MARKET OVERVIEW

The Global High Purity Aluminum for Targets market plays a crucial role in the contemporary metal industry, presenting a distinctive niche with its specialized applications. This unique market segment focuses on delivering aluminum of exceptionally high purity specifically designed for target manufacturing. Unlike conventional aluminum, high purity aluminum for targets requires a meticulous production process to meet the stringent quality standards demanded by industries such as electronics, aerospace, and medical imaging.

In the competitive landscape of the metal market, the high purity aluminum for targets sector distinguishes itself by catering to highly specialized needs. The industry revolves around producing aluminum with purity levels surpassing traditional standards, reaching grades as high as 99.999%. This extraordinary purity is imperative for applications where even trace impurities can compromise performance, making it a critical component in the production of sputtering targets used in thin film deposition processes.

The demand for high purity aluminum in target manufacturing is primarily driven by the escalating requirements of advanced technological applications. The electronics industry, in particular, heavily relies on sputtering targets made from high purity aluminum for the production of thin films in semiconductor devices. This strategic utilization enhances the performance and reliability of electronic components, contributing to the ever-evolving landscape of cutting-edge technologies.

Aerospace is another sector where the Global High Purity Aluminum for Targets market finds its significance. The lightweight yet durable properties of high purity aluminum make it a preferred material for manufacturing aerospace components. From structural elements to specialized parts, the industry benefits from the unique combination of strength and low density offered by high purity aluminum.

The medical field is yet another domain where the importance of this market becomes apparent. High purity aluminum targets play a pivotal role in medical imaging, particularly in X-ray tube production. The ability of high purity aluminum to provide consistent and reliable performance in such critical applications underscores its indispensable nature in the healthcare sector.

Production techniques employed in the Global High Purity Aluminum for Targets market are highly specialized, ensuring the elimination of impurities to meet the stringent quality requirements. Processes such as vacuum distillation, zone refining, and electrolytic refining are employed to achieve the desired level of purity. The precision in manufacturing reflects the commitment of the industry to deliver materials that conform to the exacting standards of its diverse clientele.

The Global High Purity Aluminum for Targets market stands as a testament to the capacity of the metal industry to cater to highly specialized demands. Its role in shaping advancements in electronics, aerospace, and medical imaging is undeniable. As industries continue to push the boundaries of innovation, the market for high purity aluminum targets will likely remain a cornerstone in providing the essential materials that underpin technological progress.

Global High Purity Aluminum for Targets market is estimated to reach $442.8 Million by 2031; growing at a CAGR of 6.5% from 2024 to 2031.

GROWTH FACTORS

The Global High Purity Aluminum for Targets market is poised for significant growth due to a variety of factors. One of the primary drivers is the increasing demand from the electronics industry. As technology continues to advance, the need for high-quality materials in the production of semiconductors, LCDs, and other electronic devices becomes more critical. High purity aluminum, known for its superior conductivity and durability, plays an essential role in ensuring the efficiency and longevity of these products.

Another key factor contributing to market growth is the rise in renewable energy projects. Solar panels, for example, require materials that can withstand harsh environmental conditions while maintaining high performance. High purity aluminum is an ideal choice for these applications due to its resistance to corrosion and high reflectivity. As the world continues to shift towards sustainable energy sources, the demand for such materials is expected to surge, further driving the market.

The medical sector is also a significant contributor to the growth of the high purity aluminum market. With the ongoing advancements in medical technology, there is a growing need for high-quality materials that can be used in the manufacture of medical devices and equipment. High purity aluminum’s biocompatibility and non-reactive nature make it a preferred material in this industry, ensuring patient safety and device reliability.

However, the market does face certain challenges that could impede its growth. The high cost of production is a notable concern. Producing aluminum of such high purity requires sophisticated technology and processes, which can be expensive. This cost factor can limit the adoption of high purity aluminum, particularly in cost-sensitive industries. Additionally, the availability of raw materials is another challenge. The extraction and refinement processes are resource-intensive, and any disruption in the supply chain can have significant impacts on the market.

Despite these challenges, there are numerous opportunities for growth. Technological advancements in production processes are expected to reduce costs over time, making high purity aluminum more accessible. Furthermore, the increasing focus on sustainability and recycling could provide new avenues for market expansion. Recycling aluminum is significantly less energy-intensive than producing it from raw materials, and as industries look for more sustainable practices, the demand for recycled high purity aluminum is likely to grow.

While there are hurdles to overcome, the Global High Purity Aluminum for Targets market has a promising future. The growing demands from the electronics, renewable energy, and medical sectors, coupled with advancements in production technology and a push towards sustainability, are key drivers that will propel the market forward in the coming years.

MARKET SEGMENTATION

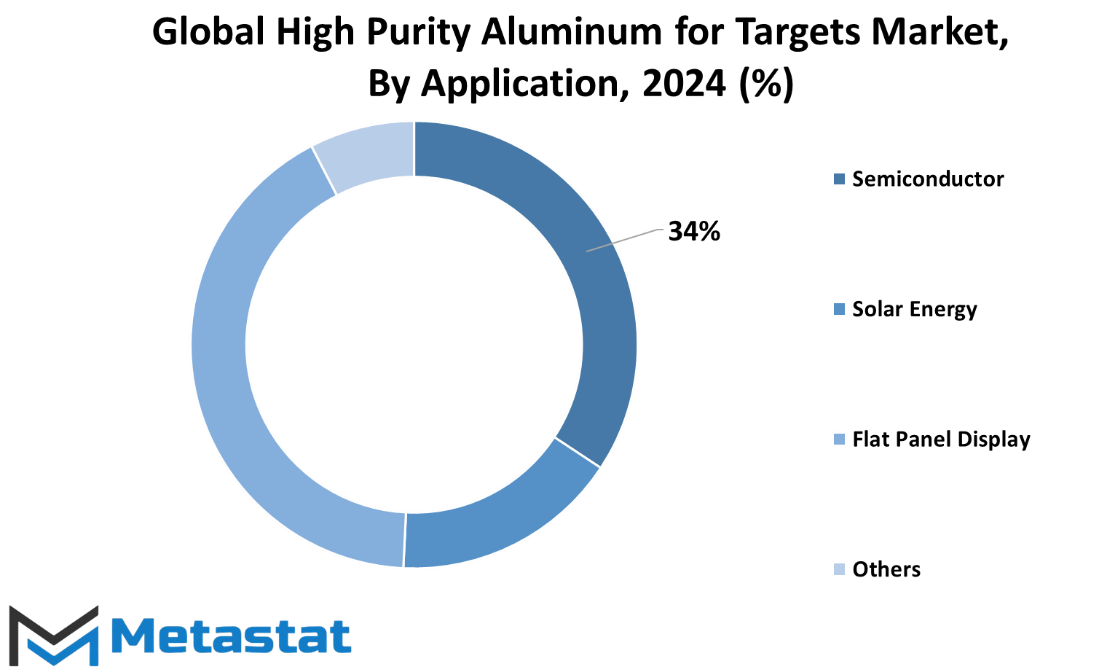

By Application

The Global High Purity Aluminum for Targets market is poised for substantial growth, driven by several key applications, including the semiconductor industry, solar energy, and flat panel displays. As technology continues to advance, the demand for high purity aluminum in these sectors will likely increase.

In the semiconductor industry, high purity aluminum is essential for producing reliable and efficient electronic components. The purity of the material ensures that semiconductors function with minimal defects, which is crucial for the performance of devices such as computers, smartphones, and other electronics. As our reliance on digital technology expands, the need for semiconductors—and by extension, high purity aluminum—will grow. The ongoing advancements in artificial intelligence, the Internet of Things, and 5G technology will further amplify this demand, making high purity aluminum a critical material for future innovations.

Solar energy is another significant application for high purity aluminum. As the world seeks sustainable energy solutions, solar power stands out as a clean and renewable resource. High purity aluminum is used in the production of solar panels, where it enhances the efficiency and longevity of the panels. With global efforts to reduce carbon emissions and combat climate change, the solar energy sector is set to expand rapidly. This growth will drive the demand for high purity aluminum, making it a key component in the transition to greener energy sources.

The flat panel display market also benefits from the use of high purity aluminum. Flat panel displays are found in a wide range of devices, from televisions and monitors to smartphones and tablets. The clarity and performance of these displays are significantly improved with high purity aluminum. As consumer preferences shift towards higher resolution and better display quality, manufacturers will increasingly rely on this material. The future of visual technology, including potential developments in augmented and virtual reality, will further boost the demand for high purity aluminum in display technologies.

Beyond these primary applications, high purity aluminum finds use in various other industries. Its exceptional properties make it valuable for aerospace, automotive, and medical applications, among others. As technology progresses and new uses for high purity aluminum are discovered, its market potential will continue to expand.

The future of the Global High Purity Aluminum for Targets market looks promising. The semiconductor, solar energy, and flat panel display industries will be the main drivers of this growth. As these sectors evolve and innovate, the demand for high purity aluminum will rise, ensuring its importance in a wide array of technological advancements and environmental initiatives.

By Type

The Global High Purity Aluminum for Targets market is poised for significant growth, driven by advancements in technology and increasing demand across various industries. High purity aluminum, classified by its purity levels into 5N, 6N, 7N, and other types, is essential for numerous high-tech applications. The purity level is crucial as it directly influences the performance and efficiency of the end products.

Looking at the 5N type, which is 99.999% pure aluminum, it is commonly used in electronics and aerospace sectors. This level of purity ensures minimal impurities, making it ideal for applications where performance and reliability are paramount. As technology continues to advance, the need for even purer forms of aluminum becomes more apparent. The 6N type, with a purity of 99.9999%, and the 7N type, with a purity of 99.99999%, are gaining traction, especially in sectors such as semiconductor manufacturing and precision optics. These industries require materials with the highest levels of purity to ensure the functionality and longevity of their products.

The drive towards higher purity aluminum is not just about meeting current demands but also about anticipating future needs. With the rapid development of technologies like quantum computing, advanced sensors, and next-generation communication systems, the demand for 6N and 7N aluminum is expected to rise. These technologies require materials that can perform under extreme conditions and with high precision, something that only the highest purity aluminum can provide.

In addition to technological advancements, environmental considerations are also playing a role in shaping the market. High purity aluminum production involves sophisticated processes that can be energy-intensive. However, there is a growing emphasis on developing more sustainable production methods. This includes recycling high purity aluminum and improving the efficiency of purification processes. As the world moves towards more sustainable practices, the high purity aluminum market will likely see innovations that reduce its environmental footprint while meeting the increasing demand.

The market is also witnessing diversification in applications. Beyond traditional uses in electronics and aerospace, high purity aluminum is finding new roles in medical devices, renewable energy systems, and high-performance coatings. This diversification is a testament to the material’s versatility and the ongoing search for better, more efficient materials across industries.

The Global High Purity Aluminum for Targets market is on an upward trajectory, fueled by technological advancements and a growing range of applications. As industries continue to evolve, the demand for high purity aluminum, particularly the 6N and 7N types, will increase. This market is set to play a critical role in supporting future technologies, making it an exciting area to watch in the coming years.

REGIONAL ANALYSIS

The global market for High Purity Aluminum for Targets is segmented based on geography into several key regions: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America is further subdivided into the United States, Canada, and Mexico. Europe includes the UK, Germany, France, Italy, and the rest of Europe. The Asia-Pacific region covers India, China, Japan, South Korea, and the rest of Asia-Pacific. South America consists of Brazil, Argentina, and the rest of South America. The Middle East & Africa is divided into GCC Countries, Egypt, South Africa, and the rest of the Middle East & Africa.

Looking at the future, North America, with the U.S. at its core, will likely continue to play a significant role due to its strong technological base and ongoing research and development in advanced materials. The region's demand for high purity aluminum will be driven by its applications in electronics, aerospace, and defense industries. Canada's growth in this market will be supported by its mining sector and technological advancements, while Mexico's manufacturing boom will contribute to increased demand.

Europe, with its robust industrial base, particularly in Germany and the UK, will see steady growth. The automotive and aerospace sectors will drive the demand for high purity aluminum. France and Italy, known for their advancements in precision engineering and high-tech industries, will also contribute significantly to the market. As environmental regulations become stricter, the shift towards more efficient and sustainable materials will further boost the demand for high purity aluminum in Europe.

Asia-Pacific, led by China and Japan, is poised for substantial growth. China's massive electronics and manufacturing industries will continue to demand large quantities of high purity aluminum. Japan, with its cutting-edge technology and focus on innovation, will drive market expansion. India and South Korea, with their growing industrial sectors and increasing investments in technology, will also contribute to the rising demand. The region's overall economic growth and industrialization will ensure its position as a major player in the market.

South America's market growth will be driven by Brazil and Argentina, where industrial and technological advancements are gaining momentum. Brazil's mining industry and Argentina's growing manufacturing sector will be key contributors. The rest of South America, with its gradual industrial development, will add to the overall demand.

In the Middle East & Africa, the GCC countries, with their economic diversification efforts and focus on high-tech industries, will lead the demand for high purity aluminum. Egypt and South Africa, with their developing industrial bases, will also see increased demand. The region's growth will be supported by investments in technology and infrastructure development, aiming to reduce reliance on traditional industries and embrace advanced materials.

The global High Purity Aluminum for Targets market will see varied growth across different regions, driven by technological advancements, industrial growth, and strategic investments in high-tech industries. Each region's unique economic landscape and industrial capabilities will shape its future demand for high purity aluminum.

COMPETITIVE PLAYERS

The global market for High Purity Aluminum for Targets is characterized by a range of competitive players, each contributing significantly to its growth and development. This industry, vital for various high-tech applications, is influenced by several key players, including Xinjiang Zhonghe Co., Ltd., Norsk Hydro ASA, CHALCO Shandong Co., Ltd., United Company RUSAL Plc, Sumitomo Chemical Co., Ltd., C-KOE Metals, Columbia Specialty Metals, LLC, KM Aluminum Co., Ltd., Nippon Light Metal Co., Ltd., Sasol Limited, and Baikowski SAS. These companies drive innovation and expansion within the sector, shaping its future trajectory.

Xinjiang Zhonghe Co., Ltd. and Norsk Hydro ASA are notable for their extensive production capabilities and technological advancements. Their commitment to research and development ensures a steady supply of high-quality aluminum, meeting the increasing demands of industries such as electronics, aerospace, and automotive. CHALCO Shandong Co., Ltd. and United Company RUSAL Plc also play crucial roles by leveraging their vast resources and expertise to maintain a competitive edge. Their global reach allows them to cater to diverse markets, fostering international cooperation and growth.

Sumitomo Chemical Co., Ltd. and C-KOE Metals have distinguished themselves through their specialized products and focus on sustainability. By prioritizing eco-friendly practices and innovative solutions, they address environmental concerns while enhancing product performance. Columbia Specialty Metals, LLC, and KM Aluminum Co., Ltd. contribute to the market with their focus on niche applications and customized solutions, catering to specific client needs and expanding the industry's scope.

Nippon Light Metal Co., Ltd., Sasol Limited, and Baikowski SAS are key players recognized for their technical expertise and high standards of production. Their dedication to quality control and continuous improvement ensures that the aluminum produced meets the stringent requirements of advanced technological applications. These companies' efforts in exploring new markets and applications will likely drive future growth and diversification in the industry.

As we look towards the future, the competitive landscape of the High Purity Aluminum for Targets market will be shaped by these companies' ability to innovate and adapt. The increasing demand for high-performance materials in various cutting-edge technologies will push these players to develop more efficient and sustainable production methods. The collaboration among these industry leaders, along with their strategic investments in research and development, will undoubtedly propel the market forward, opening new opportunities and applications for high purity aluminum. This dynamic interplay of competition and innovation will ensure the industry's continued evolution, meeting the ever-growing demands of modern technology.

High Purity Aluminum for Targets Market Key Segments:

By Application

- Semiconductor

- Solar Energy

- Flat Panel Display

- Others

By Type

- 5N

- 6N

- 7N

- Others

Key Global High Purity Aluminum for Targets Industry Players

- Xinjiang Zhonghe Co., Ltd.

- Norsk Hydro ASA

- CHALCO Shandong Co., Ltd.

- United Company RUSAL Plc

- Sumitomo Chemical Co., Ltd.

- C-KOE Metals

- Columbia Specialty Metals, LLC

- KM Aluminum Co., Ltd.

- Nippon Light Metal Co.,Ltd

- Sasol Limited

- Baikowski SAS

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252