MARKET OVERVIEW

The Global Industrial Absorbents market, rooted in the environmental safety and waste management industry, will continue to determine the ways in which industrial premises are able to handle hazardous and non-hazardous liquid spills. It addresses the materials engineered to soak up oils, chemicals, and various other fluids during operational mishaps or routine maintenance. Absorption capacity and compliance to regulatory, workers' safety, and environmental stewardship will be the main targets for the market and will increasingly pave the way for demand and product development.

Industrial absorbents are often engineered with specific properties dedicated to oil-only, universal, or chemical-specific purposes. The Global Industrial Absorbents market will evolve with these distinctive characteristics, providing answers targeted to many markets, that include manufacturing, energy, transportation, and chemical processing. These sectors are closely watched by regulatory bodies, calling for absorbents explicitly meeting performance and disposal standards. Performance requirements will tighten and become more inclusively application-oriented in tandem with the introduction of new solvents and compounds used in various production lines.

The demand for more performant containment and clean-up solutions will continue to increase, as this trend already took place in the on-site manufacturing and energy activities focusing on safety and environmental protection. The Global Industrial Absorbents will develop effective products encompassing polypropylene, recycled cellulose, and natural fibers maintaining low waste generation. The supply of absorbents shall cover forms that can include sheets, pads, socks, pillows, or granules to fit localized containment needs. Customization of such products to particular industrial processes will most likely increase in range due to the demands from users for quantitative absorption capacity and resistance to a specific chemical.

Technological development in manufacturing processes will bring into play improved categories of absorbents. With increasing automation and efficiency in the production line, absorbents would be designed and fabricated with those advancements in view. This would allow higher volumes of liquid to be absorbed per unit of material while retaining integrity. The Global Industrial Absorbents market will also consider biodegradable and reusable alternatives to meet environmental obligations and sustain in an ecological-friendly manner.

Another key area within this market will include spill response training and integration into workplace safety protocols. Industrial operators will start to see absorbents not just as products but as components of a larger environmental control system. As a result, absorbents will be incorporated into emergency kits and spill-response plans and may even become part of real-time monitoring systems for leak and hazardous mitigation recognition.

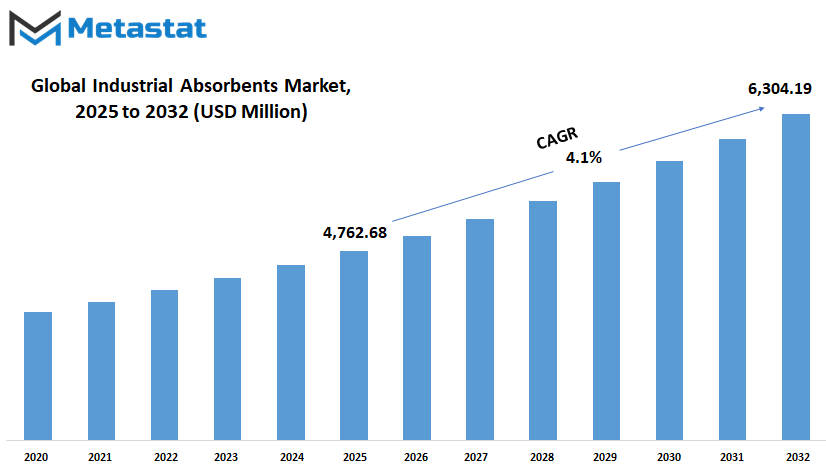

Global Industrial Absorbents market is estimated to reach $6,304.19 Million by 2032; growing at a CAGR of 4.1% from 2025 to 2032.

GROWTH FACTORS

There is expected to be a moderate growth in the Global Industrial Absorbents market in future years, especially owing to rising awareness regarding environmental safety and workplace cleanliness. Industries will be increasingly concerned about the impact of spillages on the environment, as they undergo development. These absorbent materials are applied to manage leaks, spills, and other accidental release of harmful liquids during construction, manufacturing, chemical processing, and oil and gas operations. With health and safety increasingly becoming a regulatory concern, absorbents will be widely utilized by industries to comply with such regulations.

Increasing demand for clean operating procedure-supportive products is one of the main growth drivers in this market. An awareness campaign on which companies operate with minimum damage to the environment will increase demand for reliable absorbents. Safety in the workplace is also an increasing concern, with industries expected to adopt products that would prevent slip, contamination, or long-term damage due to chemical exposure. Thus, apart from saving lives of workers, such measures will help save companies from penalties and promote uninterrupted business functions.

Another factor that is likely to contribute to market growth will be the rising incidence of industrial accidents and unplanned leakages. With more industries running their operations at a larger scale with the use of complex machinery and chemicals, on the installation of high-risk for the spillage will be in a greater number. The absence of absorbents at such times will be considered as negligence for any company; thus, absorbents must be readily available all the time. The growing awareness regarding proper waste disposal will also help promote absorbents that are safe to be disposed of, and reuse, if possible.

There are nevertheless hindrances to growth. The price of good-qualitative absorbents can act as a barrier to the establishment of smaller companies in the market. The utilization of absorbents will also be slowed down in regions where excessive training has not been acquired with regard to the disposal and usage of such materials. Some synthetic absorbents might have environmentally damaging effects, and this could deter certain consumers from using them or push them to seek alternatives.

Nonetheless, there would still be numerous opportunities for the Global Industrial Absorbents market. Absorbents are expected to be appreciated and more in use newly, specially with the emergence of a sustainability culture, if they are manufactured with natural or biodegradable inputs. If manufacturers can respond to the changing needs of modern industry by providing cheap, safe, and environmentally friendly options, the market for sustainable absorbents can grow further. As industries shift toward cleaners, with strict new safety regulations, the market can be expected to respond with innovation and an increase in varied types of products, customized for specific applications.

MARKET SEGMENTATION

By Material Type

It is anticipated that the Global Industrial Absorbents market is set on a forward-looking trajectory facilitated by the anticipated upgrading of environmental standards, the increase of awareness on workplace safety, and the increasing need for better spill management. Thus, as they run towards improving their operations but curbing their environmental footprint, so will absorbent materials advance towards greater usage across various sectors like manufacturing plants, oil refineries, and waste disposal facilities, this use then also plays a vital role in avoiding hazards and helping create cleaner working environments. In the future, further change might occur towards the direction in which the absorbents are applied and produced.

According to material type, the market mainly splits into natural and synthetic absorbents. Natural absorbents have been considered preferred for being degradable and environmentally safer. Generally, these absorbents are made from pure organic sources such as cotton, wool, cellulose, or even crop residues. However, with environmentalist as a commitment of several organizations, the use of natural absorbents will continue to spread, especially in those areas where sustainability is one of the emphases for improvement. Some performance areas may not match those of synthetic absorbents, but developments in processing methods will narrow the gap faster.

On the contrary, synthetic absorbents are characterized by their toughness and high durability with higher absorbency. These are composed of polyethylene, polypropylene, or any other man-made fiber. Because they are well relied upon with long shelf life, synthetic absorbents are usually utilized in areas where cleanup is required to be fast and efficient. The demand for synthetic absorbents will remain high due to that; and with increasing demands from industries and the number of events, sure the incidence for these types of absorbents will keep soaring. However, the increasing concern over plastic will push the manufacturers to see how to make those materials recyclable or reusable in the future.

The balance between natural and synthetic materials in the Global Industrial Absorbents market is likely to shift into new coins with improvement in technology and increasing attention paid to environmental impact. There is also a possibility that researchers and producers will start focusing on the blending benefits of both forms, which will possibly produce hybrid materials having the advantages of biodegradability of natural fibers with absorbency usually associated with synthetic ones. Hence making the transition towards safety and sustainability. The use of industrial absorbents will grow as the need for cleanliness and safety within industrial workspaces increases, with material innovation during this period significantly shaping what comes next.

By Product Type

Often, potential benefits of using industrial absorbents are unharnessed due to ignorance of their usage in very minimum units and generally due to absence of knowledge about them. Industrial absorbents help control unintentional releases of liquids, such as oils, chemicals, and other hazardous substances. These products are becoming more significant in everyday operations across many industries like manufacturing, energy, chemical processing, and much more.

Making a comparative study of the different types of absorbents, it will not take an observer long to see that each product comes with its specific use. The pads are among the absorbents that get to be used more widely. Considered easy to handle, it is pretty straightforward to soak anything up with a pad and it requires very little effort to do so. Usually, they are utilized in daily routines to mop up minor

spills and leaks. The rolls, on the other hand, are particularly good for larger surface coverage where slipping hazards may occur. Particularly important, these are in factories and warehouses, where safety on the floor is a major concern.

They are more useful in situations where more absorbency is required in one specific location; they are good at handling really large leaks and are most commonly found under machines or containers that are leaking fluids. Granules are used in a slightly different way; they are spread over a spill, they absorb the liquid and then are swept away. This is what makes them a good option for large spills or uneven areas. Booms and socks are positioned around spills, or along doorways and drains, to prevent fluids from spreading any further. These are particularly useful when there is an emergency or when working with hazardous chemicals.

Repeated Uses: Any spillage-prone area does not remain isolated to a few accidents or mishaps that need to be dealt with; there shall be more such accidents in a busy time. Sheets and mats are actually reusable in this context, plus they are built to endure strength so as not to get over-exhausted when used repetitively, making them better value than costlier options for busy sites. Other specialized absorbents are in constant production and development in accordance with new requirements emerging from industries. The time is coming when organizations will find absorbents not just efficient but also sustainable using less material in the process of waste being created.

Modernization saw the above becoming even more possible with globalization in the transformed landscape of the future. The need will continue to be great for high-performance goods that are safety-enhancing, environmentally oriented, and reduce downtimes. This vision of futuristic solutions will redefine the rules of engagement by which absorbents are applied across the future.

By Type

The Global Industrial Absorbents market, in future, is expected to rise due to the increased awareness regarding safety in workplaces, environmental protection, and waste containment. As industries mature and safety rules become stricter, the demand for effective absorbent materials will only grow. These products are already essential to cleaning up spills, handling hazardous stuffed things, and keeping work environments safer. There will be an impact on future absorption types, which will drive their development in terms of technology on the necessity for advanced absorbent types needed in future in responding to product, chemical, and accidental spillages.

Oil-only absorbents are one of the major product categories in the Global Industrial Absorbents market. These are constructed purely for soaking up oil and similar substances and at the same time repelling water. They are intended for use in the marine area as well as for the factory and transport facilities where oil leakage poses a serious threat. Such absorbents will play crucial roles in the coming years in preventing injuries to workers and damage to the environment. However, industries will continue to depend on oil-only absorbents, but with increased expectations to make them lighter, more effective, and more convenient to dispose of.

The other absorbent category is universal absorbent. It is versatile: all types of liquids like mild chemicals, oils, and water-based solvents can use it. In many workplaces, this is the type of absorbent used for general maintenance and for emergency spills. With industries trying to decrease downtime and improve productivity, universal absorbers will continue to gain use because of the convenience and speed with which they offer solutions for circumstances dealing with multiple types of liquids on a daily basis.

HAZMAT or chemical absorbents are made for utilizing in high-risk conditions. These materials were designed to be resilient against very harsh acids, very corrosives, and other dangerous materials. They are to be found most commonly in laboratories, chemical process plants, and any location where the usage of harmful materials is part of their job. The development future will turn towards making these absorbents safer and highly responsive. Fast containment and neutralizing of hazardous spills will be able to avert possible long-term damage and would save costs in cleaning up.

Thrusting across all types, the Global Industrial Absorbents marketplace would now march toward better materials, smarter device designs, and quicker responses. The need for better efficiency and reliability of absorbents will push forward the market in steady growth and continuous product innovation, as companies attempt safety at par with environmental standards.

By End-Use

The Global Industrial Absorbents market is on the brink of substantial growth as industries move towards safety and efficacy in operations. Absorbents are vital agents in containing and cleaning spills, especially in industries dealing with hazardous materials. For the future, rising numbers of businesses seeking to improve environmental impact have strict regulations and are expected to develop demand for industrial absorbents. Unique contributions will be given by different industries to this overall growth with their unique needs and applications.

The oil and gas industry, the forest of industrial absorbents' needs, will continue to be the oil well for demand in industrial absorbents. The continuous growth of exploration and drilling activities around the world leads to an equal increase in the chances of spills and leakages. Absorbents hold paramount importance in preventing oil spilling on land and at sea and are essential for carrying out such activities without much environmental impact. With further tightening of regulations and the increasing awareness of the public towards environmental protection, oil companies and gas companies will always rely on these kinds of products for safety and surrounding environmental standards.

Considering that the chemical industry is also a major grower of global industrial absorbents, most chemicals are volatile, highly hazardous, and prone to leakages. Absorbents are important for quick containment of such spills and prevention of danger that may evolve from such incident. By virtue of the continuous growth of the entire chemical sector, especially in the emerging markets, the demand for absorbents is projected to increase. Companies in this sector are continuously on the lookout for products that contain spills in an efficient manner but adhere to environmental guidelines. This will cause a constant demand for more advanced absorbent materials.

Another field that will observe an increase in the application of industrial absorbents is food processing. The handling of oils, sauces, and other liquids at the food production sites invariably generates spills and leakage. To ensure cleanliness, safety, and adherence to food safety regulations, absorbents will come into high demand. The more the food industry grows globally-evidently, in developing countries, the more the dependence on industrial absorbents will grow, as challenges will arise from these developments.

Healthcare is another industry expected to bring in more industrial absorbent revenues. Absorption of blood and/or other bodily fluids and chemicals immediately has hospitals, laboratories, and clinics clamoring for the appropriate absorbent. Thus, this must be done with absorbents that are benign and not harmful to sensitive environments.

Some other industries, automotive and manufacturing, will also increase their overall demand for industrial absorbents. These industries require absorbents for dealing with oils, chemicals, and other substances during production and maintenance activities.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4,762.68 million |

|

Market Size by 2032 |

$6,304.19 Million |

|

Growth Rate from 2025 to 2032 |

4.1% |

|

Base Year |

2024 |

|

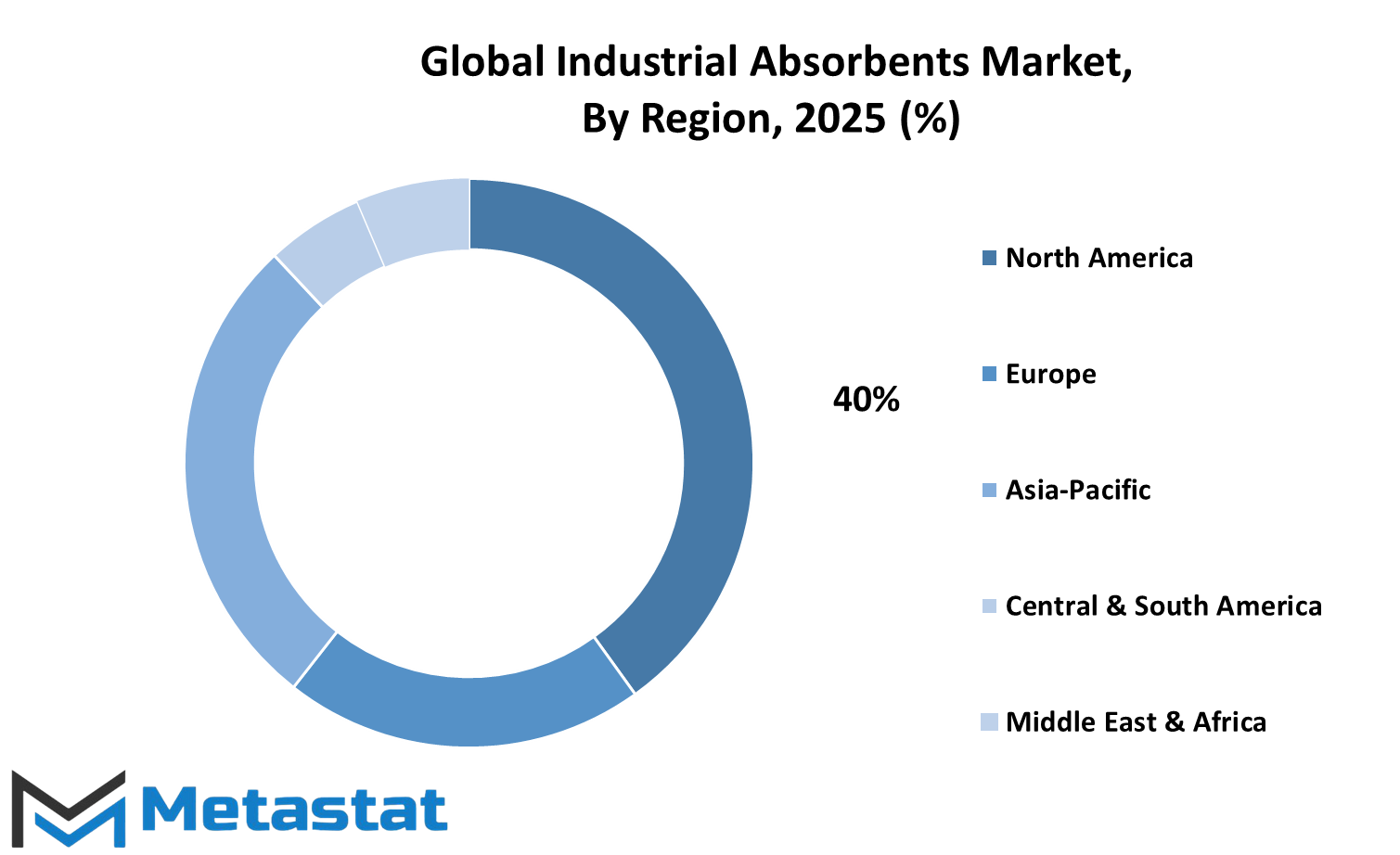

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

Safety and environmental sustainability have transformed into major factors for driving growth for the Global Industrial Absorbents market all across the globe. With the rising demand for better management of spills, leaks, and other situations considered hazardous, it seems potential that the demand for absorbent products will grow gradually in various regions around the world. The demand's magnitude will vary according to regional specifications and industrial growth, thirdly, environmental regulations will guarantee each region's unique contributions to the giant cake of market growth.

In North America, the market will remain strong, led by the United States, Canada, and Mexico. The industrial sector in the region is very much interested in purpose-oriented absorbent solutions to addressing a wide array of spills in manufacturing, oil and gas, and chemicals. The very reason stringent environmental regulations are in place to protect the environment, and human life will propel companies in the region to choose innovative products that comply with safety standards. As Mexico is also industrializing, the demand for absorbents will significantly rise, especially in light of industrial sectors, such as those concerned with manufacturing and energy. The growth of North America is expected to move at a steady pace in view of innovation and regulatory provisions.

Europe will also have an important say when it comes to the future of the Global Industrial Absorbents market. Nations such as the U.K., Germany, and France constitute major industrial hubs whose absorbents are needed for numerous sectors, such as automotive, chemicals, and food processing. With sustainability on the rise, Europe will soon see a rise in eco-friendly absorbents and reusable absorbents. Furthermore, any advance toward the implementation of regulations, aiming to limit environmental peril shall therefore hasten the acceptance and implementation of absorbent advanced products. Europe will, therefore, remain an important player in market growth as industries innovate from their regular practices toward more environmentally friendly operations.

Asia-Pacific, featuring countries particularly such as China, India, and Japan, will be a key growth driver for the Global Industrial Absorbents market. The increased level of industrialization in manufacturing and energy in these areas implies that the demand for effective absorbents will remain on the increase. With the ongoing modernization of infrastructure and industrial bases in China and India, the pressure on managing hazardous material spills more efficiently will mount. Japan and South Korea, heavily focused on high-tech solutions, will also influence future absorbent product development towards advanced materials that yield superior performance and environmental benefits.

In South America, a gradual growth will be seen in the demand for industrial absorbents in Brazil and Argentina, in correlation with the expansion of their industrial sectors. The oil and gas industries, along with mining and agriculture in the region, will further clamp the demand for better spill management products. Lastly, significant demand will be expected in the Middle East and Africa, specifically under the regions of GCC countries, Egypt, and South Africa.

COMPETITIVE PLAYERS

The Global Industrial Absorbents market is poised for growth as industries move toward safer and more sustainable methods of spill and leak management. More than ever, absorbent materials will be in demand due to rising environmental concerns and tighter regulations regarding safety and cleanup standards. These products, which are classed as absorbents, have been used in the past to control oils, chemicals, or other liquid spills, causing fewer workplace accidents and limiting environmental damage. In the coming years, companies across many sectors will be seeking efficient, affordable, and eco-friendly absorbents to fulfill these requirements.

A number of companies are already making significant contributions toward shaping the future scope of the market. Their innovations, product development, and customer support are all precedent-setting in determining the future of this market. 3M, with its diverse range of products and proven performance, remains a critical player. Even with ongoing research and a sound customer base, it is likely to keep coming up with absorbents that meet emerging demands for performance as well as environmental responsibility. Another name to look out for is New Pig Corporation, which continues to establish its status through dependable solutions and is expected to stay customer-centric and focused on product development.

On the future horizon, Oil-Dri Corporation of America considers it prudent to be in the forefront, particularly given its legacy of production and absorption solutions as naturally derived. Brady Corporation and SpillTech, however, will intensify focus on speeding up and improving efficiency for response times during spills, which will be quite crucial as industries increasingly demand faster and safer times for cleanup and workplace safety. Meltblown Technologies Inc. and Enretech are both looking towards fiber-based absorbents, which would likely gain popularity as industries favor lighter and easier solutions.

Others such as ULINE, Johnson Matthey Plc, and Kimberly-Clark Professional will continue to boost the market through even better distribution and quality. Their strength will lie in the ability to supply large volumes quickly in the face of increasing demand. EP Minerals, ASA Environmental Products, and SHARE CORPORATION will play different roles regarding companies looking at more specialized options of dealing with particular spills. ANSELL LTD and Monarch Green Inc. would present even more safety-focused applications while Safety-Kleen's strength in hazardous waste handling brings it an edge in cleanup efforts that are more complex. All these companies will lead the charge into a more dangerous and cleaner workplace while changing the landscape of the Global Industrial Absorbents market.

Industrial Absorbents Market Key Segments:

By Material Type

- Natural

- Synthetic

By Product Type

- Pads

- Rolls

- Pillows

- Granules

- Booms & Socks

- Sheets & Mats

- Others

By Type

- Oil-Only

- Universal

- HAZMAT / Chemical

By End-Use Industry

- Oil & Gas

- Chemical

- Food Processing

- Healthcare

- Others

Key Global Industrial Absorbents Industry Players

- 3M

- New Pig Corporation

- Oil-Dri Corporation of America

- Brady Corporation

- SpillTech

- Meltblown Technologies Inc.

- Enretech

- ULINE

- Johnson Matthey Plc

- Kimberly-Clark Professional

- EP minerals

- ASA Environmental Products

- SHARE CORPORATION

- ANSELL LTD

- Monarch Green Inc.

- Safety-Kleen

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252