MARKET OVERVIEW

The global industrial lighting equipment market will see very intense structural and technological changes that will be beyond the current scope. An industry with a history of providing almost reliable illumination to factories, warehouses, refineries, and production places will very soon see changes that will be less about the intensity of light and how the lighting systems will soon begin serving different purposes. Traditional imperatives of durability and energy efficiency will no longer be sufficient determinants of the fortunes of this world. There is a much bigger change ahead-an aligning of lighting infrastructure with automation, well-being, and operational intelligence.

It is towards digitization that most of the industries are marching, and the Global Industrial Lighting Equipment market is also going towards a wider network of interconnected systems. It is not going to be lighting simply to see readily, but lighting that also acts as a route for data. Intelligent lighting and the incorporation of sensors to monitor the environmental conditions such as temperature, humidity, and air quality will be the introductory stages of intelligent lighting systems. These will connect lights to centralized system data, allowing facilities to react to internal changes dynamically, as well as external ones. The active shift from infrastructure will define how industrial spaces are organized, operated, and optimized.

Design would be yet another dimension to extend the Global Industrial Lighting Equipment beyond its present concerns; design in worker performance and safety. Industrial lighting will now be judged by more than one single determination of brightness or longevity. Human-centric lighting that supports circadian rhythms and minimizes fatigue, for example, will dominate applications with mostly continuous operations. Often, those are where task or zone-specific lighting schemes will become the norm in high-risk environments, to improve accuracy and lower probability of error. All effects of light on production and focus will now translate into design strategies that haven't been before.

Further chapters for this space will be opened by the increasing incorporation of lighting systems with robotics as well as AI-driven machines. The Global Industrial Lighting Equipment market will go with automated processes that would mostly rely on vision systems because lighting quality in terms of consistency and spectrum becomes an issue. It will no longer remain a background feature, but an active contributor to the precision and success of robotic operations. The alignment of lighting applications with machine learning will thus reorient their value within modern manufacturing plants and logistics hubs.

Geopolitical considerations will also contribute to steering the market in a socially determined way, as well as the race for technological independence that leads to the establishment of self-reliant countries with respect to the production of high-grade industrial lighting components rather than supply chains and investment strategies.

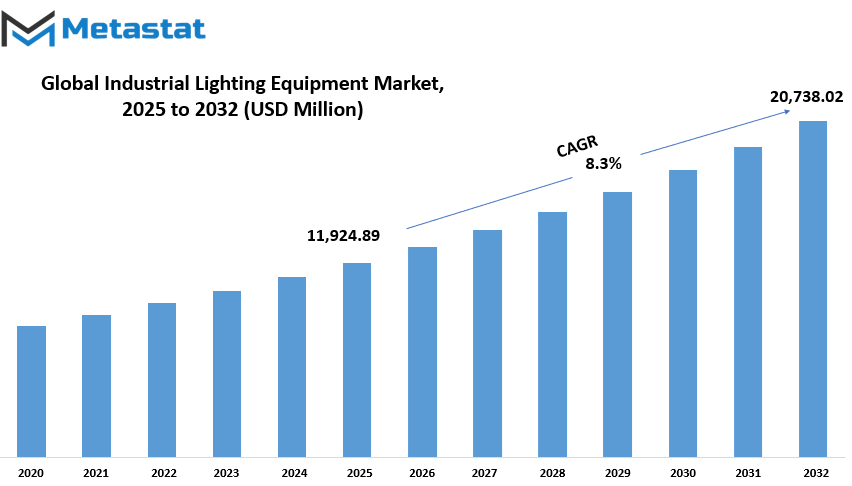

Global Industrial Lighting Equipment market is estimated to reach $20,738.02 Million by 2032; growing at a CAGR of 8.3% from 2025 to 2032.

GROWTH FACTORS

The Global Industrial Lighting Equipment market as a result of two very important significant causes. The first one is that energy-efficient lighting mainly involves the adoption of LED lights. These lights consume little power, have a longer life, and consequently help industries bring down their electricity bills. Along with this, they formalize sustainability goals and trends that grow more important as time goes by among sectors. The switch to LED lighting is gaining considerable pace and towards this end apart from better film meeting cost-effective and eco-friendly solutions. Another strong reason driving market growth is stringent regulations that require safety at workstations. Adequate lighting is sought in work environments like factories and warehouses, where one can then prevent accidents from happening and slow down efficiency. More strain is placed on industries by governments and safety authorities to maintain very high safety standards, and so the request has increased for very reliable and efficient lighting systems.

However, some deterrents are still apparent despite the rosy expectations and might even slow down the market in the near future. Primarily too high is the initial investment cost required for advanced lighting systems. Though LED and smart lighting save much on electricity bill savings in the long run, the up-front purchase can sometimes be very discouraging for most enterprises, especially when it comes to smaller businesses. This is even more true in small-scale industries, such that when they lack funding, they take longer to make decisions and usually stick to the traditional lighting methods. Another issue is a lack of awareness, or knowledge regarding advantages of upgrading to modern systems. Some small and medium-sized enterprises may not fully understand how improved lighting can boost productivity and safety, or how the savings can outweigh the costs over time.

Promising opportunities are being offered by developing smart and IoT-enabled solutions, which will also pave a platform for bringing automation to lighting systems, for example, prompt lighting systems adjustments based on movement, time-of-day, or natural light levels, thus improving energy efficiency and adding convenience and flexibility in industrial settings. Gradually, interest in smart lighting solutions is expected to rise with increasing automation and digital transformation in companies. With rising awareness and gradual technology cost reductions, there is a bright prospect for even better growth in the industrial lighting market in the not-too-distant future, particularly as these businesses start to understand and realize amenities by upgrading their systems.

MARKET SEGMENTATION

By Product Type

The market for Global Industrial Lighting Equipment is growing at a slow pace due to the demand for more energy-efficient and long-lasting lights. Lighting in industrial spaces such as warehouses, factories, and manufacturing units is required constantly to ensure safety and productivity in these areas. LED lighting is one product type that has become very popular among the different product types currently on the market as the largest contributor valued at $7,686.78 million. Its use is considered for further growth because it consumes less energy, lasts longer, and provides brighter lighting than older technologies. Many businesses are now using LED lighting for cost purposes and compliance with environmental regulations.

Other forms of lighting in the market are fluorescent, HID (High-Intensity Discharge), incandescent, and halogen lighting. Most of these types, especially fluorescent lights, are efficient given the fact that they have been widely used for years in industry. However, they are gradually going out of use with the rise in affordability of LED technology. HID lighting is largely used at the moment in areas where there needs to be strong illumination like outside spaces or even some very large warehouses, although it needs more electricity input and maintenance. In terms of all three, incandescent and halogen lighting are losing their place in industry increasingly because of their short lifespan and high energy consumption.

The transition toward using only LED lights according to most experts is not justifiable on consideration of energy savings alone. The heat emission from LED light is entirely minimized, thus providing a conducive working environment and creating a scenario wherein a part of cooling costs can be recouped. Moreover, evident is the fact that these lights are switched on instantly without having to stand waiting for warming up, thus becoming ideal in most industries requiring immediate lighting. The fact that they can withstand harsh conditions such as vibration and temperature disturbances makes these lights a perfect choice for factories and heavy-duty work environments.

Government policies and energetic savings programs also advocate high-efficiency lighting. Incentives are being offered by many countries to industries replacing their lighting systems, thus adding to the demand for newer options like LEDs. Consequently, companies in the industrial sector will replace traditional lighting with modern systems to save costs and impact sustainable practices as well.

Traditional lighting will still find suitable applications; however, the market is already shifting towards those that provide better performance and lower costs of operation. The shift to LED lighting and therefore leading the market with a strong value of $7,686.78 million, gives a very vivid picture of how industries are responding to the new standards. As technology improves and understanding widens, the direction toward smarter and efficient lighting systems will continue to evolve, shaping the industrial lighting of the future across the globe.

By Application

One constant throughout all these applications for lighting is safety. It is in every industrial setting, to help in illumination, allowing workers to work efficiently, and also assist in continuous operations. Lighting selection, on the other hand, depends on the environment of application. The segmentation of the market by applications includes Outdoor Lighting, Indoor Lighting, Exit & Emergency Lighting, Task Lighting, and Aisle Lighting. Each lighting type serves certain purposes and enhances value to industrial spaces.

Outdoor lighting is installed mostly in areas like parking lots, factory perimeters, and storage yards. This ensures safety during night operations. We are talking here about very durable lights that can withstand extremely rough weather conditions and also deliver powerful light. LED lights are increasing in popularity in this segment due to their energy efficiency as well as long service life.

On the other hand, Indoor lighting is used in production floors, warehouses, and assembly areas. The light provided should be sufficient to carry out detailed work while at the same time preventing accidents. Apart from enhancing workers' concentration, uniform and bright lighting inside these facilities could also relieve eye strain. Companies are now looking for lighting systems that are easy to maintain and do not add to their electricity costs.

Emergency and exit lighting is considered a legal and safety requirement in most industries. These lights stay illuminated during power outages to facilitate the exit of people in case of emergencies. The lighting in case of unforeseen circumstances acts as a catalyst in saving lives; hence an emphasis on reliability and battery backup.

Task lighting is directed to specific workstations where high-precision detail work is required. Task lighting is used on inspection lines or machinery maintenance zones. These are brighter lights, directed in a way to eliminate any strain on the eyes of workers performing delicate tasks.

Aisle lighting illuminates narrow paths between racks or shelves in warehouses and storage facilities. Aisle lighting enhances navigation for safe and fast handling of goods. These are generally motion-based lights, operating only to save energy when in need.

Overall, the industrial lighting market is advancing towards more energy-efficient and smart lighting systems. Lighting solutions are being sought by the industries which fulfill their operational requirements while supporting their sustainability goals. As industry develops and technology evolves, lighting will continue to become a vital part of providing safe and productive working environments.

By Technology

Such type of Global Industrial Lighting Equipment market continues to be steady growth since industries are modernizing facilities and systems for better lighting purposes. One of the driving factors could be the high need for energy efficiency and long life from such lighting systems. For monitoring long periods at a time, an industrial setting, for instance, a warehouse, factory, or outdoor production site, requires a robust illumination system that is able to withstand harsh environment conditions while also reducing energy costs. Over the years, companies have become very conscious of energy use, so they tend to choose options that offer not only a strong illuminating solution but also a reduction in total energy costs at the end.

By technology, it is further subcategorized into Smart Lighting, Traditional Lighting, Clean or Sustainable Technology Lighting, Solar Lighting, and Control Systems. Smart Lighting has become fairly popular because of its better control features: these systems can automatically adjust light to its brightness, taking into account either natural light, human presence, or hours of work. Such a system not only saves energy but also extends life for the lights. Most areas use Traditional Lighting in the past due to the low cost of initial installation and its easy installation. Most are gradually displacing it with new ones as costs decrease while performance improves.

Sustainable or Clean Technology Lighting has been gaining attention in recent years based on the materials and systems used, which are environment friendly. They consume less electricity and emit harmful gases, making them suitable for companies that want to go green. The other alternative that is gaining usage in increasingly remote or outside locations that have limited access to electricity is Solar Lighting. They charge during the day and serve at night, hence reducing operating costs and being considered a good investment for the long term. Control Systems are also integrated into the latest lighting systems since they allow users to control several lights from one place, add timers, and monitor use, making lighting more efficient and easier to manage.

Lightings are set to take industrial demand upward, especially with industries looking for modernization in their operations. And as more energy savings, less maintenance, and safer workspaces are becoming the focus, so will the advantages differ for each lighting technology. Companies will likely opt for those that are specific to their needs but mindful of long-term savings and the performance. This just shows that industrial lighting is moving beyond brightness into much smarter and much more responsible choices.

By End-user Industry

The Industrial Lighting Equipment market is a global phenomenon witnessing rising prospects with several industries on the path for an efficient and reliable lighting option. Lighting holds the difference in keeping everything under control, safe, and productive in a range of working environments. With the need for energy-efficient and long-lasting lighting on the rise, different end-user industries are influencing the direction of the market's growth and which products are under focus.

Manufacturing finds its way as one of the biggest markets for providing demand. With continuous and bright lighting, factory workers carry out assignments with accuracy and safety. Lighting is needed so that the workers can assemble parts or operate heavy machinery accordingly. With proper illuminating solutions, it minimizes errors and lowers accident risks. In the sector, LED lighting is gaining prominence for its long life, low maintenance, and ability to save electricity bills in the long run.

Adequate lighting systems are also needed for warehousing and logistics. The spaces are large and are often operated almost day and night. Good lighting will allow efficient inventory management, load, and unload shipments, as well as security. Lighting should be bright and diffused so that employees are able to see clearly, reducing possible mistakes or injury. The growth of e-commerce has seen warehouse space expansion, triggering the need for more efficient lighting systems that can compliment with such big areas with high ceilings.

In mining and mineral processing, lighting is requested to be powerful, durable, and resistant to the harsh conditions of dust, moisture, and vibrations. A lot of times, these sites are located in far-flung areas with little to no natural light, hence lighting has a greater bearing on safety and productivity. LED fixtures designed for these particular environments are much sought after because of their resilience to rough use while maintaining performance.

Agriculture is yet another burgeoning field where lighting is used for maximum gain. Farmers use specific types of lighting to promote simultaneous and healthy crop growth in controlled surroundings. Such lights support photosynthesis, hence accelerating healthy plant growth, especially in greenhouses or indoor farms. Animal lighting systems are also used to modify animal behavior and welfare.

Lastly, commercial buildings are going for modern lighting to decrease power bills and increase employee comfort. Offices, malls, and retail stores are all choosing greener lighting that promotes a healthier atmosphere for employees and customers. Smart lighting systems that be adjusted based on daylight or occupancy are gaining much traction.

Overall, the global Industrial Lighting Equipment market shall witness continued growth in light of these industries investing in lighting for enhanced safety, performance, and energy saving. The need for better solutions will push these firms to build products to meet the various needs of each industry.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$11,924.89 million |

|

Market Size by 2032 |

$20,738.02 Million |

|

Growth Rate from 2025 to 2032 |

8.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

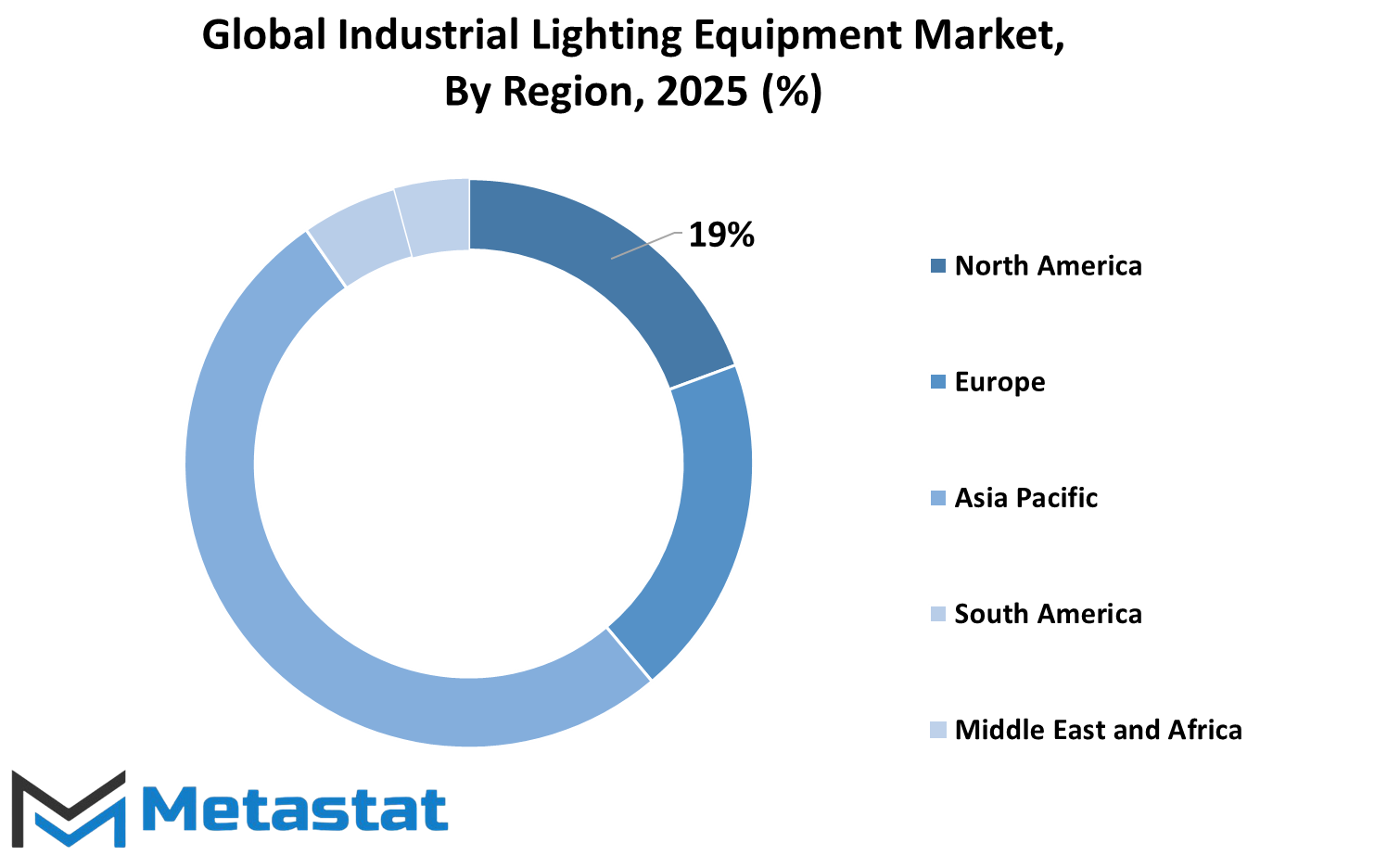

REGIONAL ANALYSIS

The Global Industrial Lighting Equipment market is segmented geographically into different areas with a view to deriving many essential resources from countries across the world. The largest such region is North America, which divides itself into a number of smaller portions, the USA, Canada, Mexico, each expected to demonstrate healthy demand due to spurred developments in industrial facilities, and energy adiitional inclinations. Together with the above-mentioned concerns, the market potentials may even continue to grow with continuous advancements in lighting systems, especially for major manufacturing companies in the region.

The European region of the market contains the UK, Germany, France, Italy, and the Remaining Europe. This dovetails perfectly into the focus on upgrading outdated infrastructures, hence increasing demand for reliable and cost-effective lighting equipment. Two countries, Germany and UK, must be singled out from the list as they currently promote the use of more sustainable solutions as they intend to encourage industries to adopt energy-efficient products. Besides, regulations pertaining to workplace safety and energy consumption are bound to sustain market demand.

Asia-Pacific is also one of the high-importance areas with respect to the global market. It consists of fast-growing countries like India, China, Japan, South Korea, and other regions in Asia-Pacific. Due to rapid industrial growth and urban development, this area has recently witnessed increased demand for new lighting systems in factories and warehouses. China and India are hence the major contributors in this matter, given their enormous manufacturing hubs and government incentives for energy conservation in industries. Increased investments in industrial automation and infrastructure projects further form the base for demands in this region.

In South America, Brazil, Argentina, and the rest of South America make complete coverage. This region may not be as fast growing as other regions, but it is discovering improvement in its activity in the industrial front and expanding its government support towards energy efficient technologies into new opportunities. Brazil, due to its size and improvement on the track for modernizing its industrial sector, should surely lead the country in its market.

Geographically, the Middle East and Africa divide into GCC countries, Egypt, South Africa, and the rest of the Middle East and Africa. Most of these areas have made progressive efforts toward improved industrial development and are currently venturing in better lighting solutions that would improve their working environments. The Gulf countries were comparatively higher in construction and manufacturing activities, which would register the increased market growth. As awareness about energy use would further prevail, industries within this region would get used to more efficient use and long-lasting lighting equipment.

COMPETITIVE PLAYERS

With global trends favoring the adoption of energy-efficient and long-lasting artificial lighting for diversified industries, so is the upsurge of the global market for industrial lighting equipment. Factories, warehouses, and manufacturing plants all demand robust and reliable lighting systems designed to withstand tough conditions while saving energy. More and more innovative systems will make creating safer environments possible as productivity and safety continue to be focal areas for businesses.

Most significantly today technology is transforming the future of industrial lighting. Industries have mostly switched from regular lighting to LEDs; this has increased energy-saving goals for many businesses, although the ultimate rewards are resulted as well by environmentally friendly lighting in most ways. Another increasing trend is that of smart lighting that can now be controlled using mobile phones or set to adjust automatically based on conditions in the workplace. They manage energy more efficiently and ensure a much safer work environment by adjusting the lighting levels according to necessity.

Players like Phillips and Hubbell Lighting, Emerson, Legrand, Acuity Brands Lighting, Toyoda Gosei Co., Cree, General Electric, Osram Licht AG, Zumtobel Group, Fulham Co., Dialight plc, Eaton Corporation, Fagerhult Group, Havells India Ltd., LEDVANCE GmbH, Lutron Electronics, NVC Lighting Technology Corporation, and Panasonic Corporation are the key players that constitute this transformation. Continuous development in products and services is what they do to ensure that the most progressive disruptive innovation happens in the industrial lighting equipment sector. Customers or manufacturers across the selected countries would benefit immensely from the research findings thrown wide open into developing more efficient and more flexible and maintenance- free products of lighting.

Another market trend being created by government regulations and energy standards relates to lighting systems that consume less energy. This is probably one of the reasons that the industrial lighting sector is moving toward advancement and development in user-friendliness. The market will thrive even more with every industry switching its lighting systems to meet safety standards and cut down on energy costs. Major players make sure their support remains solid with innovations that go on in technology for the industrial lighting equipment market.

Industrial Lighting Equipment Market Key Segments:

By Product Type

- LED Lighting

- Fluorescent Lighting

- HID (High-Intensity Discharge) Lighting

- Incandescent Lighting

- Halogen Lighting

By Application

- Outdoor Lighting

- Indoor Lighting

- Emergency & Exit Lighting

- Task Lighting

- Aisle Lighting

By Technology

- Smart Lighting

- Traditional Lighting

- Sustainable/Clean Technology Lighting

- Solar Lighting

- Control Systems

By End-user Industry

- Manufacturing

- Warehousing & Logistics

- Mining & Mineral Processing

- Agriculture

- Commercial Buildings

Key Global Industrial Lighting Equipment Industry Players

- Philips

- Hubbell Lighting

- Emerson

- Legrand

- Acuity Brands Lighting

- Toyoda Gosei Co.

- Cree

- General Electric

- Osram Licht AG

- Zumtobel Group

- Fulham Co.

- Dialight plc

- Eaton Corporation

- Fagerhult Group

- Havells India Ltd.

- LEDVANCE GmbH

- Lutron Electronics

- NVC Lighting Technology Corporation

- Panasonic Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252