MARKET OVERVIEW

The Asia Pacific Specialty Chemicals market is a massive multi-faceted industry, endowed with strong influence, and is gaining complexity. The specialty chemicals sector will go beyond the classical uses as the region continues to establish itself as a global powerhouse in manufacturing, technology, and industrial advancement. This industry will not just cater to conventional sectors such as automotive and construction but will deeply embed itself into emerging sectors that demand precision-engineered materials. From biotechnology to smart materials, specialty chemicals will, in the Asia Pacific, change from secondary products to prime constituents for future innovation.

Within the coming years, the Asia Pacific Specialty Chemicals market will portray a very drastic swing towards tailor-made solutions specifically designed for niche sectors. Sustainability will become a given, not a choice, as these firms do not just manufacture chemicals but also engineer substances conforming to rigid environmental standards. The growing interest in biodegradable polymers, eco-friendly adhesives, and water-soluble materials will create opportunities frightfully away from traditional commodity chemicals. Molecular customization will create a new set of requirements for specification so that industries will meet requests that are even more hard to satisfy with time.

Urbanization and technological integration of Asian economies will act as expansion catalysts for high-performance specialty chemicals. Advanced filtration chemicals and performance coatings will find even higher demand compared to traditional applications in compact megacities, where air and water quality continue to be of concern. These changes will not be passing fashions; instead, they are long-term changes that will compel the Asia Pacific Specialty Chemicals market to rethink materials science for applications that have not yet been realized.

Furthermore, it will be an irreversible change of specialty chemical firms' operating models in the Asia Pacific region brought about by digitalization. Automation, predictive analytics, and machine-learning concepts will not remain on the periphery but will be the central theme for product innovation and supply chain management. Such a change will modify the way companies design, test, and deliver specialty chemicals, wherein agile manufacturing would allow small-batch, highly specific production runs, thus opening for a more dynamic and responsive industry landscape.

Consolidation will continue in the large global specialty chemicals sector, whereas the Asia Pacific Specialty Chemicals market will incubate a wave of regional players who pay more attention to specialization rather than size. Local companies can then use their deep insights into the local cultural, environmental, and regulatory nuances to produce materials uniquely suited to their markets. This will generate a thriving ecosystem for innovators, and academic institutions, startups, and legacy companies will therefore form the backbone of future advancement.

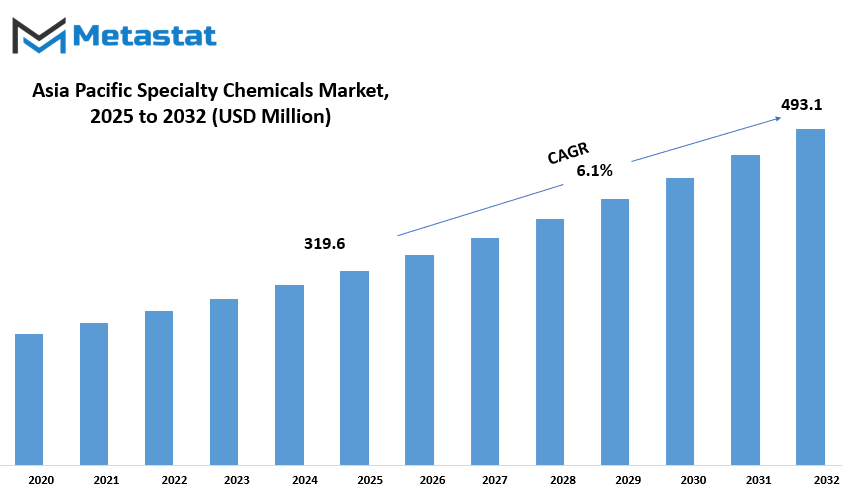

Asia Pacific Specialty Chemicals market is estimated to reach $493.1 Million by 2032; growing at a CAGR of 6.1% from 2025 to 2032.

GROWTH FACTORS

Asia pacific specialty chemicals market is projected to grow at steady rates due to increasing demand from various end-use industries. The growth of industries like automotive, electronics, construction, personal care, and so on leads towards increasing demand for high-performance chemicals. Specialty chemicals are those chemicals that have been designed to provide or use unique properties compared to their commodity counterparts to improve product quality and efficiency, enhance performance, or modify the durability of the product - indeed, an essential component of modern manufacturing and daily life. This almost forces industries to devote endless efforts into finding better ways of meeting customer expectations; specialty chemicals offer.

The manufacturing technologies of chemicals improve rapidly, and this accounts for another important factor driving the market. The latest methods and innovations allowed companies to optimize their chemical quality and efficiency. These improvements would lower production costs, reduce waste, and make it possible to strengthen quality standards. Such developments have made businesses across the Asia Pacific more optimistic when investing in specialty chemicals, knowing that they are looking at making strides towards newer developed, more reliable products. Unceasing research and development focus provides room for the advancement of companies to develop more sophisticated products to be made available to the market that would cater to the changing needs of various industries.

There are little hurdles before the market which are hindering its overall growth. One of the most critical issues is the tight environment legislation. Governments across the Asia Pacific region have notified the increased awareness on environmentalism and are establishing stringent rules to minimize pollution and ensure safety in chemicals production. Even though these regulations are essential to protecting the environment and public health, it puts chemical manufacturers under additional pressure. They require more money to be spent on creating cleaner technologies and have to comply with complex requirements that could delay production and increase costs.

Another hurdle for the industry is the proportionate fluctuation in raw material prices. Many raw materials used in specialty chemical manufacture are linked with the global supply chains and with commodity markets; thus, they are further susceptible to price changes. Price variation makes it difficult for the manufacturers because none can prepare for production or maintain competitive prices for their consumers. The market tends to be ever less predictable, creating a financial mess for both producers and buyers.

However, in spite of these challenges, there exists a lot of opportunities for growth. Green and sustainable chemical solutions have gained attention, thereby providing an avenue for new innovations in eco-friendly products. Besides, the industrial and construction sectors of the emerging economies of Asia Pacific continue to expand, creating new markets for specialty chemicals.

MARKET SEGMENTATION

By Type

The Asia Pacific Specialty Chemicals market is continuously growing and has the scope of a bright future ahead. Unlike general chemicals, special chemicals are produced on the basis of the performance or function expected from the chemical and not on the basis of the chemical composition. Most industries use it, and therefore they become important in modern manufacturing and production. The industries that are driving the increase in demand for specialty chemicals in the Asia Pacific region include agriculture, construction, textiles, and water treatment. The more an economy grows, and the lifestyles of consumers evolve, the more importance specialty chemicals will have.

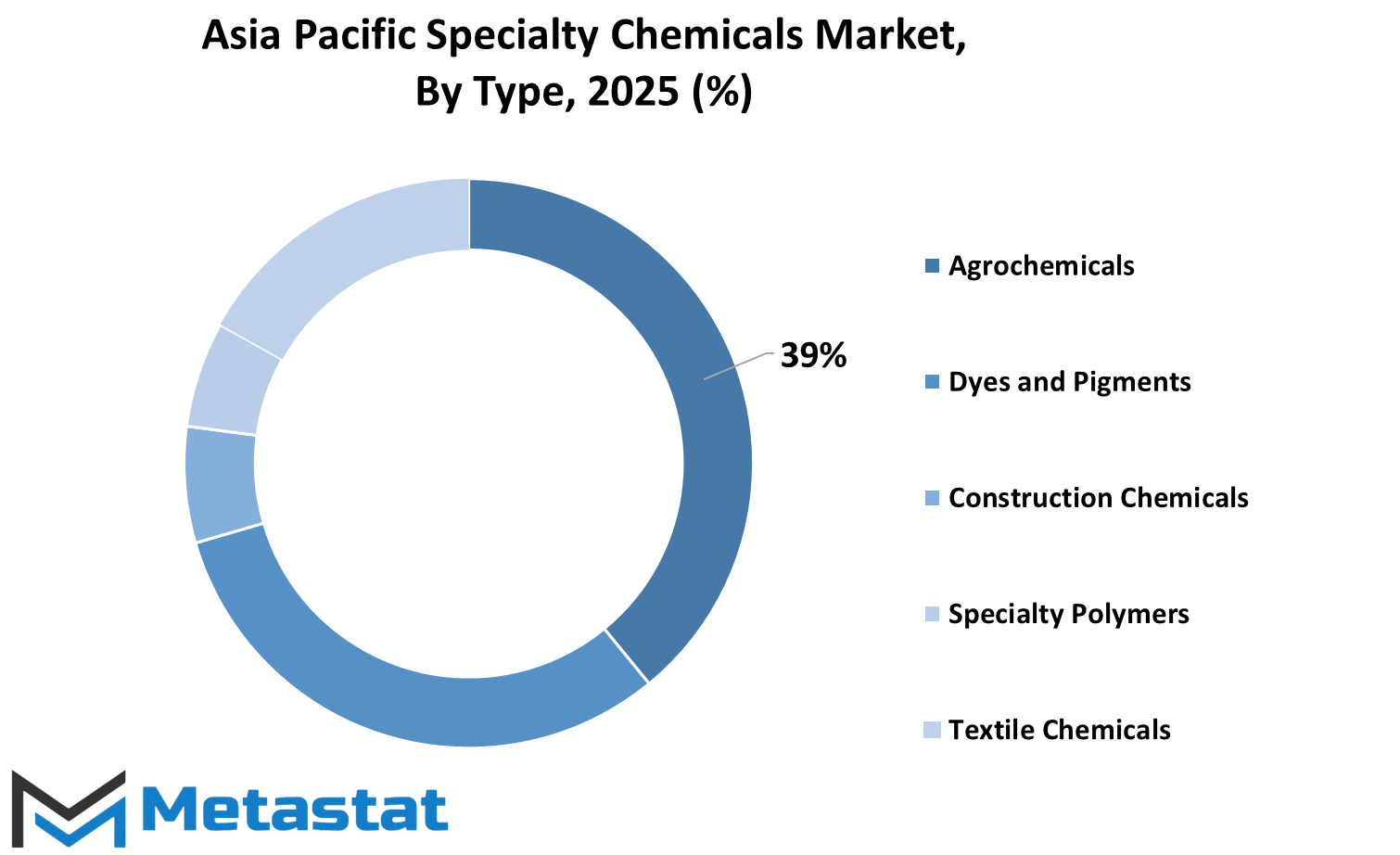

There are further subdivisions of this market in type. Each subdivision serves a distinct purpose. With a price of about $92.3 million, agrochemicals strengthen agriculture by protecting crops and increasing the farmers' production. Dyes and pigments impart so many bright and longer-lasting colors into textiles, paints, and printing with the last two inseparable from dyeing. Construction chemicals go on to reinforce their structures by improving the properties of the materials used. Specialist polymers have specifically tailored high-performance characteristics such as flexibility, sturdiness, heat-resistance, and chemical resistance that will serve many applications, especially those designed for automotive and electronic industries. Textile chemicals enhance the touch and look of fabrics' performance to satisfy ever-changing consumer requirements.

Base ingredients are the important building blocks of many products derived from special chemicals as they go a long way in preparing a conglomerate of finished industrial goods. Surfactants form another key segment, most prominently applied in cleaning products, cosmetics, and, more recently, in food, to stabilize mixtures. Functional ingredients are added to enhance end-product performance, enabling products to be more effective and marketable to consumers. Water treatment chemicals are a novelty in establishing ever cleaner and safer water for industrial and domestic purposes such a rapidly growing need as water resources come under more pressure. The market also entails other sorts that will minimally conform to specific requirements for various industries.

All in all, the Asia Pacific Specialty Chemicals market will find a buoyant demand on the back of industries that will seek to fulfill their need for the most efficient and specialized solutions. This strong demand will only continue to accelerate with new formulations and the increasing focus on quality and performance. At present, any company that invests in this market will count itself lucky in a few years' time when the demand for these novel chemical products will have exploded.

By Sales Channel

The Asia Pacific Specialty Chemicals market gradually is growing where different channel sales would determine how these chemicals actually reach a business or customer. By sales channel, the market divides into direct sales, distributors and wholesalers. All three sales channels perform differently from each other thus understanding their difference would explain the functioning of the market and the forces driving it for growth.

Direct sales are where the manufacturer sells his product directly to the end-user. This sort of transaction does not involve middlemen and thus provides maximum control for the manufacturer over pricing, customer relationship, and brand image. Direct sales are usually preferred by companies that have built a fairly good customer base, are confident in their abilities to manage sales, and are capable of delivering directly to the client. Direct sales also offer quicker turnaround in getting feedback from customers on issues, thus making it easier for the company to improve the product or service. However, establishing this arrangement requires quite a heavy investment and effort that may not be matched by all companies.

On the other hand, most companies prefer working with distributors. Distributors buy hefty loads from the manufacturers, sell them to smaller businesses or even retailers. They really benefit an organization in its distribution network which is a way in enabling the manufacturer to reach out to market opportunities that would be too much of a hassle for the manufacturer to reach alone. They perform most of the marketing, stock handling, and after-sales service which then allows the manufacturer to focus entirely on production and innovation while distributors take care of sales. This provides better market reach to the manufacturer; however, it also means the manufacturer loses some control over marketing and pricing of its products.

Another important way to go to the market is wholesalers. They generally buy specialty chemicals more in bulk and sell them to retailers, small scale distributors or even directly to end users. It is the wholesalers who primarily perform the trade in bulk as opposed to brand promotion or customer engagement. These are what glue up the supply chains together in that they make availability of products, where they are really needed, at the right time. The wholesaler is the solution to manufacturers in being able to clear quickly large amount inventory which aids cash flow. However, too much dependence on wholesalers may also mean giving up part of control over the sales mechanism or the brand presentation.

If much of Asia and the Pacific has been brought to this market, it would be due to the selling strategy that the company had for it. A direct sale, by a distributor, or wholesaler, has different specific advantages and disadvantages. According to a company's size, strategy, resources, and projected long term objectives, it will probably decide which selling strategy to adopt. But that fact does not change the fact that achieving the best products to the customers with the best service and building lifelong relationships is key in the end.

By Country

The Specialty Chemicals industry remains active in the Asia Pacific region, with each country having a say in determining the industry's future. However, when looking at our market, we see further disaggregation with Southeast Asia, China, Japan, India, South Korea, Australia, and Other Asia-Pacific. Therefore, each of these pockets will continue to lead in the market and assign importance as per their peculiar needs and industries.

China will be a significant force for a long while to come because of its large manufacturing background and intensive demand for specialty chemicals such as those used in the fields of construction, automobile, and electronics. Also, the governmental thrust on green technologies and cleaner production methods will spur up the demand for new chemical products. Japan shall be growing steadily mainly due to its advanced technology sector, which provides a significant demand for specialty chemicals in electronics and healthcare for better performance and quality. Thanks to its long innovative history, Japan can continue to stay competitively strong in the domain.

India's growth in the specialty chemicals sector will continue to forge ahead with rapid strides, aided by industrial growth, urban development, and a proclivity towards local production. Government initiatives favoring manufacturing and investors play to India's strengths as a true regional player. Highly advanced electronics and automotive industries will require the use of high-grade specialty chemicals that constitute world standards in South Korea. Furthermore, the country's emphasis on research and development will facilitate the introduction of new chemical solutions designed to meet the immediate emerging needs.

In Australia, there will be a gradual and steady demand in specialty chemical applications mainly through mining, agriculture, and construction activities. The increased demand for specialty chemicals that are evidently proven sustainable will also surge in demand as Australia strives towards sustainability. Associations with Southeast Asia-hotbeds of growth-as Indonesia, Malaysia, Thailand, and Vietnam will have increasing populations and evolving urban centers necessitating a draw towards manufacturing; thus, more specialty chemicals for food processing, personal care, and infrastructure will be required here.

Other parts of Asia Pacific also will contribute but at a much slower rate than the leading countries. Sooner or later, though, as the countries in this group try to build their industries and elevate their economies, the demand for specialty chemicals will increase in those regions.

On the whole, the Asia Pacific region's specialty chemical markets would keep evolving as each of the countries move forward with their different pace. Growth will be determined by factors such as government policies, industrialization, technology upgrades, and consumer preferences, all operating in a synchronistic fashion to determine the fate of the market in this region.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$319.6 million |

|

Market Size by 2032 |

$493.1 Million |

|

Growth Rate from 2025 to 2032 |

6.1% |

|

Base Year |

2024 |

COMPETITIVE PLAYERS

The Asia Pacific region has been witnessing steady growth in the specialty chemicals market due to innovation and changes in industrial development. The automotive, construction, agriculture, electronics, and personal care industries utilize specialty chemicals. Chemicals perform a defined set of deliverables and functions that allow a product to deliver certain services. Any modernization or increase in demand in any of the industries will therefore lead to an increase in specialty chemical demand. The immediate supply chains in China, India, Japan, and South Korea are leading this demand due to their growing populations, which are creating a large consumer market day by day.

Significant players in the Specialty Chemicals industry include BASF SE, Dow Chemical Company, Evonik Industries AG, Clariant AG, Huntsman Corporation, Nouryon Chemicals Holding B.V., Lanxess AG, Mitsubishi Chemical Corporation, Solvay S.A., Eastman Chemical Company, Shin-Etsu Chemical Co.Ltd., Covestro AG, LyondellBasell Industries, Wacker Chemie AG, Albemarle Corporation, Arkema S.A., Nufarm Limited, Tosoh Corporation, and China National Chemical Corporation. These companies are continually innovating on their products through research and development, making heavy investments to come up with new solutions but would have characteristics to meet different needs by industries like lightweight materials for cars, eco-friendly coatings, and so on.

The competition will be apparent as they are searching for better, safer and more efficient chemical alternatives. Sustainability is the emphasis of many, as most of the companies have adopted practices that minimize harm to the environment while maximize performance. Companies, however, increasingly cooperate through mergers and acquisitions in order to consolidate their market positions and thus increase their global vision. The Asia Pacific area is fast becoming a favored area for such investments on account of the region's cost benefits and access to semi-skilled workers.

Rapid urbanization, a burgeoning middle class, and increasing environmental awareness are likely to cause drastic changes in the market. Customers are more conscious of the materials that go into products they use day in and out, and it is up to these specialty chemical firms to anticipate and cater to said demands. Innovation, agility, and in-depth understanding of customer needs will determine who will lead the market in the imminent future. In line with industry's evolution, heightened demand will emerge for smarter and greener specialty chemicals, and those which cater to these necessities will possess the most promise in the Asia Pacific area.

Asia Pacific Specialty Chemicals Market Key Segments:

By Type

- Agrochemicals

- Dyes and Pigments

- Construction Chemicals

- Specialty Polymers

- Textile Chemicals

- Base Ingredients

- Surfactants

- Functional Ingredients

- Water Treatment

- Others

By Sales Channel

- Direct Sales

- Distributors and Wholesalers

By Country

- China

- Japan

- India

- South Korea

- Australia

- South East Asia

- Rest of Asia Pacific

Key Asia Pacific Specialty Chemicals Industry Players

- BASF SE

- Dow Chemical Company

- Evonik Industries AG

- Clariant AG

- Huntsman Corporation

- Nouryon Chemicals Holding B.V.

- Lanxess AG

- Mitsubishi Chemical Corporation

- Solvay S.A.

- Eastman Chemical Company

- Shin-Etsu Chemical Co., Ltd.

- Covestro AG

- LyondellBasell Industries

- Wacker Chemie AG

- Albemarle Corporation

- Arkema S.A.

- Nufarm Limited

- Tosoh Corporation

- China National Chemical Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252