Global Medical Robots Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global medical robots market transformed from a little exploratory project in a mechanized helper system to a major force reshaping the whole healthcare delivery system. This market started its journey towards the late 1980s and the very first innovations were mainly motivated by the need for surgery procedures with utmost precision that could not be achieved through human's steady hand. The first revolutionary moment came with the introduction of robot arms to help with delicate neurosurgeries. An academic partnership between scientists and medical doctors slowly but surely attracted the attention of the hospital sector that was looking for lower rates of mistakes and quicker turnaround of patients.

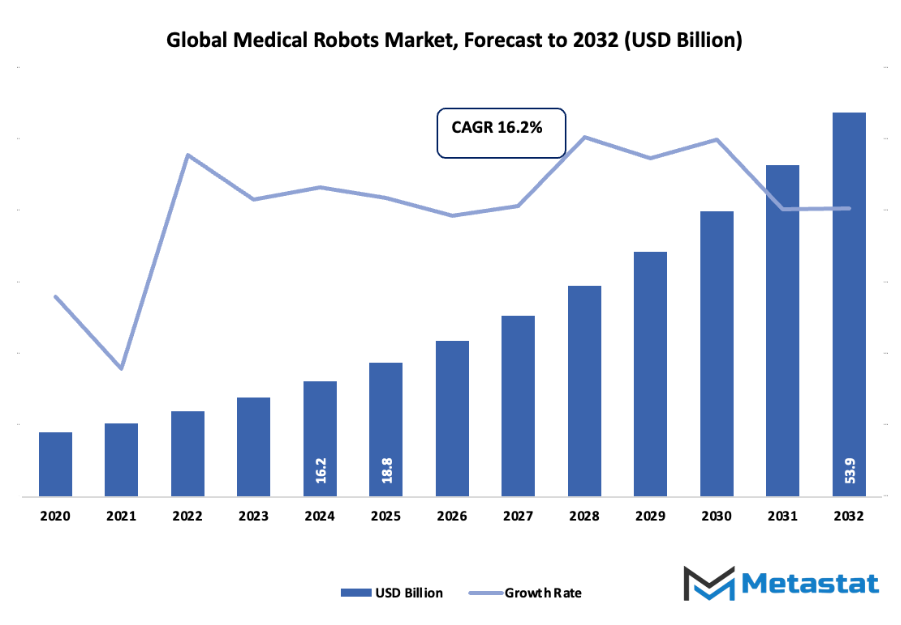

- The global medical robots market estimated at roughly USD 18.8 billion in the year 2025, with a CAGR of 16.2% during 2025-2032, thus the market can reach USD 53.9 billion and more.

- Surgical Robots command slightly less than 40.6% market share, pulling forward technological advancements and new applications through intense research.

- The principal trends supporting market growth are: Increased requirement for surgeries that are less invasive and proper healthcare, advancements in AI, imaging, and robotic systems.

- Included in the opportunities is: Widening the scope of robots in telemedicine and remote surgery applications expansion.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

During the 1990s, the technology had become more reliable and the decade saw the first robotic systems in the operating rooms of very few hospitals. The first teleoperated surgical robots brought a whole new world of possibilities to the doctors, enabling them to work from distant places, a reality that once sounded a sci-fi movie plot. These models, though, oversized, pricey, and with very few functions, still showed the medical community that machines could augment, not diminish the surgeon's talents. In the early 2000s, robotic surgery was no longer viewed as a futuristic and unproven technology; rather, it was a universal symbol of medical marvels, with world-class institutions committing enormous sums for the research aimed at improving accuracy and versatility.

The global medical robots market has seen a dramatic change in the past years and it is no longer limited to the area of surgery only. Rehabilitation, pharmacy automation, and hospital logistics have been opened up as new fields for the use of robots. Robotic exoskeletons were given to stroke patients for the purpose of helping them regain their movement while the robots in hospitals were utilized for the unloading of medication and delivery of supplies. This change in perception was so extreme that robots were no longer seen as futuristic or scary but as dependable partners in the care of patients.

Further, the changing consumer expectations have played a significant role in directing the market. Minimally invasive treatments and shorter hospital stay have been the main reasons for the continuous improvement of robotic systems. On the other hand, AI and machine learning have started to come together with robotics making it possible for the machines to take faster data-driven decisions during operations. The governments and regulatory agencies have begun to formulate more precise safety regulations thereby allowing the technology to move forward while not losing the public's trust.

The global medical robots market will still have its impact in the redefining of the healthcare-delivery process. The sector will still be allowed to enjoy the great improvements in connectivity, sensor technology, and automation that the human capacity and robotic accuracy would almost be indistinguishable. This will be the coming of next stage in the development of modern medicine.

Market Segments

The global medical robots market is mainly classified based on Product Type, Modality, Application, End-User.

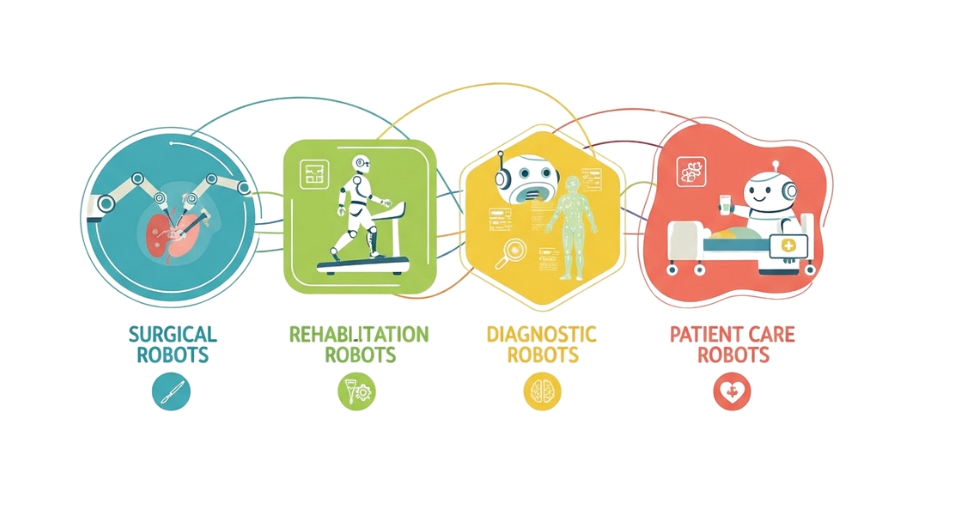

By Product Type is further segmented into:

- Surgical Robots: The use of Surgical Robots is mainly concerned with accomplishing complicated medical procedures that entail the application of higher precision, flexibility, and control compared to the standard methods. This technology allows the surgeons to operate through less invasive incisions with the provision of enhanced visualization, which in turn accelerates the healing process and minimizes the risks of complications. The segment's growth is further propelled by increasing hospitals' adoption of these systems for performing minimally invasive surgeries.

- Rehabilitation Robots: Rehab Robots are designed to aid patients in the recovery of their mobility and strength after an injury or surgical procedure. The robots perform as facilitators for physical therapy by guiding the motion of the patient and keeping track of the progress in real-time. The combined factors of the aging population and the increase of patients with mobility issues have resulted in the extensive use of rehabilitation robots in the healthcare sector.

- Diagnostic Robots: The main purpose of Diagnostic Robots is to work as a partner in pinpointing the diseases with utmost accuracy and in no time. Their role includes the collection of medical data, performance of imaging procedures, and assistance to doctors in the interpretation of results. The demand for these robotic assistants in hospitals and labs has dramatically increased due to the growing requirement of precise and timely diagnosis which is especially seen in the case of chronic diseases.

- Patient Care Robots: Patient Care Robots are the robots that are used to assist the medical staff in routine tasks like the delivery of medication, the monitoring of vital signs, and assisting patients to move around. The robots help healthcare workers accomplish more by taking over part of their tasks, and they also ensure that patients receive the same quality of care no matter when. The hospitals and nursing homes that have started to use these robots are experiencing improvements in their service delivery.

- Other: Other medical robots include systems designed for laboratory automation, telepresence, and logistics. These robots assist in specimen handling, disinfection, and remote patient interaction. The increasing need for automation in hospital environments and advancements in sensor technology contribute to the expansion of this category.

By Modality the market is divided into:

- Compact: Compact robots are small-sized systems designed for limited space settings. They offer flexibility and ease of installation, making them suitable for smaller hospitals and diagnostic centers. Their lower maintenance cost and efficient performance make them a preferred choice for healthcare facilities aiming to upgrade their technology without large investments.

- Portable: Portable robots are lightweight systems designed for easy movement across different departments within healthcare facilities. These robots can be quickly deployed for tasks such as diagnostics, teleconsultation, or patient monitoring. The ability to relocate them easily makes them an attractive solution for healthcare providers focusing on mobility and convenience.

By Application the market is further divided into:

- Orthopedic Surgery: In orthopedic surgery, robots assist in bone alignment, joint replacement, and other complex procedures requiring precision. They help in reducing surgical errors and improving implant placement accuracy. Growing incidences of bone disorders and the increasing preference for minimally invasive orthopedic procedures are fueling this segment’s expansion.

- Neurosurgery: Neurosurgery robots assist in performing delicate brain and spinal procedures with high accuracy. These systems enable surgeons to access hard-to-reach areas while minimizing tissue damage. Rising neurological disorders and demand for precision in brain surgeries are boosting the adoption of robotic systems in this field.

- Cardiovascular Surgery: Cardiovascular Surgery robots are used for intricate heart procedures where precision and stability are crucial. They assist in bypass surgeries, valve replacements, and other cardiac operations. With the increasing prevalence of heart-related diseases, hospitals are adopting these robots to ensure safer and more effective surgical outcomes.

- Urology Surgery: Urology Surgery robots are used in operations involving the urinary tract and reproductive organs. These systems help improve surgical control and visibility, leading to better patient outcomes. The rising number of prostate surgeries and urinary disorders has significantly driven the demand for robotic systems in urology departments.

- Gynecology Surgery: Gynecology Surgery robots support surgeons in procedures such as hysterectomies and myomectomies. They offer improved precision and shorter recovery periods for patients. The growing awareness of the benefits of robotic-assisted gynecological surgeries continues to strengthen demand within hospitals and specialized clinics.

- General Surgery: General Surgery robots are utilized in a variety of procedures, including gastrointestinal and bariatric surgeries. They improve accuracy, reduce blood loss, and enhance postoperative recovery. The growing adoption of robotic technology for diverse surgical needs contributes to the steady growth of this segment.

- Other: Other surgical applications of medical robots include thoracic, dental, and transplant surgeries. These systems continue to expand into new areas due to ongoing innovation and increased focus on patient safety. As technology evolves, their use is expected to become more common across various medical specialties.

By End-User the global medical robots market is divided as:

- Hospitals: Hospitals represent the largest end-user segment due to the high demand for advanced medical robots in surgical and diagnostic procedures. These facilities benefit from improved precision, shorter hospital stays, and better patient outcomes. The push for digital transformation and automation in healthcare continues to boost robotic adoption in hospitals.

- Clinics: Clinics are increasingly adopting medical robots for specialized and minimally invasive procedures. These robots help enhance service quality while reducing human error. Their compact design and affordability make them a suitable choice for smaller healthcare providers seeking technological efficiency.

- Diagnostic Centers: Diagnostic Centers utilize robots for automated sample handling, imaging, and testing processes. They improve accuracy and reduce the time required for diagnostic results. The growing need for efficient laboratory automation and reliable data handling is driving the use of robotic systems in diagnostic centers.

- Research Institutions: Research Institutions employ medical robots for developing new surgical techniques, studying biomechanics, and enhancing clinical precision. These organizations play a vital role in innovation and testing of robotic technologies before clinical deployment. Increasing funding for medical research continues to support the adoption of robots in this segment.

- Home Care Settings: Home Care Settings are witnessing rising demand for assistive robots designed to support elderly and disabled individuals. These robots help with daily activities, monitoring health, and providing companionship. Growing preference for home-based healthcare and advancements in remote monitoring technology are promoting the adoption of medical robots for personal care.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$18.8 Billion |

|

Market Size by 2032 |

$53.9 Billion |

|

Growth Rate from 2025 to 2032 |

16.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

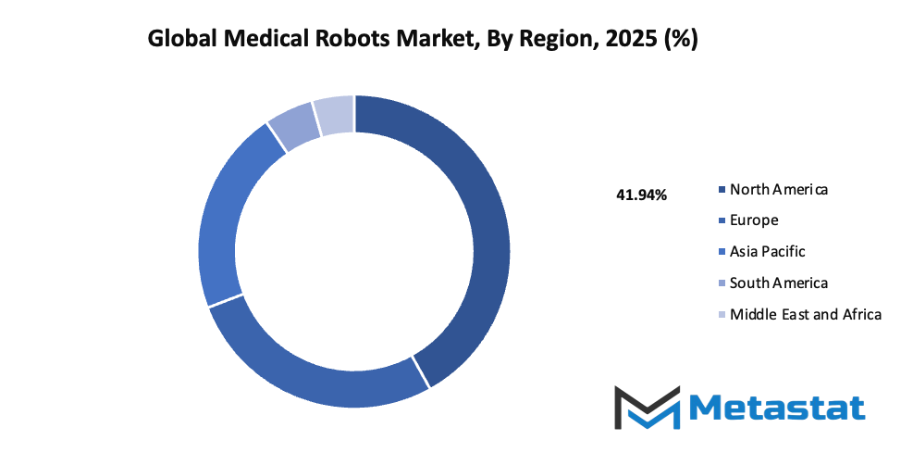

By Region:

- Based on geography, the global medical robots market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Rising demand for minimally invasive surgeries and precision healthcare:

The growing preference for less invasive surgical procedures has led to an increased use of robotic systems in hospitals and clinics. Medical robots allow accurate control, smaller incisions, and quicker recovery times, which make them attractive to healthcare providers and patients. The shift toward precision-based healthcare has encouraged the adoption of robotic technologies that enhance surgical performance and patient safety. These robots reduce complications, minimize hospital stays, and improve overall treatment outcomes, resulting in growing investment and research in robotic-assisted surgery. The demand for such advanced systems continues to rise as healthcare facilities aim to improve efficiency and care quality.

Technological advancements in AI, imaging, and robotic systems:

Continuous progress in artificial intelligence, machine learning, and imaging has transformed robotic surgery and automation in healthcare. Robots are now capable of performing complex tasks with high accuracy, guided by advanced imaging systems and AI algorithms that analyze patient data in real time. Enhanced visualization and sensor-based feedback have made surgeries safer and more effective. Integration of AI also supports better decision-making during operations and assists surgeons in improving precision. These innovations have strengthened confidence in robotic systems and encouraged broader usage across medical specialties. The improvement in technology continues to push the global medical robots market toward steady growth and wider adoption.

Challenges and Opportunities

High cost of robotic systems and maintenance:

One of the major restraints affecting the market is the high initial cost of robotic systems and their ongoing maintenance. Hospitals and clinics often struggle with the large financial investment required for installation, training, and upkeep. The expense limits access for smaller healthcare institutions and delays large-scale implementation. Even though robotic systems promise efficiency and accuracy, budget constraints often make them inaccessible for developing regions. Efforts to produce more affordable and sustainable robotic technologies could address this challenge in the coming years. Cost reduction remains a crucial factor in supporting market expansion and increasing accessibility for global healthcare providers.

Limited availability of skilled professionals for robot-assisted procedures:

The shortage of trained medical personnel capable of handling robotic systems poses another significant challenge. Robot-assisted surgery requires specialized knowledge and extensive training, which are not yet widely available in many regions. Without enough skilled operators, the full potential of robotic technology cannot be achieved. Healthcare institutions are investing in training programs, but the learning curve and certification processes are often time-consuming. Increasing educational opportunities and creating standardized training modules may help overcome this barrier. Expanding the pool of qualified professionals will be essential to ensure safe and effective use of medical robots across different healthcare environments.

Opportunities

Expansion of robotic applications in telemedicine and remote surgery:

The growing use of telemedicine and remote healthcare offers vast opportunities for medical robotics. Robotic systems can assist in surgeries performed from distant locations, allowing expert surgeons to operate on patients regardless of physical barriers. This capability can improve access to quality healthcare in remote or underserved areas. Integration with communication technologies allows real-time interaction, accurate control, and improved patient monitoring. As network infrastructure and digital tools become more advanced, robotic-assisted telemedicine is expected to expand significantly. The combination of robotics and remote care holds strong potential for enhancing healthcare delivery and shaping the future of the global medical robots market.

Competitive Landscape & Strategic Insights

The global medical robots market continues to grow as technological progress transforms modern healthcare. The industry includes both established international leaders and newer regional competitors that bring innovation and competition to the sector. Companies such as Intuitive Surgical, Stryker Corporation, Medtronic, Johnson & Johnson (Ethicon), Siemens Healthineers, Zimmer Biomet, Accuray Incorporated, Philips Healthcare, iRobot Corporation, CITRIS and the Banatao Institute, OmniGuide Holdings, Robocath, Inc., and Titan Medical Inc. play major roles in shaping the direction of this market. Each company focuses on developing robotic systems that improve precision, reduce human error, and enhance patient outcomes.

The demand for medical robots continues to increase as healthcare systems seek safer and more efficient treatment methods. Robotic technology is now used in surgery, rehabilitation, diagnostics, and hospital management, showing how versatile and valuable it has become. Minimally invasive procedures are one of the strongest driving forces behind this growth, as robotic assistance allows smaller incisions, faster recovery times, and fewer complications for patients. Hospitals and medical centers are increasingly investing in robotic systems to raise the quality of care and reduce long-term costs.

Research and development remain at the center of competition among key players. Companies are focusing on innovation to create robots that are smaller, smarter, and more cost-effective. Collaboration between healthcare institutions and technology developers helps speed up the creation of next-generation systems designed for accuracy and ease of use. Government support and funding for medical technology are also helping expand market opportunities across different regions.

Market size is forecast to rise from USD 18.8 billion in 2025 to over USD 53.9 billion by 2032. Medical Robots will maintain dominance but face growing competition from emerging formats.

The global medical robots market shows strong potential for continued expansion, supported by advancements in artificial intelligence, machine learning, and imaging technologies. As these systems become more integrated into healthcare, they will play a major role in shaping a future where technology supports better and more reliable medical care for patients worldwide.

Report Coverage

This research report categorizes the global medical robots market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global medical robots market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global medical robots market.

Medical Robots Market Key Segments:

By Product Type

- Surgical Robots

- Rehabilitation Robots

- Diagnostic Robots

- Patient Care Robots

- Other

By Modality

- Compact

- Portable

By Application

- Orthopedic Surgery

- Neurosurgery

- Cardiovascular Surgery

- Urology Surgery

- Gynecology Surgery

- General Surgery

- Other

By End-User

- Hospitals

- Clinics

- Diagnostic Centers

- Research Institutions

- Home Care Settings

Key Global Medical Robots Industry Players

- Intuitive Surgical

- Stryker Corporation

- Medtronic

- Johnson & Johnson (Ethicon)

- Siemens Healthineers

- Zimmer Biomet

- Accuray Incorporated

- Philips Healthcare

- iRobot Corporation

- CITRIS and the Banatao Institute

- OmniGuide Holdings

- Robocath, Inc.

- Titan Medical Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252