MARKET OVERVIEW

The Global Industrial Blades market, which covers the requirements for precision in package and metal processing, food processing, and recycling. Such blades have the strength and performance engineered into them to perpetuate high-volume operations where consistency and wear resistance define the efficiency of machinery. Such tools are all about cutting, slitting, shearing, or otherwise shaping materials in an industry setting; they must remain razor sharp, however, to operate well under conditions that are often beyond reasonable imagination.

Industrial blades are used in many areas, each requiring a specific blade type to address different materials and cutting environments. From circular blades for slitting metal coils to straight knives used in the paper industry, and from profile blades for manufacture on-the-roll to scribing knives in the building industry, the Global Industrial Blades market will be a major supplier to industries that require close tolerances and repeatable results. Manufacturers across regions life afresh invest in blade technologies that bring reduced downtimes and maximum throughput of production. Such demands will spur innovation not only in design but also in materials science, coatings technologies, and sharpening techniques.

Customization is going to be dominant in the future scenario of the Global Industrial Blades market. These specialized requests will influence production processes, hence encouraging manufacturers to adopt precision machining and advanced quality assurance systems. Indeed, such special requests would incline suppliers to improve their inspection and testing regimes to meet those tolerance levels because of the high level of accuracy demanded from them.

The Global Industrial Blades market would also be driven by changes in the automation trends of the manufacturing sector. Blades used in such automation processes within factories need to be aligned with the equipment sensors and precision motors as factories become smart and the stages of production are handled by an increasing number of robotic systems. Feedback of the cutting system with the aid of automations will necessitate blade designs to be more uniform and predictable in wear behavior ensuring seamless operations without any unpredicted interruption in maintenance.

The Global Industrial Blades market will receive broader acceptance from the geographical regions investing in developing or expanding manufacturing infrastructure. Demand for these types of facilities localized in blade production capacities will arise from such countries focusing on self-sufficiency in industrial production. This will enhance local players instead giving more operational space to technological or partnership transfer opportunities.

Be influenced by environmental considerations on product development in the Global Industrial Blades market. With industries concentrating on reducing material waste and energy consumption, blades that give longer life and retains edges even in heavy-duty load applications will be prioritized. Recyclability of Worn Blades and the development of sustainable materials will form a broader procurement decision for major manufacturers.

With the advancement of industrial technology, the Global Industrial Blades market will continue to evolve to precision, adaptability, and reliability-these qualities that must be present in modern manufacturing environments to operate with as little disruption as possible.

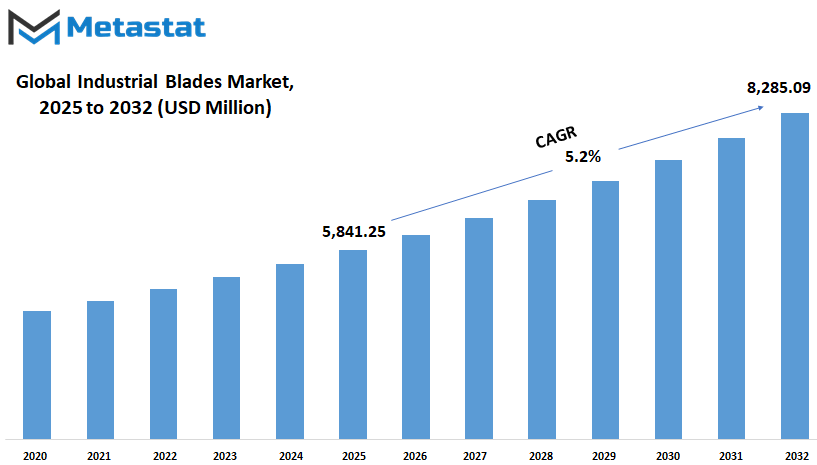

Global Industrial Blades market is estimated to reach $8,285.09 Million by 2032; growing at a CAGR of 5.2% from 2025 to 2032.

GROWTH FACTORS

The Global Industrial Blades market is anticipated to witness gradual growth over the coming years due to various drivers that are expected to shape this market. One of the major drivers of this market is the increasing demand from different industries for precision-cutting tools. Industries such as food processing, packaging, plastics, textiles, and automotive manufacturing are the major ones that depend considerably on these blades for smooth operations. These specialized industrial blades are known to enhance performance, minimize wastage of materials, and ensure clean and accurate cuts, which has been mainly important as companies are focused on improving the quality and speed of their outputs.

Another very strong driver, which is actually pushing the market ahead, is automation and sophisticated manufacturing technology. As organizations proceed to install equipment that works much faster and accurately, that means the demand for superior blades, which can withstand constant use, will increase. Blades have to be able to work effectively with a wide range of tasks, including metals, plastics, and composites. The current trends in manufacturing are pushing towards increased demand for effective cutting instruments.

There are challenges also which may act as barriers to market growth. One is a high raw material cost, which makes manufacturing blades very expensive. This may restrict end consumers from being able to afford the product, especially in the case of small businesses or newer markets. Moreover, environmental regulations would hinder some fabrication processes or materials in the industry. Consequently, such laws or case scenarios would require a change in some companies, which might add expense to them and slow down the pace at which they produce.

Regardless of such worries, there do exist some good prospects which could help in building the Global Industrial Blades market. Development of sustainable materials and energy-efficient production techniques may potentially result in a forthcoming generation of blades that can be both high-performing and sustainably produced. Such companies interested in developing research and innovation may find them as future leaders in the market as demand increases for tools integrating environmental considerations.

In addition to this, newly industrialized infrastructure and manufacturing in developing regions would result in more demand for industrial blades. The more a country progresses into factories and production capabilities, the more tools will be needed. Companies that give local needs for products and offer reliability will stand to benefit from this potential growth. In the future, the market will likely grow at a gradual pace because of the boosting innovation and technology which generates the need for increased precision in various industries.

MARKET SEGMENTATION

By Blade Type

The future of the Global Industrial Blades market looks quite promising and is forecasted to experience sustained growth over the next few years due to increased demand across various industries. These blades are vitally important for cutting, shaping, and resizing materials in manufacturing, packaging, automotive, and construction sectors. With industrial operations being pushed more towards increasing efficiency, it is ever so important to have sharper and more durable blades. Industrial blades typically help in being accurate and fast either while cutting through metal sheets or precision cutting of packaging materials. Demand relates not only to efficiency but also to operating with the least waste and maximum consistency.

According to blade types, the market consists of slitting blades, shearing blades, circular blades, band saw blades, and others. Each of these types has its own unique advantages depending on the application. Slitting blades are normally made for cutting materials into narrower segments and find application in paper, textile, and metal industries. On the other hand, shearing blades are more focused on straight-line cut applications where an edge finish is necessary. Circular blades are quite preferred in food processing and woodworking for very clean and even cuts. Band saw blades are flexible and frequently used for odd or curved cutting tasks. The "other" category contains specialized blades for distinct and customized demands in the industry and are often tailored to a given production line.

Interestingly enough, the market's future will be greatly determined by technology and sustainability. With automation working its way deep into factories, blades must now flirt with machines that work around the clock. We have heard the call for better blades with an even louder voice for those same blades to last longer. As reducing environmental impact will remain the larger themes for businesses, the main focus will start shifting toward the recyclability of blade materials and energy-saving designs for when the actual cutting takes place. Thus, this will interest manufacturers in reviewing the very materials and processes they have long been using.

As industries adopt faster and more modern machinery relying on high-performance blades, the Global Industrial Blades market is expected to keep expanding. Blade types will continue to evolve based on the type of material being cut; and improve as durability becomes critical from the perspective of reducing downtime and maintenance. In the not-too-distant future, we may expect an increasing number of 'smart' features being incorporated into blade systems, including real-time wear and usage sensors. All of this bodes no fewer changes toward a market that is shifting to contemporary needs while staying true to performance and reliability.

By Material

In accordance with the industrial forces a new future is opening up for the Global Industrial Blades market in which durability, precision, and efficiency are bound to mean more than ever. As industries will get into ways of improved cutting, shaping, and refining of materials, this increasing demand for high-performance blades will become reality. Different materials used for making these blades bring their own characteristics to suit different applications according to the user's choice. Hence, to some it seems that the focus will not only be on blades just for the sake of functioning; a future will also include the long serviceability, better performance, and less wastage.

High carbon steel blades have a long-standing reputation for hardness and edge retention. They are useful in circumstances where wear resistance is important, and their economy makes them feasible for widespread use. However, as longer life becomes more important, these materials are under scrutiny due to performance potential. One example would be high-speed steel, capable of working well at elevated temperatures and maintaining its edge for long periods in a production environment where the tools are constantly under stress.

With its toughness and strength, tungsten carbide makes an attractive future blade material. Hence this material is chosen for cutting applications involving harder materials. The material is also being further developed to meet the needs and demands of fully automated and robotic cutting systems, which are likely to gain wider acceptability in the future. The avenue of ceramics is also becoming increasingly popular. These blades are characterized by the resistance to corrosion and wear and find applications in conditions where metals would either fail or get damaged. Such increasing use suggests that clean and smooth cuts will soon prove to be more critical than ever.

If anything is promising for future prospects, it might be polycrystalline diamond, one of the less-used materials due to its cost. It exhibits tremendous hardness properties, thus contributing precision unparalleled by any other grade. In the evolution of industries, with more importance given to minimal error while cutting difficult materials, these blades could be increasingly pressed into longer production lines requiring accuracy and repeatable results.

Looking ahead, the arenas comprised by the manufacturing, construction, and processing sectors will begin to shape the Global Industrial Blade Market in the future based on how well each of the aforementioned materials themselves meet shifting needs in those arenas. The focus will then shift toward making blades that last longer, perform better, and become readily adaptable to new technology and changing user expectations.

By Coating

The Global Industrial Blades market is today progressively moving towards meeting the most demanding requirements in terms of precision, durability, and performance, usually found in various industries. Food processing, packaging, textiles, paper, plastics, and metal industries have deeply rooted requirements of these blades. What makes them unique is not only the quality of the materials that are used but also the coatings applied on them, which directly influence their strength and lifespan. With the growing production needs, the demand for blades to perform longer under hard conditions will be caused. Coating, therefore, will come in as protective and performance booster.

These types of coatings have varying advantages depending upon the type of usage and material being cut. Titanium nitride is a standard coating chosen because of reduced friction and increased wear resistance. The golden-looking finish is not only aesthetic but helps to keep the sharpness of the edge longer and at the same time lengthens the lifespan of the blade. Chromium Nitride, on the other hand, is very good in corrosion resistance as blades are employed in environments where there is moisture or chemical exposure. Zirconium nitride, on the other hand, finds preference in certain applications because of its smooth cutting ability and strength, being thus a trusted variety in speed- and accuracy-driven industries. Of course, diamond-like carbon coatings are unique by way of hardness they possess, which is nearly close to that of actual diamonds. Thus, it enables blades to cut tougher materials with infrequent changes. However, there are instances where uncoated blades are preferred mainly either to cost or application, especially where subject matter being cut is soft or operation does not generate enough heat.

The forecast is that the demand for specialized coatings will continue to grow as industry standards shift and workers want to keep the tools last much longer with lower downtime for changeovers. Another aspect driving consideration is environmental and energy efficiency, which will also lead manufacturers to prefer coatings that can be effective but safer to produce and dispose. These changes will immensely lead to new designs and innovations in coating materials and techniques, which pave ways for newer developments. As technology moves forward, blade solutions tailored specifically to certain types of industrial needs will be showcased. In this future, sharper edges will not be the only focus, along with intelligent tools to increase productivity without affecting safety or sustainability. The Global Industrial Blades market will soon place such shifts between performance and purpose through careful material selection and advanced coatings.

By Application

Disruptive technology and industry shifts will redefine the Global Industrial Blades market. The future market shifts fare on applications and production processes focusing on more precision, efficiency, and durability. A primary driver for this increased market is the rise in demand for blades that will be capable of working in more challenging conditions and tasks, particularly in the metalworking and automotive industries. With the new progressive machinery, cutting tools will also have to advance. It means that blades will need to endure longer, cut cleaner, and minimize their waste.

Metalworking blades are at the core of everyday production. These tools have to stay sharp and true while cutting tougher materials. Today, manufacturers focus on newer materials and coatings for longer blade life and better performance. These will likely define a trend for the future of how blades will be manufactured and used. As factories will move into automation, there will be a more demanding environment that will call for tools that could render continuous and high-speed jobs without frequent replacements. Consequently, this would lead to higher demand for smart solutions that would alert operators regarding issues with a blade before total failure happens.

This will also be triggered by the advancement of both the automotive and aerospace industries, which will affect the Global Industrial Blades market as both industries will demand a high level of precise accuracy in operations. Even a small slip may cause operations to stall or raise safety issues. Thus, manufacturing technology will continuously develop high-performance blades capable of tolerating very narrow tolerances for these sectors. Energy and construction industries will follow suit as they require blades that can work on bulk without compromising the quality thereof. Whether cut through strong building materials or processing components that are components for systems of renewable energy, hence, the demand will increase for blades that are to combine strengths with precision.

These developments will also benefit other markets based on the principles of cutting, shaping, or refining materials. Each application may have its challenges, but the need for reliability and an improved output remains constant. The market is expected to increase in regard to custom-built blade designs that will be offered for specific uses, which will improve performance and lower costs.

In a scenario filled with ever-advancing industrialization and driving forces behind enhanced productivity, the Global Industrial Blades market is going to be taking smart transformation into stronger, more intelligent blades with efficiency that matches old and new manufacturing steeper needs.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$5,841.25 million |

|

Market Size by 2032 |

$8,285.09 Million |

|

Growth Rate from 2025 to 2032 |

5.2% |

|

Base Year |

2024 |

|

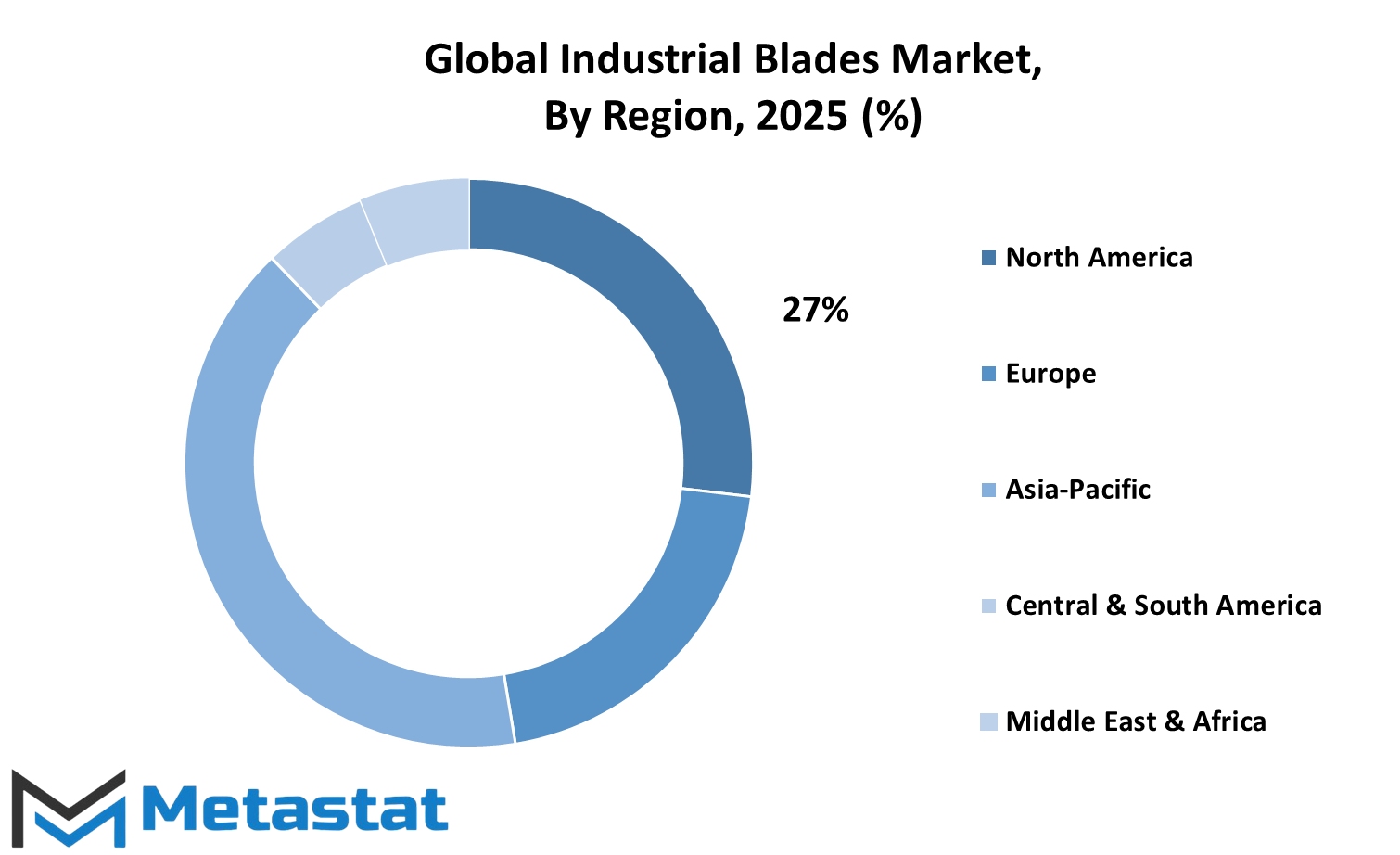

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

Demand for Global Industrial Blades market will continue to grow in different geographical segments, owing to industrial development and manufacturing requirements around the world. Geographically, the market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these segments lends its own opportunity and their determining factors are quite dependent on the type of local industry, their current economic conditions, and fast-moving technology development affecting these sectors.

North America, especially the U.S., has a long strong industry and the situation seems poised to continue. The ongoing development of automation and advanced manufacturing tools will ensure that there is still a high demand for precision cutting tools such as industrial blades. Indeed, Canada and Mexico play their parts in this, with Mexico growing its manufacturing sector-during these times-and Canada's stable infrastructure bolstering this demand.

Germany, UK, France, and Italy-(have from times immemorial)-been quality production-oriented countries. These countries will continue pushing for efficient and durable tools in automotive and engineering. The rest of Europe, though economically diverse, will certainly contribute to the need, especially where modernization of labor-intensive industries is taking place to realize productivity increase.

Asia-Pacific is predicted to be a major nation in the near future for the Global Industrial Blades market. Due to the consistent efforts in industrialization pushed across nations like China and India, electromechanical machines or high-speed production lines require well-constructed and easy-to-use sharp cutting tools. Companies known to depend on a technology-oriented industry like Japan and South Korea require high-performance blades, and as these smaller regions of the world develop their infrastructures and production capabilities, their demand here will only leaven in future generations.

Brazil and Argentina are the most important South American contributors. Both are actively working on improving their industrial capacities and this will undoubtedly call for better machines and tools, including industrial blades. The trend may not be equal to that in the Asia-Pacific or North America zones but it will contribute greatly toward the global market.

Before the end of 2023, the world will begin to see countries under the Middle East & Africa, along with GCC nations, Egypt, and South Africa, slowly ramping up their new investments in industrial zones and diversifying their economies, which will consequently be matched by an increase in demand. Though the region is yet in early stages in adopting large-scale manufacturing, efforts toward growth will help platform the Global Industrial Blades market, rendering it a region to watch in the years to come.

COMPETITIVE PLAYERS

A group of established players competes strongly in the Global Industrial Blades market, with each trying to push innovation and efficiency one step further. Bosch, Stanley Black & Decker, DeWalt, Makita, Milwaukee Tool, and others are active in the development of the next generation of industrial cutting tools. What distinguishes these manufacturers is not only their historical legacy but their responsiveness to technological and consumer demand changes. In the area of industrial cutting, these players will focus on smarter solutions, longer blade life capabilities, and better performance as new materials and cutting needs come up.

One of the more noticeable trend changes in the market is the extent of automation and intelligent manufacturing systems. Advanced prerequisites for cutting are being gripped by top companies like Kyocera Corporation, Kennametal, and Sumitomo Electric. These manufacturers anticipate a shift toward more precise and efficient cutting with a focus on the automation of blade systems. In the near future, blades may be not only strong but provide real-time feedback on wear, angle, and pressure integrated with smart machinery. Innovations of this kind are likely to be extremely valuable for a company in its bid for a competitive edge, especially when other industries look for opportunities to cut downtime and maximize output.

Another aspect influencing the competitive environment is sustainability. With the primary focus on waste reduction, Freud America, Inc., Lenox, and Amada have dedicated a lot of energy to exploring environmentally acceptable materials and processes such as the use of recycled metals, improvement of coating technologies, and redesign of blades with longer life without sacrificing quality. These practices will not only create noise in the market but also respond to increased demand from customers who are becoming increasingly aware of the environmental impact of tool production and manufacture.

Customization is likely to come into play. Shars, Tormek, and Walter Tools should engage more in producing industry-specific products: food processing, automotive, or heavy machinery. Generic solutions do not have a place in this landscape; rather, the focus will pivot toward building tools that solve particular problems. With this space emerging, smaller or more niche brands could afford to compete against the giants in a more level playing field.

Changing expectations of customers, new technologies, and environmental concern will continue to affect the Global Industrial Blades market. With so many key players vying for their attention and loyalty, fast-smart tools, fast-clean condoning, and fast-specificity across industry will surely mark the next chapter.

Industrial Blades Market Key Segments:

By Blade Type

- Slitting Blades

- Shearing Blades

- Circular Blades

- Band Saw Blades

- Other

By Material

- High Carbon Steel

- High Speed Steel

- Tungsten Carbide

- Ceramics

- Polycrystalline Diamond

By Coating

- Titanium Nitride

- Chromium Nitride

- Zirconium Nitride

- Diamond-Like Carbon

- Uncoated

By Application

- Metalworking

- Automotive

- Aerospace

- Energy

- Construction

- Other

Key Global Industrial Blades Industry Players

- Bosch

- Stanley Black & Decker

- DeWalt

- Makita

- Milwaukee Tool

- Lenox

- Irwin Tools

- Bahco

- Tormek

- Freud America, Inc

- M.K. Morse

- TaeguTec LTD.

- Kennametal

- Kyocera Corporation

- Snap-on

- CMT

- Klein Tools

- Shars

- Amada

- Walter Tools

- Knipex

- Tungaloy

- Sumitomo Electric

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252