MARKET OVERVIEW

The market of Global Geometric Dimensioning and Tolerancing Solutions falls in the narrow section of the industrial measurement and quality assurance area. This section plays a very important role in the exact specification, measurement, and inspection of geometrical characteristics of parts and assemblies from various manufacturing industries. It includes software, hardware, and associated services that work to enable correct interpretation and application of the principles of GD&T through the entire product development cycle, starting from design to prototyping, and on to production and quality control. The growing use of Global Geometric Dimensioning and Tolerancing GD&T Solutions is driven by an increase in the complexity of modern products and the increasing emphasis on precision engineering.

The industries that have higher working tolerances and a need for finer quality will increasingly be looking to GD&T solutions to ensure consistency and reliability over the lifecycle of their products. These solutions enable the marking and sharing of geometric needs, improve processes for waste minimization, and ensure that parts fit and interact properly. This makes GD&T a very significant concern in industries like the automotive, aerospace and defense, electronics, and heavy machinery sectors, where even small non-conformity to the design specifications can result in major operational issues. The Global Geometric Dimensioning and Tolerancing GD&T Solutions market involves software tools used for creating and interpreting engineering drawings with GD&T symbols and also for simulating and validating these designs before they are manufactured.

These tools provide capabilities for developing detailed product specifications, meeting international standards like ISO and ASME. They enable analysis by the engineer of potential issues in tolerance stack-ups that could result in part failure or expensive rework. With modern software packages, this further extends to 3D modeling, virtual metrology, and even inspection automation capabilities that enable deeper, more effective product development and quality assurance methodologies. The hardware segment of the global GD&T solutions market includes CMMs, laser trackers, optical comparators, and other equipment applied in the physical measurement and inspection of parts.

These are increasingly being integrated with software programs in GD&T for measurement automation, reducing human errors and allowing on-the-spot feedback on manufacturing performance. Integration of hardware and software will remain one of the key trends in this marketplace-enabling companies to achieve higher levels of precision and efficiency in the production processes. Apart from software and hardware, the Global Geometric Dimensioning and Tolerancing Solutions market also caters to a range of services, including training, consulting, and technical support, among other services. These become quite important in enabling an organization to ultimately implement GD&T practices and meet its requirements toward industry standards. Since companies are under great pressure to reduce the time-to-market and lower the production cost, expert guidance and support in the adoption and utilization of GD&T solutions will see increased demand.

In simple words, due to the increasingly strict quality and performance requirements, the market for Global Geometric Dimensioning and Tolerancing Solutions will have a very important role in the manufacturing industries. This will contribute to innovations, effectiveness, and competitiveness in various sectors, mainly because it can help companies achieve precision in dimensional control with the technology and tools required.

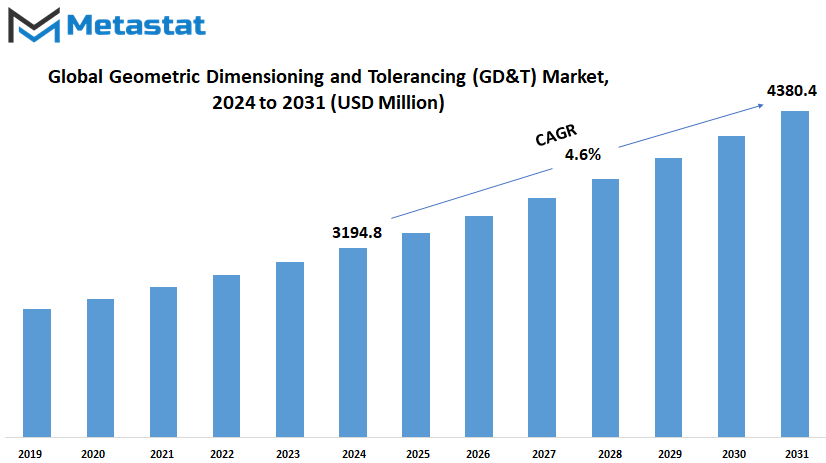

Global Geometric Dimensioning and Tolerancing (GD&T) Solutions market is estimated to reach $4380.4 Million by 2031; growing at a CAGR of 4.6% from 2024 to 2031.

GROWTH FACTORS

The Global Geometric Dimensioning and Tolerancing (GD&T) Solutions market is growing at a high rate based on the promising factors that would shape its future. Presently, several industries are widely realizing the need for accurate measurement and standardization, which further enhances the market for GD&T solutions. It is driven by the increasing demand for precise and effective manufacturing across various sectors.

Rapid advancements in manufacturing technologies-one of the principal growth factors for the GD&T solutions marketManufacturing techniques such as additive manufacturing and automation are gaining greater acceptance and popularization. The dependency of such technologies on the dimensional and tolerance specifications thus becomes critical, so rigorous standards are required so that products can be delivered according to quality and performance expectations. As the manufacturers see the need to put these measures in place properly, the GD&T solutions market will flourish.

The increasing intricacy of products acts as the major market growth influencer as well. Typically, modern products carry sophisticated designs comprising highly diverse parts that must be dimensioned and toleranced with very high accuracy to achieve proper performance. Such intricacy calls for advanced GD&T solutions so that details of such specifications may be managed and communicated effectively, thereby growing the market.

Despite these positive trends, however, there are factors that might impede the growth of the market. One reason is the costliness involved in initiating GD&T solutions. Small manufacturers are especially at risk of being priced out of opportunity by the initiation and training costs that may prove too burdensome to adopt such solutions. The complexity of GD&T systems may also prove a barrier for organizations that do not possess the technical skills to exploit them profitably.

Positive outlook is expected in the GD&T solutions market. There will be a realization of standardization in the industry due to increasing quality control that will add new areas for the expansion of the market. Others such as software and tool technologies that are making GD&T easy and user-friendly are good reasons to expand the market in the future. Companies that introduce ease and lower cost solutions in GD&T implementation will be rewarded at the expense of an evolving marketplace.

The global GD&T solutions market is growing favorably. Developments in manufacturing technologies and the increasing complexity of product technologies are supportive factors for the growth of the industry. Despite a limitation of growth-posed challenges, such as cost, complexity, innovation, and demand for high-quality standards provide significant opportunity for the development of the market over the coming years.

MARKET SEGMENTATION

By Type

The increasing requirement for precision in manufacturing is further propelling the expansion of the Global Geometric Dimensioning and Tolerancing Solutions market. As industries adopt the most advanced technologies like automation and robotics, accurate measurements and precise specifications are becoming ever so essential. Thus, GD&T solutions directly contribute to ensuring consistency and quality in all components-from the automotive, aerospace, to the electronics sector, among others.

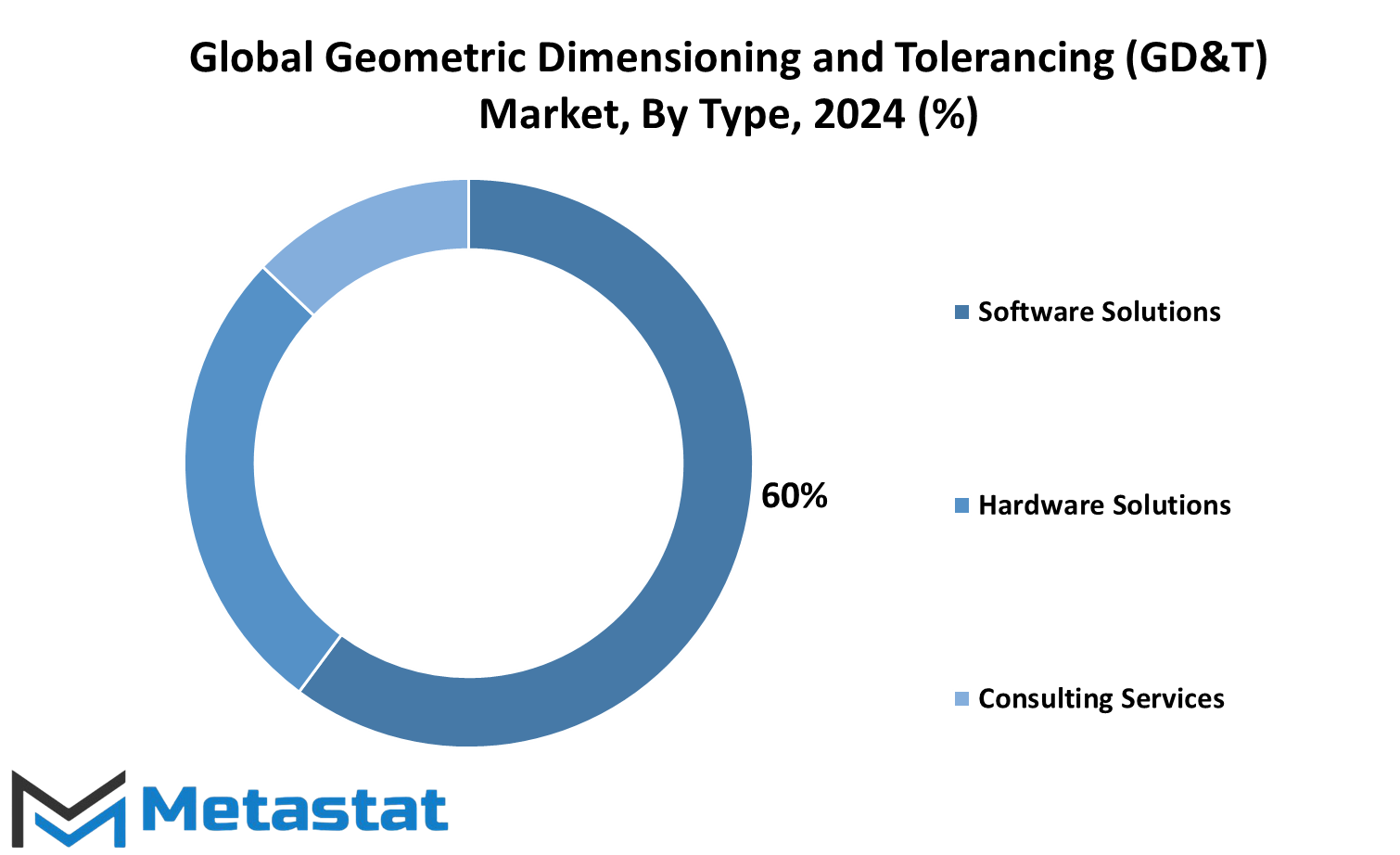

The market can be segmented into many categories based on the kind of solutions offered. Software solutions are becoming important aspects because companies start to use digital tools for their design and manufacturing processes. Such software packages enable the designing engineer to develop, analyze, and interpret very complex geometric specifications with increased ease and accuracy. Such software solutions help in reducing errors and improve communication across teams within a company during production. Obviously, the software portion will progress further by including artificial intelligence and machine learning to become more effective and intuitive tools for the analysis of GD&T.

On the hardware side, this tool remains an important instrument in the measurement and testing of parts. It helps verify whether the tolerance agreed upon was met in the components that were fabricated. As manufacturing technology advances further, hardware solutions would be innovative as well with the adoption of 3D scanning and advanced sensors. This would then make it possible to measure faster and more accurately, thus indirectly fostering more productive production with quality inspection.

Another important portion of the GD&T solutions market constitutes consulting services. Many organizations require professional guidance and advice in order to properly implement the adoption of GD&T within their operations. As more industries become aware of its importance, this consulting service is likely to grow continuously. Consultants give businesses an idea on how to apply the principles of GD&T and ways of improvement and processes, and compliance with industry standards. As new technologies arise, the consultant will advise on the means to integrate them into the current systems.

Going forward, this Global Geometric Dimensioning and Tolerancing (GD&T) Solutions market will continue growing as the demand for accuracy and efficiency in manufacturing increases. Companies will require more advanced tools and technologies to improve precision and accuracy, and opportunities in the market will emerge. Overall, it will first offer enormous potential to those sectors in which precision is a primary consideration. To lead such growth, innovations in software, hardware, and consulting services will spearhead the future of manufacturing.

By Technology

The Global Geometric Dimensioning and Tolerancing (GD&T) Solutions market is changing immensely, mostly due to a number of technological advancements and fast growth in demands within a significant number of industries. One of the markets widely important for maintaining precision and quality in manufacturing and engineering processes is categorized into three types: Software Solutions, Hardware Solutions, and Consulting Services. All these are expected to growth in the future based on their convergence with the future needs and innovations.

The market for GD&T majorly falls under the domain of software solutions. These provide designers with powerful tools, tools for analysis, and verification of geometric dimensions and tolerances. This technology will further be enhanced by incorporating advanced features in software solutions related to enhanced data analytics and artificial intelligence. Simulations might be more accurate, and thus decision-making processes with better accuracy to achieve greater efficiency in the design and manufacturing process.

Hardware solutions are also very important, comprising the application of tools and devices for measuring and checking the physical dimensions and tolerances. With advances in technology, hardware solutions would be more accurate as well as easy to use. Advancements in sensor technology, measurement devices, and more will provide better accuracy as well as speed in results. This is going to be highly required for those sectors that require more accuracies, like aerospace and automotive manufacturing.

Consulting services in the GD&T market advise and assist companies in the implementation and optimization of current practices of GD&T. The consulting need in industries is bound to grow with the advent of new technologies and updated standards. Under new technologies, consultants will be the guiding force for businesses to shift along with the change and stay updated in order to realize full benefits from GD&T practices. The demand of these services is bound to grow due to the fact that companies have to stay ahead and comply with the latest environment.

The future prospects for the Global Geometric Dimensioning and Tolerancing (GD&T) Solutions market shall be developed further with sustained growth and change. Improvement in the software and hardware technology will enhance the accuracy and efficiency required, while consulting services shall further help businesses adjust to new challenges and opportunities. This shift would make the GD&T market increasingly work to ensure the quality and precision of the products belonging to several industries.

By Enterprise Size

The Global Geometric Dimensioning and Tolerancing (GD&T) Solutions market is one of the key sectors in the precision engineering industry, which has numerous growth and transformative impacts across its spectrum. As industries advance, the role of GD&T solutions becomes more crucial. These are needed products that would fulfill strict specifications and quality standards, priorities of any competitive position in this market.

As far as size is concerned, the market undeniably distinguishes between SMEs and Large Enterprises. Both segments approach the GD&T solutions differently, since the needs and the scope of the problem of SMEs vary with those of large enterprises.

Cost and adaptability are the two prominent focus areas of SMEs. SMEs have fewer resources than Large Enterprise companies and require cost-effective, scalable, and adaptable solutions for GD&T. This area requires extremely user-friendly and flexible GD&T tools, as SMEs require solutions that are rapidly integrable and do not involve an outlay of finances. Progress in this area of cloud-based GD&T solutions can be expected to drive growth in this segment because the solutions allow for lower up-front costs as well as easy scaling. This is also enabling SMEs to remain competitive, as they ensure that their products may comply with international standards without necessarily developing major in-house capabilities related to the use of advanced GD&T tools.

Large Enterprises can afford to invest in advanced solutions of GD&T. Such companies need performance tools to be able to handle complex geometrical specifications and complement other enterprise systems seamlessly. Its support for extensive data analysis and reporting capabilities will be a must in the management of large volumes of data taken from all production runs, as well as high precision accuracy across different product lines; hence, Large Enterprises require GD&T solutions that support multiple languages and that are aligned with various international standards as they spread out to the global market. Ahead of the curve, the future of this Global GD&T Solutions market will be determined by technological innovation and industry needs. The growth in artificial intelligence and machine learning may position the GD&T tools on a more complex and predictive platform for the automatic determination of errors. More stress on sustainability and on sustainable environmental issues will push the need for more efficient and less wasteful GD&T solutions.

The global geometric dimensioning and tolerancing solutions market is ready to grow and diversify further, where segments will have different opportunities and challenges in front of them-one that is distinct for small and medium-sized enterprises and large enterprises. Advancements in technology are going to further improve the ability to meet stringent quality standards and remain competitive in the international market.

By End-Users

The Global Geometric Dimensioning and Tolerancing (GD&T) Solutions market is set to experience significant growth and transformation as it adapts to the changing needs of various industries. By examining the end-users of GD&T solutions, it becomes evident that each sector will play a pivotal role in shaping the future of this market.

The automotive industry is a major driver in the GD&T solutions market, given its continuous pursuit of precision and efficiency. With advancements in vehicle technology, including electric and autonomous vehicles, automotive manufacturers require increasingly accurate measurement and tolerance standards. The evolution of automotive design and production methods will likely push the demand for sophisticated GD&T solutions, ensuring that components meet stringent performance and safety standards.

In the aerospace and defense sector, the importance of GD&T solutions cannot be overstated. This industry relies heavily on precise engineering and manufacturing to meet the rigorous demands of aircraft and defense systems. As technology advances, including the development of more sophisticated aerospace systems, the need for detailed and reliable GD&T solutions will grow. Innovations such as lightweight materials and complex geometries will necessitate advanced GD&T tools to ensure components fit together correctly and function as intended.

Industrial manufacturing will also drive growth in the GD&T solutions market. As manufacturers adopt more automated and advanced production techniques, the need for precise dimensional control will become even more critical. GD&T solutions will help manufacturers maintain high-quality standards and reduce errors, supporting the industry’s shift toward smart manufacturing and Industry 4.0.

The healthcare and medical devices sector presents another significant opportunity for GD&T solutions. The growing complexity of medical devices and equipment, driven by technological advancements and personalized medicine, will require precise measurement and tolerance standards. GD&T solutions will help ensure that medical devices meet the necessary specifications and perform reliably, ultimately improving patient outcomes.

Electronics and semiconductors, too, will influence the GD&T solutions market. As electronic devices become smaller and more intricate, maintaining precise dimensions and tolerances is essential for ensuring their functionality and reliability. GD&T solutions will play a crucial role in meeting the demanding specifications of modern electronic components.

The energy and utilities sector, encompassing both traditional and renewable energy sources, will benefit from GD&T solutions as well. The development and maintenance of infrastructure, from power plants to wind turbines, require rigorous dimensional control to ensure operational efficiency and safety.

Other sectors not specifically mentioned will also contribute to the growth of the GD&T solutions market. Each industry will have unique requirements for geometric dimensioning and tolerancing, but all will benefit from advancements in this technology. As industries continue to evolve and embrace new technologies, the demand for precise and reliable GD&T solutions will increase, driving innovation and growth across the market.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$3194.8 million |

|

Market Size by 2031 |

$4380.4 Million |

|

Growth Rate from 2024 to 2031 |

4.6% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The Global Geometric Dimensioning and Tolerancing (GD&T) Solutions market is experiencing significant changes as it evolves across different geographical regions. This market is segmented into several key areas: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these regions has its own unique characteristics and growth drivers, which will shape the future of GD&T solutions.

In North America, the market is further divided into the U.S., Canada, and Mexico. The U.S. remains a dominant force in the GD&T solutions market due to its advanced manufacturing sector and high demand for precision engineering. Canada and Mexico also contribute significantly, with Canada focusing on high-tech industries and Mexico increasingly becoming a hub for manufacturing and assembly.

Europe includes major markets such as the UK, Germany, France, Italy, and the Rest of Europe. Germany and the UK are notable for their strong industrial bases and emphasis on engineering excellence. France and Italy also play crucial roles, with France investing in technological advancements and Italy focusing on high-quality manufacturing processes. The Rest of Europe reflects a diverse range of smaller but growing markets that contribute to the region's overall growth.

Asia-Pacific is a dynamic region with rapid industrialization and technological advancements. This area is divided into India, China, Japan, South Korea, and the Rest of Asia-Pacific. China stands out as a major player, driven by its vast manufacturing sector and increasing adoption of advanced GD&T solutions. Japan and South Korea are leaders in technology and precision engineering, while India and the Rest of Asia-Pacific are catching up with significant investments in industrial growth and technology.

South America includes Brazil, Argentina, and the Rest of South America. Brazil and Argentina are central to this region, with Brazil's expansive industrial base and Argentina's growing technological sector. The Rest of South America features emerging markets with increasing interest in GD&T solutions as they develop their manufacturing capabilities.

The Middle East & Africa is segmented into GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa. The GCC Countries, including Saudi Arabia and the UAE, are investing heavily in infrastructure and advanced technologies. Egypt and South Africa are making strides in industrial development, while the Rest of Middle East & Africa includes various emerging markets with a growing focus on GD&T solutions.

Overall, the Global Geometric Dimensioning and Tolerancing (GD&T) Solutions market is set for growth across all regions. Each geographical area will contribute to the market's expansion through their unique industrial capabilities and technological advancements, creating a diverse and robust global market.

COMPETITIVE PLAYERS

The Global Geometric Dimensioning and Tolerancing (GD&T) Solutions market is witnessing a dynamic shift as key players continue to evolve and adapt to changing industry demands. This market is shaped by a range of prominent companies that are leading the way in advancing GD&T solutions. As we look towards the future, it is evident that these players will play a significant role in shaping the landscape of GD&T technologies.

PTC Inc., a major contender in this sector, is known for its innovative approaches in design and engineering software. Their offerings will likely continue to enhance the precision and efficiency of GD&T applications. Siemens AG, with its strong foothold in automation and digitalization, is expected to drive advancements in GD&T through its extensive range of engineering solutions.

Dassault Systèmes is another key player whose expertise in 3D design and simulation will significantly influence GD&T practices. Their solutions are anticipated to offer enhanced capabilities for complex dimensional and tolerancing tasks. Autodesk Inc., renowned for its design software, will contribute to the market with tools that streamline GD&T processes and improve overall design accuracy.

Hexagon AB, known for its metrology and inspection technologies, is poised to offer cutting-edge solutions in GD&T. Their focus on precision measurement will likely push the boundaries of what is achievable in the market. Carl Zeiss AG, with its expertise in optical measurement, will continue to impact GD&T through high-precision tools and systems.

Mitutoyo Corporation, a leader in measurement instruments, will maintain its role in providing reliable and accurate GD&T solutions. Nikon Metrology Nv is expected to advance the market with its sophisticated imaging and measurement technologies. FARO Technologies, Inc., with its focus on 3D measurement and imaging, will play a crucial role in enhancing GD&T capabilities.

Renishaw plc, known for its precision measurement and manufacturing technologies, will continue to drive innovation in GD&T solutions. Their commitment to high-quality measurement tools will support the ongoing development of the market.

In the coming years, these companies will likely push the boundaries of GD&T solutions, incorporating new technologies and methodologies to meet evolving industry standards. The competitive landscape of the Global Geometric Dimensioning and Tolerancing (GD&T) Solutions market will be shaped by these players as they work towards creating more advanced, efficient, and accurate tools for dimensional measurement and tolerancing.

Geometric Dimensioning and Tolerancing (GD&T) Solutions Market Key Segments:

By Type

- Software Solutions

- Hardware Solutions

- Consulting Services

By Technology

- 2D Solution

- 3D Solution

By Enterprise Size

- SMEs

- Large Enterprises

By End-Users

- Automotive

- Aerospace & Defense

- Industrial Manufacturing

- Healthcare & Medical Devices

- Electronics & Semiconductors

- Energy & Utilities

- Others

Key Global Geometric Dimensioning and Tolerancing (GD&T) Solutions Industry Players

- PTC Inc.

- Siemens AG

- Dassault Systèmes

- Autodesk Inc.

- Hexagon AB

- Carl Zeiss AG

- Mitutoyo Corporation

- Nikon Metrology Nv

- FARO Technologies, Inc.

- Renishaw plc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252