MARKET OVERVIEW

The Global Iron Powder market has a significant role in just about every industry that uses an important raw material in manufacturing, metallurgy, or chemical applications. This is a market based on very fine powders of iron which will play an important part in powder metallurgy, welding, magnetic materials, and chemical manufacture. For every industry that seeks better materials offering increased performance and efficiency, iron powder will continue to occupy a central place in the processes that require precision, strength, and versatility.

The Global Iron Powder market serves all these industries that require special grades of iron powder that are application specific. Powder metallurgy is a prime segment in which iron powder is used to produce precision components with high strength and durability. It can create very complex shapes with little waste, which makes it the technology of choice in automotive, aerospace, and industrial manufacturing applications. Soft magnetic composites made from iron powder will also contribute to progress in electrical and electronic applications, where energy efficiency and magnetic performance matter.

The Global Iron Powder market encompasses applications beyond metallurgy such as catalysts, water treatment, and purification processes. Iron powder will continue to serve the chemical industry with its reductive properties for hydrogen sulfide removal and wastewater treatment. Iron powder also acts as a major substance used in welding or brazing, which forms strong and reliable joints between metals for construction, infrastructure, and heavy machinery manufacturing.

There will always be advancements in the technology being used to produce and refine materials in the Iron Powder market. Innovations in atomization, reduction, and electrolysis are bound to improve the quality and purity of iron powder and help industries get better mechanical and chemical properties for their end products. Modification in particle size distribution and surface characteristics may also affect optimization for targeted applications since more efficient and precise production processes may be achieved.

Environmental factors will also affect the Global Iron Powder market, with a major driving force towards sustainable production methods and recycling programs. The industries will search for ways of making iron powder use more efficient, minimizing wastage, and improving recyclability. With the further development of regulatory frameworks, manufacturers will find it easy to run their processes in accordance with sustainability goals, improving overall product quality and performance with environmental standards.

It is expected that the Global Iron Powder market will see changes in its demand due to technological advancements in additive manufacturing or 3D printing. The increasing application of metal powders in additive manufacturing will present new openings for the application of iron powder, especially in making lightweight and high-strength parts in aerospace, automotive and medical applications. Demand for high-purity, finely classified forms of iron powder will continue to grow with the progression of 3D printing technology, which will be determinative to the market for the next several years.

Innovations in the Global Iron Powder market will develop as manufacturers, research institutions, and other industry stakeholders collaborate in R&D efforts. As industries push the level of material science forward, so will the role of iron powder extend into "traditional" applications and other new applications that require high-performance, cost-effective solutions. The different advances in processing and material properties will continue over time, but the market will get more diversified as it supports progress on various fronts where precision-engineered iron powder belongs to the production and operations needs of the given application.

This really means that both common and advanced alloys are, will be, active participants within the respective areas of research. Basically, the study was designed to address the factors that are responsible for the scope of an iron powder manufacturing plant and to complement the above ideas with some reactions.

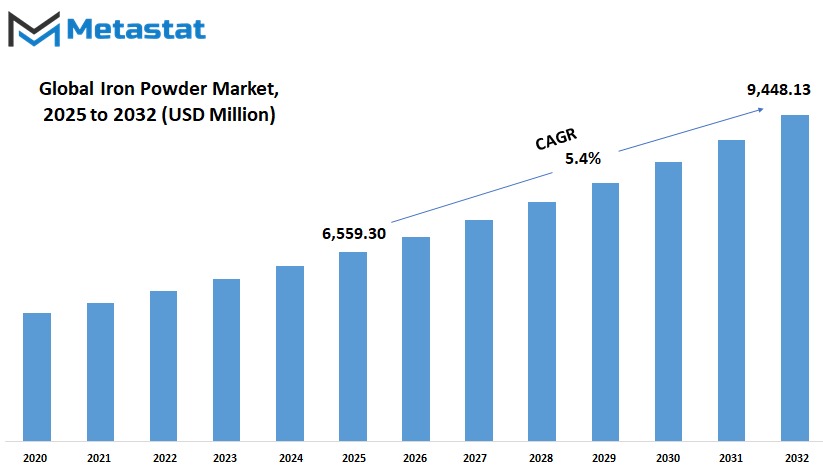

Global Iron Powder market is estimated to reach $9,448.13 Million by 2032; growing at a CAGR of 5.4% from 2025 to 2032.

GROWTH FACTORS

The Global Iron Powder market is set to grow rapidly, with various factors determining its growth in the coming years. The major driving force is the increasing automotive demand, where iron powder finds applications in the manufacturing of components such as bearings, gears, and camshaft pulleys. The increase in demand is more aggravated in countries such as China and India, where substantial increases have been seen in vehicle production.

Additive manufacturing or 3D printing is yet another emerging factor supporting this growth. High purity and consistency of iron powder further support building complex structures in aerospace, healthcare, and electronics fields. The dependency on iron powder is expected to grow as these industries adapt to advanced manufacturing methodologies.

Despite these opportunities, the market is hindered by certain challenges that could slow down the growth process. One of the key concerns is fluctuations in raw material prices. Volatility in iron ore prices caused by factors like global economic conditions and mining problems could result in pricing instability for iron powder producers causing disruption in overall market equilibrium.

Another challenge is the environmental regulations. The production processes for iron powder may lead to air and water pollution, and governments around the world are enforcing stricter emission and waste disposal standards. This compliance will require investments in cleaner technologies, thus raising the operational costs of manufacturers.

Competition from substitute materials is an issue as well. The development of composites and progessive polymers offers the industries a choice that might rival iron powder in certain applications, thus taking away potential market shares.

Nonetheless, with the challenges come opportunities for market growth. The increasing interest in iron powder for sustainable fuel alternative offers immense potential. The prospects of iron powder being used as a replacement for industrial fossil fuels resonate with global sustainability initiatives opening up new applications as well as markets.

Furthermore, enhancement in technology and infrastructure has increased production efficiency and product quality. The manufacturers investing in innovative techniques shall address the emerging needs of various industries, thus gaining leverage in the market.

In conclusion, beyond possibility, the presence of demand emerging from industries and technology and applications might suggest a dynamic atmosphere where change is taking shape even currently.

MARKET SEGMENTATION

By Type

The global iron powder market is predicted to have a significant growth trajectory because of advancement in manufacturing technologies and soaring demand in respective applications through different industries. Iron powder is an ultra-finely milled form of iron that is used in several applications, including automotive components, chemical production, and fortification of food. Thus, it is a versatile industrial material in modern manufacturing and industrial processes.

In 2025, the market is divided by typology into Atomized Iron Powder, Reduced Iron Powder, Electrolytic Iron Powder, and Carbonyl Iron Powder, amounting to USD 3,049.55 million, USD 1,724.73 million, USD 1,045.85 million, and USD 739.17 million, respectively. Its leading market position is justified due to high purity with constant particle size, which is suitable for powder metallurgy and additive manufacturing. The automotive industry shows a growing preference for this type of iron powder in the production of precision components that require high strength and durability.

Reduced Iron Powder takes second place due to extensive applications in chemical work and water treatment. High surface area and high reactivity make it suitable for these applications. The Electrolytic Iron Powder enjoys the highest purity and is mostly used in the electronics industry in the production of magnetic materials and inductive components. Iron powder of Carbonyl type is characterized by fine particle size and spherical shape and finds application in the manufacture of inductive electronic components and as a nutritional supplement in food applications.

The automotive sector is one of the main movers of the iron powders market. The enhanced focus on electric vehicle (EV) applications has opened further avenues for the use of iron powder in the manufacture of soft magnetic components needed in electric motors. With global warming favoring the acceptance of EVs, the need for specialized iron powder products will consequently grow.

Asia-Pacific is the leading region with respect to geography, while China, India, and Japan head the market in production and consumption. Rapid industrialization along with increased investments in infrastructure and automotive manufacturing has pushed demand for regionally manufactured iron powder. In addition, the pro-manufacturing and pro-technological innovation policies by the governments will also drive market growth in the area.

Technological advancement in additive manufacturing, basically 3D printing, has had a big impact on the iron powder market. Using iron powder to produce complex geometries with high precision has transformed manufacturing processes in every industry. This trend promises to continue, with current research focused on the potential enhancement of iron powder properties for more specialized applications.

By Manufacturing Process

Use of iron powder has been introduced from the long era of production methods through physical, chemical, and mechanical methods. Each of the processes has specific benefits along with its specifications targeting various sectors for consumption.

The physical production method includes atomization and electro-deposition to which most of the process has been adapted. It is generally possible to achieve very high purity of iron powder with regularity of sizes of particles within it. Atomization means disintegrating the molten iron into very fine droplets which will thus solidify into powder. On the contrary, electro-deposition is the process, which involves taking the iron particles from the solution onto a cathode. Ultimately, all above techniques play a major role in demanding intensive and stringent quality specifications for industries like automotive and electronics.

Reduction and decomposition among chemical methods are also used as techniques of getting iron powdered form. Reduction mostly involves treatment of iron oxide by reducing agents such as hydrogen gas or carbon monoxide to obtain a high purity iron powder. Decomposition involves breaking down iron carbonyl to yield fine iron particles. These methods also highly fulfil specific properties of powders, which can be customized for certain applications.

The method of milling or grinding iron has become quite an uncommon technique to produce powder. It is energy intensive and yields less uniform size of the particles. It has prospects in some applications where these characteristics are acceptable or even considered as a value-added aspect.

The Global Iron Powder market being among those that shall develop growth due to emerging technologies and the expanding horizon in industrial applications. Emerging sources for iron powder application come from 3D printing or additive manufacturing. An iron powder is a fundamental material in the construction of complex metal components with high precision and efficiency. It is the height at which industries like aerospace and automobile have adopted additive manufacturing and would continue to increase demand for quality iron powder.

The turning experience of the electronics industry as a big consumer of iron powder, when inductors and transformers are made from it, has seen an upwards tendency towards fine-tuned iron powder that will possess certain magnetic qualities as electronic devices become small and performance-driven. It emphasizes the need for improved technologies in powder manufacturing that meet the emerging demand of the electronics sector.

By Purity Level

The Global Iron Powder market is bound to see major changes in the light of technological advancements and industrial evolution. This market is subdivided according to purity levels into High Purity Iron Powder, Standard Purity Iron Powder, and Low Purity Iron Powder, all of which cater to distinct applications across the industry. The future position of these segments will be determined by upcoming trends and innovations.

High Purity Iron Powder, with very low impurity content, is increasingly being demanded in applications requiring precision and reliability. Electronics, medical devices, and energy storage applications rely on this grade for its excellent magnetic properties and conductivity. For example, the demand for High Purity Iron Powder will likely increase for use in the fabrication of magnetic materials and components for rechargeable batteries. The demand will be further fueled by advancements in technologies associated with electric vehicles and renewable energy solutions that use high-performance materials to promote efficiency and durability.

Standard Purity Iron Powder finds extensive applications in traditional manufacturing processes, powder metallurgy being one of them for components in automotive, bearings, and gears. The compromise between quality and cost is thus useful in mass production environments where precise material properties are important but ultra-high purity is not critical. Development in manufacturing technologies coupled with the need for greater efficiencies in production will keep Standard Purity Iron Powder alive in industries that are trying to balance performance and costs.

On the other hand, Low Purity Iron Powder is not an important factor for purity-demanding applications. It finds application in ballast, counterweights, and some particular coatings. There may not be huge growths in demand for this grade, but it will continue to serve certain industrial needs that are able to compromise with the purity of the materials.

The factors that dictate the future of iron powder will be a lot. Technological improvements in manufacturing methods may increase the quality and decrease the cost of High Purity Iron Powder such that it becomes available to a wider coat of applications. Also, with the increased emphasis today on sustainability and environmental responsibility, we may see innovations in manufacturing processes that create greener forms of production. Industries are likely to put in some R&D to create potential new applications for iron powder in some emerging areas such as additive manufacturing and advanced electronics.

By End-User Industry

The market for Global Iron Powder is seeing a transformational change, principally owing to technological advancements in various industries. Iron powder is a finely-ground metal supplied to engineering sectors including automotive, aerospace, defense, oil and gas, medical, etc. These industries utilize the unique properties of iron powder to improve product performance and manufacturing efficiency.

Iron powder is an important ingredient in powder metallurgy for producing automotive components, which is way powder metallurgy allows for work with complex geometry and precise tolerance, contributing to the design of more efficient and lighter-weight vehicles. Slowly, the demand for iron powder will increase as the automotive industry continues to develop with vehicle designs and manufacturing processes.

Applications of iron powder are very relevant for the aerospace and defense industries. In compliance with strict standards of strength and reliability, iron powder is used to make high-performance components for aircraft and defense equipment. Aero technology continues to evolve and defense spend rise, guaranteeing demand for iron powder in those sectors.

The iron powder is very widely employed in oil and gas-related applications, from manufacturing drilling equipment to being incorporated into some catalysts that are used in refining processes. The design of iron powder-based equipment is, for these reasons, always aimed at maximizing efficiency and durability.'

High-purity iron powder also has a variety of uses in medicine, such as iron supplements for iron deficiency and the manufacture of some medical instruments. With health being the focus and development of future medical technologies, iron powder is expected to be more integrated into the medical field.

Apart from the specialized industries, however, iron powder finds a variety of applications. It is being increasingly used in powder-based additive manufacturing, thereby producing complex structures with preferable material properties. Therefore, iron powder may very well be considered an important material in modern manufacturing.

In the coming times, the Global Iron Powder market is anticipated to witness promising growth and expansions driven mostly by technological advances and new applications over several industry domains. In fact, emphasis on sustainable and efficient manufacturing processes heightens the need for iron powder in the future. It is expected that with industries now innovating and asking for materials that exhibit performance and adaptability, iron powder will actually play an integral role in determining the future of manufacturing and product development.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$6,559.30 million |

|

Market Size by 2032 |

$9,448.13 1 Million |

|

Growth Rate from 2025 to 2032 |

5.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

Interpreting the external environment in which Iron Powder operates are growth drivers or constraints for the development of iron powder. Iron powder applies in manufacturing, automotive, and construction, so its demand is expected to grow with rapid industrialization and technological advancement. The distribution of iron powders to different regions gives a view into the economic growth occurring as well as the changing needs of different industries.

In North America, the U.S., Canada, and Mexico will together sustain growth of iron powder. Demand in the U.S. automotive and aerospace industries is being boosted by strong manufacturing, while technical innovations in Canada are likely to have an impact on the future of iron powder applications based on sustainable production methods. This growth in demand for iron powder may also be fueled by the rise in Mexico's industrial sector as the country continues strengthening its manufacturing capabilities.

The UK, Germany, France, and Italy are other key contributors to the iron powder market in Europe. With its highly developed automotive and machinery industries, Germany is expected to keep dominating the market. Meanwhile, increased adoption of metal powder technology in additive manufacturing, and sustainable production methods in the UK and France, are projected to further support the growth of the iron powder market. On the other hand, with its booming industrial base, Italy will provide support for market growth, whereas the rest of Europe will also likely follow this trend, with its industries modernizing and adopting different technologies.

The Asia-Pacific region is likely to cement its position as the next big thing for the global iron powder market. India, China, Japan, and South Korea are expected to be the leaders. The sheer size of production and consumption in China would exert a significant influence on the market. The impetus for growth is an enormous industrial infrastructure and increasing requests for high-performance materials. Demand is supported further by India's booming construction and automobile industries, while Japan and South Korea are busy driving technology and high-precision manufacturing. With strengthening industrial sectors and increasing impetus for modernization, the rest of the region would gradually see growth.

Brazil and Argentina are leading the way for growing promise for South America. Demand from Brazil's construction and automotive industries is expected to sustain the market growth, while Argentina's focus on industrial expansion may be of assistance. The remaining part of South America is expected to undergo steady growth with strengthening economies and increasing demand for metal powders from various applications.

The development of the iron powder market is also attributed to the region of the Middle East and Africa. Being actively industrialized, the GCC countries such as Saudi Arabia and UAE are expected to create the demand for iron powder, while Egypt and South Africa are seen to be expanding their industrial activities and possibly turning into emerging markets for future developments.

COMPETITIVE PLAYERS

The Global Iron Powder Market is undergoing many changes due to the growing competition among key players in the future. With technology improvement and their increased use in the industrial sector, companies are now mainly focused on innovating and collaborating strategically to better strengthen their positions. Companies dealing in this market know that iron powder's demand will rise in industries such as automotive, aerospace, electronics, and healthcare. The rising demand is mainly forcing manufacturers to improve product quality and look into better sustainable production practices while working on extending their global presence.

Examples include companies such as Höganäs AB, sampadgroup, JFE Steel Corporation, which are investing in R&D activities to produce high-performance iron powder suitable for advanced applications. These companies are not only focused on improving product efficiency but also on developing environment-friendly manufacturing processes to align with the sustainability goals. Meanwhile, BASF SE and INDUSTRIAL METAL POWDERS (INDIA) PVT. LTD. are also utilizing their expertise in chemical and material sciences to render refined powders having enhanced purity and performance characteristics. This competitive environment encourages innovation and drives companies to focus on differentiation through better quality products and customized solutions.

Another factor contributing to competition is that additive manufacturing increasingly uses iron powder. For instance, Micrometals, Inc., Thermo Fisher Scientific Inc. and QMP Inc. are engaged in metal powders optimized for the 3D printing technologies. These are creating new avenues in custom manufacturing, as they enable industries to produce intricate components at a very high precision. With the integration of improved techniques into industrial processes, iron powder with consistent particle size distribution and better flow properties is being supplied into the market because of the evolving needs in the industry.

Global suppliers like Shanghai Greenearth Chemicals Co., Ltd., Reade International Corporation, and American Elements are expanding their distribution networks to reach out to an expanding customer base. Increasing strategic partnerships and acquisitions have emerged as common strategies through which companies can gain global or regional markets and, hence, improve their supply chains. While firms such as Schlenk Metallic Pigments GmbH and Ashland are in the fray, emphasis is on the product diversification specialized by these companies in iron powders for coatings, pigmentation, and other industrial applications.

Increased production in electronics and energy storage applications is convincing companies such as CNPC Powder, Dowa Electronics Materials Co., Ltd., and Belmont Metals to continue investing in iron powder formulations for effective conductivity and energy conservation. New market opportunities emerge from the growing adoption of iron-based materials concerning batteries and magnetic applications.

Iron Powder Market Key Segments:

By Type

- Atomized Iron Powder

- Reduced Iron Powder

- Electrolytic Iron Powder

- Carbonyl Iron Powder

By Manufacturing Process

- Physical

- Chemical

- Mechanical

By Purity Level

- High Purity Iron Powder

- Standard Purity Iron Powder

- Low Purity Iron Powder

By End-User Industry

- Aerospace & Defence

- Automotive

- Oil & Gas

- Medical

- Others

Key Global Iron Powder Industry Players

- Höganäs AB

- sampadgroup

- JFE Steel Corporation

- BASF SE

- INDUSTRIAL METAL POWDERS (INDIA) PVT.LTD.

- Micrometals, Inc.

- Thermo Fisher Scientific Inc.

- QMP Inc.

- Shanghai Greenearth Chemicals Co.,Ltd

- Reade International Corporation

- American Elements

- Schlenk Metallic Pigments GmbH

- Ashland

- CNPC Powder

- Dowa Electronics Materials Co., Ltd.

- Belmont Metals

- Pometon

- SAGWELL USA INC.

- Serena Nutrition

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252