Global Medical Helium Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

As clinical imaging and breathing remedies maintain to boost, how will the growing dependence on helium push the industry to innovate amidst a constrained worldwide deliver? With ongoing issues over helium shortages, ought to new extraction technology or recycling methods reshape the marketplace’s future and decrease uncertainty for healthcare vendors? As demand grows throughout hospitals and diagnostic facilities, how may fluctuating expenses and supply disruptions affect lengthy-time period making plans and investment inside the clinical quarter?

- The global medical helium market valued at approximately USD 2935.4 million in 2025, growing at a CAGR of around 7.2% through 2032, with potential to exceed USD 4777.6 million.

- Liquid Helium account for nearly 69.9% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing global installation and usage of MRI systems in diagnostics., Expansion of minimally invasive surgeries using helium-based laser systems.

- Opportunities include Development of helium recapture and recycling systems for healthcare facilities.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The global medical helium market and its industry will move far beyond the boundaries that define its current use, gradually shaping a future where this rare gas influences innovation in ways that will feel almost invisible yet deeply impactful. As healthcare structures grow more dependent on technology that call for balance, purity, and precision, helium will take on a role that stretches beyond acquainted clinical imaging packages. Researchers will discover new ways to use helium in superior cooling systems, permitting gadget to feature with extra performance and balance, especially in settings in which constant performance could be critical. This shift will inspire hospitals and laboratories to rethink how they control their resources, guiding them towards answers a good way to assist long-term technological boom.

In the coming years, the industry can even flow closer to greater thoughtful sourcing and recycling practices. This trade will assist now not handiest the sustainability of the gas however additionally impact how institutions plan for operations. With global demand increasing, companies will start to invest in systems that capture and reuse helium, taking what was once considered a temporary asset into a long-term resource. Such changes will gradually reshape supply networks and offer new opportunities for collaboration between scientific communities and industrial partners.

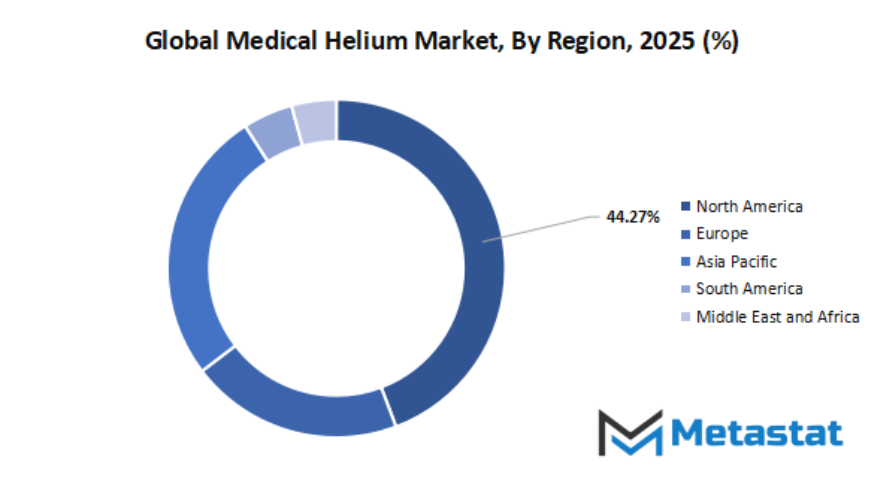

Geographic Dynamics

Based on geography, the global medical helium market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Market Segmentation Analysis

The global medical helium market is mainly classified based on Product Type, Application, Distribution Channel, End-User.

By Product Type is further segmented into:

- Liquid Helium

Liquid helium will continue to support advanced cooling needs across healthcare systems connected to the global medical helium market, with growing demand driven by the growth of imaging technologies. Growing attention toward smoother operational efficiency will encourage wider adoption as healthcare providers push toward stable, long-term solutions supported by reliable temperature control for critical equipment.

- Gaseous Helium

Gaseous helium will preserve to play an important position inside the global medical helium market, due to the fact that various scientific packages require its solid and inert residences. Greater concerns about safety, a controlled deliver, and regular pressure will direct wider use as healthcare infrastructure movements towards better precision for tactics requiring dependable fuel stability and purity.

By Application the market is divided into:

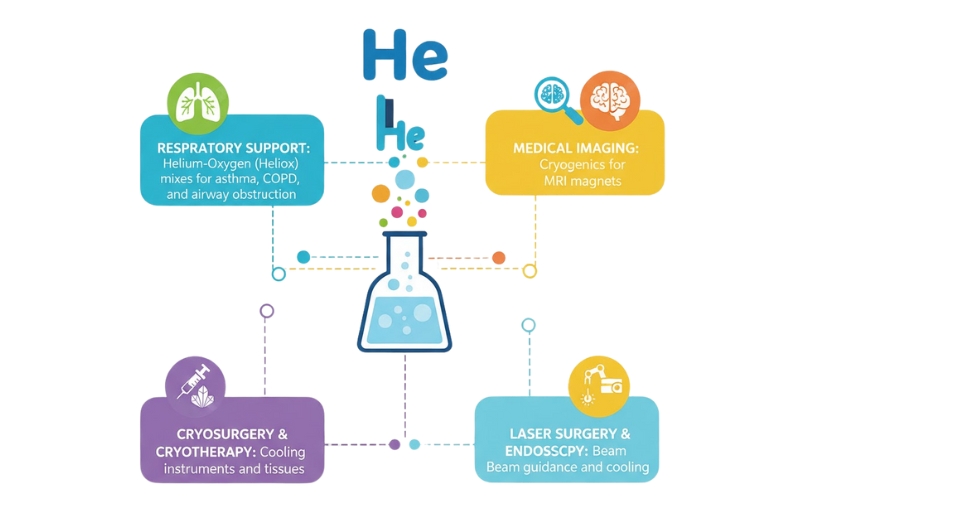

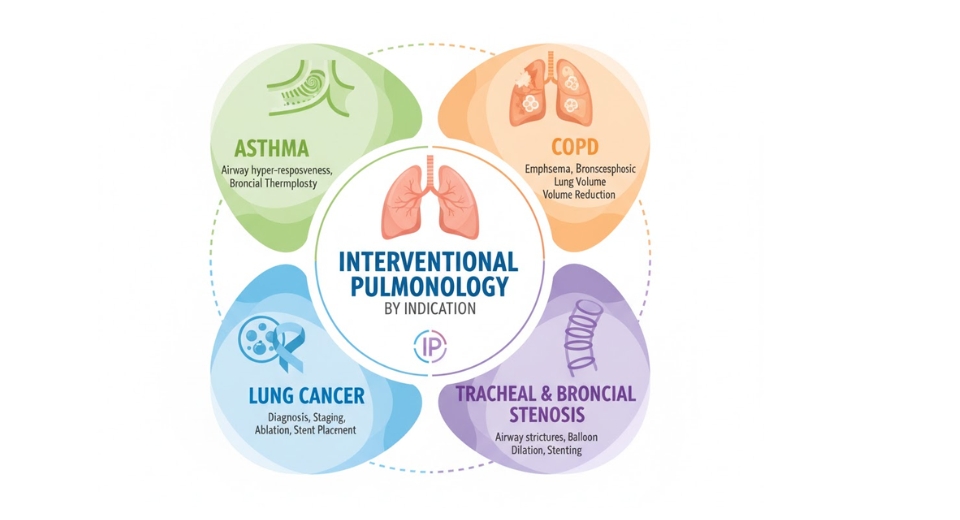

- Magnetic Resonance Imaging (MRI)

Magnetic Resonance Imaging will hold to anchor a huge percentage of the global medical helium market, supported with the aid of rising installations of advanced scanners. Future improvements in clinic networks will power more potent reliance on helium-based cooling structures and encourage innovation that supports reduced consumption and smoother system overall performance throughout increasing diagnostic departments.

- Nuclear Magnetic Resonance (NMR) Spectroscopy

NMR Spectroscopy will keep to see growth in the global medical helium market because of an increase within the analytical skills of research institutions. Increasing clinical exploration will necessitate fairly solid cooling and operational consistency, strengthening call for helium helping correct molecular analysis across pharmaceutical development, organic research, and fabric studies.

- Cryogenics

Cryogenic applications will strengthen the overall momentum of the global medical helium market, as growing attention is paid to advanced preservation, experimental research, and cooling technologies. Increased adoption across medical storage systems and scientific setups will motivate continuous innovation that supports high-performance refrigeration environments driven by dependable helium usage.

- Others

Other applications in the global medical helium market will see a steady advancement as new techniques in both healthcare and scientific fields propel the controlled use of helium. Growth will continue to emerge from specialized procedures, niche treatments, and emerging technologies tied to dependable, safe, and contamination-free gaseous environments within sophisticated operational platforms.

By Distribution Channel the market is further divided into:

- Direct Sales

Direct sales routes in the global medical helium market will increase due to large healthcare institutions seeking uninterrupted supply and better relations with vendors. Increasing demand for predictable delivery schedules and guaranteed quality will lead providers to seek out long-term contracts to ensure seamless medical and research operations.

- Distributors

The networks of distributors that link to the global medical helium market will keep on expanding due to the demand from smaller facilities looking for flexible access and broader regional availability. Strong demand from mid-scale hospitals, diagnostic setups, and laboratories will further boost the distributor-driven supply structures to enhance outreach and ensure consistent product accessibility.

By End-User the global medical helium market is divided as:

- Hospitals

Hospitals will continue to be one of the major contributors to demand in the global medical helium market, backed by the expansion of diagnostic units and the integration of advanced imaging systems. Increasing patient volumes coupled with upgrades in technology will keep helium consumption strong, as medical facilities look for stable cooling performance in critical diagnostic machinery.

- Diagnostic Centers

The growth of healthcare networks and increased usage of MRI systems will consequently drive the global medical helium market with the support of diagnostic centers. Emphasis on the delivery of quality scanning services will promote continued dependence on helium-powered cooling processes that guarantee machine integrity and performance throughout daily operations.

- Research Laboratories

Research laboratories will reinforce long-term growth in the global medical helium market, as scientific exploration advances across an array of disciplines. Increasing experimental work, molecular analysis, and cryogenic research will depend on dependable helium supply developed to maintain accuracy, stability, and controlled environmental conditions for sensitive procedures.

- Others

Other contributors to the global medical helium market will extend consumption to serve the needs of specialized medical setups and research fields. Growth in this sector will come from precision activities dependent on strong cooling, contamination-free gas flow, and stable operational environments supportive of newly emerging technologies across a wide range of healthcare and scientific disciplines.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2935.4 Million |

|

Market Size by 2032 |

$4777.6 Million |

|

Growth Rate from 2025 to 2032 |

7.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Competitive Landscape & Strategic Insights

The global medical helium market will remain in the spotlight as hospitals worldwide rely on a constant supply of this extraordinary gas for imaging, respiratory care, and research applications. It has come to play a crucial role in modern treatment because of its ability to cool advanced medical systems and to support patients during critical procedures. With expanding hospital ability and technological development, excessive-purity helium demand will upward push, thereby starting up a area for both lengthy-installed organizations and more moderen suppliers to compete for more potent positions.

The marketplace represents a mix of famend international gamers and emerging nearby members striving to secure their supply chains and meet the growing expectancies of the healthcare sector. Companies like Linde p.C, Air Liquide S.A., Praxair, Inc., and Air Products and Chemicals, Inc. Retain to play important roles due to their experience and extensive distribution networks. These businesses are joined by others, such as Messer Group GmbH, Taiyo Nippon Sanso Corporation, Matheson Tri-Gas, Inc., Gulf Cryo, and Iceblick Ltd., which introduce similarly competition thru specialized answers that meet each neighborhood and global necessities. Their capability to hold high requirements at the same time as making sure well timed delivery will shape how hospitals and diagnostic centers select their providers.

Among these global names, various regional operators come forward to meet the growing demand and reduce dependence on imported supplies. The presence of companies like The Linde Group, Buzwair Industrial Gases Factories, Ellenbarrie Industrial Gases Ltd., Universal Industrial Gases, Inc., and NexAir LLC indicates the diversified supply landscape. Groups such as CryoGas International, Iwatani Corporation, Gazprom Export, Weil Group Resources, LLC, Somatrach, and RasGas Company Limited further expand access by offering production or export capacity to support medical institutions in different countries. Their increased participation brings stability to the market, particularly during times when global supplies are constricted.

With increased competition, suppliers will develop stronger distribution systems, purify the gas further, and maintain storage solutions equal to those required by hospitals. Many will invest in technologies that limit waste or enhance extraction for a better chance at long-term access to this finite resource. As helium is an essential component in MRI machines and other life-support applications, medical facilities will continue to rely on partners who can ensure safe and consistent delivery during intense pressure. Innovation, long-term planning, and responsible use of the resource by these companies, which cannot be replaced easily, are likely to shape the future of the global medical helium market. The growth of healthcare systems and the advancement of different medical procedures further place the above-mentioned industry leaders and rising competitors in a position to influence how smoothly this supply reaches those who need it most.

Market Risks & Opportunities

Restraints & Challenges:

Extreme volatility in deliver and vulnerable to international helium scarcity:

The destiny situations are going to put pressure at the global medical helium market due to the fact volatile sourcing will result in unpredictable availability. A restricted range of production sites, with growing intake, will convey supply towards vital tiers in which healthcare operations are at risk of interruptions. This will, in flip, make stronger tracking, long-term contracts, and opportunity sourcing techniques important for retaining balance.

High cost and complicated logistics for storage and transportation:

Handling helium becomes more and more stressful with a want for temperature-controlled garage and specialized delivery systems. These necessities will raise operational prices for hospitals and diagnostic facilities, setting financial strain on procurement groups. Such demanding situations will inspire superior packaging answers and virtual tracking systems aimed toward decreasing losses and improving universal performance in the global medical helium market.

Opportunities:

Development of helium recapture and recycling systems for healthcare facilities:

Future utility of recapture era will facilitate greater sustainable usage in the global medical helium market. Hospitals will look to appoint clever recycling devices with the capability to seize the unused fuel from their imaging system, lowering waste and reliance on sparkling supplies in the process. This will growth fee financial savings, enhance deliver safety, and make sure lengthy-time period useful resource conservation for medical environments.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 2935.4 million in 2025 to over USD 4777.6 million by 2032. Medical Helium will maintain dominance but face growing competition from emerging formats.

Beyond technical advancements, the market will also impact educational and research plans as institutions begin to engage with new applications. Students, engineers, and medical professionals will look toward uses that have yet to be considered, unlocking discoveries to support both healthcare and scientific progress. In this way, the global medical helium market will not just grow; it will cultivate a re-imagining of the future by the industry, building a path to progress that will still be realized over time.

Report Coverage

This research report categorizes the global medical helium market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global medical helium market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global medical helium market.

Medical Helium Market Key Segments:

By Product Type

- Liquid Helium

- Gaseous Helium

By Application

- Magnetic Resonance Imaging (MRI)

- Nuclear Magnetic Resonance (NMR) Spectroscopy

- Cryogenics

- Others

By Distribution Channel

- Direct Sales

- Distributors

By End-User

- Hospitals

- Diagnostic Centers

- Research Laboratories

- Others

Key Global Medical Helium Industry Players

- Linde plc

- Air Liquide S.A.

- Praxair, Inc.

- Air Products and Chemicals, Inc.

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- Matheson Tri-Gas, Inc.

- Gulf Cryo

- Iceblick Ltd.

- The Linde Group

- Buzwair Industrial Gases Factories

- Ellenbarrie Industrial Gases Ltd.

- Universal Industrial Gases, Inc.

- NexAir LLC

- CryoGas International

- Iwatani Corporation

- Gazprom Export

- Weil Group Resources, LLC

- Somatrach

- RasGas Company Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252