Global Extrusion Coating Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global extrusion coating market has been in the packaging and materials industry ever since it developed from a small-scale manufacturing process into a complex process molding today's packaging items. It began its beginnings in the mid-20th century when business entities started looking for options to conventional lamination processes that were not only time-consuming but also had low scope of application. With the increased demand for light, flexible, and water-resistant packages, Extrusion Coating emerged as a cutting-edge technology that could improve the performance and the lifespan of paper, foil, and film substrates. Basic polyethylene coatings employed in food packaging and paper cups dominated the global market of Extrusion Coating in its formative years.

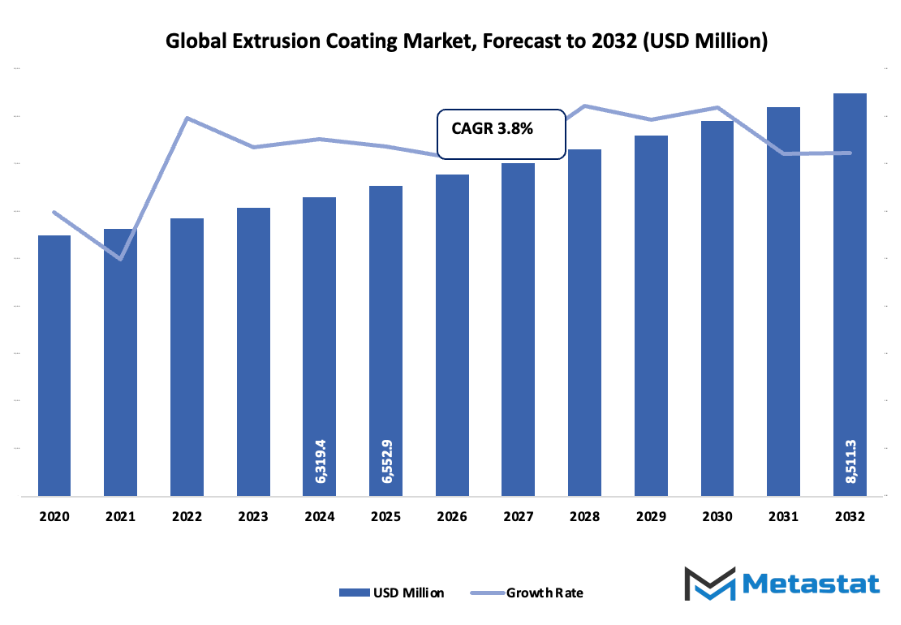

- Global extrusion coating market valued at approximately USD 6552.9 million in 2025, growing at a CAGR of around 3.8% through 2032, with potential to exceed USD 8511.3 million.

- Low Density Polyethylene (LDPE) account for nearly 62.2% market share, driving innovation and expanding applications through intense research.

- Key trends driving growth: Increasing Use of Extrusion Coating in Food & Beverage Applications

- Opportunities include: Rising Adoption of Biodegradable and Sustainable Coating Materials

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

As years passed, co-extrusion and multi-layer systems transformed the sector so that manufacturers could blend various polymers for desired functionalities like oxygen barrier, heat stability, and chemical resistance. This was a turning point because industries discovered that Extrusion Coatings could not only protect but could also be an innovation tool for products and brands. The transition from manual control to computer-automated extrusion lines in the late twentieth century further transformed the industry. Computer monitoring systems and precision engineering enhanced efficiency and consistency of quality, facilitating new markets for packaging pharmaceuticals, construction materials, and consumer goods. With increased global trade, the industry for Extrusion Coating worldwide adapted to international standards for safety and recyclability, responding to regulatory and environmental issues. With the recent demand from consumers for aesthetic and sustainable packaging, production priorities have been overhauled. Producers are focusing on bio-based and recycled polymers, and bio-based and recycled materials will dominate future production priorities. Producers will have to embrace cleaner technologies in an effort to reduce energy use and waste. These changes are not only redrawing production strategies but also shaping future product design and marketing strategies across industries.

Market Segments

The global extrusion coating market is mainly classified based on Material Type, Substrate, Application.

By Material Type is further segmented into:

- Low Density Polyethylene (LDPE): Low Density Polyethylene (LDPE) holds a major position in the global extrusion coating market because of its flexibility and strong sealing capability. It provides an excellent moisture barrier and is widely used for food and liquid packaging. Easy processability and cost-effectiveness make LDPE a preferred material in many industries.

- Ethylene Vinyl Acetate (EVA): Ethylene Vinyl Acetate (EVA) is used in the market due to its toughness and adhesive properties. It enhances flexibility and transparency in coated products. EVA also supports better bonding with substrates, making it suitable for packaging that requires high strength and product protection.

- Polypropylene (PP): Polypropylene (PP) is valued in the market for its superior heat resistance and clarity. It provides excellent chemical stability, which helps in preserving product quality. PP is often used for applications that demand durability and protection against moisture and heat exposure.

- Polyethylene Terephthalate (PET): Polyethylene Terephthalate (PET) is gaining traction in the market because of its strong mechanical strength and recyclability. It maintains transparency and offers good gas and moisture barrier properties. PET-coated materials are increasingly used in high-performance packaging applications.

- Other Material Type: Other material types in the global extrusion coating market include blends and specialty polymers used for unique packaging requirements. These materials improve coating strength, gloss, and resistance to chemicals. Manufacturers are exploring new formulations to enhance performance while reducing environmental impact.

By Substrate the market is divided into:

- Paper: Paper is a widely used substrate in the global extrusion coating market due to its renewable nature and adaptability. Coated paper provides better moisture protection and improved printability, which helps in enhancing packaging appearance. It is mostly used in food and beverage packaging.

- Paperboard: Paperboard holds a significant role in the market as it offers rigidity and durability. Coated paperboard ensures a smooth surface, which enhances printing and branding quality. It is preferred for cartons, liquid packaging, and other consumer product applications.

- Aluminium Folis: Aluminium Folis are important in the market for their superior barrier against light, moisture, and oxygen. These coatings help preserve the freshness and shelf life of packaged goods. Aluminium-based coatings are common in pharmaceutical and food packaging sectors.

- Polymer Films: Polymer Films contribute largely to the market by offering flexibility and strength. They provide excellent resistance to tearing and punctures, making them suitable for various packaging forms. Their use helps in extending product shelf life and maintaining product quality.

- Other Substrate Type: Other substrate types in the global extrusion coating market include non-traditional materials designed for specialized needs. These substrates are used to improve coating adhesion and environmental resistance. Innovations in substrate technology aim to enhance recyclability and reduce waste generation.

By Application the market is further divided into:

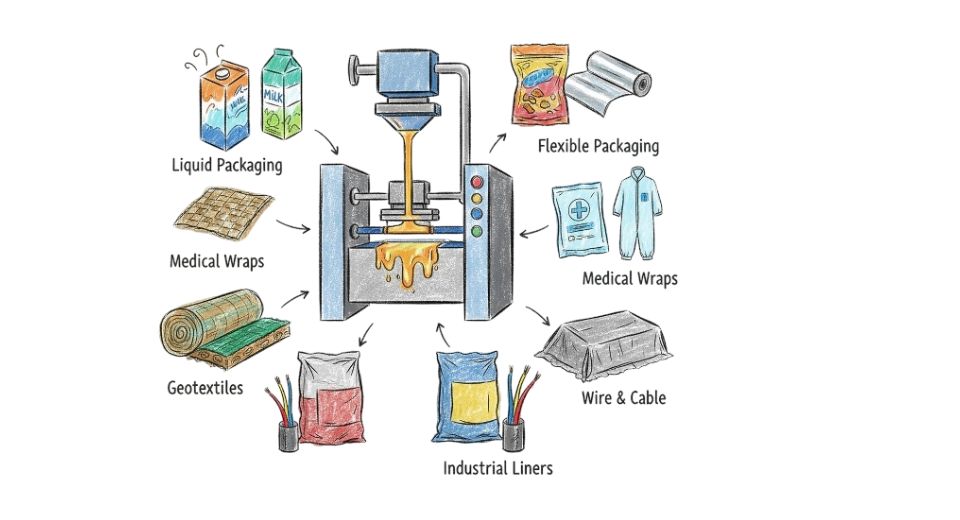

- Liquid Packaging: Liquid Packaging is a major application in the global extrusion coating market, driven by the growing use of coated paperboard in beverage cartons. The coatings provide leak resistance and durability, ensuring safe transport and storage. This segment benefits from rising demand for ready-to-drink products.

- Flexible Packaging: Flexible Packaging plays an essential role in the market due to increasing demand for lightweight and convenient packaging. It offers superior protection against moisture and oxygen. Flexible formats also support product visibility and reduce transportation costs.

- Medical Packaging: Medical Packaging in the market ensures hygiene and product safety. Coated materials protect medical devices and pharmaceuticals from contamination. The focus on sterile and tamper-proof packaging solutions drives demand for extrusion-coated materials in this segment.

- Personal Care & Cosmetic Packaging: Personal Care & Cosmetic Packaging uses extrusion-coated materials for improved shelf appeal and protection. These coatings prevent moisture and oxygen from damaging the contents. The growing use of premium and sustainable packaging in cosmetics supports the expansion of this application.

- Industrial Packaging: Industrial Packaging is an important segment in the market, focusing on heavy-duty and moisture-resistant materials. Coatings help improve durability and maintain product integrity during transport and storage. Industries use these materials for bulk packaging and chemical products.

- Other Applications: Other Applications in the global extrusion coating market include agricultural, construction, and consumer goods packaging. These coatings add strength and resistance to external factors such as humidity and temperature. Continued innovation supports wider adoption in various industrial sectors.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$6552.9 Million |

|

Market Size by 2032 |

$8511.3 Million |

|

Growth Rate from 2025 to 2032 |

3.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

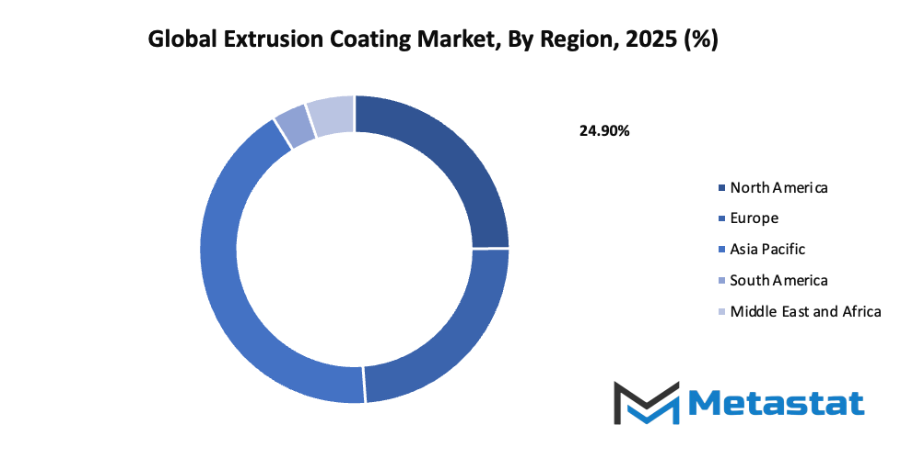

- Based on geography, the global extrusion coating market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Growing Demand for Flexible Packaging Solutions: Flexible packaging has become an essential part of modern manufacturing because it offers durability, lightweight design, and cost-effectiveness. The global extrusion coating market benefits from this trend as industries shift towards flexible materials for packaging food, beverages, and consumer goods. This approach ensures better product preservation and longer shelf life.

- Increasing Use of Extrusion Coating in Food & Beverage Applications: The food and beverage sector uses Extrusion Coating to enhance the safety and quality of packaging materials. The global extrusion coating market supports this demand by providing coatings that act as barriers against moisture and contamination. This improves the freshness of packaged food while ensuring compliance with safety standards.

Challenges and Opportunities

- Fluctuating Raw Material Prices: The cost of raw materials used in the global extrusion coating market, such as polymers and resins, often changes due to market instability and supply issues. These fluctuations affect production costs and pricing strategies. Managing these variations requires better sourcing methods and efficient supply chain management.

- High Initial Capital Investment: Setting up Extrusion Coating facilities involves heavy investment in machinery, technology, and infrastructure. The market experiences slower entry for new players due to high initial costs. However, once established, the process delivers consistent output and long-term returns through improved product performance.

Opportunities

- Rising Adoption of Biodegradable and Sustainable Coating Materials: With a global focus on environmental responsibility, the adoption of biodegradable and eco-friendly materials is increasing. The global extrusion coating market is responding to this change by offering sustainable coating solutions that reduce waste and carbon emissions. This shift supports environmental goals and appeals to eco-conscious consumers.

Competitive Landscape & Strategic Insights

The global extrusion coating market stands at a significant turning point as technological progress and sustainability goals continue to shape its future. The industry brings together some of the most influential international leaders and rapidly growing regional competitors, each working toward innovation, efficiency, and environmental responsibility. Major participants such as PPG Industries, Inc., The Sherwin-Williams Company, Akzo Nobel N.V., Solvay SA, Axalta Coating Systems, Chevron Phillips Chemical Company LLC, INEOS, SABIC, Reliance Industries Limited, Cleanse Corporation, Exxon Mobil, Valspar Corporation, The Lubrizol Corporation, Formosa Plastics Corporation, Borealis AG, LyondellBasell Industries Holdings BV, and DowDuPont continue to play central roles in defining the direction of the market.

In the coming years, the focus will move toward materials and processes that reduce waste, improve recyclability, and lower carbon emissions. Companies are expected to invest heavily in research and development to create coatings that balance performance with environmental safety. The shift from conventional plastics toward bio-based and recyclable materials will become a defining trend. As government policies tighten around sustainability and plastic use, manufacturers will need to adapt production methods to meet stricter regulations while maintaining product quality and cost efficiency.

The market’s growth will also rely on advancements in automation, digital monitoring, and smart manufacturing technologies. Automation will allow greater precision in coating thickness and uniformity, while digital systems will help track production performance and minimize resource use. These innovations will not only boost productivity but also allow producers to meet the growing demand for customized coating solutions across packaging, automotive, and construction applications.

The competitive landscape will likely become more dynamic as established international companies work to strengthen their global presence while regional players expand through partnerships and localized innovation. This mix of global expertise and regional adaptability will encourage healthy competition, pushing the industry toward faster technological progress and broader market reach. As customer expectations evolve, businesses will focus on providing more efficient coatings that meet performance needs and align with future environmental standards.

Market size is forecast to rise from USD 6552.9 million in 2025 to over USD 8511.3 million by 2032. Extrusion Coating will maintain dominance but face growing competition from emerging formats.

Looking ahead, the global extrusion coating market will transform through continuous innovation, sustainable practices, and strategic collaboration among global and regional companies. The pursuit of cleaner technologies, efficient production, and responsible material use will shape its path, leading to a more resilient and forward-looking industry that meets both economic and environmental goals.

Report Coverage

This research report categorizes the global extrusion coating market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global extrusion coating market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global extrusion coating market.

Extrusion Coating Market Key Segments:

By Material Type

- Low Density Polyethylene (LDPE)

- Ethylene Vinyl Acetate (EVA)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Other Material Type

By Substrate

- Paper

- Paperboard

- Aluminium Folis

- Polymer Films

- Other Substrate Type

By Application

- Liquid Packaging

- Flexible Packaging

- Medical Packaging

- Personal Care & Cosmetic Packaging

- Industrial Packaging

- Other Applications

Key Global Extrusion Coating Industry Players

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Akzo Nobel N.V.

- Solvay SA

- Axalta Coating Systems

- Chevron Phillips Chemical Company LLC

- INEOS

- SABIC

- Reliance Industries Limited

- Cleanse Corporation

- Exxon Mobil

- Valspar Corporation

- The Lubrizol Corporation

- Formosa Plastics Corporation

- Borealis AG

- LyondellBasell Industries Holdings BV

- DowDuPont

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252