MARKET OVERVIEW

The global delivery apps market will continue changing the way goods, services, and food are digitally transported to consumers from vendors. Its market with mobile-based applications functions as a platform; users place and track the order, coordinate users to service providers, and finalize transactions in real time. This application is essentially designed to promote efficiency and convenience for demanding users of speedy, accessible, and easy-to-use digital environments.

The function of delivery apps has expanded from just providing food ordering to becoming an entire ecosystem and will eventually cater to groceries, pharmacies, consumer electronics, household essentials, and more. The global delivery apps market will witness continuous innovations on new software constructs of delivery time reductions and route optimization through data analysis and artificial intelligence. Businesses in this segment would be going all out to refine customer interfaces, backend logistics systems, and real-time communication tools for increased reliability as well as engagement with users.

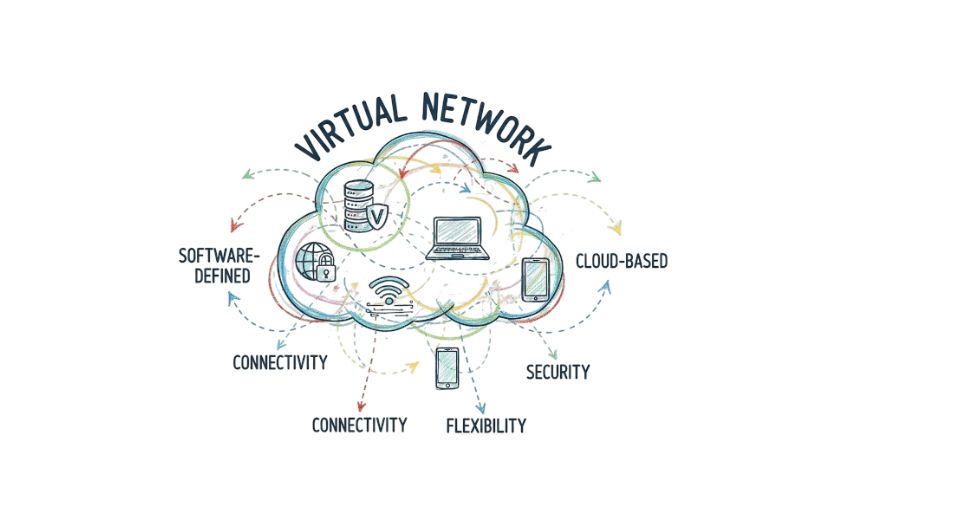

This will dictate the expansion of this market across urban and semi-urban geographies as population standards rise, and lifestyles do not spare on-demand services. Infrastructure will comprise hybrid digital and third-party logistics, independent couriers, and integrated gateways through apps. The global delivery apps market can expect to rely heavily on technological advancements that will bring user expectations in line with operational capabilities, including easy order processing, dynamic pricing algorithms, and scalable backend systems that can withstand peak loads during most high-demand periods.

Consumer behavior is going to remain a strong influence on the direction in which delivery apps take shape. Future generations of these apps will be founded on personalization, real-time feedback loops, and user-centered features. Behavior patterns will be analyzed by developers and platform manufacturers to improve features like predictive ordering, voice-enabled commands, and multilingual support. The services of the global delivery apps market will thus be customized to local preferences while maintaining the same propelling operational model that could be deployed across a myriad of regional geographies.

Most significantly, these platforms will increasingly be regulated on how they are designed and managed by specific government scrutiny, data protection laws, and provisions on fair labor practices. Companies in the global delivery apps market will need to engineer systems that are transparent, compliant, and resilient to cyber threats in order to meet government regulations and public safety. They will also need to manage relationships with service providers—such as drivers, riders, and delivery partners—ensuring fair compensation and support mechanisms through app-based interfaces.

Further, the environmental issues and sustainability practices shall dictate the design and execution strategies across the industry generally. For example, carbon neutral delivery options, electric vehicle integrations, and eco-packaging are elements to be embedded within applications and brand positioning. The global delivery apps market would be a place that was not only making possible the logistics demand but also hoped to align itself with wider societal and environmental values.

The global delivery apps market will be increasingly integrated into consumer behavior in high technologies in the near future, packing complexities. Here, the paradigm would also shift, and henceforth digital environments would be as much operationally efficient as personalized while negotiating with regulations, infrastructure, and changing user expectations.

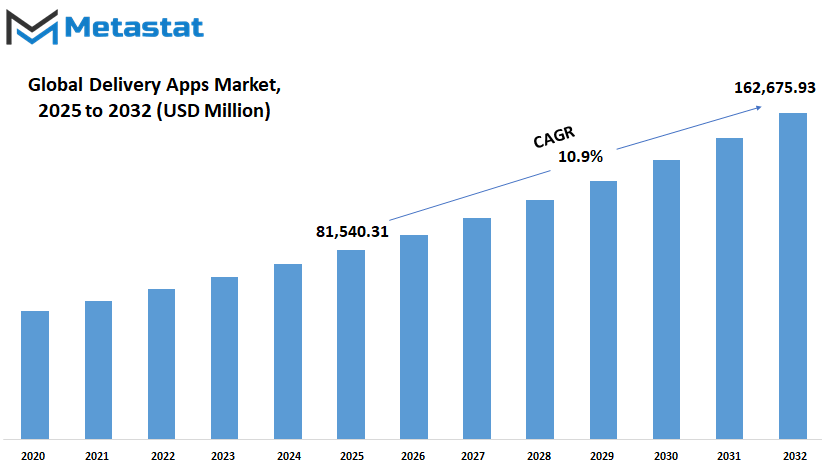

Global delivery apps market is estimated to reach $162,675.93 Million by 2032; growing at a CAGR of 10.9% from 2025 to 2032.

GROWTH FACTORS

The global delivery apps market is commencing its journey toward sustainable change with furious momentum primarily depending upon consumer shopping behavior that continues to change. Consumers have become more inclined toward shopping from the comforts of their homes, especially with regard to food and groceries and other essentials. This growing demand for convenience, coupled with a desire for contactless services, has given way to the rising appetite for these apps across different regions of the world. With increasing user comfort levels in online ordering, app developers and service providers' territories have turned into finding paths to enhancing their platforms and remaining in the forefront in a rapidly changing environment.

The online shopping boom can be listed as the top reason encouraging the global delivery apps market. There is an increasing number of people with smartphones worldwide, and it becomes easier for them to access such services that had earlier required stepping out. E-commerce is undergoing rapid growth, and with it, apps for delivering goods are just into the door. This tendency will be further pushed as smartphone penetration increases in the areas, which, until now, were lagging in technological adaptation. The perfect blend of internet access and cheap mobile devices has provided a wider audience for delivery services than ever.

Nonetheless, this growth has challenges that could hinder progress. One of such big challenges is extreme competition. With many players entering the market, the app providers are often forced to significantly reduce prices to lure users in. These short-term gains are, however, at the expense of profit margins of the firms operating their platforms. Another one comes from logistics-related issues, especially with last-mile deliveries. Although reaching the customers' doorsteps remains a challenging endeavor in many places, with any delays considered an inconvenience toward customer satisfaction.

However, technology is addressing these challenges in new ways. AI would offer an advantage in improving delivery routes, estimating order demand, and resource management. Simultaneously, limited testing and partial implementations of drone technology exist in various areas. A broad acceptance of drone delivery may resolve a big chunk of issues glued to the last mile. The benefits of these recent findings would be higher delivery speed and lessened operational costs. With further development of these technologies, the razor-thin global delivery apps market would probably see ways of expansion to keep up with the ever-increasing consumer expectations.

MARKET SEGMENTATION

By Service Type

The interest circles of the traveling world's fresh delivery apps refreshed fast and are scheduled to keep that way in the future. It will see how technology progresses and changes people's lifestyles. The demand for convenience in food delivery, especially changing the way people think about going out to eat. These delivery apps have ceased to be a secondary addition to a person's daily routine and have become a vital part of most people's lives now. With the global delivery apps market expanding, the services on offer will become more versatile to satisfy different tastes, preferences, and modes of dining.

It can be seen from the service type segmentation of the global delivery apps market that even food delivery will offer more avenues of service. More and more people will turn to local restaurants, a segment where smaller, independent dining establishments fall, because they still want to have variety while supporting their local businesses. The trend of going green and consuming locally sourced foods will push quite a number of consumers to order from these restaurants. Placing orders becomes easier with technology. Thus, this segment will be a growingly important segment in the market. Local restaurants will also have enhanced online visibility, which would facilitate efficient delivery through apps and make it much more attractive.

Additionally, chain restaurants having a solid foundation in delivery space will likely pour more resources into the battle for customers. The huge networks would help these restaurants for potential customers recognize their respective brands automatically while ordering meals. Meanwhile, competition rises in the delivery space, these chain restaurants may indulge in using more novel promotions or loyalty programs to set themselves apart. They will also work to improve their delivery processes, ensuring that food arrives quickly and maintains its quality. As more and more people start using the delivery apps, chains are going to continue thriving and reaching even more customers.

From what it was before considered something for high-end dining establishments where this experience had to be done in person, gourmet dining will soon join the market in going delivery. With convenience becoming synonymous with no compromise on quality, gourmet dining is bound to go on delivery and become available on delivery apps. Increasingly, high-end restaurants will exploit this new delivery space by having distinctly created menu items or meals that can be ordered only for delivery. With such movements, gourmet dining experience will change, delivering quality meals into one's home. Thus, this myriads of different types of service will shape the immediate future of the global delivery apps market as it stretches its focus over a wider base of consumers than before.

By Ordering Method

The global delivery apps market is going to keep defining how people will interact with product and service provision with just a few taps. As technology grows, facing the shifting needs posed by such customers, companies will indefinitely keep on searching for increasingly smarter, faster, and more dependable ways to satisfy those needs. An area that stands out remains the order placement choice. User interactions with delivery platforms will strongly influence the app models that thrive and their design. Two major ordering types will determine the future of the space: Native Apps and Progressive Web Apps.

Native Apps are developed specifically for a particular device or operating system. By and large, it has offered a very fluid and fast user experience, and this will keep on being a preference for users that want speed and consistency. Downloaded directly to smartphones or tablets, these apps can work offline, as they do not require constant internet access, and provide superior access to device features like location services or push notifications. Businesses are likely to continue this type of investment because they control design and performance. On the flip side, they require expensive maintenance and updates across devices, something difficult for some smaller businesses.

Progressive Web Apps, on the other hand, are becoming a wise choice for many companies. It is the type of website that behaves like an application when used through a mobile browser. These applications don't require downloads-great for users who want to save on storage space. They can also be more easily updated and are operable across several devices for the ease of the user. Indeed, as people worldwide find affordable smartphones and connections, Progressive web apps would find their way too many users, especially across territories where fast devices are not available.

Going forward, it is likely that the Global Delivery Apps space will, in the early days, be shaped somewhat by a blend of all these approaches. Big corporations might stick with Native apps for their loyal users, while smaller or newly arising can find that Progressive Web Apps make more sense. It will all boil down to consumer behavior, technological trends, and how companies want to balance speed, cost, and convenience. In either case, the mode of ordering would have a significant role to play in the future growth of these services and in keeping their connection with the users.

By Delivery Method

The global delivery apps market has entered a rapid development, as its pace are advanced by the evolution of technology and changing behaviour of the consumers. The future must also be anticipated to owe several factors - including different modes of delivery, which are important ways of getting goods from businesses to consumers. These factors are important in the formation of the global delivery apps market, and already two major types have developed: in-house and third-party delivery. These two delivery modes will develop different preferences associated with the advantages and disadvantages that they present in particular areas.

Home delivery is emerging rapidly among many companies that want tight control over the delivery process, where it gives such companies direct access to logistics, delivery timing, and customer service. It will also allow these companies to personalize a customer's experience by ensuring that their goods are delivered on time and in good condition. Innovations such as real-time tracking and improved route planning will make in-house delivery more efficient. This can be very advantageous for companies that deal with high-value or perishable goods where reliability and speed become crucial. In-house delivery also promises to work on the brand by making customer interaction and satisfaction part of the delivery journey.

On the opposite side, third-party couriers provide a different set of advantages to which, in recent years, enterprises have relied on becoming more dependent. With such services, companies outsource the whole delivery process to specialized providers. Third-party couriers provide experience, infrastructure, and capabilities that are unavailable on an expending basis to smaller or less established companies. Through third-party services, businesses can manage wider delivery options without having to invest very high into a fleet of vehicles or managing their own logistics. Third parties express the most alluring of services because they usually benefit companies with a broader market where managing deliveries across geographies becomes expensive and complex. Third-party focus on delivery most often creates the speed and efficiency that a business might not have in its portfolio but is just in demand. The future demand for these services will be based on fast, reliable delivery options because they seem to be what most customers expect.

In the global delivery apps market, both delivery methods will continue to exist in the future, allowing companies to choose the method that fits their needs best. It creates a savvier decision to have in-house delivery to some organizations, while others may find third-party courier access better suited for meeting a wider reach. The market continues to evolve with advancements in technology that create opportunities as well as challenges for delivery providers worldwide based on the changing consumer expectations.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$81,540.31 million |

|

Market Size by 2032 |

$162,675.93 Million |

|

Growth Rate from 2025 to 2032 |

10.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

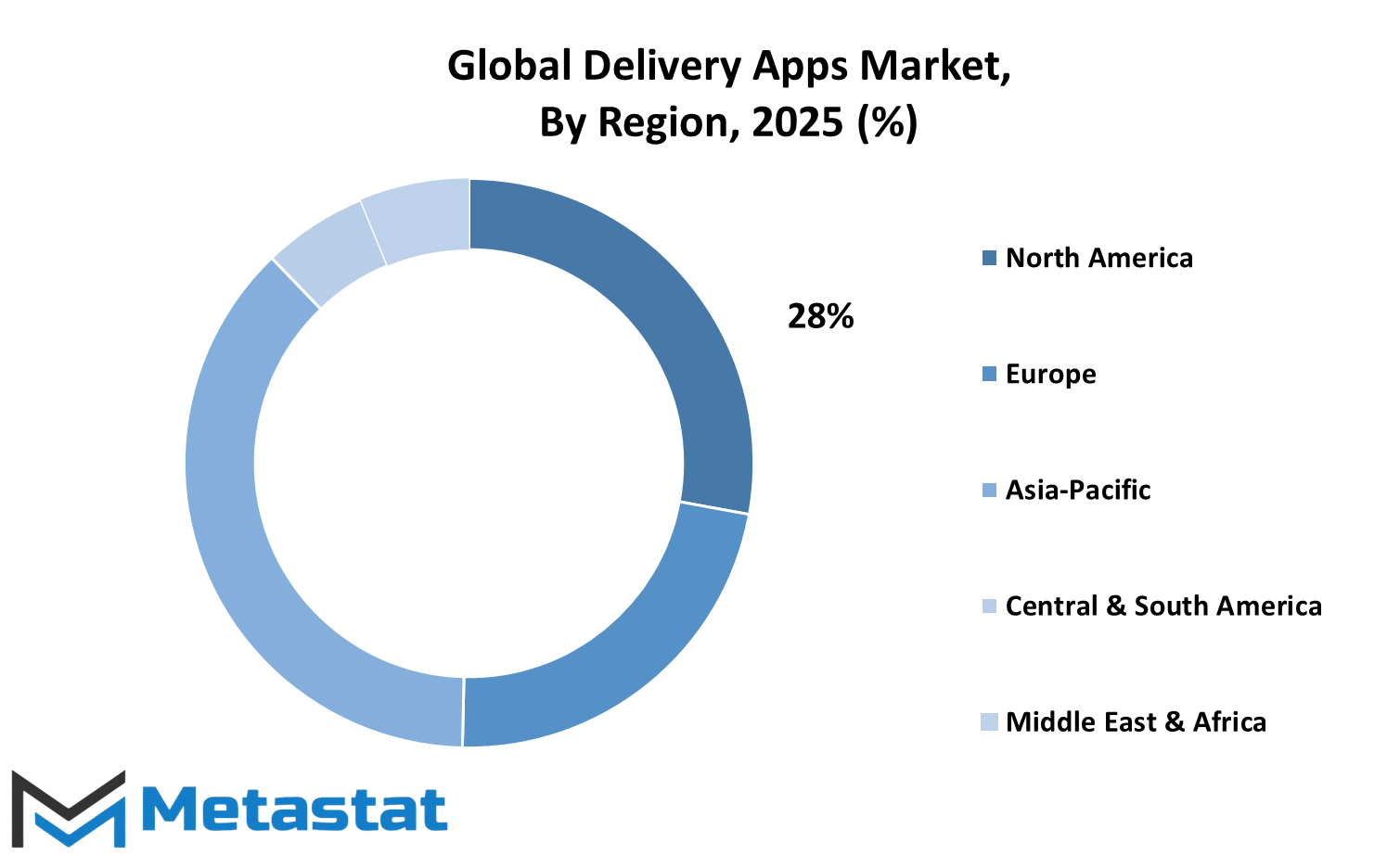

The global delivery apps market will have positive potential in the forecasted years owing to technological developments and changing consumer behaviors. The market will expand to different regions for fast and efficient services in the next several years. The market is understood geographically since it shows how each area is likely to grow towards a future of delivery services.

The continent of North America currently has high demand for delivery apps and there will be a sustained growth in that demand in the U.S., Canada, and Mexico. This is also true as these countries use technology more and more as part of offering convenience and speed to consumers. As urban areas expand, demand will increase where people demand quick delivery services, especially for groceries, meals, and other ancillary deliveries. Apps are expected to continue shaping how consumers access products in the U.S., a place where the population is quite tech oriented and smartphone penetration is quite high. Development of the technology will similarly take place in Canada, while the rising middle class and urbanization will boost Mexico in keeping up with the new trend of delivery apps.

Europe has a highly mature economy and adopts high technology, which will shape the future of the global delivery apps market as well. The emergence of delivery app registrations includes British, German, French, and Italian citizens. Consequently, the behavior of household consumption shifted from "managing and cooking for oneself" toward convenience and online shopping: delivery services will be part of retaility. Hence, small European countries will also not be left out, all will adapt according to the increasing need for efficient delivery solutions. Growth within the European market is expected as more local delivery startups come up with innovations and compete against the global giants.

The Asia-Pacific region will give a boost to this market, particularly India, China, Japan, and South Korea. Raging urbanization has made consumers in this region increasingly dependent on digital platforms. India and China with their billion-plus populace and ever invigorated middle class will also accentuate the booming demand for delivery services, food and groceries, and e-commerce foremostly. As in the case of Japan and South Korea, both of which are recognized for their technological advancement, they will continue to lead other nations in app development and delivery efficiency trends. Other countries in the region will likely follow suit consequently as usage of mobile continues to expand while city dwellers will, in turn, heighten their demand for convenience.

In South America, Brazil and Argentina would prepare to progress in their delivery apps market with an increasing trend of e-commerce. Thus the need for application is augmented as more and more people turn to online shopping and seek faster, more reliable ways to have their items delivered. In the Middle East and Africa, the markets, including those of the UAE, Egypt, and South Africa, will also help in broadening the scope of the global delivery apps market. This is majorly due to investment in technology and infrastructure in these regions.

COMPETITIVE PLAYERS

The global delivery apps market is continuing on its track of increase, owing to consumer demand for offered convenience and speed. This will be further guaranteed by future trends in the competitive landscape, which will be in the favor of the already established and new entrants who will continue to develop according to emerging technologies and consumer preferences. While Uber Eats, GrubHub, and Postmates are currently riding fully on the upward curve of growth, the time will probably come when their relevance may be affected by increased competition in the area from region-controlled firms and cutting-edge startup companies. The companies will remain competitive with a proper mix of efficient services, attention to the customer's needs, and an anticipatory approach toward technology development.

As such, Uber Eats has traditionally lingered among the giants in this space. Its ownership of Uber's long and broad network of transportation services gives an edge to it over numerous competitors. Nevertheless, other companies are quickly catching up. For example, DoorDash has turned into a robust rival due to the company's emphasis on offering a plethora of both restaurant options and claims of speedy service. Expansion capability to cover more delivery, such as buying delivery provisions and other household overpriced items, has proved to be an enticing asset among many customers.

However, mainly a pizza delivery service, Domino's Pizza has already started using this app model and seems to become increasingly integrated into the wider delivery ecosystem. In this sense, the company has put in a streamlined online ordering system which gives it a huge competitive advantage by being able to ride with the waves other apps are riding. Other companies such as Caviar and Seamless also keep on improving their services in terms of widening their offerings as well as reducing their delivery speeds.

Zomato has been international by pushing the borders and expanding footprints into new markets with a food delivery option and restaurant discovery service. Instacart, a grocery delivery darling, is itself preparing to take advantage of the broader delivery ecosystem by bettering its app and penetrating new market segments. Goldbelly, which specializes in delivery of specialty foods from well-known restaurants, has been carving out its niche with the consumer looking for unique culinary experiences finished in their doorsteps.

The competition will increasingly become more torrid as the global delivery apps market grows. Innovative personalization of services and efficient delivery systems will be the main requirement for the major actors in this type of market. The market changes at high speed, and efficient systems need to be at par with it. As companies begin applying artificial intelligence and data analytics, they are likely to go ahead with tailoring their offerings even more closely to serve the individual preferences of customers. Partnerships, acquisitions, and collaborations will be seen more and more in the future, as the companies try to be ahead in this fast-changing competition.

Delivery Apps Market Key Segments:

By Service Type

- Local Restaurants

- Chain Restaurants

- Gourmet Dining

By Ordering Method

- Native Apps

- Progressive Web Apps

By Delivery Method

- In-house Delivery

- Third-party Couriers

Key Global Delivery Apps Industry Players

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252