate congestion and keep travelers flowing efficiently.

One of the key drivers of growth in the global apron bus market is the increasing volume of flights and growing airport activities. As more individuals travel by air for personal and commercial purposes, airports have to cope with increased passenger numbers. Apron buses fill that gap without requiring costly adaptations of buildings or floor plans. A second important consideration is growing emphasis on passenger comfort and experience. Most airports and airlines are now investing in apron buses that provide improved interiors, smoother rides, and timely schedules to enhance the way passengers feel about their trip.

Alternatively, the global apron bus market may encounter some setbacks that will hinder its advancement. Excessive costs associated with the maintenance and replacement of these buses may discourage some airport authorities from upgrading or growing their fleets. Also, stringent regulations and environmental issues may be a challenge, particularly where countries are transitioned to cleaner modes of transport. The limitations might force manufacturers to produce buses conforming to newer standards, which takes time and investment to comply with.

Nevertheless, the future holds promising prospects for the global apron bus market. The demand for greener transport as well as electric cars is set to redefine the construction and operation of apron buses. Several firms are already piloting battery-powered buses that offer lower emissions and cost savings in the long term. In the years to come, airports might have to depend more on such alternatives not only to comply with regulations but also to enhance their reputation and cut operating expenses. Smart technology might also render apron buses more effective, with real-time tracking and scheduling systems helping to coordinate better. They indicate that, despite the hurdles, the global apron bus market is highly promising for development and innovation in the future years.

MARKET SEGMENTATION

By Type

The global apron bus market is showing consistent growth as airports all around the world continue to look for ways to enhance their ground support services. As sustainability and efficiency become increasingly important, the need for apron buses has increased further. These buses, which are used to transport passengers between terminals and aircraft, are an indispensable component of the entire air travel process. In addition to supply chain efficiency and dependability, they ought to be designed so as to promote the general air travel experience.

Their functionality, in addition to increasing airport expansions, is driving wider adoption and usage in many countries. An increasing number of airports are not only prioritizing functionality but also the ecological ramifications of operation. As a result, the shift towards hybrid and electric apron buses is growing. Hybrid and electric vehicle are becoming more popular for their capacity to reduce fuel intake and emissions.

This is especially applicable for airports that are under pressure to support stricter environmental regulations. By switching to such alternatives, airport operators are not only meeting compliance needs but also improving their public image. The electric segment, specifically, is likely to play a growing function due to reduced operating costs in the long run. While these vehicles may need higher money upfront, their long-term benefits, such as reduced maintenance requirements and smaller power cost, make them an attractive choice. Hybrid buses, however, are presenting a cost-effective leap for airports that do not yet have a possibility to completely transition to electric but still need to reduce emissions. The future of the global apron bus market will be influenced by developments in battery technology, more intelligent charging systems, and more refined design elements aimed at passenger comfort and driver protection.

As the cities of the world grow larger and more reliant on air travel, the demand for cleaner and efficient ground solutions will be greater. Government and airport authorities also introduce new policies to encourage the use of clean energy vehicles, which will maintain the global apron bus market. Apron bus manufactures will probably make more effort to create models that meet such demands without raising prices too high. Overall, the global apron bus market is poised to flourish. With growing concerns for the environment, rising air traffic, and smart airport planning, the use of electric and hybrid apron buses will be on the rise. It's an indication that the ground transport industry at airports is poised to change and get better with cleaner and smarter solutions dominating the headlines.

By Sales Channel

Hybrid and electric models are gaining popularity due to their ability to decrease fuel consumption and lower emissions. This is particularly relevant for airports that are under pressure to accommodate tougher environmental regulations. By making the switch to these alternatives, airport operators are not only fulfilling compliance requirements but also enhancing their public perception. The electric segment, in particular, is poised to play an increasing role because of diminished operating expenditures over the long term. Although these cars might require more money initially, their long-run advantages, like fewer maintenance needs and lower power cost, make them a compelling option. Hybrid buses, however, are presenting a cost-effective leap for airports that do not yet have a possibility to completely transition to electric but still need to reduce emissions.

The future of the global apron bus market will be influenced by developments in battery technology, more intelligent charging systems, and more refined design elements aimed at passenger comfort and driver protection. As the world's cities become more populous and increasingly dependent on air transport, there will be a greater need for ground solutions that are efficient and cleaner. Government and airport administrations also launch new policies to promote the adoption of clean energy vehicles, which will sustain the global apron bus market. Manufactures of apron buses will likely make greater efforts to produce models that satisfy these demands without increasing prices too significantly.

In totality, the global apron bus market is well-placed to thrive. As environment concerns grow, increasing air traffic, and advanced airport planning, the adoption of electric and hybrid apron buses will increase. It's a signal that the airport ground transport industry is set to transform and improve, with greener and smarter solutions taking center stage.

By Application

The global apron bus market will keep expanding steadily, driven by the heightening emphasis on passenger convenience and the demand for more efficient airport transportation. As air transport becomes more accessible and rampant, airports continually work towards optimizing their infrastructure to accommodate the growing number of passengers. Apron buses are important in this endeavor by filling the gap between terminals and aircraft. Their capacity to carry passengers straight over the tarmac makes them vital in instances where jet bridges are unavailable or impractical owing to airport design or traffic.

A significant driver of the global apron bus market future growth will be the way airports are responding to technological shifts and passenger demands. Airports, big and small, are compelled to streamline travel and make it quicker. Domestic airports tend to use apron buses to handle short-haul flight traffic with minimal strain on fixed infrastructure. However, international airports are spending more on sophisticated bus systems that offer improved comfort, accessibility, and capacity. Demand for these buses in international environments will probably increase as world connectivity enhances and airports seek to modernize without the need for colossal construction.

Sustainability is also a critical factor. Most airports globally are striving to minimize their carbon footprint. This transition is forcing manufacturers into producing apron buses that consume cleaner forms of energy, i.e., electric or hybrid engines. These are not just about complying with environmental regulations but also about informing the airport experience to conform to the increasing interest by the public in environmentally friendly ways of traveling.

Future airports will be built with scalability and flexibility. Apron buses provide a utilitarian approach that can shift to various levels of passengers without huge investments in modifying the current airport design. This level of flexibility will be highly relevant as passenger travel patterns change and as some airports seek to grow their demand without growing their footprint.

With the accelerating rhythm of urbanization and the growth of air transport in hitherto under-served areas, apron buses will become increasingly precious. The global apron bus market will be influenced by innovation, customer demand, and the demand for cleaner, more flexible transportation modes. As airports continue to juggle cost, convenience, and sustainability, apron buses will be a sensible and fundamental aspect of airport operations globally.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$569.6 million |

|

Market Size by 2032 |

$1180.0 Million |

|

Growth Rate from 2025 to 2032 |

11.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

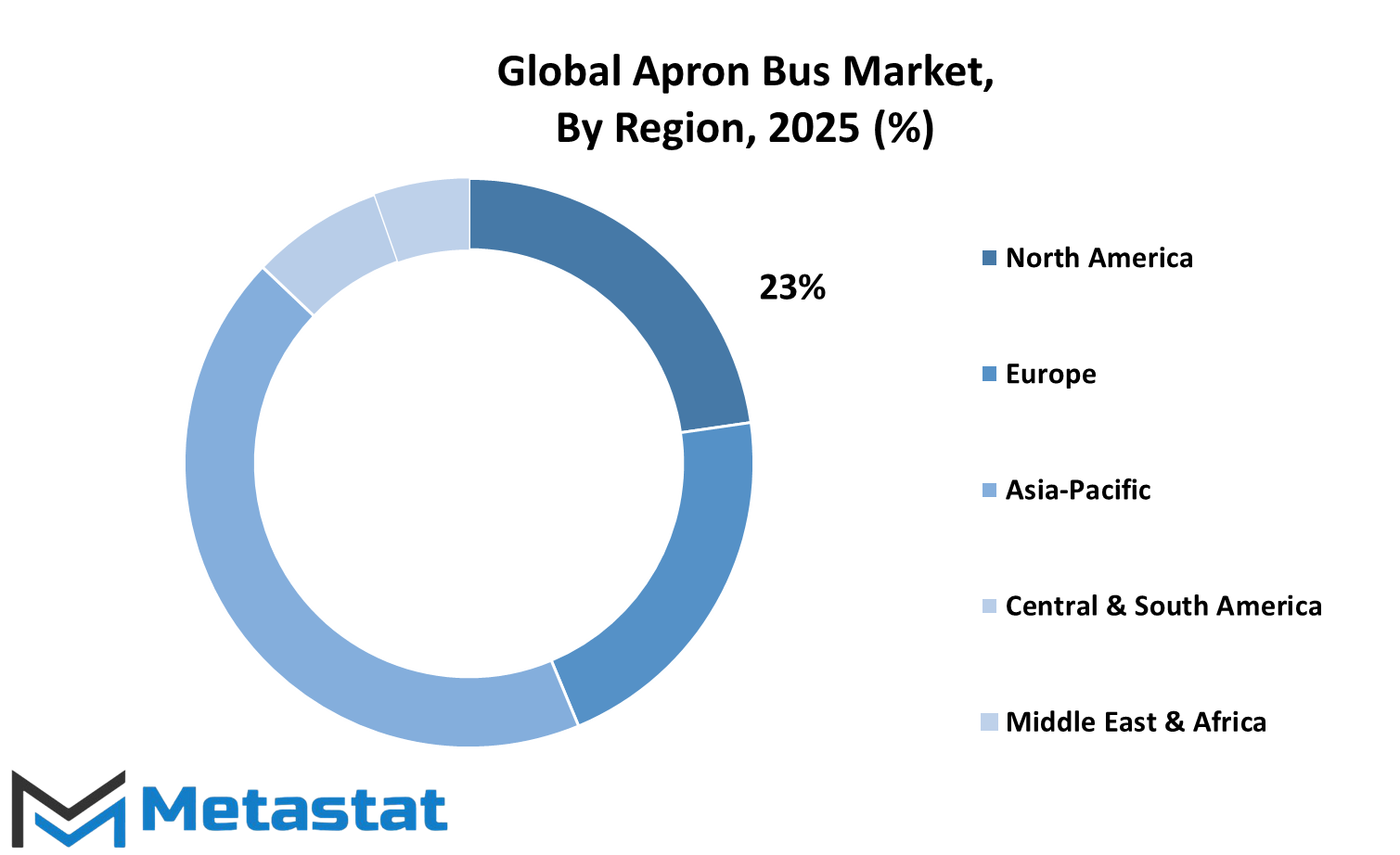

The global apron bus market is increasing gradually as airport infrastructure keeps on improving across the globe. As airports get busier and air travel becomes more prevalent, apron buses will have an increasing role in linking passengers to planes efficiently. These buses are frequently utilized in airports that lack jet bridges or where planes are positioned far from the terminal. With the increasing number of visitors and widening air routes, the demand for apron buses will rise in every region.

Considering the future, various regions will see this growth in various ways. North America, encompassing the U.S., Canada, and Mexico, is likely to keep investing in airport development. The U.S. particularly is modernizing many regional and international airports, which will, in turn, generate demand for apron buses. In Canada and Mexico, also airport authorities are starting to pay greater attention to improving passenger handling and minimizing delays, both of which apron buses promote.

In Europe, the emphasis is now placed on enhancing airport efficiency and sustainability. The UK, Germany, France, and Italy are all making efforts to upgrade their older airport transport systems to more environmentally friendly and modern ones. There is increased usage of apron buses with electric or hybrid power, and this should increase in the future as well. These developments are being implemented not only in big airports but also in smaller regional airports throughout the rest of Europe.

Asia-Pacific, including India, China, Japan, South Korea, and neighbouring nations, is experiencing some of the most rapid airport expansion. With air travel becoming increasingly accessible to more people, the need to process large volumes of passengers economically is increasing. Apron buses offer a convenient and adaptable solution, particularly in growing airports where permanent infrastructure is scarce or being built. Such a demand is likely to increase as new airports start up and existing ones expand.

In South America and Brazil and Argentina, airport modernization is on the cards. Economic growth and more global travel are compelling airport authorities to implement improved ground transportation options. Apron buses are an economical and reliable solution to this requirement.

In Middle East & Africa, specifically in the GCC nations, Egypt, and South Africa, investment in airports is gaining traction. New airports are being constructed, while existing ones are being upgraded, and apron buses will be a major contributor to improving the efficiency and smoothness of passenger transit. The more these regions develop, the greater their requirement for state-of-the-art ground transport will become.

COMPETITIVE PLAYERS

Through the next several years, the global apron bus market will keep building momentum as airports globally focus more emphasis on improved and passenger-centric ground transportation modes. These buses are crucial in transporting passengers between terminals and planes, particularly where jet bridges are restricted or not viable. The increasing need for enhancing passenger experience, decreasing wait times, and maximizing turnaround time for planes has created increasing demand for efficient apron buses that are reliable, roomy, and eco-friendly. As air traffic grows, especially in developing countries, the demand for improved airside transportation will keep increasing.

Various companies are playing an active role in determining the course of the global apron bus market. Every player has its own competencies, tactics, and ideas about the future. Players like AB Volvo and BYD Motors Inc. have made it their mission to create cleaner and more environmentally friendly models, employing electric-powered buses that minimize emissions and costs of operation. The same applies to COBUS Industries GmbH, which is well known for its expertise in apron buses, continually improving its models according to changing airport requirements. Xinfa Airport Equipment Ltd. has gradually increased its presence by concentrating on flexible designs suitable for high-density airports, particularly in Asia.

Some of the other contributors, such as Mallaghan GSE and Solaris Bus & Coach sp z oo, are still presenting updates that combine durability with comfort for passengers. Their models are designed to accommodate regular stops, rapid loading, and extended running hours without involving compromise on safety or convenience. BMC Otomotiv Sanayi ve Ticaret A.Ş. and Yutong Bus Co., Ltd. are placing greater emphasis on regional customization, making their products comply with local regulations and airport standards. Such measures provide them with a competitive advantage in their focus on markets.

While this is happening, TAM-Europe Ltd and Azad Coach Pvt. Ltd. are going from strength to strength through collaborations and innovations, providing good-quality products at affordable prices. Firms such as Ashok Leyland Ltd., Isuzu Motors Ltd., and MAN Truck & Bus SE have decades of experience in producing vehicles, and this enables them to produce apron buses with high-performance levels and compatibility with the entire world.

In the years to come, competition in the global apron bus market will only increase. With advances in technology and sustainability on the forefront of everyone's minds, these companies will invest significantly in cleaner engines, automated systems, and smart transport features. As airports continue to evolve, the competition between these companies to provide faster, safer, and cleaner apron buses will become more crucial than ever.

Apron Bus Market Key Segments:

By Type

- Electric and Hybrid

- Fuel

By Sales Channel

- Direct Sales

- Distributor

By Application

- Domestic Airport

- International Airport

Key Global Apron Bus Industry Players

- AB Volvo

- BYD Motors Inc.

- COBUS Industries GmbH

- Xinfa Airport Equipment Ltd.

- Mallaghan GSE

- Solaris Bus & Coach sp z oo

- BMC Otomotiv Sanayi ve Ticaret A.Ş.

- Yutong Bus Co., Ltd.

- TAM-Europe Ltd

- Azad Coach Pvt. Ltd

- Ashok Leyland Ltd.

- Isuzu Motors Ltd.

- MAN Truck & Bus SE

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252