MARKET OVERVIEW

The India Commercial HVAC market plays an essential role within the heating, ventilation, and air conditioning industry paradigm, affecting how businesses and large-scale infrastructures regulate indoor environments. This market is concerned with some of the most advanced climate control solutions available for commercial establishments, including offices, shopping complexes, hospitals, hotels, and industrial facilities. With the increasing demand for energy-efficient systems that incorporate technology, HVAC solutions for commercial spaces will consistently evolve to meet operational requirements and environmental standards.

Commercial HVAC systems in India would provide temperature, humidity, and air-quality control for efficient operation of large-scale applications. With residential HVAC systems designed for smaller, simply configured spaces, commercial-in-work systems are being designed for heavy-duty use; having large capacity, durability, and operational reliability will always be a priority. The India Commercial HVAC market will witness advances, with businesses focusing on indoor air quality, sustainability, and cost-effectiveness.

The demand for HVAC solutions in commercial buildings extends beyond basic temperature control. Maintaining air circulation, providing adequate ventilation, and reducing airborne contaminants are essential tasks of the systems. As industries continue modernizing their infrastructures, intelligent automation and monitoring systems will be integrated into commercial HVAC technologies to enhance system performance. Remote control capabilities, predictive maintenance, and real-time data analytics establish a new standard for optimally empowering operations also embraced by businesses.

Regulations along with environmental policies shall keep determining the India Commercial HVAC market, fostering developments in energy-efficient cooling and heating technologies. Commercials shall be looking for systems that advance the sustainability targets by reducing carbon emissions and energy utilization. Smart technology shall prevail, adjusting temperatures dynamically according to occupancy levels, outdoor weather, and air quality criteria. An increasing interconnectedness of buildings will allow HVAC systems to be integrated with digital platforms for enhanced management and automation within IoT.

Commercial HVAC systems are dimensioned according to requirements specified by different industries, which lead to the development of customized solutions. Large commercial establishments may require centralized air conditioning systems, while smaller ones may opt for modular configurations that offer scalability. The India Commercial HVAC market will continue to cater to different industries, enabling businesses to obtain systems that meet specific operational requirements.

Overall, the India Commercial HVAC market presents significant opportunities for growth and innovation, driven by factors such as urbanization, regulatory mandates, technological advancements, and changing customer preferences. As businesses and industries continue to prioritize efficiency, sustainability, and comfort, the demand for advanced HVAC solutions is expected to remain robust, positioning the market for continued expansion in the years to come.

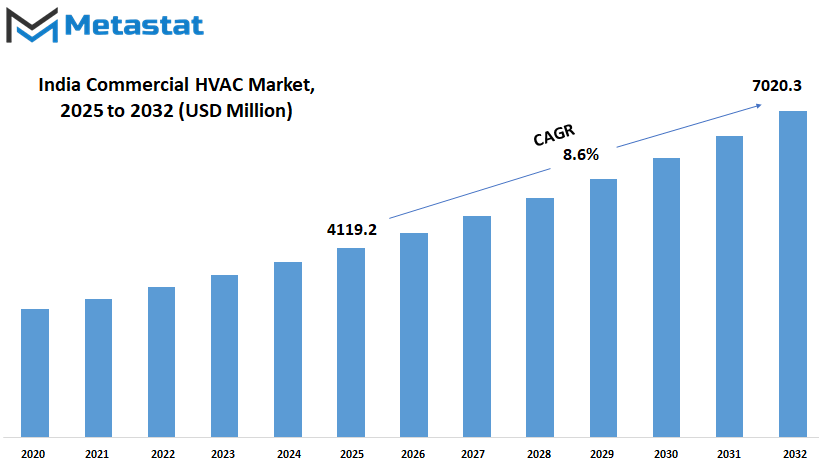

India Commercial HVAC market is estimated to reach $7020.3 Million by 2032; growing at a CAGR of 8.6% from 2025 to 2032.

GROWTH FACTORS

The rising need for better heating, ventilation, and air conditioning systems is setting the commercial infrastructure toward the future. Urbanization being on a rapid track, businesses and commercial spaces are on the rise, translating into greater demand for advanced climate control solutions. In fact, the heat wave and climate change effects have almost made cooling systems a necessity. All of these will go a long way to shaping the India Commercial HVAC market.

The expansion of commercial real estate has shifted focus toward maintaining comfortable indoor environments. Modern buildings accommodate and even entertain large numbers of workers and visitors, making air conditioning a basic necessity. In an environment where businesses are trying to enhance employee productivity and customer experience, energy-efficient HVAC solutions are going to become a key consideration for infrastructure planning. This trend looks set to remain, thereby expanding the relevance of technologically advanced solutions in the future.

On the contrary, demanding as it may seem, this sector is contending with a few significant hurdles that may hinder growth. One of the bigger challenges is that, by most standards, HVAC systems remain generally expensive. While a modern HVAC system may be much more efficient and, therefore, more likely to save money in the long run, many companies remain hesitant to put down the initial costs of installing such a system. These start-up costs are further compounded by other incidences like installation and maintenance. It then becomes apparent why many companies feel unable to replace existing setups. On the other hand, the sustainability and operational-cost aspects become an issue when considering the huge energy consumption associated with such systems. This has prompted many companies to inquire about technologies that might pull together performance and affordability, intensifying the pressure on manufacturers to design new technologies for addressing this need.

Environmental regulations have also placed pressure on the market. Governments and regulatory authorities are tightening the screws to minimize carbon footprints and reduce excessive energy consumption adversely impacting the environment. The upgrade to comply with such regulations usually places a financial burden on companies. This green push would likely carve the path of HVAC technology towards energy-efficient solutions that fulfill sustainability objectives.

The other element of interest in the following years is still strong innovation. Companies are actively researching HVAC systems that are designed to consume less energy while still performing efficiently. Smart systems with automated controls, AI-operated temperature adjustments, and refrigerants friendly to the environment are expected to come up in demand. This could lead to an alteration in the operational landscape as firms seek long-term solutions, ones that are both environmentally responsible and economically viable.

MARKET SEGMENTATION

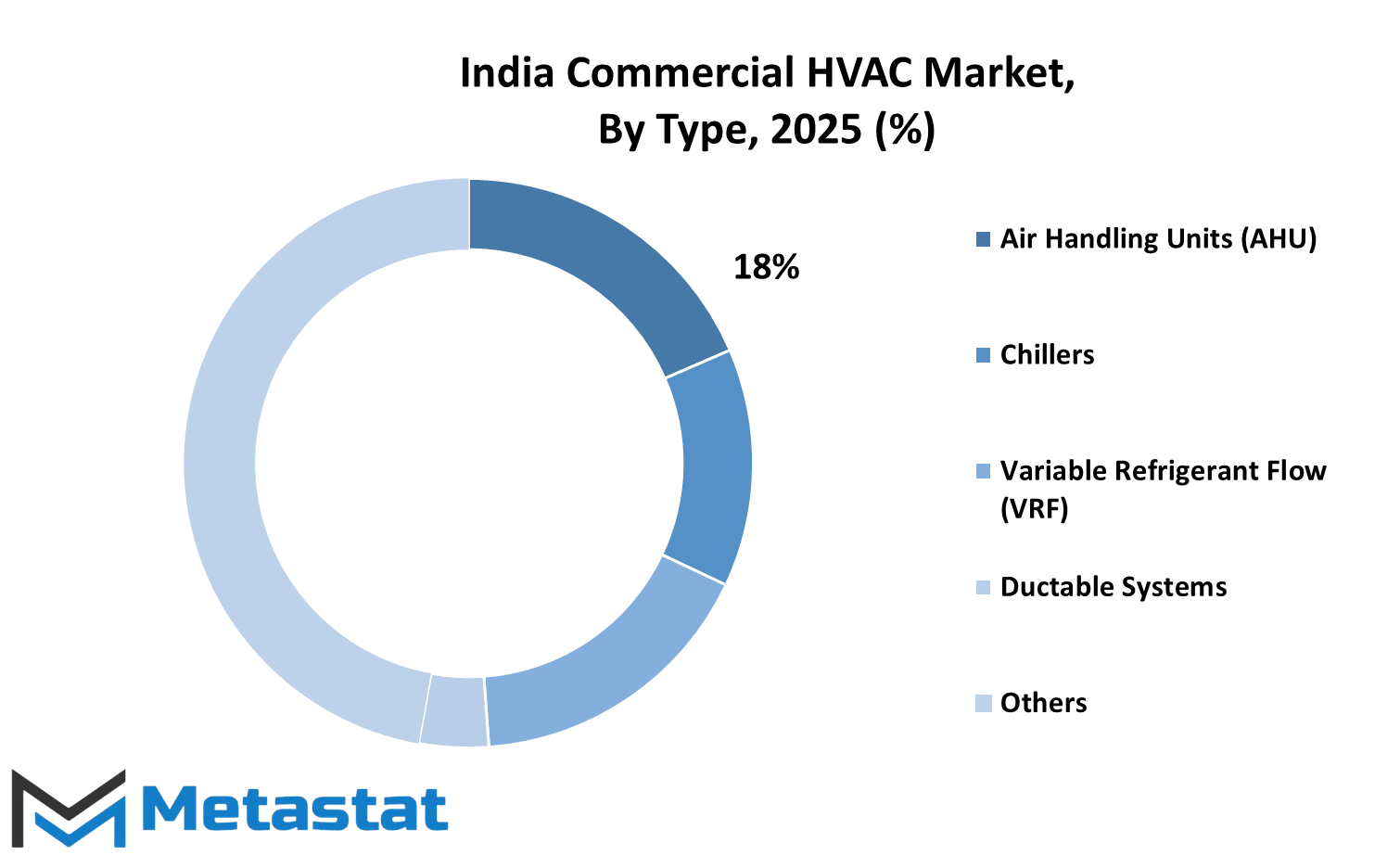

By Type

The India Commercial HVAC market is set to experience consolidation over the years. With increasing urbanization and infrastructure project initiatives, it is expected that heating, ventilation, and air conditioning systems will be demanded more and more. This demand is apparent with an increased number of offices, shopping complexes, and malls throughout the nation, with efficient climate control solutions being high in demand.

An emerging trend in the market is the incorporation of smart technologies, particularly IoT. An upgraded HVAC system nowadays comprises smart thermostats that connect to smartphones and tablets so users can change indoor temperature settings remotely. Such devices can learn user preferences, adjust settings accordingly, and send maintenance alerts, in turn improving energy efficiency and user-friendly experiences. The trend toward intelligent climate management has somewhat benefited from the increased availability of Wi-Fi-enabled appliances.

Energy efficiency is its main focus. Environmental concerns are forcing consumers to turn to HVAC equipment that requires less fuel and electricity and performs well. The ECBC was instated with the aim to lower the annual consumption of electricity. Some buildings are adopting hybrid systems that use gas and solar power, thus, proving to be both economical and sustainable.

In system types, Variable Refrigerant Flow (VRF) systems have started to take the spotlight. Depending on the control method and building configuration, these systems offer precision temperature control applicable for a wide range of applications. Flexibility and efficiency in VRF systems create a strong alignment with the market's shift toward more responsive energy and carbon-efficient solutions.

Another growing trend is ductless HVAC installation. Attacking older structures with traditional ductwork is often infeasible due to space or cost considerations. Ductless units provide a workable alternative that allows for easier installation without the need for major design changes. Such an approach will help more modern infrastructures with already existing problems of air leaks associated with conventional duct systems.

The automation through software offers HVAC operations tremendous opportunities. Systems nowadays nurture and analyze data about usage patterns and performance for preventive maintenance and fast issue resolution. Abilities such as self-diagnosis and automated reporting render operational reliability and minimize downtime, which are the two factors that drive efficient building management.

Now we can witness how the SaaS concept is being embraced by the HVAC industry. A Building Automation System with SaaS serves to monitor outside conditions like temperature and humidity, adjusting the internal environment in response. For instance, the SAS controls the heating and cooling of the building, preferring to utilize the energy when required, based on ambient light.

By Application

Altering this presents significant parameters to twist with the commercial HVAC Indian market brought forward by a rapidly urbanizing environment, marvelous technological developments, and enhanced energy efficiency. In the case that cities are expanded and infrastructure projects multiply, the demand for more sophisticated heating, ventilation, and air conditioning systems will rise significantly in commercial spaces.

Workplaces are turning into offices that create spaces favoring comfort and productivity for employees. Modern HVAC has been combined with smart technologies, which allow personalized climate control systems with better air quality. In addition, operational performance bases can be improved regarding real-time usage and occupancy to save energy.

Shopping malls have turned into multifunctional areas rather than places where only retail activities are conducted. The states-of-the-art HVAC technologies help ensure a common volume of indoor climate even with different activities or heavy usage with regard to the number of customers. These systems can operate using different levels of utilization as well as varying outdoor climates, ensuring that customers and employees are comfortable. Incorporating energy efficiency features would help mall operators further decrease their operating costs and environmental footprint.

The hospitality sector, which includes hotels and resorts, is continuing to personal patronized comfort for its guests. And with the right distribution of different parts of modern HVAC systems, i.e., individualized controls for each guest room and keeping common areas appropriate, it will be able to relate to that. Becoming energy-efficient and adopting sustainable practices in HVAC are indicative of the industry's awareness of environmental responsibility; nevertheless, such forms also aim at a better guest experience.

Important healthcare facilities, such as hospitals and clinics, need to maintain a very precise temperature and quality of air, ensuring the safety and comfort of patients. Advanced HVAC systems are run to keep the environment sterile, control humidity levels, and filter harmful inhalable microbe contamination. These improvements lead to better patient outcomes while complying with strict health care standards.

Recognizing a potential need for modern HVAC systems, commercial spaces such as educational institutions and industrial settings are even commonly being referred to. The same case applies with schools and universities, as reliable temperature control and improved air quality are needed for a comfortable study environment that directly affects students' performance. Advantages with HVAC include ensuring best operating conditions for machinery while increasing the level of safety and productivity of the workforce in industrial facilities. These applications will now see an interfacing between smart technologies like IoT, and transform the full landscape of HVAC.

By Square Footage

Urbanization, technological advancements, and the growing requirement for energy-efficient climate control across buildings of varying sizes will propel the India Commercial HVAC market toward rapid growth. With increasing urbanization coupled with increased infrastructure projects, there will be more demand for sophisticated types of HVAC systems to serve the unique needs in different commercial spaces.

The focus is mainly shifting towards efficient HVAC installation that delivers performance without consuming too much floor space. Smaller commercial establishments, such as boutique shops or compact offices, are slowly adopting this type of HVAC. This trend also sees a growing interest by small businesses to these energy-efficient, cost-effective, and installation-efficient compact units.

Mid-sized commercial spaces, such as larger retail stores and middle-sized corporate offices, are becoming popular with advanced HVAC technologies. This segment has owners and facility managers investing in systems capable of not just maintaining indoor comfort but also of controlling their smart functions with automation features that facilitate better energy management and operate at lower costs in the long run.

As typical examples, large commercial buildings include vast shopping malls, hospitals, and schools, where the same issues and challenges are encountered but from different angles concerning HVAC installation. The massive size of such buildings warrants the installation of robust H&AC systems capable of ensuring uniform climatic conditions in huge areas. In response, there is a growing trend toward the establishment of centralized HVAC solutions with advanced zoning facilities for different sections of a building and allowing precise temperature regulation within the different areas, thereby enhancing the comfort levels for the occupant inhabitants and improving the overall energy efficiency.

The industrial sector, which comprises manufacturing facilities and massive warehouses, is actually another major working sector for the HVAC market to grow. Instead of being general-purpose systems for air conditioning, these specialized ones should be able to exhaust the heat production of machines and satisfy indoor air quality standards that are essential for the lifetime of the equipment as well as the safety of workers. The more modern and advanced industries become, the greater will be their growing need for custom-designed HVAC solutions dedicated to their specific operational requirements.

Another aspect concerning HVAC India's future is government efforts to increase the efficiency of its energy consumption by encouraging sustainable development. Green building standard adoption initiatives and use of eco-friendly refrigerants drive more businesses to replace old systems or incorporate new HVAC systems that comply with such regulations. These regulatory pressures both further environmental aims and spur innovation in the industry, resulting in more efficient and greener products being developed.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4119.2 million |

|

Market Size by 2032 |

$7020.3 Million |

|

Growth Rate from 2025 to 2032 |

8.6% |

|

Base Year |

2024 |

|

Regions Covered |

India |

COMPETITIVE PLAYERS

The growth of the commercial HVAC market in India appears to be at an incredible pace, due to rapid urbanization, infrastructure development, and, mainly, due to the new focus on energy efficiency. Certain key players of the industry have emerged as leaders in this respect- each one leaving their special footprint over the landscape of the industry.

Voltas Limited is the leading Indian manufacturer for HVAC equipment and air conditioners. Part of the Tata group, it was founded in 1954. Its wide range of products and branding with a long-standing legacy have ensured their dominance in the country.

Blue Star Limited was founded in 1943 primarily for manufacturing HVAC solutions and commercial refrigeration. Among some of the air conditioning systems sold by Blue Star are inverter split ACs, fixed-speed split ACs, and window ACs. They also sell air coolers and air purifiers. The company's emphasis on quality and innovation has made it a trusted name in the industry.

Daikin Airconditioning India Private Limited, a subsidiary of Daikin Industries Limited, Japan, was established in 2003 and is a major manufacturer of residential and commercial air-conditioning systems. The focus of Daikin has been towards energy-efficient and sustainable solutions and thus has become the favored choice for commercial enterprises willing to targeting energy consumption and environmental impact.

Established in 1986, Carrier Airconditioning & Refrigeration Limited is one of the leaders in high-technology heating, air-conditioning, and refrigeration solutions in India. They have a complete product portfolio that caters to the needs of several fields of industries, such as IT, health, and hospitality-making them one of the choicest names on the HVAC map of India.

Joint venture between Johnson Controls and Hitachi, Johnson Controls-Hitachi Air Conditioning India Limited manufactures and sells a broad range of residential, commercial, and industrial air conditioning solutions. Innovative and sustainable approach drives them to be the first choice for businesses that need energy-efficient HVAC solutions.

LG Electronics India Private Limited was founded in 1997 and has a diverse range of consumer electronics, including air conditioning systems and air purifiers. Their emphasis on energy efficiency and smart features has been widely accepted by consumers.

Founded in 1995, Samsung India Electronics Private Limited deals in a wide array of electronic appliances, HVAC included. Its modern designs combined with next-generation technology have backed its stronghold in the Indian HVAC market.

The company began operations in 2010, manufacturing HVAC systems along with various electrical and electronic appliances. Energy efficiency and sustainability are its focus areas, in which it excels.

Thermax Limited has always been associated with energy and environment solutions- HVAC, and in the areas concerned with sustainability and innovation, they have become one of the key players in the market.

Godrej & Boyce Manufacturing Co. Limited are leading names for air conditioning solutions available in India, and they are real talk on the market because they'll push the standard quality.

Siemens AG provides advanced HVAC control systems and solutions intended for commercial and industrial needs, focused on saving energy and in many cases even sustainable functioning.

Panasonic India Pvt. Ltd. provides a variety of air conditioning products and solutions for use in residential, commercial, and industrial applications in India. Their focus on technological innovation and energy efficiency makes them the best choice among consumers.

These companies are not only rivaling each other but also working in collaboration to promote the growth of the industry. Their concentration lies on innovation, sustainability, and customer satisfaction, thereby framing and shaping the future of the commercial HVAC market in India. As high energy-efficient and intelligent HVAC systems demand continues to grow, these key players position themselves well to lead the industry toward a more sustainable and technologically advanced future.

India Commercial HVAC Market Key Segments:

By Type

- Air Handling Units (AHU)

- Chillers

- Variable Refrigerant Flow (VRF)

- Ductable Systems

- Others

By Application

- Offices

- Malls

- Hotels

- Hospitals

- Others

By Square Footage

- Less than 5,000 Sq. Ft.

- 5,000 - 20,000 Sq. Ft.

- 20,000 - 50,000 Sq. Ft.

- 50,000 - 200,000 Sq. Ft.

- 200,000 - 500,000 Sq. Ft.

- More than 500,000 Sq. Ft.

Key India Commercial HVAC Industry Players

- Daikin Industries, Ltd.

- Voltas Limited

- Blue Star Limited

- Carrier Corporation

- Hitachi, Ltd.

- LG Electronics

- Samsung Electronics

- Johnson Controls International PLC

- Honeywell International Inc.

- Trane Technologies

- Mitsubishi Electric Corporation

- Thermax Limited

- Godrej & Boyce Manufacturing Co. Limited

- Siemens AG

- Panasonic Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383