MARKET OVERVIEW

The global gas separation membrane market, the most recent publication made available by Metastat Insight, examines trends through mapping how procedural operations, industrial uses, and material advancements are shaping the direction of this industry. The application of membranes in the separation of gases has become an industry staple within numerous industrial settings, particularly where purity, efficiency, and compact solutions are demanded. These membrane systems have gained traction in industries where traditional separation techniques might not provide the optimal combination of output and operating flexibility. Their capacity for backing particular processes without overly extensive infrastructure has made them an attractive choice for plants seeking to simplify and update their operations.

Year by year, the demand for membrane-based technologies has increased further with the requirement for systems that are simpler yet effective. Unlike complicated equipment setups, gas separation membranes offer a cleaner and more accessible path towards the treatment of different gas mixtures. Applications that demand careful gas control—like fuel processing, chemical production, or environmental management—tend to resort to these solutions as a means of facilitating consistency in their products. Not just the footprint of these systems makes them attractive but also their flexibility to various scales of operation, thus addressing a broad set of industrial requirements.

The technology behind these membranes keeps advancing, with materials being engineered to hold up against challenging conditions yet still perform well. Engineers and scientists consider durability, fouling resistance, and selectivity to ensure systems are productive for long periods. Every membrane layer has a specific function in terms of flow regulation and separation, and great efforts have been directed towards guaranteeing these pieces perform under actual stress conditions. This has enabled users across a wide range of industries to trust these systems with increasing confidence in their ability to remain functional in extreme conditions.

Supply chain dynamics affect the manner in which the global gas separation membrane market functions. From procuring the materials that are utilized in membrane manufacturing to delivering finished systems to industrial customers, every step of the supply chain must be synchronized to provide dependability. Stakeholders in this market are prioritizing predictability in their procurement and shipping in order to decrease disruptions. In response, customers are more focused on partners who are not only able to provide product consistency but also logistical reliability, so delivery timeframes and availability of services become valuable indicators when assessing providers.

System integration, meanwhile, has become more advanced, with plants wanting to integrate membrane technologies easily into their existing systems. Whether retrofitting existing plants or constructing new units from the ground up, there's a concerted focus on ensuring compatibility and seamless operation between elements of the production environment. The customization flexibility of membrane systems contributes to their attractiveness here, enabling operators to tailor configurations that precisely meet their specific process requirements. This capability to shape solutions in accordance with specific operating patterns contributes a further level of usefulness to the technology, allowing it to acquire traction in industries which appreciate accuracy and efficiency.

Maintenance and operational management have also changed with these technologies. Businesses are targeting systems which need less interference while providing consistent performance. The long lifespan of membranes, coupled with reduced maintenance procedures, enables operators to spend more time on strategic activities instead of continuous troubleshooting. Built-in monitoring tools now provide real-time data that enables users to identify minor faults before they develop into major issues. This active management approach is particularly important in facilitating uniform output at reasonable operational costs.

Sustainability is becoming an integral part of the larger discourse around industrial processes, and membrane technologies are in the sights for their possible contribution to making that shift. Their relatively low energy demand in relation to more conventional separation technologies makes them particularly well-suited for situations where efficiency is tightly measured. In those processes with a longer-term vision for minimizing emissions or waste, these technologies fit into those efforts without necessitating wholesale redesigns of current processes. This compatibility with continued sustainability goals lends another level to discussion of the long-term sustainability of membrane systems.

Market observers are not only monitoring the technical elements of the global gas separation membrane market but also observing closely at the behaviors of users. Various regions may emphasize different operational results, and manufacturers of membranes are challenged to meet these regional subtleties. Whether the nature of gas being treated or environmental demands related to particular geographies, there is a growing necessity to customize offerings to accommodate diverse conditions. Such sensitivity to the needs of others ensures that solutions from membranes that are floating around are not one-size-fits-all but expertly chosen for their respective applications, indicative of an industry in tune with its consumers.

The report focused on the global gas separation membrane market as reported by Metastat Insight illustrates how this area is evolving as a response to sophisticated industrial needs. The balance of technology, efficiency, and customization has created membrane-based systems as an attractive option for buyers looking for customized gas separation solutions. With ongoing improvement of materials, wiser integration, and increasing alignment with operational goals, these systems are set to continue at the forefront in a variety of applications. As industries strive for compromise between performance and simplicity, the inclusion of membranes within this range continues to widen, providing clarity and function in operations requiring both precision and dependability.

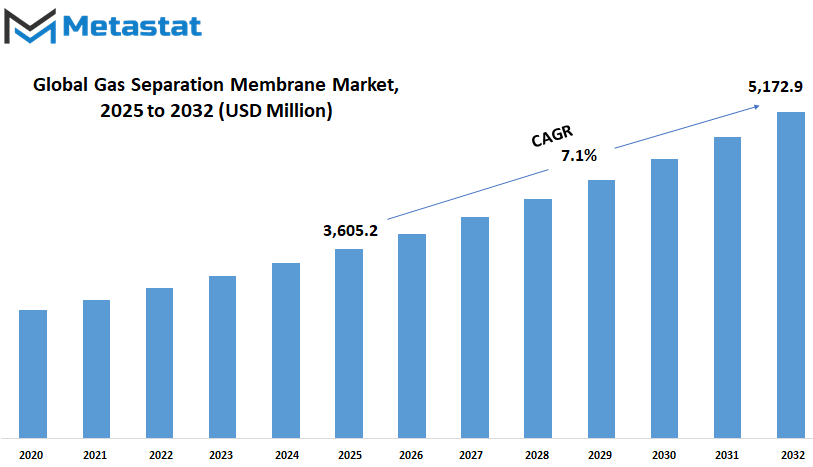

Global gas separation membrane market is estimated to reach $5,172.9 Million by 2032; growing at a CAGR of 7.1% from 2025 to 2032.

GROWTH FACTORS

The global gas separation membrane market is predicted to experience steady growth over the next few years. This trend will be promoted by an increased emphasis on cleaner energy and better gas processing technologies. Most industries are now gravitating toward technologies that are efficient as well as eco-friendly. As the demand for natural gas grows and nations attempt to minimize their carbon footprint, the demand for improved gas separation techniques will also grow. These membranes separate gases like carbon dioxide, nitrogen, and methane. They are crucial in the refining of natural gas, hydrogen production, and in clean energy applications.

One of the principal drivers of the global gas separation membrane market is the increased pressure to reduce greenhouse gas emissions. Governments and industry are striving to comply with tighter regulations on air pollution and climate change. The use of membrane technology will aid this goal by providing a cost-efficient and energy-saving solution to conventional methods. One of the key drivers that will aid in the growth of the market is the growing application of this technology across the food and beverage, electronics, and medical industries, where gas purity is essential.

There are, however, some issues that may hinder market growth. Some of the key concerns include the substantial initial investment needed in order to install membrane systems. Most of the companies are still reluctant to invest heavily in finances, particularly with uncertain economic times. There is another possibility of a membrane's limited lifespan and fouling, which may impair their functioning and result in extra maintenance expenses. All these problems can keep certain industries from using the technology in a large way.

In spite of all these problems, there is still much scope for the global gas separation membrane market. Progress in material science will yield more effective and long-lasting membranes. These advances may minimize the need for maintenance and increase life duration, thus becoming more attractive to more industries. Furthermore, increasing interest in hydrogen as a source of energy is likely to bring new horizons. Membranes find application in hydrogen production and purification and are likely to grow in the next few years.

With increased investment in research and governments' support, the global gas separation membrane market has the potential to become a vital component of future energy infrastructure. With industries shifting towards cleaner and more intelligent solutions, these membranes will have a more prominent role and aid in the development of a more sustainable future.

MARKET SEGMENTATION

By Application

The global gas separation membrane market is likely to be a major influencer in determining the way industries treat gases in the years to come. The membranes find applications in several processes that isolate certain gases from mixtures, hence improving industrial operations and their ecological-friendliness. With increasing worries over energy consumption and emissions, businesses will seek more efficient means of treating gas separation, and this market will provide viable solutions.

Among the most important areas gas separation membranes are impacting is nitrogen production and enrichment of oxygen. Both are increasingly being used in healthcare, food storage, and industrial production. Industries can conserve energy and save money by utilizing membranes to isolate nitrogen and oxygen. As the technology is made more efficient, it will take over from the older and wasteful methods.

Another expanding field is the recovery of hydrogen. With more cleaner fuels being developed and hydrogen increasingly becoming important, recycling and capturing it will become imperative. Hydrogen recovery from gas streams is facilitated by membranes, which minimize loss and maximize supply. This method not only contributes to green energy initiatives but also reduces manufacturing costs in processes where hydrogen is utilized on a continuous basis.

Carbon dioxide removal is another primary application for gas separation membranes. With the increasing emphasis on emissions control, numerous businesses are looking to membrane technology in order to reduce their carbon footprint. The membranes can be used to filter out carbon dioxide from industrial flue gases or natural gas, assist in complying with environmental regulations while maintaining operations at a high level of efficiency.

Vapor and gas separation, as well as vapor/vapor separation, increasingly play a crucial role in refining and chemical production. Such processes assist in controlling the flow of gases and vapors more accurately, resulting in improved product quality and minimal waste. As industries gear up towards intelligent systems, the necessity for efficient separation techniques will continue to increase.

Dehydration of air is another worthwhile usage, particularly in an environment where humidity can ruin equipment or impact product quality. Membrane removal of water from air serves to provide consistent performance and prolong equipment life. This is quite useful in compressed air systems and other controlled environments.

H2S removal is essential in oil and gas production because hydrogen sulfide is toxic as well as corrosive. Membrane systems can be used to remove this gas safely, safeguarding people and equipment. With industries demanding cleaner and more efficient solutions, the global gas separation membrane market will continue to grow on the back of practical needs and constant innovation.

By Material Type

The global gas separation membrane market will continue to grow as businesses look for more efficient and environmentally friendly means of dealing with gases. It is used in the separation of gases from mixtures in many industrial operations, such as the removal of carbon dioxide, natural gas processing, and hydrogen recovery. With greater recognition of the environment and the need for sustainable solutions, businesses are beginning to appreciate the benefits of these membranes. They not only contribute but also support emission reduction and energy efficiency initiatives.

By material type, the global gas separation membrane market is divided into Polymide and Polyaramide, Polysulfone, Cellulose Acetate, and others. Each of them possesses some advantages that coincide with some applications. Polymide and Polyaramide membranes are chemical and heat resistant, thereby proving to be an ideal choice in harsh industrial conditions. Their ability to function under pressure makes sure they deliver consistent results even when working for long periods. Polysulfone is, however, appreciated for mechanical strength and stability. It is suitable where durability and performance are needed in the working process. Cellulose Acetate, although a little older in usage, remains viable due to it being easy to produce and efficient in natural gas processing. The remaining materials come into play when new requirements are being made and customized solutions are required.

The future of the industry will be shaped by advancements in material science and technology. As businesses bear more of the burden of adhering to environmental legislation, gas separation membranes will be a key part of their operations. Researchers are already considering how to make these membranes even more selective and durable. Future designs can offer faster processing, less waste, and greater flexibility, which will be useful in industries with more complicated gas mixtures. Greater emphasis is also being placed on the application of these membranes to enable cleaner energy solutions, such as hydrogen fuel and carbon capture systems.

Companies and researchers are working together to make more possible with gas separation membranes. As longer-term cleaner production and sustainability receive more attention, there will be increased demand for high-technology gas separation materials. Demand will lead to new uses and ongoing innovation in the field. Thus, the global gas separation membrane market will remain important to allow industries to meet both performance and environmental goals.

By Module

The global gas separation membrane market is anticipated to rise steadily because of the growing need for energy-saving and green technologies. The membranes are central in separating gases from mixtures across various industries such as the oil and gas, chemical processing, and environmental management sectors. With the emphasis on sustainability increasing, the demand for clean sources of energy and emissions control keeps on rising. This transition will be expected to drive businesses to embrace gas separation membranes more increasingly, particularly in areas where conventional means are too costly or no longer feasible.

In the future, developments in material science will bring about the development of more resilient, affordable, and efficient membranes. Consequently, industries will gravitate towards solutions that enable faster and more precise separation of gases. This change will not just enhance performance but also decrease energy usage. Additionally, governments globally are set to encourage efforts that lower greenhouse gases. This encouragement is going to come in policy modification or funding, further spurring growth in this market.

When the market is analyzed in terms of the type of module employed, there are a number of types to mention: Spiral Wound, Hollow Fiber, Plate and Frame, and so on. Spiral Wound modules are preeminent for their compact construction and high surface area, which makes them valuable in applications where space is scarce. Hollow Fiber modules provide flexibility and can deal with large gas volumes. Their design allows them to be used in different industrial applications with ease. Plate and Frame modules are typically chosen for their ease of maintenance and ability to be customized for specific needs. The Others category includes newer or less common configurations that may gain attention as technology advances.

In the near future, the global gas separation membrane market will likely see more collaboration between manufacturers and research institutions. This collaboration might lead to the creation of increasingly specialized membranes for specific gas blends or aggressive operating conditions. As economies expand and evolve, so will their needs for gas separation. The call for cleaner, more intelligent, and more flexible systems will dictate investment and innovation. With the proper combination of regulation, technology, and market demand, the gas separation membrane industry is well-set for a bright future.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$3,605.2 million |

|

Market Size by 2032 |

$5,172.9 Million |

|

Growth Rate from 2025 to 2032 |

7.1% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

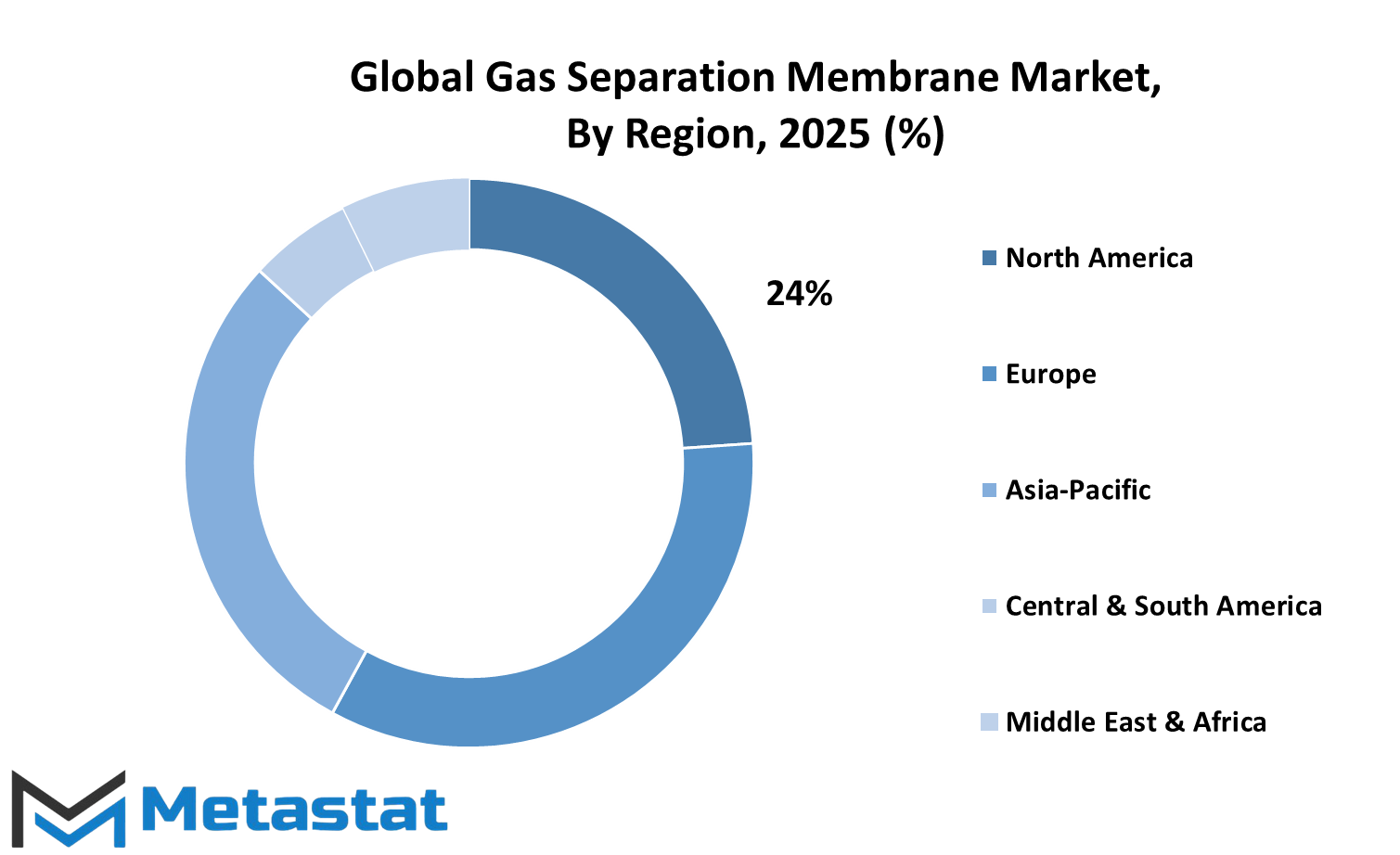

The global gas separation membrane market will continue to expand throughout the various regions based on increasing industrial requirements and initiatives for energy efficiency improvement. By observing the distribution of this market around the globe, one can see distinct trends that indicate long-term growth possibilities in most regions of the world. Every region poses its own drivers, challenges, and future opportunities, influenced by both regional conditions and global international factors.

In North America, the sector will gain from robust investments in industrial innovation and environmental policies. The United States has particularly been augmenting its interest in mitigating emissions and promoting clean technology. Canada and Mexico will also contribute to growth, particularly with the increasing cross-border trade and energy partnerships. Natural gas processing and hydrogen production are industries that will increasingly utilize such membranes in the near term, and hence, increase demand for the same.

Europe will also have a significant role in the future of this market. Nations such as Germany and the UK are leading the way with cleaner technologies, and gas separation membranes play into their sustainable plans. Low-carbon industries will be supported by governments and tighter environmental regulations will advance this market. Energy projects are becoming increasingly prevalent in southern Europe, which may open up new prospects for companies involved in this space.

Asia-Pacific is likely to witness the most rapid transformation. China and India are developing rapidly and require more effective means of controlling energy and industrial processes. They are also suffering from pollution issues and, therefore, seeking solutions that will lower toxic emissions. Japan and South Korea, which have robust manufacturing industries, will probably continue employing gas separation technologies to enhance their operations.

South America, although smaller compared to the rest, is promising in Brazil and Argentina. With industries maturing and the local economies set to modernize, the need for cleaner and more efficient gas separation will increase. This can give rise to new business opportunities in nations that are only now taking this technology more seriously.

The Middle East and Africa will also drive future development of this market. Owing to the emphasis placed on energy diversification, nations in the Gulf and North Africa are beginning to investigate these membranes for use in natural gas processing. In the long term, various regions of the region will begin to introduce such technologies in order to remain aligned with global energy and environmental developments.

COMPETITIVE PLAYERS

The global gas separation membrane market is slowly gaining traction as companies start to seek cleaner, more efficient means to handle gases for various processes. As the world becomes increasingly concerned with the efficiency of energy usage, corporate responsibility for the environment, and the longevity of operational expenses, the demand for state-of-the-art solutions for gas separation becomes increasingly evident. Despite still being in its nascent stage, this market already hosts a number of firms guiding the future of the industry. These players not only advance the technology but are opening up the technology for wider industrial adoption as well.

Gas separation membranes are employed in processes where selective filtration of gases is necessary. These membranes are designed to allow certain gases to pass through while retaining others. They provide industry with a substitute for the older, more energy-intensive separation technologies. As technology continues to grow, the efficiency of these membranes is improving with better durability. This development is increasing their appeal to industries such as oil and gas, chemical processing, and even air filtration. The market will continue to expand as industries continue to make a transition towards cleaner operations.

Competition between major players in the global gas separation membrane market will contribute significantly to its growth. Some of the key companies, including Air Products, Air Liquide, and UBE, are constantly striving to enhance their products. They conduct research, seek out new materials, and experiment with better designs. Grasys, Evonik, and Schlumberger contribute uniquely, with a focus typically on a specific industrial requirement or geographic location. Each of them adds value in some form, be it improved customer service, cheaper products, or superior performance.

Some of the notable contributors are IGS, Honeywell, MTR, and Borsig. All these organizations are seeking collaborations, upscaling productions, and creating newer generation membranes. They are not only targeting present market demands but also the needs that industries may have in the near future. Parker Hannifin and ANDRITZ are also a part of this dynamic picture, with both looking to acquire an advantage through innovation.

In the future, the global gas separation membrane market can expect to witness greater usage with industries trending toward environmentally friendly and cost-saving practices. Competitive companies will continue to push the envelope by offering solutions that are not only technically feasible but even practical to adopt. As this gains traction, the future of gas separation is expected to be defined by steady enhancements as well as ambitious innovations.

Gas Separation Membrane Market Key Segments:

By Application

- Nitrogen Generation and Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- Vapor/Gas Separation

- Vapor/Vapor Separation

- Air Dehydration

- H2S Removal

- Others

By Material Type

- Polymide and Polyaramide

- Polysulfone

- Cellulose Acetate

- Others

By Module

- Spiral Wound

- Hollow Fiber

- Plate and Frame

- Others

Key Global Gas Separation Membrane Industry Players

- Air Products

- Air Liquide

- UBE

- Grasys

- Evonik

- Schlumberger

- IGS

- Honeywell

- MTR

- Borsig

- Parker Hannifin

- ANDRIT

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383