Global Gas Detection Equipment Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global gas detection equipment market has come a long way from being a small yet safety-conscious niche to a major player in the modern industry worldwide. At the beginning, gas detection was a manual and extremely unreliable procedure, which often relied on simple chemical reactions or poor-quality flame-safety lamps used in coal mines. The concept was straightforward but very helpful—detecting the very dangerous, very invisible gases before they got a chance to inflict any harm. With the rapid industrialization of the twentieth century, accurate detection systems became more and more necessary in factories, refineries, and chemical plants to ensure the safety of the workers and to avoid disasters. The very first systems set up the foundations of what later on became an organized and technologically advanced global gas detection equipment market.

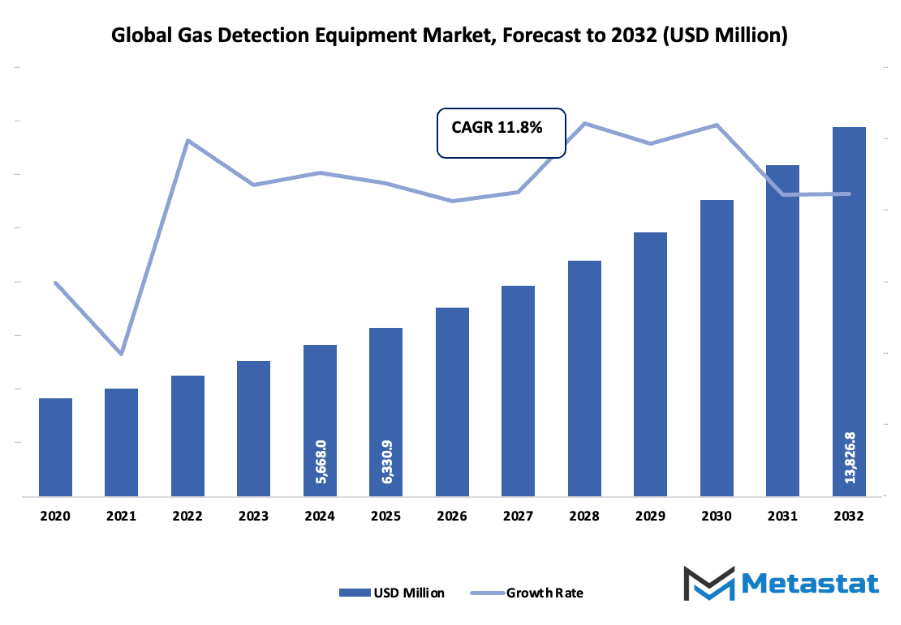

- The global gas detection equipment market was valued at around USD 6330.9 million in 2025, with a CAGR of around 11.8% through 2032, with the possibility to surpass USD 13826.8 million.

- Portable Gas Detectors account for nearly 46.0% market share, driving innovation and expanding applications through intense research.

- Key trends driving growth: Increasing Emphasis on Workplace Safety Regulations, Growing Adoption of Industrial IoT (Internet of Things) Technologies

- Opportunities include: Integration of Artificial Intelligence (AI) for Advanced Gas Detection Systems

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The period from the mid into the late twentieth century was a watershed one, for it was then that the use of electronic sensors was made widespread. The two types of sensors, catalytic bead, and infrared, each had its advantages, but together they formed a new standard of precision and total control of the monitoring process. Under pressure from the governments of the main industrial nations, manufacturers were forced to spend money on reliable detection instruments which, at first, were only meant to be used for compliance. This situation sparked off a race between companies to come up with the best and most innovative solutions, and gas detection eventually became an integral part of the operations rather than just being a compliance requirement.

At the dawn of the 2000s, the global gas detection equipment market was already somewhat connected with the digital revolution. Companies were equipped with the technology to predict leaks and malfunctions even before they happened thanks to wireless connectivity, real-time monitoring, and data analytics. At the same time, the miniaturization of sensors enabled the production of portable detectors, thus making personal safety equipment more reachable and efficient. Concurrently, these innovations reflected and supported the trend of corporations going green and adopting proactive risk management strategies.

The market is not static today but still changing in accordance with the altered industrial practices and new technologies. The detectors are no longer just able to sense the presence of a gas, but they now also come with predictive intelligence capabilities, and integration with automation networks is another feature that has become an important area of focus. The demand for smart, versatile, and networked detection systems will be even greater as the oil and gas, pharmaceutical, and manufacturing sectors, among others, move towards intelligent facilities. The evolution of the global gas detection equipment market from its early trial-and-error phase to state-of-the-art safety networks has been synonymous with innovation. It also portrays the aspiration of mankind to ensure the safety of the environment during industrial development, if not to achieve it outright.

Market Segments

The global gas detection equipment market is mainly classified based on Product Type, Gas Type, Sensor Technology, End-use Industry.

By Product Type is further segmented into:

- Portable Gas Detectors: Portable Gas Detectors have been established as the primary safety measure among various industries. This innovative solution is targeted for individuals and simultaneous identification of unsafe gases is their main feature. They are designed with a higher degree of comfort, portability, and usability for confined spaces or places with limited oxygen supply. Their versatility and speed in detecting gases make them the best option for temporary monitoring and emergency situations. The demand for portable devices is anticipated to go up as industries place more emphasis on worker safety and mobile monitoring solutions.

- Fixed Gas Detectors: The use of Fixed Gas Detectors will guarantee the safety of the atmosphere in manufacturing operations at all times. These systems are installed at certain locations and are highly sensitive to gas leaks or dangerous levels. They are linked to the control panels which sound the alarms or turn off the machinery, etc., in case the dangerous level is detected. In general, industries choose fixed detectors in cases where there is a vast area that needs monitoring done constantly. Early detection of dangerous situations has become part of their role in preventing accidents and ensuring both people and machinery are kept safe.

- Detector Tubes: Detector Tubes are going to keep on being an easy but powerful option for gas detection. Their operating principle involves sampling the air through a tube, which if it encounters a particular gas, changes its color. The procedure is manual, and that is the reason it is considered to be the most reliable method for doing spot checks and performing quick testing. Detector Tubes are appreciated for being inexpensive and having low maintenance requirements. They are well suited for fieldwork or laboratories, which need quick and inexpensive analyses without complex instruments.

- Others: Other gas detection products will include advanced systems and accessories that support the performance of main detectors. These can include alarm systems, calibration tools, and data loggers that help in accurate measurement and safety reporting. The development of smart solutions with wireless connectivity will further support market growth, enhancing both efficiency and convenience in monitoring operations.

By Gas Type the market is divided into:

- Flammable Gases: The deployment of flammable gas detection devices will be indispensable to the elimination of fire and explosion sources. These systems find their application mainly in the industries where natural gas, fuels, or solvents are present. The detectors are capable of spotting gas leaks long before they become a threat, thus the area is always safe for work. Very high safety levels and the fact that frequent industrial accidents have been a major concern is what has led many companies to put in place reliable detection systems for the safe handling of flammable gases.

- Toxic Gases: The identifying of poisonous gases being released into the environment will be essential for the protection of people around and for the preservation of air quality. The detection units are able to detect the presence of such gases as carbon monoxide, hydrogen sulfide, and ammonia which in the case of human exposure can be fatal even at very low concentrations. Sectors like production, chemical processing, and mining rely heavily on this technology to protect their workers from inhalation. Having the machines serviced regularly and calibrated increases their functional ability and reduces the risk of being found out of compliance with the safety standards.

- Oxygen: Monitoring devices will be in place to ensure that there is enough oxygen in the places that are either enclosed or risk-prone. Both the lack and too much oxygen can have disastrous effects. These detectors are placed on the market mainly for utilization in confined spaces, laboratories, and chemical plants. The apparatus creates a wholesome atmosphere and gives warning to the workers when the outside levels have breached the safe limits. Constant observation of oxygen levels through the use of dependable sensors minimizes the risks of both suffocation and fire.

- Others: Detection systems for other gases will include those designed for specialized applications such as refrigerants, carbon dioxide, or specific industrial compounds. These devices address niche safety requirements in different fields. The increasing variety of industrial gases has led to broader equipment demand, ensuring that each gas type is detected accurately to maintain operational safety.

By Sensor Technology the market is further divided into:

- Electrochemical: Electrochemical sensors will be widely used for detecting toxic gases and oxygen. These sensors operate by generating electrical signals through chemical reactions when exposed to specific gases. Known for their accuracy and low power use, they are suitable for both portable and fixed detectors. Regular calibration helps maintain long-term reliability and ensures correct readings in safety-critical environments.

- Infrared: Infrared sensors will be important for identifying flammable gases and carbon dioxide. They work by measuring how gas molecules absorb infrared light at specific wavelengths. These sensors offer long-term stability and are less affected by environmental factors like humidity. Their fast response and low maintenance needs make them ideal for continuous monitoring in harsh industrial settings.

- Metal Oxide:

Metal oxide sensors will be effective for detecting combustible gases. They function by changing electrical resistance when exposed to gases. These sensors are durable and capable of working in varying temperature and humidity conditions. Used mainly in industrial safety and environmental monitoring, metal oxide technology provides a cost-effective solution for detecting gas leaks. - Catalytic: Catalytic sensors will be used primarily for flammable gas detection. They operate by oxidizing gas on a heated surface, which produces a measurable signal. These sensors are known for reliability and rapid detection capabilities. However, they require regular calibration and maintenance to perform effectively. They are most common in industries dealing with hydrocarbons and other combustible materials.

- Zirconia: Zirconia sensors will be used mainly for measuring oxygen concentration at high temperatures. These sensors are highly stable and suitable for industries such as metal processing and power generation. Their strong performance in harsh conditions makes them valuable where accuracy is essential. Zirconia sensors provide consistent data that help in process control and safety assurance.

By End-use Industry the global gas detection equipment market is divided as:

- Oil & Gas: The oil and gas sector will remain the largest user of gas detection equipment due to high risks of leaks and explosions. Continuous monitoring is essential during extraction, refining, and transportation. The industry depends on both fixed and portable detectors to ensure worker safety and environmental protection. Technological advancements will further strengthen reliability and efficiency.

- Government & Military: Government and military sectors will use gas detection systems to maintain safety in operations involving hazardous materials. These detectors help during emergency responses, training, and defense applications. Reliable detection supports protection of personnel and ensures quick reaction during chemical or gas exposure incidents. Continued investment in advanced systems will improve readiness and response capability.

- Manufacturing: Manufacturing industries will rely on gas detection systems to prevent accidents from chemical leaks or combustion. Proper monitoring supports a safe workspace and helps meet safety regulations. Automated systems will provide early alerts, minimizing production loss and ensuring compliance. The growing focus on worker safety will increase demand for advanced detection devices.

- Chemicals & Petrochemicals: The chemicals and petrochemicals industry will require continuous gas monitoring due to the handling of volatile substances. Any small leak can lead to serious hazards. Reliable detection equipment ensures safe production processes and protects both employees and assets. Strict environmental and safety rules will continue to push the use of advanced gas detection technologies.

- Water & Wastewater: The water and wastewater sector will use gas detection systems to monitor gases such as methane, hydrogen sulfide, and chlorine. These gases can form during treatment processes and pose safety risks. Fixed and portable detectors help maintain safe conditions for workers and prevent contamination. Growing awareness of environmental safety supports market demand in this sector.

- Metal & Mining: Metal and mining industries will depend on gas detection systems to monitor hazardous gases in underground and surface operations. Methane and carbon monoxide detection is critical for worker protection. Reliable detectors help prevent explosions and suffocation incidents. The adoption of advanced monitoring systems will strengthen safety measures in high-risk mining environments.

- Other: Other industries such as food processing, pharmaceuticals, and construction will also use gas detection equipment for maintaining safety standards. These sectors handle gases for various purposes, and detection systems ensure controlled and safe use. Increasing awareness about occupational health and safety will continue to support adoption across multiple fields.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$6330.9 Million |

|

Market Size by 2032 |

$13826.8 Million |

|

Growth Rate from 2025 to 2032 |

11.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

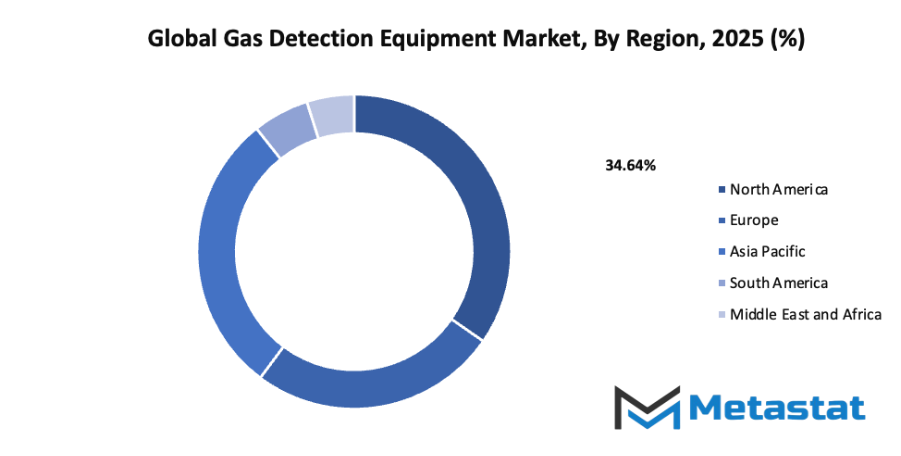

By Region:

- Based on geography, the global gas detection equipment market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing Emphasis on Workplace Safety Regulations: The growing number of accidents caused by gas leaks has resulted in stricter workplace safety laws. Governments and regulatory bodies are enforcing standards that require the installation of efficient gas detection systems. Compliance with these laws helps industries prevent loss of life and property, leading to steady growth in the global gas detection equipment market.

- Growing Adoption of Industrial IoT (Internet of Things) Technologies: The adoption of IoT in industrial environments is enhancing the efficiency of gas detection systems. IoT-enabled devices provide real-time monitoring and data sharing, improving decision-making and response times. Integration with cloud-based systems allows remote management and maintenance, leading to higher productivity and reliability within the global gas detection equipment market.

Challenges and Opportunities

- High Initial Investment Costs: The installation and setup of gas detection systems often require a significant financial commitment. Many small and medium enterprises find it difficult to allocate resources for such expenses. This factor slows market expansion in developing regions, as companies prioritize cost reduction over safety enhancements despite potential long-term benefits.

- Challenges in Calibration and Maintenance of Equipment: Regular calibration and maintenance are vital for accurate readings and reliable performance of gas detection equipment. Improper upkeep can lead to false alarms or missed detections, increasing risks in hazardous environments. Skilled personnel and routine checks are essential, but these processes can be time-consuming and costly, affecting operational efficiency.

Opportunities

- Integration of Artificial Intelligence (AI) for Advanced Gas Detection Systems: Artificial Intelligence is transforming how gas detection systems operate. AI-powered solutions can analyze patterns, predict potential leaks, and reduce false alarms through automated learning. This technology enhances safety measures and system reliability, creating a strong opportunity for companies to develop advanced products in the global gas detection equipment market.

Competitive Landscape & Strategic Insights

The global gas detection equipment market has experienced significant growth over the past decade, driven by increasing safety regulations, technological advancements, and a growing focus on industrial safety across various sectors. Gas detection systems play a vital role in identifying the presence of harmful gases in environments such as manufacturing plants, mining sites, oil and gas facilities, and chemical industries. These devices help reduce the risk of accidents, ensure compliance with safety standards, and protect workers and assets from hazardous exposure. As more industries adopt automated and smart monitoring systems, the demand for reliable gas detection equipment continues to rise across multiple applications.

The global gas detection equipment market benefits greatly from strong competition between established international brands and rising regional firms that aim to expand their presence. The industry is a mix of both international industry leaders and emerging regional competitors. Important competitors include Honeywell International Inc., Drägerwerk AG & Co. KGaA, MSA Safety Incorporated, Industrial Scientific Corporation, Fluke Corporation, Teledyne Technologies Incorporated, Siemens AG, Sensidyne, LP, Bacharach, Inc., Trolex Ltd., 3M, Emerson Electric Co., Thermo Fisher Scientific Inc., GfG Gesellschaft für Gerätebau mbH, Yokogawa Electric Corporation, RKI Instruments, Inc., ABB Ltd., Ion Science Ltd., Lynred, United Electric Controls Company, Det-Tronics, Crowcon Detection Instruments Ltd., and Conspec Controls Inc. Their continued innovation, product diversification, and emphasis on digital integration have set high standards for product reliability and accuracy in gas detection technologies.

Technological progress has played a major role in shaping the market. The introduction of wireless connectivity, real-time data analysis, and compact sensor technology has transformed how gas monitoring is performed. Many devices now connect with centralized systems that provide instant alerts and reports, improving safety and response time in case of leaks or contamination. Continuous research into sensor sensitivity and durability has also contributed to longer product lifespans and reduced maintenance costs, making modern systems more efficient and affordable for industries of all sizes.

Government initiatives and strict safety regulations have further encouraged the adoption of gas detection equipment. Industrial sectors such as oil and gas, mining, construction, and chemicals are under constant supervision to ensure worker safety and environmental protection. Companies are investing heavily in advanced monitoring tools to meet compliance requirements while maintaining operational efficiency. This growing awareness about occupational safety has led to a steady rise in the installation of both portable and fixed gas detection systems.

Another key factor influencing market expansion is the shift toward automation and the Industrial Internet of Things (IIoT). By integrating gas detection devices with digital platforms, companies can monitor several sites remotely and detect potential threats before they escalate. This approach minimizes downtime, prevents costly incidents, and enhances overall productivity. As industries move toward sustainability, gas detection systems are also being developed with energy-efficient designs and eco-friendly materials.

Despite the progress, challenges remain, including high installation costs for large-scale systems and the need for continuous calibration to maintain accuracy. However, ongoing innovation and growing competition among key players are likely to address these issues over time. The rising use of smart sensors, coupled with cloud-based monitoring and predictive maintenance technologies, promises to make the future of gas detection more precise, connected, and accessible.

Market size is forecast to rise from USD 6330.9 million in 2025 to over USD 13826.8 million by 2032. Gas Detection Equipment will maintain dominance but face growing competition from emerging formats.

In conclusion, the global gas detection equipment market continues to strengthen as industrial sectors prioritize safety and efficiency. With steady technological advancements, expanding applications, and strong competition among global and regional manufacturers, the market is expected to witness sustainable growth. Increasing awareness about workplace safety, environmental standards, and digital transformation ensures that gas detection technology remains an essential component of modern industrial operations worldwide.

Report Coverage

This research report categorizes the global gas detection equipment market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global gas detection equipment market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global gas detection equipment market.

Gas Detection Equipment Market Key Segments:

By Product Type

- Portable Gas Detectors

- Fixed Gas Detectors

- Detector Tubes

- Others

By Gas Type

- Flammable Gases

- Toxic Gases

- Oxygen

- Others

By Sensor Technology

- Electrochemical

- Infrared

- Metal Oxide

- Catalytic

- Zirconia

By End-use Industry

- Oil & Gas

- Government & Military

- Manufacturing

- Chemicals & Petrochemicals

- Water & Wastewater

- Metal & Mining

- Other

Key Global Gas Detection Equipment Industry Players

- Honeywell International Inc.

- Drägerwerk AG & Co. KGaA

- MSA Safety Incorporated

- Industrial Scientific Corporation

- Fluke Corporation

- Teledyne Technologies Incorporated

- Siemens AG

- Sensidyne, LP

- Bacharach, Inc.

- Trolex Ltd.

- 3M

- Emerson Electric Co.

- Thermo Fisher Scientific Inc.

- GfG Gesellschaft für Gerätebau mbH

- Yokogawa Electric Corporation

- RKI Instruments, Inc.

- ABB Ltd.

- Ion Science Ltd.

- Lynred

- United Electric Controls Company

- Det-Tronics

- Crowcon Detection Instruments Ltd.

- Conspec Controls Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252