Global GPS Tracking Device Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global GPS tracking device market quietly started to emerge, long before these devices became essential in logistics or personal transport. Initially, the satellite navigation technology was still in its infancy, and the hardware for GPS was enormous, costly, and mostly limited to military use. The opening up of GPS signals by the U.S. government for public use in the 1990s was the first significant turn in the course of events. This decision led to a flurry of innovations and experiments among the first tech companies, who started to build the notion that small receivers could, besides guiding cars, even help in monitoring assets and supporting business operations practice.

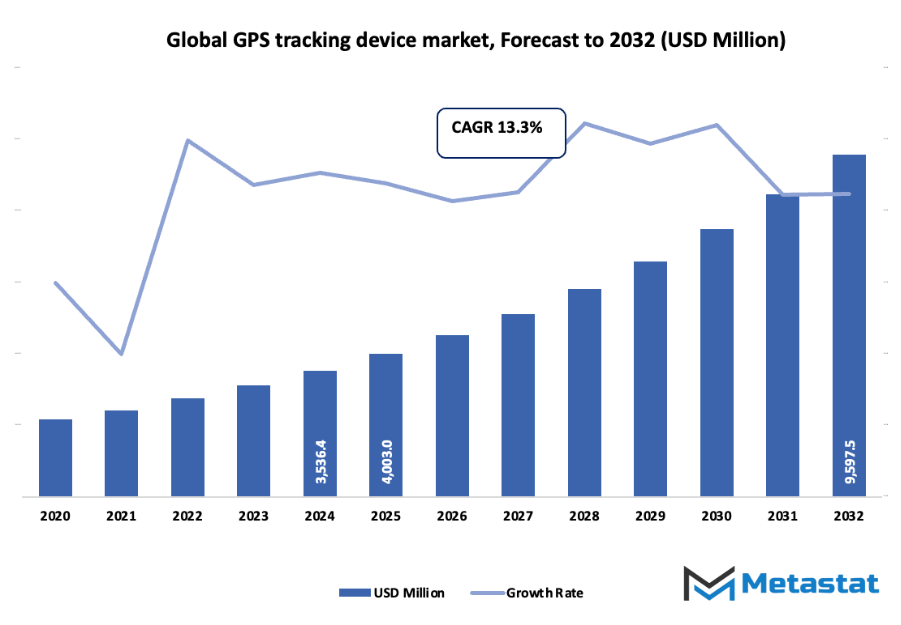

- The global GPS tracking device market is estimated to be worth around USD 4003 million by the year 2025, while the annual average rate of increase is expected to be about 13.3% through 2032, with the possibility of reaching more than USD 9597.5 million.

- The market share of Standalone Trackers is almost 38.6%, which is the main factor causing the research to be more rigorous and, thus, the application to be wider.

- The main growth factors are: rising need for fleet management solutions, and increasing worries about vehicle theft and security.

- The merger of GPS tracking with IoT technologies is one of the major future advantages.

- The main take-out is: the market will increase its worth tremendously in the next ten years, thus giving rise to substantial opportunities for development.

The 2000s were a decade when companies sought to miniaturize GPS modules and at the same time reduce production costs. The improvement in mobile networks gave GPS units the power to transmit position data live, rather than merely storing it for later accessing. Fleet operators were so tech-savvy that they were able to know the exact locations of their trucks and their mileage, thus giving them a leg up in planning and fuel spending. It was indeed the commercial transportation sector that initially created a demand for such high-precision location data that the whole industry could see it as an asset beyond just routing.

The introduction of smartphones into people's everyday lives altered consumer expectations considerably. Customers got accustomed to perpetual location awareness, and companies were quick to provide the same level of service with special tracking devices. Gadgets got sleeker, the duration of the battery got extended, and the merger with the cloud-based platforms produced the analytics dashboards that would soon lead to decision-makers. Governments also imposed their rule on the industry by tightening regulations about the safety of roads, the transparency of shipping and emergency response. All these factors combined led to the introduction of tracking as a standard practice for not only school buses, but also rental cars and even shipping containers.

The global GPS tracking device market, in the upcoming years, will stress on uninterrupted connectivity and automatic reporting. The devices will be in contact with the sensors that keep track of different parameters such as temperature, speed, and maintenance thus ultimately aiding in logistics planning that is almost completely automated. Surveillance would not be a deterrent anymore for small businesses that, in the past, avoided the tracking for its high cost. Subscription-based platforms along with better satellite networks will make it a lot easier for them.

Today, the global GPS tracking device market stands as a result of decades of shrinking hardware, expanded network coverage, and rising customer expectations for instant information. The next phase will push these devices deeper into everyday infrastructure, shaping how assets move, how people travel, and how companies make decisions based on live data.

Market Segments

The global GPS tracking device market is mainly classified based on Type, Components, Deployment Type, Industry.

By Type is further segmented into:

- Standalone Trackers: Standalone trackers are self-sufficient devices that keep track of the user's location and provide monitoring requirements without being connected to other vehicle systems. The device is a great help for businesses that want to keep an eye on their goods not only during transit but also in their daily operations. The reliable tracking activity motivates companies to make better scheduling decisions, and in turn, they experience fewer delays, and stronger security for their assets in the case of commercial uses.

- OBD Devices: OBD devices are connected to a vehicle's diagnostic port, which provides access to location data and engine performance information round the clock. The device installation is very easy, thus large vehicle fleets can be quickly deployed with the device installation. Through this, the businesses are not only able to see more clearly the asset usage, maintenance needs, and operational efficiency but also the='unnecessary downtime' or 'manual data collection' is reduced.

- Advance Trackers: Advance trackers give very comprehensive information about the user's location, the vehicle's speed, and the behavior of the driver. The device has sensors, communication modules, and alert functions that enhance safety and fleet management. This kind of tracker provides accurate real-time data that aid businesses in lowering asset misappropriation, fuel expenses, and uncertainty in operations during transport.

By Components the market is divided into:

- GPS Loggers: GPS loggers are devices that record the exact location of the user and save it in the device memory for later viewing. Such a device is particularly useful for those activities that need to have a record of the exact routes taken without the need for constant connectivity. The data that is retrieved later can be used by the companies to analyze patterns, make the necessary adjustments in their planning, and prove the history of the movement of their assets. The simple design along with the reliable storage capabilities provides monitoring that is cost-effective and does not add a burden to the operations of the companies.

- Personal GPS Trackers: Personal trackers are tiny devices that are either held by people or attached to their properties. The device gives constant awareness of the user's location for safety and supervision. Companies assign these trackers to workers in remote locations and use them also to secure a valuable asset that is in portable form. Their petite size makes it easy to carry them and to make them a part of different daily situations and thus, their use is almost regular.

- Real-Time GPS Trackers: Real-time trackers provide the location information continuously via communication services. The organization gets instant visibility of the asset's movement and can quickly take care of any delays. The instant visibility promotes decision-making related to changes in the route, risk avoidance, and delivery timing based on information. Technology, in this case, is a factor that greatly impacts the level of trust and speed of the response.

By Deployment Type the market is further divided into:

- Commercial Vehicles: The installation of tracking devices in commercial vehicles plays a vital role in the optimization of business operations like travel paths, controlling fuel habits, and unauthorized use prevention. The clear location enables accurate dispatching and helps in improving delivery schedule. The operational oversight that is enhanced results in increased productivity and a decrease in financial loss which was caused by delays or the improper use of company resources.

- Cargo & Containers: Companies build up their control over goods with tracking units mounted on cargo and containers, especially during transport or storage. Awareness of location cuts down theft, loss, and confusion during the movement of goods over long distances. The device not only helps businesses keep records of shipment progress but also assists in managing customer expectations related to delivery timings and safety.

- Other: Other deployment categories refer to monitoring of equipment, machinery, and specialized assets that require frequent checking. Tracking devices keep organizations informed about the location of their assets and prevent misplacements while reducing the need for manual tracking. The constant location information access promotes better planning and stronger resource management across different industries.

By Industry the global GPS tracking device market is divided as

- Transportation & Logistics: In the logistics sector, tracking devices are crucial as they not only keep an eye on the fleet's movement, but also help in cutting down the waiting time, and enhancing the delivery accuracy. When the assets are visible clearly, the companies can make decisions that will result in better fuel use and planned routes. Continuous location of the vehicle helps in keeping the company accountable to the customers and providing trustworthy service.

- Construction: The rents and usage of the large-scale construction equipment are the main reason the constructors are training the devices to watch at the building site. Their tracking method will assist in reducing the loss of equipment and enabling the right timing of use. The gadget will provide the controllers with instantaneous information about the location of the asset, which will be one of the factors in minimizing the project's progress and cost efficiency across or on large multi-site jobs.

- Government: Government tracking devices are used for service vehicles, emergency fleets, and monitoring public infrastructure. The location tracking leads to better operational planning and it is easier to hold the service personnel accountable. The device not only allows public resources to be used efficiently but also supports quicker response in critical situations.

- Oil & Gas: Oil and gas production usually means working in remote and difficult places where they have very expensive equipment. The devices are very helpful to the ground personnel in tracking the machines and vehicles and lowering the risk that comes with moving materials that need to be protected. The companies are not only conducting business in a more transparent way but are also changing the communication channels regarding safety across and in between the different project zones.

- Metals & Mining: Mining companies benefit from tracking devices by monitoring trucks, machinery, and transported materials. Asset visibility reduces delays and minimizes lost equipment. Location data helps coordinate operations in challenging terrain, ensuring improved workflow and efficient resource movement.

- Others: Various other industries adopt tracking technology to improve oversight of assets, transportation activities, and equipment safety. Consistent monitoring reduces financial loss and strengthens planning decisions. Reliable location information assists organizations in streamlining operations and maintaining greater control over valuable resources.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4003 Million |

|

Market Size by 2032 |

$9597.5 Million |

|

Growth Rate from 2025 to 2032 |

13.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

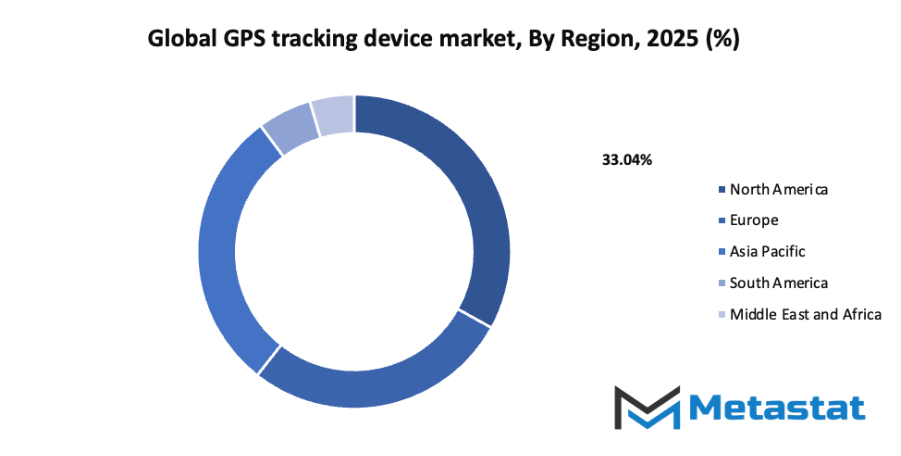

- Based on geography, the global GPS tracking device market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing demand for fleet management solutions:

Growing business activity across logistics and delivery services encourages wider adoption of GPS tracking technology. The global GPS tracking device market gains stronger demand as fleet managers seek better control over location data, fuel usage, and route planning. Faster access to accurate tracking information supports reduced travel time and improved operational efficiency across transportation networks. - Growing concerns regarding vehicle theft and safety:

Rising vehicle theft cases encourage stronger monitoring systems. GPS tracking offers real-time location detection, helping recovery teams locate valuable assets without delay. Continuous location updates support safer travel routines, while emergency alerts help reduce losses. Stronger awareness regarding asset protection encourages more businesses to adopt GPS tracking technology for safer transportation.

Challenges and Opportunities

- Privacy concerns and regulatory restrictions:

Government rules focus on responsible data handling and limit unnecessary tracking activity. Regulations require transparent data collection and secure storage procedures. Businesses must follow strict data protection standards, increasing the need for compliance planning. Privacy concerns encourage companies to build trust by adopting clear data policies and stronger security within tracking systems. - High initial investment and ongoing maintenance costs:

Purchasing advanced tracking hardware and paying for continuous software support increases overall spending for businesses. Smaller companies may delay adoption due to budget pressure. Regular updates and technical maintenance add additional expense. Careful planning and long-term cost analysis help ensure sustainable use of GPS tracking technology across fleet operations.

Opportunities

- Integration of GPS tracking with Internet of Things (IoT) technologies:

Combining GPS tracking with IoT sensors allows faster access to location data, engine status, and fuel information through a single platform. Real-time connectivity supports automatic alerts and predictive maintenance. IoT-enabled tracking encourages smarter decisions, reduces downtime, and improves asset management across multiple business activities.

Competitive Landscape & Strategic Insights

The global GPS tracking device market shows strong growth due to rising demand for accurate location data, improved fleet management, and asset security. Many sectors such as transportation, logistics, and public safety now depend on reliable tracking hardware and software. Advanced sensors, longer battery life, and wider network coverage encourage organizations to shift from manual tracking to automated monitoring. Strong competition encourages constant improvement, affordable pricing, and new product features, which helps customers receive solutions that match different operational needs.

A large group of well-known corporations plays a major role. Garmin Ltd. delivers tracking hardware known for durability and consistent performance. Trimble Inc. focuses on advanced positioning systems that support construction, agriculture, and logistics. Sierra Wireless, Inc. and CalAmp Corp. support connected tracking platforms, allowing smooth data transfer between hardware and management platforms. Shenzhen Concox Information Technology Co., Ltd. and ORBCOMM Inc. supply devices for vehicle, asset, and personal tracking on a global scale. MiX Telematics Ltd., Queclink Wireless Solutions Co., Ltd., Geotab Inc., Trackimo Inc., and Ruptela push stronger innovation through data analytics and flexible device options. Spireon Inc., Teltonika UAB, Meitrack Group, and ATrack Technology Inc. offer solutions for fleet supervision and asset recovery in logistics and rental services. Major communication and technology firms such as Verizon Communications Inc., Qualcomm Technologies, Inc., and Hexagon also support tracking solutions through strong network infrastructure and advanced positioning systems.

The global demand encourages each corporation to improve accuracy, reduce device size, and create user-friendly platforms. Enhanced security features help prevent equipment loss and unauthorized access. Strong customer focus leads to clearer reporting dashboards, faster response times, and improved route planning, reducing operational cost.

Market size is forecast to rise from USD 4003 million in 2025 to over USD 9597.5 million by 2032. GPS Tracking Device will maintain dominance but face growing competition from emerging formats.

The global GPS tracking device market continues to attract new investors and technology partners. Growing concern for efficiency and safety supports continued expansion of hardware, software, and data services. Constant progress encourages organizations across many sectors to adopt trusted tracking solutions.

Report Coverage

This research report categorizes the global GPS tracking device market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global GPS tracking device market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global GPS tracking device market.

GPS Tracking Device Market Key Segments:

By Type

- Standalone Trackers

- OBD Devices

- Advance Trackers

By Components

- GPS Loggers

- Personal GPS Trackers

- Real-Time GPS Trackers

By Deployment Type

- Commercial Vehicles

- Cargo & Containers

- Other

By Industry

- Transportation & Logistics

- Construction

- Government

- Oil & Gas

- Metals & Mining

- Others

Key Global GPS Tracking Device Industry Players

- Garmin Ltd.

- Trimble Inc.

- Sierra Wireless, Inc.

- CalAmp Corp.

- Shenzhen Concox Information Technology Co., Ltd.

- ORBCOMM Inc.

- MiX Telematics Ltd.

- Queclink Wireless Solutions Co., Ltd.

- Geotab Inc.

- Trackimo Inc.

- Ruptela

- Spireon Inc.

- Teltonika UAB

- Meitrack Group

- ATrack Technology Inc.

- Verizon Communications Inc.

- Qualcomm Technologies, Inc

- Hexagon

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252