MARKET OVERVIEW

The global hidden camera detector market constitutes a niche within the broader security and surveillance technology industry, with a particular interest in manufacturing, sales, and applications of highly specialized equipment for detecting concealed recording devices. These tools are designed to address growing concerns regarding illegal monitoring, violations of individual privacy, and clandestine monitoring of public and private spaces. As individuals, institutions, and organizations continue to develop interests in having control over their environments, there will be continued demand for such detectors to be utilized in various settings.

This is a market that is directed at products with the express ability to detect the presence of small, concealed cameras, generally disguised. These products operate by detecting several kinds of signals, light reflections from lenses, or electromagnetic emission traditionally emitted by hidden cameras. While they appear to be of limited value, their utility will become more forceful as unobtrusive surveillance devices miniaturize, become cheaper, and easier to install. Therefore, the global hidden camera detector market is informed by both technical innovation in hidden camera technology and growing cognizance of potential invasion of privacy.

Commercial sites such as hotels, locker rooms, restrooms, and rental properties will increasingly employ hidden camera detectors to provide security and foster client confidence. Similarly, tourists traveling for vacation or on business will keep searching for transportable alternatives that allow them to feel secure in unfamiliar lodging. As the awareness of hidden recording devices grows worldwide, the demand for such will most probably receive greater attention from households, government departments, and the private sector as well.

Hidden camera detectors will be offered in numerous forms, including hand-held devices, mobile phone-compatible devices, and wearable tech. Their level of sophistication and accuracy will vary based on customer needs ranging from basic models to detect reflected light from lens-based cameras to advanced detectors to identify radio frequencies and network streams. The market will further advance with innovation in the areas of portability, cost, and effectiveness of these devices, for a wide swath of customers.

While regulations on privacy and enforcement differ by country, unauthorized surveillance fear is being turned into a universal issue. This will fuel the development of anti-spying products. The global hidden camera detector market will be set by local awareness campaigns, media, and technology expertise, which will regulate the adoption and reliance on such products in different groups of people. However, despite its general applicability, the market's acceptance will remain diverse according to cultural norms, standards of law enforcement, and consumer expectations in each region.

The future of the global hidden camera detector market will likely coincide with broader privacy technology innovation. Customers will increasingly expect complete personal security sets that encompass hidden camera detection as just one of numerous integrated elements. As technology becomes more integral to daily life, people will increasingly insist on knowing they are not watched or recorded without consent.

This is not a market of devices or gadgetry; it crosses social discomfort, cyber ethics, and human need for secure, personal spaces. The motivations for clandestine surveillance, and the reaction with proper countermeasures, will dictate the course of this segment in coming years.

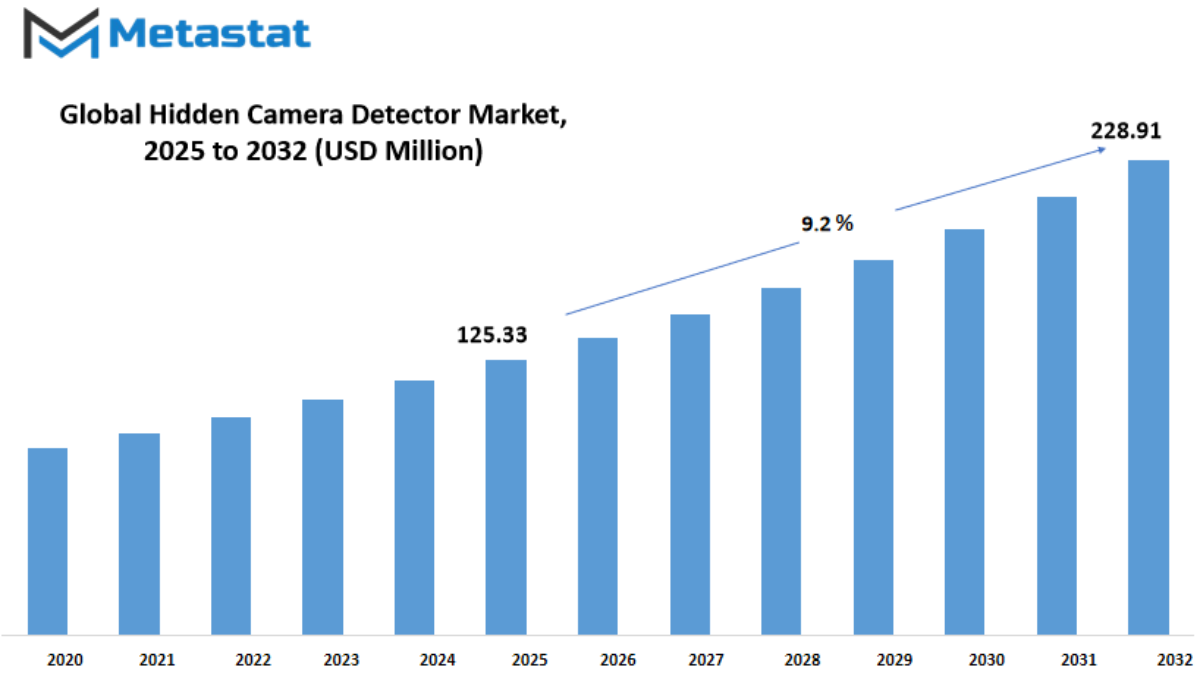

Global hidden camera detector market is estimated to reach $228.91 Million by 2032; growing at a CAGR of 9.2% from 2025 to 2032.

GROWTH FACTORS

As concerns around personal privacy continue to grow, there is a noticeable shift in the way people view their safety in both public and private settings. One of the outcomes of this shift is the rising interest in devices that can detect hidden surveillance tools. This is where the global hidden camera detector market finds its momentum. The demand for these devices is increasing steadily as more people, from individual consumers to large enterprises, seek ways to protect their privacy. Whether it’s hotel rooms, rental apartments, changing rooms, or workplaces, the fear of being watched without consent has led many to look for practical ways to counter such invasions. These detectors help identify and locate covert surveillance devices, offering a sense of security that’s becoming more important in modern life.

Enterprises are also turning to these tools to safeguard business meetings and confidential data. With technological advancements making hidden cameras smaller and harder to detect, both individuals and companies are starting to view these detectors not as a luxury, but as a necessity. The tools have evolved from basic gadgets into more sophisticated devices that can be used with little training. Many are now portable and even come with AI capabilities, improving their performance by identifying suspicious devices more accurately.

Despite this growing need, there are a few challenges that the global hidden camera detector market faces. One of the main issues is the limited ability of current detectors to identify advanced hidden cameras that do not emit signals. These cameras are harder to locate, which reduces the reliability of some existing solutions. Additionally, there is a general lack of awareness among consumers about these devices. Many people are either unaware that such tools exist or are unsure of how to use them effectively. Adding to the problem is the absence of strong, consistent rules across countries, which makes it harder for manufacturers to set standards or expand globally.

Looking ahead, the market is expected to benefit from the increasing development of AI-enabled, compact devices that are easy to carry and use. These will appeal to professionals who travel frequently, as well as everyday users who want added peace of mind. As awareness grows and technology continues to advance, the market has the potential to become a common part of personal security, offering people more control over their privacy in an increasingly connected world.

MARKET SEGMENTATION

By Type

The global hidden camera detector market is expected to grow steadily in the coming years due to increasing concerns around privacy and surveillance. As technology keeps advancing, so does the ability to record or stream video without being noticed. This has led to a rising demand for tools that help people feel safer in private and public spaces. With more people becoming aware of hidden cameras in hotel rooms, rental homes, offices, and changing areas, the need for reliable detection devices will continue to grow.

The market is divided into several types of detectors that serve different purposes. Handheld detectors are the most common type and are designed to be easy to use. They are small, usually battery-operated, and can be carried around to scan rooms or areas for hidden devices. These tools are useful for individuals traveling or staying in unfamiliar locations. Wearable detectors are becoming more popular as well. These devices can be clipped onto clothing or worn as accessories, allowing users to detect hidden cameras while on the move. This type offers convenience without drawing attention.

Portable detection systems are slightly more advanced than handheld or wearable types. They often combine several features such as camera lens detection, radio frequency scanning, and thermal sensing. Though they are still easy to carry, these systems are typically used by security professionals or organizations conducting thorough sweeps. Fixed installation detectors, on the other hand, are placed in specific areas to continuously scan for hidden surveillance devices. These are often used in sensitive locations like government buildings, conference rooms, or private offices where long-term monitoring is required.

Smartphone applications have entered the market as a cost-effective and accessible option for basic detection. While not as powerful as physical devices, they offer features such as light reflection detection and network scanning to help identify unauthorized devices. These apps may not replace professional tools, but they provide an added layer of personal security.

Looking ahead, the global hidden camera detector market will likely expand with the growth of smart environments and connected devices. As more people seek control over their surroundings, especially in shared or temporary spaces, manufacturers will need to focus on improving accuracy, reducing false alarms, and making detectors easier to use. With privacy concerns showing no sign of slowing down, the demand for hidden camera detectors will keep pushing the industry forward into more advanced and user-friendly solutions.

By Technology

The global hidden camera detector market is growing steadily as concerns about privacy continue to rise across personal and professional spaces. As technology gets more advanced, so does the need for tools that can keep up with the risks it brings. People are becoming more aware of hidden surveillance, which is pushing demand for reliable and easy-to-use detection tools. The global hidden camera detector market is expected to continue expanding as these tools become more accessible to the average person, not just experts or law enforcement.

One of the main reasons behind this growth is the wide variety of detection technologies now available. These tools are becoming more specialized and effective, offering users different ways to find hidden cameras. Analog Detection methods, for instance, use basic signal detection to identify unusual transmissions. While this method is more traditional, it still proves useful in environments where simple monitoring is enough. On the other hand, Digital Detection offers a more precise way of scanning, which is useful in places where a higher level of accuracy is needed.

Wireless Detection is another important segment. With more hidden cameras relying on Wi-Fi or Bluetooth connections, tools that can pick up these signals are essential. These devices search for unauthorized connections in an area, making them effective in both homes and public places. RF Detection works in a similar way but focuses more on radio frequencies. It scans for signals that hidden devices send out, helping users find them without needing to know exactly where they are. Meanwhile, Infrared Detection is often used in darker spaces. It spots the heat given off by electronic devices, making it easier to find cameras that are hidden in objects or behind walls.

As technology becomes a bigger part of everyday life, the global hidden camera detector market will likely move toward smarter solutions. Future products may combine several types of detection in one device, using machine learning or smart scanning to improve accuracy. These tools might be used not just by security experts but also by regular users, including travelers, business owners, and parents. The market’s future will depend on how well these tools balance effectiveness with ease of use.

Privacy will remain a strong concern, and with that, the need for better detection tools will keep growing. As more people look for ways to protect their personal spaces, the global hidden camera detector market will continue to play an important role in offering that peace of mind.

By Application

The global hidden camera detector market is expected to grow steadily over the coming years as privacy becomes an increasing concern for people in both personal and professional environments. With advancements in technology making hidden cameras smaller and harder to detect, the need for reliable detection tools will rise across various areas. People today are more aware of potential threats to their privacy, which is pushing demand for tools that help identify and remove hidden recording devices from sensitive spaces.

This market is divided by application, and each area shows signs of strong future growth. In security surveillance, businesses and homeowners will likely continue to invest in these tools to ensure their environments are not being watched without consent. Offices, hotels, and rental homes are becoming common places where such tools are needed, especially with the growing popularity of short-term stays and shared spaces. Hidden camera detectors offer peace of mind in these settings, which will lead more users to depend on them.

Corporate espionage prevention is another important application. As companies handle more digital data and confidential meetings, ensuring that physical spaces are secure from hidden recording devices is a priority. The global hidden camera detector market will grow in this segment as companies adopt new policies and invest in employee training on how to check for surveillance risks. With the rise in remote and hybrid work, private meeting areas and boardrooms will become regular places for using these detection devices.

For personal privacy protection, individuals are starting to take control over their own safety. People traveling or staying in unfamiliar locations will carry portable detectors to avoid being secretly recorded. This growing awareness, especially among younger users and frequent travelers, supports further growth. As tools become easier to use and more affordable, they will be used by more people on a regular basis.

Another growing use is in event and party monitoring. Organizers of private gatherings, including weddings, conferences, or VIP functions, will want to ensure privacy for their guests. This means using detection tools before and during events to create a safe and private setting. The global hidden camera detector market will see expansion here, especially in professional event planning circles.

In investigation and law enforcement, these tools help officers and investigators protect evidence, avoid leaks, and maintain control over sensitive situations. As investigations grow more complex, the need for dependable detection tools will increase. This area of the market will likely see steady adoption by agencies that value accuracy and speed.

By End-User

As technology continues to move forward, concerns about privacy and surveillance have grown more widespread. One area that has gained attention is the global hidden camera detector market. With the increasing use of miniature recording devices in public and private spaces, the need for tools that help individuals and organizations detect hidden cameras is becoming more important. These detectors help users locate concealed recording devices, providing a layer of safety and awareness in both personal and professional environments.

The global hidden camera detector market is being shaped by the rising need for privacy in a digital age. These tools are no longer used only by security professionals. Today, people from various walks of life are looking for reliable ways to ensure that they are not being watched without consent. This change is pushing manufacturers to create devices that are smaller, more accurate, and easier to use. As the tools improve, their use is expected to spread even further, helping people feel more secure wherever they are.

Looking into how the market is divided by end-user gives a clear picture of its growing importance. In residential areas, homeowners are using hidden camera detectors to protect their personal space. Whether it's checking rented apartments or ensuring privacy in bedrooms, the use of such tools at home is rising. In the commercial sector, businesses are taking steps to protect their offices, meeting rooms, and staff rest areas. The presence of hidden cameras in these settings can lead to legal troubles, so early detection is vital.

Government use is also increasing. Agencies are using these devices during sensitive meetings and inspections to avoid data leaks or security threats. Industrial zones, where trade secrets and innovations are stored, are turning to this technology as well. It's about staying one step ahead to protect valuable assets. Educational institutions, such as schools and universities, are adopting hidden camera detectors too. They are being used to safeguard student areas and ensure that staff and students alike are not subject to unauthorized monitoring.

In the future, the global hidden camera detector market will likely expand further. As awareness grows and more people understand the risks of hidden surveillance, demand will continue to rise. New features may include smarter detection powered by AI or wireless monitoring options, making these devices even more useful. This steady growth reflects a global push to take privacy seriously and use tools that help maintain personal and public trust.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$125.33 million |

|

Market Size by 2032 |

$228.91 Million |

|

Growth Rate from 2025 to 2032 |

9.2% |

|

Base Year |

2024 |

|

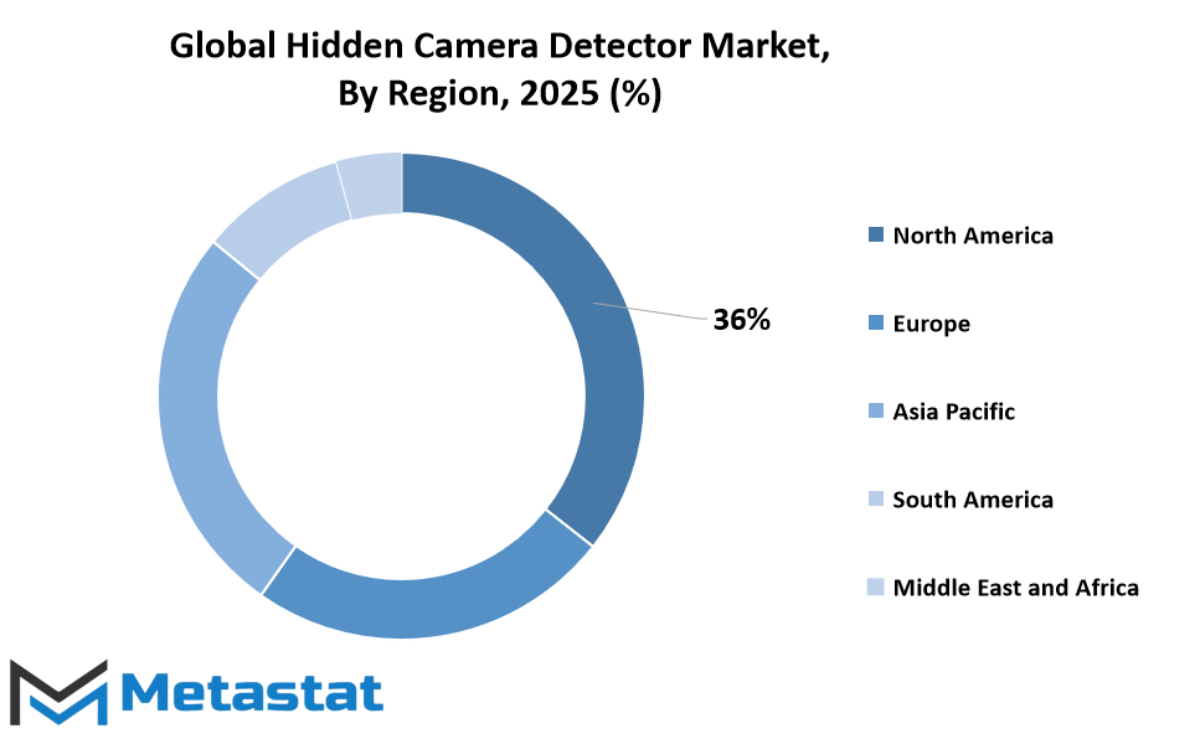

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

As technology continues to move forward, concerns about privacy and surveillance have grown more widespread. One area that has gained attention is the global hidden camera detector market. With the increasing use of miniature recording devices in public and private spaces, the need for tools that help individuals and organizations detect hidden cameras is becoming more important. These detectors help users locate concealed recording devices, providing a layer of safety and awareness in both personal and professional environments.

The global hidden camera detector market is being shaped by the rising need for privacy in a digital age. These tools are no longer used only by security professionals. Today, people from various walks of life are looking for reliable ways to ensure that they are not being watched without consent. This change is pushing manufacturers to create devices that are smaller, more accurate, and easier to use. As the tools improve, their use is expected to spread even further, helping people feel more secure wherever they are.

Looking into how the market is divided by end-user gives a clear picture of its growing importance. In residential areas, homeowners are using hidden camera detectors to protect their personal space. Whether it's checking rented apartments or ensuring privacy in bedrooms, the use of such tools at home is rising. In the commercial sector, businesses are taking steps to protect their offices, meeting rooms, and staff rest areas. The presence of hidden cameras in these settings can lead to legal troubles, so early detection is vital.

Government use is also increasing. Agencies are using these devices during sensitive meetings and inspections to avoid data leaks or security threats. Industrial zones, where trade secrets and innovations are stored, are turning to this technology as well. It's about staying one step ahead to protect valuable assets. Educational institutions, such as schools and universities, are adopting hidden camera detectors too. They are being used to safeguard student areas and ensure that staff and students alike are not subject to unauthorized monitoring.

In the future, the global hidden camera detector market will likely expand further. As awareness grows and more people understand the risks of hidden surveillance, demand will continue to rise. New features may include smarter detection powered by AI or wireless monitoring options, making these devices even more useful. This steady growth reflects a global push to take privacy seriously and use tools that help maintain personal and public trust.

COMPETITIVE PLAYERS

The global hidden camera detector market is expected to grow steadily as people and businesses become more concerned about their privacy and security. As technology continues to develop, the use of hidden surveillance devices is also rising, making it more important than ever to detect these tools before they are misused. Hidden camera detectors are devices that help locate tiny and often disguised cameras that could be used for unauthorized recording. These detectors work by identifying the signals or lenses of hidden cameras, offering a layer of protection for individuals in private settings like hotel rooms, changing areas, or confidential meeting rooms.

The demand for these detectors will likely continue to rise, especially in regions where personal and corporate privacy is under threat. With the expansion of wireless networks and compact recording tools, hidden surveillance equipment is becoming easier to hide. This has pushed many industries, such as hospitality, government, and private security, to look for reliable detection solutions. It’s not only travelers or business professionals who are investing in these tools, but also landlords, schools, and everyday consumers who want to feel safe in their surroundings.

Key players in the global hidden camera detector market are working to make their products more user-friendly and advanced. Companies such as JMDHKK, Selcom Security, Noyafa, KJB Security, and Zetronix are improving their technology to offer better detection accuracy. Some have begun to include features like mobile app connectivity, GPS tracking, and alert systems. Others, like LawMate and SpyCentre, are focusing on creating compact devices that are easy to carry without drawing attention. Startups such as Asleesha and The Signal Jammer are also entering the space, bringing fresh ideas and competitive pricing. Facamword and CIU are also gaining attention with their efforts to produce budget-friendly yet effective options.

As privacy issues continue to gain public attention, the focus will shift toward affordable and efficient products that can be used by anyone, regardless of their technical skills. More countries may introduce regulations that support the use of hidden camera detectors in sensitive locations. This could open up new business opportunities while also encouraging innovation. Companies that can adapt to changing privacy needs and invest in better detection features will likely stay ahead of the competition. Overall, the global hidden camera detector market will keep evolving, with competitive players pushing the boundaries of what these devices can do to meet growing privacy concerns.

Hidden Camera Detector Market Key Segments:

By Type

- Handheld Detectors

- Wearable Detectors

- Portable Detection Systems

- Fixed Installation Detectors

- Smartphone Applications

By Technology

- Analog Detection

- Digital Detection

- Wireless Detection

- RF Detection

- Infrared Detection

By Application

- Security Surveillance

- Corporate Espionage Prevention

- Personal Privacy Protection

- Event and Party Monitoring

- Investigation and Law Enforcement

By End-User

- Residential

- Commercial

- Govement

- Industrial

- Institutional (Schools, Universities)

Key Global Hidden Camera Detector Industry Players

- JMDHKK

- Selcom Security

- Noyafa

- KJB Security

- Zetronix

- LawMate

- SpyCentre

- Asleesha

- The Signal Jammer

- Facamword

- CIU

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252