MARKET OVERVIEW

The India ethanol market is an important part of the country's biofuels and energy industry, which is constantly moving towards a complex intersection of policy, change in demand and emerging technology. While most conversations around this market are focused on the production volume or fuel combination mandate, a darker view highlights several low-discus dynamics that will shape its direction in the coming years.

India has traditionally rely on sugarcane as the main source of ethanol. However, this crop-specific dependence is being seen as a limit rather than a strength. The challenges of climate stress and water use are motivating both government and private sector institutions to detect rice straw, maize and damaged food grains. Changes towards the second generation ethanol, although still in their early stages, it will eventually change how manufacturers contact for source of raw materials. This infection will not be overnight, but a network of localized supply chains will be required that are not yet in place.

The regulatory environment around the India ethanol market will probably become more fine, especially with wide clean energy goals. While current framework supports the incentives related to production, upcoming policy decisions will need to address land use, farmer compensation model and logistic infrastructure issues. Policies can also begin factor in state-wise assets, given that some areas are more favorable than others for grain or biomass-based ethanol production.

Another unspecified aspect lies in the technology pipeline. The India ethanol market will eventually see a quiet but impressive infusion of digital tools AI-powered yield from prediction models to blockchain applications that ensure traceability in the supply chain. These changes, although the consumer does not see immediately, will redefine backend operations for manufacturers and suppliers. The next wave of competition is not just about how much the ethanol is produced, but how efficiently and continuously it goes from the crop to the consumer.

On the demand side, India will go beyond the fuel of ethanol market vehicles. Industrial and chemical sectors are preparing to shift to bio-based inputs, as global buyers seek cleaner sources in response to ESG commitments. It can open export channels that remain largely unused. However, this opportunity will bring an inquiry around quality standards, traceability and certificates, which will motivate manufacturers to upgrade production protocols.

The infrastructure development will also quietly determine the future prospects. In particular, the rail and road network designed for ethanol logistics must be scaled. The installation of ethanol-specific storage terminals and pipelines will be required to avoid the obstacles of the supply. While the government has prepared the basis for ethanol combination, spontaneous distribution will be the next major obstacle.

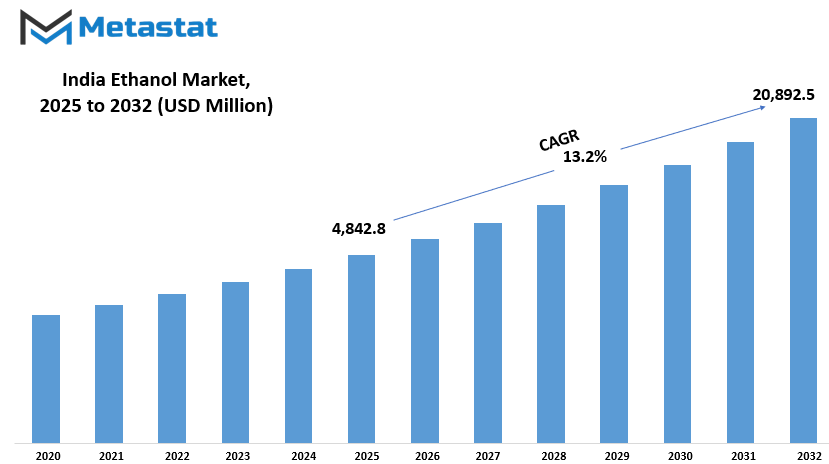

India ethanol market is estimated to reach $20,892.5 Million by 2032; growing at a CAGR of 13.2% from 2025 to 2032.

GROWTH FACTORS

The India ethanol market will witness a noticeable change run by both internal strategies and external pressures. One of the strongest forces that forward this market will be the growing government mandate to combine ethanol with petrol. These policies will not only promote the use of cleaner fuel, but will also reduce the country's dependence on imported crude oil. At the same time, increasing global push for permanent practices and energy security will support the development of ethanol as a viable option. Ethanol, being an renewable fuel, will naturally attract attention as India tries to balance development with environmental responsibility.

However, the journey will not be without any difficulty. A major challenge that will continue to face the industry is a limited availability of feedstock. Since ethanol in India is mostly produced from sugarcane and maize, this area will be heavily connected to agricultural production. This relationship will affect the stability of production for the quality of cultivation season and yield. In addition, the logistics will continue to act as a bottleneck. Ethanol requires a reliable network for storage, transportation and distribution, and these features have not yet been fully developed across the country. As the demand increases, the absence of a strong infrastructure will become a visible range and will need to focus on both public and private players.

Nevertheless, there will be clear opportunities that can shape the future of this market in a positive way. A major area of focus will be the second-generation ethanol, which uses non-food biomass such as crop residues and agricultural waste. This approach will not only reduce pressure on food crops, but will also provide a permanent method of production. As India improves its technical abilities in the region, it will unlock the ability of more stable and environmentally friendly ethanol supply.

At the same time, more companies and global investors will see it as an opportunity to contribute to India's Clean Energy Mission. Green Energy Space will get strong support with foreign direct investment and policy assistance. This will bring financial resources and innovation to the market, which will help in moving from its current scale. With the right plan and long -term vision, India will move forward despite the ethanol market barriers. This will become an important part of the country's energy strategy, which will offer cleaner fuel solutions and support a future that depends less on fossil fuels.

MARKET SEGMENTATION

By Type

The India ethanol market is developing with a clear difference between its two main types: bio ethanol and synthetic ethanol. The bio holds an important part of the market, which is priced at $1,917.6 million. This form of ethanol originates from renewable biological sources, such as agricultural waste, sugarcane and other plants. It is seen as an important option for traditional fossil fuels as it can reduce dependence on crude oil and low emissions. On the other hand, synthetic ethanol is made through chemical processes using petroleum-based raw materials. Although it is less preferred due to environmental concerns, it still plays a role in the overall supply of ethanol in India.

The demand for India ethanol market is expected to increase continuously as the government pushes for cleaner energy and better fuel efficiency. India plans to mix ethanol with petrol, which will help reduce pollution and support its goal of energy security. This policy will create opportunities for ethanol producers, especially those working with bio-based ethanol, as it aligns with the attention of the country on sustainable development. The production and use of bio ethanol will probably increase as it uses renewable raw materials and supports agricultural sectors by creating additional income sources for farmers.

On the synthetic ethanol side, production will continue but can withstand challenges because environmental rules become strict. Synthetic options include chemical methods that are more energy-intensive and less environmentally friendly, so its share can be less over time because bio ethanol becomes more widely accepted and financially viable. However, synthetic ethanol still contributes to the current demand, especially where the supply of bio ethanol is limited.

The India ethanol market will also benefit from progress in technology which improves production efficiency and low cost. Innovation in fermentation processes and better use of raw materials can increase output and make ethanol more competitive against traditional fuel. This progress will encourage investment and partnership between growers, governments and other stakeholders.

In summary, the India ethanol market will continue to develop with dominance with bio ethanol due to its environmental benefits and government support. Synthetic ethanol will be part of the market but with less loud. Together, they create a dynamic energy field that is moving towards cleaner options and supporting India's long -term energy and environmental goals.

By Source

The India ethanol market will see good sized improvement as it shifts consciousness on distinctive sources for ethanol manufacturing. The market especially divides into two key sources: molasses-based totally and grain-based totally ethanol. Each of these sources will influence the enterprise in unique methods, reflecting India’s assets, agricultural styles, and government regulations.

Molasses-based totally ethanol manufacturing will maintain to hold a sturdy role in India. This sort of ethanol is made from the by-product of sugar manufacturing, molasses, that's broadly to be had due to the us of a’s huge sugar enterprise. Since molasses is an handy uncooked fabric, many distilleries use it to supply ethanol successfully. The availability of molasses relies upon heavily on the sugarcane crop, and India’s fame as one in all the largest producers of sugarcane ensures a constant deliver. This connection will keep molasses-based ethanol as the dominant supply in the near destiny.

On the other hand, grain-primarily based ethanol, which uses grains like maize or corn, will gradually benefit greater interest. Although currently a smaller proportion of the marketplace, this phase has the ability to extend because the authorities encourages the usage of alternative raw materials for ethanol production. Grain-based totally ethanol production will aid the diversification of resources, reducing dependence on molasses by myself. However, the venture lies in balancing the demand for grains as meals and as gas. The availability of grains, pricing, and policies will affect how quick this phase can develop. Still, it's going to play an crucial role inside the ordinary ethanol supply.

The India ethanol market can also be shaped through regulations aimed toward increasing ethanol mixing in gas. The authorities' push for higher ethanol mixing percentages will pressure call for from both molasses and grain-primarily based sources. Distilleries may also increase their capacity to fulfill this demand, investing in better era and expanding manufacturing. This push will encourage the exploration of latest raw substances, however molasses and grains will remain the number one recognition.

In summary, the India ethanol market will expand round molasses-primarily based and grain-based totally production. Molasses will keep its lead because of its near link with sugarcane farming, whilst grain-based ethanol will upward push as a complementary source. Government guide and converting demand styles will encourage increase in each segments, helping India give a boost to its role in the ethanol industry.

By Distribution Channel

The India ethanol market is prepared into one of a kind channels through which ethanol reaches its purchasers, in particular divided into Direct Sales, Distributors, and Wholesalers. Each of these distribution channels will play a sizable position in how ethanol merchandise are delivered and fed on across the united states. Direct Sales will contain producers or manufacturers selling ethanol immediately to the give up users. This approach will possibly create a greater sincere connection among manufacturers and customers, slicing down on middlemen and potentially decreasing costs and transport instances. Industries that require large volumes of ethanol, consisting of gasoline blending companies or pharmaceutical manufacturers, will benefit from direct purchases because it will permit for better control over supply and satisfactory.

Distributors, then again, will act as intermediaries between the producers and the smaller buyers or stores. They will buy ethanol in bulk from producers and then supply it to numerous smaller clients or outlets. This channel will provide flexibility and ease for producers to reach a wider consumer base while not having to handle more than one small transactions. Distributors will also be answerable for preserving stock and ensuring timely delivery, which will help stabilize deliver chains, specially in areas which are far from production centers.

Wholesalers will be some other crucial part of the distribution chain. They will function through purchasing ethanol from manufacturers or vendors in massive portions and then promoting it to shops or smaller corporations. Wholesalers will serve neighborhood markets and smaller industries that may not have the capacity to buy without delay from manufacturers or huge vendors. Their role could be critical in making sure ethanol availability in more remote or much less handy areas. They may even help in breaking down bulk quantities into attainable sizes for retail clients.

In the destiny, these distribution channels will adapt in keeping with marketplace demands and adjustments inside the ethanol enterprise. The upward thrust in demand for ethanol as a gas additive and in other sectors will probably encourage a more prepared and efficient distribution system. Direct Sales may additionally grow in importance as industries are seeking for greater control over their deliver chains, but Distributors and Wholesalers will keep to offer vital aid in attaining diverse markets. Each channel will contribute in its personal manner to making ethanol on hand all through India, assisting the USA's efforts in the direction of purifier energy and business boom.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4,842.8 million |

|

Market Size by 2032 |

$20,892.5 Million |

|

Growth Rate from 2025 to 2032 |

13.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Application

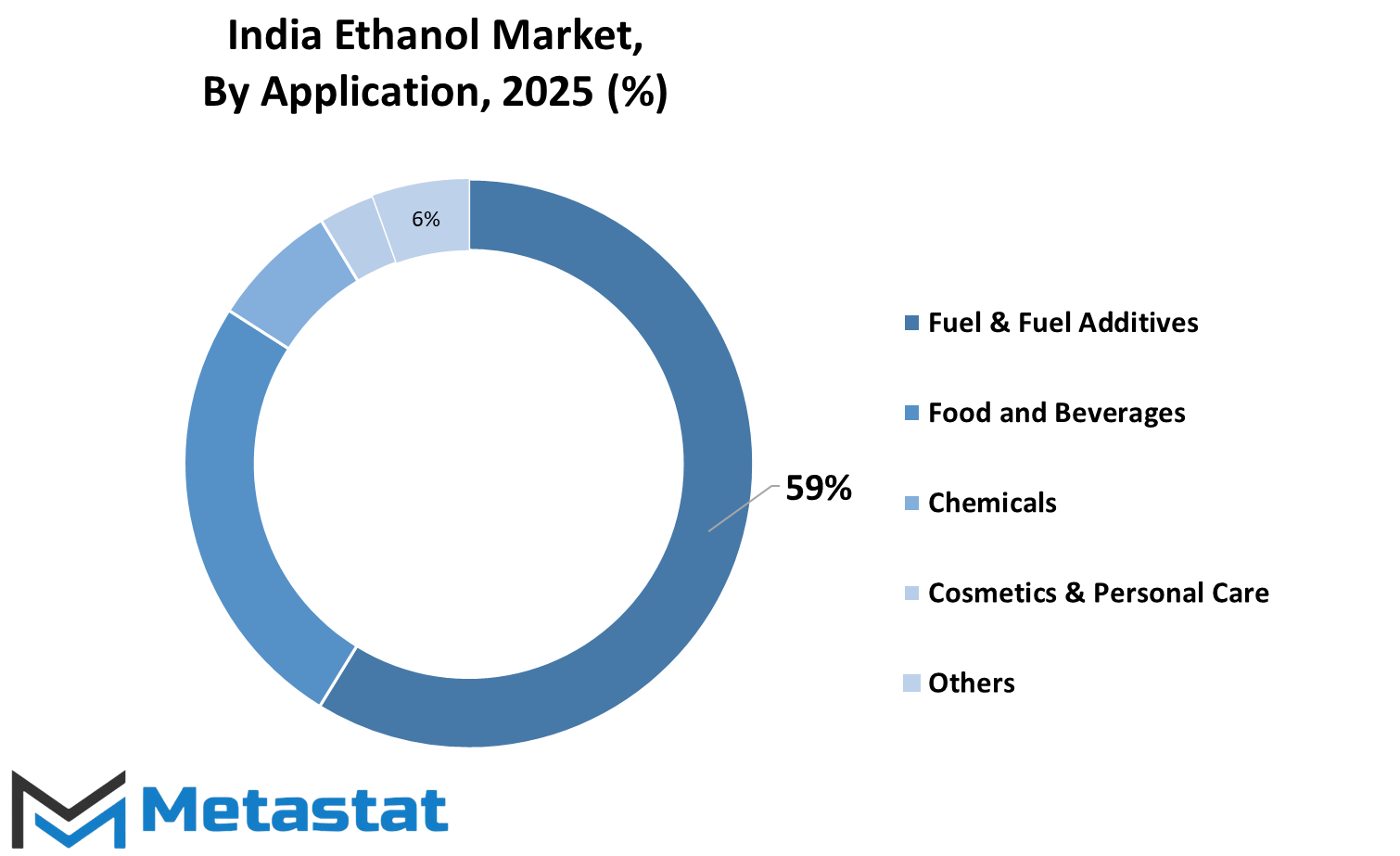

The India ethanol market will retain to show critical developments throughout numerous applications, reflecting the USA's converting business and client wishes. One of the primary uses of ethanol in India is as gas and gasoline additives. This segment will stay widespread as the government pushes for purifier and greater sustainable energy assets. Ethanol mixed fuels will be promoted to lessen reliance on conventional fossil fuels and cut down pollutants. Efforts to boom ethanol mixing in petrol, focused on better possibilities, will lead to accelerated demand in this category. This pass will now not handiest guide energy safety but also encourage the increase of local agriculture, as ethanol is essentially made from sugarcane and other biomass.

In addition to fuel, ethanol unearths widespread use within the meals and beverages zone. Ethanol acts as a solvent and preservative in many food processing operations. It is also a key component within the production of alcoholic drinks. This segment will maintain steady growth as client spending rises and greater merchandise reach city and rural markets. The rising preference for packaged and processed ingredients will also force ethanol call for here. The marketplace will adapt to changing tastes and stricter protection requirements, as a way to influence how ethanol is used and processed in this industry.

The chemical compounds enterprise will maintain to rely on ethanol for production numerous merchandise. Ethanol serves as a raw cloth or intermediate for making different chemicals, consisting of ethyl acetate and acetic acid. This application will stay essential as chemical manufacturers are searching for price-powerful and regionally available inputs. With India increasing its commercial base, call for ethanol in chemicals can even grow gradually, assisting sectors together with prescription drugs, paints, and adhesives.

Ethanol’s position in cosmetics and private care will also grow. It is broadly used as a solvent, antiseptic, and preservative in many splendor and hygiene products. As patron focus about non-public care rises, so will the call for products containing ethanol. This fashion will boost the ethanol market on this phase, specially with increasing exports and the rise of domestic brands centered on natural and secure components.

Other applications, such as prescription drugs and commercial makes use of, will contribute to the overall market but to a lesser volume compared to the categories noted above. The India ethanol market will evolve as a crucial a part of the USA's approach to stability monetary growth with environmental and fitness issues. Each software region will develop at its personal tempo, reflecting wider traits and authorities rules encouraging sustainability and self-reliance.

REGIONAL ANALYSIS

The India ethanol market is part of a larger worldwide landscape this is divided primarily based on geography into regions together with North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these areas plays a unique function in the usual ethanol market, influenced by way of their own economic activities, agricultural ability, and authorities policies.

In North America, the marketplace is further broken down into the USA, Canada, and Mexico. The U.S. Is a key participant in ethanol production and consumption, often setting tendencies that impact other countries. Canada and Mexico additionally contribute appreciably, especially in terms of ethanol utilization in transportation fuels and industrial packages. The ethanol market in this location will continue to be shaped by regulatory frameworks geared toward lowering carbon emissions and selling renewable energy resources.

Europe’s ethanol marketplace includes countries like the United Kingdom, Germany, France, Italy, and the relaxation of Europe. These international locations will cognizance on integrating ethanol as a cleanser fuel alternative, encouraged by weather dreams and electricity security issues. The European Union’s rules encouraging biofuels will assist demand increase, with extraordinary international locations advancing at varying rates depending on their electricity techniques and agricultural manufacturing capabilities.

The Asia-Pacific area carries India, China, Japan, South Korea, and different international locations in the region. India’s ethanol marketplace is expected to amplify swiftly because of authorities tasks to growth ethanol mixing in fuels, aiming to reduce reliance on fossil fuels and improve rural economies thru sugarcane and different crop production. China, Japan, and South Korea will even affect the marketplace, every with their personal power rules and technological improvements to enhance ethanol use.

In South America, Brazil, Argentina, and the relaxation of the continent contribute significantly to the ethanol market. Brazil stays one of the biggest ethanol producers globally, pushed through its big sugarcane industry and authorities support for biofuels. Argentina and different nations also are involved in developing their ethanol sectors, aiming to take gain of their agricultural assets and meet domestic electricity desires.

Finally, the Middle East & Africa region consists of the GCC international locations, Egypt, South Africa, and different countries. While this location has historically been centered on oil and fuel, there is a developing hobby in diversifying energy sources. Ethanol production and consumption will probable boom, supported by way of efforts to adopt purifier fuels and reduce environmental effect.

Overall, the India ethanol market fits within this global context however stands out due to its authorities' push for ethanol blending goals and the U.S.A’s agricultural capability. This marketplace will preserve to develop as India works to satisfy its energy demands sustainably whilst contributing to the wider ethanol supply chain across Asia-Pacific.

COMPETITIVE PLAYERS

The India ethanol market will continue to grow because the USA makes a speciality of increasing its manufacturing and use of ethanol as a cleanser fuel alternative. Several key players will play enormous roles in shaping the enterprise’s future. Companies which include Praj Industries Ltd., Bajaj Hindusthan Sugar Ltd., and Shree Renuka Sugars Ltd. Can be at the leading edge, contributing to both production ability and innovation. These corporations, in conjunction with Balrampur Chini Mills Ltd. And Godavari Biorefineries Ltd., have been investing in new technologies and expanding their facilities to meet the rising call for for ethanol.

The authorities' push in the direction of blending ethanol with petrol to lessen dependence on fossil fuels will encourage greater investments from groups like HPCL Biofuels Limited and Triveni Engineering & Industries Ltd. These companies will work closely with agricultural manufacturers and sugar turbines, considering the fact that sugarcane remains the primary uncooked cloth for ethanol production in India. Other essential agencies consisting of India Glycols Limited and Simbhaoli Sugars Ltd. Will also advantage from this elevated call for, as they awareness on improving manufacturing performance and diversifying their product portfolios.

Dhampur Sugar Mills Ltd. And E.I.D. - Parry (India) Limited will continue to make bigger their ethanol operations, aiming to boom their proportion within the marketplace. Their efforts will probable include upgrading infrastructure and adopting higher distillation techniques to enhance output and decrease prices. Meanwhile, Dalmia Bharat Sugar and Dwarikesh Sugar Industries will explore partnerships and collaborations to bolster their function and discover new market opportunities.

DCM Shriram Ltd. And Mawana Sugars Limited are expected to align their manufacturing techniques with countrywide guidelines assisting ethanol mixing objectives. They will possibly spend money on research and improvement to enhance yield and sustainability practices. These combined efforts from diverse groups will guide India’s purpose of accomplishing higher ethanol blending possibilities within the coming years.

Overall, the India ethanol market will depend closely on the coordinated movements of those key players, the government’s supportive regulations, and the increasing awareness on sustainable strength answers. As the Moves towards purifier fuel alternatives, the industry will maintain to conform and increase, with these organizations gambling crucial roles in meeting the developing call for.

India Ethanol Market Key Segments:

By Type

- Bio Ethanol

- Synthetic Ethanol

By Source

- Molasses

- Grain Based

By Distribution Channel

- Direct Sales

- Distributors & Wholesalers

By Application

- Fuel & Fuel Additives

- Food and Beverages

- Chemicals

- Cosmetics & Personal Care

- Others

Key India Ethanol Industry Players

- Praj Industries Ltd.

- Bajaj Hindusthan Sugar Ltd.

- Shree Renuka Sugars Ltd.

- Balrampur Chini Mills Ltd.

- Godavari Biorefineries Ltd.

- HPCL Biofuels Limited

- Triveni Engineering & Industries Ltd.

- India Glycols Limited

- Simbhaoli Sugars Ltd.

- Dhampur Sugar Mills Ltd.

- E.I.D. - Parry (India) Limited

- Dalmia Bharat Sugar

- Dwarikesh Sugar Industries

- DCM Shriram Ltd.

- Mawana Sugars Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252