MARKET OVERVIEW

The India Thread Rolling Dies market will prove to be an important and integral part of the country's manufacturing sector, particularly concerning the production of high-quality fasteners, bolts, and other threaded components. The importance of this market in the overall manufacturing process of the respective industries is critical to sectors such as automotive, aerospace, and construction. The growing demand for accurate, strong, and affordable components will drive the India Thread Rolling Dies market during the coming years, thereby making it an important focus area for manufacturers and suppliers.

Thread rolling is a cold working process that involves creating threads on a cylindrical surface. Here, the dies work to form the threads by rolling material between two or more dies under pressure. High-quality thread rolling dies used in this process are to ensure the production of reliable and durable threaded components. Such dies are produced from a number of materials including high-speed steel, carbide, and tool steels, which would depend upon the specific requirement of the application. India's manufacturing sector is expected to expand further and, in turn, the demand for high-precision components will continue to increase.

The automotive industry will also act as a key driver in the market. With the increasing trends of the automotive industry, demanding complexity and lightness, manufacturing will depend on thread rolling dies to produce high-performance parts. Similarly, the aerospace industries will require thread rolling dies to meet with the stringent standards of aircraft components requiring strength and durability. The India Thread Rolling Dies market will also see growth in the construction sector, as structural applications require robust fasteners. There will be a need for high-quality threaded components with ongoing infrastructure development projects, thereby fuelling the market. Looking into the future, new technological developments will be vital to the India Thread Rolling Dies market. Newer materials used for making dies, better techniques for manufacturing, and increased use of automation in the production of dies will make the rolling threads die more efficient and functional. This market will focus on supplying more solutions to meet clients' precise requirements and produce within quicker time and with precision.

More consolidation is expected in the market for India Thread Rolling Dies as significant players continue their efforts to enhance product offering. Companies will be forced to emphasize die design improvements under the strong pressure of changing industry standards and thereby the market competitiveness as a whole. Growing demand for highly engineered and precision-threaded components will also push the suppliers more into innovation, thereby strengthening market positioning.

Although challenges such as higher cost of advanced materials as well as continuous technological updation would persist, the scenario for the India Thread Rolling Dies market remains optimistic. And with India becoming a better manufacturing hub, the demand for thread rolling dies will only appreciate.

This will mean growing market, therefore home-based producers and international sellers looking to take advantage of the new demand for high-quality threaded components in India. In conclusion, the India Thread Rolling Dies market will become an integral part of the country's manufacturing ecosystem, offering solutions that meet the precise needs of various industries. As demand continues to grow, manufacturers will focus on improving die quality, material selection, and production efficiency to cater to the future needs of the market.

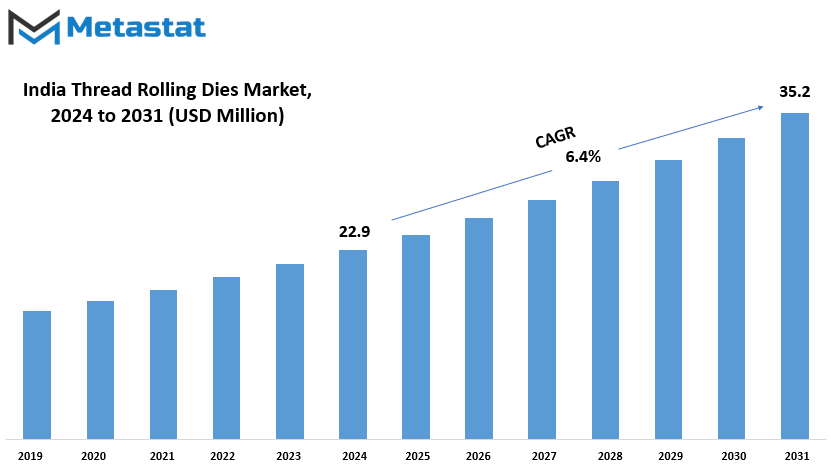

India Thread Rolling Dies market is estimated to reach $35.2 Million by 2031; growing at a CAGR of 6.4% from 2024 to 2031.

GROWTH FACTORS

The demand for precision manufacturing is driving the growth of India thread rolling dies market. With evolving industries across the country, the need for high-quality components in automotive and aerospace sectors has been very high. Thread rolling dies, which are the main tools used for the formation and shaping of threads on metal parts, are in higher demand as manufacturers look for more efficient, durable, and precise tools for their production processes. This growth is highly interrelated with the increasing automotive and aerospace industries, which demand thread rolling dies to produce components that need high-grade quality and specifications. The good growth, though positive, has challenges which would be a restraint for expansion in the thread rolling dies market in India.

The initial high investment costs for developing and producing these dies are some of the key hindrances. The machinery, the technology, and the human expertise required to produce this kind of specialized tool will be costly, and not many small businesses or new market entrants may be able to afford this level of investment. Moreover, in order to adapt to newer technologies, upgrading the available infrastructure can be very cost-prohibitive. Availability of qualified labor force is another hindering aspect to the growth of this market. The process for the making of thread rolling dies needs utmost precision and technical know-how. If there is an inadequacy in this segment of skilled workers, it can make the manufacturers incapable of competing against the rising demand for the same product. Delays, higher cost, and lower quality can come through inadequate supply of skilled labor forces; it will affect the competition factor in the Indian thread rolling dies market. Despite all these challenges, there are vast opportunities on the horizon. The Indian thread rolling dies market is opened to new possibilities with technological advancement.

Automation and advanced manufacturing techniques help the manufacturers enhance the quality and efficiency of the thread rolling dies and satisfy the rising demand while lowering the cost. Besides, government initiatives aimed at supporting the manufacturing industry in India open up additional opportunities for the growth of the market. All of the initiatives would provide finance opportunities, encourage innovation incentives, and better the business environment in terms of manufacturing thread rolling dies. Thus, given proper investment in both technology and training, this market continues its growth in subsequent years.

MARKET SEGMENTATION

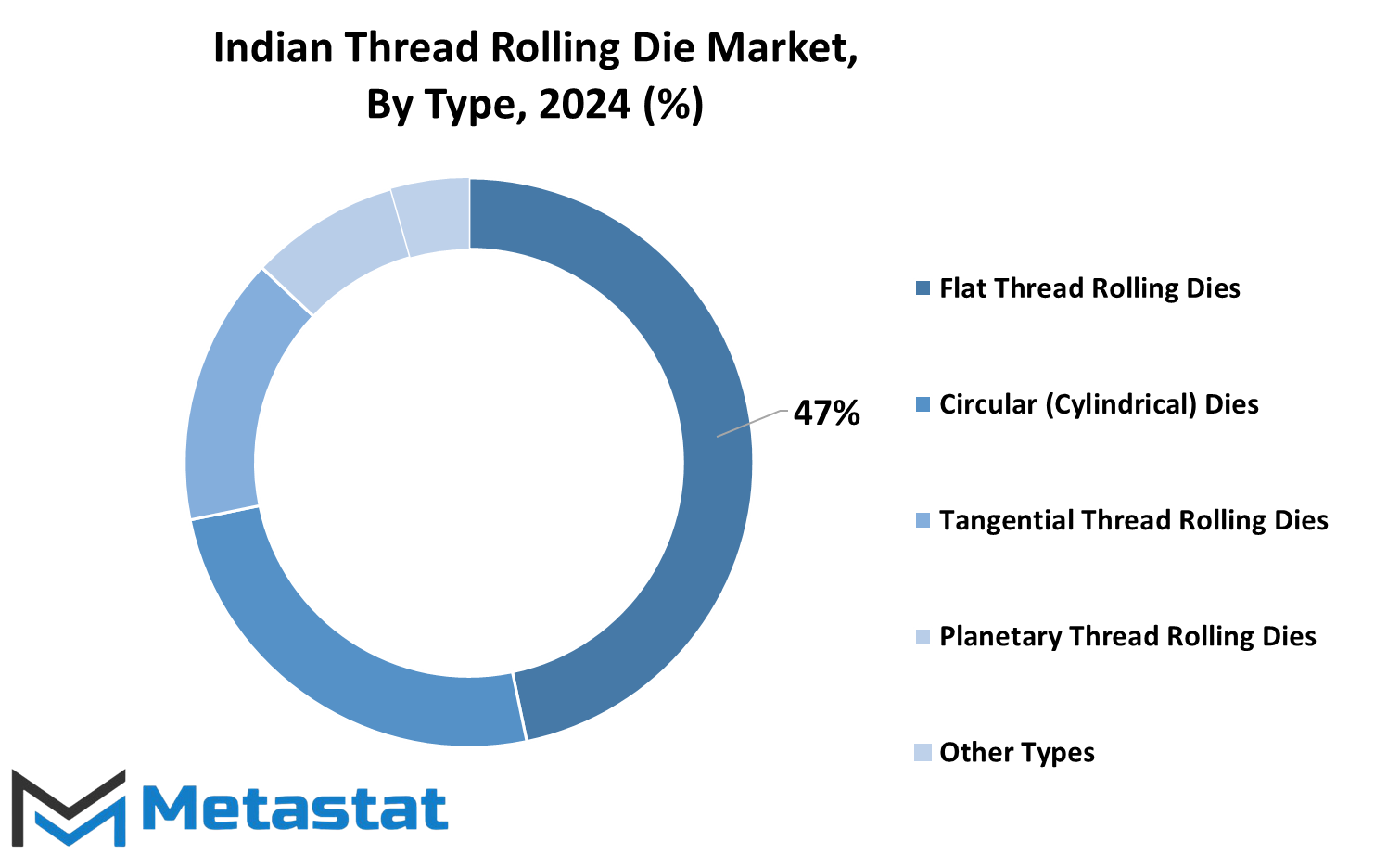

By Type

Further, the type of dies is divided into many categories based on their designs and functions. These categories include Flat Thread Rolling Dies, Circular (Cylindrical) Dies, Tangential Thread Rolling Dies, Planetary Thread Rolling Dies, and others. These types are designed to meet various needs in manufacturing processes that involve thread rolling to make threads on metals or other materials.

Flat Thread Rolling Dies are widely used for the production of threads on cylindrical workpieces by applying pressure in a flat configuration. These dies are mostly used in mass production where uniformity and precision are very important. Their design ensures that the threads are formed efficiently and accurately, making them ideal for high-volume manufacturing.

Circular (Cylindrical) Dies is, as the name gives an idea, used for cylindrical workpieces. These die presses force in a circular manner around the material so as to form the threads, widely used in industries for threading rods, bolts, etc., and other cylindrical parts; they are designed to create smooth and continuous processes ensuring high productivity and consistent output.

Tangential thread rolling dies work on the principle of applying tangential pressure to the material. Such a die is used for parts that have specific thread patterns and precision. It is commonly used for more specialized applications where the geometry of the thread needs to be in strict specifications. The tangential pressure allows the creation of very detailed and precise threads, which makes this type ideal for parts that require high accuracy.

Planetary thread rolling dies are unique in that there are multiple dies that spin around a central point and are somewhat like the orbit of planets in a solar system. This design is useful where uniform pressure distribution is required while producing threads on larger or more complicated components. These dies can easily provide better efficiency in rolling and are commonly used by industries that require high volumes, such as automotive, to produce.

Other types of thread rolling dies include those tailored for specific work or material. These would include variations on the basic forms mentioned earlier, tailored for specific uses or industries. Each serves an important purpose in ensuring the effectiveness, accuracy, and efficiency of the process of producing threads for just about any kind of use, in multiple industries.

By Material Type

The market can be subcategorized into various types of material, which include High-Speed Steel (HSS), Carbide, Tool Steel, Alloy Steel, and other special varieties. Each material differs with unique characteristics that make the appropriate one suitable for a range of specific applications. High-speed steel can withstand high temperature levels without losing its hardness, a fact that makes HSS special. This makes it suitable for all tools that are applied in cutting and machining metals, especially in high-precision manufacturing industries. HSS withstands the conditions with its strength and durability to keep up with good performance in demanding conditions.

Carbide is much harder compared to steel, and hence, it is used when wear resistance is superior. It is used in cutting tools where sharpness is required for quite a long time. Hard metals and other tough material machining is perfect with carbide tools. The tools have exceptional hardness, enabling them to be used on high-speed operations. Some of the industries that value this tool include manufacturing and construction.

Tool steel is made for tool which specifically demands to have strength, hardness and also the abrasion resistance. Alloy Steel is a material which involves introducing elements like chromium, nickel, and molybdenum into steel and offers improved strength, toughness, and resistance to corrosion.

Last But Not Least, Other Specialized Alloys include very large groups of materials produced specifically to provide various industrial needs that may require some forms of corrosion resistance, increased strength, or improved thermal properties. These alloys are very key in electronics, medical instrument manufacturing, and defense applications, among others, for they require specially tailored material to meet their specific requirements. Each of these materials has a significance in the market with unique benefits towards several manufacturing and industrial requirements.

By Distribution Channel

The market is divided into three categories by the distribution channel. Direct sales, distributors and dealers, and online platforms comprise these three categories. All these channels are important in how products reach consumers; they provide various methods and benefits to businesses and buyers alike.

In direct sales, companies sell their products directly to the customers without using any intermediary. It would allow for a closer contact between the company and the consumer, which would facilitate trust and loyalty. Business can have more control over the sales process, including price, promotion, and customer service. In most cases, direct sales are common in industries requiring customer education and support like some technologies or high-end products.

The distributors and dealers are middlemen who facilitate manufacturers in taking their products to consumers. They help get products in a wider market through their logistics and distribution network. The model is beneficial for companies who are seeking a wider reach in places that they may not be accessible directly. Distributors normally buy commodities in large quantities from producers and sell them to retailers or dealers who sell at the end-user level. This channel reduces the burdens of logistics on the producing companies, allowing them time to concentrate on production. They also ensure that all their products are available to end-users in different regions. Online channels have recently gained much importance.

This rise in e-commerce has made many businesses shift to digital platforms to reach more people. Online selling is convenient for both the seller and the buyer. The consumer can shop from anywhere at any time, and the business will save costs on running a physical store. Online platforms can vary from the Amazon marketplace to a niche site. Businesses can thus have a wide range of choices and choose the best one to fit their products. Each of the distribution channels has unique advantages, and businesses mostly adopt a mix of various combinations to ensure that they provide their products to the potential markets in an efficient manner. Some of the main advantages of direct sales are personalized service, expanding reach through distributors and dealers, and the convenience that an online platform offers can facilitate accessibility. Understanding of the channels helps companies design optimization strategies for meeting their customer needs and growth in a specific market.

By Application

The India Thread Rolling Dies market is categorized based on its various applications. It holds a large share in the automotive industry. In the automotive industry, it is valued at 7.56 million USD in 2023 and accounts for 35.1% of the total thread rolling dies market. This segment is anticipated to expand at a compound annual growth rate of 5.95% from 2024 to 2031. In 2031, the market value for the automotive industry will be 12 million USD. Other critical industries that affect the thread rolling dies market are aerospace and defense, construction and infrastructure, industrial machinery, electronics and electrical components, medical devices, and fastener production. In those industries, there is the thread rolling dies that use to manufacture its various products by producing high precision threaded parts for use in almost all forms of applications.

In the automobile industry, these types of dies have greatly been significant in manufacturing extremely durable components for the car to be assembled into highly qualitative ones. The aerospace and defense industry makes use of the thread rolling dies in manufacturing parts designed to have extreme precision and strength such as fasteners and structural components. The construction and infrastructure sector uses thread rolling dies for the mass production of hard, strong, and long-lasting fasteners used on buildings and other massive constructions. These dies are also relied upon by industrial machinery manufacturers to produce parts that have to face heavy use and wear.

Thread rolling dies produce components. The electronics and electrical components industry relies on thread rolling dies to ensure that components carrying both strength and accuracy assure proper working of various pieces of equipment. Medical equipment requires precision and safety, so this industry also creates other types of equipment as a spin-off through which surgical instruments, implants, and other essential equipments used globally can be created.

The fastener production industries manufacture various types of fasteners. With their development further, they need varied fasteners for different applications in growing numbers across various industries. The thread rolling die produces very durable, accurate and efficient tooling. The industries find these dies very productive as well as efficient as an essential tool for use by manufacturers. Thus, demand for thread rolling die would be increased steadily by this sector in the coming years.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$22.9 million |

|

Market Size by 2031 |

$35.2 Million |

|

Growth Rate from 2024 to 2031 |

6.4% |

|

Base Year |

2022 |

COMPETITIVE PLAYERS

In the Indian thread rolling die market, there are a number of major players who make contributions towards growth and development. Amongst them are Mohindra Precision Tools Pvt. Ltd., Accurate Auto Lathes Private Limited, HTMT Private Limited, and Kadimi Tool Manufacturing Company (P) Ltd. These are considered to be some of the major companies in this space, especially for their experience in producing high-quality thread rolling dies for a range of industrial applications.

Other major players in the market are DIC Tools, A.S. Engg. Enterprises, and Industrial Machinery Corporation, all of which contribute significantly to the industry. The companies specialize in the design and manufacture of precision tools used in the production of threaded components widely used across sectors. Companies like Boltrack Engineers and Linear Ways India are always upgrading the industry by bringing advanced technology and innovative solutions to meet the growing demand for efficient and durable dies.

Other important companies in the market are Nbeson Tools India, Malkar Industries, and Mascot CNC Tools & Equipments Private Limited, which provide high-quality thread rolling dies to cater to industries like automotive, aerospace, and engineering. These companies have gained strong reputations for their reliable products and commitment to customer satisfaction. Further, Wellcut Tools (India) Pvt. Ltd. is also a prominent one that provides precision-driven solutions, supporting manufacturers in producing threaded components with accuracy and consistency.

These companies are the backbone of the India Thread Rolling Dies industry. It will be great to see such companies making a lot more effort because of the continued improvement and growing requirement for their products in different applications. Due to this factor, threaded component manufacturing industry will require companies like those mentioned above much more. Their contributions are making the future of the industry and helping to keep India on the map as a player in the global manufacturing world.

India Thread Rolling Dies Market Key Segments:

By Type

- Flat Thread Rolling Dies

- Circular (Cylindrical) Dies

- Tangential Thread Rolling Dies

- Planetary Thread Rolling Dies

- Other Types

By Material Type

- High-Speed Steel (HSS)

- Carbide

- Tool Steel

- Alloy Steel

- Other Specialized Alloys

By Distribution Channel

- Direct Sales

- Distributors and Dealers

- Online Platforms

By Application

- Automotive Industry

- Aerospace and Defense

- Construction and Infrastructure

- Industrial Machinery

- Electronics and Electrical Components

- Medical Devices

- Fastener Production

Key India Thread Rolling Dies Industry Players

- Mohindra Precision Tools Pvt. Ltd.

- Accurate Auto Lathes Private Limited

- HTMT Private Limited

- Kadimi Tool Manufacturing Company (P) Ltd.

- DIC Tools

- A.S. Engg. Enterprises

- Industrial Machinery Corporation

- Boltrack Engineers

- Linear Ways India

- Nbeson Tools India

- Malkar Industries

- Mascot CNC Tools & Equipments Private Limited

- Wellcut Tools (India) Pvt. Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252