MARKET OVERVIEW

The Global Industrial Tire market is a sizeable segment of the greater industrial market which caters to machines and equipment used in construction, manufacturing, mining, logistics, and other industries. While completely different from tires used in passenger vehicles, they have to hold heavy weights and maneuver difficult terrains and extreme operational environments. This market includes tires manufactured from solid rubber, polyurethane, and pneumatic compounds materials which improve durability and performance.

Global Industrial Tire markets include industries in which there is specialized focus on using vehicles and equipment. All these heavy machines are backed by durable tires of high performance, such as forklifts, skid-steer loaders, cranes, etc. The market will go on to take shape along technology lines in increasingly newer innovations in tire designs, materials usage and manufacturing processes. Environmental regulations and the increasing sustainable development concerns will also influence future developments in industrial tire manufacture to eco-friendly and energy efficient tire solutions.

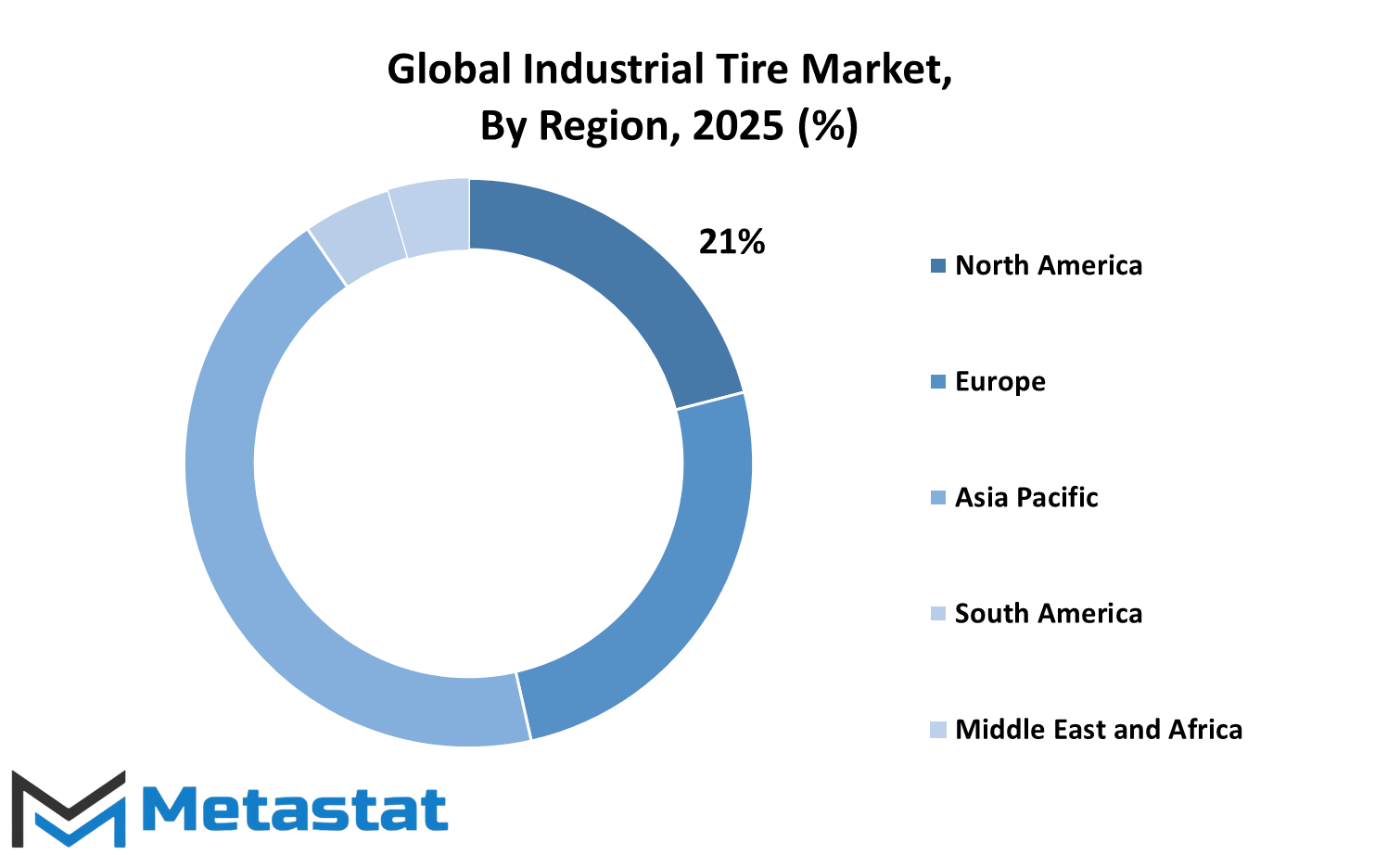

Geographically, the Global Industrial Tire market spans the key regions of North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Each of these regions is characterized by particular demand based on its industrial activities, development of infrastructure, and the prevailing economic conditions within it. Asia-Pacific would remain one of the major contributors to growth in this market because of its rapid industrialization and urbanization. North America and Europe will maintain a high demand for tires with standards of performance safety and quality in their respective established industrial bases.

The market will slow towards smart tire technologies, combining sensors and real-time monitoring systems to improve performance and maintenance benefits. Thus, an operator will be able to monitor the pressure, temperature, and wear of tires, hence helping in reducing downtime and improving efficiency. The innovative technology that these vehicles have will also create an impact on tire design by implementing more automation and autonomous vehicles in industrial applications.

Also, industries apart from being with the Global Industrial Tire market, differentiate the original equipment manufacturers from the aftermarket such as OEMs. OEMs sell directly tires to equipment manufacturers so that they have a full assurance that it is compatible and performance standards are met from the beginning. The aftermarket, on the other hand, represents the segment that is mostly addressing replacement and maintenance of equipment that are already under operation, thus lending itself to the opportunity for both customization and improvement. Both segments are dynamic with respect to the market activity and, into the future, the....

It further drives the Global Industrial Tire market by proper regulation policy and safety standards since the manufacturers will have to comply with the national and international guidelines to ensure reliability and safety of the products. Sustainability concerns will motivate research and development efforts in developing tires that are less harmful to the environment while still achieving performance standards.

The Global Industrial Tire market will develop, however, along technological advancements, regulatory changes, and changes in the industrial demand. Its significance in the industrial area would continue very much intact, with constant innovation being complemented by changes in trends and technology. The demand would still be there due to the fact that industries continue to seek efficient solutions and at the same time sustainable solutions. That will in turn determine the future shape of the market.

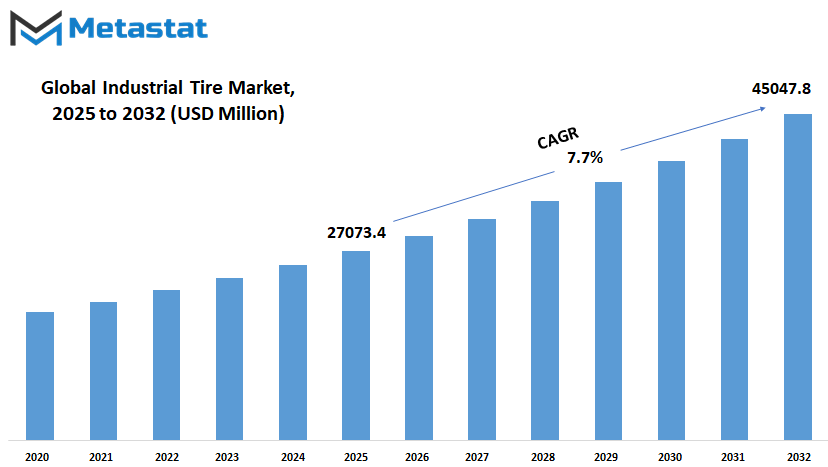

Global Industrial Tire market is estimated to reach $45047.8 Million by 2032; growing at a CAGR of 7.7% from 2025 to 2032.

GROWTH FACTORS

There are bound to be some notable growth prospects for the Global Industrial Tire market in the forthcoming years, mainly attributed to some key drivers. One of the key driving forces for this growth is the rise of industrial processes at the global level. As industries tend to grow, so do the requirements for good and durable tires. It is in industries such as construction, manufacturing, and mining that heavy-duty machinery actually uses tires for smooth operation.

Another key driver of growth is tire technology itself. Tire manufacturers have stressed on the development of tires that can last long, perform under extreme conditions, and require minimum maintenance, thus making them favorable to commercial interests aiming at reducing operational costs.

The environmental considerations will, at their hand, define the Global Industrial Tire market in the future. Pressure on companies to adopt sustainable practices has induced the development of eco-friendlier tires manufactured from recyclable materials. This puts forth not only environmental gains but market gains as well. Further, in turn, automation and smart technology intruding upon all realms are also making their way into tire design. The integration of sensors into tires for real-time monitoring of tire pressure and performance is gaining momentum, handing real-time data over to businesses on how to optimize their own operations.

Parallel to this growth, some challenges could impede market growth. One, high costs of advanced industrial tires would deter small and medium-sized enterprises from adopting them. The other is the market price fluctuations of raw materials that directly affect manufacturing costs of tires, thus risking the steady-price maintainability of the companies. Stringent regulations over tire disposal and recycling are burdensome, operationally-wise, for the manufacturers.

Opportunities would appear on the side of the tire market despite the mentioned challenges. With infrastructure development being put to focus, especially in the developing world, increased demand for construction equipment and the consequent demand for industrial tires will follow. New designs of tires will be required by the shift towards electric and hybrid industrial vehicles, thus furnishing manufacturers with an opportunity to innovate and capture newer market segments. Stronger demand for industrial tires will find a way into the supply through better logistics toward improved supply chain efficiency as businesses seek reliable and durable products doted with such specifications.

In concluding, the obstructions in the way of growth are there, but the overall picture for the Global Industrial Tire market appears to be a very bright one. Continuous developments in technology, combined with increasing demand for sustainable and efficient industrial solutions, would greatly foster the market, ushering thus more avenues for further growth and innovation in the years to come.

MARKET SEGMENTATION

By Tire Type

The Global Industrial Tire market is expected to witness extensive growth in the near future, propelled by rapid industrialization, progressive technology, as well as consumer requirements for performance-oriented and durable tires. Industrial tires are meant for some applications that require heavy-duty services; construction, mining, manufacturing, and material handling are some examples. Industries are steadily constantly expanding and modernizing their fabrications, which means they will need even more the reliable and high-performance tires when it comes to the applications in question.

Of the various factors that are going to affect the future of Global Industrial Tire market, segmentation based on tire characteristics, particularly on the opposition of Radial Tire and Bias Tires, will be a major influence. Radial tire is increasingly becoming the choice of industry as it lasts longer, cost-saving by less fuel consumption, requires less labor because it is easier to maintain, and also offers flexibility, superior traction, and fuel savings.

The design of these tires consists of arranging the cord ply at 90 degrees to the direction of travel, providing smoother riding plus increased tire life. On the other hand, Bias Tires with crisscrossed layers of fabric have greater strength and resistance to cuts and punctures. They are typically chosen for application with fairly rugged terrain and heavy loads.

The current trend in the market is expected to raise demand for radial tires because of their superior fuel efficiency and longer lifespan. The shift would be propelled by an increasing focus on sustainability and cost-effectiveness in industrial operations. Even at that, there will be a fair vacuum of consumption for Bias Tires, especially in areas where toughness and durability were regarded supreme.

Technology will, therefore, play a vital role in determining the fate of the Global Industrial Tire market in the future. The technology of smart tires will involve the introduction of sensors in the tires that will directly monitor tire pressure, temperature, and wear, thus improving safety and efficiency within the environment of industries. This will result in minimal downtimes, but in increased life of the tires and a better value return for industries.

Additionally, the increasing attention given in terms of eco-materials and processes towards which wheels are manufactured will affect the tire production. Many companies are now focused on investing in research aimed at coming up with tires that withstand time while proving to be eco-friendly, thus creating a trend likely to attract most of the eco-conscious customers.

The Global Industrial Tire market is expected to change due to increasing technological advancements and meeting the demands of the industrial sector through good quality and sustainable tire production. The segmentation of tire types underlines the trends toward consumer preference for Radial Tires from Bias Tires as they progress toward efficiency and longevity in particular. However, the demand for these Bias Tires supports the argument for strength and resilience regarding specific applications. As the industries innovate, so will the industrial tire market innovate to offer new services for the future.

By Application

The market expected for Global Industrial Tire is on a trend of extensive growth within a few forthcoming years due to advancements in technology and the increasing demand across different sectors. The market is expected to be valued at very impressive valuations across applications by 2025. The agricultural sector alone will hold USD 8129.9 million in value to show its particular demand for tires providing efficient, durable performance for modern farming equipment. Most of these specialized tires are for all-weather and varied-terrain performance as mechanization in agriculture increases.

One of the most important sectors mining is expected to account for USD 12229.5 million by the end of 2025. This means that mining is the industry using heavy-duty tires, which can be applied in very harsh environments and carrying heavy loads. With mining operations expected to expand, as invariably ever, to meet the increased global demand for minerals and resources, the requirement of robust, long-lasting tires will become even more essential.

For the same reason, technological innovations brought out in tire manufacturing will also form an important arm in improving the durability and performance of such tires while reducing downtimes and increasing operational efficiency.

The construction industry is also a substantial contributor to the Global Industrial Tire market, which is projected to be worth USD 5180.6 million by 2025. Construction projects from residential buildings to very large-scale infrastructure rely heavily on machinery equipped with industrial tires. The indoor application grows further from the push for urbanization and infrastructure projects around the globe, thereby driving the demand for tires that meet high standards of safety, traction and longevity.

Other applications are also expected to go to the level of USD 1533.4 million by 2025, such as those in material handling and transportation within industrial settings. This versatility in the tires comes in handy in working in different conditions, of which the operations are smooth and efficient. Industries' continuous optimizations in logistics and material handling will translate to high demand for this most-reliable industrial tire.

The Global Industrial Tire market will look at different phenomena in the long run, including technological advancements, environmental regulations, and a shift toward sustainability. Probably, manufacturers would channel their efforts towards producing eco-friendly tires with better fuel efficiencies and carbon footprints. Another thing will be the smart technology inclusion of sensors, which would enrich safety and performance through real-time monitoring of tire conditions.

Undoubtedly, the Global Industrial Tire market is set on a strong growth trajectory, driven by rising demands across various sectors, agriculture, mining, construction, among others. The prediction of valuations by 2025 is indicative of the growing priority on higher durability and performance tires amid industrial operations across the globe. The future looks bright for industrial tires, with advances that take sustainability and technology into consideration positioned to meet the evolving needs of applications.

By End User

Industrial tire demand is on an increase with a steady growth for the foreseeable future; thus, increasing variability in demand for durable and efficient tires is likely to drive their expansion through worldwide technological development and industrial growth. Market segmentation by end-user includes construction equipment, agricultural equipment, mining equipment, etc. Each of these divisions plays a very pivotal role in industrial tire prevention.

In construction equipment, higher demand for robust industrial tires will be brought in by urbanization and infrastructure projects worldwide. Generally, construction machinery ought to have tires that can carry heavy loads over rough terrains, and this sector is going to be the key driver for the market as more projects are coming on stream in developed and developing countries. Increased development of smart cities and sustainable forms of construction will further project the need for innovative tire solutions with superior performance and longevity.

The agricultural equipment sector is another large segment contributing to the Global Industrial Tire market. As the population grows, the demand for food production is expected to go higher, and this results in the increased use of agricultural machinery. Special-purpose tires are fitted on tractors, harvesters, and other farming equipment to enable their smooth operation and efficiency under different conditions. The increasing trend towards precision farming and the growing usage of advanced agricultural technologies may push the demand for industrial tires to support these modern agricultural practices.

The mining undertakings will contribute significantly toward the industrial tire market. Mining activities involve tires that are capable of performing in extreme conditions and heavy-duty applications. With the increased demand for minerals and resources in support of technological advancement and infrastructure projects, large-scale mining activities would commence, in turn creating an increased demand for industrial tires that are durable and reliable. Further channeling into sustainable mining practices will push the development of eco-friendly tire solutions that meet industrial changing requirements.

Other sectors, such as logistics, materials handling, and manufacturing, are likely to have an influence on the Global Industrial Tire market. The growth in e-commerce and the necessity for seamless supply chain management would result in increased demand for industrial tires for warehouses and distribution centers. As industries automate and optimize their processes, the demand for specialized tires that can support various machinery and equipment will only increase.

In general, the Global Industrial Tire market will grow across varying sectors; each of these sectors will build up the demand for advanced, durable, and efficient tires solutions. The future of this market thus rests upon technological innovations and sustainable development that let it respond to the continue changing needs of varied industrial demands the world over.

By Product Type

The Global Industrial Tire market has much awaiting change with the passing years. With industries growing and technologies varying, there shall be a rise in the demand for efficient, durable, and specialized tires. There are two main product types in the market: Pneumatic Tires and Non-Pneumatic Tires based on industrial needs.

Pneumatic Tires are filled with air and widely used in industries that require cushioning and shock absorption. Also, they are specially suited for the areas with rough terrain so that their performance can provide better traction and a pleasant ride. Increased operational costs and safety standards will lead to innovations within Pneumatic Tires based on materials of better durability and tread patterns that can withstand tough working conditions while providing excellent serviceability. These improvements will be crucial in industries like construction, mining, and agriculture, where heavy machinery grounds itself on tire performance.

By contrast, the Non-Pneumatic Tires measure on rising demand in the industry due to a lack of air pressure, making them highly resistant to punctures. In such industries where sharp objects and debris are a common bane, such as waste disposal and manufacturing, these Non-Pneumatic Tires shine through. One thing for certain is in the future; improvements in Non-Pneumatic Tires will revolve around the lightweight and flexible materials that guarantee fuel efficiency while decreasing wear and tear on machines. Another expectation is that these will soon be more customizable, allowing industries to pick and choose certain designs to suit their operational requirements.

An effort for sustainability being on the front, it is only natural that the transition of both Pneumatic and Non-Pneumatic Tires goes in alignment with such environmental objectives. They would have to invest in eco-friendly materials and recycling processes, from tire production to disposal, to minimize the negative environmental impact. The integration of smart technology in tires meant for industrial use, such as sensors for monitoring tire pressure and wear, would improve efficiency and safety; thereby, minimizing downtimes and optimally managing resources.

Regional developments and economic factors probably shall have a say regarding changes to the Global Industrial Tire market. Emerging economies will provide a fertile ground for industrial activities and increased demand for both tires. The old economies are striving to do opposite - that is, upgrade existing equipment with the latest tire technologies for higher performance and sustainability.

In conclusion, the Global Industrial Tire market is about to witness an evolution on the heels of technology, materials, and sustainability practice improvements. The rhetorical division between Pneumatic and Non-Pneumatic Tires testify to the understanding of the various industries' diverse needs, all of which are pushing innovations that will shape the next twenty years of this market. With industries continuing to grow and adapt, the demand for specialized, efficient, and ecological tires will keep inflating the importance of this market in global industrial operations.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$27073.4 million |

|

Market Size by 2032 |

$45047.8 Million |

|

Growth Rate from 2025 to 2032 |

7.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

Accordingly, the global industrial tire market will be expected to experience a steady growth factor in the coming years by technology advancements and rising industrial activities across the various parts of the world. As the industries expand, the need for safety and efficient tire tires increases, thereby affecting how the markets develop across the globe. This market is further divided geographically into North America, Europe, Asia-Pacific, South America, and Middle East & Africa, with each contributing its segment to the growth of this market.

Key North American countries involved in the manufacturing of industrial tires include the United States, Canada, and Mexico. The basis of purchase for this region is bolstered by the presence of a strong manufacturing base as well as leading tire manufacturers. The U.S. has been a pioneer in innovations related to tire technology and a focus on sustainability, particularly as industry relies increasingly on automated machinery and more advanced vehicles.

There is Europe led by the UK, Germany, France, Italy, and the rest of Europe. In fact, it is a matured yet very dynamic market. Germany and the UK are leading in this region due to their excellent industrial sectors with a focus on high-performance tire solutions. Environmental regulations and the drive towards eco-friendliness in the production method have led to the manufacture of sustainable tire materials, placing Europe at the frontline in green technology in this market.

The fast-growing market will be the Asia-Pacific, including India, China, Japan, South Korea, and the Rest of Asia-Pacific. Growth is primarily being driven by China and India due to rapid industrialization and elaborate infrastructure projects in both nations. Besides, urbanization and industrialization in these countries are expected to continue rising demand for industrial tires, especially heavy-duty and rough terrain tires.

South America shows a developing market with a great deal of potential, which extends to Brazil, Argentina, and the Rest of South America. Industrial tires are increasingly needed in Brazil due to its growing agricultural and mining sectors, both of which will require modernization in their activities as they become associated with these industries. The expected consequent demand will therefore trigger growth in its market.

Also on the rise is the Middle East and Africa. This region is subdivided into GCCs, Egypt, South Africa, and the Rest of the Middle East and Africa. The creation of industrial tires is ultimately directed at the construction industries and oil and gas sectors, which are most of the time drivers of the demand for industrial tires in the GCC countries. Meanwhile, South Africa's mining sector and Egypt's infrastructure development projects further boost the expansion of this market in the region.

The global industrial tire market, therefore, holds strong promises in the future even as these technological innovations and regional industrial growth influence the same. Almost all manufacturers and stakeholders will likely enjoy opportunities in the expanding market as industries worldwide seek more efficient, sustainable, and durable solutions.

COMPETITIVE PLAYERS

The Global Industrial Tire market is likely to undergo major changes in the years to come due to the technological advances, economic shifts, and demand by various industries. If the world pursues automation and sustainable industrial practices, the performance and durability required from the tires will be more serious and critical. This trend will change the competitive landscape as major companies will be striving to innovate and meet the evolving customer needs.

This major business investment in R&D has been followed by key players like Balkrishna Industries Limited (BKT), Carlisle (Titan International, Inc.), Michelin Group, Bridgestone Corporation, and Continental AG, among others, in the Global Industrial Tire market. These companies are concentrating on the production of tires that not only last long but are also expected to be more fuel efficient and environment friendly.

For instance, such companies include the Michelin Group and Bridgestone Corporation, both known as early frontrunners in developing eco-friendly tire solutions aligned to global sustainability goals. The shifting focus toward green technology is not merely a publicity gimmick; it has become a necessity as industries are called upon to reduce carbon footprint.

Hankook Tire & Technology Co., Ltd., Kumho Tires Co. Inc. and Yokohama Rubber Co., Ltd. are also pushing boundaries into new territories by integrating smart technologies into their products. Such smart tires can monitor their status in real-time, providing operational efficiency and predictive maintenance information to the user. This technological edge could become a critical differentiator in what is clearly a very competitive market, as businesses strive to minimize downtime and hence maximize productivity.

Apollo Tire Ltd., CEAT Limited, and Sumitomo Rubber Industries, Ltd. (DUNLOP) are extending their geographical horizons to developing economies where the pace of industrialization is increasing. These companies customize their products according to different advantages such as extreme weather conditions or supporting heavy-duty equipment used in the construction and mining industry. Their success in penetrating the myriad of diverse market needs can put them in an advantageous position for accessing a larger market share.

Of course, there are other significant players such as ZBJY (Zhongce Rubber Group), Mitas Tires, Prometeon Tyre Group S.R.L., and MRF Tyres that are not far behind. They have been raising their production capacities and expanding their distribution networks to ensure timely delivery and customer satisfaction. With supply chains now getting very complex, efficient logistics will be highly important in maintaining competitiveness.

In the future, the Global Industrial Tire market will likely witness much more of collaboration and partnership among these important players. Collectively, the companies could harness their resources and expertise to hasten the pace of innovation and bring the fruits of such efforts to market sooner. This collaborative mode might also aid in navigating regulatory hurdles and tapping into new opportunities.

The Global Industrial Tire market, at this point, is all set to get transformed with a new-age thrust of technology, sustainability, and globalization. Indeed, those companies that can adapt to such trends and continue to meet customer expectations will be the frontrunners in this dynamic industry, which will continually change over time.

Industrial Tire Market Key Segments:

By Tire Type

- Radial Tires

- Bias Tires

By Application

- Agricultural

- Mining

- Construction

- Others

By End User

- Construction Equipment

- Agricultural Equipment

- Mining Equipment

- Others

By Product Type

- Pneumatic Tires

- Non-Pneumatic Tires

Key Global Industrial Tire Industry Players

- Balkrishna Industries Limited (BKT)

- Carlisle (Titan International, Inc.)

- Michelin Group

- Bridgestone Corporation

- Continental AG

- Hankook Tire & Technology Co., Ltd.

- Kumho Tires Co.Inc.

- Yokohama Rubber Co., Ltd.

- Apollo Tire Ltd.

- CEAT Limited

- Sumitomo Rubber Industries, Ltd. (DUNLOP)

- ZBJY (Zhongce Rubber Group)

- Mitas Tires

- Prometeon Tyre Group S.R.L.

- MRF Tyres

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383