Global Brewery Software Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global brewery software market is setting the tone for a new era in the brewing cycle as convention is blended with state-of-the-art digital solutions. Breweries, ranging from small artisanal breweries to mass manufacturers, will increasingly come to depend upon niche platforms to manage their operations. The sector will not only embrace solutions that track production, inventory, and sales but also require solutions that enhance collaboration between departments and promote higher levels of transparency in supply chains. The focus would be on accuracy in recipe management, real-time tracking of resources, and integrated functioning of distribution channels.

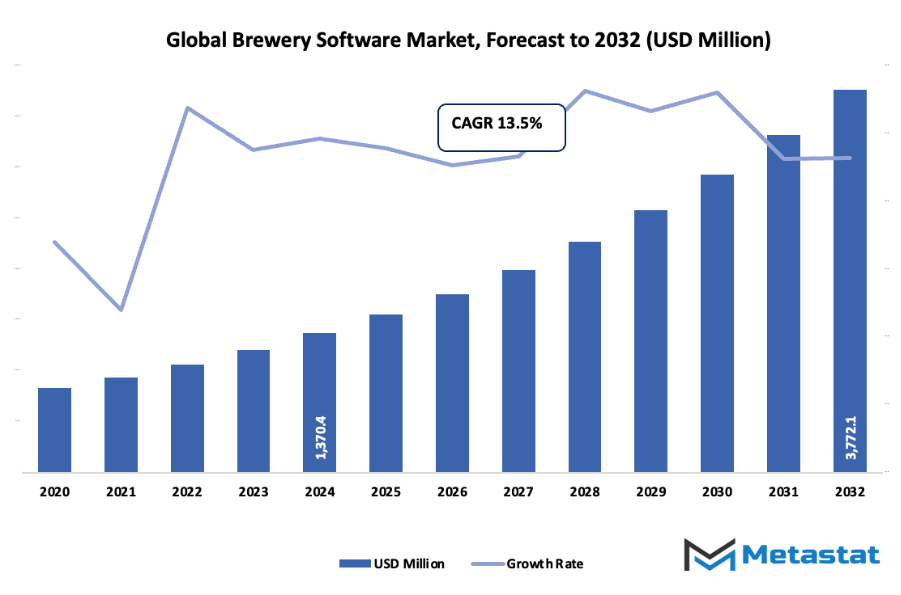

Global brewery software market worth around USD 1554 million in 2025, growing at a CAGR of around 13.5% from 2032, with potential to go beyond USD 3772.1 million.

- Cloud Based hold almost 74.4% market share, fueling innovation and broadening applications through vigorous research.

- Key growth drivers: Increased Demand for Craft Beer, Regulatory Compliance Necessity

- Opportunities: Integration with IoT and Automation

- Key fact: The industry is poised to grow by leaps and bounds in terms of value in the next decade, pointing towards high growth prospects.

- The global brewery software market started as a limited initiative to assist breweries in recipe management, production tracking, and ensuring quality.

In the initial years, the majority of breweries used manual logs and spreadsheets, which usually produced errors and inefficiencies. With breweries expanding in size and competition growing, there was a growing need for precise digital systems. The advent of brewery-specific software revolutionized the game, allowing manufacturers greater control over inventory, brewing schedules, and regulatory compliance. With time, integration with cloud platforms enabled remote monitoring, real-time data analysis, and more efficient supply chain management, propelling the market into a new stage. A turning point was reached when consumer interests began to move towards craft beer and experimentation with distinct flavours. Such a change necessitated flexible software with capabilities to accommodate multiple recipes and smaller batch sizes.

Regulations also tightened, making compliance features more crucial. Today, the global brewery software market is still growing with artificial intelligence, predictive analytics, and automation being key drivers. Future innovations will probably be centred around sustainability, efficiency, and customized brewing experiences, guaranteeing continued growth and innovation for many years to come.

Market Segments

The global brewery software market is mainly classified based on Deployment Mode, Functionality, End-User

By Deployment Mode is further segmented into:

- Cloud-based deployment in the global brewery software market will give breweries access to data and real-time analytics with flexible options. The growing use of remote monitoring and digital collaboration solutions will enable breweries to streamline operations, cut costs, and scale systems rapidly based on demand, enabling future growth in a connected world.

- On-premises deployment will remain appropriate for breweries that place great importance on data security and total control over systems. In the global brewery software market, this method will be advantageous for larger breweries with well-established IT infrastructure, facilitating tailored configurations, lower reliance on third-party servers, and the capacity to integrate software more tightly with current production and inventory processes.

By Functionality the market is divided into:

- Inventory management solutions for the global brewery software market will enable breweries to better track raw materials and finished goods. Higher-end forecasting tools will minimize waste, optimize stock levels efficiently, and enable sustainable production methods. Future advancements will include AI integration to forecast demand trends and optimize supply chain efficiency.

- Production management software will be at the forefront of refining brewing operations. Solutions that track production phases, ensure consistency, and reduce downtime will benefit the global brewery software market. Integration with IoT devices will help breweries automate processes, optimize resource utilization, and boost productivity over the coming years.

- Quality control modules will ensure that brewery products are in accordance with set standards. The global brewery software market will implement sophisticated testing tools and automated reporting systems to assist breweries in detecting early deviations, ensuring regulatory compliance, and establishing consumer trust. Predictive analysis can be employed in future systems to avoid quality problems before they arise.

- Sales and distribution software will increase market coverage and optimize order management within the global brewery software market. By leveraging real-time monitoring, customer information, and demand prediction, breweries will simplify deliveries and increase distribution channels. Future developments will enable more responsive and adaptive sales approaches based on market patterns

- Other features in the global brewery software market will assist brewery operations with reporting, employee management, and maintenance scheduling. Future systems will integrate several modules in a single platform, decreasing manual labor and enhancing operational visibility. These solutions will increase efficiency and assist breweries in reacting more quickly to market demands

By End-User the market is further divided into:

- Craft breweries will increasingly depend on the global brewery software market to ensure creativity while running operations effectively. Adoption of software will optimize small-scale production, manage costs, and monitor customer preferences. Emerging trends will be concentrated on incorporating digital marketing analysis and sustainability functionalities to fuel expansion without sacrificing artisanal standards.

- Microbreweries will enjoy software solutions that make day-to-day management easier and more effective resource utilization. For microbreweries in the global brewery software market, such systems will enable small operations to remain efficient, optimize production consistency, and push distributions. New tools will enable microbreweries to respond fast to shifting consumer needs and regulatory requirements.

- Other brewery styles will employ the global brewery software market to simplify processes and coordinate varied operations. Inventory, production, and distribution will be supported by software across scales. More automation, predictive analytics, and sustainability tracking will follow in future developments, keeping all styles of breweries competitive and enhancing performance.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1554 Million |

|

Market Size by 2032 |

$3772.1 Million |

|

Growth Rate from 2025 to 2032 |

13.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

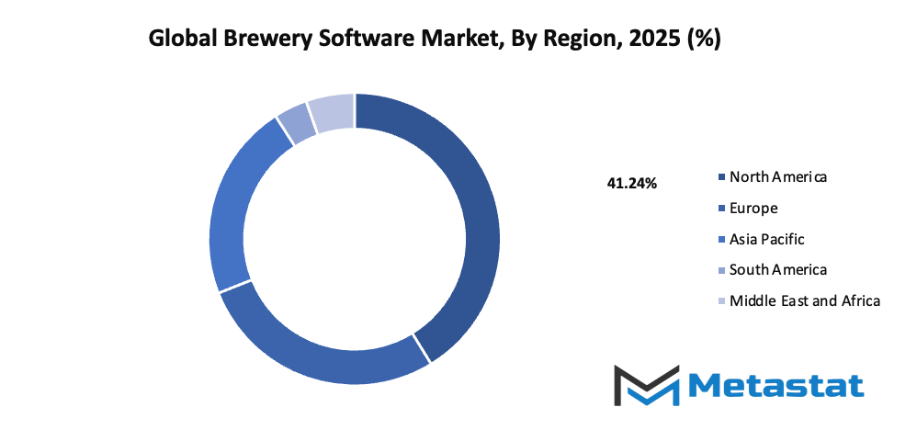

By Region:

- Based on geography, the global brewery software market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Rising Craft Beer Demand: The growing popularity of craft beer will fuel the global brewery software market. Small and medium-sized breweries require tools to manage production, track ingredients, and maintain quality consistently. Customized software solutions will help breweries meet consumer expectations while managing limited resources efficiently, leading to a more organized and profitable operation.

Need for Regulatory Compliance: Strict food and beverage regulations will continue to boost the global brewery software market. Software that ensures accurate reporting, traceability, and adherence to quality standards will become essential. Compliance-related functionalities will reduce the risk of penalties and help breweries maintain consumer trust, making regulatory-focused software a critical investment for the future.

Challenges and Opportunities

High Implementation Costs: High initial costs for installing brewery software may slow adoption. The global brewery software market will need to address this issue by offering flexible pricing models and scalable solutions. Despite upfront expenses, the long-term benefits of automation, data insights, and streamlined operations will encourage breweries to invest in software solutions.

Resistance to Digital Adoption: Some breweries remain hesitant to adopt digital solutions due to traditional practices and limited technical skills. The global brewery software market will grow as awareness increases about the advantages of digital tools. Demonstrating efficiency improvements, cost savings, and simplified operations will gradually reduce resistance and encourage widespread software adoption.

Opportunities

Integration with IoT and Automation: Integration with IoT devices and automation systems will shape the future of the global brewery software market. Real-time monitoring of production lines, predictive maintenance, and automated quality control will improve operational efficiency. The combination of software with advanced technologies will make breweries more agile, competitive, and capable of meeting growing consumer demands.

Competitive Landscape & Strategic Insights

The global brewery software market is witnessing significant growth as breweries of all sizes increasingly adopt digital solutions to manage operations, production, and distribution. The market is shaped by a mix of well-established international leaders and ambitious regional players, each offering specialized solutions that address the unique challenges faced by modern breweries. Companies like Plaato, Precision Fermentation (BrewIQ), AccuBrew, TankNET (Acrolon), Fermecraft (Deacam), Fermly, OFS (OfSystems), Ekos, Ollie, BlueCart, Breww, Premier Systems, VicinityBrew, The 5th Ingredient Inc., Brew Ninja, Unleashed, Brewery Software Solutions, BrewPlanner, Encompass Technologies, Tripleseat, ACC Software Solutions, and Brewtarget are at the forefront, introducing software that enhances efficiency, reduces waste, and streamlines inventory and production management.

The competitive landscape in the global brewery software market is dynamic, with companies continually innovating to meet growing demands for automation, data analytics, and cloud-based solutions. Software platforms are expected to integrate advanced features such as predictive analytics, real-time monitoring, and remote control of brewing processes. Smaller players in regional markets often focus on providing highly customizable solutions that cater to local requirements, while global leaders emphasize scalability and seamless integration across multiple facilities.

Looking ahead, the global brewery software market will likely see accelerated adoption of intelligent systems capable of supporting sustainability goals, optimizing supply chains, and improving product consistency. Strategic insights suggest that collaboration between software providers and breweries will become essential, as solutions that combine operational efficiency with enhanced customer engagement will gain a competitive edge. Companies that can anticipate industry trends, adapt rapidly, and offer solutions that balance technology with usability are poised to shape the future of brewery management. The market will continue to grow as innovation drives breweries to rely on software not just for efficiency but as a critical tool for long-term success.

Market size is forecast to rise from USD 1554 million in 2025 to over USD 3772.1 million by 2032. Brewery Software will maintain dominance but face growing competition from emerging formats.

In the future, breweries will use software to break free from manual record-keeping, achieving consistency in each batch they produce. This evolution will enable producers to stay true to themselves while satisfying the growing expectations of a heterogeneous global consumer market. Software designed specifically for brewing will also be instrumental in compliance, making brewers sure that their products comply with both local and international regulations.

Report Coverage

This research report categorizes the global brewery software market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global brewery software market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global brewery software market.

By Deployment Mode is further segmented into:

- Cloud Based

- On Premises

By Functionality the market is divided into:

- Inventory Management

- Production Management

- Quality Control

- Sales and Distribution

- Others

By End-User the market is further divided into:

- Craft Breweries

- Microbreweries

- Others

Key Global Brewery Software Industry Players

- Plaato

- Precision Fermentation (BrewIQ)

- AccuBrew

- TankNET (Acrolon)

- Fermecraft (Deacam)

- Fermly

- OFS (OfSystems)

- Ekos

- Ollie, BlueCart

- Breww

- Premier Systems

- VicinityBrew

- The 5th Ingredient Inc.

- Brew Ninja, Unleashed

- Brewery Software Solutions

- BrewPlanner

- Encompass Technologies

- Tripleseat

- ACC Software Solutions

- Brewtarget

US: +1 3023308252

US: +1 3023308252