Global IT Vendor Risk Management Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

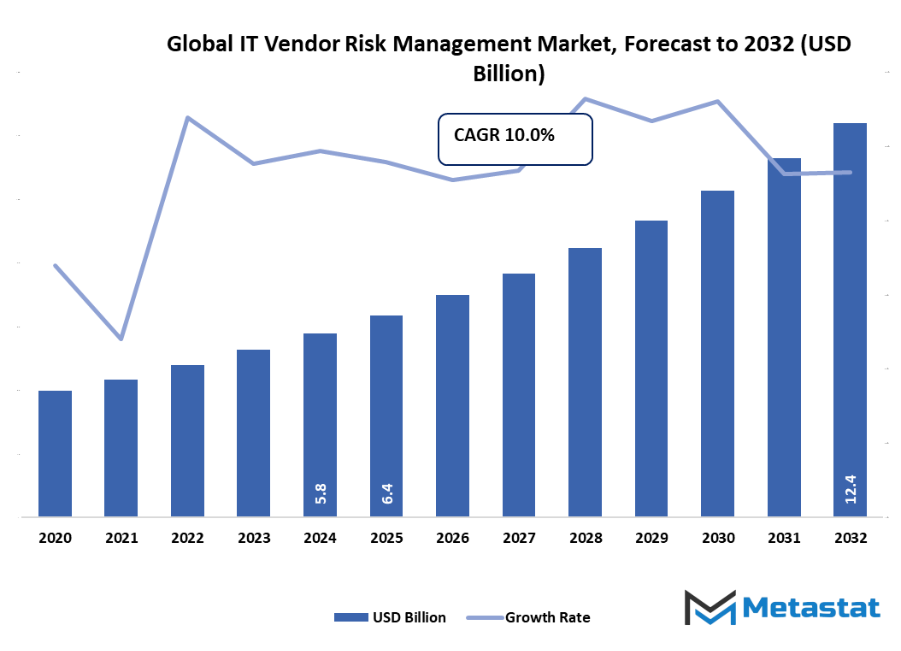

- Global IT vendor risk management market valued at approximately USD 6.4 billion in 2025, growing at a CAGR of around 10.0% through 2032, with potential to exceed USD 12.4 billion.

- On-Premises account for a market share of 27.7% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Increasing reliance on third-party IT service providers, Rising regulatory requirements for data protection and compliance

- Opportunities include: Growing adoption of AI-driven risk assessment tools creates new opportunities

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global IT vendor risk management market is expected to be the most important division of the information technology and enterprise risk management industry. The main focus will be on the identification, assessment, and mitigation of the risks related to third-party vendors. This market will bring organizations the needed tools and platforms to keep track of vendor performance, guarantee regulatory compliance, and protect the privacy of data throughout the already complicated supply chains. IT vendor risk management solutions will combine the features of automated risk assessment, real-time monitoring, reporting dashboards, and analytics to empower organizations to become active in the management of the types of risk that may affect external partners, such as operational, financial, and cybersecurity ones.

Platforms will be relied on more by organizations to assist them in vendor due diligence, risk exposure evaluation, and running good mitigation programs across different suppliers, contractors, and service providers. The solutions will use advanced technology like artificial intelligence and machine learning to foretell the possible risks, to check the vendors' behaviour, and to give the priority to the remedial actions of the risks. Moreover, platforms will also entail regulatory support and audit readiness, which will make businesses being able to comply with worldwide standards of regulation and frameworks defining the industry they belong to.

Market Segmentation Analysis

The global IT vendor risk management market is mainly classified based on Deployment Mode, Solutions, Functionality, Industry Vertical.

By Deployment Mode is further segmented into:

- On-Premises: On-premises deployment will continue to be a viable option for companies that desire absolute control over sensitive vendor data. This alternative ensures data security, conformity with internal policies, and adjustment according to enterprise-specific risk frameworks, thus being appropriated to highly regulated sectors such as the financial service area and the public sector.

- Cloud-Based: Organizations will turn to cloud-based solutions more often mainly because of the flexibility, remote access, and the cost-effectiveness of such solutions. Businesses can keep track of vendor risk, get contracts organized, and meet regulatory requirements from any place. Cloud systems encourage the use of real-time analytics and updates which make the process more effective and less costly in terms of resources used for the IT vendor risk management.

- Hybrid: It is the hybrid installation that will combine the advantages from the security provided by on-premises and the flexibility offered by the cloud. Companies can have the most confidential data kept within their walls and still enjoy all the other benefits of the cloud such as monitoring, reporting and collaborating. This method of handling risk offers great flexibility allowing the risk to be managed in different parts of the world having vast geographical coverage.

By Solutions the market is divided into:

- Vendor Assessment and Monitoring: The vendor assessment and monitoring solution enables businesses to measure the supplier's performance, exposure to risk, and operational reliability. Constant monitoring is a great way to cover all your bases making sure that all potential disruption situations are being addressed.

- Contract Management: Contract management services will make it easier to create, keep, and track vendor agreements. The automatic running of contract workflows will lower the potential for errors, heighten the observance of the set rules, and guarantee that the renewals or renegotiations take place on time.

- Compliance Management: Compliance management tools will allow organizations to meet all the necessary requirements set by regulatory bodies and internal policies. These tools will make regulating easier, in addition to keeping the necessary documentation and making sure that the vendors meet the set standards for the industry.

- Risk Assessment and Scoring: Risk assessment and scoring tools will compute the riskiness of the vendor encompassing such matters as operational, financial, and cyber threats. These tools will make it easier for the team to decide and address the problems targeted correctly.

- Performance Management: At the initial stage, performance management solutions will be implemented to monitor and keep records of vendor KPIs and the service quality they offer and also to find out where improvements can be made through such initiatives as the regular assessment of vendor goals and fostering supplier relationships.

By Functionality the market is further divided into:

- Operational Risk Management: Is all about spotting the causes and taking measures to prevent disruptions in vendor operations.

- Financial Risk Management: Keeps the vendor's finances in check to avoid situations like defaults or interruption of the supply chain.

- Compliance and Regulatory Risk Management: It makes sure that the business is in accordance with the laws, standards, and industry-specific regulations.

- Cybersecurity Risk Management: It evaluates the security measures taken by the vendor in terms of IT to avoid hacking and loss of data.

- Third-Party Risk Management: Measures the overall risk of external suppliers and partners.

By Industry Vertical the global IT vendor risk management market is divided as:

- Financial Services: Keeps the bank in line with the rules and manages supplier risks in the spheres of banking, insurance, and fintech, among others.

- Healthcare: Data of patients are protected and vendors are ensured of meeting tough healthcare regulations.

- Telecommunications: Vendor risk is managed for network infrastructure, software providers, and service partners, among others.

- Retail: Tracks the compliance and performance of the suppliers who serve global supply chains.

- Government: Keeps vendor operations that are safe and follow the rules for the new public projects and IT procurement.

- Manufacturing: Deals with the operational and supply chain risks in production, while ensuring the production's continuity.

- Education: Makes sure that IT vendors meet security standards and support institutional operations effectively.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$6.4 Billion |

|

Market Size by 2032 |

$12.4 Billion |

|

Growth Rate from 2025 to 2032 |

10.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

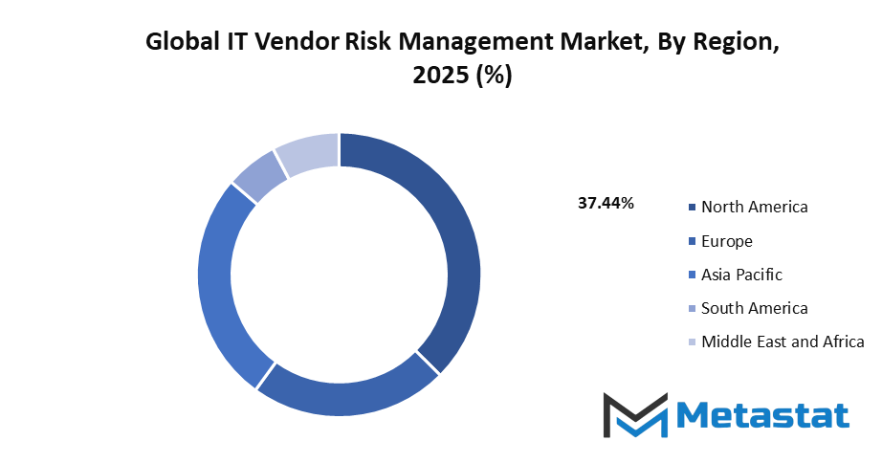

By Region:

The global IT vendor risk management market will display very diverse patterns of demand on a regional basis, which will largely reflect disparities in the level of technology adoption, regulation, and sophistication of supply chains. The US, Canada, and Mexico constitute the North American region, which will still hold the lead position of the market due to such factors as the high level of digital maturity, the widespread use of enterprise risk management frameworks, and the strictly implemented requirements for cybersecurity. The companies in the area will thus be more and more inclined to use vendor risk management platforms so as to be able to monitor the third-party compliance, carry out risk evaluations with the aid of technology, and also enhance the operational resilience within the network of the vendors who are their partners.

Going by what is going to happen in Europe, the countries consisting of the UK, Germany, France, Italy, and the rest of the continent, the market penetration would be supported by, among other things, very strict data privacy laws, mandatory compliance with industry-specific regulations as well as a commitment towards supply chain transparency. The adoption of IT vendor risk management solutions by private companies and government institutions in Europe will help them not only to comply with the regulations, but also to do the real-time monitoring of the vendors and carry out risk avoidance practices in a more organized fashion throughout their worldwide activities turns out.

The geographical regions of Asia-Pacific, India, China, Japan, South Korea, and all the countries bordering them will be markets that develop at very high speed, which comes from strengthening digital infrastructure, exponentially rising outsourcing operations, and high awareness of third-party risk. Brazil and Argentina will be leading the way in South America while the Middle East & Africa, which includes the GCC states, Egypt, and South Africa are the other two regions of the world that will, on the whole, see a gradual rate of uptake as companies within these areas will be updating their risk management processes and implementing cloud-based platforms so that this exercise can be done in the quickest and most efficient way possible. In all the different geographic markets, the global IT vendor risk management market will present these companies with the opportunity to boost transparency, lower their risk exposure and shield their supply chains as they incorporate the model of being more globally connected into their business.

Market Dynamics

Growth Drivers:

Increasing reliance on third-party IT service providers: The global IT vendor risk management market is greatly influenced by the rapidly increasing reliance on third-party IT service providers. It has been observed that organizations are gradually outsourcing the most critical operations like cloud services, software development, and infrastructure management. Thus, vendor oversight is becoming a necessity. Risk management systems help validate the favourable performances of the vendors, anticipate the possible disruptions, and ensure operational continuity, so that the goals of the business can be achieved without being hindered by third-party engagements.

Rising regulatory requirements for data protection and compliance: Regulatory requirements in data protection and compliance have become more rigorous, and this is another factor that raises the global IT vendor risk management market. The financial services, healthcare, and government sectors, among others, are not only required but also expected to maintain a high level of compliance with regulations like GDPR, HIPAA, and the most relevant standards respectively. By use of IT vendor risk management solutions, organizations can continually monitor and manage the state of compliance, facilitate audit activities, and instill confidence in the vendors when it comes to legality. Resultingly, not only are the sensitive data shielded but also the chances of being fined or acquiring a bad reputation are minimal.

Restraints & Challenges:

- High costs and complexity of implementing risk management frameworks: One of the major restraints is that it is very expensive and complex to set up the risk management frameworks in a comprehensive manner. For small and medium-sized enterprises, the prices of software licensing, integration, and training may become a burden, eventually affecting the adoption rate. Moreover, complicated risk management processes require high technical expertise that makes even the first-time installation and subsequent maintenance more difficult.

- Limited visibility into vendor operations and security practices: Generally speaking, a big problem that organizations are facing is that they do not have a clear view of their vendors' operations and security. It is common that companies do not have access to the activities of their partners in real-time, so it is pretty hard to identify even the slightest risks. If proper surveillance is not in place, there could be some latent risks such as cybersecurity gaps or operational inefficiencies that are not visible and hence may lead to business interruption or the breaking of compliance.

Opportunities:

- Growing adoption of AI-driven risk assessment tools creates new opportunities: Generally speaking, a big problem that organizations are facing is that they do not have a clear view of their vendors' operations and security. It is common that companies do not have access to the activities of their partners in real-time, so it is hard to identify even the slightest risks. If proper surveillance is not in place, there could be some latent risks such as cybersecurity gaps or operational inefficiencies that are not visible and hence may lead to business interruption or the breaking of compliance.

Competitive Landscape & Strategic Insights

A diverse array of global IT vendor risk management market players, comprising established multinationals and newly formed regional companies, will contribute to an attractive and dynamic market with a mixed competitive landscape. Besides companies like IBM Corporation, RSA Security LLC, MetricStream Inc., LockPath, Inc., BitSight Technologies, ProcessUnity, Inc., and SAI Global Pty Limited, no other companies will be able to offer solutions as broad as that which fuses risk assessment, continuous monitoring, compliance management, and analytics-driven insights. In other words, these service providers will look to offer large-scale, secure, and tech-enabled platforms that are highly versatile enough to handle complex vendor ecosystems for big enterprises.

Amongst these competing companies, there are also some small, new, and unique ones like Prevalent, Inc., LogicManager, Inc., Aravo Solutions, Inc., OneTrust, LLC, NAVEX Global, Inc., RiskWatch International, LLC, RapidRatings International, Inc., SecurityScorecard, Inc., Venminder, Inc., Galvanize, Inc., Optiv Security Inc., RiskRecon, Inc., and CyberGRX, Inc., which will open a way to the market by offering highly focused solutions, targeted risk intelligence, and simple-to-operate platforms for organizations with less than 250 employees. They will concentrate on agile movements, easy merger with already present systems, and to give organizations tools for foresight in handling third-party risks and abiding with coming updates of standards.

Genuine market growth will be plugged-in by continuous creative ideation, alliances with cloud and cybersecurity providers, and enhanced automation capabilities. Global companies will be upscaling their presence on the international stage, improving their platform interoperability, and making the vital step of integrating advanced analytics and artificial intelligence to position themselves as the providers of predictive vendor risk insights. Taken together, the global IT vendor risk management market will continue to make strides in dealing with the third-party risk management challenge as that which is technology-driven, compliant with regulation, and operationally resilient will be the hallmark of competitive leadership.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 6.4 billion in 2025 to over USD 12.4 billion by 2032. IT Vendor Risk Management will maintain dominance but face growing competition from emerging formats.

In short, the global IT vendor risk management market will turn out to be of maximum importance in the organizational value protection and operational resilience provision against the surge of third-party dependencies. Such visibility of comprehensive risks, the automatic assessment, and the provision of insights that organizations can act on will be some of the ways in which organizations will be able to keep continuity as well as secure data, and make decisions relating to vendor partnerships. This market will still move forward as organizations use the technology-driven approaches to protect their supply chains and digital ecosystems and therefore decide to take the risk management as the primary concern of their portfolios.

Report Coverage

This research report categorizes the global IT vendor risk management market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global IT vendor risk management market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global IT vendor risk management market.

IT Vendor Risk Management Market Key Segments:

By Deployment Mode

- On-Premises

- Cloud-Based

- Hybrid

By Solutions

- Vendor Assessment and Monitoring

- Contract Management

- Compliance Management

- Risk Assessment and Scoring

- Performance Management

By Functionality

- Operational Risk Management

- Financial Risk Management

- Compliance and Regulatory Risk Management

- Cybersecurity Risk Management

- Third-Party Risk Management

By Industry Vertical

- Financial Services

- Healthcare

- Telecommunications

- Retail

- Government

- Manufacturing

- Education

Key Global IT Vendor Risk Management Industry Players

- IBM Corporation

- RSA Security LLC

- MetricStream Inc.

- LockPath, Inc.

- BitSight Technologies

- ProcessUnity, Inc.

- SAI Global Pty Limited

- Prevalent, Inc.

- LogicManager, Inc.

- Aravo Solutions, Inc.

- OneTrust, LLC

- NAVEX Global, Inc.

- RiskWatch International, LLC

- RapidRatings International, Inc.

- SecurityScorecard, Inc.

- Venminder, Inc.

- Galvanize, Inc.

- Optiv Security Inc.

- RiskRecon, Inc.

- CyberGRX, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252