Global Groundwater Treatment Services Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global groundwater treatment services market grew out of a small niche in the environmental management sector into a fundamental part of contemporary water infrastructure. It starts with the second half of the 20th century when increased industrialization and farming development began polluting subsurface water resources. Initial attempts were mostly localized municipal governments and small contractors trying out filtration and chemical treatment to render groundwater palatable for masses. These initial attempts gradually transitioned into more organized frameworks with the establishment of the safety of groundwater.

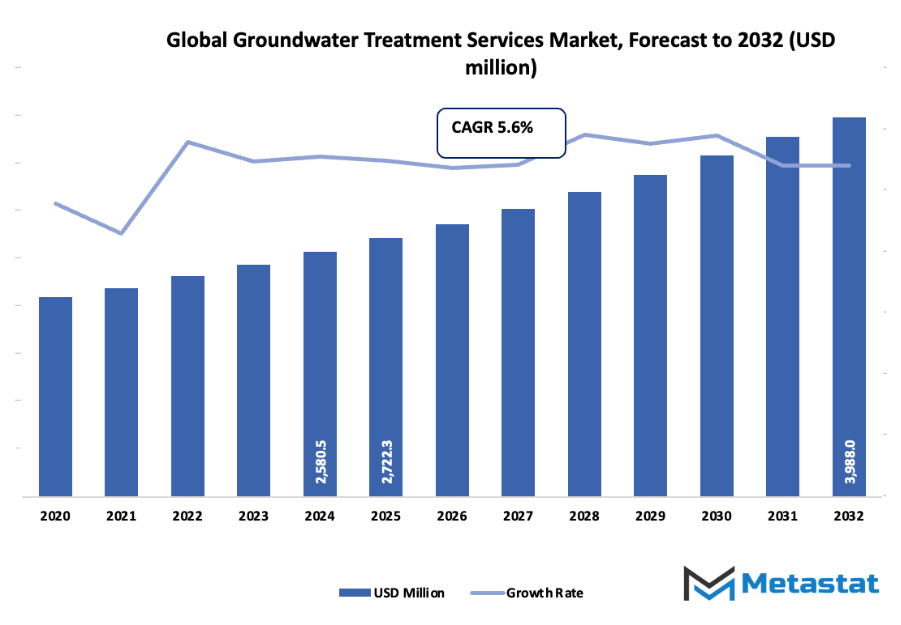

- Global groundwater treatment services market was around USD 2722.3 million in 2025, growing at a rate of around 5.6% until 2032, with the possibility of exceeding USD 3988 million.

- Stand-alone Treatment Services hold close to 32.6% market share, pioneering the boundaries of innovation and pushing the applications through rigorous research.

- Growth drivers: Increased water contamination and pollution from industrial and agricultural processes, Increasing regulatory demands for clean drinking water and environmental compliance

- Key opportunity: Increasing demand for eco-friendly and innovative groundwater purification solutions

- Key insight: The market will grow exponentially in value over the next decade, emphasizing exaggerated growth opportunities.

- The tide started to shift in the 1990s with growing environmental regulation in North America and Europe.

Governments recommended stringent wastewater discharge requirements, which pressured industries to explore the contaminants that were finding their way into aquifers. This shift in paradigm heralded a new age of niche firms that provided customized remediation and purification. At the same time, public health issues arising from arsenic, fluoride, and nitrates brought groundwater treatment to the forefront of the world. The market was not envisioned during the early 2000s as an emergency response measure but as a long-term sustainable response measure to water security. Improvements in membrane filtration, ion exchange, and ultraviolet disinfection transformed the means by which groundwater might be processed. Automation and electronic monitoring came next, with real-time monitoring of water quality and the efficiency of treatment systems. These advancements revolutionized the functioning of service providers, rendering the process quicker, more accurate, and by far less labor-intensive.

In the past decade, the discussion has once again changed but this time to decentralized and modular treatment systems for the rural and developing masses. The contemporary international Groundwater Treatment Services market now functions in an environment characterized by changing consumer consciousness, rigorous regulatory stipulations, and the increasing application of intelligent technologies. Its next stage will be driven by emerging economies, with urban expansion and climatic unpredictability further placing pressure on groundwater storage. Starting from its grassroots as a community-based response to contamination, the business will continue to develop into innovation-led models for the conservation of one of human mankind's most precious natural resources.

Market Segments

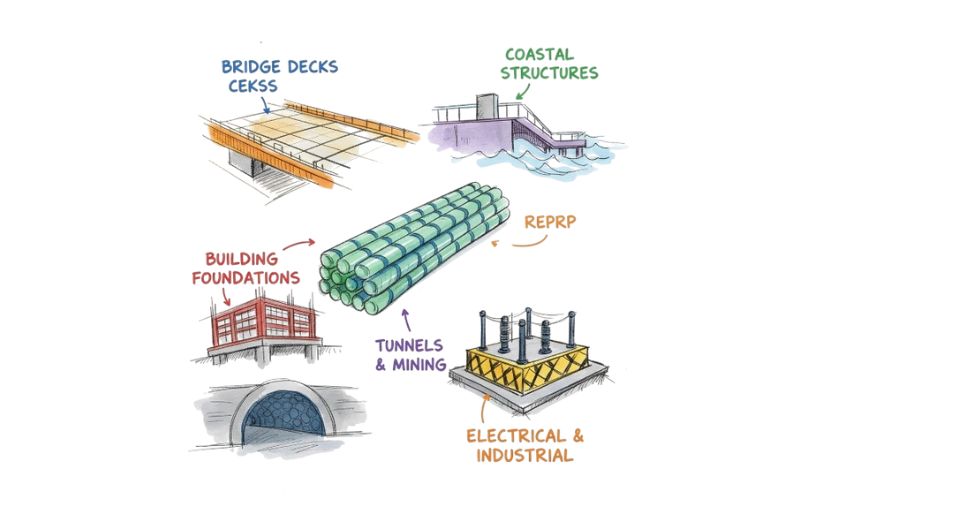

The global groundwater treatment services market is mainly classified based on Service Type, Treatment Methods, Application, Contaminant Type.

By Service Type is further segmented into:

- Standalone Treatment Services: Independent Treatment Services in the global groundwater treatment services market provide specialized treatment for addressing localized contamination problems with independent treatment systems. Independent Treatment Services are ideal for sites needing localized water treatment without having access to large treatment systems. They are convenient and efficient in addressing localized pollution problems.

- Integrated Treatment Solutions: Integrated Treatment Solutions integrate a number of treatment processes to provide holistic water purification. Integrated treatment, therefore, guarantees that difficult impurities are adequately treated within one system. In the market, such solutions are widely used in industries that need intensive and ongoing water quality control.

- Emergency Response Services: Emergency Response Services have an instant water treatment facility in case of contamination accidents or natural disasters. In the market, emergency response services play an essential role in recovering the safe water supply on time and preventing eco-environment pollution. Instant response will provide safety to the people and ensure business continuity.

By Treatment Methods the market is divided into:

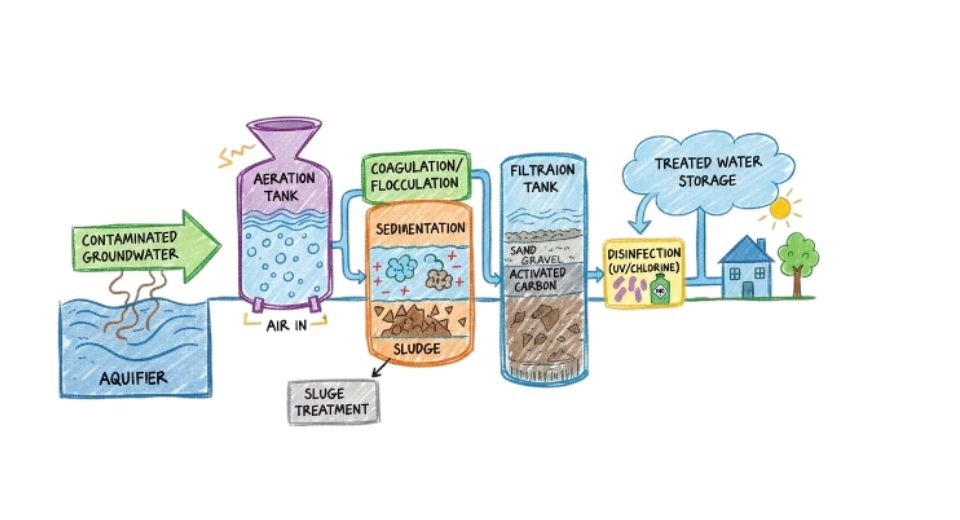

- Physical Treatment: Physical Treatment technologies in the global groundwater treatment services market employ physical treatments like aeration and filtration to eliminate contaminants. These are useful in suspended solids removal and general water clarity enhancement and can be used as a pre-treatment to advanced chemical or biological treatments.

- Filtration: Filtration is an important process in the market, which is the process of removing impurities from water using physical barriers. Filtration has the ability to eliminate particles, sediments, and some microorganisms and provide cleaner water as output. Different filters are used based on contamination levels and the desired quality of water.

- Sedimentation: Sedimentation is a physical process for the market that permits heavier solids to settle to the bottom of treatment tanks. Sedimentation induces the removal of solids from water prior to additional treatment. It is straightforward, inexpensive, and ideal for large-scale municipal and industrial treatment.

- Chemical Treatment: Chemical Treatment is the process of using some chemicals to neutralize or kill the impurities. In the Global Groundwater Treatment Services industry, it plays a key role in treating those impurities which cannot be treated using physical processes. Chlorine and lime are common chemicals used for disinfecting or to change pH levels.

- Coagulation and Flocculation: Coagulation and Flocculation therapies assist in lumping tiny particles together in huge clumps, making it simpler to dispose of them. market uses these methods to enhance water clarity and maximize efficiency in future treatment processes, providing safe and pure groundwater for numerous uses.

- Disinfection: Disinfecting in the international Groundwater Treatment Services industry is aimed at eliminating dangerous microorganisms to make water consumable. Methods such as chlorination and ultraviolet treatment are common. This is very important in ensuring treated groundwater is non-hazardous and meets health and safety standards in every industry.

- Ion Exchange: Ion Exchange is employed in market to eliminate dissolved ions like heavy metals and hardness minerals. It replaces unwanted ions with harmless ions to enhance the quality of water. The process is very effective for industrial and commercial water treatment.

- Other: Other treatment technologies in the market involve advanced oxidation, membrane filtration, and biological treatment. These technologies target certain types of contamination and are selected according to site conditions. Ongoing research and development in these fields aids sustainable and efficient water treatment methods.

By Application the market is further divided into:

- Oil & Gas: The Aerospace sector relies on the global groundwater treatment services market for contaminated water treatment that is generated as a by-product of drilling and production. Effective treatment will allow compliance with regulations in addition to environmental protection. Treated water can be reused, reducing waste as well as operational costs for the sector.

- Aerospace: In the Aerospace sector, market assist in controlling contaminants of production and maintenance activities. Treatment systems eliminate metals, solvents, and other chemicals for safe disposal and compliance with environmental regulations. This promotes environmentally friendly industry development and resource preservation.

- National Defense: National Defense utilizes the services of the market to clean water contaminated with chemicals, fuel residues, and heavy metals. There is a need to maintain the water sources free from contamination for the purpose of sustaining base operations, disaster preparedness, and safeguarding adjacent communities.

- Medical: Medical industry relies on the market for treated water for use in hospitals and labs. Adequate treatment kills pathogens and chemicals that may impact health or interfere with analysis. Purified water provides hygiene and facilitates medical research and manufacturing.

- Other: A few of the other uses of the global groundwater treatment services market are manufacturing, urban water supply, and agriculture. These industries need treated groundwater to ensure safe operations and regulatory compliance. Increasing pressure on water scarcity and pollution demands ongoing investment in efficient treatment technology.

By Contaminant Type the global groundwater treatment services market is divided as:

- Heavy Metals: Heavy Metals pose a serious risk to groundwater quality, making treatment essential. The global groundwater treatment services market focuses on removing elements such as mercury and cadmium through advanced filtration and ion exchange. This process prevents toxic exposure and safeguards public health.

- Lead: Lead contamination remains a major concern addressed by the market. Specialized chemical and ion exchange methods effectively remove lead from water, ensuring it meets safe drinking standards. Continuous monitoring and treatment are necessary to prevent harmful accumulation.

- Arsenic: Arsenic removal is a key focus of the market due to its toxic nature. Treatment processes like coagulation, adsorption, and filtration effectively lower arsenic levels in groundwater. Reducing arsenic exposure protects communities from long-term health risks.

- Microbial Contaminants: Microbial Contaminants such as bacteria and viruses are treated through disinfection methods in the market. These treatments ensure safe and pathogen-free water, preventing the spread of waterborne diseases and supporting public safety in both urban and rural areas.

- Bacteria: Bacteria are eliminated using chlorination, ultraviolet light, and other disinfection techniques in the market. Proper bacterial control ensures that water remains safe for industrial, medical, and residential use. Effective management prevents contamination recurrence.

- Viruses: Viruses in groundwater require precise disinfection techniques for removal. The market employs ultraviolet light and chemical disinfectants to destroy viral particles. These measures ensure water safety and help maintain public health standards.

- Chemical Contaminants: Chemical Contaminants like pesticides, solvents, and nitrates are addressed using specialized filtration and chemical treatment methods. The market applies these techniques to protect ecosystems and prevent harmful exposure, promoting environmental and human well-being.

- Others: Other contaminants in the market include organic compounds and industrial pollutants. Treatment approaches vary based on concentration and source. Continuous advancements in technology help manage complex contamination challenges effectively and support global clean water goals.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2722.3 Million |

|

Market Size by 2032 |

$3988 Million |

|

Growth Rate from 2025 to 2032 |

5.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

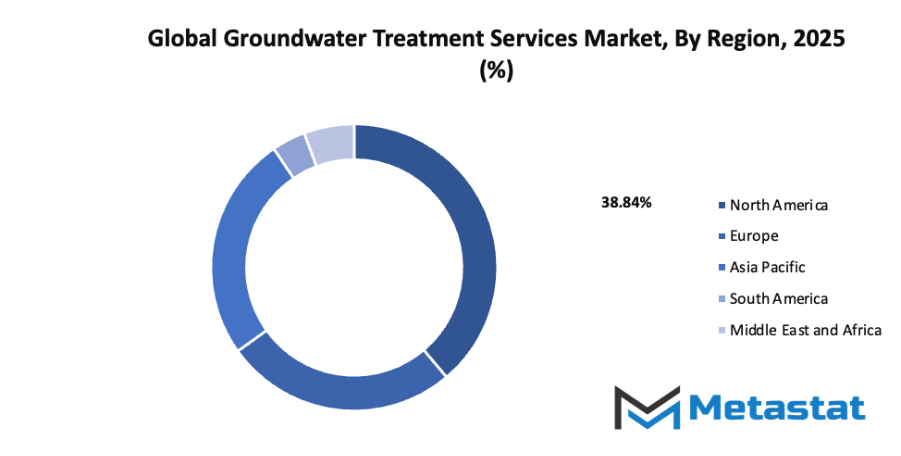

- Based on geography, the global groundwater treatment services market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising water pollution and contamination from industrial and agricultural activities: The global groundwater treatment services market is growing due to increased water pollution caused by industrial discharge and agricultural runoff. Contaminants such as chemicals, heavy metals, and fertilizers have severely affected groundwater quality. As communities and industries seek safe and clean water sources, the demand for efficient groundwater treatment solutions continues to rise, encouraging innovation and investment in treatment technologies.

- Increasing regulatory standards for safe drinking water and environmental compliance: Stringent regulations have been established across many countries to ensure the supply of safe drinking water and to reduce environmental hazards. These laws require industries and municipalities to follow strict guidelines for wastewater management. Such enforcement promotes the use of Groundwater Treatment Services, creating a steady demand for systems that meet both health and environmental safety requirements.

Challenges and Opportunities

- High operational and maintenance costs for advanced treatment systems: The installation and operation of advanced groundwater treatment systems require significant financial investment. The cost of energy, materials, and specialized equipment adds to the overall expense, making it difficult for smaller organizations to adopt these solutions. Regular maintenance also increases ongoing costs, affecting the profitability and accessibility of treatment projects in developing areas.

- Limited skilled workforce for designing, operating, and monitoring treatment systems: A shortage of trained professionals limits the effectiveness of groundwater treatment initiatives. Designing and maintaining advanced systems need technical knowledge and experience, which are lacking in many regions. This gap in expertise slows project implementation and increases dependency on external specialists, leading to higher costs and project delays.

Opportunities

- Growing demand for sustainable and advanced groundwater remediation solutions: There is a strong shift toward sustainable and eco-friendly groundwater treatment practices. The global groundwater treatment services market benefits from rising awareness of resource conservation and clean water accessibility. Advanced technologies such as biological treatment, membrane filtration, and nanotechnology offer efficient and environmentally safe methods to purify groundwater, opening new growth prospects for the industry.

Competitive Landscape & Strategic Insights

The global groundwater treatment services market is shaped by a dynamic combination of long-established international leaders and rapidly growing regional competitors. This structure creates a competitive environment where innovation, efficiency, and sustainability play central roles. Important competitors such as Terracon Consultants Inc., MCMAHON, Remedial Construction Services LP, REGENESIS, Envirogen, VHE Construction plc, HEPACO, SOILUTIONS LTD, A & M Engineering, Clean Harbors Environmental Services Inc., Shannon & Wilson Inc., Hull’s Environmental Services Inc., GeoSyntec Consultants, Keller Management Services LLC, and Veolia contribute to the market’s expansion and technological progress. Each company brings a unique approach to addressing contamination, water purification, and environmental restoration, which enhances the collective advancement of the industry.

Groundwater contamination continues to be a major environmental concern, and growing industrial activity has increased the demand for effective treatment solutions. Companies that focus on advanced filtration, bioremediation, and chemical treatment methods are gaining attention for their ability to provide sustainable results. The industry is steadily moving toward methods that not only remove pollutants but also restore the natural quality of water. This transition reflects the global commitment to environmental responsibility and resource preservation, as clean water remains essential for both ecosystems and human health.

Competition among these companies encourages steady improvements in efficiency and cost-effectiveness. Many organizations are investing in research and digital monitoring systems to optimize performance and reduce long-term expenses. Automated systems that track contamination levels and treatment progress are becoming more common, making the process more transparent and manageable. The growing use of data analytics is also helping organizations design treatment plans that are tailored to specific locations, minimizing waste and maximizing results.

From a futuristic viewpoint, the market will likely rely on smart technology, real-time data tracking, and artificial intelligence to enhance accuracy and sustainability. Companies that successfully integrate these tools will set new standards for performance and reliability. The combination of experience from international leaders and creativity from regional competitors will continue to push the market forward. Collaborative projects and partnerships across borders may also rise, helping to share knowledge and create consistent global standards.

Market size is forecast to rise from USD 2722.3 million in 2025 to over USD 3988 million by 2032. Groundwater Treatment Services will maintain dominance but face growing competition from emerging formats.

In the coming years, environmental regulations are expected to become stricter, which will encourage more investment in advanced groundwater treatment methods. The focus will shift toward long-term solutions that maintain water quality rather than temporary fixes. The efforts of companies such as Terracon Consultants Inc., REGENESIS, Veolia, and others will likely inspire smaller firms to adopt similar practices, creating a cycle of growth and improvement that benefits both the market and the planet. Through continued innovation and global cooperation, the future of the market will move closer to achieving sustainable water management for generations ahead.

Report Coverage

This research report categorizes the global groundwater treatment services market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global groundwater treatment services market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global groundwater treatment services market.

Groundwater Treatment Services Market Key Segments:

By Service Type

- Standalone Treatment Services

- Integrated Treatment Solutions

- Emergency Response Services

By Treatment Methods

- Physical Treatment

- Filtration

- Sedimentation

- Chemical Treatment

- Coagulation and Flocculation

- Disinfection

- Ion Exchange

- Other

By Application

- Oil & Gas

- Aerospace

- National Defense

- Medical

- Other

By Contaminant Type

- Heavy Metals

- Lead

- Arsenic

- Microbial Contaminants

- Bacteria

- Viruses

- Chemical Contaminants

- Other

Key Global Groundwater Treatment Services Industry Players

- Terracon Consultants Inc.

- MCMAHON

- Remedial Construction Services LP

- REGENESIS

- Envirogen

- VHE Construction plc

- HEPACO

- SOILUTIONS LTD

- A & M Engineering

- Clean Harbors Environmental Services Inc.

- Shannon & Wilson Inc.

- Hull’s Environmental Services Inc.

- GeoSyntec Consultants

- Keller Management Services LLC

- Veolia

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252