Global Gas Turbine Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

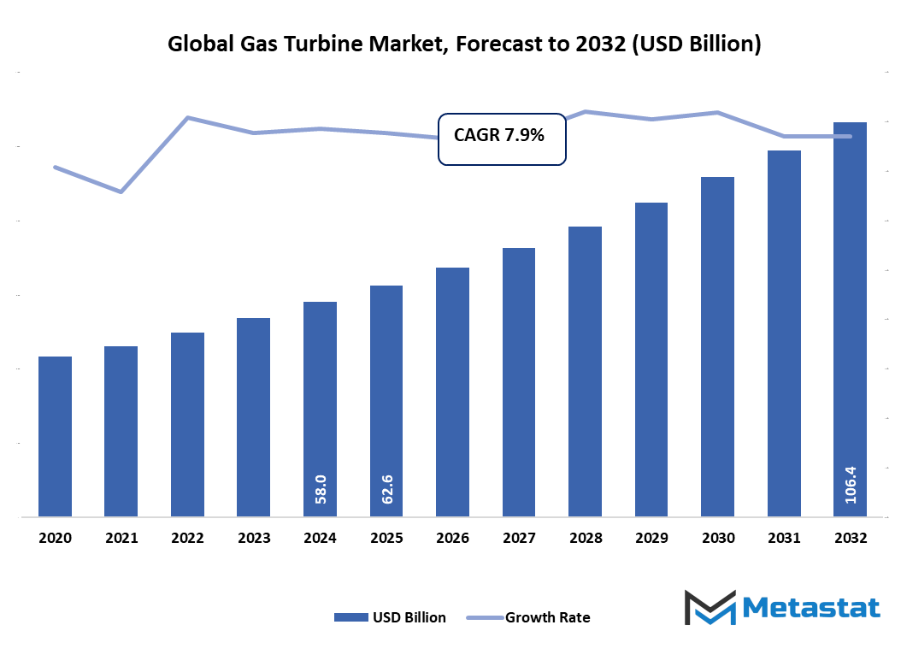

- Global gas turbine market valued at approximately USD 62.6 million in 2025, growing at a CAGR of around 7.9% through 2032, with potential to exceed USD 106.4 million.

- Combined Cycle account for a market share of 79.0% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing demand for efficient power generation systems, Rising adoption of gas turbines in aviation and defense sectors

- Opportunities include: Advancements in hybrid and renewable-integrated turbine technologies present new opportunities

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

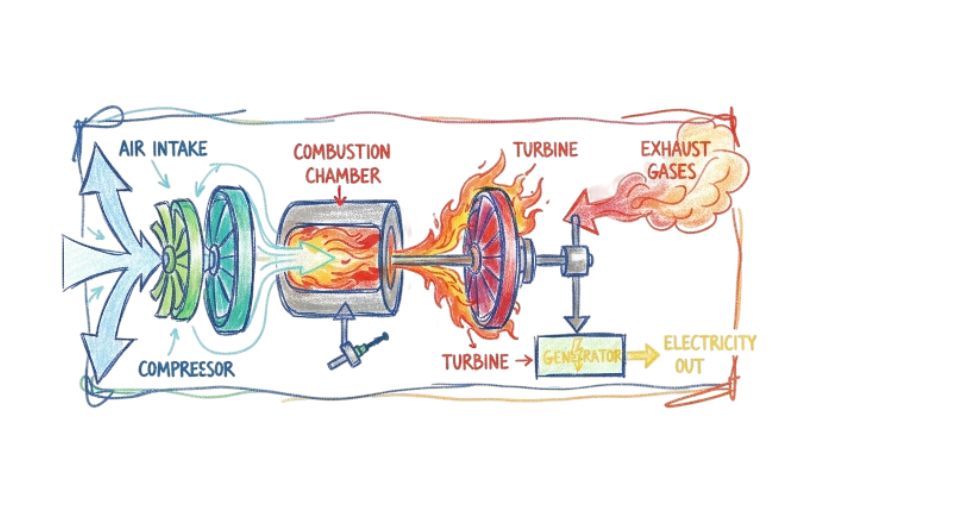

The global gas turbine market will be a vital part of the energy and power generation industry along with the high-efficiency turbines segment which will be utilized mainly for the production of electricity, industrial power, and aviation. The market will cover a spectrum of gas turbines single, double, and mixed-fuel set-ups that will be operable on natural gas, syngas, or dual-fuel enabling energy producers to have dependable and flexible energy outputs. It is expected that gas turbines will become important mechanical solutions for the power plant, industry, and driving applications and thus will provide features like short time for reaching the operating mode, high performance of operation, and compatibility up with renewable energy sources as hybrid energy systems.

The emphasis, as usual, will be on innovations in the design, usage of materials, and cooling technologies for extending the thermal efficiency limit, reducing pollutants, and elongating the useful life of a gas turbine. Intelligent monitoring systems and timely repair/makeover solutions will be a part of turbine operations thus will allow turbine managers to regulate performance, foresee faults, and reduce downtime to the minimum level. Consequently, these changes will be a back-up of meeting with stricter environmental regulations, particularly in places geographically located and such as areas reducing carbon emissions and opting for cleaner energy production.

Market Segmentation Analysis

The global gas turbine market is mainly classified based on Type, Fuel Type, Capacity, End-User Industry.

By Type is further segmented into:

- Combined Cycle: CNGs (Combined cycle gas turbines) will be the main cause of a large part of the global gas turbine market, as they are more efficient and have less emissions. In these systems, the waste heat is extracted from the GT and used for producing additional power. Thus, these systems are the best choice for power generation from large-scale and for the usage of the industrial sector.

- Simple/Open Cycle: Simple or open cycle gas turbines are mainly used in peaking power plants and industrial applications where a quick start-up and operational flexibility are required. These turbines have the advantage of lower capital costs and are appropriate for short-term or intermittent power generation.

- Cogeneration/CHP: Combined heat and power (CHP) or cogeneration gas turbines will be leveraged to produce both electricity and thermal energy at the same time. These installations lead to higher overall energy efficiency and lower operational costs thus, they become the first choice for the industrial facilities and commercial establishments which are striving for the sustainable energy solutions.

By Fuel Type the market is divided into:

- Natural Gas: Natural gas is likely to continue to be the leading fuel mainly because of its plentiful supply, less carbon emissions, and overall cost-effectiveness. It is the leading option for the energy sector and industrial application, as it allows high-efficient utilization through combined cycle and open cycle turbines.

- Liquid Fuels (Diesel/Kerosene/LPG): It is expected that liquid fuels like diesel, kerosene, and LPG will be the main energy sources in areas where the natural gas network is still not sufficiently developed. These types of fuels grant the operator local flexibility for faraway off-grid places, so the energy supply is reliable enough for industrial, marine, and backup uses.

- Other Fuel Types (Hydrogen, Biogas): Industries adopting sustainable energy will propel the hydrogen and biogas sectors to prominence in the future. The two fuels cut carbon emissions and assist in green agendas, giving the gas turbine manufactures who are into eco-friendly solutions, the chance to expand further.

By Capacity the market is further divided into:

- Below 30 MW: Turbines with less than 30 MW will be dedicated to small-scale power generation, energy systems with distributed generation, and industrial plants. These machines are excellent for local electricity generation and can work on demand and satisfy fluctuating consumption.

- 31 to 120 MW: The medium power consisting of turbines with capacities ranging from 31 to 120 MW will be the focus of the regional power plants and their respective industrial facilities. These energy solutions will showcase the balance brought about by the aspects of efficiency, cost and scalability for various applications across emerging and developed markets.

- Above 120 MW: The big energy production projects will be the main arena for high-capacity turbines with over 120 MW, including those at the utility-scale level. They will target on collaborate with combined cycle or cogeneration systems to achieve the highest efficiencies, reliability, and integration.

By End-User Industry the global gas turbine market is divided as:

- Power: The power sector will be the major end-user of gas, employing these turbines for base load, peak, and combined cycle power plants. In such a way, the turbines will accomplish the function of stabilizing the grid, easing the penetration of renewables, and generating electricity efficiently.

- Oil and Gas: Oil and gas industry turbines will be primarily in support for onsite power, mechanical drive applications, and pipeline compression. Fossil fuel-powered-plants with strict reliability and fuel flexibility requirements in remote and harsh conditions are where such turbines will fit.

- Other End-user Industries (Industrial, Marine): Other non-energy sectors such as the marine and industrial spheres might incorporate gas turbines in their respective combined heat and power, propulsion, and niche industrial applications, thus making use of flexibility, efficiency and curtailing the issue of operational downtime.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$62.6 Million |

|

Market Size by 2032 |

$106.4 Million |

|

Growth Rate from 2025 to 2032 |

7.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

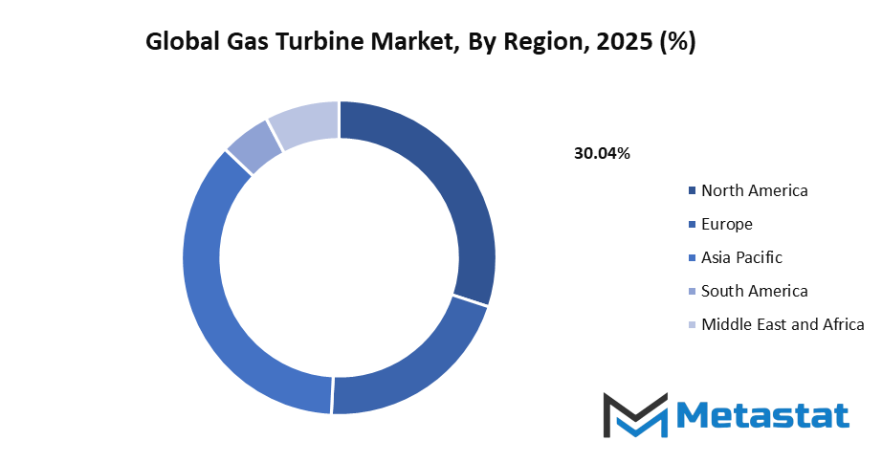

By Region:

The Gas Turbine Market across the world will have different impacts in different regions where these effects will be influenced by factors such as the state of energy infrastructures, industrial demand and the willingness to adopt advanced power technologies. It has been noticed that the United States, Canada, as well as Mexico that form the whole of North America, will always be the first among the turbine adopters. That will, undoubtedly, be the outcome of their already existing power generation infrastructure, high levels of industrial activities, and the general trend of involving energy solutions which are both efficient and flexible in utility.

Operators in the area are going to be increasingly making use of gas turbines for power coming off utilities but also for the application of industry. Thus, they will be focusing on efficiency in conjunction with the rapid due to fluctuation of energy demand, responsiveness.

Europe which includes the UK, Germany, France, Italy, and the rest of the continent will be very active users because of rigorous environmental regulations, the shift towards a low carbon-emission energy system, and the ongoing updates of the current thermal power plants. In the continent, gas turbines will be used not only to produce electricity but also for the combined heat and power (CHP) sector, something which will make industries as well as urban centers take energy efficiency to the maximum and at the same time lower their operational emissions.

In the next couple of years, the Asia-Pacific area which comprises India, China, Japan, South Korea, and other close-by countries will be the fastest-growing region with a high demand for energy and thus, industrialization and investments in the power infrastructure will naturally follow. If we look at the market in South America, it will move quite slowly, in the first place, led by Brazil and Argentina, among others. Urbanization in the Middle East & Africa area including the GCC countries, Egypt, and South Africa will be the key factors that will drive the global gas turbine market in the area, apart from the general infrastructure development, industrial growth, and government promotion of efficient energy production as a result of the initiative.

The global gas turbine market will be helping in accommodating power generation and industrial needs that are unlike anywhere else in the world. It will however be a major player in achieving not only diverse needs but also for providing reliable, flexible, and cleaner energy solutions in all regions.

Market Dynamics

Growth Drivers:

- Growing demand for efficient power generation systems: The increasing need for energy systems that are efficient can be the main factor driving the global gas turbine market in the future. In this case, gas turbines have given high efficiency and reliability along with rapid starting capability (both in base load and peak load applications). In order to cope with the soaring need for electricity while still being able to maintain the energy efficiency and the operational flexibility, the utilities and the industrial facilities are increasingly turning to these kinds of systems.

- Rising adoption of gas turbines in aviation and defense sectors: Moreover, the growing use of gas turbines in the sectors of aviation and defense has been one of the major growth drivers of the global gas turbine market. Besides the high power to weight ratio, turbines provide an excellent feature of durable performance even in harsh surroundings. They are, therefore, completely necessary to airplane propulsion and naval applications. All over the world defense infrastructure expansion and military fleets being modernized will become the areas from which the deployment of turbines in specialized applications beyond traditional power generation will be further encouraged.

Restraints & Challenges:

- High initial installation and maintenance costs hinder adoption: The huge initial installation, great maintenance costs, high capital investment are still the major shackles restraining the competiveness of the global gas turbine market. The complex installation process and the ongoing maintenance that goes on may limit the technology, especially, in the small and medium enterprises or emerging markets, which are mostly facing budget constraints.

- Environmental concerns over carbon emissions limit market growth: Moreover, fears about greenhouse gas emissions are a major obstacle to the market's expansion. Specifically, gas turbines, and more so those that rely on fossil fuel combustion, are contributors to the emission of greenhouse gases. It is quite plausible that the implementation of strict regulatory standards, accompanied by the increasing advocacy for clean energy, could collectively depress the uptake of traditional gas turbine-powered solutions, manufacturers thus being compelled to mobilize to assure they are producing cleaner alternatives.

Opportunities:

- Advancements in hybrid and renewable-integrated turbine technologies present new opportunities: Hybrid and renewable-integrated turbine technologies' progress takes the market to new heights. To begin with the combining of a gas turbine with renewable energy sources such as the sun or the wind can offer several advantages which include but are not limited to grid stability and carbon footprint reductions. The breakthroughs in hydrogen-fueled turbines, biogas integration, and the upgrading of combined-cycle configurations force the manufacturers and utilities to bring high-efficiency solutions to the market that are sustainable, which in turn makes the market grow long-term.

Competitive Landscape & Strategic Insights

The global gas turbine market will comprise both traditional multinational corporations and new regional players, which will spark the competition between them tremendously. The outcome of this competition will be beneficial for the consumers as they will receive products of better quality and at more reasonable prices. The main competitors will be companies that belong to the group of the largest and the most technologically advanced ones such as General Electric Company, Siemens Energy AG, Mitsubishi Heavy Industries Ltd, Kawasaki Heavy Industries Ltd, Ansaldo Energia SpA, MAN Energy Solutions SE, Wartsila Corporation, Rolls-Royce Holdings plc, and Solar Turbines Incorporated. Their advanced turbine designs, high-efficiency solutions, and extensive global service networks will be one of the main reasons for continuous setting of industry benchmarks. These companies will be committed to delivering turbines that are scalable, reliable, and environmentally compliant, which would be further used in power generation, industrial, and mechanical drive applications.

They will be accompanied by regional and emerging competitors such as Capstone Green Energy Corporation, Doosan Škoda Power, IHI Corporation, Bharat Heavy Electricals Limited, Harbin Electric Co Ltd, Shanghai Electric Group Co Ltd, OPRA Turbines BV, Baker Hughes Company, Vericor Power Systems LLC, Zorya-Mashproekt, and Nanjing Turbine & Electric Machinery Group, who will be able to attract more customers as a result of offering highly specialized solutions, services that match the local conditions, and technologies that are cost-competitive. Their core business operations will revolve around the areas of turbine efficiency, emissions reduction, and the provision of predictive maintenance solutions to meet the operational and environmental needs of varied end-users.

The main elements of strategy in the market will be the need for the permanent introduction of new products and the establishment of partnerships with energy providers, in addition to using digital monitoring and predictive analytics. The companies will work hard on gaining a stronger foothold in the regional market, upgrading their service offerings, and launching high-efficiency low-emission turbines to keep up with the competition. As a matter of fact, the global gas turbine market will still be an arena for the competition as the technological advancement, operational efficiency, and environmental compliance will be the main criteria for taking the lead and achieving success in the sector.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 62.6 million in 2025 to over USD 106.4 million by 2032. Gas Turbine will maintain dominance but face growing competition from emerging formats.

With the development of the global gas turbine market, the energy suppliers and industrial operators will be able to provide just the right amount of demand that suits efficiency operations and environmental sustainability. Gas turbines will be at the heart/decentralized power generation, combined heat and power (CHP) systems, and grid stability solutions. Through the use of technological advancement, operational flexibility, and regulatory adherence, the market will alter the manner in which energy is generated, ushering in a worldwide transition to more resilient and efficient power infrastructure.

Report Coverage

This research report categorizes the global gas turbine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global gas turbine market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global gas turbine market.

Gas Turbine Market Key Segments:

By Type

- Combined Cycle

- Simple/Open Cycle

- Cogeneration/CHP

By Fuel Type

- Natural Gas

- Liquid Fuels (Diesel/Kerosene/LPG)

- Other Fuel Types (Hydrogen, Biogas)

By Capacity

- Below 30 MW

- 31 to 120 MW

- Above 120 MW

By End-User Industry

- Power

- Oil and Gas

- Other End-user Industries (Industrial, Marine)

Key Global Gas Turbine Industry Players

- General Electric Company

- Siemens Energy AG

- Mitsubishi Heavy Industries Ltd

- Kawasaki Heavy Industries Ltd

- Ansaldo Energia SpA

- MAN Energy Solutions SE

- Wartsila Corporation

- Rolls-Royce Holdings plc

- Solar Turbines Incorporated

- Capstone Green Energy Corporation

- Doosan Škoda Power

- IHI Corporation

- Bharat Heavy Electricals Limited

- Harbin Electric Co Ltd

- Shanghai Electric Group Co Ltd

- OPRA Turbines BV

- Baker Hughes Company

- Vericor Power Systems LLC

- Zorya-Mashproekt

- Nanjing Turbine & Electric Machinery Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252